It was only a matter of time…

We could all see the massive “tech bubble” growing from a mile away.

But the reality is… the bubble we’d been watching was more like Hoover Dam — holding back a virtual SEA of overvalued stocks…

Throughout 2021, we watched as the headlines revealed just how dire the crisis was getting…

Tech stocks’ prices were sky-high…

The frenzied IPO market reached valuations we hadn’t seen in two decades…

By December 2021, It was apparent the dam couldn’t hold much longer — the cracks were plain as day and growing by the minute.

But despite all the red flags and warning bells…

Investors just kept piling in.

And then things got downright out… of… control…

- Ugly drawings of idiot-looking apes that you could save to your phone — going for millions of dollars…

- Digital tokens that did absolutely nothing — soaring to the moon (including a Crypto platform showcasing $14 billion per day in trading volume)…

- “Phone apps” that allowed bored millennials to play in the stock market like it was some kind of cute video game…

It was inevitable that the dam would break…

And that’s exactly what happened.

The “bubble” burst…

The dam broke…

Tech stocks crashed and burned for the second time in our lifetime…

Laying waste the portfolios of millions… again.

And while 2022 is behind us…

In the next few minutes, you’re going to witness research which has me convinced that the last year’s tech crash is not only going to spill into this year…

It’s going to get worse!

(Unless you know how to use these torrents of ruin to 3.3X… 3.5X… or even 6.5X your money…)

Unfortunately, these tech stocks are likely to continue this downward spiral…

Generating untold anxiety… pain… and broken dreams for more Americans than I care to even think about.

If I’m right, billions more will be lost in the weeks and months… and possibly years… ahead…

Money that for many may never be recouped.

But it’s not all doom and gloom… as billions will also be made.

Because…

When pumped-up tech stocks plummet…

Fast Profits Tend to Follow

(For those who know the secret I’m about to share…)

Take a look…

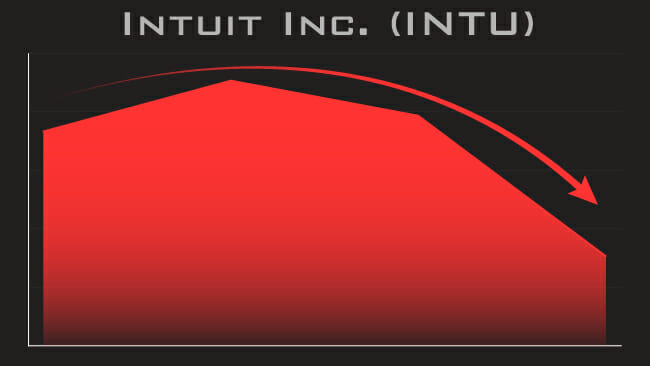

During the Dotcom crash in 2000, Intuit’s share price dropped 10%.

But by utilizing a type of trade I call a “Crash Contract”…

(Like the one I’ll show you how to buy today…)

You could have flipped that 10% drop…

Into a 371% gain…

In only 3 days.

That’s good enough to turn $500 into $2,355…

$1,000 into $4,710…

Or $2,500 into $11,775.

Now, making nearly 4X your money in 72 hours is a good start.

But that’s only the tip of the iceberg…

The Dotcom crash delivered rapid-fire “Crash Contract” opportunities…

Like the chance to flip Oracle’s 24% nosedive…

Into a 444% gain in 14 days…

That’s good enough to turn $500 into $2,720… and $2,500 into $13,600…

In just 2 weeks!

It also handed “in the know” investors a shot to turn a 23% slide on the software company, Autodesk…

Into a 633% gain… just 4 days later.

Giving you the chance to watch a $2,500 investment grow into $18,325 in under a week.

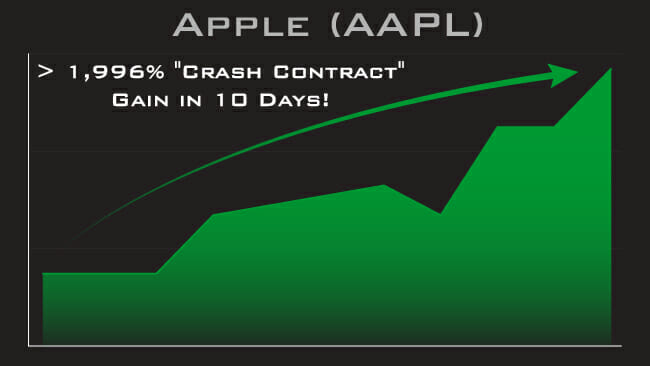

And better yet, with one simple “Crash Contract,” Apple’s 23% skid in 2002…

Could have handed you an astonishing 1,996% gain…

In only 10 days.

Think about that for a second…

You could have turned $1,000 into $20,960…

Or $2,500 into $52,400…

On a stock whose share price was going down.

And you could have done it in a little over 2 weeks!

Now before I go any further…

I want to state the obvious…

Not every tech stock drop can hand you those kinds of gains — and some take a little longer to play out.

Some “Crash Contracts” don’t make any money at all…

And in full transparency, just like any investment, there is a chance you could lose money…

But while these “Crash Contracts” could turn against us… we have safeguards in place to mitigate the risk as much as possible. (More on that in a minute.)

Bottom line: we’re going to be dealing with a market bloodbath for a long time to come…

And I expect to see opportunities to ride the mayhem to consistent profits week in and week out. So even with the odd loser in the mix…

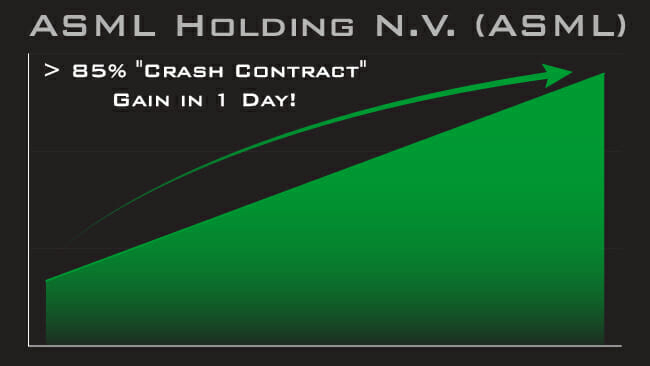

With the chance to pocket an 85% gain in 1 day, like this “Crash Contract” on the microchip company ASML…

I doubt you’d be complaining.

Which brings me to why I’m here with you today.

The dam has burst — and it’s happening all over again…

Tech stocks are falling off a cliff…

And these “Crash Contracts” are soaring…

Which means RIGHT NOW is your chance to get in on the action.

And that’s good news, because…

My proprietary system identifies stocks that are ready to plummet to earth like an anvil

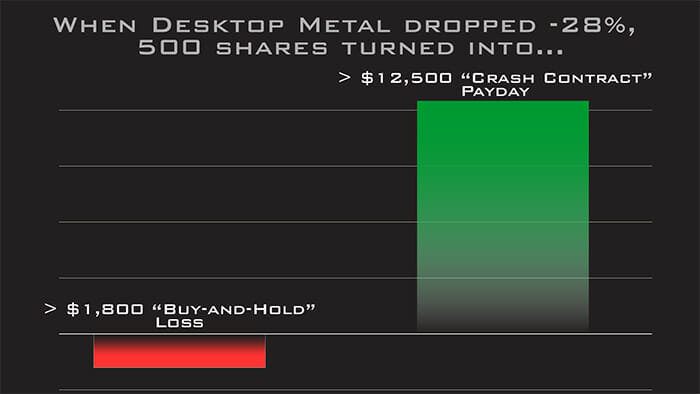

Case in point: my system zeroed in on 3D printing company Desktop Metal as a tech stock ready to sink…

Then, when its price dropped 28%…

This “Crash Contract” I recommended shot up 400% in just 22 days.

That’s enough to turn $500 into $2,500…

Or $2,500 into $12,500 — in a little over 3 weeks!

Let that sink in…

You could have paid $6,500 for 500 shares of that stock — and watched $1,800 of it vanish into thin air…

Or you could have paid just $2,500 to trade those same 500 shares — and profited 4X your initial investment.

Even better, the more tech stocks fall…

The faster your “Crash Contract” gains could start to pile up.

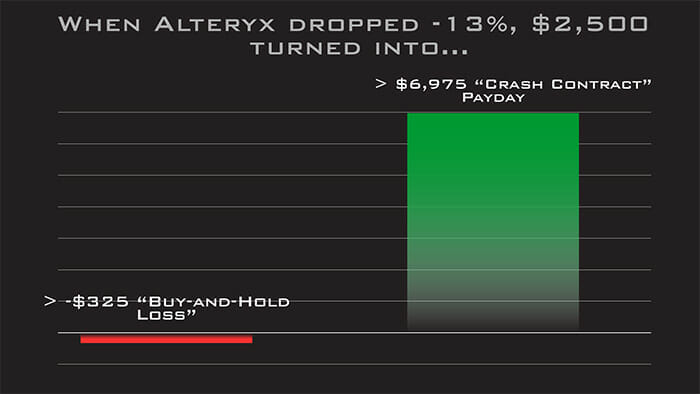

Like when this 13% slide in the computer software company Alteryx…

Turned into a 179% “Crash Contract” gain in 22 days.

Turning every $2,500 invested into $6,975…

Instead of losing 13 cents of every dollar you would have put into buying those shares outright.

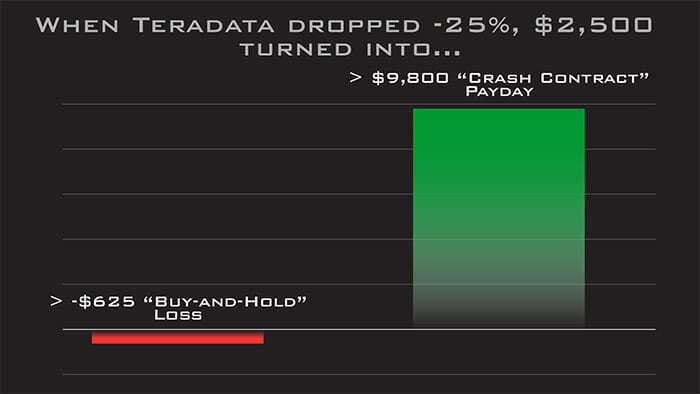

Or this 25% buy & hold nightmare slide on the cloud software company Teradata…

Turned into a sweet 292% gain after just over a month…

Again, saving you from watching a full quarter of your initial stake get sucked down the drain…

Instead converting every $2,500 invested into $9,800.

Now, get this…

So far I’ve shown you the kind of gains I was seeing back when folks were still able to convince themselves the economy was recovering…

In other words, these “Crash Contract” gains happened when the cracks were just starting to appear — before the dam burst…

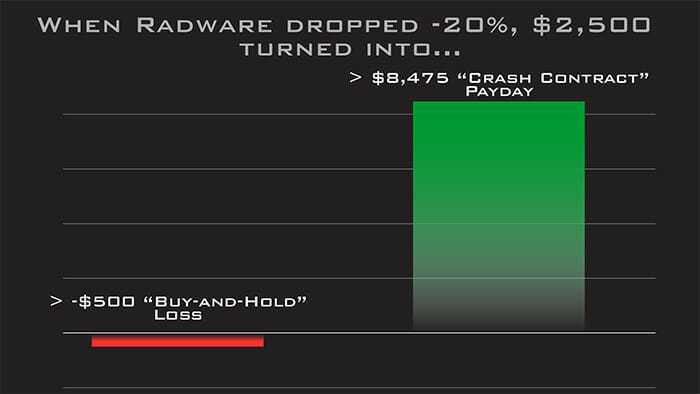

Like in February 2022, when I singled out the cybersecurity company Radware as primed for a fall…

And a 20% collapse on the stock’s price…

Sent the “Crash Contract” I recommended soaring 239% in under 2 months.

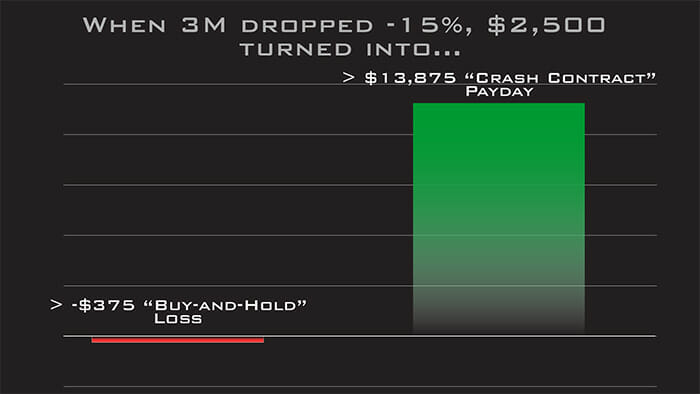

Or when a 15% drop in the multinational giant 3M at the end of August…

Could have handed you a 555% “Crash Contract” gain in just 19 days.

That’s enough to turn $2,500 into a $13,875 payday!

And while the gains I’ve described may be exceptional…

They are only a fraction of the opportunities my system has pinpointed.

And as I’ll explain in a minute, even with all the current chaos I believe we are still at the beginning stages of this tech crash…

This is no simple blip on the radar before everything returns to “normal,” my friend.

We won’t get out of this mess anytime soon.

But that doesn’t mean you and I can’t profit through it.

My system hunts for these kinds of stock-drop profit opportunities day and night…

Scanning 630,000 tickers… parsing through countless potential trades…

And pumping out only the best profit opportunities that come from “Crash Contracts.”

And just to prove to you just how confident I am that my system will work for YOU…

I’m going to show how to get your hands on the name and ticker symbol behind a “Crash Contract”… with the potential to hand you a quick payday worth up to $24,525… FOR FREE

And no, these “Crash Contracts” are NOT some multi-leg “iron condor” derivative trade that you need a master’s degree to understand…

A slow- bleeding “short-sell” technique…

Or a credit swap that takes a million bucks just to get a seat at the table.

In fact, if you’ve never heard of anything like “Crash Contracts” before…

You’re not alone.

Here’s how Barron’s recently referred to the investment strategy behind what I call “Crash Contracts”…

And make no mistake…

“Wall Street secret” doesn’t mean overly technical and complicated…

At least not in this case.

CNBC says this…

Truth is, snapping up your first “Crash Contract” couldn’t be simpler.

Just a few clicks or a quick call to your broker… could put you in position to profit when tech stocks DROP like a stone

When I say just a few clicks… I really do mean just a few clicks.

We’re talking maybe 2 minutes of “work” once you’ve got a few of them under your belt…

And if you place a call your broker instead… it’s just as fast and simple.

Seriously, driving to Home Depot to pick up a replacement flapper for your toilet… THAT’s complicated compared to picking up a “Crash Contract.”

Heck, you could make this move on your smartphone while waiting in the checkout line with your groceries!

At the same time…

“Simple” doesn’t mean wimpy profits.

“Crash Contracts” are one of the best strategies I’ve ever come across for bagging huge, fast gains.

And I’m not the only one who thinks so.

When talking about this strategy, Market Watch declares…

It’s thrilling to know that you have a shot at banking huge gains when pumped-up stocks come crashing back down to earth…

Especially if you got burned when the Dotcom bubble burst in 2000.

But this time around, you won’t be handcuffed while crashing tech stocks fall through the floor.

Because with the “Crash Contract” technique I’m revealing today…

You have the shot at turning plummeting tech stocks into monster gains.

And while I’m excited to show you how these trades work…

(And even more excited about the $24,525 potential profits they could hand you…)

I do want to be clear about something…

I’m NOT excited about watching these tech stocks crumble.

And in the long-term, I’m certain that technology — and the might of American innovation — will continue to be highly lucrative for investors.

But, as you’ll see today, in the short-term, all the signs are clear…

The dam has burst… and we’ve just gotten started.

And while the flood of crashing stocks rages, some tech companies are going to fall harder and faster than the rest.

My system locks onto these “Hindenburgs” like a heat-seeking missile…

And sets you up to pocket profits when they plummet.

I know this whole idea probably still feels weird.

Betting against stocks, and potentially winning like never before…

Is that even… fair?

But when you have a look at the pumped-up stocks I’m highlighting for you today, I think you’ll agree that they deserve to go down.

(Or at least that you deserve to a shot at making money hand over fist betting against them.)

And the reality is — if you don’t make these trades…

Someone else will.

In other words, when it comes to these “Crash Contracts”…

We’re not looking to revel in anyone else’s pain…

It’s not personal. It’s just business.

And business is about to boom.

My system has uncovered some “Crash Contracts” with the potential to hand back 3.5X… 6.5X… up to 21X your money… in a single shot

With those kinds of profits, your life may never be the same (as long as you get off the sidelines and ride the wave).

Which is why I’m sending this urgent message to you today.

Which is why I’m sending this urgent message to you today.

Hi, my name is Jim Pearce.

I’m the Chief Investment Strategist here at Investing Daily.

And over the past 33 years, I’ve helped investors profit from uncertain and chaotic markets.

First, while working on Wall Street with $50 million under my direct control…

(My “High Net Worth” clients were happy to see they didn’t lose a dime during the 2008 financial crisis.)

And now I help everyday investors cut through the stock market mayhem to stack up potentially life-changing profits.

These are good folks, like Doug I., who was so thrilled with my recommendations he wrote:

And Michael L., who also wrote in:

And then there’s Chris, who shared this:

Now I can’t promise you’ll achieve the same extraordinary results as these folks.

And hopefully you already understand that nothing in the stock market — as in life — is ever guaranteed.

But today, I want to show you a strategy that you absolutely NEED right now for any hope of financial survival in the coming mayhem.

To be frank, the stock market is only going to get uglier before it gets better.

To some that’s scary news…

But for you, if you follow my lead today, this could be one the most lucrative opportunities of a lifetime.

Because today I’m revealing a unique type of trade primed to pump out big profits when the stock behind my #1 “Crash Contract”… goes DOWN.

And if the 2000 Dotcom bust is any indication of what’s to come…

Tech stocks TODAY have a lot further to fall.

Do you remember seeing this headline back in the 2000?

Even if you don’t remember the headline… no one who lived through it could forget what came next.

The NASDAQ fell off a cliff. In 2000 it collapsed 39.28% alone.

But here’s what everyone seems to forget.

Tech stocks kept falling… and falling…

A FED interest rate hike burst the tech bubble and sent the economy into a recession…

And tech stocks continued to plummet until they finally hit rock bottom in 2002.

It was HORRIBLE if you got caught holding gutted-out shares…

But, oh boy — it sure was GREAT if you were using what I call “Crash Contracts”…

TWO YEARS that handed investors the chance to make great profits with “Crash Contracts” like:

- Intuit’s 10% drop… that could have handed you a 371% gain in just 3 days…

- Autodesk’s 23% plunge… would have given you the chance to see a 633% gain only 4 days later…

- And the mighty Apple’s 23% “correction”… that could have handed out a whopping 1,996% gain – in a mere 10 days. That’s good enough to multiply $2,500 into $52,400.

And remember… all of these plays were on stocks that were going down.

A few quick clicks in your brokerage account is all it would have taken to get in on the action!

And while those gains may be long gone… what’s coming our way THIS TIME could soon make those “stellar” returns look like a drop in the bucket.

But this time will be different… this time you won’t have to sit on the sidelines.

All you need to get into these explosive opportunities is a web browser and an internet connection.

(Or even an old-school land line with a rotary phone will do the trick!)

Now these “Crash Contract” gains are exceptional… and your experience may be different with the “Crash Contract” I reveal today.

But it’s clear there are fortunes to be made when you know how to pick off the biggest stragglers in a stampede of pumped-up tech stocks.

And those kinds of gains are back on the table with my #1 “Crash Contract”…

Because…

We have been repeating the first phases of the Dotcom crash — for OVER A YEAR!

Consider — Big Tech’s FAANG stocks have had their teeth ripped right out of their swollen heads…

They’re barely hanging on by their gums.

Facebook (Meta) shares plummeted 70% year-to-date… at one point making it one of the five worst-performing S&P 500 stocks in 2022…

Apple took a 15% hit…

Amazon got smacked hard in the mouth, losing 40% year-to-date…

Streaming giant Netflix plunged hard, losing 50% of its market cap… but, hey, at least they went from last position on the S&P 500 to number 484…

And Google (Alphabet) shed 36% of its market cap compared to last year.

And for what it’s worth, we can throw in tech darlings Microsoft and Tesla — which each went down over 30%.

Add it all up…

This represents well over $1.4 trillion in lost market cap. From just 7 tech stocks.

And yet if you believe Bloomberg, the worst is still to come.

Remember, I said “the first phases” of the Dotcom crash — unfortunately, there’s a LOT more pain to come.

Look: you might think I’m just using scare tactics during a small “lull” in our former bull market…

That’s fine. It’s your call.

Just understand this…

Ignoring what I’m saying today could cost you big time, tomorrow.

Because what I’m doing is essentially like dialing back the clock and giving you the opportunity to profit from falling stocks like in the last tech bust.

That’s why I’m beating this drum so hard.

You can forgive yourself for missing out when the world went to literal hell and tech stocks collapsed in the early 2000s…

But if you miss out this time around…

Especially after seeing everything I’ve just shared with you…

Well, I hate to say it but…

THAT’S on you.

The sentiment about tech stocks has changed.

The days are long gone when these companies could rocket to the moon on the promise of growth….

Now they need to show REAL profits — you know, like REAL businesses.

Making money is going to get harder and harder for a lot of companies…

Because the FED interest rate hike that burst the 2022 bubble…

Well, it isn’t over yet. Not even close.

Forbes reported:

With each tick UP in interest rates…

The economy gets pushed closer to a recession.

Just like in the Dotcom crash, we could watch more of the dam collapse and get swept away…

Back in 2000, the blood-letting began while interest rates were higher (more on that in a second)…

But the tech bubble was there. And once it started to burst…

There was no stopping it.

Remember: The Dotcom crash ran all the way from 1999 through 2002…

Which is one reason I believe we’ve just gotten started with the current tsunami of pain.

This time, the crash got started when interest rates were LOW…

But not anymore.

You knew it was coming…

This hit the technology sector H-A-R-D.

And just like in the Dotcom crash, each tick UP in interest rates…

Will just add more fuel to the fire…

Remember, right when the Dotcom frenzy was getting red-hot in the year 2000…

Then-Chairman of the Federal Reserve, Alan Greenspan, decided to cool off the mania by raising interest rates…

Three times in 1999…

And a fourth time on February 2, 2000.

This is important because…

As interest rates inched up, the return on “safe” bonds started to look more appealing than holding risky tech stocks.

Then on March 21, 2000, the FED pushed up interest rates again.

In a matter of months, the FED raised rates from 4.75% to 6%…

And that herculean leap set off an unstoppable chain reaction in the stock market.

Investors started to dump tech stocks in favor of bonds…

Panic took hold as the selloff intensified.

And we witnessed one of the most astonishing crashes in stock market history.

Which is one reason why the soaring interest rates we’re seeing now have me very, very concerned…

I believe it means the government is just setting us up to watch more of the dam crumble and get swept away.

In other words…

We’ll witness this tsunami of crashing tech stocks pick up more speed and power… and cut an even wider path of destruction.

(And THIS is the fastest and easiest way to scoop up the profits from the biggest drops.)

Listen, there will be glimmers of good news for certain tech stocks in the months to come…

But it won’t be enough to stop the flood. Not even close.

On the other hand, the bad news will likely keep rolling in like clockwork. Month after month…

But with the system I’m showing you today, you’ll be able to position yourself to reap BIG profits from the mayhem… while most other investors simply panic and try to pick up the pieces.

And it all starts with the ONE technology stock I’ve pinpointed that has the potential to fall harder and faster than all the rest.

This big loser could pile up huge, fast “Crash Contract” gains.

In fact, if all goes to plan…

Investors who tap into this “Crash Contract” could put as much as $24,525 in their pocket.

So it’s best to get in TODAY, so you’re positioned for the biggest possible profits.

Now, when it comes to making profits from crashing stocks…

The first thing that comes to mind for many investors is…

Short selling.

But I want to make this clear…

“Crash Contracts” do not involve shorting a stock.

Shorting a stock leaves you too open to tremendous risk… just ask the guys at Melvin Capital…

They shorted GameStop.

And when the Robinhood crowd drove share prices through the roof…

They lost $4.5 billion.

Instead, “Crash Contracts” are the most basic form of an options trade.

Now before you run for the hills because I said options, give me just a few minutes to put your mind at ease…

The simple options trade I use to profit from these falling stocks removes the major risks associated with short selling.

Meaning there are no margin calls or painful short squeezes.

I’ll say it again — this is the exact opposite of some multi-leg “iron condor” derivative trade… slow-bleeding “short-sell” technique… or credit swap that takes a million bucks just to ante in.

And most importantly, unlike shorting a stock…

With this strategy, your losses, if any, are always capped.

Which means, even if the stock starts to go up…

The most you stand lose is your initial investment.

But, while your losses may be capped…

Your profits are virtually unlimited

Best of all: if you know how to buy a stock, you can easily make the options trade I’m talking about.

All it takes is a few extra clicks in your investment account (or a short call to your broker)…

And you should be all set to potentially pocket monster profits when stocks plummet…

If you’re not already.

So, before I lift the hood and show you how my system actually works…

Let’s take a look at how this kind of strategy has changed the lives of some other real-life, down-to-earth folks.

(Spoiler: as far as I know, none of these folks are Wall Street insiders or financial whiz kids.)

Let’s take David H., who used this approach to turn a 142% profit with just 1 of these trades.

That’s enough to turn every $500 invested into $1,210 — at a time when the S&P 500 gave a negative return of 18%!

And another one of our fans named David scored BIG with a single-trade home run…

Can you imagine it? Profiting eight times your money — from a single trade? With just a tiny tweak to the way you normally trade stocks.

Without sitting glued to your computer for 10 hours a day, frying your eyeballs as you gaze non-stop into 3 giant monitors…

That’s what my top-level trading service, Mayhem Trader, is all about.

John N. knows this, and wrote in:

And Todd H. kept it short and sweet…

A gain like that would turn every $500 invested into $5,500!

Of course, not everyone has this level of success following my work… every trade is a different opportunity and the amount you stand to make is directly dependent on how much you’re willing to put down on these “Crash Contracts.”

And yes, on occasion some trades do turn against us… just like any investment, there is the potential to lose money.

But it does show what’s possible.

Best of all, I’m going to make trading options a turnkey, no-brainer for you today…

And it’s all thanks to my proprietary options trading system.

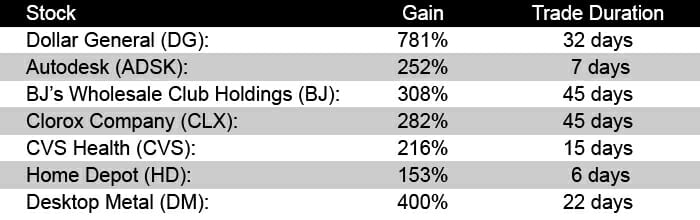

One that allows me to put together trades that can deliver huge, fast potential profits from stock market mayhem. Like these…

- 781%… in 32 days

- 505%… in 3 days

- 400%… in 22 days

- 252%… in just 7 days

- 308%… in 45 days

- 555%… in only 19 days

- 653%… in a mere 7 days

This is the precise system that uncovered my #1 “Crash Contract” which could hand you a quick $24,525 payday.

If you’re still with me, you are just a few moments away from getting your hands on everything you need to make this trade today.

But before we get to that…

You need to know: you can’t just jump online and randomly pick any old “Crash Contract”…

That’s a recipe for disaster.

You need guidance.

So it’s only fair to give you a quick peek “under the hood” to show you how my system works.

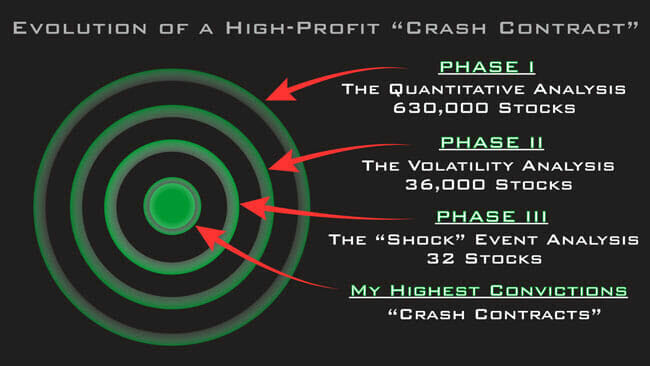

It starts with…

Phase 1: The Quantitative Analysis

You can think of this as the “how naked is the emperor?” step…

And we can actually measure the answer precisely.

My computer screens through 630,000 stocks with a series of valuation ratios…

- Price-to-Sales Ratio

- Price-to-Cash-Flow

- Price-to-Earnings-Growth

This analysis is important because…

A stock with these abnormally high ratios is overvalued.

Or in other words, it has a long way to fall.

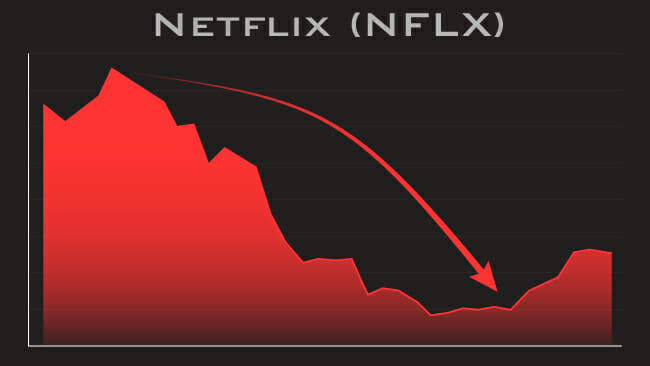

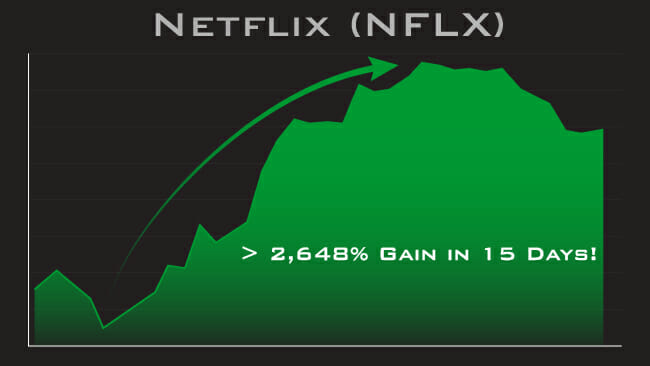

To show you what I mean, let’s take a look at when Netflix had an abnormally high Price-to-Earnings ratio.

Now to set up the example, let’s remember that the Price-to-Earnings ratio (or P/E ratio for short) simply compares the stock price of a company to the company’s profits.

That’s important because it gives investors a standard measure to compare companies…

In a similar way that batting average lets us compare hitters in baseball.

In general, a company with a low P/E ratio compared to its competitors is considered undervalued.

And a company with a high P/E ratio compared to its competitors is considered overvalued.

OK, now that we have that covered, let’s look at the Netflix example…

Back in 2011, the average P/E ratio for entertainment technology stocks was 24.

That means any entertainment tech stock with a P/E ratio over 24 was considered overvalued.

Now that same year, Netflix had a P/E ratio as high as 68.32.

Simply put, Netflix was extremely overvalued…

An indication that the stock was due to drop hard and fast.

That’s exactly what happened.

Subscribers revolted against a price raise and quit the service.

And Netflix plummeted 62%.

But investors who could see the writing on the wall and picked the right “Crash Contract” had an opportunity to pocket a 2,648% gain in just 15 days.

That would have turned every $500 invested… into $13,740!

In just 2 weeks.

More importantly, the further a stock falls, the higher potential profits for our “Crash Contract.”

After Phase 1 analysis, the universe gets narrowed down significantly.

From there I want to find which of these high-flyers could fall the furthest… the fastest.

Which brings us to…

Phase 2: The Volatility Analysis

With the new list of high-flying, precariously-priced stocks, my computer eats through millions of data points per day: crunching through endless gigabytes of trade volume, advanced decline lines, Bollinger bands, and more…

And a “deep dive” analysis is critical here…

Because it separates the minor volatility blips…

From the deeper-rooted, persistent, and correct doubts.

The companies that get singled out by this test become my highest-conviction targets.

But even when I’ve got my crosshairs locked dead center on a target…

There’s still a final key step to ensure you’re only getting the biggest, fastest profit opportunities on the market.

Phase 3: The “Shock” Event Analysis

In this final phase, I take a “hands-on” approach.

I personally scour the financial news and tap into a rolodex of industry contacts that only comes with years of experience “in the trenches”….

To pinpoint specific, fast-approaching “shock” events that will likely trigger a selloff…

And more importantly, identify a “Crash Contract” profit opportunity.

To sum it up, the road to uncover “Crash Contracts” looks like this:

And when it’s all said and done…

You’re getting trades on the verge which major price movement, which could explode in a matter of DAYS

Like the one I’m tracking as I write this today…

My Current “Crash Contract”…

WEX Inc (WEX): This Payment Processor’s “Swan Dive” Could Take the World by Surprise

WEX Inc. provides financial software to help companies manage fuel, travel, and other recurring expenses. In other words, they make it easier for companies across the world to simplify benefits, optimize transportation, and make and receive payments.

They focus on small businesses, especially the vehicle fleet industry, online travel agencies, and health care.

WEX recently released its 2022 full-year results which were highlighted by a 24% jump in quarterly revenue compared to last year. They also recently rocketed to their highest closing price in eighteen months…

This is likely why Wall Street has been showing such confidence in the company.

But I have my doubts…

Let me show you exactly why WEX ticks all the boxes my system requires to set it up as a “Crash Contract.”

First, the stock is way overpriced.

It wasn’t so long ago that WEX appeared to have hit the bottom, at just over $125.

Fact is, some tech stocks have experienced a “dead cat bounce” over the last few months…

You know the old expression — “Even a dead cat will bounce if it falls from a great height.”

These tech stocks fell A LOT when the bubble burst… and it’s not uncommon to see a temporary bounce down the road…

Even though the stock may already be dead on arrival.

Which is exactly what I think we’re seeing here with WEX, as it recently shot up from $125 a share to $200…

However, what’s bad news for them — could be a perfect opportunity for you…

Because the company shows signs of being spread too thin.

They started in energy — but now they’ve moved into transportation, finance, and even health. This stretches their software too thin and takes them out of their areas of expertise.

It’s almost like they’re trying too hard to be everything to everyone… and that loss of razor-sharp focus could end up hurting their stock’s value.

And speaking of getting spread too thin…

These folks operate on five continents. There’s nothing automatically wrong with that — it can be great when a company expands…

But for a younger company… and after that much expansion so quickly…

It could be that they’re set up for a big plateau as they find it harder to keep tapping into new markets around the globe.

Then there’s the whole issue of offering services through “the cloud”…

Let’s face it: everyone is on the cloud now.

We’re likely moving into a time when really high margins for offering cloud-based services are a thing of the past…

And businesses once willing to shell out big bucks on cloud computing now look cut costs…

And tech stocks are likely to take the brunt of the hit

It will get harder and harder to charge a premium. And that could spell BIG trouble for a cloud services company like WEX.

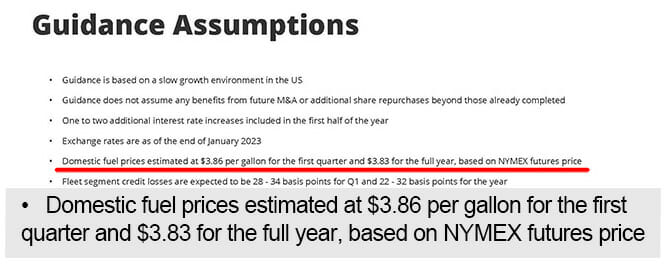

Finally, this company is especially vulnerable to rising gas prices…

In fact, they recently said as much in their latest quarterly earnings presentation — right on page 14!

If fuel prices go the wrong way — they’re going to be in real trouble.

I could go on…

Like how they’ve seen major “credit losses” as trucking customers — the core of their business — struggle to make payments as the economy deteriorates…

Bottom line: I know it makes folks feel good to see a tech company doing well right now. It gives them hope.

But hope doesn’t pay the bills — not in families, and not in corporations.

And as you can see…

When we dig a little deeper…

It becomes clear why I believe this firm looks like it’s about to go the way of Peloton… the FAANGs… and so many others.

One which could hand out HUGE gains on the ride down…

IF you pick up the “Crash Contracts” my system singles out.

But here’s the thing…. if you want to turn this soon-to-be loser into a potential profit windfall…

Two things need to happen…

First, don’t just rush out and buy the stock…

You need the options code for this trade to work….

I don’t encourage you to fill in the gaps on your own, of course.

There are dozens of option codes to choose from.

Each with its own risks and rewards.

My system isolates the optimum option trade for you to tap into for maximum profits.

The second thing (and this is KEY) is that you need to make your move NOW.

Remember, these “Crash Contracts” are designed to get in the trade and out with the cash quickly…

In full transparency, the trade on WEX may have already come and gone by the time you read this.

But even if you aren’t able to get in before WEX takes a tumble…

My system is sniffing out new “Crash Contracts” on a near daily basis… and no matter what, when you join me today you’ll get the key details behind my current #1 “Crash Contract” (as outlined above) inside your copy of my special report…

Tech Crash Cash: Your Shot at Sky High Profits When The Next Tech Stock Goes Bust

Inside this exclusive report, you’ll find the FULL easy-to-follow instructions that let you execute this trade with little more than a few clicks of your mouse… or read out loud to your broker over the phone.

That includes:

- Exactly how to make this simple trade

- Exactly how much to pay (and NOT pay)

- Exactly which option code to enter (there’s 100s of them) — your broker needs this in addition to the stock ticker or this trade will not work

- Exactly how much profit you could make

Bottom line…

All my research is laid out for you…

In plain, easy-to-understand English.

And if everything I’ve said to you today has you chomping at the bit to discover the details of this “Crash Contract” then I’ve got good news…

Here’s how to get your copy of

Tech Crash Cash For FREE

It’s simple.

All you need to do is accept my personal invitation to join my elite research advisory called Mayhem Trader.

Within minutes of accepting this invitation today, you get the full details that will help you buy your first “Crash Contract.”

And you’ll be well on your way to lock in your shot at a potential $24,525.

While I believe my top “Crash Contract” could deliver BIG profits in 2023…

That’s just the beginning.

Remember, my system screens over 630,000 stocks each day for the biggest movers…

Which identifies “mayhem profit” opportunities with stunning regularity… across ALL industries.

Just take a look for yourself:

That’s proof positive that you could have turned a $500 stake in each of these opportunities…

Into $11,960 in profits…

In just days and weeks, not years and decades.

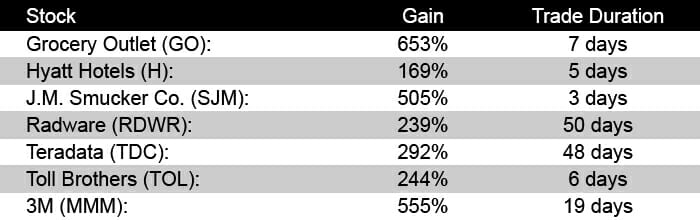

And there’s more, like…

These trades would have turned a small $500 stake in each company into a $13,335 windfall…

Again, in just days or weeks.

While the markets have caused so much pain to Americans and their portfolios…

With trillions in retirement gains wiped out…

My subscribers have had the chance to use my system to profit from the mayhem, over and over again.

And remember, these gains didn’t take a decade to drag in.

With each of the trades we’ve featured today, you could have cashed out in weeks… not years.

Of course, not every trade is a winner, and just like with any other financial move you make… nothing is guaranteed.

That said… out of the 38 trades recommended in 2022, we walked away with an average GAIN of 49.27%…

In a year that saw:

- The Nasdaq Composite hand back a 33.1% loss…

- The Dow Jones Industrial Average dip 8.8%…

- And the S&P 500 give up 19.4% for the year

The trades discussed today were all real recommendations that a small group of elite investors had the opportunity to take part in…

And they’re the exact type of trades I want to send you every single month.

Right now, you have the opportunity to secure your shot at a potential truckload of profits inside Mayhem Trader…

When you say “Yes” to my special invitation today, you’ll immediately receive your copy of Tech Crash Cash.

Along with…

YOUR EXCLUSIVE MEMBERS-ONLY PROFIT KIT:

- Brand-New Trade Alerts EVERY Month: The market never goes on vacation — and neither do we. Each month, I’ll hand you the BEST trade my system singles out. And if it zeroes in on more than one? That’s more shots for you to go after HUGE gains like what you saw today.

- Full Access to my Model Portfolio AND My Watchlist: All of my current and future “buy” recommendations, right at your fingertips 24 hours a day, 7 days a week.

- Private Access to the “Members Only” Mayhem Trader Website: Your personal online cockpit for navigating the markets & lining up promising “Mayhem Trades” using my quick-to-implement method. I do the heavy lifting — you just enter a few keystrokes in your account or place a quick and simple call with your broker.

- PLUS: Weekly Email Updates and so much more!

And when you take action today, you’ll also get…

Mayhem Trader New Member Bonus #1:

The QuickStart Trading Guide to Turning Mayhem into Money ($229 Value: Yours FREE)

Your easy QuickStart guide will give you EVERYTHING you need to profit from my research, including:

Your easy QuickStart guide will give you EVERYTHING you need to profit from my research, including:

- How frequently to expect new plays

- What makes some of them pop faster than others (only if you’re interested in what’s “under the hood” — not necessary to profit)

- How to close out your trades for fast profits

- Our favorite brokerage platforms & which one is right for you

- What to do once you’ve secured a big gain in a short time

- And much, much more!

But here at Investing Daily, one of America’s oldest financial publishers… we don’t just hand you trade instructions and send you on your way.

In a growing jungle of misinformation, fearmongering, and fly-by-night “advisory services”…

We’re one of the rare few publishing groups whose track record spans decades… some of our work goes all the way back to 1974.

We emerged through BOTH the Dotcom bubble and the Great Recession of 2008.

Stronger than ever.

And joined forces with StreetAuthority to broaden our reach even further.

It pays to ride with a team who’s been there again and again and emerged on TOP every time.

But in the spirit of making this decision as easy as possible for you…

I’ll also hand you instructions on an odd trade that lets us in on some of these “Crash Contracts” for zero dollars down

Your second New Member bonus is called…

The Zero-Dollar Trade: Your Quick Guide to Getting “Crash Contracts” Practically for FREE

This report is valued at $249, but when you join Mayhem Trader today, it’s yours FREE.

This report is valued at $249, but when you join Mayhem Trader today, it’s yours FREE.

Inside are instructions on how to greatly reduce the price to make these “Crash Contracts”…

And in some cases how to make them completely free… while at the same time maximizing your potential gains.

And while the Zero-Dollar trade comes with more risk…

The potential rewards are enormous.

Now, if you’d rather stick to your shot at up to $24,525 from the normal “Crash Contracts” — no sweat.

But if you’re the type who likes to jump straight into the “deep end” with both feet, this FREE report was made for you.

Add it all up and you’re getting $478 worth of bonuses for FREE when you join Mayhem Trader today.

But I want to go one step further.

I’d like to hand you a HUGE

Quick-Action discount too!

Normally access to a year’s worth of Mayhem Trader recommendations runs $5,000…

And considering you could make as much as $24,525 on your first “Crash Contract” alone…

You’d probably agree that joining Mayhem Trader at its full retail price is a screaming deal.

But you won’t pay $5,000 when you agree to join me right now…

The markets are a disaster, Americans are hurting…

And my system is designed to pinpoint profit opportunities in exactly these conditions.

It just doesn’t make sense to insist on offering it at full retail. Not now…

So I’m going to slash thousands off the price, to get the ball rolling.

That’s right! You can get started with Mayhem Trader today for just $1,950.

Or in other words, for what many folks spend on a cup of crappy gas station coffee per day…

You could lock in a shot at stacking up profits, month after month for an ENTIRE year.

(Your credit card will NOT be charged… and you can review ALL of your order details)

I must note that there are no refunds when you join Mayhem Trader.

I'm sorry if that seems harsh.

But my experience has been that the folks who have the most success with my program are the ones serious enough to put some real skin in the game...

And are OK with the fact that all sales are final.

But if you have even the LEAST bit of doubt about joining me today...

I have one last thing that I believe will help you overcome your last-minute jitters.

Today when you join Mayhem Trader...

You're covered by our “20/20 Guarantee”

If for some reason, you don’t see the opportunity to lock in twenty total winning trades over the next 12 months... or at least one gain of 20x your money or more...

Just reach out to our VIP concierge via phone or email...

And we’ll give you a full credit for the amount you put into Mayhem Trader today.

You can use it for another full year of Mayhem Trader, as a way of letting me make good on my promise…

Or you can use it towards any of our other premium advisories at Investing Daily.

No hard feelings.

No questions asked.

That's how confident I am that Mayhem Trader is the very best trading system available to you in 2023 and beyond.

But there is just one catch...

I can only extend this special offer to a limited number of investors today

I wish I could let the doors open forever.

But my publisher insisted he wasn’t going to let everyone join under this insane discount.

The good news is… since you’re seeing this special presentation, he hasn’t shut the offer down yet…

So don’t delay – make your move now!

Let's recap everything you'll get when you join Mayhem Trader today.

- Tech Crash Cash: Your Shot at Sky High Profits When The Next Tech Stock Goes Bust

- Full-Year membership to Mayhem Trader (at a HUGE discount)

- Mayhem Trader New Member Bonus #1: The QuickStart Trading Guide to Turning Mayhem into Money ($229 Value | Yours FREE)

- Mayhem Trader New Member Bonus #2: The Zero-Dollar Trade – Your Quick Guide To Getting “Crash Contracts” Practically for FREE ($249 Value | Yours FREE)

My research indicates that the tech stock crash has just begun...

Which means you have an important decision to make... and there's no time to waste.

I'm ready to send my #1 "Crash Contract"...

Along with the QuickStart Trading Guide and the Zero-Dollar Trade reports...

Directly to your inbox the moment you take up my offer to join Mayhem Trader today.

Click the button below to take the next step right now.

(Your credit card will NOT be charged… and you can review ALL of your order details)

The choice is now in your hands...

Are you going to simply sit back and watch what could be the biggest moneymaking opportunity of a lifetime from the sidelines...

Or are you going to lock in your shot at up to $24,525 in profits today?

You've seen how market mayhem holds the potential to 21X your money when tech stocks drop.

And you've seen the blaring warning signs that the flood of crashing tech stocks has a L-O-N-G way to go before it plays out.

Your best move is to act now.

After all, it only takes a slight move in interest rates — or even some other unforeseen event — to trigger a fresh round of falling values.

And when tech stocks plummet, most investors will be left watching a massive profit opportunity pass them by.

But with Mayhem Trader, you'll have everything you need to scoop up the profits...

Starting with this #1 "Crash Contract" that could hand you up to $24,525 in the weeks to come.

Right here, right now is your big chance...

As tech stocks crash and burn...

You can look back at this day as the time you let thousands...

And potentially ten of thousands of dollars...

Slip through your fingers.

Or you can remember it as the day you made a bold move for you and for your family...

And locked in your shot at profiting wildly from stock market chaos.

I've made the decision as easy as possible for you by adding on thousands worth of discounts and free bonuses...

And you're covered by my 20/20 Guarantee too...

But you must act now.

There are a limited number of spots open today…

And when they're all snapped up, we’re going to shut this opportunity down.

Don't miss out.

Click the button below to join Mayhem Trader today.

(Your credit card will NOT be charged… and you can review ALL of your order details)

I'll see you inside.

To your wealth,

Jim Pearce

Chief Investment Analyst, Investing Daily

Founder, Mayhem Trader

Copyright © 2023 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy