The AI Boom Runs on Electricity.

We Own the Companies That Provide It.

My essential-service portfolio has quietly delivered 803.9% average returns over 36 years. In 2025, both portfolios beat the market on a risk-adjusted basis—again. Here’s how to join us.

This is the average total return across our 41 current holdings—not a single cherry-picked winner. It includes dividends reinvested, measured from each position’s entry date. Some holdings are up 4,000%+. Others are newer. The average tells you what consistent, long-term ownership of essential-service stocks has actually produced.

Hi, I’m Robert Rapier.

If you’ve been following my work, you know I don’t chase headlines. I don’t buy stocks because they’re exciting. And I don’t promise overnight riches.

What I do is simpler: I find companies that provide services people can’t live without—electricity, natural gas, water, telecommunications—and I buy them at reasonable prices.

Then I hold on while they pay me.

It’s worked for 36 years. And in 2025, it worked again.

Our Growth Portfolio returned 16.5%. Our Income Portfolio returned 10.7% with a 4.8% yield. Both beat the S&P 500 on a risk-adjusted basis—meaning we made competitive returns while taking substantially less risk.

The Income Portfolio had an average beta of just 0.41. In plain English: it was less than half as volatile as the overall market.

That’s not a fluke. That’s the whole point.

2025 Performance: Both Portfolios Beat the Market

Competitive returns with substantially less risk.

32% less volatile

59% less volatile

Full market risk

THE ESSENTIAL SERVICE ADVANTAGE

The companies in our portfolio share one trait: they sell things people refuse to stop paying for.

Electricity. Natural gas. Water. The connectivity that runs modern life.

These aren’t discretionary purchases. When the economy slows, people cut back on restaurants, vacations, new cars. They don’t cut back on keeping the lights on.

This creates a structural advantage that’s hard to replicate:

Constant demand. Usage barely dips, even in recessions. People need heat in winter and cooling in summer regardless of GDP growth.

Regulated returns. Many of these companies operate under rate structures that guarantee them a reasonable profit. The Supreme Court established this principle in 1865, and it hasn’t changed.

Barrier to entry. You can’t just build a competing power grid. The infrastructure is already in place, and regulators aren’t handing out new franchises.

Pricing power. When costs rise, these companies can petition for rate increases—and they usually get them.

The result? Stocks that tend to hold up when everything else is falling apart.

In 1998, when the market dropped 20%, utilities gained 4%. After the dot-com crash, they rose 42% while tech stocks were still finding the bottom. In 2008-2009, they recovered faster than the S&P 500.

We’ve been making money this way since 1989. The approach doesn’t wear out because the underlying logic doesn’t change.

WHY 2026 LOOKS DIFFERENT

I’ve been doing this for 36 years, and I can count on one hand the number of times the setup has looked this favorable.

Here’s what’s happening:

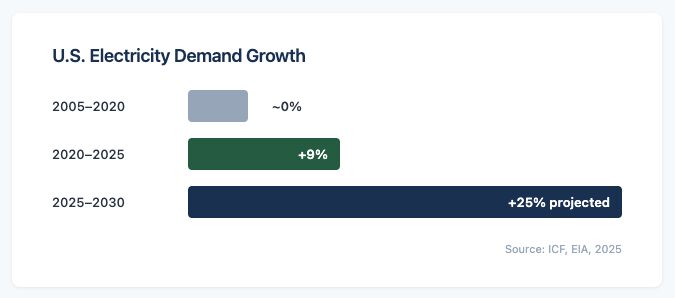

The grid is under stress. Coal plants are retiring faster than replacements come online. At the same time, electricity demand is growing 2-3% annually—the first sustained growth in decades.

Data centers are multiplying. AI models don’t train in the cloud. They run on physical hardware that consumes enormous amounts of electricity. Data centers now account for 6-8% of total U.S. power consumption, and that number is projected to reach 11-15% by 2030.

U.S. electricity demand is growing at its fastest pace in decades. This is the tailwind behind our 2026 thesis.

Scarcity pricing has returned. The PJM Interconnection’s 2025 capacity auction showed what happens when supply gets tight: prices rise. For the first time in a generation, utilities that own reliable, dispatchable power are being paid premium rates.

This is exactly the environment where essential-service stocks thrive.

The companies that own the infrastructure—the power plants, the pipelines, the transmission lines—are no longer being taken for granted. They’re being valued.

NRG Energy, one of our Growth Portfolio holdings, was up 72.7% in 2025. That’s not a fluke. It’s the market recognizing that electrons matter.

IS UTILITY FORECASTER RIGHT FOR YOU?

- You’re within 10 years of retirement (or already there)

- You want income you can actually live on—not 1.3% yields

- Sleeping well matters more than bragging rights

- You’ve seen enough market crashes to appreciate stability

- You’re willing to be patient for meaningful returns

- You understand that boring often beats exciting

- You want to double your money in 6 months

- You’re chasing meme stocks or crypto moonshots

- You need constant excitement from your portfolio

- You’re looking for complex options strategies

- You think 4-6% yields are “too boring”

- You’re not willing to hold positions for years

WHAT YOU GET WHEN YOU JOIN

When you become a Utility Forecaster member today, you get immediate access to:

- The Complete Portfolio — 41 holdings with an average total return of 803.9%. You’ll see every position, every entry price, every current recommendation. No guessing, no hunting. Just the full picture of what we own and why.

- Robert’s Current Best Buys — The 10 stocks I’d buy right now if I were starting fresh. Five in the Income Portfolio, five in the Growth Portfolio. Each one ranked by our proprietary system, with specific buy-under prices.

- Weekly Email Issues — Every Friday, you’ll receive my analysis of what’s happening in the essential-service sector. Portfolio updates, new recommendations, options trades, and deep dives on themes that affect our holdings.

- The Safety Rating System — Our 8-point screening process that evaluates every stock before it enters the portfolio. We look at dividend coverage, debt levels, regulatory environment, and more. If a stock doesn’t pass, it doesn’t get in.

- The Early Warning System — A proprietary model based on the DuPont analysis framework that helps us identify dividend cuts before they happen. When warning signs appear, you’ll know.

- The “How They Rate” Table — Our comprehensive ranking of 200+ essential-service stocks, updated regularly. You’ll see at a glance which companies are overvalued, which are bargains, and which ones we’re watching.

- Private Website Access — Our full archive of research, plus real-time portfolio data. Every article, every briefing, every recommendation we’ve ever made.

- Options Guidance — For members who want to boost their income, we provide covered call and cash-secured put recommendations on our holdings. These strategies can meaningfully increase your yield without adding significant risk.

YOUR BONUS REPORTS

2-Year Members Receive All Four:

1-Year Members Receive:

WHAT MEMBERS ARE SAYING

FEATURED HOLDINGS

I can’t reveal specific ticker symbols until you’re a member, but here’s a sample of what’s in the portfolio:

These are the kinds of companies we focus on: boring, essential, and highly profitable over time.

THE MATH BEHIND 33% YIELDS

You might have heard me mention that our portfolio averages a 33% yield on cost.

That sounds impossible. The S&P 500 yields around 1.3%. How can we be earning 33%?

The answer is time and dividend growth.

We bought them when they were yielding 3-5%. We held on while they raised their dividends year after year. Now those same positions are paying us 60%, 80%, 100%+ on our original investment.

HERE’S WHAT WE CAN DO FOR YOU

I’d like you to try Utility Forecaster and see if it works for you.

- Full portfolio access (41 holdings)

- Weekly email issues

- Robert’s Best Buys list

- Safety Rating System

- “How They Rate” table

- Private website access

- Options trade guidance

- 1 bonus report

- Full portfolio access (41 holdings)

- Weekly email issues

- Robert’s Best Buys list

- Safety Rating System

- “How They Rate” table

- Private website access

- Options trade guidance

- ALL 4 bonus reports ($199 value)

- Extra year of market insights

- Rate locked for 2 years

🛡️ Both options include our 90-day money-back guarantee

THE “SLEEP WELL AT NIGHT” GUARANTEE

Try Utility Forecaster for 90 days. Review the portfolios. Read the weekly issues. Check out the Best Buys. Even make an investment or two if you’re ready.

If you’re not satisfied for any reason, call us and we’ll refund every penny. No questions. No hassle.

And you keep everything you’ve received. The reports, the portfolio data, the issues—they’re yours regardless.

If you decide to cancel after 90 days, I’ll still send you a prorated refund for the remaining portion of your subscription.

I can make this guarantee because I know the service works. If you give it an honest try, I’m confident you’ll stay.

WHY I’M NOT CREATING FAKE URGENCY

I’m not going to tell you this offer expires at midnight. It doesn’t.

I’m not going to claim there are only 50 spots available. There aren’t.

What I will tell you is this: the market is in the process of repricing essential infrastructure. Grid scarcity is showing up in capacity auctions. Data center demand is showing up in utility earnings. The re-rating is happening now.

Dominion Energy is already being paid for infrastructure it built years ago. NRG had a 72.7% year. Entergy is spending $41 billion because they see what’s coming.

I don’t know how long this window stays open. Once the market fully prices in the structural shift, the easy gains will be behind us.

If you’ve been thinking about this, now is a reasonable time to act—not because of an artificial deadline, but because the opportunity is real and present.

HOW TO JOIN

Select your membership below and complete the secure order form.

You’ll receive immediate access to the Utility Forecaster website, including the complete portfolio, all current recommendations, and your bonus reports.

Your first weekly issue will arrive this Friday.

💳 All Major Cards Accepted

🛡️ Money-Back Guarantee

If you have questions, call us toll-free at (800) 832-2330. Our customer service team is available Monday through Friday, 8:30 a.m. to 6:00 p.m. EST.

With best wishes for safe profits,

Robert Rapier

Chief Investment Strategist

Utility Forecaster

Copyright © 2025 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.