“The prognosis looks good for telehealth stocks” — U.S. News & World Report

Up 8,336% So Far, The Telemedicine Trend Still Has Room To Make You Rich If You Grab These Stocks NOW

In the next few moments, I’ll reveal not one… not two… but THREE ways to play the telemed megatrend for a shot at MASSIVE gains, including:

1 The ultra-profitable, off-the-radar medical data firm built by Warren Buffett himself…

2 The “handheld” healthcare company sending shareholders to the moon while saving tens of thousands of lives…

3 And the AI technology lab that’s taking personalized medicine on a quantum leap in 2021…

I’ve even got a date — June 1st — that could mark the launch

of the next leg up, if you’re smart enough to get in on time…

I still can’t believe this stat flew under the radar last year… but it did.

An 8,336% surge that swept through hospitals, clinics, and small-town doctors’ offices around the country.

And the current predictions of another 5-fold increase by 2026 are looking like they’ll be several BILLION dollars short of the truth, at the rate we’re going.

Ever since I found out about this 8,336% number, my mind’s been racing.

Not in panic…

Or in fear.

I’m just shocked…

Shocked that more people aren’t paying attention to this.

Because this… this is a BIG deal, and the pandemic lockdowns only made it more important.

(In fact, some say that the lockdowns may have accelerated this trend by 5 to 10 years).

So I’m paying attention.

And you should, too.

Because the main thing I’m afraid of with this one is that you might miss out if you don’t take action FAST.

Before June 1st, if you can.

I’ve figured out what you need to do…

Laid it all out for you in plain English.

And I want to get this information into your hands ASAP — and here’s why…

As soon as I saw that 8,336% number cross my screen, I realized the future had arrived —

and it was time to make a move…

Look, most of the time when someone talks to you about investments – or anything to do with the markets — they’re working on a theory of what will happen in the future.

Usually about 2-3 years out.

This is different.

I’m not talking about some “might happen” thing here. I’m telling you about something that’s going on RIGHT NOW.

You see, America’s healthcare system is far from perfect.

This last year has made that abundantly clear.

It’s a space that’s SCREAMING for change and improvement.

Normally, all that change would be incremental.

Bit by bit, painstaking detail by detail, you’d get hospitals and doctors to change their ways. And the entrenched bureaucracy would fight you every step of the way.

But we’re not living in normal times now.

We’re surviving the Pandemic Era… and the Pandemic Era has forced whole industries to pack multiple years – and even decades — worth of innovation and change through a very small window of time.

Practically overnight, hordes of “never gonna change” bureaucrats, best practice “experts,” and masses of posturing “influencers” got swept aside.

Everyone is doing things differently now.

Things that were “Jetsons stuff” a year ago are “normal stuff” now.

Things that were “Jetsons stuff” a year ago are “normal stuff” now.

And one of the biggest examples of this is telehealth, also known as telemedicine.

At its most basic, telemedicine is doing a doctor’s appointment over the phone.

But now, thanks to the popularity of video calling apps and video conference systems like Zoom, most telemedicine appointments are video sessions with your doctor, a virtual “face to face” experience you can have without ever leaving home.

Year over year, telemedicine usage spiked 8,336% nationwide.

And I’ve found a way — three ways, actually — for you to translate this telemedicine spike into a major portfolio windfall

My name is John Persinos.

My name is John Persinos.

I’m the Editorial Director of Personal Finance, an award-winning financial publication from Investing Daily in Falls Church, VA.

Never heard of us?

That’s okay — it’s never been our goal to be famous.

Our mission is to make you incredibly wealthy.

Even if you’re starting with a small account… and especially if you like to play it safe.

For nearly 50 years, a thoughtful, cautious, careful approach is what has gotten us our results…

And we do get results.

Now, these results are excellent. Exceptional, really. Your own personal experience with us may differ.

But, I’ll be 100% transparent here…

I’d love to see your name added to our list of outstanding success stories.

But I’m not going to do it by feeding you a load of predictions and hype.

I’ll just showcase the opportunity telemedicine is delivering right now…

And let you make this logical decision for yourself…

There’s A Telehealth BOOM Happening

Right In Front Of Your Face

We’ve spent the last year having scary number after scary number thrown at us by the mainstream media, so I completely understand how you might have missed this.

All those nightly “breaking news” reports about case rates, infection rates, transmission rates, vaccination rates…

It’s number noise at its finest.

It’s number noise at its finest.

And it’s hiding the real story from you.

At peak usage in 2020, telehealth visits were 69% of all doctors appointments, as Americans opted to stay home to see their doctor.

One of those Americans might even have been you…

If not, just ask around. I can guarantee that someone in your circle of friends “Zoomed” with their doctor in 2020.

Because it’s not crazy fantasy tech anymore… it really is the new normal.

After years and years of encouraging us all to go in and see our doctors regularly, we can finally just stay home and have the doctor come to us, more or less whenever we want.

It’s the return of the house call, in many ways.

You just prop up your phone or tablet on the kitchen table, tap the screen a few times, and like magic… there’s a doctor.

You can go over lab results, do certain kinds of therapy, get prescription refills approved, monitor symptoms, and so much more…

It’s no wonder some 83% of telehealth patients say they expect to continue with it, even when their doctors’ offices “fully” reopen.

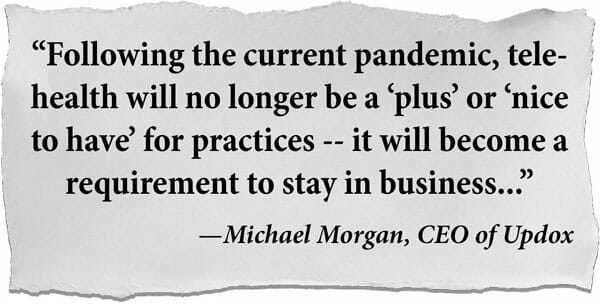

In fact, according to reports from the industry insiders’ journal Medical Economics:

It’s that last line there that really has my attention.

“A requirement to stay in business.”

Because at the end of the day, as much as the medical field is about health…

It’s also about the bottom line.

So let’s talk about the money here…

For them — and more importantly, what’s at stake for you, too — if you let me show you how to profitably get in on this megatrend…

Telemedicine’s Revenue & Usage Growth Is Truly Staggering To Consider…

Telehealth has been circling around as an investable option in health markets for a few years now.

But the numbers were just not good enough — there was nothing to get any rational investor excited.

Between 2015 and 2019, for example, telehealth usage in this country crept up by a paltry 5%.

Some three-quarters of Americans reported having either no access to telehealth or little to no knowledge of their telehealth options.

Even worse? Many insurers — and even Medicare — wouldn’t cover telehealth except in extraordinary circumstances.

That all changed on March 13th, 2020, when President Trump made an emergency declaration under the Stafford Act and the National Emergencies Act that expanded where and how telemedicine could be used.

Already eager to minimize in-person visits to limit COVID-19 spread — and now confident they were going to be FULLY reimbursed for their time — doctors, clinics, and hospitals around the country went “all-in” on telehealth.

- Medicare went from covering 13,000 telehealth visits a week to paying for more than 1.9 million visits a week — a total gain of 12,976.92%

- Suddenly, virtually everyone was talking about telehealth, as 69% of all medical appointments became telehealth appointments.

- And telehealth companies turned in epic performances on the stock market, with firms like American Well, Nuance, and iRhythm Technologies delivering double and even triple-digit gains.

But all that? It’s really just the beginning…

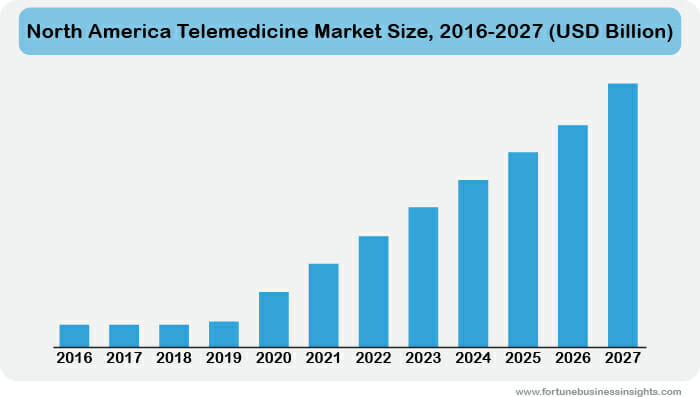

From $17.9 billion in 2019, the Telemedicine Market is expected to hit $185.6 billion by 2026.

That’s a 9x increase over where we stand today…

Which means that as far as investing in the telehealth space is concerned, you really haven’t missed out… yet.

Here’s what I mean…

Getting In On A Trend At Just The Right Time Is The REAL Key To Profits (And The Difference Between Making $$$$ And Losing Your Shirt)

I’ve been around long enough — spent more than 30 years as an investigative financial journalist, in fact — that I’m now instinctively suspicious of “hot new thing” kinds of companies.

And remember, between 2015 and 2019, the telemedicine industry as a whole only increased by 5%.

If you’d been an “early adopter” you would have been bored stiff… and broke.

Plus, you always run the risk — especially in the health field — that the “hot new thing” is going to flame out, badly.

More than a few times I’ve seen companies make a massive run up only to crash brutally back to earth when they can’t deliver on their promises.

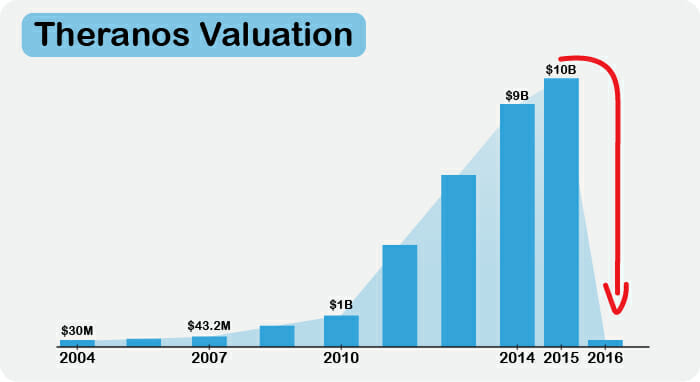

I mean, just look at Theranos, which is pretty much the poster child for what I’m talking about here…

They came hot out of the gate with HUGE claims that they could diagnose just about everything from just one drop of blood.

A lot of folks bought into the hype, bringing the company’s value up to $10 billion dollars at its peak.

Then came scandal after scandal, lawsuit after lawsuit, and the hard truth that the company just couldn’t do what it claimed.

These days? Theranos is basically worthless.

And it’s a prime example of why sometimes getting in on “Day 1” with many new health technologies is a good way to go broke.

That may seem counterintuitive to you. But, there are times when it pays to wait…

To see how the technology actually performs over time and when it’s put to a real-world test (like the trial-by-fire we just watched the telehealth industry go through)…

Then, once you have a real “proof of concept” on your hands, you can get into a stock that capitalizes on the technology at the right moment for maximum upward growth.

Come in at the right time… in the right place … to see the REAL magic happen

Now, I’m not talking about trying to “time” the market in the sense of being a day-to-day momentum chaser.

Life’s too short to run after every headline, or every tick up and tick down in a stock.

But if you think of major market trends like waves…

And imagine yourself as a surfer…

And imagine yourself as a surfer…

Then, what we do here at Personal Finance is watch that big wave swell, hop on as it heats up, and cash out while the getting’s good.

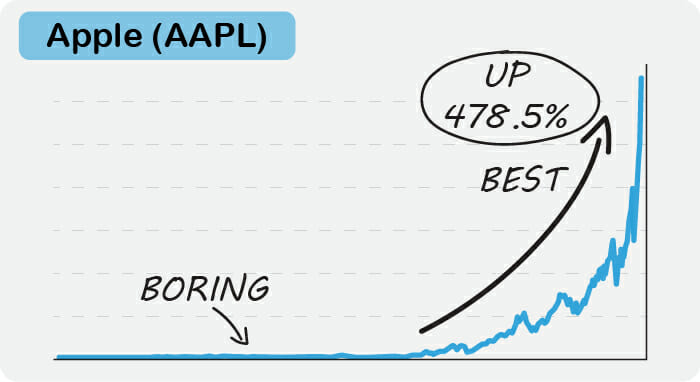

Take a look at what we did with Apple, for example…

It’s been a red-hot stock the last few years, but for decades beforehand it delivered much more modest gains.

So my team didn’t recommend it until the fundamentals were right.

Then, when Apple did get their numbers in the right place, we hopped on that wave and rode it for seven years of gains, skipping years of boring returns to pocket the best.

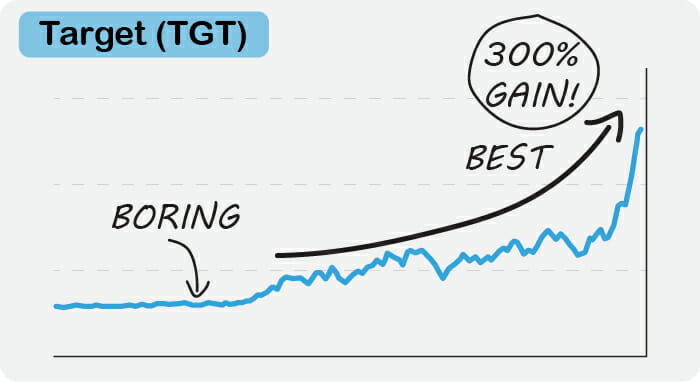

We’ve got the same thing going on with Target, a longstanding “stable” stock in the consumer goods market.

Well, it was… in 2017, Target started a dramatic run higher as the retail sector caught fire.

Personal Finance subscribers got a timely alert and were able to scoot into the stock, just in time.

The position is currently up nearly 300% — and climbing.

We’ll harvest those gains in due time.

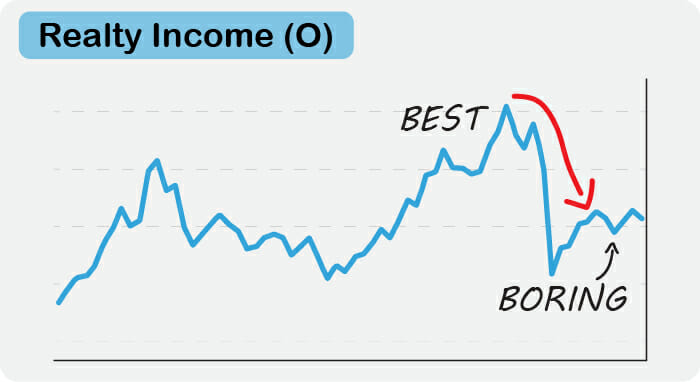

Or we might ride the wave for as long as it lasts, as we did with Realty Income, a major player in the REIT markets.

REITs were a hot play… right up until they weren’t.

That’s why you saw Realty Income plummet this past year, a crashing wave that erased years of gains.

Luckily, Personal Finance subscribers were well away from the stock by then.

After nearly six straight years of hefty dividend payments and returns — more than 119% banked — we opted to skip away from the stock in search of more interesting waters to surf.

After all, when a stock… or an entire sector… takes a turn for the worse, there’s no reason to stick around and suffer.

New breakthroughs (and new millionaires) are continually being born. So as a new opportunity builds, you want to watch for the right time and then make the right move…

Which is what I’d like to invite you to do with me here…

It’s Time For The Same Kind Of Magic

To Happen With Telehealth…

Here’s Why…

As little as 10 years ago, this whole telehealth thing was all still basically “Jetsons stuff.”

And even as things heated up, there were still 3 major roadblocks stopping the train from leaving the station.

But thanks to new innovations — and the 100% pure industrial accelerant that was the COVID-19 pandemic…

The 3 major roadblocks to success in telehealth — ease of use, data security, and the ability to get a truly personalized diagnosis from a remote doctor — are finally being conquered.

I’ve uncovered three companies…

Companies you could start investing in RIGHT NOW, if you want…

That will carry day-to-day users and telehealth doctors successfully through whatever lies ahead…

While pumping out billions in profits for their shareholders.

Let me tell you a little more about each one……

Telehealth Booster #1:

The “Easy Button” Company

That Makes It Mainstream

One of the reasons telehealth stayed on the sci-fi fringes for years was that it was never very easy to use.

You needed to install special systems on your computer, jump through hoops with your hospital, doctor, and clinicians, and God help you if you ran into technical trouble along the way.

Then the “app people” got hold of it…

Suddenly, telehealth went from complex to user-friendly and stress-free… and a virtual doctor’s appointment was no harder to do than any other video call. Talking to your primary care doctor is as simple as catching up with the grandkids on FaceTime, Skype, or Zoom.

Big hospitals and major insurance companies got interested. The Medicare people got interested, too.

They could see the potential cost savings… and thanks to this year’s pandemic, the potential for saving lives has never been more clear.

Now, there’s a lot of neat little companies crowding into this space… and some big players, too, like Apple, Google, and Microsoft.

But you don’t want to touch any of those with a 10-foot pole.

Hot young things out for a fast buck and old greedy bastard legacy firms don’t serve YOUR bottom line.

What you want is a company who makes telehealth — SIMPLE telehealth — their core business.

That’s the kind of company that’s going to give you the results you want.

Results like zipping up 99.65% in a year:

And that’s before the pandemic.

During the first wave of the pandemic? This company popped up another 74.86%.

But it’s what happened next that truly made my heart skip a beat…

That additional pop up – another 25% — happened while things were “normalizing” in doctor’s offices around the country. And once again, the stock didn’t drop… it went up!

Because now, you see, the telehealth cat is out of the bag. We’re not dropping back down to the paltry 13,000 visits a week we saw before the pandemic rolled through.

Some 80% of those million-a-week telehealth users from the peak of the pandemic plan to continue using telehealth services for the foreseeable future…

Which means what you’ve seen so far — impressive as it may be — is what I believe is the “boring” section of this stock’s lifecycle… and the “best” gains are actually just ahead of us…

As long as users feel safe, of course.

Which brings me to Telehealth Booster #2…

Telehealth Booster #2:

The Health Data Protection Firm

Warren Buffett Built

I’ll start with the returns at stake here, because they’re ridiculous.

Not ridiculous in the sense of “the biggest number you’ll ever see.”

But ridiculous in the sense that this firm delivers regular, repeatable double-digit returns you can bank on this year… next year… and likely for as long as you choose to hold onto the stock.

Warren Buffett himself held shares for nearly 50 years.

Now, he started back when it was a privately-held firm — more on that in a minute.

But in 2009, the company went public.

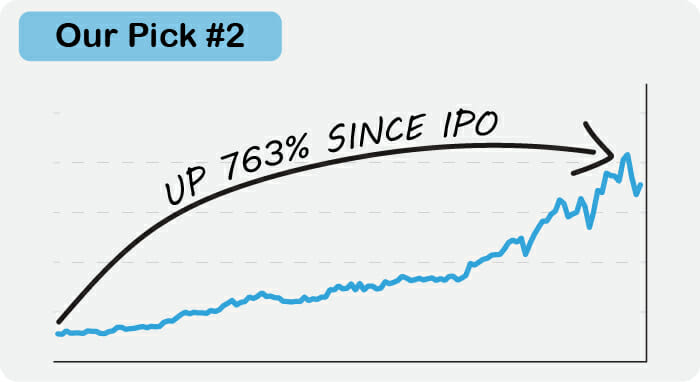

And in the 11 years since it IPO’d, this company — which I’d like to emphasize is NOT a household name AT ALL — has delivered gains of 763%.

Up 763% Since IPO!

That’s impressive… and as you can see from the chart pattern there, those gains aren’t a flash in the pan or sudden run-up kind of thing, either.

No, this firm is known for its CONSISTENCY.

They’ve delivered steady double-digit gains each and every year they’ve traded…

Analysts expect 2021 to be a double-digit growth year, too…

How does the company do it?

Well, this firm is LITERALLY in the business of AVOIDING LOSSES.

It was designed by the best — Warren Buffett himself, back in the early 1970s.

Buffett and his insurance industry partners custom-built this company to crunch data in order to help Berkshire Hathaway (and other firms like it) identify and avoid risky situations or losses.

And when you’re designed to avoid losses, profits are almost automatic.

This is a Buffett-built, safety-net company that could easily become the shining star of your portfolio.

Especially once the broader Wall Street crowd realizes that this company ALSO has linked up with an app that puts a meaningful privacy fence around your medical records.

It effectively shields your most personal health information from prying eyes… and protects the company from liabilities caused by hacks.

Win-win…

PLUS, this new partnership expands the size of this company’s potential market by 10x.

All the gains — those double-digit, continual gains — that I’ve shared so far have been based on a sliver of the health market, one that clocks in around $1.32 trillion.

But with their new expansion, they’re tapping into a market that’s predicted to be worth over $10 trillion in the next 12 months.

10x more reach… and potentially 10x more profits, right out of the gate.

So that’s your privacy, profitably covered.

And we touched on ease-of-use issues…

Which just leaves the big question — how good is telehealth for you as a patient, really?

It’s pretty good, actually. And it’s about to get a whole lot better, thanks to…

Telehealth Booster #3:

The “Quantum Brain” That Could Unlock

Truly Personalized Treatment

What I’m about to tell you about here is truly mind-blowing stuff, in terms of what this company can do for patients (and your pocketbook, too).

But I’m not just sharing because it’s “cool tech”, although it very much is…

The company behind this technology is actually one of The 50 Best Stocks of All Time, according to Kiplinger.

Maybe it’s the decades of double-digit annual gains that makes them say that…

Or the juicy dividend — north of 5%!

All votes in its favor for sure…

And then COVID happened.

Sorting through something as complicated as the coronavirus, medically speaking, is too much for a single human brain to handle.

So this company built an AI system to tackle it (and diabetes, and heart disease, and cancer).

It has the power to analyze illness and disease at the cellular level, factor in lifestyle, health history, and genetic variations, and help your human doctor get you a treatment plan that addresses your unique needs and physiology.

How can it do all that?

Well, frankly, the whole thing’s gone quantum… which means it processes information in chunks of data so big they call them “qubits”… and what they’re promising to be able to do by 2023 makes StarTrek tech look like Tinker Toys.

So imagine being able to dial up a doctor on demand, practically the first second you think you need one…

… explain your symptoms…

…get a live diagnosis…

…get a test ordered right away, if needed…

…and have all your health records update in real time, where you can see and control what’s happening… in a way that lets you get back to living your life the way you want… FAST.

That’s what these three companies collectively make possible.

And they do it all in a way that’s PROFITABLE, too.

But there is a change coming…

Why June 1st Could Be The Start Of The Next Big Leg Up For Telehealth Companies…

Last year, COVID-19 and the associated lockdowns acted as 100% pure industrial accelerant for companies with a telehealth connection.

Now – while COVID isn’t completely gone from our lives – these firms have to address the incredible growth they’ve experienced so far and figure out how to navigate the growth that remains in front of them.

Which, as I’ve mentioned, is substantial. Fortune Business Insights is calling for the total market size to rocket up 9x from where it stands today.

On June 1st, major players from across the industry will be gathering to finalize their plans for telehealth innovations, payments, and usage improvements in the years ahead.

Representatives from personalized medicine leaders like Ro, private insurance groups, biotech leaders like Illumina, and Alphabet-spinout Cityblock (a Medicaid administrator) will compare notes, reach consensus, and potentially come out with some serious market-moving announcements.

Will you be ready?

Let’s make sure.

It’s Time For YOU To Unlock Your “Ready Now” Chance For Telehealth Profits Today…

BEFORE The Next Surge

I want to get the key information you need to know about each of these three companies into your hands ASAP.

Because as much as telehealth has grown in the last 12 months… I believe we’re just getting started here.

That’s why I’ve put all the key details you’ll need to know inside a special fast-action report I’m calling Telehealth Profit Boosters: The 3 Best Ways To Play The Telehealth Boom.

Inside Telehealth Profit Boosters you’ll discover:

- The names and ticker symbols for each of the companies I’ve shared with you today… so you can see

for yourself that the telemedicine profit potential I’m talking about is real…

for yourself that the telemedicine profit potential I’m talking about is real… - Descriptions of the latest mergers, acquisitions, and product launches from these companies… including why this points to the potential for a long, upward path for telemedicine investors – at least the 9x industry-wide currently predicted, if not more…

- And most importantly, exactly how to play each company — when to buy and at what price… so you won’t have to ever wonder if you’re doing the right thing, should you choose to invest…

Now, if I were selling this report on its own to the general public… and let’s be clear, I’m not, because I’m reserving it exclusively for you…

I’d say these insights are worth at least $199.

But I’m willing to send you this detailed fast-action report… for FREE… when you subscribe to Personal Finance today.

A 45+ Year Track Record Of Creating

Life-Changing Wealth For Our Readers…

Personal Finance is unlike any investing service you’ve ever seen.

It’s created by a team of four top-notch analysts:

Jim Pearce, Robert Rapier, Jim Fink, and myself… John Persinos.

Between us, we have over 110 years of “in the trenches” experience helping investors like you make money.

We’re united with a single goal — one we take very seriously…

To help you become incredibly wealthy.

We’re not satisfied delivering mediocre returns that just barely beat the market…

And we don’t want you to suffer through years of “boring” performance in your portfolio when you could be out there harvesting some of the best returns available.

So we don’t talk about ways you can earn small-change or eke out an extra percent or two of portfolio growth.

Instead, Personal Finance is designed to present you with opportunities to generate life-changing fortunes… month after month, and year after year.

That’s why many of our subscribers — once they’ve found us — stay with us for years, if not decades.

A Service With Investing Ideas You Can Actually Understand… And Realistically Use

To Improve Your Life

Each month, you’ll receive the latest issue of Personal Finance from our team.

It’s 16 pages packed with useful, money-making, and life-improving insights, with the biggest opportunity of the month highlighted right on the front page.

You can read it quickly, so that you can take action quickly.

If you feel inspired to make an investment, we’ll put everything you need in front of you – stock tickers, entry/exit pricing, and potential trade windows that could help you make the most of our insights.

And that’s not all you’ll get…

When you subscribe to Personal Finance today, you’ll also unlock:

- Intra-Day FLASH Alerts — Any time the team uncovers an urgent BUY opportunity or when our research indicates it’s time to take profits on an open trade. You’ll never wonder what to do or when to do it… we’ll be with you every step of the way.

- Weekly Update Emails — Containing important news affecting the economy, the market, or our portfolio positions.

- Our Confidential, Members-Only Website — This secure, password-protected membership site is where you’ll have 24/7 access to all past issues of Personal Finance, FLASH Alert history, and portfolio summaries.

- Direct Access to the Personal Finance team — Your subscription to Personal Finance includes daily opportunities to interact directly with me and the other experts in our private Stock Talk forum. While we can’t give personalized financial advice (it’s prohibited by the government) we do share our insights about the general market and promptly address questions when we hear from you.

- VIP Concierge Hotline — Where a real live human is available whenever you have a question or concern you need handled right away.

Plus… because you’ve come this far with an interest in the potential of investing in the booming telehealth market…

I’ve created two more special bonuses just for you…

Bonus Gift #1:

Your Health Privacy Restored

With all the hacks, snooping, and “sharing” going on without your permission, your medical records are probably much more public than you’d like.

And with telemedicine becoming more mainstream, it’s a bigger and bigger problem all the time.

So let’s stop that, together.

I’ve put all the details you need to know about protecting yourself into a quick little report, Stop Sharing: How to Opt-Out of Health Data Sharing in America.

It includes:

It includes:

- What you need to do to get ALL of your medical records back in your hands — super important to know if you’ve ever moved or changed doctors!

- The step-by-step measures you need to take to eliminate faulty data from your current medical record…

- Free and easy ways to reclaim your health privacy — a secret fewer than 4% of Americans even know is possible!

Even if you do NOTHING else, putting the information in this report to good use could help you strip “bad facts” out of your health records and stop 3rd party scammers from running amok with your data, potentially stealing your identity, and robo calling you with quack “cures” at all hours of the day and night.

Bonus #2:

10 “Under-The-Radar” Winners

To Outsmart the Market in 2021

Inside this gem of a report, you’ll discover 10 of my team’s top stock picks for 2021.

Inside this gem of a report, you’ll discover 10 of my team’s top stock picks for 2021.

These are companies that get completely ignored by most Wall Street analysts… mainly because they do just fine without greedy bankers meddling in their business.

This premium report reveals the precise details you need to take advantage of these “under-the-radar” profit streams this year, and well into the future.

Instant Access To These Bonuses —

And Everything Personal Finance Has To Offer — Is Just One Affordable Click Away…

With everything you receive as a Personal Finance member…

You might expect membership to cost thousands of dollars.

However…

Our regular price is $99 a year.

We could charge a lot more — others certainly do.

But our mission… the same mission that has carried our publisher through nearly 50 successful years in business…

Is to support individual investors like you, who are interested in the kind of sound, useful insights that can turn a small account into a much bigger portfolio.

Which is why…

Given that you’ll receive a minimum of 12 opportunities to generate double, triple, or even quadruple-digit returns each year…

And a single well-played recommendation could cover your annual membership fee 100 times over…

I think you’ll agree… $99 is a fair price.

But I don’t want to just be “fair” with you… I want to go one step further…

When you click the button below to start your Personal Finance subscription today, you won’t need $99 to get started.

For you… today… right now… I’m willing to slash the starting price of Personal Finance by 60%.

You’ll be able to get started for just $39 for the first year.

And the price for the second year — which you’ll want to know since many of our subscribers stay with us for multiple years and even decades at a time.

If you opt to “double up” your subscription right at the start, I’m willing to double down on bonuses and discounts for you in a bonus suite so generous, you’ll need to click through to see it…

More comfortable ordering by phone? Dial 800-543-2049

And that’s STILL not all…

Your Satisfaction Is Covered By Our

“Risk Nothing, Keep Everything”

100% Money Back Guarantee

And, even after three months, you're still free to cancel anytime and receive a refund on the unused portion of your membership. All of the issues and valuable reports that you’ve received are yours to keep, just for giving Personal Finance a try. That’s right… even if you cancel far down the road… you keep everything and are free to benefit from what you’ve learned, for years to come.

More comfortable ordering by phone? Dial 800-543-2049

The Next Move Is Yours…

Remember, all too often, when you hear about an investing idea, it’s based on something that “might” happen down the road a couple of years.

Not this.

The telemedicine boom is happening right now… right in front of you.

And it’s far from over…

There’s still plenty of time for you to get in on the next leg up — NOW — before it happens without you.

Don’t delay and miss out when this is an opportunity you can start profiting from today.

More comfortable ordering by phone? Dial 800-543-2049

John Persinos

Editorial Director

Personal Finance

Copyright © 2021 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.