- Every time your neighbor streams that zombie show on Netflix… YOU’LL GET PAID.

- Every time your wife buys a book on Amazon or “likes” her friends on Facebook… YOU’LL GET PAID.

- Every time your kids share a selfie photo, do a video chat, or play their online games… YOU’LL GET PAID AGAIN.

- And every last time anyone, anywhere in the world looks something up on Google… YOU’LL GET PAID EVEN MORE.

Ordinary Americans Just Like You Are Pocketing An Extra $8.47 Every Second In “Digital Rent Checks” – Here’s How

One simple move gets that money flowing your way right now…

(HINT: You won’t buy a single “tech stock.” And the less you know about computers, the better!)

Dear Reader,

There are two ways to get rich from the Internet.

One way you hear about all the time –

Some genius geek in a dorm room invents the next big thing and BOOM! They go from broke to billionaire.

It’s a great story. But the happy ending never lasts.

Because nobody stays king of the hill in Silicon Valley for long.

There’s always another geek. Another dorm room. And another next big thing to “disrupt” the last one.

That’s why investing in technology stocks directly can be so risky.

And why I prefer the other way of getting rich from the Internet.

Instead of hoping for a windfall that may never come (and won’t ever last), this simple investing move lets you collect a little piece of “digital rent” from every tap, click, swipe, and video stream…

Not a lot.

A fraction of a cent here, a couple of pennies there.

Who’s impressed by that?

Nobody. Until you finish doing the math…

3.2 billion people use the Internet. And when you get a cut of EVERYTHING they do online, it adds up fast.

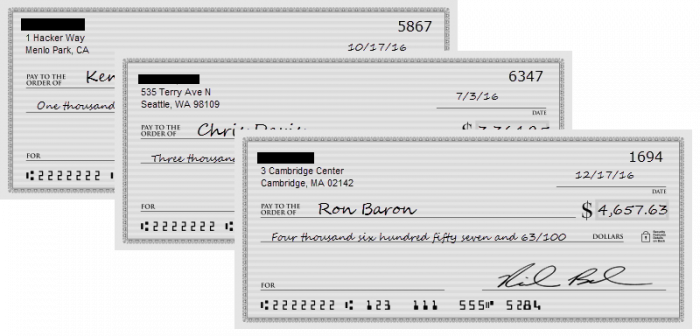

Ken H. from Boston made more than $4,518 for his family from these digital rent checks last year.

C. Davis from Tucson, Arizona has collected more than $13,457 in total. Just by making this one simple investing move.

And Ron B. from New Jersey has racked up more than $74,522 since March.

How fast?

Well, that depends on the life-changing decision YOU’RE about to make today. And on how fast you make it.

You WON’T become an overnight millionaire.

But you WILL feel like a million bucks.

And remember, this cash is flowing in at the rate of $8.47 per second.

So if you make this 1 simple move today, you’ll be holding your first digital rent check in your hands within a matter of weeks…

I guarantee it.

(And so does your Uncle Sam. According to a little-known government document called PL 86-779, if you follow my instructions, you WILL get a cut of these regular digital cash flows.)

It’s the law!

How To Get The Likes Of Facebook, NetFlix, YouTube, Amazon, And Google To Send You Regular Checks – Without Owning A Single Share Of Any Of These Expensive Stocks

Let’s be honest.

Half of today’s Silicon Valley superstars will never turn a dime of real profit.

Buy their shares, and you might enjoy paper gains… for a while.

Get out fast enough, and you might even put something in your pocket before the bubble pops.

That’s a risky – and stressful – way to live.

| What does the industry say about Investing Daily and Personal Finance?

And our industry peers keep handing us this award:

|

You have to keep an eye on the markets 24/7, and listen to every breaking tech rumor to avoid getting burned.

It’s just not for me.

(If you ever hear me say, “When’s the Snapchat IPO?”, please slap me right in the face until I regain my senses. )

But on the other hand…

You simply can’t ignore the technology sector if you want to make big money these days.

The Internet is the fastest-growing wealth generator in the history of the world.

It was worth more than $8 TRILLION according to a study the McKinsey Institute did – five years ago.

That’s why I was so happy when I discovered a way to take all the guesswork, all the legwork, and all the heartburn out of technology investing.

What I’m about to show you isn’t a theory.

It’s a fact.

It’s happening all around you – right under your nose – and literally right under your feet.

And most of the people who will profit from it aren’t the wolves of Wall Street or the toast of Silicon Valley.

They’re ordinary Americans just like you.

With a few hundred, or maybe a few thousand bucks to invest.

And a solid understanding of three, common-sense rules. I’ll tell you the first two right now…

RULE #1: If you want to take up space, you have to pay the rent.

Even $300 billion tech companies like Facebook and Google obey this rule. So do all their past, present, and future competitors.

They have no other choice.

And as you’ll see in a minute, these Internet companies take up a LOT of space.

RULE #2: Everyone who pays the rent has a landlord.

So who’s the landlord behind all these Internet companies?

You.

If you make this one simple investment today.

It’s ridiculously easy.

You don’t need any kind of special brokerage account or trading permission.

You don’t need web smarts.

Heck, you don’t even need to understand how computers work at all.

In fact, you’ll have a much EASIER time profiting from this investment if you’re not too dazzled by the “magic” of modern technology.

After all…

I Learned Everything Worth Knowing About The $8,000,000,000,000 Global Internet –

By Staring At This Pile Of Virginia Dirt

First, a moment of confession.

This is me. I like my steak bloody, my beer cold, and my investments simple. Like Ford Motors. I bought it for $2 a share a few years back — then sold it at $15 a share. (I pocketed $127,344 in total.) This is how I beat the S&P 500 year after year… and make my readers into millionaires.

I’m a creature of the indoors.

Most days, you’ll find me holed up in my office, up to my eyeballs in charts, graphs, and the fine print of financial statements.

It’s not for everyone, but I love it.

And, it’s a big part of my job.

My name is Jim Pearce. I’m the Director of Portfolio Strategy here at Investing Daily.

(I also serve as Chief Investment Strategist for our highly-acclaimed Personal Finance newsletter.)

At last count, there were more than 10,000 millionaires among our subscribers – and by 2020, we plan to more than double that number.

We’ll do it by helping people just like you build their portfolios the smart way.

What do I mean by “the smart way”?

I mean reliable cash flow.

Check after check after check hitting your bank account.

Reliable checks like these are right up my alley.

The smart way also means combining steady income with serious asset appreciation.

So the profit that my Personal Finance subscribers see in 2017 should be in the range of 20% to 30% a year. If this turns out to be an “up” year, you might see returns approaching 100%. (Our AVERAGE is tripling the S&P 500.)

And – most importantly of all – the smart way means waiting until just the right moment to put your money to work.

That time is now.

But it took a traffic jam and a big old pile of dirt to prove it to me.

You see, on my way home from the office a few weeks ago, I got hung up in an epic traffic jam.

Bad luck, right?

No, good luck…

Because that traffic jam was the most important moment of my entire investing career.

It led me to discover how to get my hands dirty – quite literally – by touching the very backbone of the Internet.

How This Blue-Collar Secret Unlocks $8.47 Per Second In Digital Landlord Rent For You

When I grew up, TVs had rabbit ears.

It felt like magic to just pull the knob and have the screen come to life.

But behind that magic was a whole network of antennas and wires. Towers and broadcast centers.

The people who owned that network – the landlords – got rich leasing out “bandwidth” on that infrastructure.

Did I ever think about that, when I was kid?

Nah.

As far as I was concerned, Dragnet just appeared out of thin air.

It’s the same with the Internet now.

Wi-fi is like magic, available on demand anywhere my kids want to tune me out.

They don’t think about where it comes from.

Yet it’s powered by the same kind of network that originally drove TV.

Miles and miles of antennas, wires, and cables.

The internet is generating trillions of wealth. But how do you invest in it safely and profit reliably? One little scoop at a time…

You don’t see them because these days, most of those lines are buried deep underground.

And how often do you drive past a construction crew and a dirt pile without ever giving it a second thought?

It’s what I usually do.

But there I sat the other night, locked up in that big traffic jam I told you about.

Eventually, I found the cause of the back-up…

Construction work.

Pile after pile of dirt.

I’ll confess I put my head back and groaned.

I didn’t realize (yet) that I was looking at $8.47 per second in potential profit… and so are you, if you’re smart enough to keep up.

As a couple of hard-hats walked by, I rolled down my window and asked what was going on. Who was responsible for this mess?

They gave me a name.

And since I was basically parked in traffic anyway, I pulled out my phone and looked up the company (and its stock ticker symbol).

I was shocked.

The Internet’s biggest landlord was laying cable and building a new property right under my nose!

- This landlord serves every major tech firm in Silicon Valley, plus some of Wall Street’s biggest names, too.

- Their tenants are companies you’ve heard of – IBM, Facebook, LinkedIn, Adobe, AT&T, JP Morgan Chase.

- Plus 1,968 more you probably haven’t heard of… including the “next big thing” IPOs that will eventually replace them.

- And a full 70% of all this Internet traffic was running through one cluster of unmarked buildings in Loudon County, Virginia.

In other words:

No Matter Who Wins Or Loses In Silicon Valley… Investors In This One Stock Get Paid No Matter What.

As I looked at this stock’s fundamentals, I realized there was a clear path for me to turn myself into an Internet landlord, too.

People laughed at this. But it’s actually smart. You see, once you realize the Internet is actually a physical thing… you also realize you can OWN it. And make big “rent money” without investing in risky tech stocks. (Read on to find out how.)

Highly stable income flow… steeply rising property values… none of the typical tech-world risks…

Land-lording it over the Internet seemed like a no-brainer.

When I finally got home that I night, I couldn’t help myself…

I spent the entire dinner hour telling my family about my plan to become an Internet landlord.

My kids thought I’d lost my mind.

“You’re nuts, Dad,” they said. “The Internet doesn’t have landlords.”

Typical Millennials!

They think the whole digital world is their playground. And okay, maybe it is.

But I bet you a steak dinner if you handed a Millennial a map of the real guts of the Internet – something I’m about to do for you – they wouldn’t even be able to read it.

In fact, they’d probably laugh at you just for trying.

It happened to a U.S. Senator, live on late night TV…

Let Them Laugh At Your

“Internet Map” Now…

(You’ll Get The Last Laugh

When They PAY UP Later)

A few years back, the late Senator Ted Stevens became the laughingstock of the younger generation.

Maybe you remember it…

Stevens was giving an unscripted speech about traffic flow on the Internet.

As many of us do when we’re speaking off the cuff, he made some generalizations to get his point across.

And he called the Internet “a series of tubes.”

The wi-fi generation had a field day. Late night comedians mocked him mercilessly.

Here was an old senator with no understanding of technology.

The Internet as a series of tubes! Ha, ha, ha.

Well, look behind the curtain, and the laughter dies away.

Because guess what?

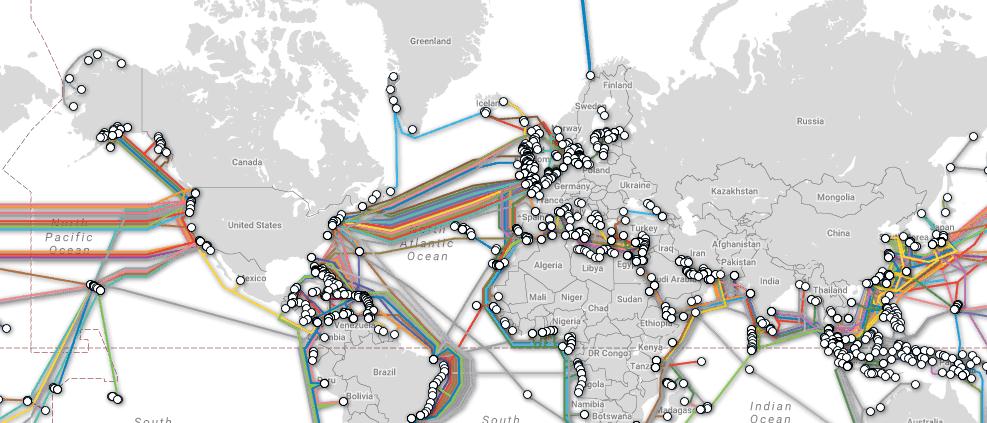

Yes… the Internet is, in fact, a series of buried cables and tubes. And this simple piece of common sense could make you a TON of money in 2017.

Now, these aren’t vacuum tubes like the ones that inhabited the back of our parents’ TVs and radios… these are steel and Kevlar tubes that protect the very backbone of the Internet world-wide.

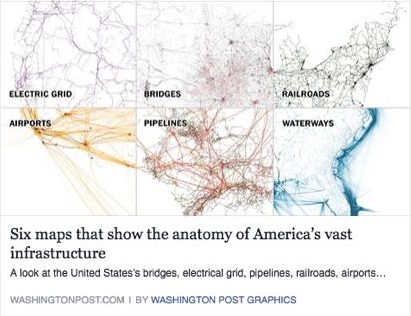

Here’s a map of some of those tubes:

After they criss-cross the ocean, those tubes dive down into the dirt here in the U.S.A.

And connect via underground cable pipelines to “data center” buildings like this one.

The Internet lives here … making you money right under your nose!

It’s four minutes west of my office here at Investing Daily…

That nondescript structure houses one of the main artery roads of the Internet.

Like most of these “artery” buildings, it’s unmarked.

You could drive by and never even suspect what was inside.

Yet that building is tied into one of the most reliable power grids in the country, with a state-of-the-art security system, biometric access, and closed-circuit television monitoring.

Meaning, the company that owns that building isn’t messing around. Their Fortune 500 clients expect that their fair share of Internet bandwidth will always be up and running.

And in return for that “always on” privilege – so that billions of everyday users can swipe, tap, stream, and click to their heart’s content – these companies fork over astronomical amounts of digital rent.

That one building – approximately 10,000 square feet available for rent – collects millions in leasing fees annually.

And this building is just one of 156 locations this group operates across North America, Europe, Asia and Australia.

(There’s likely to be one quite close to your house. I’ll show you how to find it.)

These “data centers” keep the Internet running for all of us, worldwide.

Rain or shine. No matter what.

There’s a much safer way to take a bite out of these massive Internet profits. And it could make you $8.47 per second (or more) today.

Even when sharks attack!

I’m not kidding. Just take a look at this guy trying to snack on an underwater data cable —>

And now you know why these cables are made of Kevlar… to keep the Great Whites off.

Try getting your kids to believe that’s real!

They prefer to believe the Internet works by magic.

But the Internet isn’t magic.

It’s something you can touch.

Something you can see.

And most importantly, something you can OWN.

That’s why I recently got myself on the list for a private tour of the Internet “data center” by my office. And why I’m thrilled to have uncovered THE ONE COMPANY with a chokehold on the Internet all around the planet.

So yes, I’ve held these digital rent checks in my very own hand.

And let me tell you how it feels…

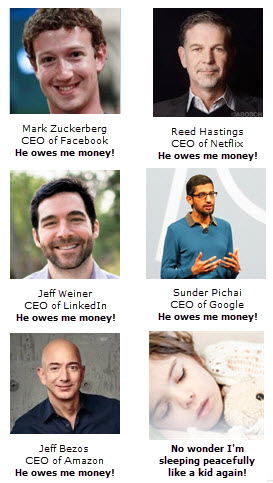

What It’s Like to Collect Rent Checks From Facebook CEO Mark Zuckerberg & Dozens Of Other Top Silicon Valley Players

Since I started getting rich with digital rent checks from Facebook (and hundreds of other companies), I’ve been sleeping better.

In fact, I’ve never slept so well in my life.

Forget buying a new mattress.

If you want to stop tossing and turning at night, this is the key.

I feel rich everywhere I look.

And more than rich… smart. Because now I have CONTROL over what’s happening.

My kids playing on their phones again?

It’s making me money.

The wife watching recipe demos in her Facebook feed?

It’s making me money.

When I drive home late at night and see the flickering light of the TV over at the neighbors – streaming that zombie show again, or the one with the dragons – I smile.

It’s making me money.

And the rent comes in on time, every time.

I open my mailbox and pull out check after check after check.

It makes me more satisfied than Joe Friday closing a case.

Let Other Investors Chase Those Rare, Flashy Wins While You Get Rich The EASY Way, With Quiet Consistency…

The basic, “unsexy” nature of this tactic is exactly why I love it.

It’s collecting rent on the physical infrastructure of the Internet.

Most Wall Street types yawn at that kind of “boring” play.

They want you to do things with your money that are more complicated… put you into “sexier” investments. Then they profit by churning you in and out of big bets that never pay off.

They’ll bend your ear for hours about IPOs for overhyped companies like Snapchat or Uber.

(Both of which I already profit from as a landlord… but because I’m not following the typical Wall Street playbook, I’m not risking a penny.)

See, I’ve been burned by sexy tech investments before…

In the dot.com “gold rush” of the late 1990s I succumbed to the hype. I put 5% of my portfolio into tech stocks that went against everything I believed in as a research-driven investor.

When the market imploded a few years later, I paid the price.

Fortunately, the rest of my portfolio did quite well so I could absorb that loss without any pain. But it reminded me why I should stick to my system.

My system is designed to keep me (and you) from throwing money away on flashy investments that almost never work out.

It helps me find “boring” ways to profit from hot trends – tactics so old-fashioned and dull, no talking head on TV will ever cover them in prime time.

What’s missing from this picture? HINT: It’s worth $8.47 per second.

Yes, infrastructure has been in the news lately, thanks to Trump.

But the focus of the mainstream media isn’t on the digital space…

They think they’re covering it all by talking about the infrastructure most people see every day – bridges, roads, airports, railroads, ports, and electrical systems.

But they’re wrong.

I’ve sat through the dirt pile traffic jams to prove it!

Which means I’m the only one with the first-hand experience to explain this to you today – and darn near the only one paying attention…

Only one in 500 professional investment analysts are even covering this unique stock.

So who cares about being trendy?

I’d rather be rich.

If that’s truly your goal today, this is the only game in town…

You Could Be Holding Your First “Digital Rent Check” In Your Hands In A Matter Of Weeks!

Let’s take a closer look at how this works.

These data centers feel like something from a sci-fi movie:

And it’s true.

Touching the Internet will get you all filthly — filthy rich!

Because they’ll continue to power the Internet in 2017. And 2027. And 2037.

Every new social media site… all the latest apps… the new “virtual reality” headsets… even those futuristic self-driving cars… they all need big chunks of ground-powered Internet space to operate.

In other words, the Internet is a real thing.

You can reach out and touch it.

And if you want to make some serious money in 2017… you should.

Because right now, with all the booming tech developments going on, data center space is at a premium. Occupancy rates are sky-high.

Which brings me to my third common-sense rule for profitable Internet investing.

(Did you think I forgot I owed you one?)

RULE #3: When everybody wants in all at once, the landlord can raise the rent.

And that’s exactly what’s about to happen here…

As I listened in on this stock’s shareholder call on October 27th, 2016, ear glued to the phone, I heard my favorite Internet landlord say their flagship offering was 96% booked for six years straight.

Imagine the Waldorf Astoria hotel being 96% booked every single day of the year. They could charge premium rates. Not just on the weekends… but on Mondays, Wednesdays… anytime. And they’d be the envy of every hotel on the planet.

That’s VERY good news for you today… but there’s more…

They’re leasing, buying, and building new spaces to rent out as fast as they can – here in the U.S., and also overseas in major tech centers like London, Amsterdam, and Frankfurt.

So when a Deutsche Bank analyst asked, “Should we expect some steady increases in those booking numbers?,” this landlord’s Chief Financial Officer said “Yes.”

Then he used a phrase that made me laugh…

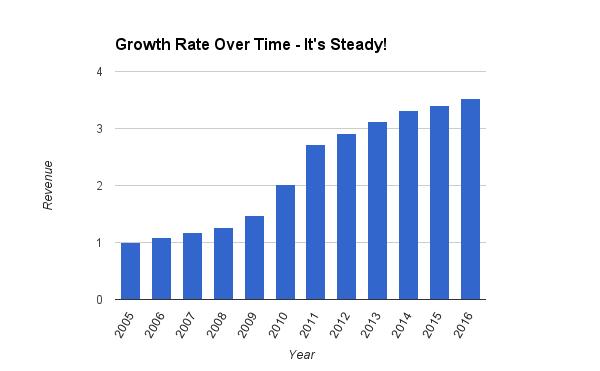

Directing the analyst to their growth rate charts, the CFO said, “We have a pretty steady-Eddie run rate trend.”

You don’t hear that kind of talk from the CFOs of the stereotypical tech-world darlings.

Get those folks on the line and it’s all about being “pre-revenue” and “poised for exponential growth.” They hype you up for a hockey stick, straight up kind of growth rate.

But Silicon Valley’s favorites rarely turn a dime of real profit.

(So their investors get a hockey stick right to the face.)

I’ll take a steady-Eddie all day long, thanks.

Especially since this company has made actual, touchable, SHARABLE profits since year one.

In fact, since the company is structured as a real-estate investment trust (REIT), it’s bound by law to share 90% of its taxable income with you.

That’s the PL 86-779 rule I told you about before… it was actually created by President Eisenhower.

For this REIT, it means that over $180 million per month in Internet rent… or $8.47 per second…

… is flowing right to REIT shareholders like you.

Digital Rent Isn’t The Only Way You Profit, Either…

I mentioned just a moment ago that this particular company was buying, leasing, and building new data centers to rent to the Internet as fast as possible.

So let’s talk for just a moment about some of the properties they’ve picked up …

They’re in popular places.

70% of the Internet runs through this tiny patch of land. So if you make this investment today, you’ll OWN the one key “toll booth” of the 21st century. (Right when traffic on the “road” is going to DOUBLE!)

For example, in the third quarter of 2016, they acquired an additional parcel of land next to their existing (and fully rented) buildings in Loudoun County, Virginia.

And that’s EXCELLENT news for your pocketbook.

Here’s why…

You see, Loudoun County is just outside the nuclear blast radius for Washington, D.C.

So you can thank Eisenhower for this one too.

He figured it out during the Cold War, when the Pentagon needed a close-by but safe place to put the supercomputers that processed missile launch patterns.

Even today, with the Cold War in the rear-view mirror, so many data centers are housed in Loudoun County that an estimated 70% of all Internet traffic worldwide flows through the region.

But Loudoun County isn’t very big.

And the Internet has to compete with hordes of D.C. commuters, retail groups, and government contractors for space – Loudon is one of the fastest growing counties in America.

Commercial real estate in this area is expensive, and it continues to appreciate as the supply dwindles.

If this company I’ve been talking about ever gets tired of collecting rent on a fully occupied set of data centers, they could cash out the buildings – tenants and all – for an enormous profit.

And just like the regular rent, your share of that profit will turn up in your mailbox. Remember, you’re REQUIRED BY LAW to profit.

But even that possibility for an extra payday wouldn’t be the end of your profits here…

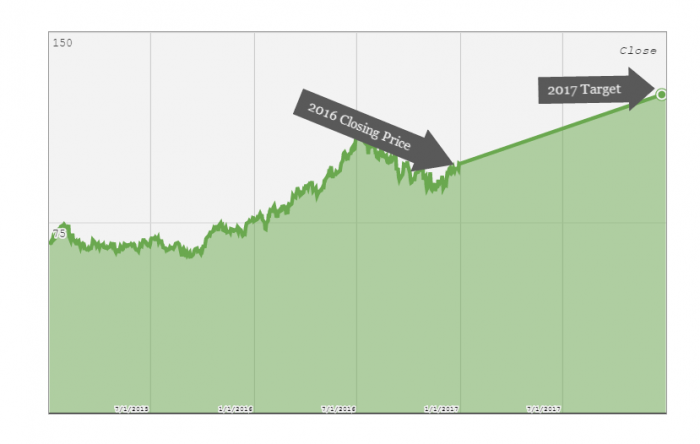

Want An Extra 29.56% Gain For Your Portfolio? Consider It Done (And There’s More Where That Came From…)

There’s one more reason to like this “Internet Landlord.”

Over the last year, the stock has gone up 29.56%.

That’s IN ADDITION to the dividends that go into your rent check.

As you can see, the 2017 outlook is strong, for reasons I’ll show you in just a moment.

(Here’s a hint – we may owe President Trump a big ‘thank you’ too.)

It’s the best of all possible worlds, really.

- You get stock price surges like you own a trendy tech stock, but you don’t have to put a dime into a single one of those flash-in-the-pan companies.

- Land – which they’re not making any more of – increases in value and pads your bottom line.

- Your mailbox fills with regular “rent checks” from the existing Internet-based and Internet-using companies renting from this company’s data centers (and at last check, the average tenant still had 5.8 years left on their lease).

It’s not nearly as exciting or sexy as accurately picking the “next big thing.”

It’s just way, way smarter.

Which means you’ll sleep well.

But you’ll also eat well too…

Why Starve For Yield? Barron’s Says This Company Will “Outperform” Other Income Investments

What kind of return are you getting on your savings account?

Or the money hidden in your mattress?

Basically zero.

Factor in inflation and it’s less than zero.

Your money is losing value the longer you sit on it.

Even most corporate bonds and dividend stocks aren’t doing much better.

You’re “starving for yield.” But why?

This company I’d like to share with you offers you three ways to win – regular income, asset appreciation, and stock appreciation.

(As a recent article in Barron’s just confirmed. They rate it “outperform” and say it’s “attractively valued.”)

Which means check after check… gain after gain… all headed straight for your pocket.

And if you’re worried about anything interrupting that regular stream of cash flow, I’ve got great news on that front.

Not even our nation of busy-body bureaucrats can stop this train.

In fact, the recent election was a big move in our favor.

What President Trump’s $550 BILLION Promise Means For Your Bottom Line…

Trump’s election surprised insiders in D.C. and Wall Street.

A lot of them are still burying their head in the sand, struggling to process it.

But while the insiders whimper, business people all over the country are taking action.

And profiting.

Trump, after all, has been obsessed with infrastructure for months now.

Remember this?

Or this?

And now all this talk is turning into action.

President Trump has already approved more than $550 billion in infrastructure investments.

And despite all the high-tech language around it, what I’m recommending to you today is PURE INFRASTRUCTURE.

These data centers are the very backbone of the Internet. Without them, the whole system collapses.

Facebook goes black and doesn’t come back.

No more Uber rides or YouTube videos.

They don’t work without a strong infrastructure of data centers.

And for all the data centers we have now, the system wants MORE so the Internet (and everything on it) can move FASTER.

So while everyone held their breath (and their bankbook) last fall, waiting to see what would happen, right now the floodgates are about to swing wide open.

As Jim Kerrigan, Managing Principal from the North American Data Agency put it in a post-election interview with Data Center Knowledge:

“There is significant pent-up demand… the biggest challenge is a lack of existing supply in key markets.”

Bo Bond, Managing Director at competitor Jones Lang LaSalle, also weighed in:

“I believe the election results won’t adversely affect data center momentum we have going into the New Year… We are very bullish on 2017!”

And that’s not all…

Todd Batem an, North American Agency Practice Leader for CBRE’s Data Center Solutions Group, said:

an, North American Agency Practice Leader for CBRE’s Data Center Solutions Group, said:

“… Any administration that plans on investing in infrastructure and mitigating taxes will benefit the data center industry.”

It all adds up to RIGHT NOW being the perfect time to become an Internet landlord.

Now Is Your Moment – You’ve Waited Until The EXACT Right Time To Jump Into This

The Internet – and all things connected to it – aren’t fads or novelty plays anymore.

Think about it this way.

If I’d told you 20 years ago… or even 10 years ago… that you’d carry around a little glass rectangle everywhere you went, you might have laughed at me.

But today, the average American spends ONE FULL THIRD of their waking hours looking at their phones and going online.

1.2![]() BILLION people use a Facebook app every single day, posting photos, streaming Facebook Live video or playing games.

BILLION people use a Facebook app every single day, posting photos, streaming Facebook Live video or playing games.

44% of sho![]() ppers head straight to Amazon – scooping up more than $32 billion worth of goods per quarter by the end of 2016.

ppers head straight to Amazon – scooping up more than $32 billion worth of goods per quarter by the end of 2016.

Netflix ![]() users watch 100 million hours of video per day… with another 300 hours of video uploaded to YouTube every minute.

users watch 100 million hours of video per day… with another 300 hours of video uploaded to YouTube every minute.

Goo![]() gle now processes over 40,000 search queries every second… over 3.5 billion searches per day… and a whopping 1.2 trillion searches per year worldwide.

gle now processes over 40,000 search queries every second… over 3.5 billion searches per day… and a whopping 1.2 trillion searches per year worldwide.

And as much as we’re using the Internet now, by 2019 – just two short years away – total traffic is expected to DOUBLE.

Imagine doubling the traffic on a toll road. Or doubling the amount of oil that flowed through a pipeline. Who would profit?

|

Start Collecting Your Internet Rent Checks Right Away – Before They’re Out Of Reach When the “traffic” through these data center pipelines doubles in the next 24 months, the investing world’s best-kept-secret will become front page news. And you probably won’t be able to afford shares of this Internet Landlord stock. Think about Berkshire Hathaway. If you bought in early, shares were just $19 each. Now they’re $239,070 a piece. Crazy comparison? Not really. Berkshire Hathaway makes a considerable amount of their money by investing in infrastructure and real estate at key moments in history. BNSF Railroad… Northern Powergrid… Clayton Homes… and REITs like the one I’m telling you about today… Now, no one can say with 100% certainty how fast any one stock can grow. But here’s the bottom line: You may NEVER have another chance to get in on this one for such a small investment – less than $100 as of this writing. More comfortable ordering by phone? |

Not the users – the owners.

They’d get rich.

The current crop of Internet Landlords knows this.

That’s why they’re building so much right now… they know there’s TONS of potential money on the horizon.

Plus, if you act now – there’s still plenty of room for you to get into the game before the Wall Streeters come and try to crowd you out.

As I showed you earlier, infrastructure is in the news, but the most important (and most lucrative) type of infrastructure is buried right under most people’s noses.

Minor details like that are what create MAJOR profits.

And remember, there’s just 1 stock to buy right now to start the money flowing.

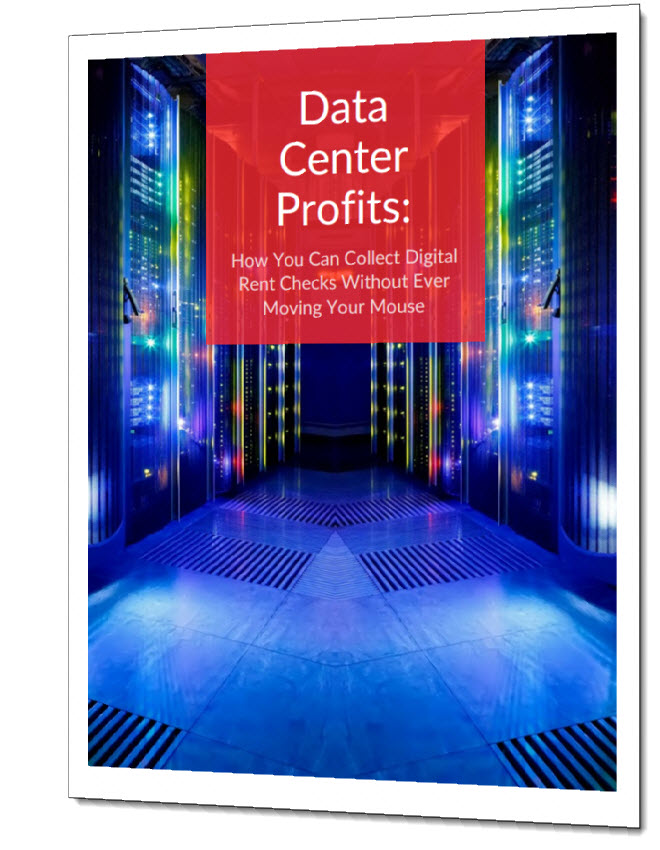

I cover all of this – and more – in a special report I’d like to send you, Data Center Profits: How You Can Collect Digital Rent Che cks Without Ever Moving Your Mouse.

cks Without Ever Moving Your Mouse.

If this report was available for sale (it’s not), it would be valued at $99.

But it’s yours FREE today.

Inside Data Center Profits: How You Can Collect Digital Rent Checks Without Ever Moving Your Mouse, I’ll reveal:

- Why you don’t need tech smarts to lord over the Internet: In fact, it’s our know-it-all kids & grandkids who are missing this opportunity. With basic business sense (and no computer savvy), you can quickly see how landlording for the Internet is a no-effort way to create a major win for your portfolio.

- The one stock to buy now: This proven player is my personal favorite. Over the last decade, it’s gushed out dividend growth of 252%. Plus massive stock price gains. I can’t wait to tell you all about it.

- Paydays to watch. You’ll get the full schedule for your “digital rent check” mailings, so you can put yourself on the list to collect each one of these reliable, regular payouts. (A check in January… April… July… October… get your name on the list right now, and you won’t miss a single one.)

With the information in this report, you’ll be able to confidently decide if this kind of “steady-Eddie” investment is right for your situation right now.

And I’d like to send you the full report – FREE – as my gift to you with your new subscription to Personal Finance.

Personal Finance is unlike any investing service you’ve ever seen.

When I was brought here to lead the team, I knew I was coming to a place where razzle-dazzle was OUT and real profits were IN.

What kind of profits?

Well, unlike so many financial websites and TV shows, we’re not about what everyone else is already doing with their money.

By the time anything hits the news, it’s too late – stay away.

That’s how we’re able to increase subscribers’ wealth, rain or shine – no matter what the market is doing. A track record that dates all the way back to 1974, when Personal Finance was founded.

For instance:

On December 28, 1987, the plunging dollar was making headlines. We took the contrarian tack and recommended put options on the Japanese yen. In 2 weeks, we booked a 371% profit.

On December 28, 1987, the plunging dollar was making headlines. We took the contrarian tack and recommended put options on the Japanese yen. In 2 weeks, we booked a 371% profit.

We got in ahead of the crowd in the roaring 1990s. Our readers enjoyed serious gains all decade, including 503% with Pacific Century, 2,012% with Softbank, 293% with Cisco, 525% on Sony, 454% on KLA-Tencor, 349% with Winstar Communications… to name just a few.

We got in ahead of the crowd in the roaring 1990s. Our readers enjoyed serious gains all decade, including 503% with Pacific Century, 2,012% with Softbank, 293% with Cisco, 525% on Sony, 454% on KLA-Tencor, 349% with Winstar Communications… to name just a few.

In the bear market of 2000 – 2002, stocks slumped 35%. Yet our Personal Finance portfolio gained 20.8% per year.

In the bear market of 2000 – 2002, stocks slumped 35%. Yet our Personal Finance portfolio gained 20.8% per year.

10k with us became $17,360!

In the bull market from 2003 to 2007, we delivered a series of triple-digit winners – a 455% gain from Great Plains Energy, a 117% gain from Cardinal Health, a 150% gain from Schlumberger, and a 103% gain from Nabors Industries.

In the bull market from 2003 to 2007, we delivered a series of triple-digit winners – a 455% gain from Great Plains Energy, a 117% gain from Cardinal Health, a 150% gain from Schlumberger, and a 103% gain from Nabors Industries.

But what about the biggest rain cloud of all?

2008, and the Great Recession that followed?

I saw it coming and steered my clients away from danger.

I kept their money safe. And then, while everyone else was still licking their wounds, my clients and I scooped up stocks that had been unfairly beaten down and held on to them just long enough to bank six-figure gains…

Like the $127,344 I pocketed by trading Ford Motors.

Here’s what it comes down to:

No One Loses A Nest Egg On My Watch!

| “Your recommendations have served me nicely. They’re a bit out of the ordinary and they force me to think ‘fresh.’ ” – William B. |

| “Excellent concise advice. I have definitely made money due to Personal Finance.” – Robert K. |

| “Time-honored advice about how to acquire and maintain wealth (not get rich quick schemes).” —Grayson V. |

| “Most of my financial education has been a result of a long-term subscription to this service, as well as most of my investment success. I would not leave home without my copy.” – John B. |

Over the years, Personal Finance has recruited the best of the best into our group.

We pull in top gurus from every market sector, so you can beat the S&P 3x or even 5x in bull markets, bear markets, and everything in between.

We do not beat the same drum in an echo chamber around here month after month. If you want to hear a group of gurus chant, “Buy gold, buy gold, buy gold,” until your brains mush out your ears, we’re not for you.

Each issue of Personal Finance – and you get a fresh issue every two weeks – highlights the biggest new opportunity right on the front page.

We give you the rundown on why it’s a trend or stock you need to know about immediately, and then we let you be a grown up and decide if it’s right for you.

If it’s not, that’s okay. We provide you plenty of other opportunities, too.

Opportunities to make serious money, including six-figure wins and triple-digit profits on picks.

I gave you examples from our 42-year history, but you’re probably wondering about our more recent performance.

It’s darn good, if I say so myself:

From 2014 To 2016, Our Closed Trades Have Generated Subscriber Returns Of 126.70%.

But I’m 126.70% confident that we can do even better over the next 12 months.

That’s why I want to offer you two more FREE bonus reports, to get you started investing in our freshest income plays…

INCOME-GENERATING BONUS #1 (YOURS FREE)

How To “Trump” The Profits You Made In 2016 – And Make This Your Best Year Ever

All through the election cycle, Trump flashed his wealth in our faces.

Private jets… gold-plated front doors… a multi-story Manhattan penthouse…

He has business interests in properties in 23 countries, and owes a significant portion of his wealth to the income + appreciation structure of real estate investment trusts (REITs).

So why not join in the fun?

Our Internet infrastructure play makes it easy for you to make money, and so does this special report, Profit Like The Landlord-In-Chief: How You Can Mimic Trump’s Success With REITs. (a $79 value)

Inside, you’ll discover:

- Why REITs beat regular stocks. These investments have returned nearly double what the stock market did over the past two decades. (According to a recent study by Investopedia.) Plus their cash flows are more stable.

- Key cash & tax advantages of REITs. Who wants to live on a restrictive fixed income? REITs can be your way out. And for some investors, your REIT profits could be tax-free!

- Case studies of successful REIT investors, like Trump, so you can see exactly what they’ve done to make themselves rich. You’ll also see how to make money yourself with REITs (sooner rather than later).

Plus, if you’re going to make money and be the Internet’s landlord, you owe it to yourself to know exactly where your investments are based and buried. That’s why I’ve created…

INCOME-GENERATING BONUS #2 (YOURS FREE)

Your Exclusive Map Of The Internet’s Buried Backbone!

Inside Internet You Can Touch: Your Map To America’s Top Data Centers, you’ll find:

- One-of-a-kind maps to the nation’s biggest data center locations, so you can see exactly where you make money. This is information you will NOT see elsewhere – our analyst team sweated to find it and put it together just for you!

- Details about getting tours from the major data center companies. You might not have realized this, but when you make money as an Internet landlord, you can tour data center sites. What better way to keep your eyes on your money than to schedule your own free walk-through of the facilities?

- This one is a $79 value – but it’s also yours FREE today if you place your order before midnight TONIGHT.

And of course, the longer you’re with us… the more reports like this you’ll get.

Each one will be timely. Concise. And clearly written. You’ll be able to quickly and easily pull out profitable ideas and put them to use in your portfolio by partnering with us on an ongoing basis.

But, don’t just take my word for it…

What Our Long-Term Subscribers

Say About Us

“I have made quite a lot of money following your investment advice.” – Margot F.

“I have been receiving Personal Finance for many years and have come to rely on it as my main source of information. I was able to build my portfolio to $2M+ and now receive plenty of dividends.” —Glenn C.

“It is a comprehensive resource for the limited time I have to focus on my investment strategies. My family has used it for more than 15 years.” – Heather M.

“I’ve been pleased with the performance year in and year out. The ability to get feedback on specific issues from the experts is just the icing on the cake.” —J. Thomlinson

“I have gotten Personal Finance for over 10 years and it has helped me make wise choices when purchasing stocks.” —Carol M.

“I really appreciate that you guys get right back on questions from the subscribers. Makes for a great community!” —Pete

“I just recommended Personal Finance to my boss who is getting close to retirement age and didn’t know how to transition his portfolio from growth to income. He thanked me and loves Personal Finance as much as I do!” —Jason G.

“Well, I have been subscribing to 3 or 4 for financials letters for years. Have cancelled several because I really like yours!!! The information really makes sense. Even I can understand it.” —Ray C.

“If you want to improve your financial status, subscribe to Personal Finance.” —Adrian L.

As I mentioned earlier, we count more than 10,000 millionaires among our subscribers.

And our goal is to more than double that number, starting today.

So, How Much Does It Cost To Become An Internet Landlord Today?

That’s the natural next question, right?

I’ve seen newsletter services like Personal Finance charge as much as $500 for their publications.

Some as much as $5,000.

And they don’t include anything nearly as valuable as the money-making report I’d like to send you, Data Center Profits: How You Can Collect Digital Rent Checks Without Ever Moving Your Mouse.

Still, you won’t pay even a fraction of those rates when you join Personal Finance today…

I’ll cut straight to the chase and tell you that Personal Finance usually costs $99 per year.

That’s a flat-out steal. Especially when you consider that this one recommendation alone could put thousands into your pocket.

And if you act now, you won’t even have to pay that much.

We’re serious about adding another 10,000 millionaires to our subscriber list. We want you to be one of them.

So we want to make it a no-brainer decision for you to join us today.

If you’re prepared to take action right now, you can join Personal Finance for only $39.95.

Your subscription will include:

- 24 New Issues per year. Every two weeks, we release a new 12-page issue stuffed with a comprehensive analysis of major market trends and emerging investment stories. That includes updates on our Growth and Income portfolios, the latest picks for our “Maximum Income for Retirees” portfolio, and our Big Opportunities section.

- Personal Finance Flash Alerts. Any time there’s breaking news on one of our positions, or a new opportunity comes along that can’t wait, you’ll get a flash trade alert in your email inbox.

- Award-winning research and guidance. We dig deeper and outwork the competition to bring you opportunities that WORK. We have a wall full of awards to prove it – and remember – our closed trades for the last two years have given subscribers 126.70% in portfolio gains!

- Members-Only Website Access. Inside this password-protected website, you’ll get an easy-to-find collection of all our research. That includes every issue, flash alert, and Special Report we’ve put out since the year 2000.

- Stock Talk Message Boards. This one is a subscriber favorite. Here’s something you’ll find unique about Personal Finance: You can ask me questions directly using our Stock Talk message boards. I enjoy answering your questions, and I’ll respond promptly.

And one more thing …

I’m a big fan of the “show, don’t tell” approach to investing.

And I know it’s one thing for me to tell you about Personal Finance’s industry-leading track record and exceptionally smart research team.

To trot out sound bites from other people – even people who love us.

And it’s something else entirely for you to see the results yourself, in black and white at the bottom of your bank or brokerage statement.

So right now, I’d like to invite you to test us out – risk-free – for the next 90 days.

Here’s how that’ll work …

Profit From Our Insights Or You Pay Nothing

When you subscribe to Personal Finance right now, you’ll pay just $99 $39.95 for your first year’s subscription (a low introductory rate you won’t see available outside this page).

I’ll immediately send you my FREE special report, Data Center Profits: How You Can Collect Digital Rent Checks Without Ever Moving Your Mouse (a $99 value).

Inside, you’ll see what you need to do to start getting your “digital rent checks” coming to you.

Then, on top of that easy income opportunity, the team and I will send you fresh market insights and recommendations every two weeks in the full issues of Personal Finance.

You can put us to the test in the markets. And, if you don’t like what happens in the first 90 days – if you’re not seeing profits, income, and appreciation like you want – all you have to do is reach out and let us know.

We’ll give you a full refund along with our sincere thanks for giving Personal Finance a try.

And, your copy of Data Center Profits: How You Can Collect Digital Rent Checks Without Ever Moving Your Mouse – packed with detailed company profiles and payout schedules – is yours to keep and use as you like.

TODAY ONLY: Be One Of My First 100 New Subscribers And Get Two Additional Money-Making Reports

I want you to make money – FAST.

So, in addition to Data Center Profits: How You Can Collect Digital Rent Checks Without Ever Moving Your Mouse, your personal map to the cash centers in your neighborhood, and our exclusive report on making “Trump Money” using his real estate secrets, if you agree to put Personal Finance to the test right now, I have two more special reports to make 2017 your best investing year EVER. (But only if you’re one of the first 100 to order today.) You’ll get:

- 10 Tech World Losers To Dump Now. Not every Internet-related play is a winner. Some are big losers. Do you have any of these stink bombs in your portfolio? (A $49 value – yours FREE.)

- 2017’s “Best Of” Stock Picks. I pulled my brain trust together and challenged them to create a list of their top picks for the year ahead. It’s a fast read. You can finish it in 10 minutes and then get busy making money. (A $49 value – yours FREE.)

But these extra profit-maker reports are only yours if you’re one of my first 100 new subscribers today.

Get Started With Personal Finance Now

More comfortable ordering by phone? Dial 800-832-2330

You Absolutely Can’t Lose Today – And You Have Many, Many Predictable Ways to Win

With our “Profit or Don’t Pay” guarantee, there’s no way for you to lose out by joining us.

But I can think of many, many predictable ways for you to make money. For you to WIN.

You’ll win every 90 days, when your rent checks from the Internet arrive.

You’ll win every other Wednesday, when your new issue of Personal Finance arrives.

And you’ll win as you follow our recommendations, netting 20% to 30% returns in average conditions and 100% returns (or more) when things go very well.

What we do isn’t always trendy, sexy, or cool.

But just like becoming the Internet’s landlord, it’s very, very profitable.

I hope you’ll join us today.

Get Started With Personal Finance Now

More comfortable ordering by phone? Dial 800-832-2330

To being the one who cashes the checks,

Jim Pearce

Chief Investment Strategist, Personal Finance

“I will create 10,000 new millionaires by 2020”

P.S. With this one stock, you collect digital rent – $8.47 per second, and heading higher – for every NetFlix show, Amazon shopping spree, and Facebook visit.

You make money when your kids or grandkids play with their phones… and whenever anyone, anywhere, uses Google to search.

Plus, it’s not just about the digital rent everyone owes you. You’ve got “a hand on the land” in some of the most lucrative real estate markets in the world – tons of appreciation is heading your way if you do this.

And then there’s the stock itself… up 29.56% in a year. Plus dividends! You don’t have to buy, hold, and pray with this one – you can make money FAST.

But, you’ll want to act quickly to get the cash flowing. Right now, the stock is cheap. A few years from now? It might be so sky-high, only Warren Buffett can buy it.

So don’t delay, and remember, when you join Personal Finance now, it’s yours for only $39.95.

Still Have Questions About Collecting Your Digital Rent Checks? This Extra Information May Help…

I’m NOT a tech person at all. Can I really become an Internet landlord without knowing anything special about technology or computers?

That’s exactly right! You don’t need any tech expertise or computer savvy to become an Internet landlord.

All you need is common sense. Common sense says that the Internet isn’t magic. It has a physical side – dirt, cables, tubes, buildings – that you can reach out and touch. That you can OWN.

And when you make yourself an owner, you can start collecting rent as an Internet landlord.

Will I really get a “digital rent” check in a matter of weeks?

Yes! Your “digital rent” checks are subject to PL 86-779, a government document that mandates that 90% of REIT income be paid out to shareholders. So, if you take my recommendation and buy the data center REIT I recommend, they MUST send you “rent checks” on a regular schedule. It’s the LAW.

The Internet landlord you’ll read about in your Data Center Profits report collects rent every second of every day. For convenience, it cuts checks on a quarterly schedule. Depending when you take advantage of this opportunity and the processing time, your first check will arrive between three and twelve weeks from today. Get your first check on its way to you now – subscribe to Personal Finance today.

This takes the risk out of investing in tech stocks… but still, why bother with investing in the Internet at all?

If you really want to make money, you can’t afford to let this safe way to profit from the growth of the Internet pass you by. The Internet is an $8 trillion business – and it’s getting bigger all the time.

By 2019, Internet traffic is set to DOUBLE… and by 2020, an additional TWO BILLION people will be active online. That means incredible profit potential for you.

As an Internet landlord, you make money from every click, tap, swipe, video stream, and online search performed by every man, woman, and child online. A little piece of everything that happens is owed to you as rent. How soon you get your first rent check depends on the action you take today. Start making money now by activating your Personal Finance subscription today.

Some of this sounds too weird to be true… Do sharks really attack the Internet? Are landlords really collecting digital rent that adds up to $8.47 a second?

What can I say? Truth is stranger than fiction.

And “fishier” too – we’re not making up the sharks. The New York Times published the first reports of sharks attacking undersea cables in 1987. The United Nation’s 2009 Environmental Program report covered it, too. Those studies – along with other tests – are why Google now pays to cover their undersea Internet cables with Kevlar so shark teeth don’t knock you offline.

Squirrels on the electrical wires… moles in the natural gas pipelines… every layer of infrastructure has its own unique pests. The Internet (occasionally) suffers from sharks. Luckily, there are already safeguards and redundancies built into the system, so not even a whole school of sharks can stop you from making money as an Internet landlord.

And yes, $8.47 per second is real too. It adds up to $180 million per month – and over $500 million per year – that this Internet landlord is collecting from all those tech CEOs on behalf of shareholders like you. Want to get your share of the cash flowing to your pocket now? You can.

What special insider and income reports do I get when I subscribe today?

When you become a Personal Finance subscriber today, you’ll receive three special reports.

| 1. Data Center Profits: How You Can Collect Digital Rent Checks Without Ever Moving Your Mouse — A $99 Value, Yours FREE | |

| Data Center Profits reveals exactly what you need to do to become an Internet landlord and get rich.

Inside you’ll find:

|

|

| 2. Profit Like The Landlord-In-Chief: How You Can Mimic Trump’s Success With REITs. A $79 Value – Yours FREE | |

Inside, you’ll discover:

|

|

| 3. Internet You Can Touch: Your Map To America’s Top Data Centers A $79 Value – Yours FREE | |

Inside you’ll find:

And, if you’re one of the first 100 new subscribers today, I’ll also send you two additional reports to help make 2017 your best investing year EVER:

Add everything together, and you’re getting $355 worth of bonus resources FREE by taking action now. So don’t delay — claim them ALL by clicking here right now. |

|

When do I get my first copy of Personal Finance?

Personal Finance is published every two weeks. New issues come out on Wednesdays.

You can choose how you get your Personal Finance subscription delivered, too. Unlike many other publishers, we still put out a print edition. So you can choose to have a hard copy delivered, read the issues as online PDFs, or both. All at no extra charge – we know how important it is to get you information in the format you like best!

While you wait for your first issue as a new subscriber, you’ll get immediate online access to all our back issues, flash alerts, and special reports. You can dive in and start following our recommendations right away. Plus, we have a Member Guide to help you find – and profitably use – every part of your Personal Finance subscription. You’ll find it in the “Resources” tab of your password-protected Member’s Only website. See it now when you subscribe today.

Can I get my money back if I decide later this isn’t for me?

Yes, you can absolutely get all of your money back if you change your mind about this opportunity.

When you subscribe to Personal Finance right now, you’re guaranteed to profit or you can get a full refund from us. No stress, no hassle. It’s simple.

Subscribe now and put us to the test in the markets. If you don’t like what happens in the first 90 days – if you’re not seeing profits, income, and appreciation like you want – all you have to do is reach out and let us know.

We’ll give you a full refund along with our sincere thanks for giving Personal Finance a try – no stress, no hassle. And all of your money back.

Get Started With Personal Finance Now

More comfortable ordering by phone? Dial 800-832-2330