Secret Retirement Plan Distributes

$30.2 Billion in Government Cash Every Month…

Plus… A Shockingly-Simple Loophole

Allows Payments Starting At Any Age

Urgent Action Required Before November 30th

You’re about to discover how:

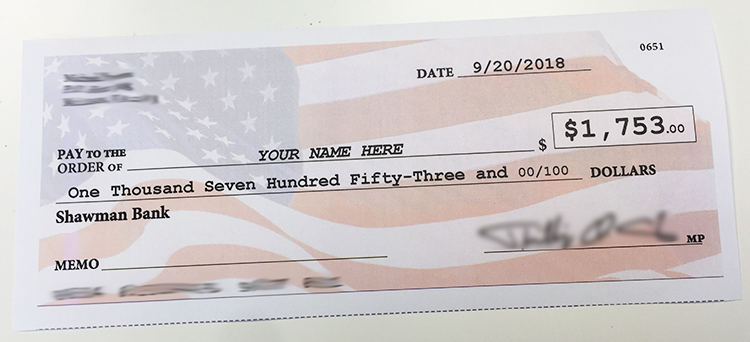

- Average Americans are receiving U.S. Government checks for $1,753 every month. (Some receive much more.)

- $363 billion in Freedom Payments will be distributed this year. (And annual payouts will almost double over the next 5 years.)

- It takes less than 10 minutes to add your name to the distribution list. (And you could receive your first payment in under 30 days.)

Dear Reader,

You already know the U.S. Government offers programs such as Social Security and Medicare to help Americans support themselves and cover the costs of healthcare when they retire.

You’re likely also aware these programs are paid for by taxes…

Primarily payroll taxes deducted from the paychecks of every American employee throughout their entire careers.

However, there’s something you may not be aware of…

Another little-known program will pay out

an additional $363 billion this year.

That’s not a misprint.

In addition to Social Security and Medicare, the U.S. Government has an additional pool of $363 billion available for distribution in the form of “Freedom Payments.”

And smart Americans are collecting their share of these payments each and every month.

Some receive checks like this…

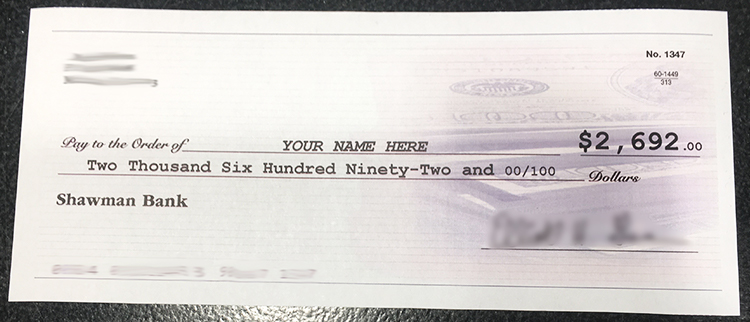

Others will open their mailbox and find one of these…

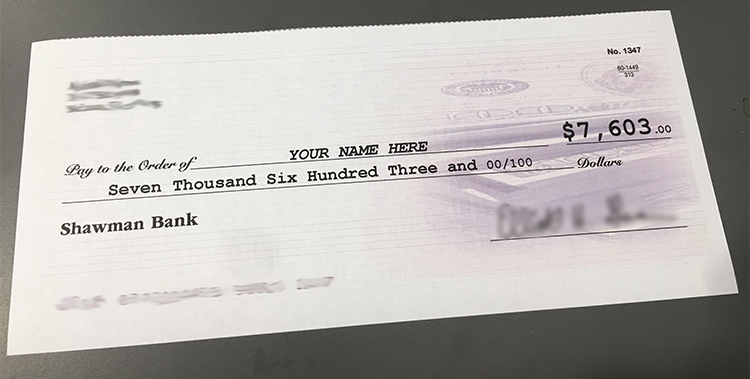

And others will walk into their banks each month and cash one of these…

If you cash a check for $7,603 every month, that’s an additional $91,236 in income you’d receive each year.

Imagine what you could do with an extra $91,236.

Imagine the luxury vacations you could take…

The incredible restaurants you could eat in…

And the amazing gifts you could buy your family and friends.

And if an extra $91,236 isn’t enough money to fund the retirement lifestyle of your dreams, there’s good news…

There’s no limit to the amount of

Freedom Payments you can receive.

In 2018, the average retiree will collect only $1,404 a month in Social Security benefits.

$1,404 a month amounts to $16,848 a year.

That’s better than nothing. But it’s nowhere close to enough to live on.

The problem is…

Aside from the periodic cost of living adjustments, there’s nothing you can do to boost your Social Security benefits. You’re basically stuck with what you get.

Thankfully, Freedom Payments are much more flexible.

In fact, there’s no limit to the monthly payments you can receive.

Once you’ve locked in your monthly benefit, you’ll continue receiving that same amount every month for life.

But at any point during your retirement, you can increase your monthly benefit with a simple 3-minute phone call.

I know that may sound a little “too easy” but I’ll explain exactly how it works in just a moment.

But first, here’s one of the most shocking facts about this “retirement” plan …

You don’t have to wait until retirement to collect Freedom Payments.

It may sound too good to be true, but…

Unlike Social Security, Medicare and other government programs, you can legally start collecting Freedom Payments at any age.

In fact, your current age, income, employment status, and geographic location are completely irrelevant…

It doesn’t matter if you’re an 18-year old student in Texas, a 38-year old surgeon in Indiana, a 58-year old truck driver in Ohio, or a 78-year old retiree living in Costa Rica…

By U.S. law, you qualify to receive Freedom Payments today.

Everyday Americans across the country

are taking advantage of an obscure,

101-year old law to collect Freedom Payments.

As you’re reading this, thousands of retirees across America are adding their names to the distribution list.

And you can, too.

Then, within 30 days, your first Freedom Payments check could arrive in the mail.

And every month after that, another check will arrive automatically… like clockwork.

With zero additional work or effort from you or your spouse.

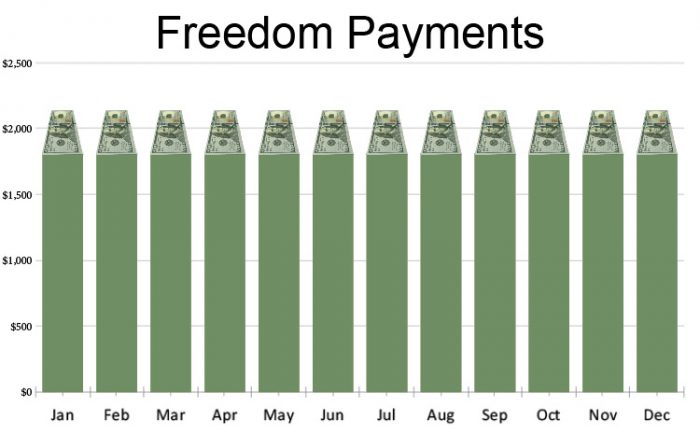

Freedom Payments are issued

the second week of every month,

January through December.

And with a very simple trick I’ll share with you, you can receive a check every month of the year.

It’s important to understand…

Freedom Payments are obligations of the U.S. Government…

Not a private, or publicly traded company.

This means whatever happens in the stock, bond, currency, or futures markets, your Freedom Payments checks will continue to arrive without fail during the second week of every month.

You may be wondering

why the government is doing this.

It won’t surprise you to know our elected officials in Washington D.C. aren’t distributing this $363 billion pool of cash out of the goodness of their hearts.

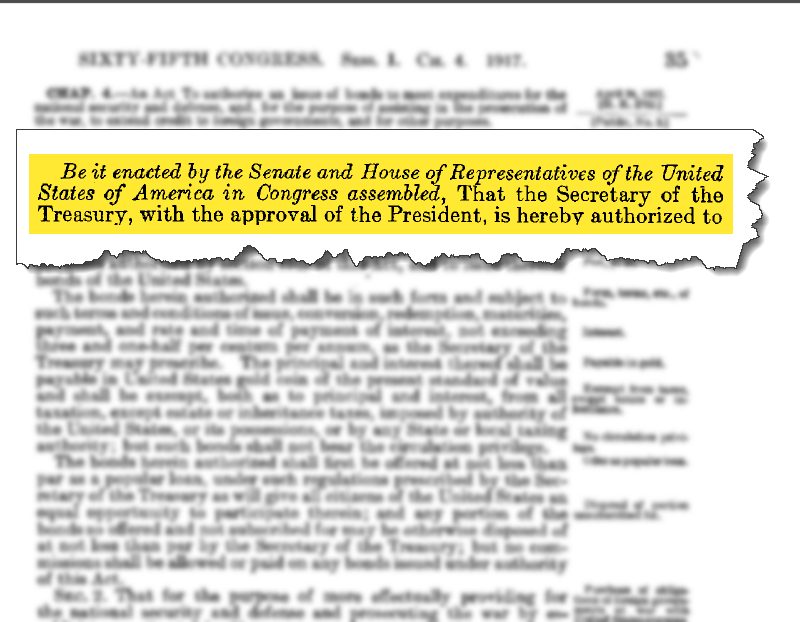

You see in 1917, Congress enacted a law giving the Secretary of the Treasury authority to make periodic payments to Americans whose names were on a special list.

And the law allowed tax dollars to be used to make these payments.

This exact wording of this can be found in the “Statutes at Large” archive in the Library of Congress…

If you’ve never heard of this law before, you’re not alone.

It’s buried deep inside 1,353 pages of dense legal language.

And at the time it was passed, America was just entering World War I.

So everyone in the country had much more important things to worry about.

But what’s important to remember here is…

This law requires the government to make

periodic Freedom Payments to

individuals whose names are on

the official distribution list.

And even though the law is over 100 years old, the government is still obligated to make these payments today.

Freedom Payments are guaranteed by the full faith and credit of the United States of America.

So unlike corporate dividends, Freedom Payments are essentially risk-free.

In fact, since the law was passed 101 years ago, the government has never failed to make a payment on time.

That’s great news!

It means you could be receiving checks like this every month…

In 1917, annual Freedom Payments amounted to only $70 million.

But payments have grown steadily over the past 101 years such that…

In total, the government is legally required to pay out $363 billion this year.

And that’s just the beginning.

In fact, Freedom Payments are expected to increase to $619 billion a year by 2023.

That means benefits could close to double in the next five years.

Creating even greater opportunities for you to collect monthly checks like this…

Or maybe even this…

Here’s where things get interesting.

The law passed in 1917 requires the government to distribute Freedom Payments to registered Americans, but…

It does not require them to advertise these payments publically or to even to mention they’re available.

By law, $363 billion worth of tax revenues have been earmarked and set aside for distribution this year.

And all you have to do to collect your share is register and get your name on the distribution list.

You can get set up in under 10 minutes.

It’s so easy, you can even use

your cell phone!

Depending on your situation, your Freedom Payments could be worth $1,753 or more.

And once you’ve locked in your monthly amount, your checks show up like clockwork each and every month.

And, as I mentioned earlier, unlike Social Security…

You’re able to increase your monthly Freedom Payments at any time.

And I’ll explain how to do that in just a minute.

In fact, in this short presentation, I’m going to explain everything you need to know about Freedom Payments.

Most importantly, I’m going to show you exactly how you can claim your share of this $363 billion pool of cash.

I’ll take you through every step as quickly as possible

Because every month, regular Americans are already collecting thousands of dollars in Freedom Payments.

And if you’re not receiving your share right now, there’s a very good chance someone else is cashing a check that should have your name on it.

Now before we continue, let me tell you a little about myself.

My name is Jim Pearce…

There’s a better than average chance you’ve never heard my name before.

There’s a better than average chance you’ve never heard my name before.

You see, I don’t have a graduate degree from an Ivy League college.

I haven’t written any best-selling books.

You’ve never seen me interviewed on CNN, Bloomberg, or CNBC.

And you won’t find me quoted in The New York Times, The Wall Street Journal, or The Financial Post.

I’m a lot more like you than the financial gurus you’re used to hearing from…

When I finished high school, I accepted a football scholarship to a small college in Virginia, graduated, and started working as a stockbroker at the age of 24.

My perfect day off includes boating on the Chesapeake with my wife and a few friends, enjoying a cold beer, and having a cigar after dinner.

But despite being a simple man with simple tastes, I’m a Certified Financial Planner with 35 years’ experience.

I’m also Chief Investment Strategist here at Investing Daily.

I’m not your typical “financial guru.”

Unlike the financial gurus you’re familiar with, I don’t spend half my waking hours focused on self-promotion.

The idea of posing for photographs, sitting in “hair and makeup” for a television interview, or waiting for a phone call from a reporter looking for a “hot sound bite” turns me off completely.

I’d much rather spend 100% of my time and energy on the things I’ve devoted my entire 35-year career to doing…

Helping people like you make smart investment decisions so you can enjoy a stress-free retirement.

Here are just a few of the many people my team and I have helped in recent years…

For example, there’s Mike Mastroni from Florida who wrote in to say…

And Dale C. who was excited to tell me about the $5,000 he made in record time…

Cathy Birmingham was ecstatic about the monthly gains we’ve helped her make so far…

Ben Werner has seen amazing results in his portfolio as well…

Then there’s Lou Myers from California who’s making the equivalent of a solid full-time salary from the recommendations he’s followed…

Tim Graybill wrote to tell me about the $63,000 he’s made so far this year…

Nate Zimmer is also having an amazing year…

And some of my proudest moments are when I hear from people like Maryann Myers who was in a really bad situation, and then…

I’m not sharing these results to brag.

It’s just that being able to help people this way brings me great satisfaction…

So, it doesn’t bother me one bit that book publishers, television producers, and newspaper reporters aren’t calling to ask my opinion.

It means I can stay focused and productive.

But despite doing my best every day for the past 35 years to help investors make money and prepare for retirement, I’ve discovered an unfortunate truth about the world of investing, and it’s this…

The stock market won’t protect

your assets in retirement.

There’s a good chance you’ve heard this advice before:

Now when the conditions are right, there’s a lot of wisdom in this advice.

Over the long term, equity markets have offered the highest returns for the average investor.

And during the peak earning years of your career, you can afford to take risks…

If you’re 10 to 25 years away from retirement, you have plenty of time to make up the money you could lose during stock market corrections and sell-offs.

And over the long haul, your wins will more often than not outweigh your losses.

So stock market investing is a good strategy… and it’s one I’ve used successfully for myself and my clients for over 35 years.

But let me tell you this…

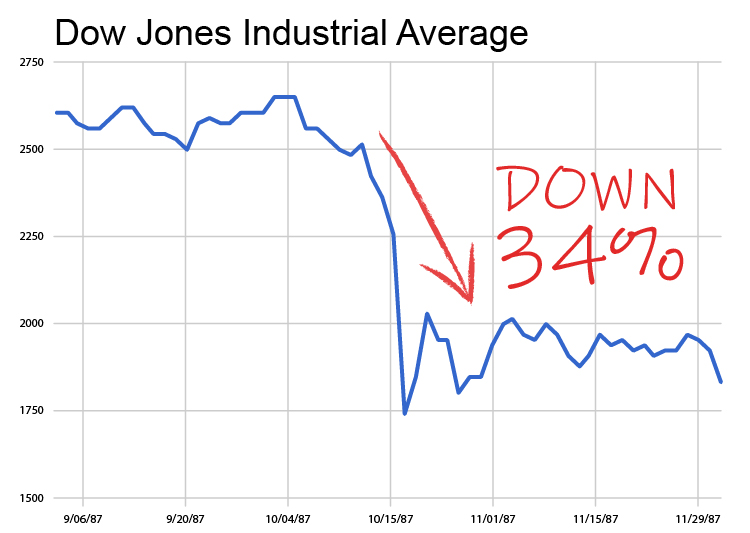

I was working as a stockbroker during Black Monday in 1987.

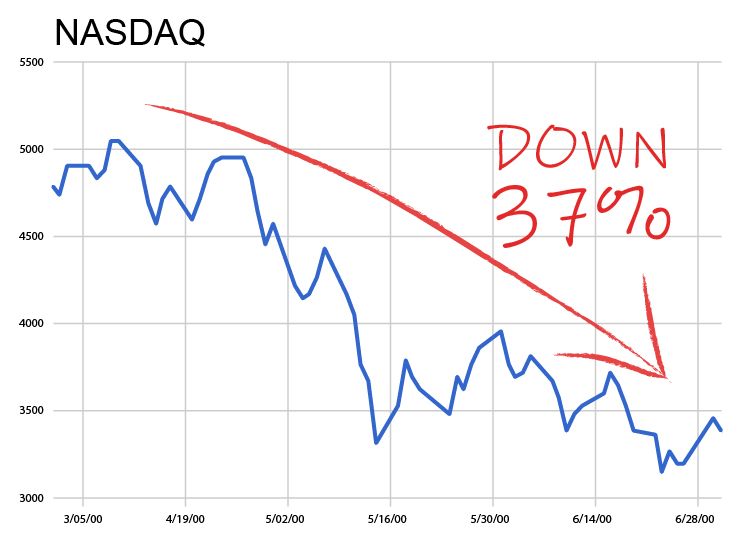

I was also advising clients during the Dot Com crash in 2000…

And again when the market tumbled during the mortgage crisis in 2009.

Each time there was a major market correction, I’d hear horror stories from regular, everyday investors who lost huge portions of their retirement savings almost overnight.

It took years for many of them to recover from those losses.

Some even had to delay their retirements in order to make up the savings they’d lost.

Hearing these stories reinforced my belief that a 100% exposure to the equity market can be a very dangerous strategy for anyone close to retirement age.

We’ve all heard the advice, “never invest more than you can afford to lose.”

But many people continue to hold the bulk of their life savings in the stock market, knowing full well they could be wiped out overnight.

It made me sick to see smart, hard-working people get their life savings decimated at the worst possible time—a year or two before they planned to retire…

Or worse yet, after they’d retired and were already relying on their savings to fund their lifestyle.

So I went in search of simple strategies my clients could use to protect their life savings and put their retirement income on “autopilot.”

Freedom Payments meet my

very strict criteria…

I told my analyst team we were going to find the best retirement income plan that existed anywhere in the market.

Any strategy we considered had to meet three very strict criteria:

- It had to completely shelter the portfolio from declines in the stock market,

- It had to generate rock-solid, risk-free income for up to 30 years, and…

- It had to be flexible—retirees had to be able to change their level of benefits at any time and without penalty.

We spent the better part of a year researching what was available.

Then one Tuesday morning at around 9:15 am, I was scanning through an investment journal when I stumbled across an obscure reference to a “Statute at Large” passed into law in 1917.

After several hours searching through the online Library of Congress, I found exactly what I was looking for…

The shocking details behind Freedom Payments

When I learned about Freedom Payments, I knew had to share my findings immediately.

In my opinion, it’s the very best way for you to avoid the stress and anxiety that goes along with every market blip you’ll see over the next 20 to 30 years.

But before we go further, I want to be very clear on what “Freedom Payments” are and what they are not.

First of all, Freedom Payments represent…

Stable, risk-free income that

does not depend on corporate dividends.

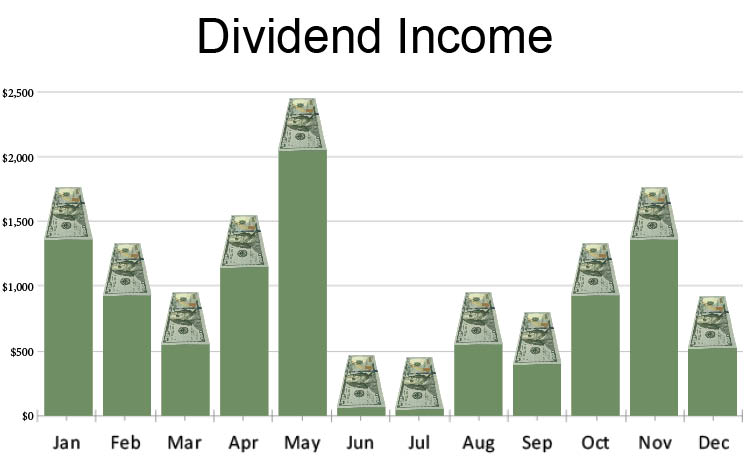

You won’t hear me bad-mouth dividends or the companies that pay them.

Dividends can play an important role in your overall investment strategy—especially during your productive, earning years.

But if you’re depending on the stability of dividends to fund your retirement lifestyle, you’ll want to pay close attention to what I’m about to share.

You see, a lot of market gurus will tell you dividends are the best way to create stable retirement income.

After all, blue chip companies generally pay dividends every three months, often increase dividends as profits increase, and rarely, if ever, miss a payment.

It’s a very convincing story.

And while it can be true…

It’s not always true.

Let me explain.

When times are good, a dividend income strategy can work well.

Dividends arrive every three months like clockwork. Your income remains stable and maybe even increases slightly over time. All is good.

But, when the overall economy starts to slow down—unemployment rates tend to increase, consumers tend to spend less money, and companies tend to become less profitable.

And when companies are less profitable, there’s always a risk they’ll decrease their dividends—sometimes even suspend them entirely—until profitability improves.

So if your long-term plan is to depend on the strength of the economy and the stock market to fund your retirement, you may quickly discover dividend income isn’t the “silver bullet” you were led to believe it was.

But what alternatives do you have?

Well, because Freedom Payments don’t depend on dividends, interest rates, unemployment rates, the state of the economy, corporate profits, or any other variable that can (and will!) surprise you in horrifically unpleasant ways from time to time…

Freedom Payments are an ideal way to put your retirement income on autopilot.

It truly is a “set it and forget it” strategy that lets you enjoy your golden years without the stress, anxiety, and regret you’ll feel every time the stock market dips into negative territory.

And here’s something else you need to know…

Freedom Payments are not an annuity contract

(and that’s a very good thing!)

Annuity contracts are agreements you enter into with an insurance company.

You agree to make payments to the insurer for a number of years prior to retirement and in return, the insurer makes predetermined, periodic payments back to you for life starting from the date you retire.

On the surface, annuities and Freedom Payments have similar features…

- They both produce regular, predictable income streams; and

- Your income doesn’t decrease if the stock market crashes.

But Freedom Payments differ from annuities in two very important ways:

1. Freedom Payments have no commissions or management fees

Annuity salespeople often charge hefty up-front sales commissions when they sell you an initial contract.

Plus… once your annuity is up and running, there can be annual management fees that add up quickly and put a dent in your retirement assets.

With Freedom Payments, however, while you may incur some very reasonable, standard brokerage commissions at the beginning when you transition into your new “plan”…

After that, you’ll be charged no fees at all for the ongoing management or administration of your Freedom Payments.

2. Freedom Payments are more flexible than an annuity

Annuities generally lack flexibility. Once you’re in, your capital is tied up—usually for life.

So, you lose the ability to access your own money, to spend it if the need arises, or to change plans completely and invest your capital in the stock market.

Instead, you’re forced to receive the same regular payments for life.

With Freedom Payments, you’re completely free to change your mind at any time.

You can change your mind about the amount of payments you receive or when you receive them.

You’re also free to move some or all of your capital out of Freedom Payments and into the stock market… any time you want.

Here’s something else you may be wondering about…

Why your broker hasn’t discussed

Freedom Payments with you…

As I mentioned earlier, Freedom Payments have been available to Americans for over 101 years.

So if they’ve been around for so long, why haven’t you heard about them before?

Well, there are a few reasons… and they’re very important to understand, so pay close attention…

Reason #1: Old Isn’t Sexy

First of all, Wall Street brokers and financial advisors love to sell the latest, greatest, sexiest investment opportunities. Things like…

- Social media

- Self-driving electric cars

- Marijuana

- Cryptocurrencies

They like to take credit for introducing you to the kind of bleeding-edge “opportunities” that make you the envy of dinner party guests and the center of attention at every cocktail party you attend.

You see, it’s far too much work for these brokers to make a 101-year old benefits program sound sexy.

Me, on the other hand…

Regular, predictable, risk-free income is one of the sexiest things I can imagine.

Nope… It’s just not in a Wall Street broker’s DNA to sell you “old and ideal” when they can make themselves and their firms appear innovative and cutting-edge by selling you “new and sexy.”

Plus, as you might have guessed, there’s also a financial angle to Wall Street’s motives.

That brings me to…

Reason #2: Old Doesn’t Pay

Look, it’s an overused cliché to criticize brokers and financial advisors for being greedy, money-hungry, self-interested hustlers.

And I don’t support that claim at all.

Truth be told, I have broker friends who are among the most honest people I know.

But let’s face it… in a business where “masters of the universe” live by an “eat what you kill” mentality…

There’s a strong motivation for some brokers to sell you products that earn them the highest commissions.

That’s just doesn’t sit well with me.

I worked as a stockbroker for over two decades and I always made it a priority to give clients advice that was in their best interests.

So it pains me when I hear stories about brokers who don’t present clients with all the available options…

Especially clients who are retired or close to retirement…

And especially because…

Registering for Freedom Payments today

could protect your retirement

from a major market correction.

As I mentioned earlier, I’ve experienced three major stock market sell-offs during my career.

And each time it happened, I met good, honest, hard-working people who had their retirement dreams shattered overnight.

Not because they’d made bad investment decisions.

In fact, many of them followed all the rules:

- They saved a good portion of their net income.

- They used tax-efficient accounts like IRAs and 401(k)s.

- They invested in solid blue-chip stocks and high-quality ETFs.

But the stock market doesn’t care about “the rules.”

And it doesn’t discriminate, either.

The stock market doesn’t care how smart you are, how old you are, or how good a life you’ve lived.

It can swallow your life savings and turn your retirement dreams into nightmares in a matter of hours.

I’m not saying any of this to scare you

And I don’t have inside information…

I can’t say when the next correction will happen.

It might be tomorrow, next month, or next year.

But one thing I can say with certainty is this…

The market can do bad things to good people.

So, if you’re retired or plan to retire within the next five years…

Protecting your life savings should be your number one priority.

And Freedom Payments allow you protect your nest egg quickly and easily.

Plus…

The sooner you register, the sooner

your life savings are protected.

Unlike other government benefit plans, you do not need to wait until a specific age to register or qualify for Freedom Payments.

If you’re currently retired, there’s no reason you shouldn’t get your name on the distribution list today.

But even if you’re five years or less away from retirement, I strongly encourage you to register immediately.

Because even though I can’t predict the future, my feeling is this…

The higher the stock market climbs, the greater the chances of a major correction.

And if you’re retired or “within striking distance” of retirement, a major market correction is something you want to avoid like the plague.

Again, I’m not saying it’s going to happen this month… or even this year.

But when it happens, I don’t want you to be staring at the balance in your retirement account wondering why so many zeros are missing and asking yourself…

“What could I have done differently?”

A regret like that can be a difficult one to shake.

So, I’m telling you right now…

Even if the stock, bond, currency, and commodities markets all lose 90% of their value tomorrow…

Even if the financial world around you is crumbling…

Even if your friends are screaming bloody murder at their brokers…

Your Freedom Payments will continue to

arrive on time and in the

exact amount you’re expecting.

In fact, if you don’t look at your TV, newspaper, or iPad, you’ll have no idea the markets are melting down.

You won’t be discussing “defensive strategies” with your broker…

And you won’t feel that surge of anxiety as you suddenly realize you’re going to need a part-time job just to make ends meet.

Instead, your most stressful decision will be…

“Where should we go for dinner this evening?”

Will it be Italian or seafood?

Hey… Why not both?

Unlike Social Security,

Freedom Payments are in no danger of going broke.

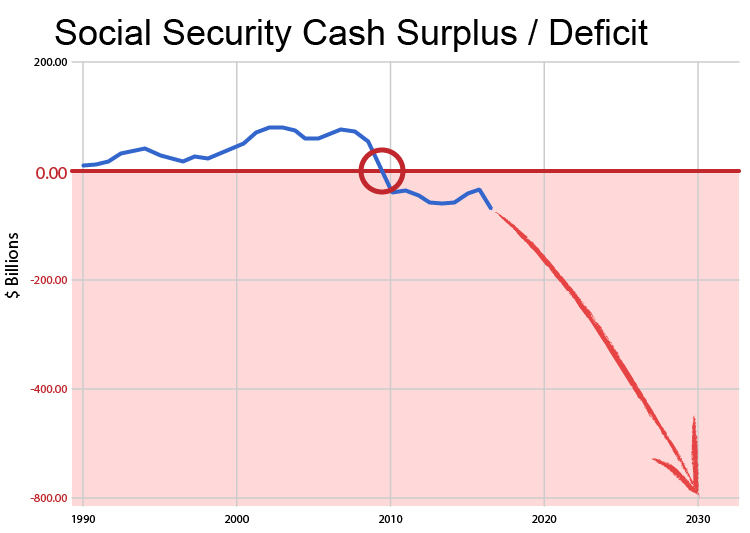

You’ve likely heard or read in the news that Social Security is in danger of going bankrupt within the next 20 years.

I’m not in a position to comment on the accuracy of those claims.

I don’t have any inside information on how well (or poorly) Social Security’s finances are being managed.

However, it doesn’t take an advanced finance degree to recognize that as more and more Baby Boomers retire, there are fewer and fewer working-age taxpayers taking their place.

To compound the problem, people are now living longer and having fewer children than in previous generations.

For Social Security, this has created a “perfect storm”…

One in which it now has to pay out more to retirees than it collects in payroll taxes each month.

This could spell disaster for all Americans in the not-too-distant future.

Thankfully, Freedom Payments aren’t at all like Social Security.

Social Security is funded solely by payroll taxes—an amount deducted from the paychecks of every American employee.

Unlike Social Security, Freedom Payments don’t depend solely on payroll taxes.

Instead, the $363 billion dollar pool of Freedom Payments has a much larger tax base supporting it, including:

- Personal income taxes

- Corporate income taxes

- Excise taxes

- Estate taxes

- “Other” taxes—including those on fuel, alcohol, and tobacco

In 2017, revenue from these sources totaled $2.2 trillion.

In comparison, the government paid out $263 billion in Freedom Payments in 2017.

So with a $1.9 trillion annual “cushion”, there are plenty of tax dollars available for the government to continue funding Freedom Payments.

When you think about it, since you’ve paid many of these taxes yourself over the years, you can think of Freedom Payments as…

A turbo-charged tax refund every month of the year!

Since we’re discussing Social Security, here’s something else you should know…

Freedom Payments don’t reduce

Social Security entitlements

by a single, red penny.

A retirement income program is beneficial only if it doesn’t reduce or eliminate your other sources of income.

Thankfully, Freedom Payments and Social Security are completely different programs. They’re funded differently and administered by two completely separate government departments.

So, whether you receive $1,753 or $17,530 a month in Freedom Payments, you’ll continue to receive 100% of the monthly Social Security income you’re entitled to.

On top of that, if you receive distributions from a separate 401(k), IRA, or corporate-sponsored pension plan, not a single, red penny of that income is impacted by the Freedom Payments you receive.

Freedom Payments are a completely independent, ongoing, and risk-free income source—one you can count on for the duration of your retirement.

And while I strongly suspect you’ll want to continue receiving those monthly checks for the rest of your days, it’s good to know that…

Freedom Payments aren’t a

lifetime commitment…

unless you want them to be.

For argument’s sake, let’s say you register and start receiving Freedom Payments checks totaling $5,342 a month. That’s $64,104 per year. Every year.

But let’s say you reach a point in life where you want to receive a little more monthly income.

Or maybe a little less.

Or perhaps you decide you’ve had enough stable, risk-free income and you need the kind of excitement you can only get from the stock market.

No problem.

When you register for Freedom Payments, you’re not making a lifetime commitment.

You have complete, unrestricted freedom to make changes any time you wish.

You can increase or decrease your benefits.

You can even “deregister” and expose your investments to the gyrations of the stock market.

It always remains your plan to do with as you please.

But again, like so many retirees I’ve spoken with…

By the time you’ve moved into “retirement mode”, you’re going to get far more pleasure playing golf or tennis, traveling the world, and spending time with family and friends…

Not watching CNBC and having your cortisol levels jump with every stock market blip.

Plus, as an added bonus…

You don’t have to sell your favorite stocks

to receive Freedom Payments.

One of the features many retirees love is that Freedom Payments aren’t an all-or-nothing deal.

Needless to say, the higher the level of Freedom Payments you choose to receive, the more predictable and stable your income will be.

But you’re free to continue investing some portion of your portfolio in the stock market.

For example, if you have Berkshire-Hathaway, Apple, or original Microsoft shares you just can’t stand the thought of parting with…

You don’t have to.

You won’t ever be forced to decide between Freedom Payments and your favorite investments. You can continue to hold stock, bond, currency, commodities, or any other investments you want.

But something tells me, once you get a taste of stable, risk-free income it won’t be long before you want to completely get off the emotional roller coaster of watching stock tickers and financial news… and maximize your Freedom Payments.

If you already have a brokerage account,

you can register for Freedom Payments today… with no additional fees.

This is truly great news.

Some benefit plans require you to open a special account, register it with a regulatory body, sign a dozen forms in triplicate, and pay expensive application and administration fees… all before you can even get started.

Not Freedom Payments.

If you currently have an investment account with a broker or financial advisor OR…

If you use an online brokerage account…

You have everything you need to start receiving Freedom Payments payments right away.

You may have to pay a few minor commissions to move your existing stocks and bonds into your new Freedom Payments plan, but there are…

- No new accounts to open.

- No special approvals or signatures required.

- No application or regulatory fees to pay.

It couldn’t be easier.

And if you have any concerns about a potential “changing of the guard” during the next election cycle, you should know…

Freedom Payments will continue

to pump cash into your account

no matter who’s sitting in the Oval Office.

Freedom Payments isn’t a Trump “thing.”

It’s not a Clinton or Obama “thing,” either.

It isn’t Republican, Democrat, Libertarian, or (God forbid…) Socialist.

Freedom Payments are available thanks to a little-known public law of the United States of America.

It’s been supported by elected officials from both sides of the aisle for over 101 years…

And that won’t change any time in the foreseeable future.

So, no matter who’s sitting in the Oval Office—whether they’re male or female, black or white, Democrat or Republican…

Your Freedom Payments will continue to arrive like clockwork starting as soon you register and continuing throughout your whole retirement.

Freedom Payments could give you

the retirement of your dreams.

After working hard and paying taxes for 40+ years, don’t you deserve a peaceful and relaxing retirement?

One that’s free from stress, anxiety, fear, and regret?

Imagine knowing exactly how much income you’ll receive each month…

And exactly when each check will arrive.

Imagine turning on your television, discovering the S&P has crashed 1,238 points…

And not feeling a single ounce of panic…

Because your Freedom Payments don’t depend on the level of stocks, bonds, currencies, futures, or anything else.

So even if the markets go to hell-in-a-handbasket, your retirement plans, hopes, and dreams all remain 100% intact.

All of this can become a reality for you starting today.

So let’s not waste any more time.

I’d like to send you a special report that reveals everything you need to start collecting Freedom Payments right away.

Put Your Retirement Income On Autopilot

With Freedom Payments

Inside this report, I break down the process step-by-step and make everything super-easy to follow.

The report covers:

- How to get your name on the Freedom Payments distribution list today.

- An exclusive video tutorial revealing step-by-step instruction on how to set up and confirm your benefits account in under 5 minutes.

- Two different methods of collecting Freedom Payments… plus the pros and cons of each method.

All the details are spelled out clearly so you can get started quickly and begin enjoying the stress-free retirement you deserve.

As great as Freedom Payments are, it’s just one of the unique income opportunities I’ve discovered.

I’d like to share another of them with you right now…

So I’ve created a bonus report I’d like to send you.

How To Collect An Extra $1,003 A Month

In Government Cash

Inside this special report, I reveal everything you need to know about one American company’s special relationship with the U.S. government…

And how you can leverage that information to collect payouts of up to $1,003 a month… every month of the year.

Plus, I share details of a special program that allows you to “supercharge” your monthly payouts to create a personal fortune very quickly.

And because I want to prove just how serious I am about helping you secure the retirement lifestyle of your dreams, I want to share one more opportunity I think you’ll appreciate…

The Biggest Legal Loophole

in the IRS Tax Code!

In this report, I share details of what’s sometimes called “the single best gift Congress ever presented to the American taxpayer.”

Inside, you’ll discover simple strategies on how to collect constant, tax-free income.

That’s right. Thanks to a loophole in the Taxpayer Relief Act of 1997, you can grow your account up to a million dollars—and not pay a single dime to the IRS.

All these details and more are revealed in this special report, “The Biggest Legal Loophole in the IRS Tax Code!”

My gifts to you.

In the reports I’ve described above, I reveal how to:

- Put your retirement income on autopilot.

- Collect an additional $1,003 every month.

- Pay fewer taxes on the income you receive.

I like to think of these three reports as the foundation of a stress-free, luxury retirement.

And I’d like to send you all three absolutely free today.

As soon as they arrive in your inbox, I encourage you to read each of them as soon as you can make time.

There’s a lot of money on the table and I don’t want you to go a day longer without stepping up and grabbing the slice you deserve.

The instructions in each report are easy to follow and if you’re a quick study, you can be up and running with all three strategies before the week is over.

To recap, here are the three reports I’m sending you today:

- Put Your Retirement Income On Autopilot With Freedom Payments

- How To Collect An Extra $1,003 A Month In Government Cash

- The Biggest Legal Loophole in the IRS Tax Code!

All three will arrive in your email inbox within minutes and they’re yours to keep forever.

All I ask in return is that you accept a risk-free, no-obligation trial of my investment advisory, Personal Finance.

Personal Finance is an exclusive membership service where I share my economic outlooks, market commentaries, and investment recommendations with members on a regular and ongoing basis.

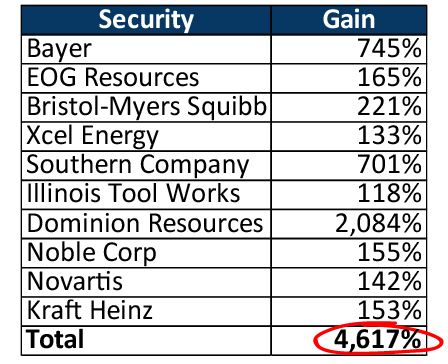

In recent months, members have seen returns like these…

If you’d invested $1,000 in each of these opportunities… you could have banked $56,167…

And a $10,000 stake in each trade could have you sitting on a life-changing $561,679.

Identifying these breakout opportunities and sharing them with members is a key focus for me and my analyst team here at Personal Finance.

We spend a major portion of our time evaluating economic conditions, analyzing markets, identifying the best companies within each industry sector, and presenting our research and recommendations to members.

It’s challenging work and we love doing it.

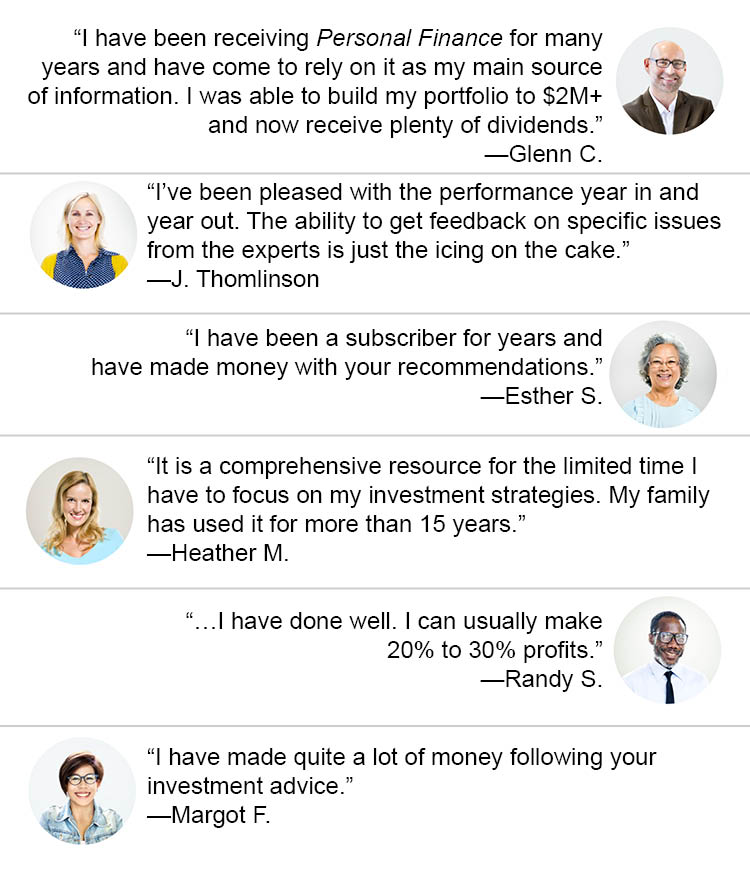

Not surprisingly, Personal Finance members love the returns we’ve helped them generate.

And they frequently write to share their experiences.

Personal Finance member Glenn C. wrote

to tell us about the 7-figure portfolio he’s

built thanks to our recommendations…

Penny L. says she collects so much money from her investments she doesn’t have to work anymore…

I don’t share these stories to congratulate myself or my team.

I share them to let you know there are real people using their Personal Finance memberships to make real money.

And I’d love you to join them.

While buy and sell recommendations are an important part of what we do at Personal Finance, they’re just the tip of the iceberg.

When you join today—completely risk-free and without obligation…

Your Personal Finance

membership includes:

Membership Benefit #1: 12 Monthly Issues Of The Personal Finance Newsletter

Membership Benefit #1: 12 Monthly Issues Of The Personal Finance Newsletter

In each monthly issue, I provide a detailed economic outlook, model portfolio summaries, investment recommendations, and specific buy, sell, and hold indicators for each model portfolio position.

Membership Benefit #2:

Membership Benefit #2:

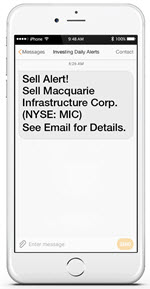

Intra-Day FLASH Alerts

Any time an investment opportunity reaches its peak, I’ll send you an instant email alert with instructions on how and when to close out your position, maximize your profits, and be ready to invest in the next breakout opportunity.

Membership Benefit #3:

Membership Benefit #3:

24/7 Access To The Personal Finance Confidential Members-Only Website

As a Personal Finance member, you have exclusive, unlimited, around-the-clock access to my private website. Here, you’ll find a searchable archive of past newsletter issues, special market reports, FLASH Alert histories, and model portfolio details. It’s all only a mouse click away and available to you 24 hours a day.

Membership Benefit #4:

Membership Benefit #4:

Personal Access to Me

I’m available almost every day in the members-only Stock Talk forum. Any time you have a question or need a clarification on a recommendation or alert, just pop your question in the forum and I’ll get back to you with an answer as quickly as I can.

Membership Benefit #5:

Membership Benefit #5:

The Personal Finance Premium Concierge Service

As a Personal Finance insider, you have access to a special phone number where you can reach my VIP concierge team every weekday during normal business hours. The team is standing by to ensure any questions, concerns, or problems you have as a member are dealt with quickly and thoroughly.

As you can see, your Personal Finance membership offers an amazingly comprehensive combination of research, communication, and exclusive member perks.

But you may be wondering, “How much does a membership like this cost?”

Our regular membership fee is $99 a year.

When you consider that fee gives you access to my 35 years of experience…

The most detailed market research you’re likely to find anywhere…

Trade recommendations that could put thousands of extra dollars in your retirement account each and every month… and could easily pay for your membership fee a thousand times over…

I think you’ll agree $99 a year is an incredible bargain.

However…

I want to make this decision easy for you.

As I mentioned earlier, I don’t have an Ivy League degree, I’m not a mainstream media darling, and I don’t drink champagne for breakfast.

Instead, I’ve been in the trenches for 35 years helping regular, hard-working Americans like you make smart investment decisions.

And I plan to continue doing exactly that until the day I retire.

In the meantime, I want to make the investment information I produce available to as many people as I possibly can.

And I want to make it available at a price that won’t create any financial strain on your budget or your lifestyle.

So for the first 1,000 new members to join Personal Finance, I’ve arranged a special 60% discount off the regular annual membership fee of $99.

If you join while we have spots remaining, the fee is just $39.95.

When you factor in the standard annual membership fee ($99), and the combined value of the three reports I’m including ($147)…

You’re receiving an all-in discount of 83% (or $206) off the package value of $246.

For your free report, bonuses, monthly newsletters, flash alerts, private website, concierge service, and direct access to me and my analyst team, I think you’ll agree…

$39.95 is an amazing price.

Two satisfaction guarantees.

But just in case you have any doubts about the value of the information you’ll receive as a Personal Finance insider, I’m going to remove all of the risk with not one… but two satisfaction guarantees.

First of all, when you accept your trial membership today, I want you to download your free report and bonuses, log into the private member’s website, review the newsletter archive, check out our model portfolios, and maybe ask a question or two in the Stock Talk forum.

Take your time.

In fact, take up to 90 days to review everything thoroughly.

And if you’re not absolutely blown away by the quality of the investment advice and treatment you receive from the Personal Finance team…

I’ll return 100% of your membership fee with no questions asked.

That sound fair?

That brings me to guarantee number two…

Even after 90 days have passed, if I don’t continue wowing you with economic research, market commentaries, and investment recommendations that help you make smarter and more profitable investment decisions, same deal…

I want you to call the Personal Finance concierge number, tell them you’ve changed your mind, and you’ll receive a refund for any unused months remaining on your membership term.

Plus, whether you remain a member for one month, one year, or ten years…

You can keep all the special reports, bonuses, and newsletters you’ve received during your paid membership term as my way of saying “thank you” for trying us out.

This isn’t a gimmick.

I feel strongly that you should receive tangible, ongoing value from your membership… or you shouldn’t pay for it.

To recap, here’s everything you receive when you join Personal Finance today:

- Special Report: Put Your Retirement Income On Autopilot With Freedom Payments

- Bonus #1: How To Collect An Extra $1,003 A Month In Government Cash

- Bonus #2: The Biggest Legal Loophole in the IRS Tax Code!

- 12 Monthly Issues of the Personal Finance Newsletter

- Intra-Day Flash Alerts

- Confidential Members-Only Website Access

- Personal Access To Me, Jim Pearce

- Premium Concierge Service

- An 83% Discount Off The Combined Package Value ($246)

- My Double-Barrel, 100% Satisfaction Guarantee

At last count, there were over 10,000 millionaires in the Personal Finance memberships ranks.

I very much want you to count yourself among them.

But you need to move quickly.

This opportunity to join Personal Finance is being made available to over 200,000 people.

But we can only accept 1,000 new members at the discounted rate of $39.95.

To claim your spot, simply click below.

The button will take you to a secure order form where you can review all the details again before you join.

If you’d prefer to order by phone, my Priority Support Team can be reached toll-free at 800-543-2049. Give them a call and they’ll get you set up right away.

Thank you for taking the time to review my research today.

I’m excited about helping you put your retirement on autopilot.

Let’s get started!

Sincerely,

Jim Pearce, Chief Investment Strategist

Personal Finance

P.S. I’ve arranged for a special discount on our two-year membership.

For only $79, you’ll receive two full years of Personal Finance access, plus the following additional bonus reports…

Bonus #3

Profit Like the Landlord-in-Chief: How You Can Mimic Trump’s Success With REITs

Profit Like the Landlord-in-Chief: How You Can Mimic Trump’s Success With REITs

You’re likely aware that much of President Trump’s family wealth came from real estate. In this report, you’ll discover three of my favorite opportunities to create a steady stream of real estate income without ever buying property.

These investments tend to generate solid, reliable cash… even in down markets. One is even 99% backed by the federal government.

Bonus #4

Data Center Profits: How You Can Collect Digital Rent Checks Without Ever Moving Your Mouse

Data Center Profits: How You Can Collect Digital Rent Checks Without Ever Moving Your Mouse

With the explosive growth of video and audio platforms like YouTube, Netflix, Hulu, Pandora, Spotify, and others… the demand for data storage has never been greater.

In this exclusive bonus, I reveal a global leader in the data center industry whose dividends increased throughout the last recession and whose stock price was 70% less volatile than the overall market during the same period.

This one’s an ideal investment for conservative investors who want steadily growing income with minimal risk.

This package—including the special report, four bonus reports, and 2-year Personal Finance membership—has a combined value of $443.

But you can have instant access to all of this today for just $79—a savings of $364.

You’ll still be covered by my 100% satisfaction guarantee AND you’ll also keep the all the bonus reports if you decide Personal Finance isn’t right for you.

Again, this special offer is only available to the first 1,000 new members. After that, the discount disappears.

Click the button below and lock in your two-year Personal Finance membership for only $79.

Copyright © 2018 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.