47 Year-Old Construction Worker’s Secret to Retiring Early

There’s a new retirement strategy that’s taking America by storm… Take these 6 easy steps (see below) to retire as early as this year.

Dear Reader,

I’m about to show you a new way to retire that thousands of people have already taken advantage of.

They’ve said “so long” to their alarm clocks and their daily commute… and “yes” to an early, stress-free retirement.

Amazingly, they didn’t follow the old retirement advice they were given decades ago.

Instead, they’re using a new approach that wasn’t even available until recently. One that takes advantage of a new retirement strategy, thanks to the changing world around us.

You may find this retirement strategy unusual. Even most financial professionals have a hard time wrapping their heads around it.

Suze Orman for one, says, “I hate it. I hate it. I hate it.”

And as the Huffington Post reported, “Some laughingly call it a cult.” Though the paper went on to admit, “they also swear it’s the path to early retirement.”

There’s no denying, this new approach to retirement is creating an endless stream of early retirees who are quitting their jobs years before they’re eligible for Social Security.

Like 47-year-old, Dominic Brady.

Like 47-year-old, Dominic Brady.

He worked at a construction company his whole life. But being away from home, sometimes weeks at a time, wasn’t what he wanted.

He longed to spend more time with his wife and two young kids.

Fortunately, Dominic heard about the retirement renaissance, and after much research, decided to give it a try.

“[It] was a scary decision,” he recollects. It didn’t use the same approach he’d been taught growing up.

He didn’t have a large nest egg. No inheritance. Instead, he still had mortgage payments, and hopes of saving up for his kids’ college tuitions.

But the new retirement strategy took these into account allowing him to retire soon after.

He enjoyed his new-found freedom, exploring India, Japan, Thailand and Australia. Then coming home to check off another item on his bucket list, “I have the Boston marathon coming up in 4 days,” he said.

As Dominic put it, “At the end of the day, I’m just a pretty average guy. That’s good news, because I figure that if I can do it, then probably you can too.”

And he’s not the only one…

Collin Johnson’s stressful job prompted him to come home one day and google, “How do I retire early?” After many dead ends, he also discovered the retirement renaissance, and retired before age 60.

Collin Johnson’s stressful job prompted him to come home one day and google, “How do I retire early?” After many dead ends, he also discovered the retirement renaissance, and retired before age 60.

Janet & Larry Garland had no hope of retiring either. They saved hard during their working years, but could barely afford to buy a home, let alone retire.

Janet & Larry Garland had no hope of retiring either. They saved hard during their working years, but could barely afford to buy a home, let alone retire.

“It didn’t matter how much you saved, it was a goal post that kept moving,” reported Janet.

Disillusioned with traditional advice, they also decided to join the retirement renaissance, and were able to retire before their 56th birthdays.

As did Tennessee pharmacist, Julius Lewis… and Tammy Huntley, who was strapped with credit card debt, student loans and a low salary… yet still retired before her 60th birthday.

As did Tennessee pharmacist, Julius Lewis… and Tammy Huntley, who was strapped with credit card debt, student loans and a low salary… yet still retired before her 60th birthday.

Taking advantage of this new retirement strategy is easy. And word of it is starting to get out…

89% of Americans don’t know this retirement option is available to them

The Washington Post reported, “an early retirement is doable. Here’s how.” And it went on to profile person after person who retired early using this approach.

Even the skeptical New York Times admitted this retirement renaissance is helping people, “retire sooner and travel more, for less.”

CNBC interviewed a number of early retirees and reported, “[this] movement is growing, with more and more people parting from their careers.”

One person they spoke to retired at age 44!

Shocking. I know!

As he told CNBC, “I think it should be possible for everyone, it’s conceptually extremely simple to do.”

With a retirement approach this powerful… it’s no wonder that Money Magazine declared, “The ranks of followers are spreading like wildfire.”

In fact, over the past two years, this movement has been covered by nearly every major media outlet…

And what’s most amazing is that in spite of this, most working-age Americans—ones that could benefit from it the most—still don’t know anything about it.

According to a 30-page report by TD Ameritrade, 89% of Americans have no idea this retirement option is even available to them.

Don’t worry if you’re one of them.

Because I’m now going to show you everything you need to know about this retirement renaissance. And how your successful retirement may be much closer than you think.

If you’re still following the traditional retirement advice of 50 years ago… You may be missing out on the most effective retirement strategy today.

I know this for a fact because I’ve spent 30 years of my career, working with thousands of Americans, showing them how to retire early.

And I, for one, couldn’t be happier to see this retirement renaissance taking off. Because it uses the same strategy I’ve been using for decades to help thousands reach their retirement dreams.

Let me show you how it all came about…

Today’s economy and stock market are different from a decade ago… and even more so from the decades before.

So it would stand to reason that your retirement strategy should adapt to these changes. It should embrace new realities and new opportunities. And discard old ones that no longer work.

As a baby boomer, I watched my parents, aunts and uncles retire happily.

Most didn’t know a thing about investing. Nor about stocks, bonds, or the stock market.

They didn’t have to.

A pension and Social Security were all their generation needed. They could count on a pension to support them through retirement.

But that all changed when Wall Street started pushing 401k’s. Their new retirement solution in the 1980s.

As they put it: who needs pensions when you can retire a millionaire with a 401k? All you had to do was save a few dollars every month.

It was an attractive offer. Especially with many companies matching your monthly contribution.

But their solution had an unfortunate consequence.

Because unlike pensions, 401k’s removed a company’s responsibility of paying you in retirement.

As Treasury Department insider, Gerald Facciani, put it, “The great lie is that the 401k was capable of replacing the old system of pensions.”

This was the unseen turning point for American retirees. And the start of our national retirement crisis.

How Wall Street stole American’s retirement

As you know, a pension promises a specific income in retirement. You don’t have to worry about meeting your basic needs. Your pension would take care of that for you.

But that all changed when 401k’s came along. Corporate America loved them because they relieved the companies of any responsibility to take care of you in your retirement years.

And like most things that benefit big corporations and Wall Street—it turned out to be a disaster for the rest of us.

Most companies phased pensions out of their employee benefits, replacing them with 401k’s.

It was now up to employees to save and know how to invest their money for their retirement.

And with rising living costs, most people just couldn’t stash enough away.

In fact, a study by the Federal Reserve found that over 60% of Americans aren’t able to save enough. That percentage is steadily rising. And most seniors will have to keep working to make ends meet.

In short, today’s retirement strategy isn’t working for most people. They aren’t financial professionals. And they don’t know about the ever-changing world of personal finance.

The truth is, to retire comfortably, you have to use another approach to personal finance that simply wasn’t available a generation ago… when most of us first received our retirement advice.

Let me give you an example of what I mean…

You don’t have to be rich to retire early

George Dougherty spent his whole life working as a photocopy machine repairman.

George Dougherty spent his whole life working as a photocopy machine repairman.

He started straight out of high school and made a modest wage most of his life. His company offered a 401k, and by age 62, George managed to save only $100,000 for retirement.

It was far from enough for him and his wife to retire on. And by any conventional method, he’d have to keep working and save hard for many years if he hoped to retire at all.

The problem was, George didn’t want to work any longer.

He looked forward to saying goodbye to city traffic and the hectic nine to five. He longed for a relaxed lifestyle where he could go fishing whenever he wanted… or travel… Where he could wake up and go to sleep without a care in the world.

I was working as a financial planner at the time, when George came to my office. So I sat down with him, and showed him how he could apply a retirement strategy that would let him do that.

At first, George wasn’t sure it would work for him. But he wasted no time putting it into effect. And to his surprise, he was able to retire soon after.

This may sound like a happy ending to George’s story. But there’s more. Because years later George’s wife told me their initial $100,000 retirement savings had grown throughout their retirement years. Enough to set up college funds for their grandchildren.

And this is what makes today’s retirement renaissance so exceptional. Everyday Americans are bypassing conventional advice. And they’re using another approach that’s letting them retire sooner and with less preparation than they ever thought possible.

Larry Tremblay is another great example…

Larry Tremblay is another great example…

After graduating, Larry skipped going to college, and got a job as an accounting clerk.

But as time went on, he struggled to save for retirement. The Fortune 100 company he worked at offered a pension plan. But as he put it, “the executives raided the funds and paid themselves astronomic salaries while cutting [our] retirement benefits.”

Retiring on a company pension and Social Security was no longer an option. And a retirement of any kind seemed like a long way away.

Larry searched online for any advice he could find. Most of it didn’t help. But eventually he stumbled on a small group of like-minded people who used a different strategy that helped them leave their jobs years early.

They did it without waiting for Social Security. And without saving a large nest egg. It was exactly what Larry was looking for.

After talking it over with his wife, they decided to give it a try, “I woke up one day and said that was it.”

Much to Larry’s surprise, the new strategy worked! And he was able to quit his job soon after.

As a result, Larry’s now living the retirement he always dreamed of…

“I travel a lot, I enjoy life and I don’t miss work. Being a healthy 56 years old when I retired has given me more opportunities to explore adventure than if I had waited until 65.”

So how can you take advantage of this retirement renaissance yourself?

That’s easy.

Just follow these two easy steps…

The new twist on Personal Finance

There are two keys to retiring early today.

The first ensures you can afford your retirement lifestyle no matter how much or how little you’ve saved… by taking a different approach to your personal finance.

We all know that the age-old advice of “spend less and save! save! save!” just isn’t enough any more. Not in a world where living costs keep rising much faster than wages.

Your approach to personal finance has to take these changes into account and take advantage of new opportunities that come along… like today’s retirement renaissance.

To help you do that, I head America’s most successful retirement advisory letter called Personal Finance.

Just look at what one of our early retirees, Lester Twiggs, had to say…

Just look at what one of our early retirees, Lester Twiggs, had to say…

Lester and his wife were never rich. His job paid a decent enough wage to live comfortably, if he watched his pennies and dollars.

They rarely went to restaurants. And drove the same old Dodge Caravan that he bought when his kids were growing up.

But the long work hours and cold winters were taking a toll. And he yearned for a warm place to retire.

Fortunately, a relative introduced him to a publication called Personal Finance.

It covered the same strategies that are fueling today’s retirement renaissance. And it was the turning point Jackson was looking for.

“It allowed me to take control of my investing and financial destiny,” he reminisced.

By following our newsletter’s advice, he discovered he didn’t have to wait until he turned 65.

As he put it, “I retired at 52. It was a good decision that allowed me to follow up on my interests.”

For the first time in his life, he was finally able to sleep in and treat every day like Saturday.

“It took a while before I stopped waking up at night thinking I had to be ready for a meeting,” he recalls.

Now, Lester and his wife travel for fun. They built a second home in Florida where, “ we have a couple of fishing boats behind our home, only 6 minutes to open water.”

Thanks to Personal Finance, Lester was able to join the retirement revolution, and enjoy a carefree retirement.

We’ve helped more people retire early than any other financial newsletter. That’s why our publication has thrived for 45 years while others came and went.

We’ve prevailed because our advice works. And it’s become the financial backbone for countless happy retirees.

Like Seattle native, Edward King, who told us, “I am very happy being retired, I retired early with the help of Personal Finance.”

Like Seattle native, Edward King, who told us, “I am very happy being retired, I retired early with the help of Personal Finance.”

Eric Pazarena, who also followed our advice and said, “I retired at 47 and never regretted it.”

Eric Pazarena, who also followed our advice and said, “I retired at 47 and never regretted it.”

Charlotte Bilko, who told us, “It is only by having you watching my back financially, that I am able to have the lifestyle I do.”

Charlotte Bilko, who told us, “It is only by having you watching my back financially, that I am able to have the lifestyle I do.”

Or Minnesota retiree, Troy Winters, who wrote, “I retired at 57 and I’m enjoying every day of it. I walked out of the office the last day and never looked back.”

Or Minnesota retiree, Troy Winters, who wrote, “I retired at 57 and I’m enjoying every day of it. I walked out of the office the last day and never looked back.”

We’ve received literally hundreds of stories like this from people who retired early thanks to our financial advice.

That’s why our research is followed by over 200,000 people around the world.

Remember how I told you that 60% of Americans can’t save enough for retirement?

Well that just isn’t the case with Personal Finance readers.

We’ve not only helped our readers retire early, but we’ve also helped them retire rich…

67% of retired millionaires did this…

In fact, in a recent survey of our readers, 67% of the respondents said theyare worth over $1 million… thanks much to our guidance.

I don’t know of any other financial service that can make this incredible claim…

Take retired millionaire Harold McMire, for instance, “I started with nothing. Zero. I used the Personal Finance newsletter for ideas [and] retired at 58, as did my wife. Now we are worry free and loving life!”

Take retired millionaire Harold McMire, for instance, “I started with nothing. Zero. I used the Personal Finance newsletter for ideas [and] retired at 58, as did my wife. Now we are worry free and loving life!”

Tony Cummins told us, “My portfolio is worth a lot more than $1 million.”

Tony Cummins told us, “My portfolio is worth a lot more than $1 million.”

Gino Meyer, another millionaire retiree, said, “I have been a subscriber almost since the beginning, I credit Personal Finance largely with my current financial independence.”

Gino Meyer, another millionaire retiree, said, “I have been a subscriber almost since the beginning, I credit Personal Finance largely with my current financial independence.”

Richard Ward, who also has a seven-figure net worth, said, “I retired at 57. Personal Finance was a key part of my investing decisions. I have benefited from all of Personal Finance’s insights.”

Richard Ward, who also has a seven-figure net worth, said, “I retired at 57. Personal Finance was a key part of my investing decisions. I have benefited from all of Personal Finance’s insights.”

Mortimer O’Sullivan, told us, “I have only held investments recommended in Personal Finance.”

Mortimer O’Sullivan, told us, “I have only held investments recommended in Personal Finance.”

Or Hawaii native, Joseph Schell, who told me his first day of retirement was, “Stress relief! I retired at 55, [having] benefited from your stock recommendations.”

Or Hawaii native, Joseph Schell, who told me his first day of retirement was, “Stress relief! I retired at 55, [having] benefited from your stock recommendations.”

Once again, I could keep showing you stories upon stories of people who retired as millionaires by following our research.

But I think you get the point: our financial insights are helping people reach their retirement dreams.

When you read Personal Finance, you’re in good company.

It doesn’t matter if you’re unprepared for retirement and still want to retire early, or if you’ve saved your whole life, and want to grow your nest egg even more.

Personal Finance can help you reach your retirement goal either way.

So if you’d like to join the thousands of Americans taking advantage of today’s retirement renaissance—and retire early—I can now help you do that…

How to retire as early as 12 months from now

My name is Jim Pearce.

My name is Jim Pearce.

I’ve spent my whole career helping people make money.

I started my career as a broker at a private brokerage firm… then I moved to investment banks and large brokerage houses.

In all, I’ve spent over 30 years specializing in one thing—helping people retire.

Whether it was growing their nest eggs… paying off debt… creating retirement income… trusts for grandchildren… I’ve done it all.

Along the way I watched the financial world change… the internet bring in discount brokerages… Wall Street invent new products for itself at your and my expense… and with each step I adapted my strategies to keep people’s retirement dreams on track.

But in 2012, I decided to leave it all behind and I retired from my corporate job.

I’d had enough of corporate America. Enough of having my hands tied by company politics, and by the constant demands to sell stocks and funds I didn’t believe in.

But I was only 53, and it didn’t take long to realize that I wasn’t ready to spend the rest of my life playing golf.

So I joined up with an independent financial research firm, Investing Daily that publishes the retirement advisory letter, Personal Finance.

I found we had the same purpose. To provide the best unbiased financial research. To make a difference in someone’s life.

If the advice worked—delivered what it promised—then subscribers stayed with us.

And with Personal Finance being the longest running financial newsletter in America—it proved to me that they were doing exactly that.

In Personal Finance, I am able to share the strategies that I personally use to manage my own finances. The ones I used to retire early from my corporate career. And co-incidentally, the very same strategies that thousands of people are now discovering coast-to-coast, sparking today’s retirement renaissance.

These strategies encompass 6 individual steps that anyone can follow and use to retire on their own terms.

If you’re looking for sound unbiased financial research to help you retire early, I honestly believe Personal Finance is your best source.

To help you take advantage of today’s retirement renaissance, I’ve put together everything you need to know into a special Retirement Report called, The 6 Steps to Retiring Early, No Matter How Much, or How Little, You’ve Saved.

In it, you’ll find:

- The exact steps I used to help George D. retire early—the photocopier repairman I told you about, who was able to retire years early though he only saved $100,000 in his 401k account.

- I’ll show you the 6 key steps that make up the retirement renaissance. Follow these simple steps and you could join the thousands of Americans who are saying ‘goodbye’ to their nine-to-five.

- And most important, I’ll show you how to avoid the No. 1 threat to your retirement in today’s world of economic uncertainty and rising prices.

It’s the reason most people fail to retire on time. Or have to come out of retirement and back to the workforce.

Unfortunately, it’s also the one thing missing from all traditional retirement plans that you absolutely must do today!

Now, I realize that for some people reading this presentation, your personal finances may be something you “already know” a lot about.

That’s okay. Because unless you’ve already joined the thousands of others in today’s retirement renaissance… you may be missing out on the most exciting opportunity available to you today.

Especially when you consider that there’s one thing about personal finance that almost nobody knows about. Even though it’s the No. 1 reason for not being able to retire.

It isn’t because you put off saving money, or didn’t have a retirement savings plan.

It’s something else altogether that once you see it, will make you wonder why you didn’t think of it yourself.

And the best part of it is, all it takes is one small change to your finances, to avoid this retirement deal-breaker.

Once again, I give you the full details in your Retirement Report: The 6 Steps to Retiring Early, No Matter How Much, or How Little, You’ve Saved.

I’d like you to have this retirement report right now.

All I ask in return is that you also try my retirement advisory letter, Personal Finance.

Let me tell you a little about it, so you can decide if it’s right for you…

Ahead of the crowd

We started Personal Finance in 1974, during one of the worst market downturns in modern history. The stock markets were crashing, inflation was spiraling upwards.

Yet, in spite of these things, our subscribers prospered. We showed them safe ways to protect their money and make it grow… And we’ve been beating the markets for 45 years since.

If you were with us in the 90’s, we showed you how to take advantage of the tech boom with gains like 2,010% in Softbank, and 520% with Sony.

In 1999 we anticipated the market top, prepared you to get out… And showed you how to profit through the coming collapse.

And while the stock market lost 35% from 2000 to 2002, our Personal Finance portfolios gained 21% each year…

In fact, if you had invested $100,000 with us then, you would have come out of the bear market $176,000 richer.

And when the bull market returned in 2003, we led you to winners like 2,400% with Intel and 450% with Great Plains Energy, to name just a couple.

Then came 2008 and we prepared you for the big selloff, and once again showed you how to profit on the way down.

For instance, one investment we showed you, a ProShares ETF, made 80% as the market crashed.

And by March 2009 when the market finally bottomed, we urged you to get back in.

It’s because of calls like this that our readers stay with us over the long run… from their working years, through their long, successful retirement.

Just ask early retiree, Archie L., who wrote, “With Personal Finance advice I have turned $130,000 into $325,000. I only wish I had started with you much sooner.”

Even Forbes Magazine took notice of us, saying we, “capitalize on playing both sides of the market.”

In fact, Personal Finance has received “the best financial advisory” award seven times from the Newsletter and Electronic Publishers Association.

In short, Personal Finance is about helping you profit from whatever is taking place in the world… whether it’s a raging bull market… its ensuing crash… or rare situations, like today’s retirement renaissance.

For instance, look at what else my research uncovered…

A large dependable income you can retire on

No matter what your style of investing, the ultimate goal for every investor is income.

You want a steady stream you can live on.

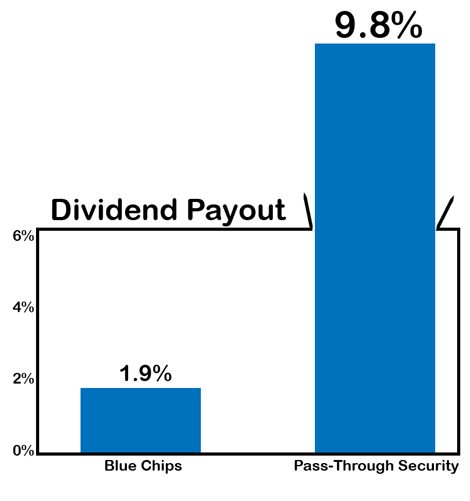

But it isn’t easy. Today’s low interest rates make it near impossible to get a decent income from blue chips, bonds or a savings account.

If you want to collect a serious income, you have to look at other investments like Pass-Through Securities.

If you’re not familiar with them, Pass-Through Securities are a special class of investments that you can buy and sell just like regular stocks. All major brokerages deal with them.

The difference is, some of their payouts are five times larger than what you’d get from a dividend paying blue chip.

In other words, if you have a portfolio of $200,000, you’d collect the same size income a blue chip investor collects from his $1 million portfolio.

That’s what Pass-Through Securities give you.

The reason you get these large payments is because Pass-Through Securities do exactly as their name suggests. They pass nearly all their profits through to you.

They invest in premium, high-return opportunities that would normally be only available to wealthy investors and hedge fund managers.

This includes stakes in private companies before they list on the stock market… large real estate deals… or business partnerships, that are otherwise impossible for regular investors to get into.

For instance, imagine investing beside Bill Gates or Steve Jobs when they only had a few dozen employees, and before their companies were on the stock market.

One venture capitalist, Arthur Rock, did just that. He put $57,000 into Apple before it went public, which turned into $14 million for him three years later.

Most people would never get a chance to invest in such an opportunity. But that’s exactly what some Pass-Through companies invest in. And they pass nearly all their profits on to you.

That’s because by law, a Pass-Through company must pay out at least of 90% of its profits to shareholders. And it does this by giving you huge quarterly dividends.

If you’re a retiree, or you wish to generate a large passive income—I can’t thing of a better way to do it.

Just ask Minnesota retiree, Flynn Thomas, who received a $12,690 check last month. And is set to receive another $12,690 next month again.

Just ask Minnesota retiree, Flynn Thomas, who received a $12,690 check last month. And is set to receive another $12,690 next month again.

Another retiree, Margaret Bradford, collects $50,040 from the same company every year. That’s more than the average working salary.

Another retiree, Margaret Bradford, collects $50,040 from the same company every year. That’s more than the average working salary.

And you don’t have to be retired to collect these huge payouts.

Take Jenny Schaefer, a single mother of two. She relies on these payments to help pay her bills, and save for her kids’ college tuitions.

Take Jenny Schaefer, a single mother of two. She relies on these payments to help pay her bills, and save for her kids’ college tuitions.

She gets a $2,400 check deposited into her bank account every single month.

Or take 74-year-old, Wayne Green, who’s been cashing quarterly Pass-Through income checks for the past 15 years.

Or take 74-year-old, Wayne Green, who’s been cashing quarterly Pass-Through income checks for the past 15 years.

His latest check was for $18,600.

That’s more money than he’ll collect from Social Security in the whole year.

Wayne is just one of thousands of retirees who’ve discovered this secret.

In fact, the company he collects checks from has been dishing out payments like this since 1997. It has never missed a payout. Not during the dot-com crash. Not after 9/11, or in the Great Recession.

And listen to this: if you had been a shareholder in 2008, your payouts would have doubled during the Great Recession! At the very same time when other blue chips were cutting or stopping their dividends altogether.

I’m sure you remember those years.

Yet, most people still haven’t heard of Pass-Through Securities.

The good news is, I’ve found 6 that deliver these large payouts.

And I have the perfect way for you to invest in them.

It isn’t by buying their individual shares.

It’s a way that lets you invest in all 6 right away, so you don’t miss the large payouts from any of them.

This way you don’t have to worry about which Pass-Through Security to buy first, or how much money you should put into each one.

Even with a small amount of savings, you can get a stake in all 6 top companies, and start collecting their large payouts right away.

If you wish to secure a passive income that you don’t have to manage daily… One that let’s you enjoy your early retirement and sleep soundly… I can’t think of a better way of doing it.

I’ve put the full details about them in my second retirement report called, The Secret to Collecting a Huge Passive Income You Can Retire On.

It’s yours free, just like the first report I mentioned, when you give Personal Finance a risk-free try.

So… Is Personal Finance right for you?

How to know if this is right for you

Personal Finance is a simple 16-page newsletter I send out each month. You can access it on your members-only website. And we deliver a print issue to your mailbox a few days after.

In it, I explain what’s happening in the economy, how it affects your finances… and what action to take so you can profit, or avoid disaster.

Then I use my experience—which includes founding an investment banking firm and years of managing over $50 million in assets—to give you actionable advice to generate money you can use now or in your early retirement.

The retirement renaissance I showed you today only scratches the surface of the opportunities you’ll find inside Personal Finance.

As I mentioned before, we’ve taught a lot of people how to make a fortune and retire early.

And many folks have written me back to tell me about their success…

Notes like these are what make all the long hours we spend finding profitable investing ideas worth it.

And I’d like nothing more than for you to be our next success story.

It all starts here with your opportunity to retire early

Within minutes of joining Personal Finance (which again is completely risk-free) …

You’ll get both retirement reports with the details on how to take advantage of a new retirement strategy, that could help you retire as early as this year.

You’ll also get full access to everything we do including…

Monthly Issues—Every month, you’ll get a 16-page issue of Personal Finance. Inside, my team and I deliver the real picture on what’s currently happening in the markets…

Then we’ll give you actionable recommendations you can profit from.

From investments that allow you to create safe, recurring income streams of 9.3%… 10%… even 11.5%…

All the way to opportunities which can safely turn $10,000 into $34,200... $43,980... even $207,370.

You’re guaranteed to find a number of exciting new moneymaking ideas in each issue.

Flash Trade Alerts—When it’s time to make a move on one of our positions, or a new opportunity comes along that can’t wait for the next issue, we’ll send a flash alert that tells you exactly what to do.

Best of all, thanks to smartphones, tablets and Wi-fi you can even make the trades when you’re away from your computer.

Private Website Access—Inside our password-protected website you’ll find our full library of research.

That includes an up-to-date collection of our model portfolios that let you know what to buy.

What price to buy it under. And even when to sell it.

The website also has copies of every issue, article, flash alert, and special report we’ve ever put out.

And it’s home to a unique feature you won’t find anywhere else...

Personal Finance’s Stock Talk Message Board—If you ever have a comment about one of our recommendations or want to dive deeper into why we made it, just post a note to our message board and we’ll be sure to answer you back.

First-Class Customer Service—And if you ever have a question or problem, you’re covered by our dedicated Customer Service staff. You won’t get a call center when you contact us. Our Customer Service staff is dedicated to our products—and they’ll do everything they can to make you happy.

I hope by now it’s clear why an independent publishing association named Personal Finance is the #1 investment newsletter in the world.

You can take the next three (3) months to decide whether or not you want to keep your subscription. If you decide Personal Finance is not for you, no problem—just let me know and I'll give you a full refund.

So how do you get started now?

Here are the details...

How to get started now...

To get started now, let me know that you're interested, and I’ll give you access to everything I’ve mentioned, in the next few minutes.

Personal Finance costs just $99 for one full year... about as much as a dinner for two at a good restaurant.

If you take advantage of the retirement renaissance I’ve told you about, your subscription can easily become the most valuable investment you’ve ever made.

If you're not happy with our work within the next three months, simply let us know, and you can get a full refund. It's that simple.

But I don’t think you’ll be canceling once you see the results of our advice.

Just look at what else I uncovered in my retirement research...

Avoid Wall Street’s retirement sabotage

If you can’t save enough for retirement... or if you’ve retired, but go to sleep worried that you’ll outlive your retirement savings... you may have fallen prey to Wall Street’s secret retirement killer.

That’s because today’s mainstream retirement strategy that’s pushed by Wall Street, is actually geared to help them more than you.

Unfortunately, even most well-meaning financial planners are unaware of this. And they pass this retirement killer on to their clients.

As Wall Street insider, Ted Benna, admitted, “[it] helped open the door for Wall Street to make even more money than they were already making.”

He should know, he was the financial consultant who created the 401k’s.

Today, this tactic generates $4.8 trillion for Wall Street’s brokerages and investment banks, while helping to prevent one out of every five seniors from retiring by age 65.

The good news is, I’ve uncovered the deception that’s sabotaging these retirements, and I lay it out in plain English in my third retirement report, called How to Avoid Wall Street’s Retirement Sabotage.

I recommend you read this report first, before you read my other two retirement reports. The information here is so valuable, that not having it is like trying to run a marathon with a ball and chain around your ankle. So make sure you read this report first and unshackle your finances for good.

Like everything else I've told you about, this research report also comes free of charge, included with your risk-free trial of Personal Finance.

As I mentioned, a one-year subscription normally costs $99. That's what thousands of subscribers have paid. But, if you sign up through this invitation, you'll get it for 60% OFF.

That's just $39.95.

Why so cheap?

Because the only way we stay in business is to provide great research that encourages you to stick around for years to come.

And I know you've got to TRY IT FIRST, to see if you like it. That's why I make it so inexpensive... and allow you to take a 3-month look, completely free of risk.

I hope you'll give Personal Finance a try. There are so many great opportunities out there for you to financially profit from. Most investors simply don't have a clue where to begin.

I can show you the secrets of retiring early. And we can show you all the other ways I’ve discovered to make your financial life prosperous. You just have to give Personal Finance a shot.

So click on the link below to sign up now...

Sincerely,

Jim Pearce

Editor, Personal Finance

Here’s the First Step to Your Early Retirement

To get started right away, let me know that you're interested and I’ll give you access to everything I’ve mentioned:

How to Avoid Wall Street’s Retirement Sabotage

Today’s mainstream retirement strategy that’s pushed by Wall Street, is geared to help them more than you. If you can’t save enough for retirement... or if you’ve already retired, but go to sleep worried that you’ll outlive your retirement savings... you may have fallen prey to Wall Street’s secret retirement killer. In this report, I shed light on this dark secret, so don’t fall prey to it any longer.

The 6 Steps to Retiring Early, No Matter How Much, or How Little, You’ve Saved

There are 6 simple steps you can follow to help you retire as early as this year. I lay them out in plain English in this report... including the No. 1 reason most Americans will not have a successful retirement. All it takes is one small change to avoid this retirement deal-breaker, and I show you how in this report.

The Secret to Collecting a Huge Passive Income You Can Retire On

I’ve found the top 6 Pass-Through Securities that deliver payouts five times larger than an S&P 500 blue chip. If you wish to secure a passive income that you don’t have to manage daily... One that let’s you enjoy your early retirement and sleep soundly... I can’t think of a better way of doing it.

These reports are yours free, when you try—without obligation—my retirement advisory letter, Personal Finance.

As mentioned, a subscription to Personal Finance usually costs $99 for a one year. Thousands of satisfied subscribers have already gladly paid that amount.

The subscription includes twelve issues, flash trade alerts, private website access, member message board plus VIP customer service.

But that’s not all.

Because if you take me up on this offer today, I’ll include a fourth retirement report, called the The Biggest Legal Loophole in the IRS Tax Code!

You see, it’s no secret that our taxes will go up in the future. Government spending is out of control and the federal budget deficit grows every year.

In fact, the Congressional Budget Office estimates the deficit will reach $900 billion this year. As a result, our taxes will have to go higher to keep the government’s head above water.

The good news is, there’s a tax loophole that lets you grow your retirement savings without paying a single dollar to Uncle Sam.

That means, your savings can grow tax-free and best of all, you’ll pay no income tax, capital gains tax, or taxes of any kind, not even when you withdraw your savings in the future.

It doesn’t matter how large your account has grown or how much annual income you receive from it.

You pay no taxes on it all in retirement!

I give you the full details of how to take advantage of this retirement loophole in your fourth retirement report. It’s also included free in your trial subscription to Personal Finance.

By trying our service now, you can get a one-year subscription for just $39.95. That’s the equivalent of paying for five months, and getting the remaining seven months free.

You get a full 12 months of our financial advice.

Why so cheap?

Because the only way we stay in business is by giving you great research that encourages you to stick around for years to come.

And I know you've got to TRY IT FIRST, to see if it works for you. That's why we make it so inexpensive.

But if you already understand the value of the information I'm offering, you may wish to try our next subscription level...

Get a second year, on us

By agreeing to pay for ten months up front, I can let you receive Personal Finance for 24 months.

In other words, for just $79, you can lock in two full years of our financial advice.

This is our best offer.

So if you understand the value of what I'm offering you here, it’s an incredible opportunity worth taking advantage of.

Of course, no matter which level of Personal Financesubscription you try, you're always protected by our risk-free guarantee.

You can take the next three months to decide whether or not you want to keep your subscription. If you decide Personal Finance is not for you, no problem. Just let us know and we'll give you a full refund.

But I don’t think you’ll be canceling once you see the progress you’re making toward your early retirement.

To get started right away, simply select the level of discount you wish to take advantage of, and fill in your membership information below.

You’ll receive access to all four retirement reports in the next few minutes.

Step #1: Choose Your Discount Level

Step #2: Enter Your Membership Information Below

PS: One more thing. Most Americans don’t realize there’s a tax loophole that lets you grow your retirement savings without paying a single dollar to Uncle Sam. I've written a retirement report on this, called the “The Biggest Legal Loophole in the IRS Tax Code!” It tells you everything you need to know. And I'll send it to you as well, free of charge. Have a look at the form on the next page for the complete details.