URGENT:

On our legal team’s advice, we’re making this offer available to a limited audience—for the next thirty days only.

Our lawyers want to avoid a “cease and desist” for sharing the secrets a billionaire author has purposefully kept hidden from ordinary investors for over 25 years.

Rare Book Reveals Secret

“THIRD RULE OF

INVESTING”

(Turns Every $10,000 Into $6.31 Million)

“THIRD RULE OF

INVESTING”

(Turns Every $10,000 Into $6.31 Million)

You Can’t Get a Copy of This Out-of-Print Book Anymore… Because Its Billionaire Author Has REFUSED to Reprint It.

You Can’t Get a Copy of This Out-of-Print Book Anymore… Because Its Billionaire Author Has REFUSED to Reprint It.

I’m Going to Reveal Its Valuable Secrets Today…

And the 5 Stocks It’s Saying Will Double in the Months Ahead.

Fellow Investor,

Today I’d like to tell you about a rare book that reveals a secret “Third Rule of Investing”… a secret so powerful that it has turned $10,000 into $6.31 million.

As you can see, my lawyers have asked me to black out the cover of this book due to the secrecy surrounding it.

This mysterious book…

- Has fewer than 5,000 copies in existence…

- Is one of the “most stolen” books from libraries…

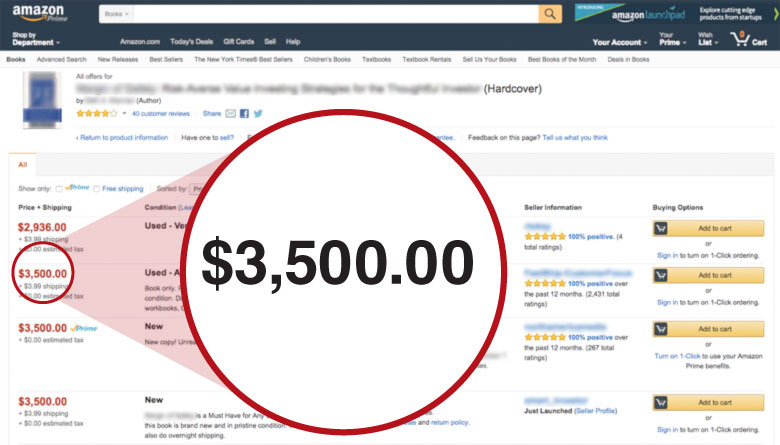

- Has an original $25 hardcover price but now sells for $3,500…

- Has secrets that a handful of investors have used to become millionaires…

Inside, the young author revealed the secret “Third Rule of Investing,” but then later regretted publishing something so valuable…

The techniques behind the “Third Rule of Investing” have been used by the likes of Warren Buffett, Benjamin Graham and John Templeton since the beginning of the twentieth century… turning them into wealth investors…

But they rarely, if ever, talk about it. It’s like a secret handshake among insiders.

Because this “Third Rule” is an investment secret so powerful…

The handful of “ordinary investors” throughout history who have discovered this secret… and how to use it… have gone on to become multi-millionaires themselves.

What’s more, this “Third Rule of Investing” works in any market. It could be a bull or bear market, recession or stagflation… it doesn’t matter.

In fact, this investment secret works best in times of uncertainty—like the market we’re experiencing today.

And in a moment, you will discover how this “Third Rule of Investing” is especially important right now…

I urge you not to hesitate. Because investors who don’t fully grasp the concept of this investment secret could lose everything…

But it’s not knowledge that just anyone can get his or her hands on easily. It’s not as simple as clicking a few buttons on the Internet.

In fact, until this book was first published in 1991, one of the only ways to learn the “Third Rule of Investing” was to attend one of Benjamin Graham’s classes in Columbia Business School, where now-legendary investors like Irving Kahn, Walter J. Schloss and Warren Buffett attended.

Another was to dig through reams of documents officially and unofficially published by Berkshire-Hathaway.

The book in question, however, described and explained the “Third Rule of Investing” as clear as day.

It was written twenty-five years ago in 1991, published by HarperBusiness.

Being a new imprint, they took risks, which included a book proposal from a young, reclusive, then-unknown hedge fund manager.

He was a quiet man. He never bragged. And he kept his successes to himself.

For instance…

Nine years before the book was published, a group of wealthy families discovered that he knew the secret “Third Rule of Investing.”

So they got together and gave him $27 million to start a hedge fund.

Imagine being in your early twenties, fresh out of college, and being handed all that money (over $55 million in today’s dollars) to manage.

That’s the kind of power and influence the “Third Rule of Investing” attracts!

And the storybook ending here is…

This young investor would go on to grow that fledgling hedge fund to almost $30 billion today. Every $10,000 invested with him grew to $6.31 million.

For a while, many people even speculated he would take over Berkshire-Hathaway after Warren Buffett retired. (After all, both investors are students and practitioners of this “Third Rule of Investing.”)

The author himself is worth $1.47B today. And for many years now, he has refused new clients and is known to be exceptionally “under-the-radar” about his business.

He doesn’t want people to know about his investing secrets.

Unlike Warren Buffett, his annual letters are notoriously hard to get. They’re only published to a select list of his wealthiest clients.

In short, all his investing wisdom, strategies and secrets are inside this book.

Here’s a Secret Loophole That Lets You Put the

“Third Rule of Investing” to Work for You…

“Third Rule of Investing” to Work for You…

Sadly, it’s near impossible to get a copy of this book today without paying a small fortune.

Why is that? You see, unfortunately, the book didn’t sell well in 1991.

In fact, it sold less fewer five thousand copies.

Because of this, HarperBusiness never printed a second run, and what was left in the warehouse was destroyed.

It was not a popular book at first because, like most “sleeper hits,” most investors simply didn’t see the true value of this book.

In fact, it’s also like the “Third Rule” stocks themselves, which go unnoticed until they later become 10-, even 100-baggers…

But over the years, as word got around of how this mysterious author grew a hedge fund 6,133% between 1983 to 2006, after fees, compared to the S&P 500’s 1,517%, even with dividends reinvested…

The myth, legend and rumors surrounding this “Third Rule of Investing” grew exponentially… and so did the book’s value.

As you can see in this picture, the book currently sells for $3,500 on Amazon.com.

Smart book collectors who bought the book at the $25 cover price in 1991 have been rewarded with one of the most highly sought-after investment books in history.

Smart book collectors who bought the book at the $25 cover price in 1991 have been rewarded with one of the most highly sought-after investment books in history.

Case in point, this book is one of the most stolen from libraries. And if you wish to borrow it, the wait list is usually years long. Investors “in the know” have even gone to great lengths to “trick” the library system to get their hands on this book to learn the “Third Rule of Investing.”

And this is where the mystery begins.

You see, despite many reasonable requests from HarperBusiness to republish the book since its tremendous growth in popularity, the billionaire author has simply refused each and every time!

Some have even suggested that he regrets ever publishing the book in the first place. Perhaps he felt the public should not be aware of the “Third Rule of Investing”… or maybe he thought it was simply too powerful for everyday investors like you and me.

His motivations remain a mystery.

My name is Jim Pearce.

My name is Jim Pearce.

And I am about to expose what this highly secretive “Third Rule of Investing” is, how it works and how you can take advantage of it.

Remember, others have before you, and have turned their small fortune into millions.

But there’s a caveat. A huge one.

You see, we don’t know how long we can keep this report in circulation. We know that the billionaire who wrote this book does not want its secrets shared with the world.

We also know that he isn’t afraid to hire lawyers. In 2012, he went after JP Morgan to collect $310 million in damages.

But we believe that the “Third Rule of Investing” is exactly the sort of upper hand self-directed investors like you need… and deserve in a choppy market like this.

That’s why I begged our lawyers to let us “sneak this out there” to as many people as we can without getting in trouble. You are one of the few lucky ones to receive this report.

What’s more…

At the end of this letter you’ll receive instructions on how to get a list of 17 stocks set to double this year… all of which were discovered using the “Third Rule of Investing.”

You can get this list absolutely free—because we limit our liability if we distribute it for informational purposes only. Our lawyers are giving me only 30 days to send it out.

Also, these 17 timely stock picks are in the perfect position right now, so you wouldn’t want to wait longer anyway.

So let’s get started.

I’m sure that you’re probably wondering… what exactly is the “Third Rule of Investing”?

Let me share it with you…

You’ve probably heard of Warren Buffett’s “Two Rules for Investing.”

“Rule No. 1: Never lose money.

Rule No. 2: Never forget rule No. 1”

—Warren Buffett

One of the greatest investing minds of our generation—a genius, in fact—tells us investing is as easy as “never losing money.”

But it’s not really helpful, is it?

When I was a stockbroker, I saw a lot of trades come in.

A lot of times, against our advice, clients would buy high and then sell low. It was like they had the worst luck. When they bought a stock, it went down the next day. When they got rid of it, it shot up the next day.

If you’ve done this yourself, you know the market feels like a roller coaster ride that won’t stop.

That’s where another rule, the third rule, comes in.

You see, the “Third Rule of Investing” tells you exactly what a stock is worth at any given time.

As you know, when you look at the price of a “stock” in the Wall Street Journal, on CNBC or on Yahoo Finance, it’s not really what the actual company selling that stock is worth.

The price you see for KO or MSFT or BAC is actually what millions of people, brokers, fund managers, algorithms and institutions believe the future price of the stock should be.

This determines why a stock is “overvalued” or “undervalued.” They are referring to the fact that the price of the stock is too high or too low when compared to the “true value” of the company.

And taking advantage of this is how you can practically never lose money in the stock market…

If you know exactly how much a company’s stock is really worth, then you can look at the prices on Wall Street and say if it’s too high or a nice discount.

The key here, then, is like shopping at a mall and waiting for an item to go on sale before you buy!

Let’s say you knew Coke shares were worth exactly $100 because you used the “Third Rule of Investing” in your research.

Let’s say it fell 40% tomorrow to $60, but it wasn’t due to any major news, economic event or any business catastrophe. Let’s say it was a minor PR kerfuffle. That’s not going to affect the business long-term.

So we can easily say that the market panicked and now they’re selling Coke for sixty cents on the dollar… and that’s a steal!

In other words, you know the TRUE VALUE of Coke is $100, and you can buy it for $60 now. And that also means, as Coke “reverts” to its TRUE VALUE… you’d make a 67% return!!!

Any sound, logical mind would pick up Coke right away. That’s what the “Third Rule of Investing” does for you. You pick up stocks everyone else is irrationally scared off of because they don’t know the TRUE VALUE.

Now, what I just told you about the “Third Rule of Investing” has a second point you might have missed.

It’s important to understand that part of what makes the “Third Rule of Investing” so powerful is the clear “knowing” that stocks always “revert to the mean.”

This means that no matter how high or how low the stock price goes… at the end of the day, it will eventually go back to its TRUE VALUE.

And that’s how some of the biggest billionaires in the world built their fortunes.

They bought stocks that were selling at a discount, and waited until they returned to the TRUE VALUE price.

I know this works because…

I’ve Done It Myself Countless Times Over

My 33-Year Career… Getting Results as High as

800%+ Returns and More!

My 33-Year Career… Getting Results as High as

800%+ Returns and More!

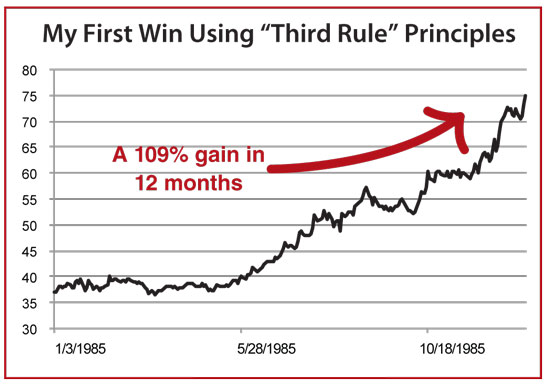

I was a 24-year-old stockbroker at Wheat First Securities—it was my first job.

And in the early eighties, there was an international company experiencing fallout from a major factory accident.

The market punished the stock. It went from $46.50 down to $34 in a matter of days. That’s a 27% sheer drop.

Now, I had done my homework using the “Third Rule of Investing.” I found out how much this company was REALLY WORTH—despite all of the market emotion—and I knew that in spite of this horrific disaster, it would survive and bounce back.

I called as many of my clients as I could and recommended they buy. Many of them did, even though I was the new guy.

Well, they were rewarded. By July 1985, the stock was back up to $46. You would’ve made a 37% return on the stock getting back to its original price.

But I asked my clients to hold on longer because I knew the TRUE VALUE of this company. And by December, my clients had 109% returns. In other words, they more than doubled their money.

But I asked my clients to hold on longer because I knew the TRUE VALUE of this company. And by December, my clients had 109% returns. In other words, they more than doubled their money.

Think about that. A lot of investors would’ve been happy to make a 37% return in seven months. But if you had just held for another five months, you would’ve doubled your money.

That’s the power of the “Third Rule of Investing”… when you know the TRUE VALUE of a stock.

Let me tell you another story, this time about The Crash of 1987.

I remember watching my Quotron that day and sweating bullets. Everyone was losing their shirts.

Out of desperation, I started combing through a list of stocks I had compiled the week before. As I did, I noticed a stock that was so undervalued it didn’t make any sense. It was a corporation called MMT.

This company held nothing but fixed income bonds, the safest investment in the world. And yet, because of Black Monday, MMT was getting knocked down 40%!

I knew this stock had to, absolutely had to, revert to its mean. Because of the market drop, it was trading at $7.50. But thanks to the "Third Rule", I knew it was worth at least $10.50.

So I called up twenty of my biggest clients. The first guy I call up trusted me and put in an order for 10,000 shares. That was a $75,000 order, which was a big deal for a 28-year-old like me. That’s almost $160K in today’s dollars.

I called more clients, working the phones in the aftermath of Black Monday while everyone else was panicking.

That’s the beauty of the “Third Rule of Investing.”

When you know exactly what stocks are worth, you don’t worry. You just go shopping for discounts.

Sure enough, MMT went from $7.50 to $11 over the next couple of months. I called it. It was one of my first calls where I went against everyone else, and I made everyone 46% richer… in just two months!

That’s when I felt really confident about myself.

But that was only the beginning of my career.

For the next 20 or so years, I kept using the “Third Rule of Investing” to find stocks for my clients and myself that were undervalued.

In 2009, after the Subprime Financial Crisis, I bought 10,000 shares of Ford at an average price of $2.39 and rode it up to the mid-teens. I also bought Genworth Financial for $1.15 and cashed out just two months later at around $6.

Those are 500–800% returns in mere months… and it all came down to knowing the TRUE VALUE of any stock even while everyone else was panicking.

But that’s not all.

The flip side of knowing the TRUE VALUE of any stock is seeing the opposite:

When a stock gets overvalued and hyped up. When the market falls heads over heels for a company, turning it into a “Darling of Wall Street” and slapping an unreasonable high sticker price on it.

Unfortunately, everyday investors fall for these fads.

It wasn’t that long ago when we had the dot-com bubble and people nearly went bankrupt on companies like Pets.com, Nortel and eBay.

Warren Buffett was famous for avoiding the whole technology sector. What did he know that others didn’t? The TRUE VALUE of these companies.

I did, too, and “skipped work” during the dot-com bubble. I told my clients to stay out of it.

At the end of the day, when you know the true value of any stock, you never overpay, you always get a discount and you always see the traps from a mile away.

So why is this important? Well, you see…

A Small Group of Investors Has Been

Secretly Using the “Third Rule of Investing”

to Get “Buffett-Like” Returns…

Secretly Using the “Third Rule of Investing”

to Get “Buffett-Like” Returns…

For the past 40 years, readers of Personal Finance have had access to the “Third Rule of Investing”… and didn’t even know about it.

Ordinary investors from all walks of life have profited from some of the most unbelievable gains using the “Third Rule of Investing,” like…

- Incredible stock returns like… 327% on Exxon… 454% on KLA-Tencor… 525% on Sony… 455% on Great Plains Energy… 2,012% on SoftBank, and more!!

- Predicting market crashes with an “early-warning system”—Members of this group were told to “GET OUT” in 1987, 1999 and 2008, preventing portfolio wipe-outs!

- Results backed by the Hulbert Financial Digest—Between 2000 and 2009, the S&P 500 lost 8.6%, but members of the “Third Rule” group made 69.2% returns…

- Buffett-like returns… during a bear market! While stocks plummeted 35% between 2000 and 2002, members made 20.8% returns PER YEAR!

- But most important of all, they took LESS RISK… The “Third Rule of Investing” shows you how to invest with 17% less risk than others…

These are just a few of their results. The list is long. And the last one is the most important.

Financial experts like to say you can’t make money without taking risks. But they’re wrong. They don’t know better. This special group has enjoyed above-average returns with less risk using the “Third Rule of Investing.”

And here’s why I’m writing you today…

I want to tell you about this group and how you or anyone can get access to their portfolio, so that you, too, can profit from the “Third Rule of Investing.”

For more than 40 years, we’ve helped our members get market-beating results in the stock market, while avoiding crashes and getting results with less risk.

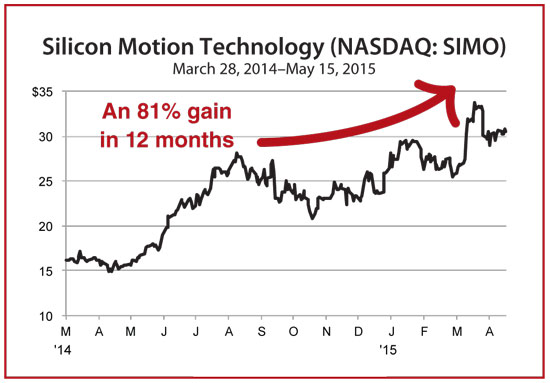

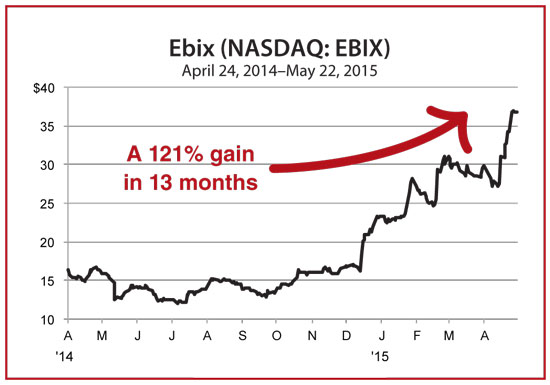

As the current head editor, I’ve done my part by recommending several winning stocks for this special community of investors. Some of my best results have included 81%, 121% and even as high as 148%. Our current holdings have provided the group with 75.47% returns!

Here’s what one of our longtime subscribers wrote:

I have been receiving Personal Finance for many years and have come to rely on it as my main source of information. I was able to build my portfolio to $2 million, and now receive plenty of dividends.”

Glenn C.

The reason my predecessors and I have achieved such a great track record for this group is because we have personally reviewed the reclusive billionaire’s out-of-print book. And as for myself, through self-study, I have personally used the “Third Rule of Investing” for over thirty-three years now!

Before I took charge of Personal Finance, I was a stockbroker and financial advisor. Understanding the “Third Rule of Investing” and how it works has helped my personal career tremendously.

You see, back in the old days on Wall Street, you had relationships with your clients. We worked closely with them and it was our job to do research, find great stocks and made sure it fit our clients’ needs.

These days, Wall Street sells you prepackaged products like mutual funds, annuities and managed funds.

There wasn’t a human connection, and I missed it.

That’s why I retired from being a stockbroker several years back. Recently, my wife and I bought a ninety-year-old bungalow in Alexandria, Virginia, to fix up over the next couple of years.

But when the publishers of Personal Finance reached out to me and asked me to join their team, I saw it as an opportunity to build a partnership with “clients” again. To help them find stocks that made money with less risk and fit their investment goals.

More importantly—I wanted to do it using the “Third Rule of Investing,” an investment strategy I knew could deliver results.

But that wasn’t all.

I’ve Been Refining “the Third Rule

of Investing” for Decades…

of Investing” for Decades…

Now, that might sound a little sacrilegious.

After all, if the “Third Rule” had worked for so many billionaires before me, why would I tinker with it?

Here’s the deal:

The “Third Rule of Investing” is actually not very easy or intuitive to use for the average layperson who hasn’t spent years studying charts, fundamental analysis and financial statements.

Yes, if you work out tons of calculations, you could technically work out the TRUE VALUE of any stock.

And once you know how to determine the TRUE VALUE of a stock, only then do you know if the stock price is overvalued or undervalued.

So to get to the TRUE VALUE of a stock, you need to do a lot of homework.

Now, what few people know about super-investors like Warren Buffett (unless you read their biographies) is they spend ten, twelve hours a day reviewing financial statements and shopping for the next big discount.

Most people simply don’t have that kind of time.

But that’s not the only disadvantage.

You see, a lot of people who subscribe to financial newsletters or listen to a particular “guru” are often annoyed that, at the end of the day, these guys picked stocks and recommended them because of their personality, instinct or some sort of “gut feel.”

There’s no clear system. I didn’t want that.

And that’s why I created a simpler version of “Third Rule of Investing” that anyone can follow as easily as 1, 2, 3.

I wanted it to be objective and rules-based. I wanted the stock analysis to be straightforward and clean.

I’ve prepared a complete description of the secrets of the “Third Rule”—including the name of the original, out-of-print book I mentioned above, as well as its billionaire author—and a list of the principles behind it. But that’s not all.

I’ve put these principles to work (as I’ll describe below in just a minute) and identified the 5 stocks perfect positioned to take off right now.

It’s all in my timely Special Report: “True Value: 5 ‘Third Rule’ Stocks About to Take Off.”

It’s all in my timely Special Report: “True Value: 5 ‘Third Rule’ Stocks About to Take Off.”

This report is yours FREE.

But as I mentioned above, due to the guidelines decided by my team of lawyers, I can only offer this report for the next 30 days. So please don’t hesitate to get your copy.

There’s more. I’d like to explain how I put the “Third Rule of Investing” into everyday practice…

INTRODUCING:

The IDEAL System for

Finding “Third Rule” Stocks

The IDEAL System for

Finding “Third Rule” Stocks

So far, the results we’ve had from using my new system for finding undervalued stocks have been amazing.

But don’t take my word for it. Just take a look at some of the results we’ve had already. These are all using the IDEAL system that helps us find heavily discounted “undervalued” stocks based on the principles of the “Third Rule of Investing.”

In April of 2014, I told my readers to get in on Silicon Motion Corporation (SIMO). It was trading at $16.87. My assessment tools told me the TRUE VALUE of this company was much higher. Sure enough, the stock went up 81% in just over twelve months!

Take a look at this one. It’s insurance software company Ebix (EBIX). My readers bought it for $16.31 and then watched it climb to $36.57 in just over a year.

Take a look at this one. It’s insurance software company Ebix (EBIX). My readers bought it for $16.31 and then watched it climb to $36.57 in just over a year.

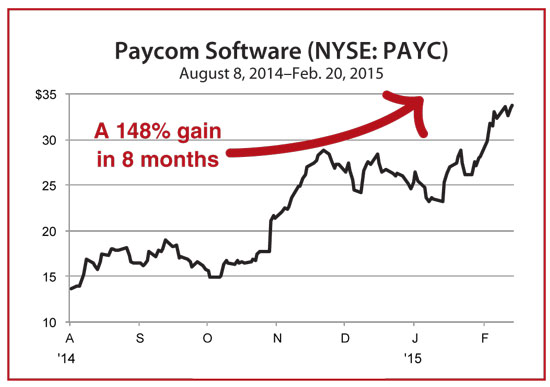

Here’s another one. I told my readers about Paycom Software (PAYC) in August of 2014. It was trading for $13.58, but I calculated the true value to be above $30. Just look at the chart below. Within eight months, it shot up to $33.77…

Here’s another one. I told my readers about Paycom Software (PAYC) in August of 2014. It was trading for $13.58, but I calculated the true value to be above $30. Just look at the chart below. Within eight months, it shot up to $33.77…

Okay, I’m sure you get the picture. I have a long list of results to back up the IDEAL system. But I want to share just one more story because it’s such a good one.

Okay, I’m sure you get the picture. I have a long list of results to back up the IDEAL system. But I want to share just one more story because it’s such a good one.

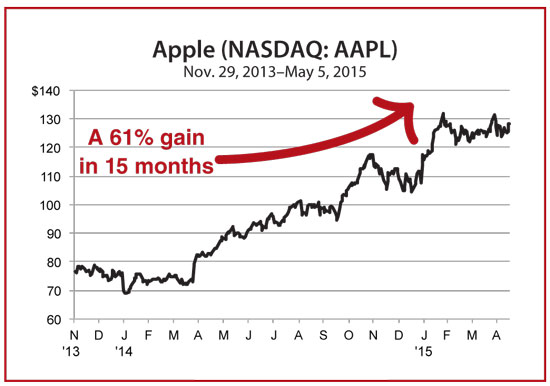

Most people find it funny, because back in 2013, everyone was calling this gigantic technology company a has-been. Saying its run was over. That it was all downhill from here on out.

You may have heard of this company called Apple (AAPL).

Seriously. Don’t laugh.

Back in 2013, all the experts, analysts and institutions were calling for “The Fall of Apple.”

CNN wrote, “Interest in the iPhone… Drying Up.”

CNBC reported, “Apple In More Trouble Than You Think.”

And Forbes flat out called it a “lagging brand.”

Well, using my “Third Rule”-driven IDEAL system, we shot back and said Apple (AAPL) was “The One Stock to Own in 2014.”

Take a look at the chart below.

Those are some amazing results. Results anyone can get if they simply understand the core principles of the “Third Rule of Investing.” Or better yet, if they have access to a robust system like IDEAL.

Those are some amazing results. Results anyone can get if they simply understand the core principles of the “Third Rule of Investing.” Or better yet, if they have access to a robust system like IDEAL.

But that's not all…

As I said, when you use the “Third Rule of Investing,” you discover the TRUE VALUE of any stock. So it’s not just about finding bargains—you can also see when stocks are overpriced and are about to fall.

On December 16, 2013, I told my readers that Amazon (AMZN) was not worth the $388.97 price tag it was charging on Wall Street. I said the TRUE VALUE was closer to $300. I told my readers to get rid of their shares of Amazon, helping anyone holding shares to avoid a costly loss. Others took up short positions on the stock so they could make money as it dropped.

Take a look at what happened in six months…

My readers made 25% from this short sale.

My readers made 25% from this short sale.

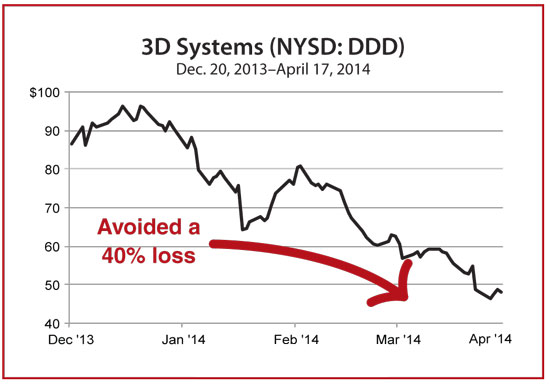

Here’s another example of the IDEAL system pointing out overvalued stocks. On the same date I told my readers about Amazon, I also mentioned 3D Systems Corp (DDD).

This 3D printing company was trading at $81.29 per share. My IDEAL system said it was way too high. The TRUE VALUE of this stock was closer to $50, indicating that this stock was likely riding a fad that wouldn’t last. Take a look at what happened in the next several months…

As you can see, by April, readers who had shorted DDD earned a 40% return!

As you can see, by April, readers who had shorted DDD earned a 40% return!

Since that time, this stock has continued to drop and is now down more than 90%. The IDEAL system’s timely warning saved my readers from a crushing loss—and let the boldest of my readers pick up extra profits on a short sale.

Whether you want to short a stock or just plain avoid it, the IDEAL system does that for you. That’s the power of knowing how to determine TRUE VALUE using the “Third Rule of Investing.”

But what’s more…

Here’s the beautiful thing about the IDEAL system. It doesn’t just pick out individual stocks. It can also quickly scan and pick out entire industries that are priced wrong as well.

Let me tell you about a report I wrote early this year called “The Dirty Dozen.”

The IDEAL system was able to identify that the healthcare industry as a whole was overvalued and was close to a breaking point.

So on April 17, 2015, I published a report that identified 12 healthcare companies that were most at risk.

Within six days, Intuitive Surgical (ISRG) fell short of earnings and sunk immediately.

Another one, Alexion, took an instant haircut.

But that’s not the end of the story. Another three companies on the “Dirty Dozen” list are down 11.53%, 14.07% and even 16.78%.

You’re probably wondering which ones they are. You may own some of these healthcare stocks in your portfolio. I would highly suggest you sell them ASAP.

When you can see which stocks are overpriced or overvalued using the IDEAL system based on “Third Rule” principles, you gain an enormous sense of calm when you invest or trade.

There’s no pressure anymore. You don’t feel like you’re gambling.

I want to show you what I mean.

As you’ve read this far and are committed to saving your retirement…

I'd like to send you my FREE report: “The Dirty Dozen: 12 Stocks to Sell Yesterday." I’ll tell you how you can get your own personal copy of it in a moment.

What’s more, I’ve updated the report to ensure you have the latest news on this overinflated industry. I’ve also included several stocks suffering from weakness in materials and in communications.

But first, you may be wondering…

How Does the IDEAL System Work?

Obviously, with respect to the current subscribers to Personal Finance, I cannot share details of its criteria with you.

It is a proprietary investment tool that only readers of Personal Finance have access to.

But I can quickly describe parts of the “engine” under the hood.

IDEAL stands for “Investing Daily Equity Analysis List.”

It’s a mouthful. But the short of it is this. It analyzes every single stock on the S&P 500 list on a “real-time” basis.

Which means, at any given moment, we have access to a system that tells us if a particular stock is overvalued, undervalued or at its TRUE VALUE.

Remember, one of the core principles behind “Third Rule” investing is knowing the TRUE VALUE of a stock so you don’t make bad investment decisions.

This helps us find bargain stocks that are about to shoot up in price, and overpriced stocks that are about to plummet… making you money on both sides of the same coin.

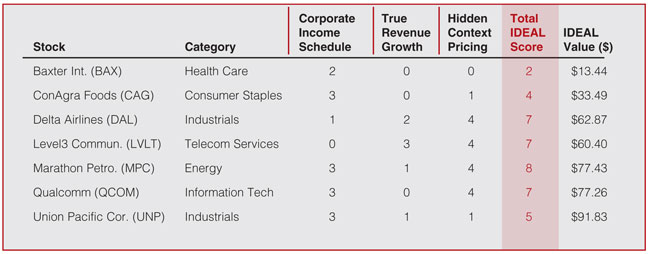

The IDEAL system is dependent on three basic criteria.

- First, there’s the “Corporate Income Schedule.” This is a metric that a lot of Wall Street guys completely ignore or dismiss. But if you take a look at all the stocks that have performed well for the past 200 years, this is one number you can’t skip!

- Next, we look at “True Revenue Growth.” A lot of stock analysts like to look at gross sales, net profits and expenses. Some even look at growth patterns. That’s all great, but unless you know what the “true revenue” of a company is, you don’t know how healthy it really is!

- Finally, there’s a simple formula I’ve designed called “Hidden Context Pricing.” This is the secret sauce where I figure out what the TRUE VALUE of a company’s share is.

Through over two decades of refining, I’ve found these are the most important and revealing metrics you can look at when analyzing stocks using the “Third Rule of Investing.”

So here’s how it works:

Each of these criteria gets a score, and then they’re combined to give a score between 0 and 10, with 10 being safe and profitable, and 0 being a glaring red flag everyone should avoid.

Here’s an example of how IDEAL’s scoring system really helps us simplify our stock analysis…

So as you can see, practically anyone who can read a simple number between 0 and 10 can use IDEAL to pick stocks.

So as you can see, practically anyone who can read a simple number between 0 and 10 can use IDEAL to pick stocks.

That’s what IDEAL is all about.

Now I need to tell you why you need to start using it immediately…

How Today’s “Two-Tier” Market

Can Wipe Your Portfolio Out!

(Why You Need IDEAL Right NOW)

Can Wipe Your Portfolio Out!

(Why You Need IDEAL Right NOW)

The IDEAL system I built based on the “Third Rule of Investing” has helped thousands of people for the past four decades build wealth.

But that’s not the most important reason I’m writing you.

You see, I’m writing you with the highest sense of urgency today because, unfortunately, we’re entering what many economists call a “Two-Tier Market.”

Due to recent global economic changes, like the China Flash Crash in late August of 2015 (which is a preview of times to come)…

…we’re left with two tiers of the stock market.

On one tier, we have grossly overvalued companies. These are the types of companies that have no foundation to back up their high stock prices.

And when crashes happen, they plummet as much as 80% or more. During the Dot-Com Crash of 2001, venerated companies like Cisco fell as much as 82%.

You need to sell these stocks immediately.

Using the IDEAL scoring system based on the “Third Rule of Investing,” I have identified “10 Overvalued Stocks to Avoid Right Now.”

I’ve put these ten stocks into a short but very important report.

These ten stocks have scored the lowest possible score on the IDEAL scoring system. If they are in your portfolio, you need to sell them immediately. I believe these stocks will fall as much as 80% or more, just like Cisco fifteen years ago.

Imagine being one of those guys who held on tight to a dead investment as it went down. I wouldn’t wish that on my worst enemies.

The “Third Rule”-IDEAL system makes sure you know exactly how much a stock is worth at any given minute… so you always make the right decisions.

“10 Overvalued Stocks to Avoid Right Now” is usually a members-only exclusive report, but because I want you to have this information in your hands immediately, I’m going to send you a FREE COPY of it.

But that’s not all…

I also wrote a report called “Crash Protection Package,” which lists out four investments that I believe will survive the upcoming crash. And in fact, not just survive, but thrive in the aftermath of it.

You will also receive a FREE COPY of this report.

Now the flip-side to all this doom-and-gloom, sky-is-falling news is the second tier of this two-tier market.

This is where there are a lot of bargain-basement-value stocks that are GROSSLY UNDERVALUED and just waiting to be scooped up… right now, if you know where to look!

The IDEAL scoring system has identified “10 Undervalued Stocks to Own Right Now” in this second tier.

Inside this report, you will see ten stocks that have the highest scores in the IDEAL system right now.

Previous high scores on the IDEAL system include Apple, which gained 60% shortly after, and Lenovo, which gave investors a quick 43% return.

The ten undervalued companies inside this report have the potential to gain 59%… 75%… and even double over the coming months as they “revert to the mean,” or in other words, return to their TRUE VALUE.

I Want to Send You These Five Reports Absolutely Free Today!

I recently put these reports together for our Personal Finance subscribers by using the IDEAL system to identify grossly overvalued and highly undervalued stocks.

- The “Dirty Dozen: 12 Stocks to Sell Yesterday!” report that lists 12 healthcare stocks you need to sell ASAP…

- The “10 Overvalued Stocks to Avoid Right Now” report that unveils stocks that are scoring extremely low on the IDEAL system. Sell them immediately!

- The “Crash Protection Package,” which reveals 4 stocks that will “weather the storm” in the coming crash.

- The “10 Undervalued Stocks to Own Right Now” report that details stocks I believe can go up from 59% to doubling your investment over the next few months.

And the timely report you read about today, which, due to legal constraints, is ONLY available for the next 30 days:

- “True Value: 5 ‘Third Rule’ Stocks About to Take Off” reveals the name of the original out-of-print book and its billionaire author, the “Third Rule” principles that have been so effective and the 5 stocks that are positioned to pull in huge profits using these principles right now. This report is a MUST-read for every serious investor.

Normally these reports are sold for $49 each. But you can get instant access to them—a $245 total value—absolutely free.

So what’s the catch?

There isn’t one.

As I have mentioned already, for the past four decades, subscribers to my newsletter, Personal Finance, have enjoyed unparalleled advice, tips and investing strategies.

They get access to some of the top investing minds in America. People who have all reviewed the core principles of the “Third Rule of Investing” and put it to use in service of over 40,000 readers from around the world.

They have enjoyed 74.9% overall portfolio returns on current holdings. They’ve avoided crashes like the Dot-Com Crash and the Subprime Crisis. And they all did it using an easy-to-understand investing system.

And what I’d like to do today is personally invite you to be a trial member.

This means I want you to simply try out Personal Finance for 90 days.

You’ll get our twice-monthly issues of Personal Finance, a 12-page newsletter delivered to your doorstep and in your email inbox. You'll also get instant online website access to our online portfolio and our library of back issues, private reports and email alerts.

I want to give all of this to you at an unbelievable price…

You won’t have to pay the $3,499 that you would for the secrets in the out-of-print book I told you about in the beginning.

You won’t have to pay the $2,000+ that other services are charging for this level of investment advice.

The annual subscription fee for Personal Finance is $99 a year.

We like to keep the price accessible. Our entire business model is built on renewals, so we only make money when we do our job—delivering top-quality research year after year to loyal subscribers.

But you won’t even pay the normal subscription fee today…

Because I’m making a very special offer to you today for only $39.95 a year.

But it gets even better: I’ll let you have this special discount rate for TWO years, locking in your savings.

So you’ll pay $79 for a two-year subscription—and you’ll gain access to my Special Report “True Value: 5 ‘Third Rule’ Stocks About to Take Off.”

So you’ll pay $79 for a two-year subscription—and you’ll gain access to my Special Report “True Value: 5 ‘Third Rule’ Stocks About to Take Off.”

Please note that due to the additional costs involved, we’re only offering this limited-time, one-of-a-kind report with the $79 two-year offer.

You still have nothing to lose, because as I mentioned already, this is a hassle-free trial membership where you can take up to 90 days to decide if it’s right for you and receive a 100% refund.

All of the Special Reports you receive are yours to keep, regardless of what you decide, with my compliments. That’s how confident I am that you’ll like what you see.

Here’s My Risk-Free Guarantee to You:

If we don't impress you in the first 90 days, simply email or call us, and any one of our friendly Customer Service representatives will refund every penny.

It’s that simple and pain-free.

Remember—IDEAL is the very best thing to prepare your portfolio for the coming two-tier market.

Since March of 2009, the S&P 500 has more than doubled.

A lot of investors made quite a bit of money.

But the coming years are a return to uncertainty.

We saw how bloody it got with the China Flash Crash in August of 2015. The DOW dropped a record-breaking 1,089 points during intra-day trading. And we saw the S&P 500 fall a record 8.1% in just two days.

But Personal Finance readers were barely affected thanks to the “Third Rule” principles that are the engine of the IDEAL system.

As we head into a choppy two-tier market, investors will need to know the TRUE VALUE of stocks.

That’s exactly what IDEAL is designed to do.

And with its real-time, easy-to-understand scoring system, you’ll always know the TRUE VALUE of any stock worth knowing about.

As you just read, the IDEAL system can save your portfolio… and can also point the way to incredible opportunities.

The core engine and very foundation of IDEAL is the “Third Rule of Investing.” It’s an investing rule that has stood the test of time and continues to turn tuned-in investors into millionaires, and in some cases… billionaires.

I want you to have access to IDEAL today.

All you need to do is give Personal Finance a risk-free test-drive. That’s it. And if you don’t like it, simply ask and we’ll give you a hassle-free full refund.

Just click the button below to get started.

Remember—you only have a very limited amount of time.

When you try out my service using the $79 two-year offer, I’ll rush you my report “True Value: 5 ‘Third Rule’ Stocks About to Take Off.”

It reveals the name of the original out-of-print book and its billionaire author. It also reveals the “Third Rule” principles that have been so effective, and the 5 stocks that are positioned to pull in huge profits using these principles right now.

I don’t think there is a better way to protect and grow your portfolio over the next five, ten or twenty years.

Just click the button below to get started.

I look forward to greeting you as a new member of our Personal Finance family.

To Your Investing Success,

Jim Pearce

Chief Investment Strategist of Personal Finance

Creator and Designer of the IDEAL system

P.S. I want to emphasize again…

We spent hours fighting with our lawyers just to get the legal permission to create this report.

They gave us a 30-day limit to get this into as many hands as possible. It was a small window of opportunity, but I had to take it. So please don’t miss out—click the button above to get started.

All the risk of putting this out there has been, and continues to be, on us.