Billionaires like Gates, Bezos, and Buffett have been fighting tooth & nail for years over…

The #1 Income Investment For Uncertain Times

Forget gold, bonds, fine art, or rare collectibles…

This once “secret” income power play is giving everyday investors the opportunity to collect payouts up to $1,452 per month (or more)… over and over again.

Here’s how to claim your share…

Fellow Investor…

If you make one simple move today…

Fresh monthly payouts could start flowing directly into your account…

In as little as 30 days.

Just how much income are we talking about?

According to a recent data survey…

James B. from Frankford, DE collects monthly payments to the tune of $1,225 with this investment asset…

Jessica Z. from North Stonington, CT is averaging $2,154 per month in extra income…

And Maurice S. from Riverside, IA is raking in a whopping $6,506 each month from this incredible strategy.

For most folks, that kind of money would be life-changing.

So it’s no wonder people from across the country are rushing to lock-in a special type of investment previously reserved for insiders and the ultra-wealthy…

One which can now provide average Americans with rock-solid income every month — for LIFE.

That’s important now more than ever before…

Because when markets turn sour, everyone suffers.

Well… almost everyone.

You’ve undoubtedly noticed that today’s financial aches and pains are unevenly distributed.

Your pain at the pump… sticker shock at the grocery store… and downright misery in the markets…

It just doesn’t flow all the way to the top.

Up there, luxury cars are full of premium gasoline… refrigerators overflow with all-organic foods… and cash never seems to be a concern.

Yes, some people seem to have a real knack for insulating themselves against market downturns.

And even if you’re new to the investing world, you’ll likely recognize a few of these faces…

There’s Elon Musk, feeling no financial pain as he snaps up submarine cars from James Bond movie sets, tweets like a maniac, and plots to put Americans back on the moon…

Jeff Bezos, who retired but still splurged on a $78 million house on the beach in Hawaii and a $500 million custom-built sailing yacht that’s longer than a football field…

Bill Gates with his 23-car garage packed full of rare Porsches…

Hedge-fund legend Michael Burry with the free time to build custom guitars for his favorite metal bands…

And of course, Warren Buffett, who laughed all the way to the bank in 2022 as his balance grew, and grew, and grew…

Good for the rich guys, right?

Actually… thanks to a little-known “loophole”… it’s good for you, too.

Or at least, it could be.

Because love ’em or hate ’em, what these multi-millionaires and billionaires do to shield themselves from financial pain and keep their pockets full of cash could also protect YOU while putting extra money in YOUR pocket…

A lot faster than you might imagine, too.

In fact, you could improve your financial position with monthly cash payouts of up to $1,452 or more — starting in as little as 30 days.

This isn’t based on chance or hope…

Your money isn’t tied up for decades on end before barely squeaking out a 10% gain either… this income hits your account, month after month.

Best of all… every penny of this profit is owed to investors like you…

BY LAW.

Here’s the thing…

Showy spending takes cold, hard cash. And I know what the rich have done to make sure it keeps coming, month after month after month…

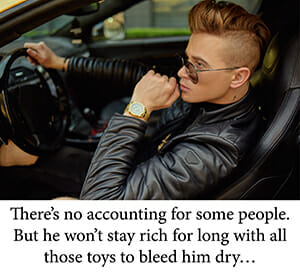

The mega rich have a reputation for splashy purchases and ridiculous in-your-face excesses.

Everything from private islands and $500 million pieces of art all the way down to Swarovski bathtubs for their dogs and $325 individually wrapped ice cubes.

But these kinds of purchases… as flashy and excessive as they are… actually serve to HIDE the real money story.

If you’re going to spend like a big shot, you’ve got to have the income to back it up.

Which is why some of the world’s savviest income-minded tycoons have made sure they’re bringing in at least $280,080 every three months in cash payments from this special asset…

Because if you don’t have serious cash flow like that… you’re not really much of a big shot.

You’re just another flash-in-the-pan “lotto winner” about to blow through all your money.

And in practically no time at all, you’ll be broke and friendless, drowning in debt and struggling to keep a roof over your head.

Now, for some people, that win/lose roller coaster is what keeps life interesting.

But for the truly wealthy — and those who aspire to be — the idea of losing it all is completely unacceptable.

They’ve managed to get to the top, and they intend to stay at the top.

So if you go digging through their financials the way I have, you’ll discover that many of the savviest investors have taken the exact same kind of steps to guarantee themselves a steady stream of cash… at least $280,080 a quarter, and often more.

Now, deep financial research isn’t something everyone enjoys.

But those who have a knack for it can learn a lot from those tedious technical charts, earnings graphs, special disclosures, and arcane tax filings.

Because those piles of paperwork are full of valuable secrets…

Including what the truly rich do to make sure they’re always flush with cash.

These high-rollers simply REFUSE to live a lifestyle even remotely resembling middle class.

And the mere thought of ever living paycheck to paycheck is enough to completely turn their stomachs.

They want their money to keep them — and their families — comfortable, forever if possible.

That’s why they rely on the special asset strategy I’m about to show you — what I believe will go down in history as “The #1 Investment for Uncertain Times.”

But you don’t need to be a millionaire or accredited investor to get that same financial stability & peace of mind…

Average investors can now harness this unique income strategy to collect up to $1,452 per month or more for just pennies on the dollar compared to what the rich folks pay…

It’s certainly an attractive idea — cash payments coming your way, quarter after quarter and month after month, for the rest of your life (and potentially far beyond that, too).

But for a select few, it’s more than a dream.

Because they took the right steps… at the right time…

That steady, reliant, and rising income is now their reality.

Sadly most investors will walk right by these opportunities without even realizing they’re there… something I hope to remedy for you if you’ll give me the next few minutes of your time.

But first, I need to address the elephant in the room.

Yesterday’s investing “mainstays” have turned into bitter disappointments — and you deserve so much better!

Let’s face it.

2022 was the straw that broke the camel’s back.

We were supposed to be coming out of a pandemic and back into some serious prosperity.

And then…

Well…

We didn’t even make it six weeks into the year before war broke out!

From there, financially speaking, it was an unprecedented economic bloodbath.

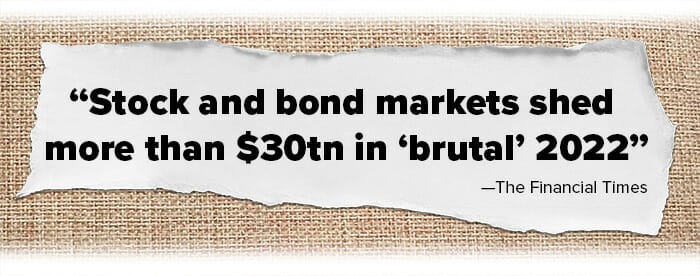

According to The Financial Times, 2022 was “the year that cost the world $30 trillion.”

No matter where you stashed your money, it seemed to be nothing but pain, pain, pain.

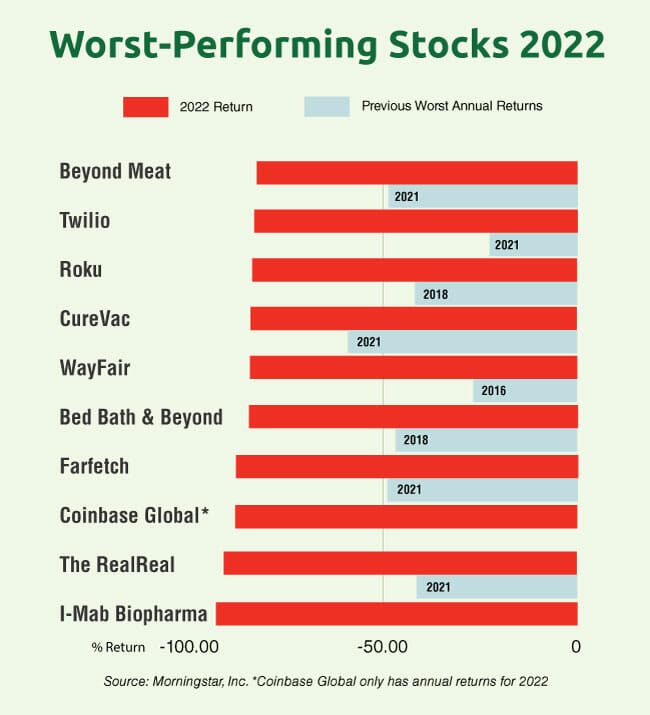

If you held everything in stocks, you got hosed…

If you had your money in bonds, you got hosed…

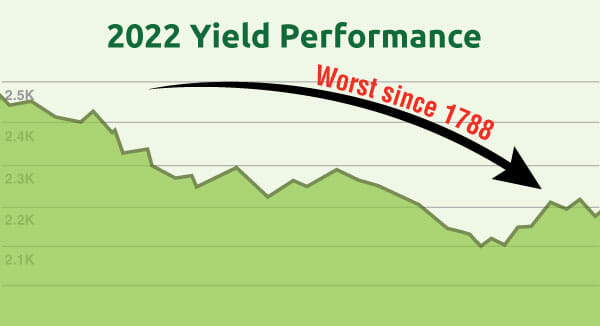

Held it in Treasuries? Hosed again! 2022 was the worst year for Treasuries since 1788.

That’s right… I said 1788!

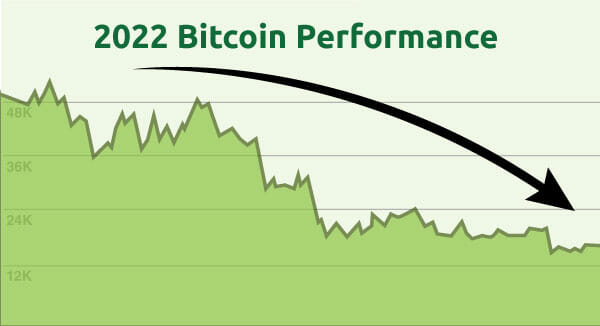

And alternative assets, like Bitcoin? Dear Lord, did you ever get hosed…

One wealth-wrecking decline after another…

With sky-high inflation as the cherry on top.

Defensive action?

Everyone was on the defensive!

People were desperate to move their money where it would be protected… and where it was possible to get some semblance of income.

So, a lot of people I know put money into what they thought would be the safest possible place — blue chip stocks that paid dividends.

Those HAD to be trustworthy, right?

Wrong again…

We’re living through the ultimate betrayal by the blue chip dividend “aristocrats”

(but hang on, because your personal escape hatch is dead ahead…)

It’s practically financial gospel…

And I certainly heard it over and over when I was coming up in the business…

Seems like reasonable advice, right?

Sure those multibillionaire CEOs and powerhouse investors might need yachts and trips to space to feel any sort of joy in life anymore…

But most folks are looking for something much simpler…

A safe place for your nest egg and a nice, reliable stream of income from your investments.

I mean, of course, the potential for serious gains also exists.

But in times like now, safety and income are the name of the game…

Doesn’t matter if you’re middle class, a 401k millionaire, or a billionaire tycoon…

When you check your accounts, you want to see deposits…

More money flowing IN than what goes out!

That’s what those safe, dividend-paying stocks are for…

Well, what they’re supposed to be for…

But lately, even some of the biggest names in the dividend game have turned traitor…

Take Disney.

I mean, it’s Disney. They’ve paid dividends for decades and have the rights to most iconic characters in the world on their balance sheet… how could you go wrong with that?

And yet… when the pandemic struck, the company stopped paying dividends.

For years now, the “House of Mouse” has left loyal investors high and dry, just when they need that “reliable” income the most.

Same for Goodyear Tires. The company went from paying out nearly 5% in annual dividends to giving shareholders a big fat nothing, just as crisis struck…

Boeing, Delta Airlines, and Las Vegas Sands…

Amplify Energy, Expedia, and The Royal Bank of Scotland…

Household names you used to be able to trust as reliable dividend-payers…

But every single one of them slammed the brakes on that gravy train!

In fact, out of all the companies that “suspended” their dividends when the pandemic hit — nearly two years later, 40% have yet to relaunch their payouts.

Yet these companies aren’t out of business. They’re not in bankruptcy… a few are even thriving!

But they’re not sharing the wealth.

They’re keeping it for themselves.

Same for the slashers, like AT&T…

The former dividend stalwart slashed its payouts by nearly 50% in 2022…

As did other big names like Anheuser-Busch, CapitalOne, Haliburton, MGM, Prudential PLC, Shell, Suncor Energy, and Wells Fargo.

All in all, as the markets soured and dividend income became more important than ever to millions of investors…

Some 232 companies slashed their dividends. Ouch!

Now, if you’re relying on your investments for income to provide life’s essentials…

A slashed or suspended dividend is a real punch in the gut.

And if you already earmarked that income to pay for prescriptions, medical bills, or groceries…

Then dividend cuts and suspensions are out-and-out unacceptable.

You need something more reliable…

More assured…

Something where it is LEGALLY REQUIRED that you get your money.

Most regular investors don’t know where to go for that kind of assurance.

They read about slashed or suspended dividends in the news and feel like there’s nothing they can do.

If that sounds like you — just know you’re not alone.

The rich, on the other hand?

Thanks to their legions of well-heeled financial advisors, they know exactly where to turn for income that’s VIRTUALLY GUARANTEED.

Here and now, I’d like to clue you in…

Not only on how they do it… but how YOU can do it too.

Why?

Simple.

You deserve to have the same iron-clad income opportunities as the world’s wealthiest people…

And I’m prepared to help make it happen.

My name is Jim Pearce.

My name is Jim Pearce.

And I’ll confess — I got my start managing money for Fortune 500 executives and other “high net worth” individuals.

At one point, I had a portfolio of over $50 million dollars under my direct control.

You might say I was a trusted insider…

And I certainly helped my clients live well-funded lives, flush with cash from their investments.

But helping the rich get richer doesn’t necessarily make the world a better place.

And while I won’t pretend to be a saint…

Dealing with that highly demanding and often ungrateful crowd made me realize that I could be putting my skills to better use.

So even as I delivered win after win for my clients (including protecting them from both the 2008 Crisis and the Great Recession that followed)…

I was hunting for a fresh opportunity.

A place where I could use my analytical skills…

Geek out on earnings reports, financial charts, and disclosure forms…

And share the kinds of potentially profitable financial market insights that could truly transform lives.

I found my perfect home here at Investing Daily, as the Chief Investment Strategist for our award-winning flagship publication, Personal Finance.

The mission of Personal Finance is to secure your retirement and make you incredibly wealthy…

Even if you’re starting with a small account… and especially if you like to play it safe.

We’ve been doing it for nearly 50 years.

And we’ve gotten, if I do say so myself, damn good at what we do.

Which brings us back to the iron-clad income opportunity I can’t wait to share with you…

An income strategy where companies are REQUIRED BY FEDERAL LAW to put 90% of the money they make right back into the hands of investors…

Which after today could be YOU.

As I just mentioned, a company has the right to slash or suspend its dividend any time it wants.

Even massively wealthy blue-chip corporations that are positively swimming in cash can alter their dividends on a whim.

They may call it “corporate strategy” but let’s be honest — no matter what they call it, the net effect of a dividend suspension is that they keep all the money and you don’t get a dime.

And that just doesn’t sit right with me.

Especially when markets turn sour and inflation seems to have infected everything.

That’s when you need income the most — reliable income that shows up in your bank account every quarter…

Or even every month.

Like the $2,168 in monthly income our data shows Ken P. from Raymore, MO is averaging from the same asset strategy you’re about to see…

Or Bill J. from Cape Elizabeth, ME who’s banking payments to the tune of $4,531 per month…

And Lynn R. from Normal, IL who our recent research shows is pulling in a life-changing $6,614 on average each month with this exciting strategy.

The fact that this income opportunity is available to ordinary Americans is nothing short of incredible.

Because for too long, this kind of income stability was restricted to those at the very top of the food chain…

Those who could afford to invest millions upfront to guarantee a lifetime of payouts later.

Hardly fair, really.

And so Congress stepped in.

Now, as usual, their intervention was loaded with bureaucratic restrictions and pages of tax carve-outs guaranteed to confuse all but the savviest accountants.

They created a new investment that aims to even the playing field by giving regular Americans access to the same income opportunities once reserved solely for use by the ultra-rich…

But then they masked these new “Equalizer” opportunities behind language that left most Americans completely in the dark about what had just happened.

What can I say? The geniuses in Congress are a special kind of “smart”…

And yet, their new Equalizer investments are full of income potential for those in the know.

Because they come with a mandate to pay out at least 90% of their taxable income to investors.

You see, there’s a little-known tax law that allows these Equalizers to pay ZERO corporate taxes…

But in order to qualify…

And trust me, with hundreds of millions or sometimes billions of dollars in the IRS’s crosshairs — they REALLY want to qualify…

Federal Law requires 90% of what an Equalizer brings in to flow right back out again to everyday investors like YOU.

As long as they’re turning a profit…

There’s no possibility of suspensions.

So you’d think everyone would be a fan…

And yet… even now, when investors are STARVING for income and yield…

Few people have these Equalizers on their radar…

Or in their portfolios.

Meme stocks and brand-name blue chips?

Even if you only trade stocks on your phone as a hobby, you can probably name several of those.

But these Equalizers…

I could name a dozen of them and most people would still draw a blank.

Most people — except for one group.

Can you guess who?

If you said “rich people,” then you’re right.

Some of the world’s wealthiest and most famous people invest heavily here, including Warren Buffett, Sam Zell, Bill Gates, and Jeff Bezos.

What can I say?

They like the money.

At a mandatory 90% payout, these Equalizers hold the potential to deliver much larger cash payouts than even the juiciest Dividend Aristocrat stocks…

But then, right at the end of 2022, everything changed.

What was good before got BETTER… and especially better for YOU

I’ve already told you that Equalizers — by law — function a bit differently than other companies (they throw off cash like crazy).

And there’s a small sub-set of Equalizers I’d like to point you toward in just a moment that are some of the most potentially cash-rich you’ll find anywhere…

For years, they’ve been very good to those who hold them — throwing payout after payout after payout to their investors.

As you’ll see in a second…

Your opportunity to use these Equalizers to generate monthly income of $340, $931, and $1,452 is just the start.

Because near the end of 2022, those payouts got hit with a major “deal sweetener”…

It’s no secret, is it, that the Democrats and Republicans don’t get along.

Yet to get key funding bills passed, even bitter enemies have to reach a compromise sometimes.

And that was never truer than what we saw in the stopgap government funding bill that was necessary to keep our country running.

It was packed with “extras,” and I’m sorry to say that not all of them had our best interests at heart.

But amid all the goodies for the rich and their special interests… was a little provision with something in it for normal investors like you…

Something that will let you potentially get a lot more out of an Equalizer play…

So before you rush out to buy into your first Equalizer, let me show you EXACTLY how they work…

What separates Equalizers from regular stock market plays…

And truthfully, even from each other…

Comes down to the underlying assets.

In typical companies, when you buy a share of its stock, you now own a fraction of the company. That’s the underlying asset.

With one of these Equalizers, the underlying asset is a piece of real property.

And when they say “All real estate is local,” they’re not kidding.

Especially now, in today’s markets.

Some Equalizers are struggling, because the real estate they own has fallen out of favor. Downtown office properties, for example, were absolutely brutalized by the pandemic.

And rising interest rates haven’t been kind to Equalizers that specialize in mortgage deals for apartment complexes or single family homes, either.

So you don’t want to own those, because they’re unprofitable, and the potential payouts — if any — would be pitiful.

And you’re not here for pennies.

You need cash — real income — that flows from the best properties right into your pockets.

That means you want to own Equalizers that own the best and most desirable tracts of land in the world.

And what those “best-in-class Equalizers” specialize in… wow.

The one thing the world’s savviest investors won’t stop loading up on — and they’re even willing to go to court for the right to keep buying as much as they want

Earlier this year, Bill Gates found himself in court.

It wasn’t some lingering divorce hearing either.

But it was still a nasty case.

You see, there was something Bill wanted.

Something with the potential to deliver serious income, even if the stock market tanked.

But the state of North Dakota wasn’t sure they wanted one of the world’s richest men to get richer owning it.

(I mean, can any of us really argue that Bill Gates NEEDS the money?)

Bill wasn’t about to take no for an answer — so they ended up in court.

To make a long story short, he prevailed, and was able to snap up what he wanted.

Not another tech company…

Not some vaccine-related research group…

Not even a fancy collectible or rare historical artifact.

Bill wasn’t out in court in the middle of the freezing High Plains for any of that.

He was there for the land.

Productive farmland.

A potato farm, to be exact.

Surprised?

I was too… at first.

But it makes PERFECT sense when you dig into it.

While you may think of the rich as the type of people who are stockpiling Mont Blanc pens, rare wines, and fine art…

Or who love super complicated investments, like laddered options or dynastic trust funds…

A lot of that stuff is exactly what I told you about earlier — nothing but a bunch of expensive status-symbol toys that you need mountains of cold, hard cash to maintain.

It fills your world with leeches. Everywhere you look, everything you touch, everything you have… it costs you money.

It fills your world with leeches. Everywhere you look, everything you touch, everything you have… it costs you money.

You’d hate living like that.

So do the rich. Well, the smart ones, anyway.

So the truly rich — and those who’d like to be truly rich — have been going after farmland in a big way.

Imagine looking at everything that grows and knowing that each and every seed, leaf, bud, or berry could put money directly into your pocket…

Up to $1,452 per month or more…

In as little as 30 days

Farmland is a transformative thing.

You take a piece of ground, care for it, and out of it will come the raw materials and ingredients necessary to feed the world and run a modern society.

We live in a world that marvels at technology…

But the real money out there isn’t what grows in the fields…

It’s the field THEMSELVES!

In fact, my recent research combining U.S. Department of Agriculture data with annual farmland returns reported to the National Council of Real Estate Investment Fiduciaries (NCREIF)…

Shows that owners of even the tiniest farms are raking in anywhere from $2,168 right up to $17,350+ per month.

All from humble little patches of land — many of which are smaller than some Walmart stores.

Which helps explain why, for decades, farmland has been hands-down one of the best places to put your money…

IF you could afford it.

So it should come as no shock that Warren Buffett — arguably the greatest investor of all time — has been buying up farmland since 1986.

More recently, rich celebrities like Chris Pratt and even NFL stars Josh Allen and Joe Burrow are following Buffett’s lead by investing in farmland.

Because not only is it becoming more scarce and more valuable…

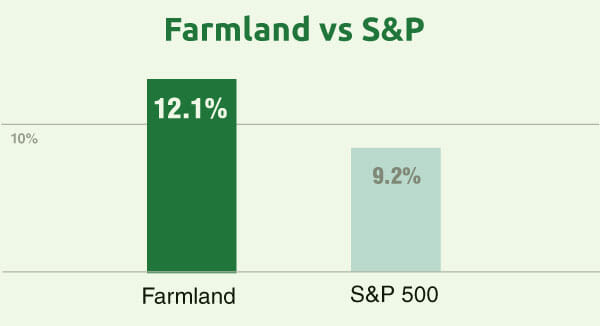

Farmland even outperforms the stock market.

Delivering an average annual return of 12.1% over the last 20 years, compared to the S&P 500 which averaged just 9.2% during the same time period.

And even better than the steady gains… you’ll notice that while the market careens up and down with crazy volatility, the growth line for farmland stays steady…

Which is because farmland returns on investment have been consistently positive since 1991.

Plus, as the late Will Rogers so eloquently put it, “Buy land. They ain’t making any more of the stuff.”

He was right… and when it comes to productive farmland, it’s even more true.

Currently, between development, re-zoning, erosion, and climate change, more than 1.3 million acres of farmland are lost each year.

So what remains simply gets more and more valuable…

And the U.S. government routinely dishes out extra tax breaks, subsidies, and investment incentives for farmland owners — just as they did at the end of 2022.

Which is where things get more and more interesting — and profitable — for you.

You can’t go out and buy a farm.

Or could you?

The thing with farmland — especially in America — is that it’s rarely for sale.

A family farm — and 96% of American farms are still family farms — might not change hands for generations.

And even what you might think of as big “commercial” farms have their roots in family farms.

Brothers that farmed next to each other… and then bought the place up the road… and then another place…

Conglomerates started as collectives.

And if you wanted to get in on the “farm scene,” you either had to know a guy who was getting out of farming with no family to follow after him (a rare scenario)…

Have a buddy who would vouch for you and then bankroll you (once in a blue moon)…

Or you had to be such a rich out-of-towner that you wouldn’t blink twice at the “outsider’s price” for the land (Bill Gates paid $13.5 million for his potato farm).

So even though farmland was where the money was…

It was simply out of reach for most people.

Until Equalizers came around, that is.

Equalizers are all about making very large real estate investments financially accessible to regular people like you and me.

And a farm certainly qualifies as a large real estate investment.

A single acre of farmland goes for more than $3,800 these days… and many farms are several hundred to several thousand acres each.

That means just to buy an average sized farm would cost you almost $1.7 MILLION.

Which simply isn’t an option for most folks.

But the beautiful thing about these Equalizers…

Is just how well they level the playing field.

Because you DON’T need to inherit farmland through your family…

And you DON’T need to be some high-roller ready to drop millions on a cattle ranch or cornfield.

Thanks to Equalizers, instead of buying the whole farm…

You can now invest in this incredible asset by purchasing individual shares.

So you can start off small if you want to…

And build up to whatever amount you can comfortably afford.

The best part is, no matter how much or how little you choose to put in…

In 30 days or less — you can start receiving monthly cash payments while your investment continues to grow.

In fact…

If you were to invest a mere 1/100th of the average farm investment registered on the NCREIF Farmland Property Index, into each of the 3 Equalizers I’m about to show you…

You could stake your claim to enough high-profit farmland to generate consistent income of up to $1,452 per month.

In other words…

Just over 21,000 total shares of these 3 Equalizers could pay you as much as $1,452 per month…

All while your shares keep increasing in value.

And your money comes in EVERY month, again and again.

How is that possible?

Very simple…

The way it works is that an Equalizer buys the land itself, and then rents it to farmers eager for a fresh piece of ground.

This is known as a “cash rent” arrangement. And farmers are happy to take it.

Why?

One of the biggest struggles farmers face is finding attractive ground to farm.

And even if you’re already farming thousands of acres, you’ll always have your eye out for adjacent sections of land you can use to increase the size of your operations, gain access to additional water rights, or use for rotational planting.

So a cash rent deal is a real win-win.

Plus, as far as tenants go — farmers are the cream of the crop.

This is because farmers don’t want to rent ground for just one season.

To be an effective grower, you need to understand the land, develop a relationship with it, and adapt your plantings to the unique quirks of each piece of soil.

So, most farm leases are multi-year affairs. A “short” farm lease might clock in at around three years — testing the ground, so to speak.

A more typical commitment? Start thinking in terms of decades.

In fact, in situations where non-farmer landlords are renting ground to an active farmer, some 41% have been renting to the same tenant for more than 10 years — and 15% have been rented by the same farmer for 20 years or more!

So with a cash rent arrangement, the farmer does all the plowing, planting, and harvesting.

All you do is just sit back… and get paid.

As a de facto farm owner, you don’t have to do any of the hard work…

but you’ll definitely still get all the money that’s due to you come harvest time… and lots of other times, too.

In fact, while quarterly payments are popular, there are a number of farmland Equalizers that offer monthly payouts, putting farm-based cash income into your pocket like clockwork every 30 days.

I’ve spent an incredible amount of time and my company’s money searching for the best ways to give you farm-based income in today’s markets — money you can legally “harvest” without interruption…

It’s not just the crops that bring in the cash. The earth itself — carefully tended and preciously guarded — is worth thousands of dollars per acre in the right hands.

Owned by an Equalizer and rented out, those thousands of dollars of value per acre flow from the very foundations of the food chain right into your pocket.

And with careful research…

I’ve found three of these Equalizer plays on track to drop consistent monthly payments of $340, $931, even $1,452 in your pocket month after month…

Income Harvest Opportunity #1:

Sweet Treats For Your Wallet

Our first income opportunity comes from the expensive side of the grocery store… fruits, nuts, and berries.

These crops — known as “permanent crops” in the industry — are time and water intensive to produce, especially if they’re organic.

Farmers spend time with them, nurturing groves and acres of berry bushes on rental arrangements that are a minimum of 5-to-10-year deals.

These long term deals contribute to consistent income for you as a part of an Equalizer — in fact, the one I’ve singled out makes a point of delivering income each and every month.

For 10 straight years, it’s delivered cash payouts every 30 days without exception.

Even better? The company is committed to raising its payouts each year at a rate higher than inflation, ensuring that your cash goes just as far as you need it to go.

What interested me most about this particular opportunity — on top of the consistent income — was the way the market treated it in 2022.

Although the company’s core business model didn’t change, and it delivered earnings and revenue beats while boosting its payouts, Mr. Market absolutely took it to the cleaners.

That means today…

You can snap up shares at 50% off the all-time highs.

That puts you in a solid position for meaningful capital gains on top of a fresh cash payout in your pocket every month of the year .

Income Harvest Opportunity #2:

Staple Crops You Can Count On For Cash

After indulging in the fancy foods that come with a fresh infusion of monthly cash, it’s time to get back to basics.

Staple crops — corn, wheat, soybeans — are a food foundation all over the world. They’re always in demand, and farmers clamor for additional ground to grow more.

That clamor for “more, more, more” has helped this Equalizer maintain a steady stock price even as our broader economy struggles. Stability like that is important… especially when you can get it ON TOP of consistent quarterly income payouts.

Even more exciting…

In 2022 they posted RECORD annual revenues — the highest in company history — while increasing profits by a whopping 16.5% year-over-year…

Profits that get paid out to investors like you.

And with this Equalizer already reporting another incredible 54% jump in profits, it’s clear that the money train has continued into 2023….

What’s next?

This Equalizer is exceptionally well positioned in core grains at a time when the Russia-Ukraine conflict has global supply chains snarled and the American southwest is in a serious drought.

Shares purchased now could be worth much more in the near future, and you’ll collect fat payouts each quarter for the “trouble” of holding shares and watching your investment grow.

Income Harvest Opportunity #3:

Towers of Cash Whenever You Look Up

Along with staple ingredients and snacking fruits, America’s rich soils are also ideal for growing the raw materials needed to power the world’s construction and manufacturing industries.

The Pacific Northwest, in particular, is home to unparalleled stretches of well-tended timber ground that have been intentionally cultivated for more than 100 years.

Not expecting to hear about trees as a “farmed” crop? You wouldn’t be the first to overlook the incredible value of a well-managed forest. And yet, out in nature, those tall trees are literal towers of money rising up from the ground.

Replanted as they’re harvested, cultivated trees like this can require a multi-generational commitment.

On your own, that’s hard to do. So this is another place Equalizers change the game for you…

Just like the other two I just showed you — this Equalizer company takes care of ALL the harvesting, heavy-lifting, and sustainable farming practices.

All you have to do?

Make your investment… sit back… and collect your share of the profits that come in like clockwork.

And this particular Equalizer? Their roots are more than 100 years old — and still growing! This is a company that understands how to stand strong in tough times.

In 2022, while other market sectors like tech & automotive fell, this firm expanded its U.S. operations by acquiring additional timber ground in the southwest. That boosted cash flows and allowed it to raise its quarterly dividend payouts for the second time in just five years..

With a 30-year history of non-stop payouts, this is a cash income play you’ll want to seriously consider making ASAP.

Now, I’ve put everything you need to know about these income opportunities into a special fast action report I’m calling…

Harvesting Income: 3 Ways To Fatten Your Bank Account With Monthly Cash.

Inside Harvesting Income, you’ll discover:

- The names and ticker symbols for each of the Equalizers I’ve shared with you today… so you can see for yourself the income potential I’m talking about is real…

- Why each Equalizer holds exceptional value in today’s market for income and potential gains… so you’ll understand why this investing strategy transforms everything you see into a potential cash harvest opportunity…

- And most importantly, exactly how to position each Equalizer in your portfolio for maximum income flow… so you can look forward to regular cash deposits beginning as little as 30 days from now…

Now, if I were selling this report on its own to the general public… and let’s be clear, I’m not, because I’m reserving it exclusively for you…

I’d expect that access to these unique income opportunities would carry a price tag of at least $199. (And frankly, it would be a STEAL at that price, considering the income that is set to hit your account month after month.)

But today this detailed fast-action report is yours “on the house” when you join me inside my exclusive investing advisory Personal Finance today.

The name may be simple but don’t let that fool you.

Personal Finance is unlike any investing service you’ve ever seen

A 49-year track record of creating life-changing income and wealth for our readers

Along with the work I do as the Chief Investment Strategist, Personal Finance is supported by a team of the industry’s leading investment analysts and income scouts, including Robert Rapier, Jim Fink, and John Persinos.

Between us, we have over 115 years of “in the trenches” experience helping investors like you bring home income + gains.

And as I mentioned earlier, we’re united with a single goal — one we take very seriously…

To help YOU become incredibly wealthy.

We’re not satisfied delivering mediocre returns that just barely beat the market…

And we don’t want you to suffer through years of “boring” performance in your portfolio when you could be out there harvesting some of the best income opportunities and returns available.

That’s why Personal Finance is designed to present you with opportunities to generate reliable income and potentially life-changing fortunes… month after month, and year after year.

Of course, you don’t have to just take MY word for it…

Here is just a small sample of results our readers have been kind enough to share with us:

Now, some of these results are exceptional to be sure.

You can’t expect every move to be a triple-digit winner…

And you should never invest more than you’re willing to walk away from.

But one thing I know with 100% certainty…

Is that these folks say our information has helped them substantially improve their lifestyle.

Because we’re dedicated to providing…

Simple Investment Ideas You Can Actually Use To Improve Your Financial Outlook

Each month, you’ll receive a brand-new issue jampacked with useful, money-making and actionable insights, with the biggest opportunity of the month highlighted right on the front page.

It’s short, simple, and sweet… designed to be read quickly, so you can get in on the action and on to the next opportunity in no time flat.

If you feel inspired to make an investment, everything you need is right there at your fingertips — stock tickers, entry/exit pricing, and potential trade windows that could help you make the most of our insights.

And that’s not all you’ll get…

When you subscribe to Personal Finance today, you’ll also unlock:

- Intra-Day FLASH Alerts — Any time I or another member of the team uncovers an urgent BUY opportunity or when our research indicates it’s time to take profits on an open trade. You’ll never wonder what to do or when to do it… we’ll be with you every step of the way.

- Weekly Update Emails — Containing important news affecting the economy, the market, or our portfolio positions.

- Our Confidential, Members-Only Website — This secure, password-protected membership site is where you’ll have 24/7 access to all past issues of Personal Finance, FLASH Alert history, and portfolio summaries.

- Direct Access to the Personal Finance team — Your subscription to Personal Finance includes daily opportunities to interact directly with me and the other experts in our private Stock Talk forum. While we can’t give personalized financial advice (it’s prohibited by the government) we do share our insights about the general market and promptly address questions when we hear from you.

- Your VIP Concierge Hotline — Where a real live human is available whenever you have a question or concern you need handled right away.

And by coming this far with me, you’ve proven you have an interest in harvesting regular income for yourself…

I have three more cash-in-your-pocket bonuses waiting for you…

Bonus #1:

AI Riches: How the Artificial Intelligence Revolution Could Hand You a HUGE Windfall

Artificial Intelligence is all over the headlines for good reason.

This truly is a technological revolution with the potential to dramatically improve our lives while unlocking generational wealth… and I’d like you to have the chance to get your share of the possible gains.

Inside AI Riches, you’ll discover:

- Why the global AI market is set to soar to more than 10x the size of the automobile industry (one of the biggest industries in the world)

- How AI changes things for the better in specific areas where smart investors are already positioning themselves for maximum potential profits

- And of course, the names and ticker symbols for three game-changing AI stocks that could potentially lead you to a $174,251 windfall

And that’s not all. I’d also like to give you…

Bonus #2:

Smart Car Profits: How One “Connected Car” Innovator Could Flood Your Account with Cash

One of the most practical applications of the AI Revolution is in our cars. Connected cars — some with the potential to drive themselves — are in testing and in use on our roads right now.

That’s why inside Smart Car Profits, you’ll learn:

- How to look past trending “guidance system” plays to the real heart and soul of the cars of the future (that’s where the profits true profits live)

- Why this unique user-friendly feature is the secret of successful mass appeal for smart cars

- The one dedicated play you can make now (for less than $20 a share) to potentially flood your account with cash

And on top of that potential smart car cash windfall, I also want to gift you the secret to even more extra income in the year ahead…

Bonus #3:

The 9-Minute Secret To Consistently Making Extra Cash

In between your regular income harvest payments, you may want to set yourself up to make more money…

And this exclusive action tutorial will show you how to get it — FAST!

Inside The 9-Minute Secret, you will learn:

- How to switch out of “passive mode” to actively make income by trading…

- Where to find extra income on days the market is up… down… or sliding sideways…

- How small wins (thanks to consistently applying your new fast action strategy) can potentially deliver more than $67,000 in extra income per year

Plus, once you know the secret, you’ll be able to bring in thousands in extra cash income on top of all your other potential gains and income harvest money.

Instant Access To These Bonuses — And Everything Personal Finance Has To Offer — Is Just One Affordable Click Away…

With everything you receive as a Personal Finance member…

You might expect membership to cost thousands of dollars.

However…

Our regular price is $129 a year.

We could charge a lot more — others certainly do.

But our mission… the same mission that has carried us through nearly 50 successful years in business…

Is to support individual investors like you, who are interested in reliable income and the kind of sound, useful insights that can turn a small account into a much bigger portfolio.

Which is why…

Given that you’ll receive a handful of opportunities with the potential for reliable cash income or double, triple, or even quadruple-digit returns each year…

And a single well-played recommendation could cover your annual membership fee 100 times over…

I think you’ll agree… $129 is a fair price.

But I don’t want to just be “fair” with you…

So, when you click the button below to start your Personal Finance subscription today, you won’t need $129 to get in the door.

For you… today… right now… I’m willing to slash the starting price of Personal Finance by 69%.

Which means just $39 covers your membership for an entire year.

But I’m STILL not done…

Because in my experience, the investors who see the most success are the ones that tend to stick to a plan… and I can’t think of a better, more put-together plan than Personal Finance.

That’s why if you opt to “double up” your subscription and join us for 2 years right at the start, I’m willing to double down on bonuses and discounts for you in a “top up” package so generous, you’ll need to click through to the next page to see it…

More comfortable ordering by phone? Dial 800-543-2049

And that’s STILL not all…

Your Satisfaction Is Covered By Our “Risk Nothing, Keep Everything” 100% Money Back Guarantee

Subscribe to Personal Finance today…

If you are not completely satisfied with Personal Finance for any reason in the first three full months simply call us and we will rush you a 100% refund of every cent you paid. You’ll have risked nothing...

And, even after three months, you're still free to cancel anytime and receive a refund on the unused portion of your membership. All of the issues and valuable reports that you’ve received are yours to keep, just for giving Personal Finance a try.

That’s right… 6, 9, 11 months down the road, if you decide that Personal Finance isn’t right for you, we’ll refund the balance of your membership, AND as a thank you for giving Personal Finance a fair try — you keep everything we’ve talked about today and are free to benefit from what you’ve learned for years to come.

More comfortable ordering by phone? Dial 800-543-2049

It’s Time To Guarantee Your Shot At Life-Changing Income

The current market turmoil has been a long time coming… and it may be a long time yet before we see it settle down…

IF it ever does.

In times like these, a steady flow of cash is exactly what you need.

Cash that is legally required to be given to you, on a fixed schedule, quarter after quarter, month after month…

Harvest after harvest.

You can’t count on regular dividend paying stocks to give that to you.

But Equalizers… and especially the type of farm-based Equalizers favored by the world’s savviest investors… absolutely will give you cash when you expect it.

On time, every time — as is required by law.

Don’t leave your finances to chance in this market.

Up to $1,452 or more in monthly income is waiting for you…

And your next cash payout could be in your bank account in as little as 30 days, .

Don’t wait...

Get started today and your first cash payout could be in your account by this time next month.

More comfortable ordering by phone? Dial 800-543-2049

Jim Pearce

Chief Investment Strategist

Personal Finance

August 2023

Copyright © 2023 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.