Looking to Tap Into the AI Superboom?

Forget Nvidia… Apple… Google… and Microsoft.

Buy these 3 companies today for a real shot at unlocking massive profits of up to 1,026% from AI’s $15 trillion “Second Surge”

Hi, my name is Jim Pearce.

Unless you’ve been living off the grid and in total seclusion for the past few years…

You’re likely well aware of the absolute obsession Wall Street has developed with artificial intelligence, or AI.

And boy are they obsessed…

In 2014 investors poured $10.9 billion into AI.

Five years later that number grew to $58.3 billion.

And in 2022 it ballooned to a staggering $85 billion.

That’s a 677% increase.

In total, we’re looking at more than $453 billion, dropped into this single sector…

In less than a decade!

More incredibly, according to the research firm McKinsey & Company…

That’s just the beginning.

Because they believe the value of the AI market could explode to $15 trillion in the near future.

And if you give me the next 5 minutes…

I’ll show you how one simple move today could let you harness that growth to turn $1,000 into $11,260…

$2,500 into $28,150…

And $10,000 into as much as $112,600.

Considering how AI is already radically reshaping everything from how we shop online…

To how we drive…

To how diseases get diagnosed… treated… and even cured…

It’s not hard to understand why I feel those numbers aren’t just possible… but could be too conservative.

I don’t think Bill Gates, the founder of Microsoft would argue with me either. He believes…

And billionaire entrepreneur Mark Cuban is confident the world’s first trillionaire will be someone who masters AI in a unique way…

It’s hard to be surprised by the enthusiasm of these visionaries when you know…

Unlike Netflix, which took 3.5 years to reach one million users…

Or Facebook, whose user count hit 7 figures in 10 months…

The AI program — ChatGPT — eclipsed the million-user milestone in a blistering 5-day stretch.

And today it has over 18 million active users!

That’s just the tip of the iceberg though…

Because ChatGPT isn’t the only AI “game” in town.

Some of the most profitable companies in the world are pouring stunning amounts of money into their own programs…

I’m talking about everyday names like Apple, which already snapped up 25 AI companies…

And whose CEO, Tim Cooks says…

Amazon invested at least $10 billion…

And Jeff Bezos, its billionaire founder, says this about AI…

Not to be outdone, search titan Google invested nearly $9.5 billion in AI…

With CEO, Sundar Pichai, proclaiming…

I shouldn’t have to say it, but I will anyway…

When tech titans like these all start publicly making predictions this bold…

And back them up with billion-dollar investments…

It’s no longer a matter of “IF” AI will continue growing and become the most lucrative investment opportunity of our lives…

It’s a matter of “HOW BIG” it will get.

But in order for the size of the AI market to matter…

You need to own the right AI stocks.

That’s why I spent over 1,560 hours of my time…

And an ungodly amount of my company’s money…

Researching AI…

Sifting through hundreds of companies’ core product offerings…

Their research and development capabilities…

Poring through financials…

And grading management teams…

All to find the “needle-in-haystack” winners of what I’m calling the “Second Surge” of the booming AI market….

Stocks that have the potential to hand you gains of up to 1,026% (maybe more).

And most importantly, get their details in front of you right now — before the rookies and Reddit crowd figure out what I’ve discovered.

That way you’ll have the opportunity to avoid the regret that comes from sitting on the sidelines…

Watching helplessly as stocks that you knew about — but didn’t pull the trigger on — shoot into the stratosphere…

Minting fortunes for someone else.

I’m talking about cutting edge, first-wave opportunities like the AI business intelligence company Domo…

Whose share price shot up over 450% in less than two years.

That’s why I moved heaven and earth to get this message in front of you today.

Because the companies I want to share with you now will likely be your last chance to make a fortune from AI.

Especially if you’re over 50 — or older — like me.

I know that may be tough to hear…

But it’s true…

Opportunities as massive as the AI megatrend sweeping the globe right now only come around about once a century…

But their profits come in waves.

And the first wave of profits…

Which went to bleeding-edge AI innovators like Domo…

And big tech outfits like Google and Microsoft…

Who have nearly unlimited resources…

Is over.

The future AI gains for these companies are already priced in…

So there isn’t much in the way of upside left.

At the same time…

I’m supremely confident that the Second Surge is when regular investors will reap REAL profits from AI…

Profits that could blast as high as 1,026%…

Maybe even more.

And according to my research…

“Takeoff” has just started.

Because now that there’s undeniable proof of the tectonic impact AI will have on virtually every facet of our lives…

And that it’s more than a way for college kids to create term papers out of thin air…

Or turn the lights on in your house (with your phone).

The race to build a proper foundation that supports AI’s massive demands on real-word infrastructure…

Is officially underway.

And if you want to position yourself for the profits this surprising sector is about to throw off…

You can’t afford to ignore what I’m going to show you in just a few moments.

Because if you do, it could cost you a shot at banking gains as high as 1,026%…

Which would be a shame…

Because a winner like that…

Is good enough to multiply every $5,000 into a wallet-stuffing $56,345.

Before I give you the details on how to make your move, let me tell you a little bit more about myself and why you may very well count today as one of the luckiest — and most lucrative — days of your life.

As I mentioned, my name is Jim Pearce.

As I mentioned, my name is Jim Pearce.

If my name doesn’t ring a bell with you, I’m not surprised.

I’ve never appeared on Fox Business or CNBC to talk about AI…

Or how it’s going to change virtually every industry in the coming years.

And no one from mainstream outlets like The Wall Street Journal or The New York Times has ever sought my opinion on what I think about it either.

And the reason for that is simple.

I’m an investing professional with 39 years of experience… not a futurist.

My job has never been — and never will be — to get attention by making outlandish predictions…

It’s to pick the best investments for my clients.

In fact, at one point, when I was managing the money of Fortune 500 executives, I had over $50 million under my direct control.

Then in late 2007, and into early 2008, I sensed some early “tremors” vibrating in the markets…

But instead of standing outside and screaming that ‘the sky is falling’ at the top of my lungs…

To anyone who would listen…

I shunned the spotlight and simply did my job.

Which in this case was to move my clients’ money into a protective downside strategy.

Disaster eventually struck, of course, but none of the folks I worked for lost a penny…

Which, if you remember, was virtually impossible.

It was also during that time I spotted an easy way to bank a massive profit on Ford.

Let’s face it — following one of the worst market crashes in history, I doubt anyone was thinking about buying a carmaker’s stock.

Especially when “too big to fail” icons like General Motors were filing for bankruptcy.

But I went against the grain and picked up shares for just over $2.

My colleagues chuckled. And a few even told me I was crazy.

But I didn’t care. This wasn’t some “gut feeling” without any sort of backup…

All my proprietary analysis pointed to the fact that Ford was going to be a huge moneymaker.

And in the end, I had the last laugh. Because when Ford shares shot up to nearly $15…

I sold for a gain of 636%.

That one move turned every $1,000 I invested into $7,367.

And while I’m not going to share exactly how much I made…

I will tell you my haul on that single trade easily hit six figures.

Shortly after closing it out, I put Wall Street in my rearview mirror for good.

I didn’t stop working though.

Instead I teamed up with the fiercely independent financial publisher, Investing Daily…

So now, instead of helping the ultra-rich add another comma to their net worth…

My “North Star” — and the guiding principle of everyone I work with — is to help regular, hard-working Americans like you see the same types of profits elite investors enjoy.

And I can tell you without hesitation…

Even though the companies I’ll share with you today may raise a few eyebrows, I believe these 3 stocks are…

Perfectly positioned to deliver safe — outsized — returns as the AI market shifts into overdrive.

As I mentioned, most investors are flocking to well-known AI stocks like Microsoft, Amazon, and Google.

There’s nothing wrong with that…

I’m sure there’s still a few good days ahead for them.

But you’ll be buying in close to the top…

So there’s no way to make REAL money…

And because of that fact alone, they’re not my favorite way to take advantage of this megatrend.

That’s why for the past few months I’ve spent most of my time focused on the fringes of the AI market…

Researching companies that have the most potential to generate profits of up to 1,026% as AI sheds its skin as a cutting-edge idea…

And grows into a powerful, transformational technology.

Companies that are doing what others can’t…

And are providing products and services that AI needs to continue its meteoric rise.

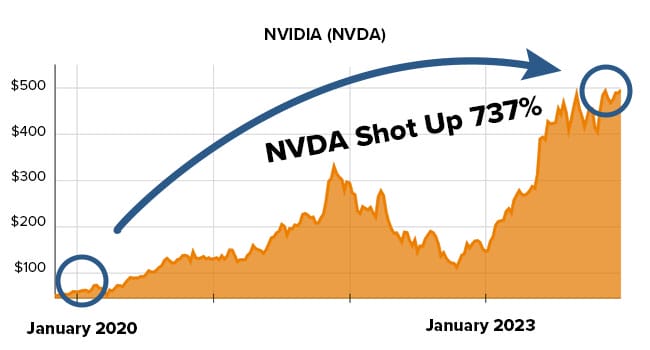

Like the chipmaker Nvidia…

That’s shot up over 737% since 2020.

That’s the ticket to not only generating life-changing money…

But doing it without the sleepless nights that come from sinking your nest egg into a company that’s doing things people with an advanced business degree wouldn’t even understand.

I mean think about it…

Even when a megatrend hits…

Some companies operating in it still struggle…

Like Domo, the little-known AI company I mentioned earlier.

It’s still around… but has given back virtually every penny of the 459% it tacked onto its share price not long ago.

Worse still, some companies that investors flock to when a megatrend hits — don’t make it at all.

Remember eToys.com… GeoCities.com… Garden.com… or Drkoop.com from when the Internet first exploded onto the scene?

No one else does either.

But the companies I want to share with you today…

I’m supremely confident they’re not going anywhere.

Because they make up the foundation of the AI Boom’s Second Surge…

And as a result, are perfectly positioned to deliver early investors up to 11x their money in the coming months.

Let me explain.

New ideas and technologies don’t just pop up…

Grab people’s attention overnight…

And spread like wildfire.

They follow a well-established path of recognition and acceptance known as the adoption curve…

Which has three main stages:

- Innovation

- Second Surge

- Saturation

Put your money into bleeding edge companies too early in the innovation stage…

When the idea and technology aren’t fully developed…

And you’ll spend years — maybe even decades — waiting for a profit…

If you see one at all.

Take the Internet boom for example.

If you caught wind of the Internet in the early 80s…

When the idea of computers being able to talk to each other…

Seemed like pure folly…

The kind that you’d see in a sci-fi movie…

And invested in a company that you believed could make it happen…

You would have waited more than a decade to see any return.

And that’s only IF the company you bought shares in survived that long.

But the minute companies realized that a website was more than just a place to put their logo and phone number…

And that it offered up a new way to reach customers…

And SELL things to them…

Ultimately unlocking billions of dollars in profits…

That’s when the Internet really took off.

And if you put your money into the right companies then…

You could have become insanely rich.

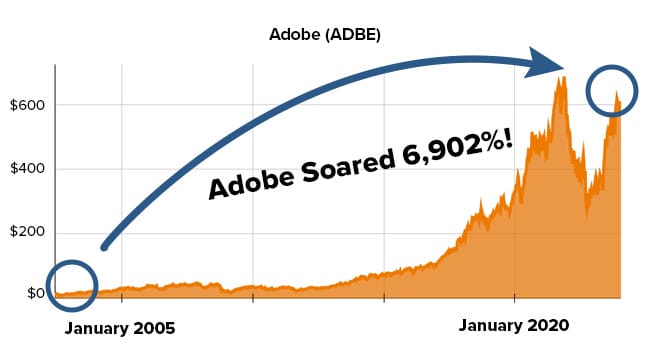

I’m talking about rock-solid outfits that provided the foundation the Internet megatrend was built on…

Like Adobe for instance. Over the past two decades the digital media software company has soared 6,902%.

That’s good enough to grow a $10,000 stake into $700,200.

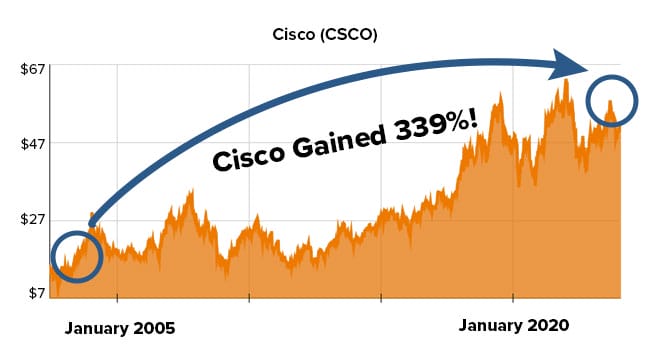

Internet networking giant Cisco gained 339%…

Growing $10,000 into $43,900.

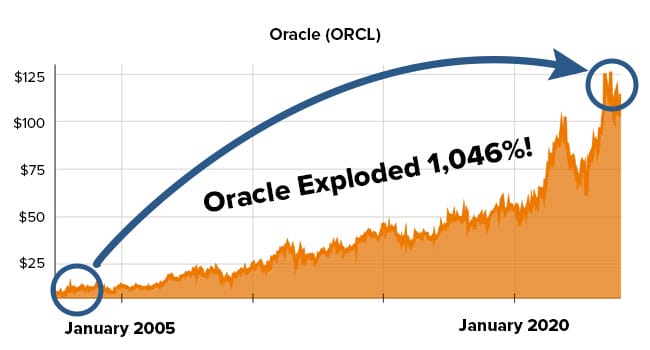

Oracle exploded 1,046%…

Turning every $10,000 invested this database management company into $114,600…

In a shade over 20 years.

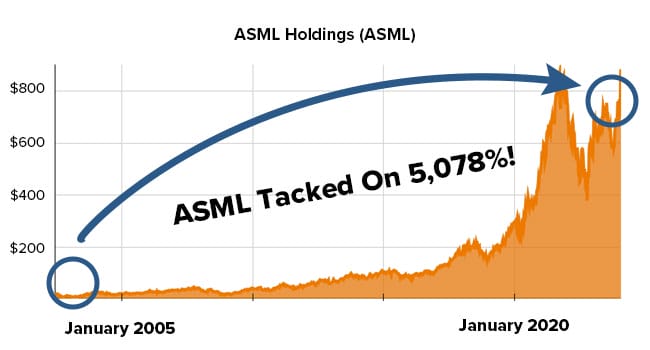

And semiconductor systems provider ASML tacked on 5,078% to its share price over the same time…

Multiplying every $10,000 into $517,800.

Winners like that are the kind that could easily fund your dream retirement…

One that puts a special gleam in your spouse’s eye…

Because you have the freedom to hop on a flight to see your grandkids without a second thought about how much it costs…

Anytime you want. As many times as you want.

And one that gives you the kind of cash cushion that finally gets you to stop talking about buying a dark cherry red 68’ Corvette… and actually put one in your driveway.

On the other hand, investing too late in a megatrend’s adoption curve…

When everyone not only knows about it…

But also understands the vast potential it holds…

Means you’ll miss out on a lion’s share of the gains.

That’s why it’s critical to invest as the innovation stage ends…

And the Second Surge begins.

Because that’s when there’s a window of time where companies that support the megatrend still trade at reasonable levels.

The reason for that is simple…

Most investors have a laser focus on what the innovators are doing…

What their products and services mean for the megatrend’s long-term potential…

And how they can profit from them.

But what they often miss…

And what they’re missing about the AI superboom at this moment…

Is that there’s a handful of “boring,” largely unknown companies that form AI’s foundation…

Providing pure-play AI companies like OpenAI (ChatGPT’s parent company) with mission critical products and services…

Or solving some of the most pressing — and potentially catastrophic — problems that come up during the white-hot innovation stage.

And since the things these companies provide don’t lead to page one headlines…

They’re generally overlooked at this stage.

I know that in today’s age of hyperconnectivity…

It’s probably hard for you to accept that Wall Street — or the mainstream press — misses much of anything…

Especially when it comes to something that could lead to a lifetime of profits…

Profits that could let you multiply your money an astounding 11x or better.

But that’s where we are right now.

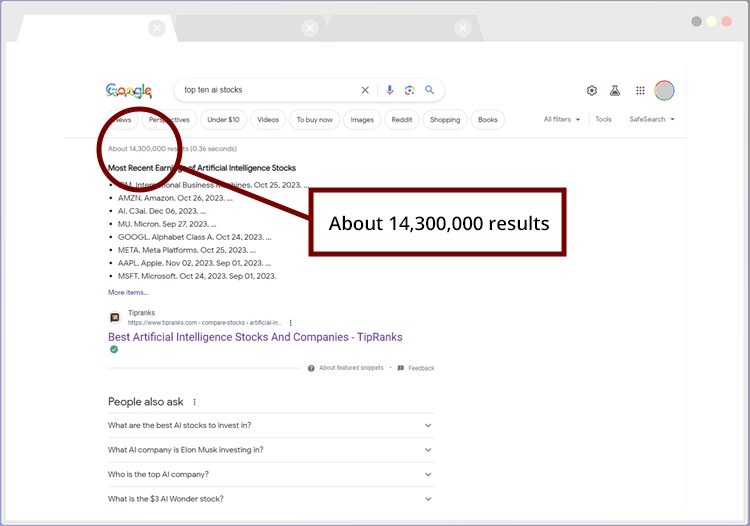

A simple Google search for “top ten AI stocks” turns up over 14 million results…

Yet I couldn’t find a single mention of any of the companies I want to show you today.

That includes…

AI Second Surge Opportunity #1:

The Ultimate AI Enabler

The first thing I want you to understand about the Texas-based company I’m going to share with you now…

Is that while it makes money from the AI boom…

It doesn’t do it by employing an army of computer scientists and programmers that “train the brains” of models like ChatGPT…

Or by coming up with new and creative questions those models will be able to answer.

Instead, it supports a market niche that’s riding the Second Surge and enjoying what I can only describe as a modern-day gold rush…

I’m talking about the foundation of AI…

Data.

If there’s one thing that should be obvious about the superboom that’s happening right now…

It’s that we’ll never use less data.

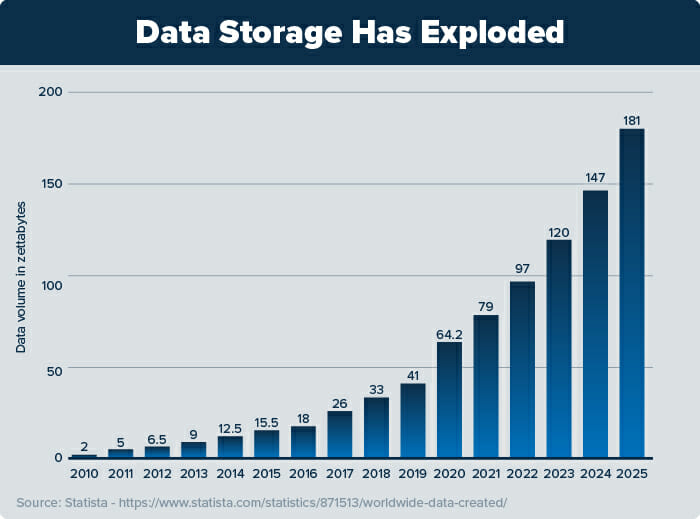

This chart backs me up…

Take a look at the amount of data created and stored in just the past decade or so…

And what the forecast shows for the next few years.

Now here’s something you may not know…

The amount of data we’re talking about in this chart is measured in zettabytes…

And a zettabyte equals 1 trillion gigabytes.

To put that in perspective…

When you download a standard-length movie…

You’re using about 2 gigabytes of data.

Which means a zettabyte holds the equivalent of 500 billion full-length movies…

It’s an absurd amount of data.

And as you can see…

We’re on track to surpass 180 zettabytes of storage by 2025…

Nearly double where we stand today.

As I mentioned before…

This company doesn’t have an army of programmers dedicated to creating computer code that thinks just like a human (or better)…

Instead — its job is simply providing a home for massive volumes of data programs like ChatGPT need…

And then making sure it all gets to where it needs to go.

I’m talking about a data center of course.

If you’ve never laid eyes on one… here’s what they look like.

As you can see from this photo…

It’s simply a big box-shaped warehouse.

And while I’ll admit it doesn’t look all that exciting… or special…

Don’t let its looks deceive you.

Because the racks of servers that take up virtually every square inch inside this building…

Form the backbone of the artificial intelligence boom.

And this savvy company provides a home for them.

That’s right — this company doesn’t own the servers or the content on them that gets zipped all around the world…

Instead it rents space in its 300+ warehouses to companies who can’t — or don’t want to — take on the costs of building, operating, and maintaining such a specialized operation.

I’m not talking little fly-by-night enterprises here either…

Its customer roster includes AI giants like Oracle, IBM, LinkedIn, and Meta.

And they’ve helped boost its revenue from $90.9 million in 2004…

To $5.4 billion today.

More importantly for you…

That blistering growth has driven its share price from $12… to well over $135!

That’s a gain of 1,026%.

Which would multiply a modest $2,500 investment into a $28,173 windfall.

And it’s all the proof you need that this company is for real.

Better yet, since we’re in the early innings of AI’s Second Surge…

Where critical infrastructure — the kind this company provides — is paramount to supporting the Superboom…

I don’t see any reason why it can’t tack on another 1,026%.

Even if it doesn’t…

And it only turns out half as good…

It would still juice $2,500 into $15,325.

Heck, in the event that I’m completely off base…

And the Second Surge only pushes this smart operator’s share price up 256%…

A $2,500 stake would still grow to $8,900.

Imagine how owning a stock like this could change your plans for the future…

You’d feel 10 feet tall…

Because it would open the doors to possibilities you’d never let yourself dream about before…

Like a set of custom-fitted Callaway golf clubs…

A 10-day Mediterranean cruise that starts in Barcelona and ends in Venice…

Or putting in a full chef’s kitchen.

I’ve put everything I know about this once-in-a-lifetime opportunity in a special report called The Everyday Investor’s Guide to Making a Fortune From AI’s Second Surge.

I’ve put everything I know about this once-in-a-lifetime opportunity in a special report called The Everyday Investor’s Guide to Making a Fortune From AI’s Second Surge.

Inside I’ll…

- Share the details on the little-known law that helped create this special company…

- Explain the one thing it does that sets it apart from virtually every other AI company…

- Walk you through exactly why I believe this company could easily tack an extra 1,026% onto its share price (again!)…

- Show you how you can get the ball rolling for less than $200.

Your chance to secure a free copy of this special briefing is coming up in just a moment…

But first, let me tell you about another surprising company you’ll find inside its pages.

AI Second Surge Opportunity #2:

The Smart Way T0 Profit From AI’s Insatiable Energy Demand

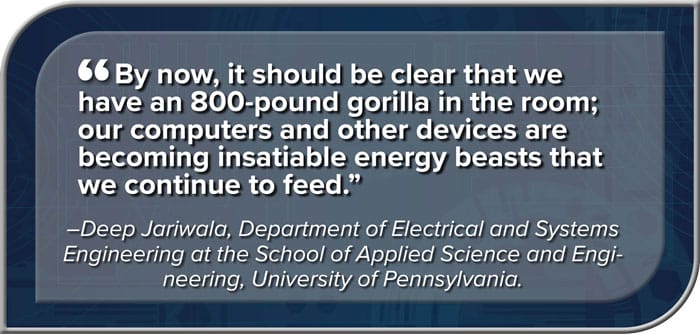

Thinking takes an immense amount of energy. In fact, scientists say the human brain uses 20% of our body’s energy on thinking alone.

So it should come as no surprise that AI computers use a lot of energy to “think” as well.

That’s not just my opinion…

Scientific American says…

Business Insider agrees, saying that Amazon’s data centers — which are home to the computers that make up the “brains” of AI — in one state alone…

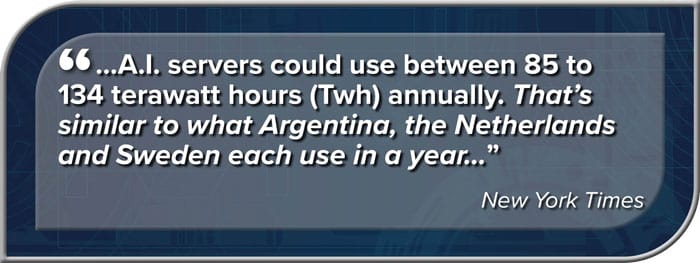

And peer-reviewed analysis by a PhD candidate at the VU Amsterdam School of Business and Economics recently led to The New York Times saying that in the next few years alone…

I added the emphasis to the last line…

Because I believe it’s critical.

As more companies start using AI — and offering it to their customers…

The demand for electricity will go parabolic.

Here at Investing Daily, we are laser focused on finding the safest investments the market has to offer…

And I’ve found an opportunity to profit from the AI’s exploding energy demand while collecting safe, reliable yields.

This unique company is a power provider that serves a state with nearly 300 data centers.

It would be an understatement to say the computers in these buildings require a lot of electricity…

Just like it would be wrong to say there aren’t more data centers planned…

Because this power provider says they have customer contracts in hand that could double data center capacity in just a few short years…

And that to support that growth…

As well as the increase in electricity usage it creates…

They’re planning on adding new power lines.

Normally, that would be a red flag for me… because it signals massive expenses.

But in this case, it’s not a major concern because the government has $13 billion set aside to modernize and expand our country’s power grid.

Bottom line: power companies like the one I’m detailing for you right now are getting “free” money from Uncle Sam to take on large transmission projects.

And since their earnings are based on the infrastructure they own…

The new power lines basically unlock the ability to boost their earnings.

And of course…

Reliable — growing — earnings mean this smart player will be able to reward investors with bigger and bigger dividends.

Naturally, the suits on Wall Street have totally whiffed on this opportunity…

It’s just not sexy enough for them.

And as a result — they’ve let the stock trade down to a share price not seen since 2011.

That’s good news though — their loss is your gain in this case…

Because you can pick up shares at a ridiculous discount.

When they finally put two and two together…

And figure out what I’ve just shown you…

It wouldn’t shock me to see shares rocket past their peak of $82.

Which means if you pick up shares today…

You’re setting yourself up for a shot at doubling your money (or more)…

From what is literally one of the safest investments in the market.

I’ll give you the full details on this power supplier…

Including the ticker symbol…

And the price to buy under in the special report.

You’ll also get the full story on…

AI Second Surge Opportunity #3:

Cash-In On The Surprising Company That’s Helping Battle AI’s Achilles’ Heel

Most people don’t know this…

But AI supercomputers can perform as much as a quintillion calculations per second…

That’s a 1 followed by 18 zeros… 1,000,000,000,000,000,000.

In one second!

Blinding speed like that comes at a cost though…

Because to perform that many calculations over and over again…

AI processors use an extraordinary amount of electricity (which we just covered)…

And that flurry of hungry activity creates AI’s Achilles heel — HEAT.

There are two things that could happen if the heat these supercomputers throw off isn’t dealt with…

First, it slows the computers down. And while the cutting-edge chips that power today’s AI units can force themselves to run at lower speeds, so they’ll generate less heat…

Those slower speeds would come with a big cost… because their users expect instantaneous results…

And rather than waiting for a slow computer to respond, they’ll just ask their questions on another AI model — which is the same as losing a customer.

The second thing that could happen if heat remains unchecked is that — to protect themselves from catastrophic damage (a single Nvidia AI processor costs around $30,000) — the computers could simply shut themselves down…

And since a computer that’s “off” can’t answer questions at all… it virtually guarantees the user will seek answers from a competitor.

That’s where our third opportunity to cash in on AI’s Second Surge comes in…

Because it’s a world leader in air conditioning…

And was savvy enough to see the opportunity to apply its technology to keeping data centers — and the AI computers inside — at optimal temperatures.

That “first-mover advantage” has led to its cooling solutions being used by over 300 data centers…

Cooling over 1 MILLION racks of AI computers…

So far.

If you want to get in on the action…

You need to make your move now.

Its share price has shot up well over 40% since late May of 2023…

And I think it could easily tack that much on again in the coming months.

So nothing good can come from waiting.

I’ll give you the full story on this company and the machines it used to grab a foothold in the lucrative AI market inside my special report called The Everyday Investor’s Guide to Making a Fortune From AI’s Second Surge.

It’s yours FREE OF CHARGE when you agree to risk free trial of Personal Finance.

Personal Finance is a simple 12-page newsletter I send out each month.

Each month, I explain what’s happening in the economy — good or bad.

Then I use my experience — which includes founding an investment banking firm and years of managing over $50 million in assets — by giving you actionable advice on how to generate money you can use now (or anytime you need it).

From how to create safe, recurring income streams of 6.64%… 10.29%… 11.09%… 10.56%… and 13.67%…

All the way to opportunities which can multiply $1,000 into $4,482… $7,577… $11,918… and even $29,529…

You’ll always come away armed with advice you simply can’t get anywhere else.

Just like today when I showed you how to make up to 1,026% from AI’s Second Surge.

You’ll also get:

Flash Trade Alerts — Any time there’s breaking news on one of our positions, or a new opportunity comes along that can’t wait for the next issue, you’ll get a flash alert that tells you exactly what to do.

Flash Trade Alerts — Any time there’s breaking news on one of our positions, or a new opportunity comes along that can’t wait for the next issue, you’ll get a flash alert that tells you exactly what to do.

Best of all — thanks to smartphones, tablets, and Wi-fi you can even make the trades when you’re away from your computer.

Private Website Access — Inside our password-protected website you’ll find our full library of research.

Private Website Access — Inside our password-protected website you’ll find our full library of research.

That includes an up-to-date collection of our model portfolios that let you know what to buy…

What price to buy it under…

And even when to sell it.

The website also has copies of every issue, article, flash alert, and special report we’ve ever put out.

Access to My Team (a subscriber favorite) — Here’s something you’ll find unique about Personal Finance: When you join, you’ll get personal attention from my team and me. If you ever have a question or a comment about one of our recommendations, just post it to our Stock Talk message boards, and we’ll be sure to answer you back. (Sorry, we can’t reply if you’re asking for personal financial advice.)

Access to My Team (a subscriber favorite) — Here’s something you’ll find unique about Personal Finance: When you join, you’ll get personal attention from my team and me. If you ever have a question or a comment about one of our recommendations, just post it to our Stock Talk message boards, and we’ll be sure to answer you back. (Sorry, we can’t reply if you’re asking for personal financial advice.)

First-Class Customer Service — And if you ever have a question or problem, you’re covered by our dedicated, U.S.-based Customer Service staff. You won’t get a call center when you contact us. Our Customer Service staff is dedicated to our products — and they’ll do everything they can to make you happy.

First-Class Customer Service — And if you ever have a question or problem, you’re covered by our dedicated, U.S.-based Customer Service staff. You won’t get a call center when you contact us. Our Customer Service staff is dedicated to our products — and they’ll do everything they can to make you happy.

I hope by now it’s clear why Personal Finance has over 20,000 subscribers…

And that when you join, you’ll get access to a suite of moneymaking ideas and tips like these have made our readers small fortunes over the years.

Like this impressive set of open gains they’re currently sitting on (I’ve censored the names in fairness to our paying members)…

- 56% on Axxxxm

- 16% on Hxxx Ixxx

- 70% on Dxxxxr Fxxxl Sxxxxs

- 1,091.82% on Vxxxxn

And even…

- 2,852.85% on Cxxxxn

Now before I go any further, I want to be completely transparent with you…

Not every trade idea we recommend does as good as these five.

In fact, some don’t make money at all.

It’s true what they say…

There are no guarantees when it comes to investing.

But considering as I sit to write this…

The average gain across our entire open portfolio — 81 trades in all — is a stout “Double-Your-Money” return of 144.2%…

That’s every trade…

Including a handful currently in the red…

It comes as little surprise our inbox is chock-full of emails from readers letting us know how happy — and wealthy — our work has made them.

I’m talking about good folks like Kenneth H., who took the time out of his busy day to send us this note saying he’s a believer…

Edward B. says he made $1,300 on a single trade.

Mary L. let me know my team is the best she’s found in decades.

John L. told us he’s sitting on a 333% gain from a stock we recommended…

And longtime reader Gene N. says he collects $27,000 in extra income thanks to our work.

These stories are extraordinary…

And your results may differ of course…

But Byron K. offered up this final piece of advice for folks who haven’t subscribed to Personal Finance yet…

“This is the best tool for the independent investor — get it!”

And now is your chance to do exactly that — for pennies on the dollar.

That’s right — Personal Finance doesn’t come with a price tag that runs into the hundreds… or even thousands of dollars if you subscribe today.

Could I charge that kind of money for the profitable recommendations I send out on a regular basis?

Absolutely. A lot of other publishers do…

But we haven’t stuck around for 50 years by charging an arm and a leg for our work.

You see, we believe if you put out quality investing research which consistently helps people profit…

They’ll stick around. So you don’t have to make all your money in one shot.

Which is why we only charge $258 for 24 issues (2 years’ worth) of our research.

But today is different.

I’m so convinced the investment opportunity I’ve shown you today is the best way to bring home profits as high as 1,026% from AI’s Second Surge…

I’m slashing our regular price by nearly 70% to get you off the bench and into the game.

Which means if you choose to join us today, you’ll only pay $78. That’s barely 10 cents a day! (If you aren’t sure about joining us for 2 years… not to worry. We have a discounted one-year subscription too.)

You can do whatever you like with the money you save of course…

But my hope is you’ll put it towards shares of the three Second Surge companies I just showed you…

Before their prices soar any higher.

Which brings me to the only catch there is in this entire situation (there’s always at least one right?)…

To prevent any hard feelings from folks who drag their feet and miss out, my publisher insisted…

This special offer is only available

for a limited time…

No exceptions — No warnings!

I’m sorry I can’t keep it open forever.

But the truth is if you’re still not convinced this opportunity is the key to helping you bank gains of up to 1,026%… you never will be.

Remember, when you join today, I’ll immediately send you my special briefing, The Everyday Investor’s Guide to Making a Fortune From AI’s Second Surge… which has a value of $149.

But that’s not all.

I want to send you two money-making “bonus briefings” too.

The first is Virtual Landlording: How to Profit From Real Estate for Pennies on the Dollar.

The first is Virtual Landlording: How to Profit From Real Estate for Pennies on the Dollar.

We all know you can make a fortune in real estate.

But did you know you can do it without risking your entire life savings on far-flung ventures like flipping houses or buying rental properties?

Well, you can. Because there’s a special type of security called a Real Estate Investment Trust (or REIT for short) you can own in your regular brokerage account.

And it gives you all the advantages of owning real estate…

But with far less risk.

Inside this briefing you’ll discover:

- Why these investments have returned nearly double what the stock market did over the past two decades…

- How REITs can be your way out of living on a fixed income…

- What it takes for your REIT profits to be tax-free…

- Case studies on who has made a fortune on these investments…

- How you can follow in their footsteps with three of the best REITs available.

You’ll also get a second bonus briefing: Piggyback Profits: The $13 Stock that Lets You Share in the Wealth of the World’s Biggest Companies.

You’ll also get a second bonus briefing: Piggyback Profits: The $13 Stock that Lets You Share in the Wealth of the World’s Biggest Companies.

Inside you’ll discover:

- Why trying to track down the next Amazon, Apple, or Facebook is such a waste of time…

- What “Piggyback” investing is and why it can be so darn profitable…

- And why one tiny $13 stock has the potential to churn out 679% gains…

The trio of briefings I want to give you today carry a value of $447.

But I’ll rush them to you free of charge when you agree to try out Personal Finance.

The minute you say “yes”…

You’re Covered By My 90-Day—Double-Barrel 100% Guarantee!

I want you to be 100% sure Personal Finance is right for you.

So I’m giving you three full months to try it out at my expense.

That’s plenty time to check out everything on the Personal Finance website…

Read a few issues…

Take part in the money-making opportunities you’ll discover in briefings like The Everyday Investor’s Guide to Making a Fortune From AI’s Second Surge.

And possibly bank a winner or two!

If at any time during those first three months you’re not happy with what you’re getting from us — or the profits you’re seeing — simply let our Customer Service team know.

And we’ll issue you a prompt, no-questions-asked refund for every penny of your membership.

I have no interest in keeping your money unless you’re 100% satisfied.

And even if it’s past the 90-day mark and you find yourself unhappy for any reason, we still have your back.

Simply let us know and we’ll give you a refund for the unused portion of your subscription.

On the off chance you decide Personal Finance isn’t all I promised, I insist you keep all the free briefings and issues you receive as my way of saying thank you for giving it a try.

I’ll be honest — I’m not too worried about that happening.

I’d never make such an outrageous offer if I wasn’t absolutely sure I could back it up. I couldn’t afford to!

But you need to make your move and join me now.

You’re In A Race Against Time

Every day you wait to make your move increases the risk that you’re leaving gains on the table.

So do yourself a favor and click the button below to reserve your free copy of The Everyday Investor’s Guide to Making a Fortune From AI’s Second Surge while there’s still time.

When you do, I’ll also rush you these two bonus briefings, too.

- Virtual Landlording: How to Profit From Real Estate for Pennies on the Dollar

- Piggyback Profits: The $13 Stock that Lets You Share in the Wealth of the World’s Biggest Companies

Just remember, to prevent any hard feelings from the feet-draggers out there…

We’re going to stop letting people join Personal Finance under this special deal… without warning… perhaps as early as midnight tonight.

So unless my publisher has a change of heart, you may never see it again.

It’s time for you to make your move.

The best choice is yours — and yours alone — to make…

Right now.

I look forward to helping you grow your wealth.

You can review your order before it’s final.

To banking 1,026% from AI’s Second Surge,

Jim Pearce

Chief Investment Strategist

Personal Finance

P.S. When you join Personal Finance today at the amazingly low, introductory price of only $78… you won’t just get one year of profitable investing advice…

You’ll get TWO!

Plus, you’re covered by my 90-Day, Double-Barrel 100% Satisfaction Guarantee which gives you three full months to check everything out…

If you’re not happy with what you’re getting from us — or the profits you’re seeing — simply let us know and we’ll give you a no-questions-asked refund for every penny of your membership fee.

Copyright © 2024 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ disclosures, terms, and conditions and privacy policy pages.