Presented by Investing Daily

The Inflation-Proof Income Summit

has now concluded

Missed the event? No problem! You can catch the recording by clicking here.

TOMORROW June 2nd @ 1 pm EST:

Inflation-Proof Income Summit

Revealed: How you could grab up to $1,300 in cold, hard cash ON-COMMAND virtually every week.

We’re down to the wire now!

I hope you’re as excited for the Inflation-Proof Income Summit TOMORROW as I am!

But before the big event kicks off, I have my final beta-test for you.

I wanted to answer this question: Are Bonus Paydays reliable?

To do so, I brought in my #1 naysayer.

His name is also Joe. He's also a proud Texan. And he’s all about collecting consistent dividends.

So when he heard my Bonus Payday technique has the potential to keep the cash rolling in week after week (no matter what the market does)…

Well, he was just a little skeptical.

Until I showed him how to pocket cold, hard "Cash-on-Command" virtually every week.

Afterward? Well, the look on his face says it all.

Click the play button below to see how YOU could collect "Cash-on-Command" week after week NOW:

TOMORROW, JUNE 2ND @ 1pm EST: I'll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit.

Your On-Command Cash Daily Update for

May 31, 2022

Yes! It really is that easy for you to pocket "Cash-on-Command" week after week.

We're only a few days away from the Inflation-Proof Income Summit on Thursday, June 2nd.

Today, I have my second beta-test for you. This time I showed a budding real estate investor that:

- With a simple set of instructions...

- And a few clicks…

- He could collect cold, hard cash ON COMMAND.

The results? An astonishing $860 with less than 2 minutes of work.

But don’t just take my word for it…

Click the play button below to see just how easy it is with your own eyes…

TOMORROW: Tomorrow I tackle the question: “Are my Bonus Paydays reliable?” PLUS, I “throw down” with my #1 naysayer.

THURSDAY, JUNE 2ND @ 1pm EST: I’ll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit.

Your On-Command Cash Daily Update for

May 30, 2022

A little light reading for your Memorial Day weekend: Here's your FREE copy of P.A.I.D. First

For the last few days, we’ve been talking about what my "Cash-on-Command" technique can do…

For the last few days, we’ve been talking about what my "Cash-on-Command" technique can do…

I showed you how I’ve put it through the paces with my “trial by fire.”

And you've seen me show an investing “greenhorn” how to rack up a $1,500 bonus with my "Cash-on-Command" secret…

But I want to show you HOW I pinpoint the most lucrative Bonus Paydays.

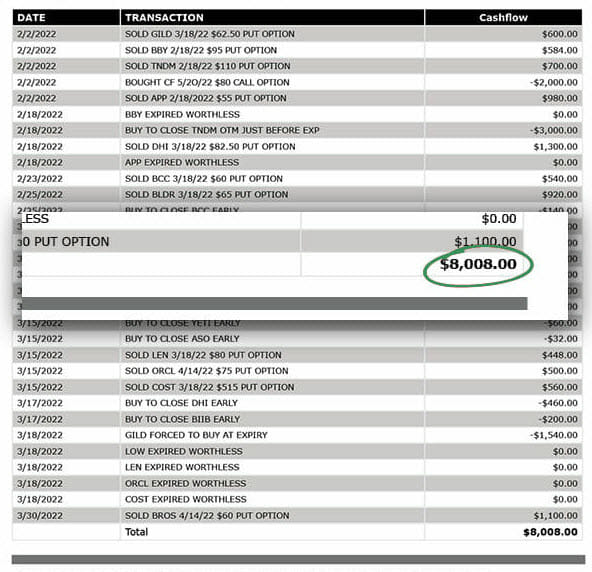

Inside this brand new FREE report, I reveal my secret P.A.I.D. First system, that has uncovered $8,008 worth of Bonus Paydays in 64 days.

Even investment pros would pay through the nose to get their hands on the insights and information in this exclusive report. But right now, you can get it for FREE.

I’ve never shown this to anyone before.

But I'm giving you the keys to the castle for FREE right now.

Click here to get your FREE copy of P.A.I.D. First.

TOMORROW: I stun my second beta-tester, a budding real estate investor we call “Boomer,” with just how quick and easy it is to collect "Cash-on-Command with my Bonus Payday technique.

THURSDAY, JUNE 2ND @ 1pm EST: I'll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit

Your On-Command Cash Daily Update for

May 29, 2022

I’ve got Good news and Bad news…

Let’s start with the bad:

Social Security isn’t keeping pace with inflation:

Like I showed you earlier this week:

The outlook for stocks to protect from inflation isn’t uplifting:

There’s always gold to protect against inflation.

But last I checked you can’t buy groceries with gold bars yet.

Cryptocurrencies like bitcoin were supposed to protect against inflation...

But as CNN pointed out:

But that’s enough with the bad news.

As I mentioned, I have good news for you too.

You already signed up for my Inflation-Proof Income Summit on June 2nd.

Which means you’ve already joined an exclusive club of investors who will see — for the first time ever — how to pocket up to $1,300 week after week with my Bonus Payday technique.

You’ve already seen the proof this week that it’s hands down the BEST investment method to stay ahead of inflation (and pocket cold, hard cash on command virtually every week).

So while the rest of the world panics about inflation going through the roof... you could be sitting back watching the cold, hard cash hit your retirement account week after week.

TOMORROW: I have a brand new FREE report for YOU. Inside, I reveal — for the first time ever — my secret method that has uncovered $8,008 worth of Bonus Paydays in 64 days. Even investment pros would kill to get their hands on the insights and information in this exclusive report. But you can get it for FREE when you join me right here tomorrow.

THURSDAY, JUNE 2ND @ 1pm EST: I'll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit

Your On-Command Cash Daily Update for

May 28, 2022

How I discovered this "On-Command Cash" secret (and how you can use it to pocket instant cash week after week)

What you’re about to read today… I’ve never shared this story with ANYONE.

Not my friends. Not my boss. Not even my own wife.

But I’m going to share it with you today because you NEED to know.

See, right now we’re stuck in the worst inflation any of us have seen in over 40 years... and it looks like prices will keep marching up, up, up.

(The price of my steak just doubled in less than 12 months.)

That's not normal. And it puts you in a really tough position as an investor.

What are we supposed to do? Runaway inflation could erase all the gains from once gold standard "safe haven" investments.

And at the same time, investments that have the potential to return BIG gains — like buying options, futures, or crypto — are more akin to gambling than investing.

So what you need is a simple way to pocket cash when you need it…

Not a month from now…

Not a year from now…

And certainly not the decade or more that some stocks take to hand out returns that can be considered anywhere close to “decent.”

This could finally put YOU in control of your financial destiny.

This isn't a fantasy.

How do I know? Because I first mastered it almost two decades ago.

It's all thanks to the single best investment advice I ever got... from, of all people, a fellow doctor.

His name was Dr. Bill.

But he’s not just any doctor.

He accurately predicted the Black Monday market crash in 1987 — he got out early and went on to make a fortune.

He was also very kind to a new resident who asked him the day after the stocks fell 22%...

“Why does every doctor look so glum today?”

That resident was me. I was fresh-faced without a cent in the stock market... and no idea that this chance encounter would change my entire life.

Dr. Bill took me aside and told me…

All these doctors, friends, and colleagues he’d known for years had just watched their life savings instantly get cut down at the knees…

Then he said:

“But not me. I got out a week ago.”

I didn’t know much about the stock market, but I knew enough to realize I should dig a little deeper into what he had to say:

“How did you do that?”

"I won't tell you my secret, kid," he told me. "But if you want to find out, all I can recommend is that you read everything you can get your hands on about the stock market."

And that’s exactly what I did… every spare moment of free time I had was spent consuming every ounce of information about the stock market I could get my hands on...

From fundamental analysis to market timing...

Technical Analysis to Chaos Theory...

The FDA drug approval process to crude oil refining...

I forgot to mention...

This may be the most “boring” investment advice I've ever gotten

(But it sure helped me make me a ton of money and it could hand you a boatload of cash too)

Because all that research and reading led me to what I like to think of as the holy grail of investing.

Because it led me to a shockingly simple way to make CASH-ON-COMMAND.

- No buying stocks...

- No buying options...

- No buying futures...

And most importantly… NO WAITING.

This unique strategy pays upfront and on command, virtually every time you click "trade."

For the first time, it finally felt like...

I was in control!

It took me decades to understand the "Cash-on-Command" secret and perfect what I’m going to reveal on June 2…

Where you'll get every ounce of information condensed into one simple system that could put cold, hard cash in your pocket week after week

It’s like collecting a bonus from work. Except it doesn’t depend on whether or not your boss is feeling generous.

It doesn’t require hours of overtime… and there are no “silly” annual reviews that seem more like an interview for the job you already have.

Now I grab a cup of coffee and pop open my laptop before work...

And when my wife asks what I’m doing, I simply tell her...

“I'm collecting my Bonus Payday.”

That's where the Bonus Payday technique comes from.

For nearly two decades now, it's been my little secret.

But that’s all about to change.

There is literally no other investment technique I know of that can keep you ahead of runaway inflation (and I've dug deep to find anything similar to this).

It's as easy as making a few clicks once a week...

It takes less time than boiling an egg...

And at my Inflation-Proof Income Summit on June 2nd, you'll get to see for yourself how my Bonus Payday technique could hand you "Cash-on-Command"... virtually every time you hit “trade.”

TOMORROW: I have bad news… and good news. The decisions you make in the next few days could lead you to the happy retirement you worked so hard for... or leave you high and dry, barely scraping by in your golden years.

THURSDAY, JUNE 2ND @ 1pm EST: I'll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit

Your On-Command Cash Daily Update for

May 27, 2022

Who is Dr. Joe Duarte & why does he want to help you get rich?

By now you may be wondering… just WHO is Dr. Joe anyway?

Well, anyone who has been with us at Investing Daily may recognize him… but truth is, this isn’t the first time we’ve seen him.

For anyone who may not know Dr. Joe’s story, we wanted to provide a little extra color on the “man behind the plan.”

We’ve enticed Dr. Joe Duarte back to our team. And our readers need his advice, now more than ever.

Dr. Duarte has been a professional investor and independent analyst since 1990. He is a former registered investment advisor and author of the bestselling Trading Options for Dummies and several other books, including Market Timing for Dummies and Successful Biotech Investing.

He’s also a medical doctor with a thriving practice. When he’s not advising investors, he’s treating patients.

With the markets in turmoil, it’s a good time for me to interview Dr. Duarte. My questions are in bold.

Technology stocks have taken a beating lately, largely due to rising interest rates. Do you think the sector is oversold or is further carnage ahead?

Technology stocks are definitely oversold. But as history shows, sectors can stay oversold for a longer time than anyone expects. What that means is that staying patient for a bit longer is likely to be a good plan.

Stocks overall had gotten pricey and the broader market, not just the technology sector, was due for a pullback. Where do you now see appealing bargains?

There are bargains everywhere at this point for sure. The real question is whether the bargains will be even better in a few days to weeks. I do like what I’m seeing in the IT and housing sectors, as well as select biotech stocks.

Robotics is another interesting sector. Of course, history shows that when selling is fear related, it is often a prelude to what could be a historic buying opportunity.

In other words, this aggressive selling in chipmakers, as well as other technology and robotics stocks, may be one of those occasions, which means that instead of walking away from this sector this is a great time to keep it in our sights.

And if that’s the case, we may be able to scoop up these companies on the cheap at some point.

On the other hand, robotics could well be headed to that familiar area of the technology trash bin, such as refrigerators, televisions, and PCs.

In other words, they are really cool, and we really can’t do without them. But since everyone’s got one and profit margins are thin, the world moves along. It’s one or the other. And I suspect we’ll know soon enough.

Rising interest rates tend to hurt tech stocks, but which sectors will benefit in 2022 and beyond from Federal Reserve tightening?

Well, if I’m right, the Fed won’t be able to tighten as much as they’ve forecast, which means that if they are forced to reverse course and actually start easing in a few months, we should see a very broad rally including technology and other areas.

One of my favorite activities when looking for areas in which to put my money is to find mismatches between stock price action and affiliated indicators that help quantify money flows into stocks and exchange-traded funds (ETFs). This analysis becomes particularly useful during the sort of volatile periods we’ve seen for the past few weeks.

It’s hard not to be concerned when the market starts crashing. But over the years I’ve learned that panic often creates an opportunity to buy stocks and ETFs at bargain prices. This is especially true when the panic is based on news items that are not fully vetted, such as current market volatility associated with the Omicron variant of COVID-19.

Do you expect inflation to worsen this year, or eventually moderate?

That’s a tough question. A lot depends on whether supply chain issues, especially in manufacturing, calm down. Labor shortages play a role as well.

Aside from the central bank’s actions, the U.S. government and other governments around the world also increased the money supply via stimulus checks, extended employment benefits, childhood credits, loan forgiveness programs, and in the case of the U.S. the Paycheck Protection Program (PPP), which lent businesses money so they could keep their operations going during the pandemic.

Meanwhile, the global economy ground to a halt. And while much of the economy has bounced back, there is still plenty of slack in the system. That’s because people, through retirement, illness, death from COVID, and maybe just because they decided to drop out of society, just never came back to work, which has kept many factories idle or working at less than full capacity.

As a result, there is too much money available and not enough production to meet the demand for goods and services. And that is the classic definition of inflation.

My guess is that we’ll see some slowing in the rate of inflation but maybe not a full return to what we had in the past few years for some time. I just think we’ve had too many long-term structural changes in the way the economy works.

Which inflation hedges make the most sense right now?

Surprisingly, stocks in select sectors such as energy and commodities may make some sense. But in the current market, investors should stay patient, nimble, and very thoughtful about where they put their money.

If I had one sentence to describe what I’m thinking it would be: “if it’s working, stay with it.”

What is the bond market trying to tell investors?

The bond market is a fickle world. And honestly, bond traders are as confused as anyone else. If they weren’t then we wouldn’t see the daily volatility that we’ve experienced.

That said, sellers have had the upper hand in the bond market for a few weeks, which is why market interest rates, such as the 10-year U.S. Treasury note yield, has been climbing.

Now, however, we are starting to see a bit of waffling in bond yields, which suggests that traders are considering the fact that if the Fed is too aggressive in raising rates, we may see a recession.

But honestly, the bond market is acting like the weather lately in my native Texas. If you don’t like it, just wait a minute.

For that matter, what is China trying to tell us? It seems that the world’s second-largest economy is slowing. What are the ramifications for U.S. investors?

Wow! China is a big puzzle at the moment. They’ve had COVID lockdowns in major port cities and now they have to deal with the Olympics and the ongoing Omicron situation.

But what’s interesting is that China is now lowering interest rates, which of course is the opposite of what the Fed is doing, which means they are worried about their economic growth prospects.

Something will have to give. Either the Fed will back down, or the Chinese central bank will start to tighten.

My guess is that the Chinese central bank is actually right and that the Fed will have to fold its higher interest rate tent in the not-too-distant future.

You’ve been characterized as a “momentum” investor. Is that a fair assessment?

I’m a momentum investor. But I‘m also a staunch researcher of company fundamentals and management.

In fact, I would say that my approach is a combination of the methods of Warren Buffett and part John Murphy and John Bollinger, two of the most recognized technical analysts of the modern era.

On the one hand, like Warren, I obsess over the fundamental aspects of a business before buying a stock. On the other, like the two Johns, I pore endlessly over stock charts, looking for key price patterns.

Of course, no investing method is perfect. As a result, the best we can hope for is that we can develop a method that is both reliable and consistent.

And over time I’ve found that by combining the best of both approaches, the fundamentals, and the technicals, I am often able to find companies whose stocks deliver explosive returns.

Here is a quick overview of the differences between the two approaches and how combining them can yield gigantic winners:

Value investors rarely look at price charts while focusing on fundamental factors such as price/earnings ratios, earnings, dividends, and return on equity.

Momentum investors focus on money flows primarily via technical analysis.

Investors who combine both technicals and fundamentals appreciate value investing tools and apply the tools of momentum investing to optimize the entry and exit points in a stock.

And we at Investing Daily call this the Catalyst Approach, given the fact that a catalyst is a substance that speeds up and optimizes a chemical reaction.

In other words, the combination of both approaches in many ways acts as an accelerant when it comes to stock investing.

TOMORROW: I’ll tell you the story of how I discovered this "On-Command Cash" secret (and how you can use it to pocket instant cash week after week).

THURSDAY, JUNE 2ND @ 1pm EST: I'll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit

Your On-Command Cash Daily Update for

May 26, 2022

This investing “greenhorn” picked up a $1,500 Bonus Payday… in less time than it takes to boil an egg?

Dr. Joe here with a special on command cash daily update for you.

I just showed my first beta tester, Jenna (an investing greenhorn whose entire experience with investing is limited to her 401k), how to pocket a stunning $1,500 in "On-Command Cash" with my Bonus Payday technique...

In less time than it takes to boil an egg.

It's true. You can see the results for yourself. Just click play NOW on the special "live" demonstration below.

TOMORROW: We’ll see the “safe haven” investments that are costing you a fortune in 2022… and how my trading system compares.

THURSDAY, JUNE 2ND @ 1pm EST: I'll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit

Your On-Command Cash Daily Update for

May 25, 2022

What would you do with an extra $67,600?

A few days ago we discussed the “trial by fire’ where I put my Bonus Paydays system through its paces and came out with an extra 8,008 in income… in just 10 short weeks.

But that’s just the tip of the iceberg!

At the Inflation-Proof Income Summit on June 2nd, I’m going to show you how you could pocket up to $1,300 virtually every week with this simple strategy.

That's a potential profit of $67,600 in one year.

Which gets me wondering: What would YOU do with that kind of money?

Buy a boat?

Build your man cave?

Take your wife on a dream vacation to Italy?

Or maybe there’s something else you’ve been dying to get your hands on?

Just a little food for thought before the big event on June 2nd.

TOMORROW: Watch as I show Jenna how to pocket $1,500 on-command with my Bonus Payday technique — in less time than it takes to boil an egg.

THURSDAY, JUNE 2ND @ 1pm EST: I'll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit

Your On-Command Cash Daily Update for

May 24, 2022

Inflation will eat you alive (unless you do THIS)

Did you buy gas this week?

Did you buy groceries?

Have you taken a look at your retirement account?

Did you like what you saw?

My bet is no. Because inflation is at a 40-year high. And everyday Americans are forced to watch while their hard-earned dollars are eaten away.

That's the highest in our lifetime!

And it's not just bad for your wallet. It's even WORSE on your investments.

Here's what I mean.

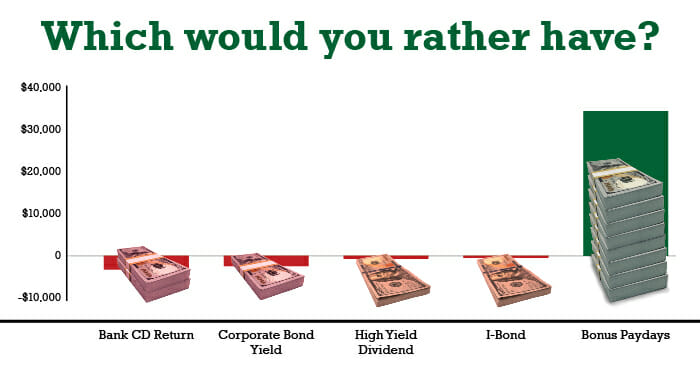

If you invested $40K today, these would be your inflation-adjusted LOSSES after just one year...

- $2,920 LOST in a bank savings account or CD

- $1,804 LOST in corporate bonds or related mutual funds

- $648 LOST on so-called “high-yield” dividend stocks (which risk being caught in a stock market crash)

In fact, even the “Gold Standard” for inflation-protected securities — the U.S. Government I-Bond — that boasts a 7.12% interest rate:

- Would have LOST you $552!

Now let's compare that to my Bonus Payday technique that bagged $8,008 in 10 weeks.

If we adjust for inflation, that would be roughly $32,734 in one year.

So which option sounds better to you?

At best, LOSING $552 against inflation with those other ordinary investments over the next year?

Or would you rather have the chance at collecting up to $32,734 in "On-Command Cash"… with my Bonus Payday technique?

If you ask me, it's a no-brainer.

I believe this technique is the #1 way to stay ahead of inflation in 2022.

It's not even close.

Which is why it was a smart move on your part to sign up for my Inflation-Proof Income Summit.

Where I'll show you exactly how my Bonus Payday technique could hand you cold, hard cash, virtually every week.

We’re just a few days away and still have a lot of ground to cover… but trust me. I believe it’s all going to be worth it.

Here’s a sneak peek at what I have in store for you tomorrow.

TOMORROW: I'm going to reveal how this strategy has the potential to hand you the best financial problem you’ve ever had... and one most investors would love to have to “figure out.”

THURSDAY, JUNE 2ND @ 1pm EST: I'll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit.

Your On-Command Cash Daily Update for

May 23, 2022

Easiest money ever?

(Up to $1,300 on command)

I've NEVER shown this strategy to anyone.

I’ve been featured in Barron's and the Wall Street Journal. I’ve written for MarketWatch. and even been declared a “Market Maven” by CNBC.

And in all that time... not ONCE have I ever revealed this strategy. To anyone.

But now — more than ever before — investors need a strategy that can help them survive, thrive, and even profit.

Because to be frank, inflation is eating everyday Americans alive.

From aluminum foil to washing machines (and everything in between) — prices are through the roof (and rising)…

It's INSANE.

What's worse? Nobody knows how long it will take for inflation to get its fill.

Even Treasury Secretary Janet Yellen had to grit her teeth and admit that...

But this is no time to tighten your belt, bury your head in the sand, and hope that inflation doesn't devour your retirement account.

Because…

On June 2nd, I'm going to help you fight back… By revealing a simple type of trade that could put cold, hard cash in your retirement account, week after week

But before the big event kicks off...

I wanted to show you just how powerful it can be.

You see, at the end of 2021 it became apparent that inflation was quickly spiraling out of control… and I knew that the time had finally come to make a change…

Not just for me… but for the millions of investors that could soon find themselves sideswiped by the market rollercoaster.

And I believe the solution starts with a simple type of trade I’ve kept tucked away for just such an occasion…

I call them Bonus Paydays.

But before I felt comfortable revealing this Cash-on-Command technique, I wanted to put this trade to the test… and I couldn’t think of a better way of proving it than putting it through the ultimate “trial by fire.”

For 10 solid weeks I made these trades...

And the results? Well, they speak for themselves.

In the first 2 weeks, my Bonus Payday technique delivered $2,8642 in on-command cash.

A good start, yes. But not enough for me to be confident enough to reveal the “dirty details” to everyday investors.

So I kept going...

In just 10 weeks, my Bonus Payday technique pumped out $8,008

You can take a look for yourself right here:

As you can see, this isn’t a cherry-picked list…

This is every trade made during this 10-week “trial by fire” (winners and losers). That said, even with the few “losers’ in the mix, my Bonus Payday technique still pumped out $8,008.

Which begs the question….

What would you do with an extra $8,000?

Put a big fat dent in your mortgage?

Get started on that kitchen renovation you've been saving up for?

Take a two-week Caribbean cruise?

The possibilities are endless when you have cold, hard cash hitting your retirement account on command virtually every week.

Even better...

With my Bonus Payday technique, you don’t have to buy the stock.

You don’t have to buy options.

And you don’t have to mess around with futures, trade currencies, or gamble your money on crypto.

The best part is the cold, hard cash hits your retirement account faster than it takes to boil an egg.

No seriously — I tested it LIVE on camera.

Here's what I mean.

Along with conducting a 10-week controlled trial...

I also conducted three live beta tests with three investors.

You can see them all right here on this page in the next few days.

Here’s what I have in store for you tomorrow.

TOMORROW: We’ll see the “Safe Haven” investments that are costing you a fortune in 2022… and how my trading system compares.

THURSDAY JUNE 2ND @ 1pm EST: I'll show you how to grab cold, hard cash up to $1,300 virtually every week at the Inflation-Proof Income Summit.