Hi, my name is Brenton Flynn. Welcome to the Total Profits Summit.

Today, Jim Fink is joining me to reveal three stocks he’s uncovered that could each turn $10,000 into $110,000.

That’s right.

The investing legend who has spent the past three years quietly plundering the options market… scoring 269 winners and 12,116% total profits…

Including a current streak where he’s delivered gains of over 9,357% without a single loss…

Is going to release the details on three “stock picks” today.

Each of these tiny – virtually unknown companies – is perfectly poised to soar up to 1,000%…

Snowballing every $10,000 invested into $110,000 in the process.

To be clear, that’s not $110,000 in total.

I’m talking about three separate chances to make that much money.

Which means you could quickly find yourself sitting on $330,000.

But the question remains, “Why?”

Why would a man who made a $5.3 million fortune trading options…

And then used those same techniques to give a small group of investors the opportunity to rack up $1,221,600…

Suddenly make the decision to switch gears and release three stock picks?

Well, according to Jim, the reason is really quite simple.

And these are his exact words…

“It’s not enough!”

I know that may seem hard to fathom.

I mean, most analysts couldn’t deliver 12,000% total profits over their entire career if their lives depended on it.

Much less do it in three years.

But it didn’t shock me one bit to hear Jim say he wasn’t satisfied.

Because hidden just behind his disarming smile and quiet demeanor…

Lies the heart of a relentless profit-seeker.

Jim doesn’t just want to help regular investors feast on the market.

He wants them to pick the bone clean.

And the thought of folks letting money on the table bothered him so much…

He combed back through decades of data and reverse-engineered a stock picking system whose sole purpose is to pinpoint opportunities like NVIDIA which skyrocketed 1,215%.

Turning every $10,000 invested into $131,586 .

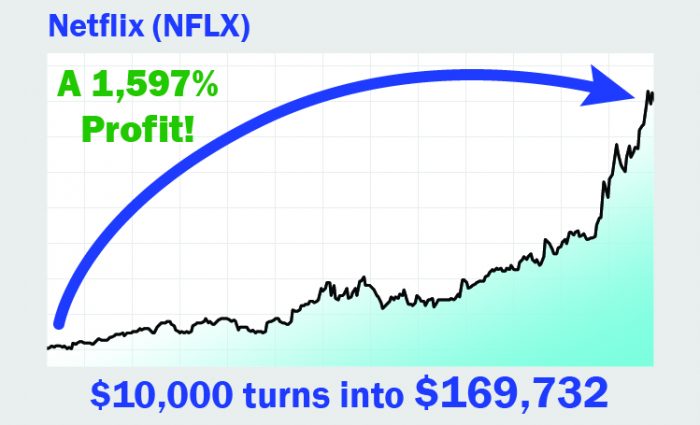

Netflix, which would have handed you over $169,732 in profits.

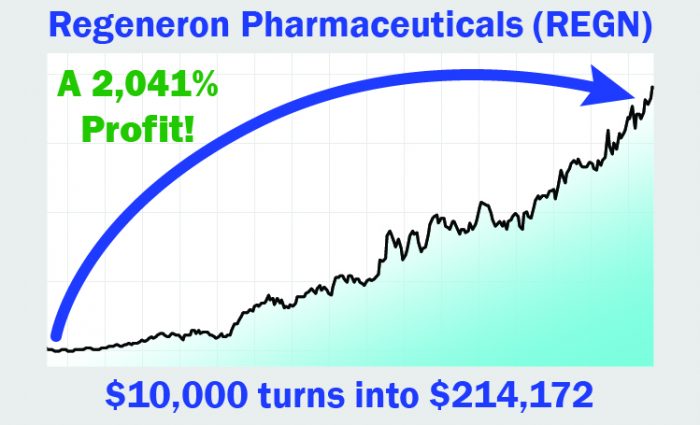

Regeneron Pharmaceuticals, which jumped from $27 a share all the way to $592.

Good enough for you to make $214,172.

Canopy Growth, which would let you cash out with more than 26 times your money.

From $10,000 to $264,731.

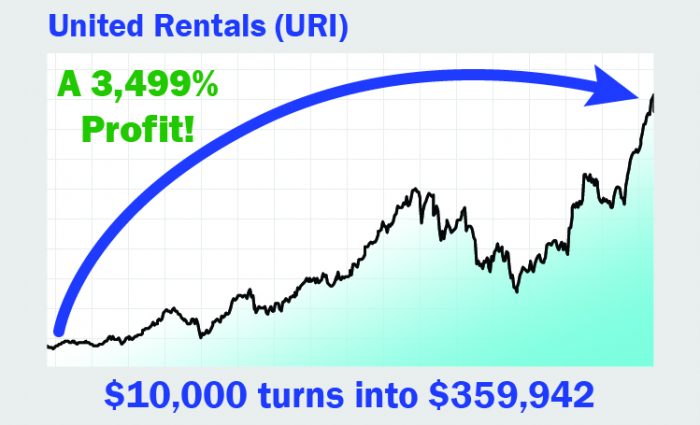

And even United Rentals. Which shot up enough to create a $349,942 profit for anyone who invested $10,000.

Now obviously, these gains are extraordinary.

And Jim will be the first to tell you nothing in the market is guaranteed.

But the potential of what he’s come up with is clear.

I mean think about it.

If you knew about each of these five opportunities before they took off.

And put $10,000 into each one.

You’d be sitting on over $1.1 million right now.

That being said, I know some folks may not have that much money to invest.

Or maybe you do. But would never dream of putting it all into one stock.

That’s understandable.

It certainly won’t prevent you from using Jim’s new system.

Since he built it to detect opportunities that could hand you 10 times… 20 times… or even 30 times your money…

You can invest substantially less.

And still see enormous returns.

Consider Netflix for example.

If you put a mere $500 into this online entertainment company, you could have walked away with $8,487.

The same small stake in Canopy Growth would have spun off a $13,237 windfall in just two years.

And a $500 investment in United Rentals would have shot up to $17,997.

I know the idea of making that kind of money from regular stocks sounds incredible.

Like a once-in-a-lifetime score even. But it’s not.

Jim built a system capable of finding investments like this over and over again.

In fact, as I mentioned a minute ago, it’s already zeroed in on three opportunities you can invest in immediately.

And I can’t think of a better way to kick off the New Year than letting him tell you about each one right now.

| Brenton: | With that, Jim, it’s great to have you here with us today. |

| Jim: | My pleasure Brenton. Thanks for putting this special event together. |

| Brenton: | Jim, we have a lot of ground to cover so I’m just going to cut to the chase.

I’ve taken a peek at your new system to get a feel for what it’s capable of… And it looks like you’ve literally invented the holy grail of investing. |

| Jim: | Well, I wouldn’t go that far. But I am pretty happy with how it turned out. |

| Brenton: | Pretty happy? C’mon.

Most of us consider ourselves lucky if we find a stock that shoots up 50% every-once-in-a-while… Or maybe even doubles. But you’ve come up with a way to detect winners far larger than that. Over and over again. |

| Jim: | Yeah, I did. And I’m excited to show it to everyone who tuned in today.

Because truth be told, I know some of these folks are never going to be comfortable with the idea of signing up for one of my options services… For whatever reason, they’re just not. So what are they supposed to do? How are they going to make enough money to pay off their mortgage? Or kick off their golden years by starting a small furniture-making business? Will they be able to afford to fly to see their grandkids more than once a year? Or at all? |

| Brenton: | Well, I believe the folks who get access the opportunities your new system pinpoints will have the chance to do all those things. And more.

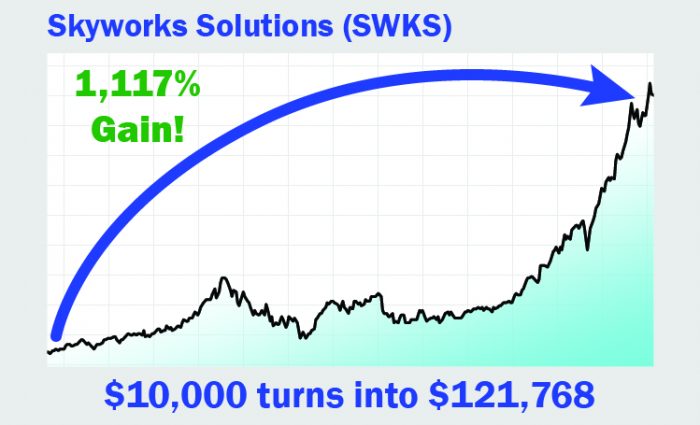

I’ve spent my entire career following the world’s top investors. Studying the tools they use to make money. And I can tell you without reservation… I’m blown away by your new program. Because it gives regular investors the chance to see mind-blowing profits from regular stocks. Regardless of their investing experience. Or the current size of their portfolio. I’m talking about the chance to make… 11x your money on Salesforce.com.

12x your money on Skyworks Solutions.

14x your money on Seagate Technology.

10x your money on Express Scripts.

17x your money on Pioneer Natural Resources.

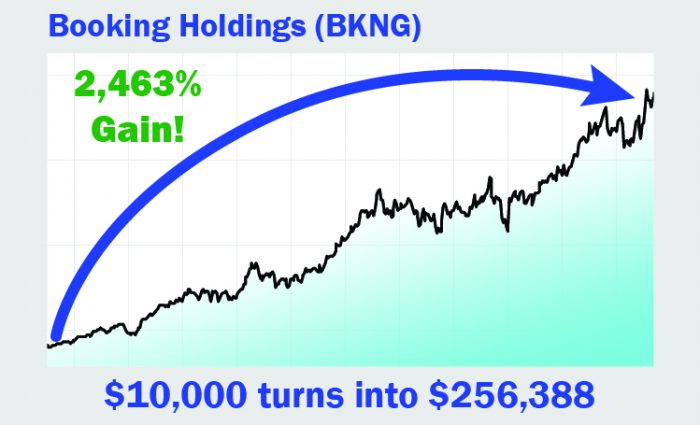

25x your money on Booking Holdings.

I’m going to stop. But not because I’ve run out examples. The reality is… Opportunities like this pop up far more than folks think, right? |

| Jim: | They do.

The problem of course… is finding them. There are over 5,000 companies trading on the NASDAQ and NYSE alone. And twice that trading in the “over the counter” market. Which is why it’s so important to have a system like the one I’ve designed. Because if you don’t have a way to single out the very best investments – you’re really just shooting in the dark. |

| Brenton: | We’re going to talk about how your system works in just a moment.

And more importantly – we’ll go through the details of the three opportunities it singled out. But before we do. I want to take a second to let everyone hear what people say about the results they’ve seen following your lead…

That’s not too shabby. But they get better. Terry P. recently told me he and his wife are building a home in Santa Fe, New Mexico with the money they’ve made from your recommendations. And that they have a guest room waiting for you!

|

| Jim: | I’ve seen that note. And I just may take them up on the offer. I love Santa Fe. It’s where my wife and I got married! |

| Brenton: | Terry’s far from the only person whose life changed thanks to the work you do Jim.

Steve S. let me know he makes money so consistently with your recommendations, he’s going to hang up his hat. And retire early.

And Paul from Framingham, Massachusetts let us know he’s not worried one bit about running out of retirement cash now that he can follow your lead.

|

| Jim: | I love getting notes like these Brenton.

Because it means I’m giving regular people a shot at making life-changing amounts of money… Using the same strategies once reserved for wealthy investors. |

| Brenton: | Like your new system for example. |

| Jim: | Absolutely. I spent months – and over $117,000 – on intensive research with one goal in mind…

To discover what companies that rallied 8x… 10x… or even 20x had that the others didn’t. Then I used that insight to create a roadmap which leads me to new opportunities just like them. And I’m excited with the results so far. In fact, I just wrapped up an in-depth research report that covers the first three companies it singled out. I’ve studied each of them extensively. And I believe all three could jump as much as 1,000%. Maybe more. |

| Brenton: | Well Jim, I’ve never seen anything like your program.

It truly is remarkable. And I think I speak for everyone watching when I say I can’t wait to hear more about these three opportunities. But before we get to that, could you walk us through how it zeros in on these investments. |

| Jim: | Well, the first thing I want everyone to know – and this is important Brenton – my system has nothing to do with penny stocks.

In fact, I intentionally designed it to weed them out. |

| Brenton: | But why would you do that Jim? Penny stocks skyrocket all the time don’t they? |

| Jim: | Absolutely. |

| Brenton: | So why throw them out then? |

| Jim: | Risk. Pure and simple. Most of these companies won’t ever amount to anything.

And their stock movements are so erratic – it’s nearly impossible to predict what will happen in the next five minutes… Much less the next few months. They are quite simply – the ultimate stock market gamble. So I decided early on not to look at them when I was creating my system. I wanted it to pinpoint real companies. With real products and services. Well-run operations that are on the cusp becoming everyday names… Sending their stocks parabolic in the process. Like Tractor Supply Company which jumped 1,174%.

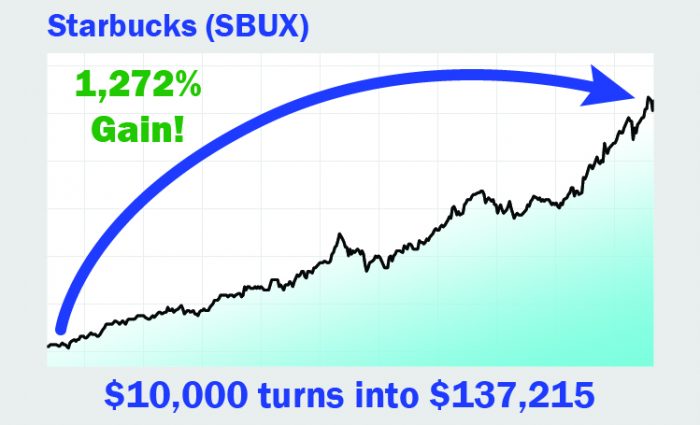

Starbucks grew 1,272%.

Sirius Satellite Radio spun off a 1,481 % gain.

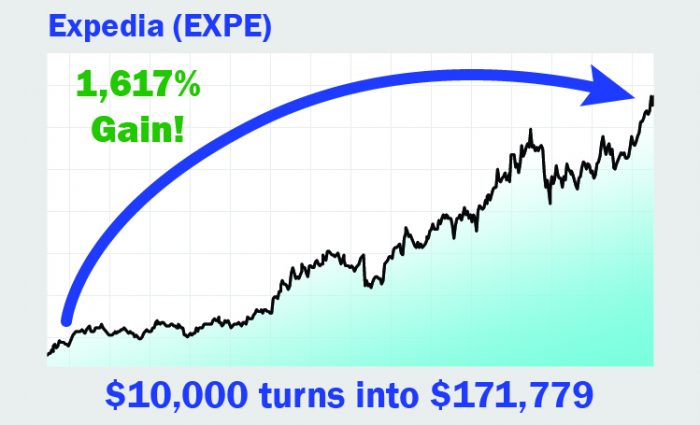

And Expedia jumped 1,617%.

|

| Brenton: | That’s truly impressive Jim.

Those are the kind of opportunities folks can make a fortune on. |

| Jim: | Well, I’m certainly not implying what I do has saved anyone’s life.

Not every trade my system pinpoints will turn out this good. It’s not a crystal ball after all. |

| Brenton: | Of course. All investments carry risk.

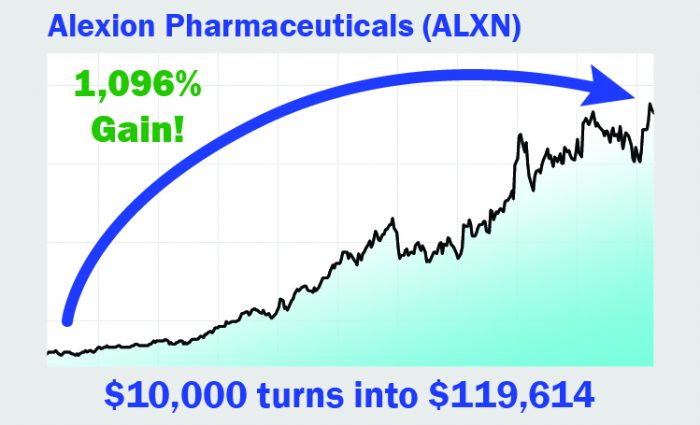

But the potential here is too large to ignore. I mean, a $10,000 stake in Tractor Supply would have turned into $127,470. $10,000 invested in Starbucks would have let you walk away with $137,215. A $10,000 investment in Sirius would have multiplied into $158,125 in a little over three years. And the same amount in Expedia would have you sitting on $171,779. That’s well over half a million dollars from just four investments. And just so we’re clear – these examples don’t involve leverage of any kind, right? |

| Jim: | Not at all. None of the opportunities we’ve covered have.

That’s not what this system does. I designed it to pinpoint regular stock trades. So as long as you have a brokerage account… You can literally buy shares today. In a matter of a few seconds. |

| Brenton: | I’m just looking back over the list of companies we’ve covered so far Jim…

And I’d have to say – most of them are fairly well known. But that’s not always the case is it? |

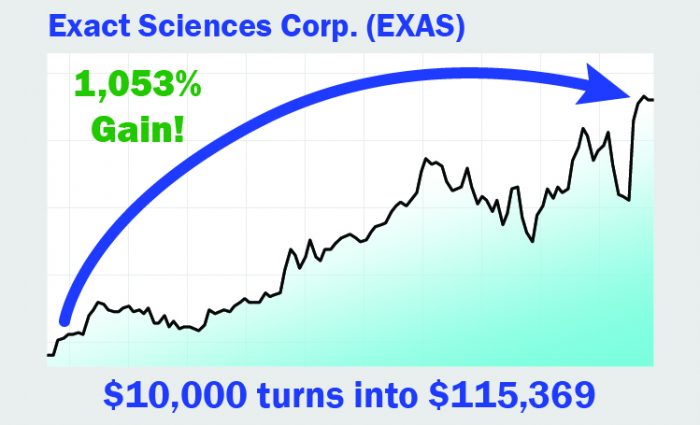

| Jim: | Not at all. I doubt a lot of viewers ever heard of Exact Sciences…

Even though it gave investors the chance to start with $10,000 in 2016. And cash out with $115,369 in 2018.

If you brought up Alexion Pharmaceuticals at a party, I’m pretty sure you’d get a lot of blank stares too. In spite of the fact that it tacked on nearly 1,100% to its share price.

Turtle Beach probably won’t ring any bells…

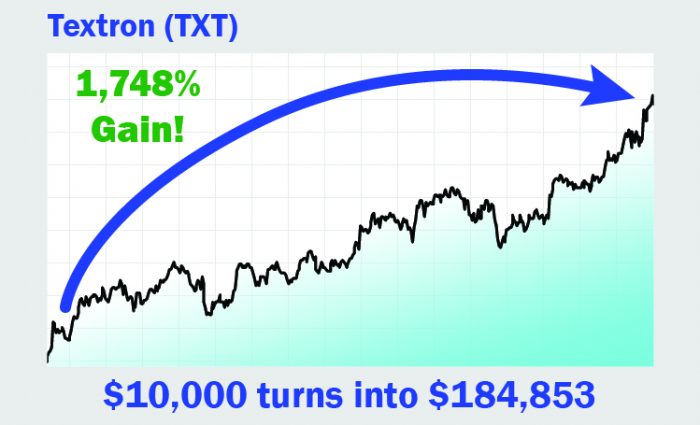

Even though it spun off a 1,601% gain in less than five months. I’m sure the same holds true for Textron too. But it still managed to shoot up over 1,700% delivering $174,853 in pure profits

And I’d be willing to bet most main street Americans don’t know a thing about Baidu or what it does.

Even though it rallied from $12 a share to an astounding $279… Turning every $10,000 into $231,907. |

| Brenton: | Gains like these are amazing.

Could you take a few minutes now to show us how your system zeroes in on these blowout opportunities? Because I want people to understand exactly how you find companies that are set to soar 800%… 1,200%… or maybe even more. |

| Jim: | Well, it’s a rigorous process that takes weeks of research.

And some of the analysis I perform is quite complicated. So I’m not going to do a deep dive into all of it now… Because quite frankly it would put most folks to sleep. But to explain it in a way that everyone will quickly understand… I pinpoint these opportunities using my new methodology called GEAR. |

| Brenton: | Just to be clear, GEAR is an acronym right? |

| Jim: | It is. G stands for Game Changing.

And it’s the first hurdle any stock must clear to have a shot at delivering the kind of profits I’m looking for. So in other words, the process starts by answering a deceptively simple question… “Does this company have a product or service that could radically transform an industry? Or even the world?” If the answer is “no” I quickly move on. |

| Brenton: | And if the answer is yes you keep going. |

| Jim: | Yep. If the company has the potential to change the way an industry works…

I move on to the next step. But I want to be clear about something here Brenton… I’m not talking about a minor improvement to an existing widget. I’m talking about fundamentally altering the way a market operates. Like the way Microsoft changed how we use computers. The way Sirius changed the way we listen to the radio. Or how Apple shattered everyone’s notions of what a phone could do. |

| Brenton: | That doesn’t feel like a “simple” question to answer though Jim…

I mean some industries are unbelievably complicated. |

| Jim: | What I meant was, the question itself is simple. But you’re right… getting to the answer isn’t.

The research is grueling. But it has to be done. Because if a company doesn’t have the potential to change an industry… The chances of it delivering gains of up to 1,000% are non-existent. |

| Brenton: | Got it. Finding a game-changer is go, no-go step. So tell us about E. |

| Jim: | Well, I also look at whether I’ve found the company Early enough…

In other words, did I find it before everyone has gotten wind of what it’s up to. Because if the company is valued too far over $1 billion it probably won’t have the kind of runway it needs deliver gains of 1,000%. |

| Brenton: | So what does that number look like in terms of share price? |

| Jim: | Well, for the most part they’ll be under $20. But not always.

There could be times where I’ll find a company that has the potential to go up 10x or more when it’s trading over $20… And if I do, I’m still going to pull the trigger on it as long as it meets all my other criteria. |

| Brenton: | Jim, I just want to take a second to point out how critical it is to find these opportunities early enough.

A few minutes ago we showed everyone how they could have made 1,671% on Expedia by getting in before it took off.

At far left of this chart was when it was trading for under $9 a share in 2009… Which is when you would have recommended getting in. And the red arrow shows when Jim Cramer proclaimed, “this stock is worth buying hand over fist” in 2016. When it was already trading for an astounding $109 per share. Can you guess how much you would have made if you didn’t find out about it until then? |

| Jim: | Oh man! If you got in that late… 50% maybe? |

| Brenton: | Lower. If we use the sell date from your chart it would have only been a 35% gain. Which means you would have missed out on virtually the entire move.

And left about $158,000 in profits on the table. |

| Jim: | Well, that’s an extreme case of course. But it does shine a light on the importance of getting in at the right time. |

| Brenton: | And not waiting for the talking heads to give you the green light. |

| Jim: | And that. They’re always late to the game.

That’s one of the reasons I came up with GEAR. So that I’d never miss out on the early innings of a massive growth opportunity. Because it’s obvious just how much it costs you. |

| Brenton: | So we’ve covered that a company has to have some game-changing element…

And that it needs to be in the early phases of growth. What’s next? What other hurdles does a stock have to clear before you’ll recommend it. |

| Jim: | I also look for Acceleration.

I want see growth in the market the company operates in. And I want to see growth in key metrics like revenue and earnings too. |

| Brenton: | What about profits? |

| Jim: | Well, a lot of small-cap, high-growth companies aren’t profitable.

But I certainly wouldn’t rule them out because of that. The key to survival and growth in the early stages of a company… Is driving money into the business. The profits will come later. |

| Brenton: | Ok. We have Game-Changing… Early… Accelerating performance. And the R stands for? |

| Jim: | Repeatable. The company needs to have the right formula to maintain that growth arc long enough to deliver gains of 1,000%. |

| Brenton: | Now I know a lot of what we’ve covered so far – like having a game-changing product in an expanding market – contributes to a company’s ability to consistently grow.

But I’m sure there’s other things you look at too. And out of them, what’s the most important one? |

| Jim: | Leadership.

The company must have a management team with the skills and financial motivation to see it through. |

| Brenton: | When you say financial motivation you’re not talking about bonuses and incentives like company cars are you? |

| Jim: | Not at all. Rewards like that just encourage short-term thinking.

I’m talking about how much of the company the executive teams owns. Because nothing provides a more tremendous incentive for success than having skin in the game. And knowing it could grow into a fortune. |

| Brenton: | So Game-changing… Early… Accelerating Performance… Repeatable…

Your GEAR system makes complete sense to me. And it’s hit on three companies that meet all the criteria? |

| Jim: | It has. |

| Brenton: | And each one has the potential deliver gains of up to 1,000%? |

| Jim: | Well, I’m not promising they’ll hit that number. When you’re shooting for massive winners, it’s possible that sometimes you’ll miss the mark. |

| Brenton: | So what you’re saying is you shouldn’t bet your life-savings on these. |

| Jim: | Right. I don’t think you should ever do that. I mean ever. It’s a recipe for disaster. |

| Brenton: | Agreed. At the same time, it’s hard to look past the upside.

Because if you put $10,000 into the three opportunities Jim is going to cover in just a moment… And each one plays out the way he expects them to… You could find yourself sitting on up to $330,000. Having said that Jim, are you ready to dive in and tell us about these companies? |

| Jim: | I thought you’d never ask!

The first opportunity is phenomenal. It’s a small company that’s literally transforming the trillion-dollar healthcare industry. And folks who have enough common-sense to get in today could make a fortune. |

| Brenton: | So we’re going to be hearing about a pharmaceutical company with some breakthrough drug? |

| Jim: | Not at all.

It’s actually a technology company that’s responsible for mapping one of the most complex forms in the universe… The human body. |

| Brenton: | Genetic testing? That’s certainly a powerful technology.

But it’s also been around for years… and there’s dozens of companies that do it. So what does this business do that’s so radically different? |

| Jim: | Well, in a nutshell it’s quickly becoming the Amazon of genetic testing. |

| Brenton: | That’s a big claim. Could you take a minute or two to explain how? |

| Jim: | Sure. Think about what Amazon does for a moment… it sells things online.

That’s certainly not a new idea. There’s nothing groundbreaking there. Yet it’s become one of the largest companies in the world, because it does everything bigger, better, and cheaper than everyone else. |

| Brenton: | It’s playing a game of scale. |

| Jim: | Right. The fact that it’s an online retailer isn’t revolutionary. There are literally tens of thousands of companies selling things on the internet.

But none of them can touch Amazon. Because its strategy – and how it executes it – is groundbreaking. The company I’ve found is no different. It’s building a low-cost, volume-driven network in the genetic testing industry. One that its competitors are clueless about how to compete with. Consider this… in 2011 Apple’s CEO Steve Jobs paid $100,000 to analyze the genes of the cancer that ultimately killed him. But today, you can get a similar test from this company for $250. And get this – its test looks at 134 genes… While its closest competitor only does 70. |

| Brenton: | Obviously looking at twice as many genes increases your chances for finding the best course of treatment… or for early detection.

So can you explain to everyone watching why a company would slash its prices when the product it offers is nearly twice as good? I mean, I’m sure some of its competitors are probably charging $1,000 for testing half the number of genes… So why would you willingly reduce the amount of profit you’re making? |

| Jim: | Well, this is where the genius lies in this company’s business model…

And why I think it could become the Amazon of genetic testing. Because it’s using lower pricing to fill the pipeline with new business and set itself up to tap into the power of Metcalf’s Law. |

| Brenton: | Isn’t that the theory where the more people who join a network… the more valuable the network becomes to each member? |

| Jim: | It is. And the most important part about that law is that the more value it provides…

The more members it attracts. |

| Brenton: | Like a snowball rolling down a hill. Getting bigger and bigger. |

| Jim: | Exactly. But in this case, instead of building a network of shoppers that love low prices and free shipping…

Who then go on to tell their friends and family… Until the company becomes worth nearly a trillion dollars… This gene mapping company is building a network that grows more powerful with every test it runs. |

| Brenton: | You mean because it catalogs all the results. |

| Jim: | Yep. Every test result… whether its normal or pinpoints a new mutation… makes the database more useful. And of course more valuable. |

| Brenton: | It’s not just valuable to the patients and their doctors either.

I would imagine drug companies, medical device companies, and advocacy groups would love to be part of a network like this. Because they could use it to find people who would benefit from their treatments, products, or services. |

| Jim: | Of course. And researchers could use it to look for connections between genetics and diseases. |

| Brenton: | Incredible. So this company is literally setting itself up to collect multiple streams of income…

I mean they’re not just going to give away access to data like this right? |

| Jim: | No way. Getting the keys to a goldmine like this will not be cheap. |

| Brenton: | I’m starting to see why you’re so excited about its prospects. |

| Jim: | The potential is immense. |

| Brenton: | Could you put some numbers to it? |

| Jim: | Sure. Estimates have the cancer market growing by two million tests a year.

And there’s up to 1.3 million women in the United States with breast and ovarian cancer who qualify for the testing this company does… But didn’t receive it. At the same time, there are over 90 million Americans living with cardiovascular disease or the aftereffects of stroke who could benefit from testing… And there are nearly four million live births each year that could benefit from screening too. |

| Brenton: | They’re staggering numbers. |

| Jim: | Well, hold onto your hat then. Because they’re largely event-driven.

There are also millions of people out there that want to know about potential problems before they crop up too. |

| Brenton: | Jim, let’s back up for just a second. When you say event-driven you mean the tests are only ordered after something bad happens? |

| Jim: | Yes. And we’ve covered those numbers. But here’s where things get really exciting.

The proactive testing market is expected to grow to over 10 million tests per year. And in the end, the company believes the total addressable market is 33o million. |

| Brenton: | That’s the entire U.S. population. Isn’t that a little ambitious? |

| Jim: | It is. And I think it goes without saying they’re not going to get it all.

But I don’t think it’s hard to see how even capturing a fraction of it could transform a small company into an industry titan. |

| Brenton: | And according to your GEAR system it’s still early enough to invest in this company? |

| Jim: | Yep. It’s valued at a billion dollars. And you can pick up shares for well under $20.

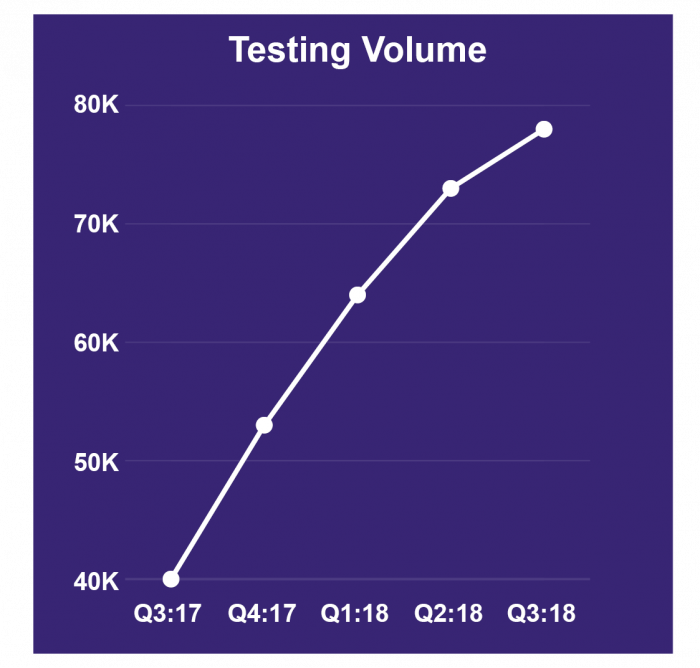

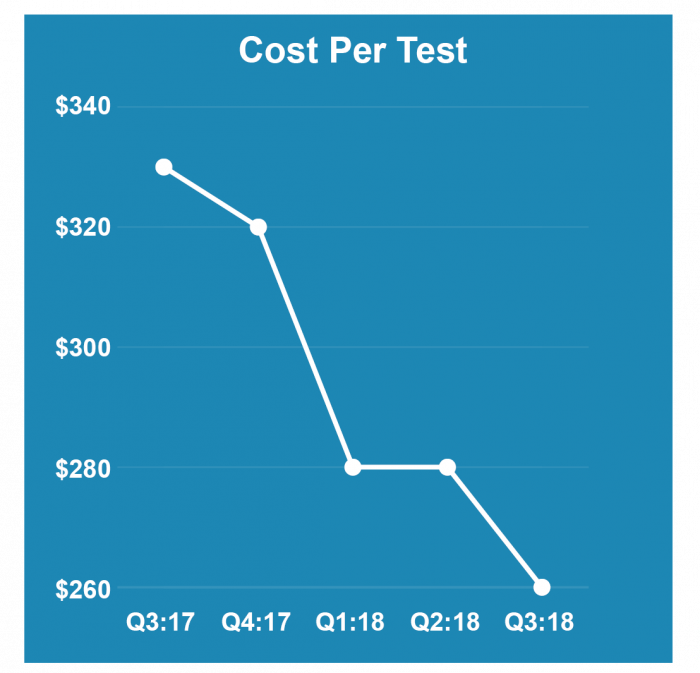

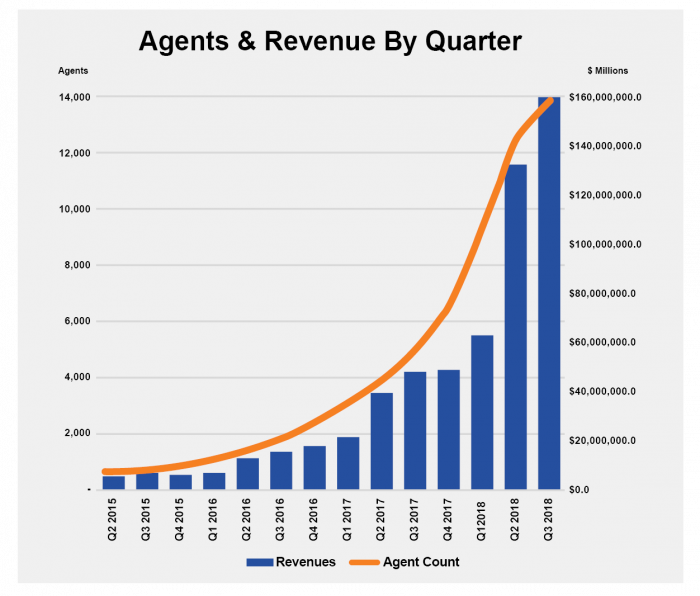

But I don’t expect that to last much longer. Every key metric I’ve looked at is accelerating. And I’ve pulled together a few charts to put a point on it. Can we bring them up as I cover them? |

| Brenton: | Sure. |

| Jim: | So as we just discussed the market itself is growing…

But more importantly so is this company’s share of it. Take a look at how its testing volume has exploded upwards… It’s a 95% year-over-year increase. And at the same time, the cost to run each test is plummeting.

|

| Brenton: | I like where this is heading. |

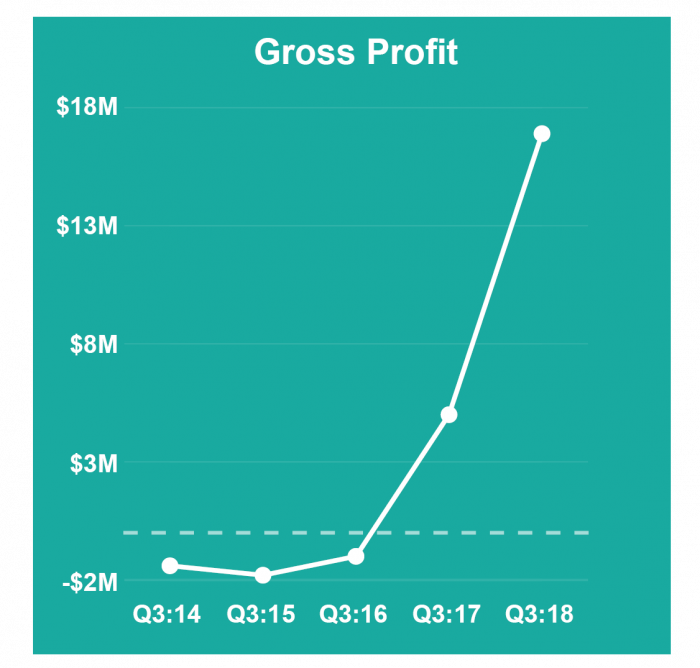

| Jim: | So do I. The growth in the number of tests has led to a 106% increase in revenue. And combined with substantial cost reductions…

Its gross profits have exploded 238%.

|

| Brenton: | Remarkable.

So it’s met all your GEAR criteria. It has a game-changing business model, it’s still early enough to get in, the numbers are accelerating… And you can tell by looking at the charts its leadership team is capable of doing it over and over. |

| Jim: | I wouldn’t expect anything less from them.

They own a massive chunk of the company’s stock. So they have a vested interest in keeping things moving forward at this blistering pace. |

| Brenton: | Earlier you mentioned Exact Sciences… they’re a company that’s best known for developing the first DNA test for colorectal cancer…

And their stock tacked on 1,053%. Is that a fair target for this company? |

| Jim: | Well, nothing’s guaranteed of course. |

| Brenton: | Of course not. But I don’t see why it couldn’t. Heck, as far as I’m concerned it has a shot at doing even better.

I mean the company you’ve just shown us provides comprehensive testing that goes far beyond focusing on one disease like Exact Sciences does. |

| Jim: | That’s true. Then again, it could get bought out before it ever has a chance to grow to that size.

That’s what happened a few months ago to a cancer testing and treatment company called Foundation Medicine. The Swiss pharmaceutical giant, Roche Holdings, swooped in and bought it… lock, stock, and barrel. |

| Brenton: | What would an acquisition like that mean to folks who pick up shares of this company? |

| Jim: | Well, using Foundation’s numbers as a guide – prices could shoot all the way to $100 a share. |

| Brenton: | Based on what it’s trading for now – that would be a gain of over 600%.

And your report has the full story, right? |

| Jim: | Absolutely. I cover everything we’ve talked about today in detail. |

| Brenton: | We’re going to make your report available to everyone in just a few minutes…

But before that happens, what do you say to people who are nervous about investing in what’s become something of a Jekyll and Hyde market? |

| Jim: | Well, I get it. It’s only natural to feel that way.

But the truth is, when you understand the stocks that meet my GEAR criteria make even more money coming off the heels of a market downturn… Like Exact Sciences which handed investors 11x their money following the 2008 crash… Or United Rentals which delivered nearly 3,500%… You’ll realize you shouldn’t be getting nervous. You should be getting greedy. Because it means you have the chance to take part in these massive profit opportunities for less than it would have cost you just a few short weeks ago… |

| Brenton: | So it’s like you’re getting these stocks on sale.

And you’ve found two more companies that meet your GEAR requirements as well? |

| Jim: | I have. But we’ve been at this for a while and I want to be sensitive to everyone’s time…

So I’ll cover them quickly. |

| Brenton: | Fair enough. |

| Jim: | The next company has produced artificial intelligence software that helps businesses advertise their locations and services… |

| Brenton: | So it helps people get their website noticed? |

| Jim: | No. There’s no point in doing that these days since most searches don’t end with a person going to a company’s website anyway. |

| Brenton: | Where do they end up then? |

| Jim: | The easiest way to explain it is with an example…

Let’s say you’re taking your daughter to a volleyball tournament and there’s some downtime in between matches… So you decide to head out and grab a cup of coffee and a donut. The only problem is you’re in a town you’ve never been in. So you have no clue where to go. What do you do? |

| Brenton: | I grab my phone and ask Google to find coffee shops near me. |

| Jim: | Right. Then you pick one that’s open… has high ratings…

And let the map get you there right? |

| Brenton: | Right. |

| Jim: | Ok. But you never went to the coffee shop’s website. And you’re not alone.

Sites like Google, Facebook, and Yelp get nearly 3x more views than corporate websites. And that’s where this technology shines. It aggregates all the information about a businesses’ product or service… Then displays it on these third-party sites when people are in the last mile of their purchase decision. Showing up at the right time like that is critical to companies these days. Think about it. You didn’t search for where to get a cup of coffee days in advance. But the minute you were ready to buy one – this company’s software made sure you had the answer. Now imagine how much money the coffee shop could make in a year from thousands of searches like yours. |

| Brenton: | I’m starting to see what you like about this business. It’s like a digital version of the yellow pages. |

| Jim: | You could say that. But the results it delivers are far more dramatic and immediate than what the old paper books could produce.

The restaurant chain Denny’s used this software and saw searches for its locations increase 174%. And Qdoba restaurants saw their profit from online orders spike 14x higher in a single month. |

| Brenton: | Ok. I’d throw numbers like that into the category of game-changing.

Especially for companies that big. And it’s clearly operating in a growing market… I mean people are never going to use the internet less to search for things they need. But does it meet the rest of your GEAR requirements? |

| Jim: | Absolutely. It’s valued at a little over a billion dollars. But shares are still trading for under $20 so there’s still plenty of room for this one to run.

And just as importantly, the key indicators I look at are accelerating. The number of companies using its technology is up 59% in the last year. And revenue is on a straight line up too… exploding 183% in the last three years. |

| Brenton: | I’ve read your writeup on this company Jim and it’s fascinating.

At one point you say this company is the new Salesforce.com. And we covered earlier how Salesforce’s share price shot up over 1,000%. So it begs the questions… Can we expect 10-fold returns from this company too? |

| Jim: | Well, I can’t promise that of course.

But my confidence is high on this company’s prospects for success. And I’m not the only one that feels that way. Big hitters like Vanguard, Fidelity, and Blackrock have all taken positions. And insiders have snapped up more than 15% of the company’s stock too. |

| Brenton: | Awesome. Could you quickly go through the third opportunity? |

| Jim: | Sure. This $600 million company is shaking up the $1.5 trillion U.S. real estate industry by taking brokerage services online.

It has no brick-and-mortar offices. Or the staff that comes with them. And since it doesn’t have to support any of those costs – it was able to create a high-paying commission structure for its agents that traditional brokerages simply can’t compete with. Look, I know we’re short on time. So I’m just going to put one slide up on the screen… Because I think it tells the whole story on this company.

As you can see – the number of agents has shot up from a few hundred to 15,000. Including a 113% burst in the past year. And it stands to reason that when you have that many highly-motivated folks selling… You’re going to bring in a ton of money. And that’s exactly what happened. Revenues shot up 216% in the last twelve months – to $397 million. I think earlier you compared this kind of growth to a snowball rolling down a hill… |

| Brenton: | I did. |

| Jim: | Well, I think that’s spot on in this case.

It has no debt holding it back from growing even further. And the executive team has proven they’re capable of repeating their success over and over again. |

| Brenton: | According to my research, they also own over 60% of the company too. |

| Jim: | That sounds about right. And again, it’s not a bad thing.

Because it means these folks have a substantial financial interest in keeping things moving forward. |

| Brenton: | Substantial is right. The CEO has hundreds of millions of dollars at stake.

And despite the numbers, it’s putting up… It’s still a virtual secret too. Unlike Netflix which has over 70 analysts covering it… this company is only being watched by six. And they don’t work for big companies like Morgan Stanley or T. Rowe Price. |

| Jim: | Well, I doubt it will be much longer until the Morgan Stanley’s of the world catch on…

I mean, you simply don’t put up the kind of numbers this company does without getting the attention of the big boys. And when that happens the days of it trading for under $12 will be gone for good. |

| Brenton: | So the time to buy is now. |

| Jim: | Absolutely. As far as I’m concerned, every day you don’t hold shares from this point on will cut into any gains you could potentially see. |

| Brenton: | Ok. Thanks Jim.

I know you’ve put all the details on each of these investments in your report, “The Three Best Stocks For 2019 And Beyond.” Do you have anything else you’d like to add before we show folks how to get a copy? |

| Jim: | Well, since you asked…

I’m putting the finishing touches on another report now that features a tiny marijuana branding company. |

| Brenton: | A marijuana branding company? We’re getting tight on time but that sounds interesting. Could you take just a minute or two and paint us a quick picture. |

| Jim: | Well, as you know marijuana has dominated the news lately…

And that’s little wonder when you see the numbers being tossed around. Fortune magazine says the U.S. market could reach $47 billion in the next few years… And Grand View Research says it expects worldwide marijuana sales to top $146 billion by the end of 2025. |

| Brenton: | That’s extraordinary considering the wine market is about $65 billion… or that cigarette sales clock in at $77 billion. |

| Jim: | It is. And this explosive growth has created a once-in-a-generation opportunity.

Because unlike the wine and cigarettes markets which have been around for decades and are dominated by massive companies… The marijuana market is the wild west. |

| Brenton: | So there are no established brands like Guinness or Gillette? |

| Jim: | Not at all. And that’s where this cutting-edge company comes in. It’s literally building the brand blueprint this market lacks…

And it’s doing it exclusively in California. |

| Brenton: | Why just one state? |

| Jim: | Well, the idea is if you can win the $3 billion California market you can roll out that structure to other states… |

| Brenton: | And Canada too I would assume. |

| Jim: | It’s just starting to work its way into Canada now. And it’ll be able to use the platform it’s building there to conquer any other country that legalizes pot too. |

| Brenton: | So it’s literally creating the Coke’s and Molson’s of marijuana. |

| Jim: | That’s exactly right. Which is why I believe the payoff could be immense. |

| Brenton: | Could it rack up gains of 2,500% like Canopy Growth did? |

| Jim: | Well, considering Canopy’s jump came largely from the news that the alcohol titan Constellation Brands took a multi-billion stake in them…

I certainly wouldn’t rule it out. |

| Brenton: | Ok Jim.

Your new report will have all the details right? |

| Jim: | Yep, it’s called “The Tiny Pot Stock That Could Make You Rich.”

And it covers everything you need to know about this opportunity. |

| Brenton: | Is there anything you want to add before we wrap this up? |

| Jim: | Just that this is an extremely time-sensitive situation.

The company released its third-quarter financials a few days ago and things are accelerating at a breathtaking pace. Revenues jumped 89% from the quarter before… And they’re up 790% in the past year. It’s distribution platform now includes 486 dispensaries. It closed a new acquisition. And it is sitting on over $75 million in cash that it can use to fund even more growth. Which means the days of it being a sub-$10 stock are numbered. |

| Brenton: | Sounds like it’s critical for folks to get their hands on this report as quickly as possible.

Now as you can imagine… the research that went into finding four opportunities that could turn $10,000 into $110,000 – is time-consuming. And expensive. In fact, as Jim mentioned earlier, he spent nearly $120,000 putting his system together. So I can’t just give the names these companies away. Instead, I’m making them available to everyone who joins our top-tier research advisory today. Jim could you tell us a little more about it? |

| Jim: | Sure, it’s called the Radical Wealth Alliance.

And it’s home to my GEAR system. But it’s also home to the proprietary systems of some of the country’s most renowned investors like Dr. Stephen Leeb, Robert Rapier, and Jim Pearce. |

| Brenton: | So you’re not the only analyst working on this project then? |

| Jim: | No. This is a total team effort.

All of Investing Daily’s analysts are involved. Which means you’re getting access to nearly 200 years of hardcore investing experience. And each month one of us will send you an email with the details on a new opportunity. Inside you’ll find a full write-up on a company that could help you make up to 1,000% or more. |

| Brenton: | So your team delivers 12 recommendations each year? Why not more?

I mean, we’ve covered more than a dozen so far in this presentation… |

| Jim: | It’s really a matter of quality.

I mean think about it… what if we put out four recommendations each month. Are folks going to have enough money to invest in 48 different companies? And even if they do, are they really going to? |

| Brenton: | Probably not. It would get a little overwhelming. |

| Jim: | Right. So then it becomes a matter of picking what you hope are the best ones.

That’s EXACTLY what we didn’t want. So we only release one a month. That way you know you’re getting the opportunity we believe holds the most profit potential. |

| Brenton: | I get it. And I think it’s worth pointing out that everyone who joins today gets your reports which include the four companies we just covered too.

So, in essence, they’re setting themselves up to see 16 opportunities that could help them turn 10,000 into $110,000. Which would add up to over $1.7 million in total? |

| Jim: | Right. I just want to point out one more time there are no sure things in investing.

So you shouldn’t bet the proverbial farm on these picks. |

| Brenton: | Agreed. And the truth is, you don’t have to when the gains are so dramatic…

Take the 2,463% profit Booking.com delivered for example. A $10,000 stake would have multiplied into $256,388… Which is an exceptional amount of money. But then again, so is the $38,458 windfall you would have made on a small $1,500 investment. |

| Jim: | Yep. I don’t know a soul who wouldn’t be tickled with making that kind of money. |

| Brenton: | Me either. And call me crazy Jim… but I’m going to go out on a limb here and guarantee that anyone who joins the Radical Wealth Alliance today will have a chance at 1,000% profits in the next year.

And if they don’t, you and your team will work for them free of charge for another year. |

| Jim: | So if they only see gains of 999% we’re still on the hook…

Even though that’s enough to turn $10,000 into $109,900? |

| Brenton: | Yep. A promise is a promise.

And there’s no fine print with this guarantee. If our team misses the mark just call our VIP service line. And we’ll add another year of Radical Wealth Alliance to your account free of charge. Most publishers wouldn’t dare make a promise this bold. And the reason for that is simple. They don’t have access to the proprietary programs our analysts use… Including Jim’s new GEAR system. Remember, Jim designed his system for folks looking to invest in companies like Salesforce.com which returned over 1,054%…

Sirius Radio which delivered 1,481%…

Exact Sciences went up over 1,053%…

Regeneron Pharmaceuticals jumped 2,041%…

Canopy Growth surged 2,547%…

Incyte shot up 3,108%…

And United Rentals exploded for a 3,499% gain…

With that kind of potential Jim, you could easily charge $25,000 or more to get access to the Radical Wealth Alliance. |

| Jim: | I could. But I’d never dream of doing that.

I’ve made enough money to retire 17 years ago at the tender age of 37. I have enough to travel the world. Provide my family with anything they could ever need… or want. And live the rest of my life in comfort. So at this point, my goal is to help other people build their own fortunes. And I think it’s safe to say the rest of the team feels the same way. Which is why we’ve set the retail price for Radical Wealth Alliance at only $5,000 per year. |

| Brenton: | That’s still not cheap. |

| Jim: | I guess it’s a matter of perspective. This service was designed for people who are committed to making massive sums of money.

Plus, we’ve found over the years, that the folks who have the most success with a program like this are serious enough to put some real skin in the game themselves. And are ok with the fact that there are no refunds after you join. There are no tire kickers allowed. You’re either in. Or you’re not. |

| Brenton: | I think everyone would agree that’s fair.

It doesn’t take a rocket scientist to figure out if you look at the membership fee as an investment in your financial future – like you should – the returns you’re setting yourself up for are staggering. Especially considering a $500 stake in each of the 21 examples we covered today would have you sitting on over $190,000. At the same time, I also know a $5,000 price tag may put Radical Wealth Alliance out of reach for some folks. So I’d like to knock it down to only $2,495 if you’re ok with it. |

| Jim: | I think the team will be perfectly fine with that.

In fact, I’d like to take it a step further Brenton. We called today’s event the Total Profits Summit because of my desire to help people milk every penny they can from the market. But it just occurred to me… A lot of viewers probably don’t have access to an options program… So I’d like to give everyone who signs up for Radical Wealth Alliance now a membership to Velocity Trader too. |

| Brenton: | Let me get this straight. You want to give away a one-year subscription to your service that’s delivered gains of over 12,000%…

The same one that we ask people to pay $3,000 a year to be a part of? But what if they don’t want to trade options? |

| Jim: | Then they don’t have to use it.

Look, there’s plenty of guys out there that buy pickup trucks with hitches who will never tow anything. But they still enjoy the comfort that comes from knowing it’s there if they need it. That’s all I’m trying to do here. To give folks access to every avenue I’ve come up with to make money. Whether they take advantage of it or not… that’s up to them. |

| Brenton: | Well, considering you’ve produced gains of nearly 10,000% in the past two years without a single loss it would be crazy to not try it out at least. |

| Jim: | I think so too. But again, it’s free. So if you don’t… no harm, no foul. |

| Brenton: | Ok. So that’s a total savings of $5,500.

We’ve never offered so much for so little before. But you know what… I want everyone who tuned in today to start 2019 off with a bang. So I’m ok with it. As long as folks who take us up on this deal commit to investing some of that money in the opportunities they’ll find in your reports. |

| Jim: | Great. I think that’s perfectly reasonable. |

| Brenton: | Well, Jim… I know I promised I’d only tie you up for about 45 minutes…

And it looks like we’ve run over. So before I cover everything that comes with this historic deal… I just wanted to thank you for your time today. It’s been amazing. |

| Jim: | My pleasure Brenton. Thanks again for putting on the Summit. |

So as Jim makes his way out of the studio, let’s take a moment to review everything you get when you become a Radical Wealth Alliance member today.

First and foremost – within minutes of joining we’ll send you the two reports we promised.

Inside you’ll get the full details on the four companies that passed Jim’s stringent GEAR screening system.

Each is poised to soar up to 1,000% or more.

And they’re the perfect way to kick off your moneymaking efforts this year.

Then, once a month, you’ll get an email alert with details on a new profit opportunity that’s been fully vetted by our team of analysts.

Then, once a month, you’ll get an email alert with details on a new profit opportunity that’s been fully vetted by our team of analysts.

And it will give you the chance to turn $10,000 into $110,000.

Maybe more.

You also get flash updates.

Whenever something new happens with one your positions – or it’s time to sell for a big profit – you’ll get an email letting you know what’s going on. And what to do next.

Best of all – thanks to smartphones, tablets, and Wi-fi you can even stay up to date when you’re away from your computer.

Best of all – thanks to smartphones, tablets, and Wi-fi you can even stay up to date when you’re away from your computer.

You’ll also get passwords to unlock the private Radical Wealth Alliance and Velocity Trader websites.

Inside you’ll find a host of valuable tools including Start-Up Guides, Video Training Series, and full portfolios.

But according to current members, the most popular thing you’ll get by far is direct access to people who can help you if you have questions.

Look, I don’t care if you’re just starting out investing…

Or whether you’ve been doing it for decades…

Everyone needs help on occasion.

And you’ll always get it on our member forums.

In fact, Jim and the rest of our analysts are so committed to your success, that if you ever do post a question…

You might hear directly from them with an answer… provided you weren’t asking for personalized investment advice.

I’ve been in the publishing business for a long time now. And I can tell you without hesitation getting support like this from analysts like Jim Fink – is completely unheard of.

But here’s the thing.

If you want access all these valuable features…

Including the two free reports that could help you make up to $440,000….

You’ve got to make your move now.

I’m only letting people join Radical Wealth Alliance for 24 hours to start.

And based on response I’ll decide whether to keep the doors open…

Or close them for good.

I understand that doesn’t give you a lot of time to make your decision.

But the truth is, if you haven’t reached for your wallet yet, the Radical Wealth Alliance isn’t right for you anyway.

And please be aware, due the fact that you’re getting $8,000 worth of research for only $2,495…

Only 500 people can take part in this deal. Total.

When we hit that number, we’re immediately closing down the order page. No exceptions.

Considering we’re expecting about 10,000 people to watch this presentation…

This is probably going to be your one – and only – chance to join.

To see all the details on this strictly-limited opportunity, simply click the big blue button at the bottom of your screen now.

Remember, Radical Wealth Alliance is a VIP trading service run by Jim Fink and our team of experts which have nearly 200 years of investing experience.

And when you join now you’re covered by my promise that if they don’t show you gains of 1,000% in the next year…

We’ll extend your membership for another year free of charge.

To review all the details on this unprecedented deal…

And to lock up your spot in the Radical Wealth Alliance…

Click the blue button below now.

This is Brenton Flynn signing off.

Thanks for watching,

Brenton Flynn

Publisher

Investing Daily

And even 32x your money on Incyte.

And even 32x your money on Incyte.