You Can’t Make Real Money on Wall Street

Follow CNBC or The Wall Street Journal,

and you’ll gain about 3% a year. Maybe.

|

Why read this? Because Personal Finance subscribers always win. When the markets go up, you make great money. When the markets go down, you still make good money. We guarantee it. |

For 41 years, we’ve been beating the markets, often by a long shot—including one year, when just in bonds alone we made 30%.

Did we beat you? Well, if you spent the last twelve months wandering along the broad S&P Highway, you’ve made very little – a few percent at best. That means all 35,000 of our loyal readers left you in the dust.

Two suggestions: Fire your broker. Let us open your eyes to a new way of wealth.

Why Your Broker Is the Enemy

Very few investors realize that THE SYSTEM is stacked against them.

Yes, the Wall Street Armada all have big research staffs. And sure, they want you to make some money. But they don’t create billionaires. Never have, never will. Major brokerages are part of the system. Together, they have more than 150 million clients. That prevents them from recommending some hot little stock that fell 20% last week and is now a bargain. Chaos would ensue.

Why? Because when everyone buys from the same pool of megastocks, no one makes real money (unless the economy is on fire). That simple. And never forget it.

Jim Pearce

My name is Jim Pearce, and I’m a graduate of THE SYSTEM. Unlike most newsletter editors, I’ve spent long years in the belly of the beast. I’ve worked as an asset manager for brokerages buying, selling, and managing stocks and bonds from financial centers as diverse as Amsterdam, Tokyo, and Tel Aviv. Heck, I even spent time at a big bank— and you can’t get any more institutional than a bank!

I learned the values, the lingo, the, um, “short cuts”—and I saw where the bodies were being buried. And finally one day, I said to heck with it.

Now I’m just like you: a happy outsider. I make my profits the same way you do—by my wits. I kowtow to no one. I follow no one’s agenda. Don’t even wear a tie anymore!

And you know what? I’ve discovered that it’s far easier to make big profits by picking and choosing from the thirty thousand investments outside the S&P than by trying to squeeze a few extra dollars out of Intel, Wal-Mart, and General Electric. Plus, it’s a lot more fun when the profits are 500% to 1,000% higher. So just follow my lead and make some money along with me.

Welcome to the party.

Sure, Amazon.com is nice, but do they love you?

The biggest profit opportunity of our time is Technology. Yet nine-tenths of the investment crowd are playing it like rookies.

Yes, technology has created multimillionaires in past ten years—and a few billionaires. They’ll continue to do so. But not in the obvious way.

Here’s what I mean: Suppose you recently bought shares of Amazon. Nice move. You made good money. But the only person getting truly rich is its founder, Jeff Bezos.

You see, the herd’s rush into this albatross has driven shares to a P/E of 298, 20x higher than the market average! That’s in spite of the fact his company has never paid out one red cent to shareholders. Because it can’t. The simple truth is Amazon only turns a profit about once in a blue moon. And when it does, it’s tragically tiny.

So what do you think is going to happen the first time the market hiccups and “Joe Investor” realizes Amazon won’t turn a real profit in his lifetime? And what happens when he finally connects all the dots that the only guys getting rich from Amazon are Mr. Bezos and the brokers who peddle his ridiculously overpriced stock?

Just ask yourself: When was the last time you saw someone in a LearJet paid for by his Wall Street profits?

I think the answer is crystal clear. Crashville.

My not so humble advice: Sell Amazon and never look back.

In contrast, the tech companies we uncover are case studies in how to woo folks like you and me. They’re like that rich uncle you always wished you had. They give investors a generous share of the profits. And the opportunity for powerful growth.

You see, unlike a lot of our competitors, we don’t believe there will ever be just one big winner. That’s an all-or-nothing proposition that could lead to the poorhouse. And if someone was peddling it to me, I wouldn’t just walk away—I’d run.

Instead, we’ve gone the extra mile and uncovered five better-than-Amazon opportunities you must get to know really well … because they’re going to enable you to pay cash for that second home in Florida or Florence or Bora-Bora

Opportunity #1: Profit from a company that’s eating Apple’s lunch.

You probably don’t know it—but there’s a smartphone maker out there that has a product better than Apple’s and sells it for 57% less. They’ve already conquered the billion-person Chinese market, and now they have their eyes fixed on the only market that can rival it… India. But I’m not recommending you buy even one share. Because that’s what the mindless herd is doing.

Instead, I’ve found a company that supplies a must-have component to not only this giant killer—but to the giants too (Apple and Samsung). This back-door approach guarantees you get a slice of virtually every cellphone sold not only in India and China, but here in the United States too.

When you join Personal Finance, I will send you Tech’s Brightest Stars, a special report revealing the bargain-priced company that’s cornered the exploding global smartphone market. It also includes all the details on…

Opportunity # 2: A government-protected virtual monopoly.

Their mission-critical infrastructure keeps every teenager on the planet out of your hair and glued to their little screens. Unlike Amazon, who couldn’t turn a profit if they wanted to… this company is insanely profitable and shares it in the form of a growing 5% dividend. (What a concept.)

Did your broker bring you profits over 20% during the recent bust?We would have. |

Opportunity # 3: A leading healthcare innovator.

In 2014 our country laid out a staggering $3 trillion for medical care. If that doesn’t scream runaway spending… nothing does. Especially when you know 86% of that money was due to chronic diseases whose impact can be reduced by introducing more innovative technology into the healthcare system.

We’ve found one under-the-radar innovator that’s helping patients reduce the impact of cardiovascular disease—an affliction our country currently spends $193 billion a year trying to manage. We’ll tell you all about it when you subscribe to Personal Finance. (We doubt your broker will do as much.)

Opportunity # 4: A networking business leading the Cybersecurity charge.

Cybersecurity is a tough business. But it’s also an extremely lucrative one for the companies that get it right. That’s because there’s one million cyber-attacks every single day, with no signs of slowing down. The companies and countries under siege spent $77 billion on cybersecurity last year, and they’ll spend $170 billion every year by 2020.

We’ve found one networking business that’s actually starting to look like a cyber-defense Army regiment. It’s already locked up key accounts in the Department of Defense, all four branches of the military, and virtually every Fortune 500 company. Profits are up over a billion dollars from last year and dividends are growing a consistent 10% year on year.

Opportunity # 5: Profiting from the “Internet of Things.”

Something incredible is happening in the world of technology. It’s called the Internet of Things and it’s quickly turning into a $14 trillion market. By 2019 this booming market will be twice the size of the tablet, PC, smartphone, and wearable computing markets…combined.

We’ve found a tiny company that produces essential intellectual property for almost anyone operating in this market. I won’t lie and say it’s a sure thing, but once things start firing on all cylinders gains of 2,000% wouldn’t surprise me. You’ll get all its details in Tech’s Brightest Stars. We’ll rush you a free copy when you join Personal Finance.

Of course, Personal Finance doesn’t just focus on stocks…

What Color is Your Bond Portfolio?

According to Wall Street superstition, the only use for bonds is to stitch them together into a giant parachute so you can safely bail out when stocks fall.

Well, there’s some truth to that. During the last stock swoon, while the S&P was losing a total of 35.1%, we were up an average of 20.81% per year for three years… mostly with conservative bonds.

Even if markets spend the next three years in the Slough of Despond, your profits from Personal Finance should be in the range of 20% to 30% a year. And if things really do pick up, you might expect returns approaching 100%. Even if markets spend the next three years in the Slough of Despond, your profits from Personal Finance should be in the range of 20% to 30% a year. And if things really do pick up, you might expect returns approaching 100%.

Jim Pearce |

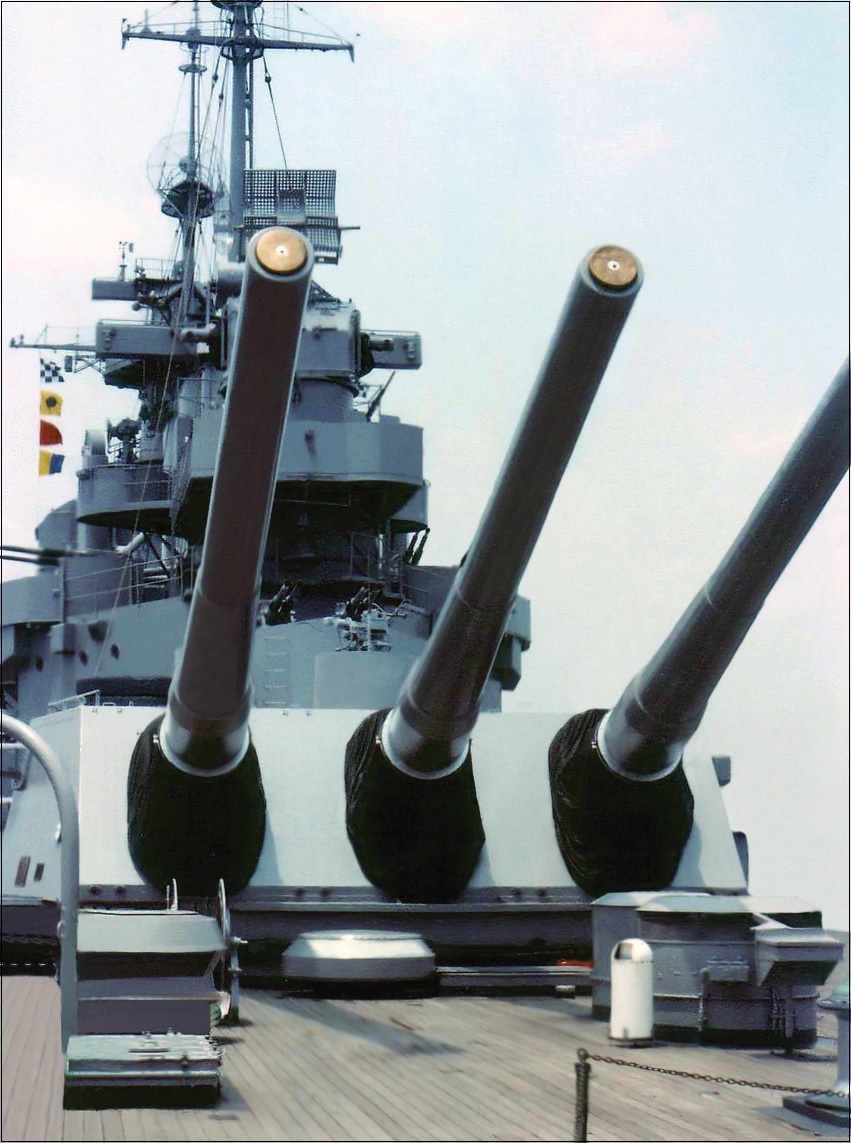

Not bad, of course, but these securities are more than a drogue chute to break your fall. In Personal Finance, we offer a whole rainbow of special tools. I built my reputation by making sensible investments. You don’t become one of America’s top retirement advisors any other way. So if you’re looking for an ambidextrous stock-and-bond gunfighter with high-caliber weapons on either hip, you can consider me your boy.

The brain-dead approach to bonds is to do the easy thing: Buy Treasuries. If you owned medium-term Treasuries last year, you made 0.3%, a dab below inflation.

But if you owned part of our special collection of income vehicles, including a unique property trust we selected, you could have made nearly 20%. That would easily pay for 48 issues of Personal Finance, at my publisher’s ridiculous introductory price of $79.

(It should be ten times that, but they seem to have an emotional need for bragging rights to one of “THE LARGEST-CIRCULATION FINANCIAL NEWSLETTERS IN THE WORLD!” Slashing the price is their cute way of making sure Personal Finance stays at or near the top year after year… while keeping their editorial staff humble—and embarrassed.)

But I’m not in it for the money, as I make my own—and you will too, by following along.

Bonds Can Beat Stocks Long Term… If You Know Bonds

New investors have a fatally flawed idea about bonds and bond funds: “When interest rates climb, they all go down, end of story.”

|

The New Personal Finance

By sheer force of hard work and brilliance, it beat the Street for 35 years – as a big, slow-moving investment letter. But then came the crash of 2008-2009. We had warned our readers months before, in 2007, to steer clear of complex securities and simplify their holdings, so we did OK. But OK doesn’t cut it with our crowd. So we hauled ourselves into drydock and massively rebuilt the whole vessel. We are now a very nimble fleet of five destroyers! A destroyer is a fast-moving but highly armed naval ship. Likewise, Personal Finance is now a powerful but flexible force captained by five of the most resourceful minds you’ve ever met. And the editor, Jim Pearce, was specifically chosen because during the 2008 crash, he was busy generating profits for his clients and a six-figure gain in his personal account. Oh, we’ve kept the same principles as always. But we are now a highly maneuverable team with an exciting new mission: Create profits for the readers in good times and bad. And don’t roll with the waves, make them. |

That may be true for most of them, but not for the ones you’ll get through Personal Finance.

Why? Because two other factors influence these investments: credit and competition.

Credit: If the issuer is improving its credit, the market will see that the risk is smaller, so that bond’s price will grow. If the issuer is like Eastman Kodak, the market will grind up your junky bonds and spit them out.

Competition: In the great eternal war between stocks and bonds, stocks aren’t looking as strong right now. That means stocks will offer less competition to bonds soon. And as the balance shifts, select bonds will attract plenty of buyers… which drives their prices higher.

Even on catastrophic days like Black Friday or Black Monday, there were always a few stocks that went up. Likewise, even in bad times for bonds, some are always going up nicely. You just have to look under more rocks to find them.

Or better, let me and my team do the looking. We can find bond offerings with stellar returns in any stock market environment, no matter how wretched. In fact, on days when no one can find a single decent stock with a telescope, we can always locate a juicy bond or two.

In the New Personal Finance,

We Don’t Buy Mutual Funds Per Se

Don’t get me wrong, to the delight of most of our long-time readers we still print our regular Mutual Fund Page in every issue. And there’s a reason for that—90 million people still own them. But we have a different take on mutual funds than everyone else in the industry. Because we don’t want our readers to be do-nothing drifters who are content to buy omnibus funds, kick back, and flow with the tides. Instead, Personal Finance is a nimble advisory that is quick to change our tack when the prevailing winds shift.

So when we recommend a fund in our portfolios, you’re assured it’s the best way to:

- Hitch a ride in a hot sector without buying 10-15 stocks, or

- Get into hot companies that are in countries or sectors where buying is difficult. For instance, while buying into Brazil has always been messy, our Brazil Fund brought us an easy 140% profit a few years back. We’re also delighted with our high returns from the Buffalo Discovery Fund (currently sporting a 21.1% annualized return), our favorite “Capped” Real Estate Fund, and the Technology Select Fund.

Ditto for our global income opportunities which allow you to shift holdings into and out of the U.S., switch types of industries, and deftly adjust your aggressiveness—thus avoiding the sit-and-rot syndrome that leaves you mired in the old-fashioned fund markets.

And of course anything beats the primitive strategy of buying last year’s winning funds, which rarely repeat.

An Embarrassment of Quiet Riches

Income investments are supposed to be steady, safe, and piddly.

Not around here.

Our total returns have typically been five to nine times higher than the market’s interest rates. And that’s when the rates weren’t a downright embarrassment. Now and then we even shock ourselves because our income portfolio blows past our growth portfolio!

And what about the “steady and safe” part? From the worst of the tech bubble collapse in 2000—to after the crash of 2008—our holdings steadily rose in value, and our readers wound up about three times further ahead than investors who followed the standard Wall Street advice.

What’s our secret? Nothing brilliant, really. We just bust our brains year after year to avoid getting stuck in the usual choice between safety and high profits.

For instance, we buy utilities from time to time. They’re sound. Come hell or low water, the world still insists on turning on lights, cooking dinner, and taking a drink of water. But here’s where we’re different: We’ll scour the global landscape to find a ute that’s so profitable, it’s a fat takeover target. So we get the safety and still cash in on the growth.

The only problem with this strategy is that when times are good for our income portfolio, it grows so fast that it romps ahead of our growth portfolio, as I said. This inevitably leads to a lot of sharp verbal jabs around the water cooler between my income researchers and my growth researchers, who are supposed to stay ahead of them.

“Triple Your Money in 22 Days!”

“Secrets of the Rockefellers Revealed!”

“Become a Billionaire in Your Spare Time!’

How many of these pitches do you get per day? I get hundreds.

But before you even think about putting one red cent down for any such offer, ask yourself: “Why are these guys selling their secrets?”

If they really worked the writers would be crazy to sell them… and their publishers would be nuts to spend their money advertising these schemes and getting just a few thousand subscriptions. Instead, they could invest their ad dollars in the NYSE and use their priceless gems of hidden wisdom to loot the market of its riches.

You know why they don’t: None of their cockeyed gimmicks work.

I’ve been around many or most of the guys who’ve developed these harebrained schemes, and I’ve known many of their ad writers (who were copyboys not long ago but now are noted gurus of the printed word). I also happen to know that none of these guys have ever worked the markets day in and day out… or at all, in some cases.

Instead, they’ve found it much easier to make a buck telling a story. What’s more, they don’t actually have to tell a good story or even a true one, thanks to the First Amendment. So they keep playing the game—and making money in print and online.

Done in by Muck Fatigue

You can make a fortune if you catch a financial tidal wave, but we can make very nice money on safe bets and skip the heart condition and high blood pressure.

After 31 years in the cold, dark heart of the banking and brokerage business, I finally got tired of the market muck and said to heck with it.

Through lots of hard work, I had become what they call “independently wealthy,” so I had enough of a cushion to quit and start spending most of my time helping you.

(But I prefer to live on my current income, not my nest egg. So I still spend some time on the side, polishing my own portfolio. That means I’m a regular investor, just like you.)

I really enjoy writing and editing Personal Finance. The job is a big plum in the investment field, and I get a charge out of just walking into my office every morning. The actual work doesn’t drain me, it energizes me.

Sure, there are a bazillion details to sift through. But the basics are pretty simple …

Avoid Mirages

The first secret of the trade you need to know is this: There is no secret. There is only intelligent hard work—and a tiny touch of luck now and then.

The only “system” I’ve ever seen work for more than six months is reading and listening to what’s happening—and then piecing together solid information into a rationale for buying or selling.

Secondly, stick to what’s likely. Trillions of dollars have been lost over the years by guys chasing a mirage of what might happen (like the next boom or bust). Maybe once in thirty years, you’ll see a multi-year buying frenzy—or a total crash like the silver collapse of 1980. It’s a lousy bet.

Yes, you can make a fortune if you catch a financial tidal wave at its peak. But here at Personal Finance, we make very nice money on safe bets, and none of us has a heart condition or high blood pressure.

Finally, remember – there is no stock market. Or bond or commodities market, for that matter. There is only a market of individual stocks. And others for bonds and commodities.

You will go insane long before you “figure out the stock market.” Picture a gigantic dog fight with a million pit bulls snarling and fighting over ten thousand pieces of meat. Who can predict the outcome of such a scene?

Well, the markets are like that—except the chunks of meat are stocks, bonds, commodities, funds, and currencies… which often come packaged as mutual funds, REITS, annuities, futures, options, trusts, IPOs, shorts, and big boxes making funny ticking noises, labeled DERIVATIVES. And the whole hodgepodge changes hands several times a second. Good luck on “figuring it out.”

Last Year’s “Sure Thing” Is the Quicksand of Today

It’s getting tougher and tougher to not get whacked out there. With the market indexes sliding around, a lot more folks are seeing red on their brokerage statements.

One of the biggest problems is “old-think,” the once-reliable Great Truths of the markets. You may have absorbed from your grandfather some foundational principles that today can drag you into chapter thirteen.

“A new whiz-bang investment system arouses more false hopes than the first three hours of a new diet.”

Let’s start with the bearded adage, Buy quality and hold it forever. It was a Socratic idea in the golden era of General Motors, AT&T, Kodak, and Bethlehem Steel. But today I have a major problem with “hold and hope.”

Sure, you might fall in love with a great company that rises year after year while paying a reasonable dividend. But though you may end up accumulating a lot of the stock, you can no longer just buy it and hibernate. The markets will pass you by in one of those sudden spurts that can give you six years’ profits in six months—if you’re asleep at the switch.

Today you have to scrutinize your holdings every quarter as if they’re all potential new buys. You do this by taking your statement in hand and going line by line. If you can’t convince yourself why you’d buy each and every company all over again, it’s time to look for an exit. Don’t get lulled into complacency. The days of yore are gone.

Next, there’s: Pharmaceuticals are a fail-safe defense in troubled times. No longer true. In fact, with rising competition from generics and a new clinical-trial failure each week, big pharma has cycled from stable and boring… to hyperexciting… to stumbling and sliding. Think about Valeant Pharmaceuticals, for instance. This one-time Wall Street sweetheart stands accused of accounting fraud. Its investors paid a heavy price… they lost more than 57% in 2015. Eek!

A little better is, Consumer staples are great in any weather. This one tends to work OK, but you must be choosy. You can’t just buy the usual suspects. I’m often kind of jolted by how many intelligent investors will buy a huge pile of consumer staples with hardly a glance at price and business conditions.

Take Proctor & Gamble. Ever since James Gamble whipped up his first batch of air-fluffed Ivory soap in 1863—deliberately, by the way—P&G has been a PR darling.

Unfortunately, a zillion other investors like it, too. They have bid up the price beyond what I think is reasonable.

Worse, it no longer treats its shareholders well, and thus has been a crummy performer for years. Until management repents, take a pass.

Last, there is: Own real things, not paper. Well, I can certainly respect the sentiment that stocks can be beaten into trash by greedy brokers… and ignorant markets… and crooks in swivel chairs who run the parent companies. That’s one reason I love bonds: they represent real assets, not promises.

But not all commodities are magic.

Gold, for example, is in snoresville. For me, paper always glitters more than gold. I would even say flat out, gold is the only raw good you shouldn’t hold today. Investors who owned gold for the last handful have one thing to show for it, a big pile of losses.

Then how about petrol? Up until the oil price crash, we’ve all done well buying mid-stream oil and gas companies, especially Master Limited Partnerships. Those who bought and held the usual, such as ExxonMobil, would have made a decent annual return too. But that return would still be a few percentage points lower than the S&P 500.

My advice: Dump oldthink. Forget the ancient formulas. Get on board with Personal Finance and stay two jumps ahead of the pack.

We Make It Simple for You

Personal Finance slices through the chaos and trashes 99% of the securities on the market.

Out of the deserving 1% that remain, we select a mere handful for your attention.

These are presented in a variety of eye-opening articles over time, but there are four constant categories:

1. Our front-page article on the biggest new opportunity. In every issue (twice monthly) we spotlight a trend that’s too juicy to ignore. You’ll get very specific recommendations for both buying and selling. (I won’t insult you here by cherry-picking our very best finds and presenting them as typical, but I assure you, we’ve dug up our share of double-your-money doozies.)

Of course, you may not be able to invest in everything, but you can be aware of the stuff that’s truly worthwhile. We always go for value; we don’t chase the latest flow of “hot” money in the markets.

2. The Growth portfolio. Our target is to beat the S&P 500—by a wide margin.Our methodology is to avoid the “usual” S&P companies, for the most part. At this writing, we do hold some more mainstream stocks like ConAgra Foods, Chevron, PPL Corp., and Verizon, but as I said above, it’s hard to make real money when you drift with the herd.Once we decide on the best sectors to hit, we work very, very hard to find undervalued stocks. You may think that’s almost impossible, given today’s overpriced markets. It’s not. If you patiently look under enough rocks, you will find gold. Why? Because the herd is the herd, and they often get spooked like the cattle they are. At the whisper of a rumor of trouble, they stampede toward the far horizon. A few weeks later, when the adrenaline rush is over, they calm down and come mooing their way back to join the Personal Finance subscribers who have been quietly grazing on the good green stuff.

“Personal Finance identifies high-quality stocks and funds in the right configuration to buy, and clarifies when and why to sell. They do the research for busy people.”Esther D. |

Alfred Adler once said, “Trust only movement.” We agree in spades. We won’t recommend anything to you until it starts moving, no matter how sterling the underlying company is. Most investment advisers will gladly tell you to buy something because it really oughtta start rising soon … it’s written in the stars … It’ll surely begin to climb Any Day Now. Alas, you can lose a lot of money waiting for a “sure thing” to get traction.

We don’t like to get caught in cyclical downdrafts, so we stay diversified. Our six main areas are: consumer, energy/environment, financial services, health care, technology, and commodity producers.

One more note on our growth portfolio. Despite the fact that it gets its name from the total returns readers are currently sitting on like 170%, 220% and 1,400%…it’s also home to companies that sport yields in excess of 5%. (We’ll give you a detailed portfolio breakdown when you subscribe.)

3. Our Income Report. Or, you might call it our “Lucrative Income Portfolio.”It consists of four very normal categories: Stocks and Preferreds, Bonds, Investment Trusts, and Exchange Traded Funds.But the angels are in the details. Right now, we favor transportation, technology, consumer staples, financials, and real estate trusts. Right away, you can see our concept of safety includes truckloads of cash. It doesn’t matter where it comes from either. We do not discriminate against any currency based on color or national origin.Yes, we like fat yields. But our bottom line is total returns that you can take to the bank … in Bora Bora.

4. Our Special Opportunities sections. If you have a little cowboy in you, you’re sure to love our collection of exciting, high-return “deals of the moment.” This is not your typical stockpile of “balanced” investing ideas. Instead, it’s a short list of very hot stocks with a high-risk/high-reward profile. They aren’t designed as a basic portfolio for anyone, but as a boost factor to add excitement and growth to your core holdings. They may even include a few short sales.These are not rigid, all-or-nothing portfolios. They are simply flexible models for you to adapt. But in the pages of Personal Finance, we always give you our very best specific recommendation on what and when to buy and when to sell.

More Helpful Features

|

Noodling About the Past A while back, some of our staff got the bug to figure out just how much money you’d have made if you’d followed all our short term market timing signals over a 20-year period. Then they asked, “What if somebody just paid his brokerage the standard minimum payout, leveraging every trade 500% long? And never paid any taxes or brokerage fees?” Brace yourself. Under those rules, they said, you’d have turned $10,000 into $4.219 billion. That’s exciting to think about, but no one ever did it, not even me. And don’t ask me how they got those numbers. Still, such high-flown figures suggest that in the long haul, nobody in the world is going to beat our recommendations by much. |

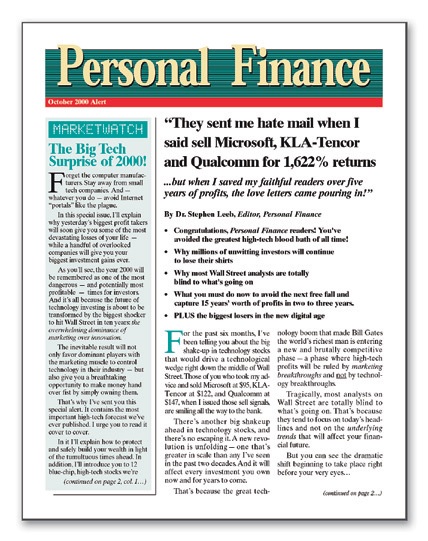

To speed your understanding of your first issue, we will send you an introductory report, Profit Now. It will give you a few paragraphs each on the other departments you’ll find in our 12-semi-monthly pages:

- Marketwatch, the brief summary that tells you in seconds whether it’s been a good two weeks or a bad two weeks… and why! Everybody reads this first. (Great for those days when you don’t have time to read all 12 pages.)

- Roundup, one page of timely mini-articles on a very broad range of financial topics.

- On the Money, a guest page written by various experts in money management, retirement planning, tax strategies, stock analysis, and so on—less glamorous subjects, to be sure, but must-read backgrounders. We live in a messy world, and we don’t ever want you to be blindsided by monetary or legal problems you didn’t know about.

- Updates on our Mutual Fund picks.

- Article Update, a page on news about past recos that command current attention.

- Monthly Scoreboard, a running total of profits from each of our portfolios. We are proud to keep you up to date on our complete performance.

- Online, read PF the Saturday before the issue date. Just download the issue from www.pfnewsletter.com. Also, you’ll find an archive of all the past issues and a useful search function. It’s a great tool to stay on top of investments.

How Can You Make Solid Money

in a Sideways Market?

Most people can’t.

Most people are expecting the market to “get back to normal” soon and start giving them fat profits on any dartboard selection from the Dow.

Ah, yes. And soon thereafter, Amelia Earhart will show up, the national debt will get paid off, and the Middle East will revert to the Garden of Eden.

All right, so things could return to the good old days. But don’t hold your breath. Today, most investors are living in a dream world, betting on the romantic scenarios issued non-stop by the permabulls of Lower Manhattan—and (after taxes) losing a lot of money.

Profit from the Panic Paradox

The more confusion in the markets, the more mistakes happen—and the more that perfectly good stocks are dropped for no good reason.

Yes, perhaps 95% of stocks and bonds are dropped for good reasons. But the rest tend to be victims of confusion, chaos, or downright panic.

That’s where the new Personal Finance comes in. I’ve assembled an editorial team that is nothing like you have ever seen before. It comes with a combined track record that has been beating the Dow, the other newsletters gurus, and even the great Warren Buffett himself.

They have proven themselves to be extremely sharp at spotting the 5% of investments that are ripe for resurrection. It’s so amazing what you can find in the NYSE dumpster.

Maybe the Market Dives Again. So What?

Yes, it is possible to find a needle in a haystack!

As patriotic Americans, we at Personal Finance clearly hope the markets rise long term.

But short term, we really don’t give a wet hanky what happens. We make money going north, south, clockwise, or upside-down. If the good times start to roll, we’ll be the first to break out the champagne, but in the meantime, we’re thriving on pure action. We make money on anything that wiggles.

Here are four ways we do it.

Our First Secret

The success of Personal Finance is built on this credo: Yes, it is possible to find a needle in a haystack.

Sometimes we feel like Madame Curie, who spent four years distilling countless tons of uranium ore and ended up with just enough radium to fill the tip of a teaspoon.

Sure, it’s messy work, sifting through some 10,153 U.S. stocks. That’s why hardly anyone does it. But that’s what it takes to find the few stocks that keep climbing while everything else falls.

As a team, we spend most of our days sifting through very large haystacks. And looking under lots of rocks. What makes it even harder is that we can’t allow ourselves to build on other people’s work. It’s too unreliable. For instance, you may be surprised to know that we never read brokerage analysts’ reports. Why?

- Because they aren’t really evaluations. They’re thinly disguised sales promotions. They seldom make clear the scary side of a stock. They’re junk.

- The stocks they analyze are too popular! Too many investors are playing with them. It’s hard to guess the direction of a feather in a tornado, and that’s what you have in the NYSE and NASDAQ.

So we spend long hours putting the entire stock market through grid after grid, sniffing out the lesser-known, often smaller stocks that will defy gravity and withstand the next whirlwind. Nobody does more spadework than we do. But the extra work keeps us #1.

Success Secret #2

“I’ve been pleased with the performance year in and year out. The ability to get feedback on specific issues from the experts is just the icing on the cake.”J. Thomlinson |

Be even more paranoid than Joe Market. Buy real assets before he does.

Now, it’s nice to be rational, but remember: Joe isn’t. So to stay ahead of Joe, you sometimes have to act just a little crazier than he does.

Here is the current opportunity: Joe has been burnt on paper assets. His trust in them is halfway to hell. Joe is ready to bite like a trout at the next real asset that gets air time on CNBC three days running.

At any time, that could skyrocket the price of platinum, gold, or tall silos stuffed with soybeans.

Whatever. Just make sure that when the panic buying starts, you’re already at the head of the line before Joe arrives.

Again, we expect to help you with that because the time is ripe for a massive shift to real assets—many of which are rapidly vanishing forever.

When Joe finally figures out that stocks are no longer in glamour mode, he will moo his way with the herd toward greener pastures with real grass, not paper options on shares of a feed company in Hoboken.

Success Secret #3

You can make money faster on the way down than on the way up.

There are oceans of overpriced stocks today that richly deserve—are even begging—to be sold short or get plastered with put options. We’ll try to get you nicely comfortable with that, primarily in our Special Opportunities section.

“I like the way the analysts think. I believe you cannot get this kind of information anywhere else. Over time, one gets the flow of how things are selected and presented. It’s my kind of publication.”Irene S. |

From time to time we will give you the opportunity to make a quick killing by selling something short—because sometimes it’s irresistible! And no, it won’t put you in the same moral bag as Hezbollah, ISIS, and the ratfink who invented the income tax. Not at all. Investors who buy puts or sell short provide a needed and valuable service to the markets.

Yes, we’ll admit that short sellers can be sharks sometimes. But in well over 90% of cases, short selling is like the safety valve on your pressure cooker, letting off excess steam continuously. If there’s no valve, pressure can build (a stock price can inflate wildly) until finally there’s an explosion, and great damage is done (the stock crashes and perhaps brings down the company).

If you want to make money in both directions, you’ll find that profits actually come to you faster with put options because stocks tend to fall faster than they rise. Bear markets are naturally shorter and move faster. But remember, short-selling is something we do only when a stock has turned south and it’s a slam dunk. And we never do it without a snug stop-loss.

Success Secret #4

Whenever the markets are not trending up, you can take them out of play. Don’t put your tail between your legs or sneak away. We’ll show you how to more than double your profits with market-neutral techniques like these two:

One: Buy some defensive or countercyclical stocks, companies that profit from bad times.

You’ll learn to love our favorite tire retreaders, dollar stores, car repair chains, vocational schools, food/beverage stocks, etc.

Two: Get bulletproof.

Now and then, we will suggest twin-investment methods, like covered calls, spreads, or straddles. They protect you from market ups and downs. In the past, many conservative investors shied away from any kind of insurance against market gyrations. Now, they are just part of the arsenal of the careful and well-equipped investor.

We don’t offer them every month. They are not the core of our strategy. But when the over-all market is giving everyone the yips, these methods can put you in a class by yourself, collecting very nice profits while other folks are pulling their hair out.

Perhaps the largest difference between the old Personal Finance and the new is the added flexibility you’ll get. It can save you from having a stroke when you look at the morning paper.

Three More Improvements

We would also like to mention three other good changes we’ve made:

- We will seldom get into a position until the desired time is seen and confirmed. This will postpone some highly rational buys that “should” take off immediately, but instead sit and play dead for weeks because the rest of the world doesn’t catch on quite as fast as we do.

- When a trade goes against us, we get out fast. By scrutinizing every blip of the market, we can spot a problem and move more quickly than a typical one-man newsletter.

- We give more attention to unknown “sleeper stocks.” This helps you avoid the constant annoyance of being jerked around by game-playing, big corporation accountants who deliberately forecast low numbers, then enjoy a nice stock jump when the quarterly reports come out. Untracked sleeper stocks have little reason to play such games.

Conclusion: You don’t have to be at the mercy of the market anymore. Get flexibility. Get the world’s biggest bag of tricks. Let Personal Finance bring you exciting profits safely—even in down times.

“We take extraordinary pride in what we do here. We don’t use tricks. We don’t even use margin or leverage. We don’t ‘front-run,’ buying our own recommendations. And since none of us make a dime at our readers’ expense, we hold our heads high 365 days a year.”

5 Revealing Stories of How Common Sense and Gut Feelings Stomped the Street

Any novice broker can read charts and tell you where a stock price ought to go.

But it takes savvy judgment to zig when the rest of the world is zagging.

What’s required is not just knowledge or experience; these are plentiful. What’s required is more like the educated instinct that propelled Sam Goldwyn to the top of the movie industry. When asked how he knew when a script was no good, he said, “My butt itches.”

So it is with our contributors past and present at Personal Finance. Here are a few run-of-the-mill examples of times when they felt an itch.

|

According to Money magazine, only five of the big investment newsletters are “worth the money,” and Personal Finance is one of them. |

- Not that long ago, Elan was one of the ‘wonder drug companies of the future.’ It was thought to have laboratories working on a variety of must-have drugs that would cure many of the world’s worst diseases. But one of our editors saw through the smoke screen. Here’s his story about what happened next:

“Their pipeline was supposed to be flush with drugs that would keep shareholders in the black for years, and everybody was recommending it, from Wall Street to newsletter editors.

“I myself had made a fortune investing in the company—on the strong recommendation of a newsletter editor in New York who was my business partner at the time.

“But then I became concerned. Their new Alzheimer’s drug was questioned by some European news services and I began to worry that I didn’t have a full handle on Elan and its labs and testing processes.

“So I began to poke around the company, contacting research firms, Elan’s leadership, its customers, and one of its key partners.

“As days progressed, I became ever more nervous, not just about Elan’s products, but its financials as well.

“I brought more and more of this information to my business partner—and was rebuffed.

“Yet I continued my inquiries and came to the conclusion that despite nearly all the Wall Street analysts’ recommendations to buy—and many objections to selling—I would do so.

“The stock was trading the $60 range when I warned my readers not only to sell Elan, but to short it.

“This brought an end to my professional and personal relationship with my business partner, who was livid over my questioning of Elan. But I was undaunted. I kept investigating and kept finding more troubles, including financial and other crimes.

“Finally, after I’d written extensively about the company (while the rest of the world kept reporting all was well), the European security regulators came in. It was then that the other media, including the Wall Street Journal, began to be intrigued with my investigation and contacted me and even helped me to extend my reportage on Elan.

“For the record: you have been probably 98% dead right on your recommendations and theories. I for one am very thankful for you and your staff.”Dan F. |

“It didn’t take long before the cops were raiding the company—and the shares plummeted to their lows of around a dollar.

“My research was spot on, saving readers a fortune while enabling them to even short it to make what some reported were gains exceeding 2,000 per cent, using my call on Elan and the option market.

“It did cost me my job as a fund manager and my friendship with an old comrade. But on balance, I was happy I had put subscribers first.”

- Making bold calls isn’t a foreign or uncommon concept to us. Not long ago, we said this about red-hot tech stock 3D Systems…

“3D Systems (NYSE:DDD) is well above our sell limit price of $80 so it is a prime candidate for put options or short sell positions for traders comfortable with those strategies.”

The stock tanked, and subscribers who listened were rewarded with this…

“We are closing our short position in 3D systems. We are proud to have the first one work out to an annualized gain in excess of 100%!

“Easy to understand advice and always right to the point.”Peter Z. |

- It is a fool’s errand to try to catch an exact market bottom. Probably no one has done it more than once or twice in a lifetime. Still, it is heartening when it happens like when one of our editors called the start of a bear market rally on the precise day the markets bounced upward. And it was not from a slavish devotion to one idolized indicator, but from his mature judgment in combining several of them. He wrote:

“The market has simply become too overstretched on the downside, and we’re due for a bounce … There’s no one magic indicator that can tell us this is the beginning of a major countertrend rally, but we have plenty of evidence….

“Double your position in the Nasdaq 100 Trust (AMEX:QQQ) and take a position in General Electric (NYSE:GE, 24.35)—a leveraged beneficiary of any rally in the Dow.”

The market bounced up immediately.

- One of our analysts says, “It’s great fun to double your readers’ money, especially when it requires warfare with the entire investment industry.

“A prime example was back when Wall Street was having its first love affair with Amgen. Out of 32 analysts who followed it, 29 rated it a buy or equivalent, and 0 called it a sell.

“Well, I had to agree with them—in the long term. It was a great stock. But no one except me seemed to notice it had scary problems near term. In particular, three of our main indicators were flashing through a fire-engine-red warning: OVERBOUGHT.

“Only one problem: It wasn’t going down! (That’s the trouble with being ahead of everybody. You have to wait until the masses catch up with you.) I was dying to sell Amgen short, but it wasn’t moving.

“Finally, it began to crumble, and I quickly told subscribers to buy Amgen put options.

“In less than a month, they gained over 100%.”

- He goes on to say, “Often the Street is trigger happy, reacting too fast to news or a rumor. But sometimes the opposite happens The analysts in the big brokerage houses get a bad case of The Slows.

“That’s what happened when I noticed analysts were dragging their feet on reporting the worsening liquidity problems in the major utilities, especially TXU.

“So as soon as the ute rally began to falter, I pounced on it, announcing that people should buy put options on the Utility HOLDRs.

“Sure enough, TXU immediately gapped lower—and dragged the rest of the utes with it.

“Just a week later, we closed out the trade for a 125% profit.

The Newsletter for Millionaires

Over ten thousand millionaires read Personal Finance now.

By 2020, we expect to have double that number. That’s because we will create more of them—in good times or bad. People like you will be making the best money of their lives. You can expect the safest profits in any climate: 20%-30% in weak markets, or up to 100% in strong markets.

Of course, it’s also nice that some top industry voices have endorsed us:

- Money magazine says that only five of the big investment newsletters are “worth the money” and Personal Finance is one of them.

- Kiplinger’s says that Personal Finance is one of the two newsletters that best cover the entire investing world … with “uncommon clarity, perceptive overviews, and specific recommendations.”

- Forbes once singled out our analysts as men who truly “capitalize on playing both sides of the market”—in up or down times.

- The newsletter publishers association named us “the best financial advisory” 9 times!

And even more important are all the letters like the ones below. Every single one comes from a regular investor who took the time out of their busy life to write in and thank us for the results they’re seeing from following our advice.

“If you want to improve your financial status, subscribe to Personal Finance.”

-Adrian L.

“Most of my financial education has been a result of a long-term subscription, as well as most of my investment success. I would not leave home without my copy.”

-John B.

“I really appreciate that you guys get right back on questions from the subscribers. Makes for a great community!”

-Pete

“Easy to read and follow advice.”

-Patrick S.

“I trust the information I get from you.”

-James V.

“I have been a subscriber for years and have made money with your recommendations.”

-Esther S.

“I have definitely made money due to Personal Finance.”

-Robert K.

“I have been receiving Personal Finance for many years and have come to rely on it as my main source of information. I was able to build my portfolio to $2M+ and now receive plenty of dividends.”

-Glenn C.

And We’re Chicken-Feed Cheap

So why then don’t we charge $300 a year? Why do we give away our standard, two-year introductory subscription for only $79?

Frankly, we make it up on the back end. Because over an eight-year span our unusually high renewal rate made Personal Finance either the biggest or one of the three biggest financial letters in the investment field. We like that. It boosts our prestige in the financial world.

True our analysts feel mildly insulted by this kind of Wal-Mart pricing. But they feel much better when they see the thousands of delighted people renewing each month. And since they’re paid on the basis of renewal volume, they’re motivated to keep every subscriber extremely satisfied—in three ways:

- They work hard to keep you making the best profits of your life.

- They oversee the fine work of our Subscriber Services Department. Unlike other financial publications, we actually have a whole department with a staff trained to answer your write-in or call-in questions. (We’ll tell you how to reach them after you subscribe.) How often have you had an urgent question about what you were doing but all you ever got was an untrained voice on the other end of the line with an accent that wasn’t familiar to you? Well, when you join the Personal Finance family, you can get answers to a virtually any question you may have. And from someone you can understand. That is a major plus! (Just don’t send us e-mails asking about the citrus crop in Laos.)

- In difficult cases where the Subscriber Services Department doesn’t have the answer to your question, you will be allowed to write, e-mail, fax, or event talk by phone with me or any of our editors. Surprised? You should be! How many other big-name, large-circulation magazines or newsletters offer you free access to their editors? Especially when your renewal price is only $97 a year?

By the way, you read that right. Renewals are $97 a year, yet an initial TWO-year subscription is only $79. And that’s for a 12-page, tightly-packed newsletter you’ll receive every two weeks!

As you might guess, most of our subscribers have been smart enough to figure out that they will never get another chance at our loss-leader intro price, so they sign up for two years right off the bat. (Do you detect a hint here?)

So take advantage of our peculiar marketing philosophy and join our happy band of present and future millionaires.

The Safest High Profits of Our Day

Ever since you made your first investment, you’ve been wishing for an advisory like this:

- Reliable, conservative profits of 20-30% per year, even in periods of record-setting losses on Wall Street. And this promise is based on safe investment vehicles with low downside risks.

- No hidden agenda. PF is ferociously independent. We can and will be very critical of any wobbly stock, troubled company, crooked brokerage, or flaky financial commentator unlucky enough to get onto our dirt list. And we’ll tell you exactly what their problems are.

- An income stream of up to 20% for income investors. Of course, it’s not all roses. In 1991 our income portfolio had a “down” year (minus 1.2%).

- Chaos-tolerant strategies that thrive on troubled times.

- Clean, simple portfolios for each main type of investor: growth, aggressive growth, income, and speculative. We don’t shower you with recommendations and leave you to sort them out.

- A reader-friendly service that values you highly. If you contact us, you will not be treated as an interruption of our business; you are our business.

Just think of where you would be if you had ridden our advice for the past five years.

You don’t have to float slowly downstream wherever the Dow takes you. You can recover losses safely and quickly. Whether you’re a beat-up bull, a wary bear, or a hungry hawk, you’ll find Personal Finance a constant feast. Please click the button below to get started.

Sincerely,

Jim Pearce

Chief Investment Strategist

Personal Finance

P.S. Don't dawdle! You know what happens to things you set aside to "look at tomorrow." Reply promptly and I'll send you free The Worst 20: A Connoisseur's Collection of Dirty Rotten Scoundrels, which exposes 20 time bombs that the blow-dried analysts on Wall Street are still pushing at you.

The old Personal Finance was a battleship, muscling the competition out of the way.

The old Personal Finance was a battleship, muscling the competition out of the way.