A Commonsense Way To Know If A Company Has The Juice To Deliver 1,000% Gains

Dear Reader,

Yesterday we posted my conversation with Brenton where I discussed just how critical it is to find a stock early enough in its growth arc…

Yesterday we posted my conversation with Brenton where I discussed just how critical it is to find a stock early enough in its growth arc…

Because if you don’t, gains of 1,000% are nothing but a pipe dream.

But that’s not the only criteria I look at of course.

My GEAR system helps me evaluate a company from four major angles.

And they are…

- Game changing. The company must a have a strategy, product or service that fundamentally alters the way a market works.

- Early. The company must be found early enough in its growth arc – and before everyone else has gotten wind of what it’s up to.

- Accelerating. The company must operate in a growing market. Its share of that market must be growing. And so must key metrics like revenue and earnings.

- Repeatable. The company needs to have the right formula to maintain its growth arc long enough to deliver gains of 1,000%.

Obviously, having a game-changing product in an expanding market – contributes to a company’s ability to consistently grow.

But I look at dozens of other variables too.

And out of them, the most important one is leadership.

It’s only common sense that a company which is stacked with executives who have previous experience growing a small organization into a massive one…

Has a far better chance of turning into a 1,000% winner than one that doesn’t.

I mean think about it, would you rather be on a plane whose pilot has been flying for 20 years… or one who has only been doing it for 20 days?

The same logic holds true for companies.

Which is why I spend a great deal of time evaluating the leadership team.

Because if they don’t have what it takes keep the business growing quarter after quarter…

In any market conditions…

Then the company has no chance at delivering quadruple-digit gains to its investors.

Which brings me to another big thing I look it…

Do the company’s top-level executives have the proper financial motivation to see their growth plans through?

Now to be clear, when I say financial motivation, I’m not talking about bonuses and incentives like company cars.

Rewards like that just encourage short-term thinking.

I’m talking about how much of the company the executive teams owns.

Because nothing provides a more tremendous incentive for success than having skin in the game.

And knowing it could grow into a fortune.

To get the answers to these questions…

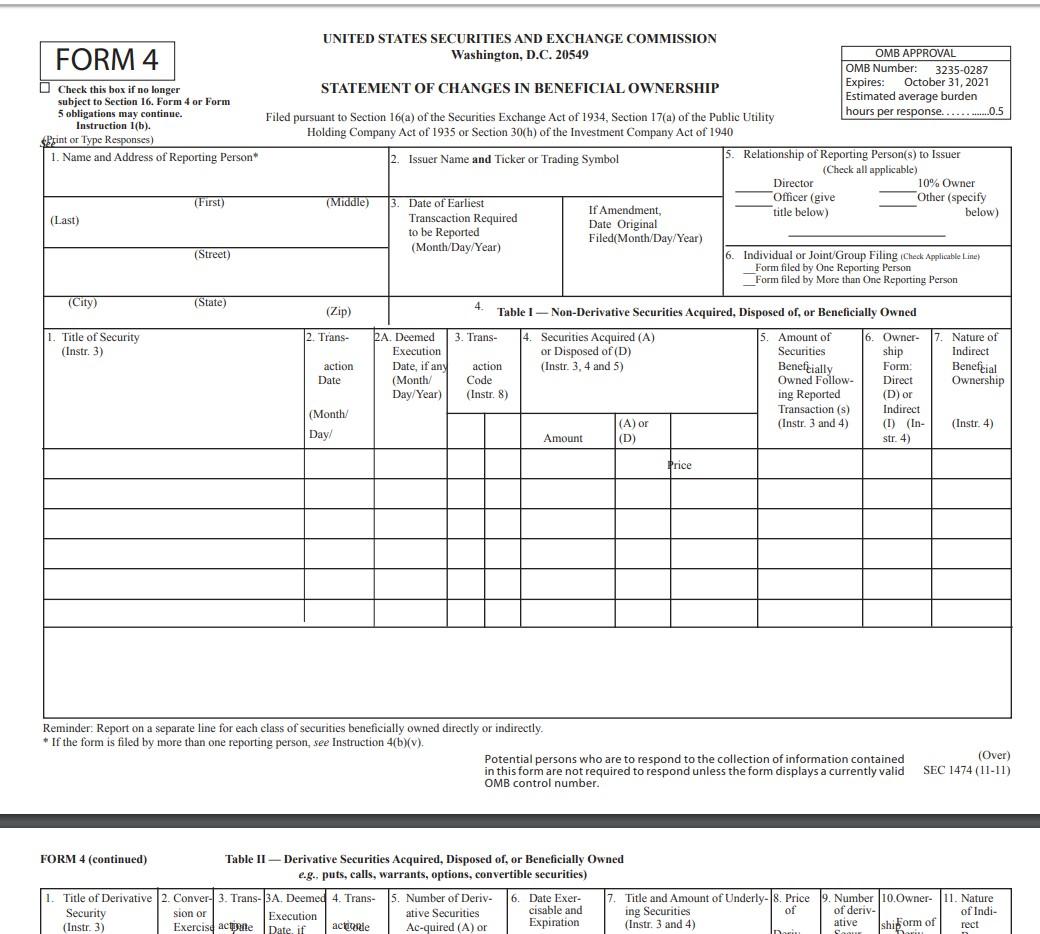

I use special, high-priced software that tracks anytime this little-known form is filed with the Securities and Exchange Commission.

Because it tells me when someone on leadership team buys or sells shares of the company they work for. Including how many.

Now obviously, if I see executives dumping shares at a breakneck pace…

It’s a major red flag.

And I won’t touch the stock with a 10-foot pole.

But when I see them loading up on shares…

And when I see that they own a significant portion of the business…

It tells me they have confidence in their ability to grow it into a powerhouse.

On Tuesday, you’re going to hear about three organizations that have highly-experienced leaders who own a massive number of shares.

Including one whose management team owns 15% of the company.

And another whose CEO has hundreds of millions of dollars at stake.

I’ll give you all their details during the Summit.

Including everything you need to know to invest in them immediately.

Until then, be sure to keep checking back to…

www.totalprofitssummit.com

Because we’re going to be posting some exciting material in the coming days including our favorite answers to the question we asked when you signed up for this event…

“How would $330,000 change your life?”

Sincerely,

Jim Fink

Founder

Total Profits Summit