Discovered: $26 Billion

Treasure Trove 48 Miles North

of the Arctic Circle

Move on this tiny $2 company today

and you could walk away with $312,400

This might sound weird, but hear me out…

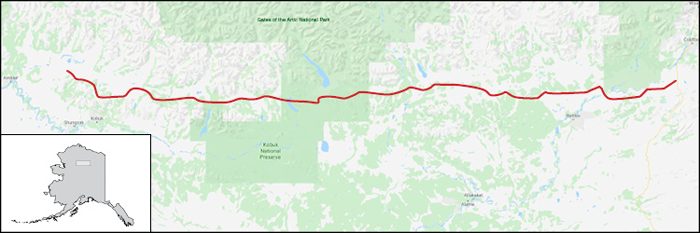

Because there’s a strange new road being built in Alaska that could make you a lot of money.

It’s 211 miles long and is going to cost $430 million. About $2 million per mile.

But the odd thing is that this road literally goes nowhere.

Take a look…

The nearest town is 168 miles away.

It’s not going to a river… or to an airport.

No, this road is heading straight to a massive deposit of a substance that is critical to our way of life.

It’s not gold, silver, platinum, or lithium. It’s not one of those strange rare earth metals, either.

It’s more important than any of them.

Without it, we’d have no smartphones, TVs, or air conditioning. Or microwaves. Or even Wi-fi.

We also need this resource for airplanes, trains, cars, trucks, and ships, too.

In fact, the world needs 24 million tons of this crucial material a year to just keep everything humming.

Since the dawn of civilization, people have relied on it to make their lives better.

The ancient Egyptians performed medical operations with it.

Moses used it to cure deadly snake bites. (It’s in the Bible, in Numbers 21:4-9.)

In 480 BC, Greek soldiers used its remarkable powers to sink the Persian fleet and save their country.

Paul Revere relied on it to help the Patriots win the American Revolution.

Thomas Edison needed it for his most important inventions, including the telephone. (He was so desperate for the stuff, he dug a mine for it right on the grounds of his New Jersey office park.)

Henry Ford couldn’t have made his first Model T without it, let alone roll millions more off the assembly line.

And We’re Still Finding New Uses for this

Miracle Metal Today…

IBM uses it to create the world’s fastest computer chips.

Hospitals use it to kill 99.9% of deadly MRSA “superbugs.”

The National Security Agency wraps its buildings in it, to protect its spies from snooping.

It’s a crucial part of the Global Positioning System, the backbone of worldwide commerce and navigation.

It’s all over your house, in your refrigerator, your washing machine, your hairdryer… you name it.

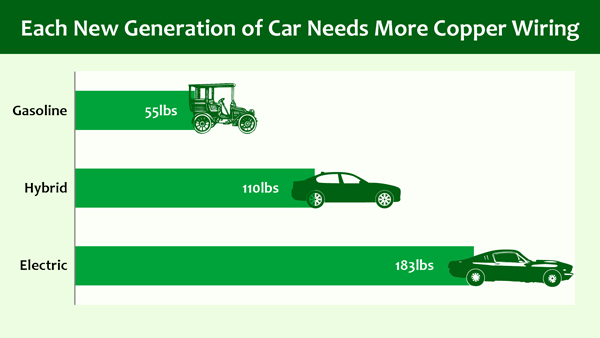

Your own car contains a staggering 50 pounds of this wonder stuff.

And new cars are going to need even more—about 180 pounds each.

That’s why every major car maker is scrambling to secure supplies. Because as you’ll see in a minute, they’re going to need a whole lot of it to survive.

And that’s a problem, because most miners are having trouble just maintaining current production levels.

Meanwhile, it’s getting harder and harder to find new deposits.

The low-hanging fruit was plucked years ago.

Old mines are running dry… and 4% of the world’s production capacity falls off the table each year.

And the few new mines being developed are nowhere near as rich as existing ones.

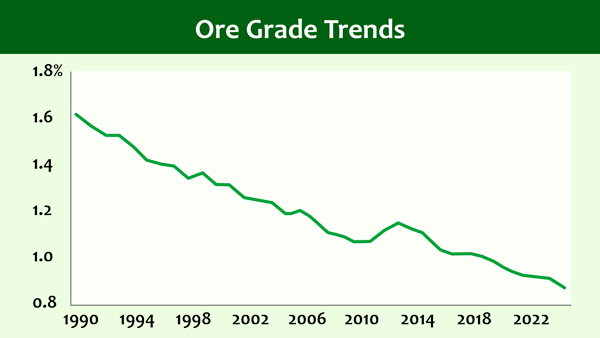

A graph of ore grades—the amount of metal you get from every ton of ore—looks like a playground slide. They have been dropping for years.

According to Mining Intelligence, the average ore grade of projects now being developed is 26% below today’s producing mines.

Which means instead of getting $1 of this metal out of every ton of ore… you only get 74 cents worth. So you have to mine 35% MORE to get the same amount.

That means 35% more labor, 35% more electricity, 35% more gas, 35% more equipment, 35% more trucks to move it all.

Which makes it all more expensive….

For the miner. For the carmakers. And ultimately for all of us…

Because it is in just about every modern convenience we use.

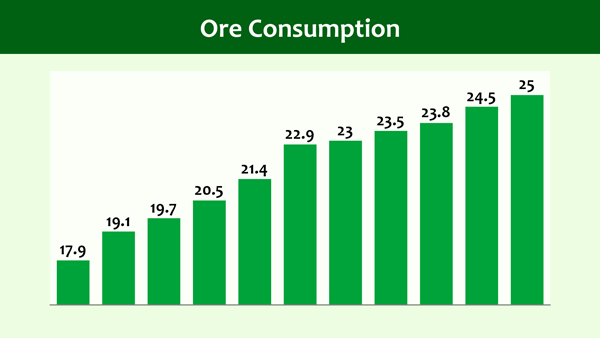

Every year for the past decade, the world has gobbled up more and more.

The consumption chart looks like a staircase…

Last year, the world consumed 23.8 million tons of the stuff… but produced just 21 million.

Next year we will need 24.5 million.

By 2027, the world will be soaking up almost 30 million tons a year.

And by the year after that, the economic forecasting firm Wood Mackenzie predicts we will be 10 million tons short. That’s 10x the annual production of the world’s biggest mine.

At that rate, the world’s known reserves will be 100% depleted long before we run out of oil, coal, natural gas, or uranium.

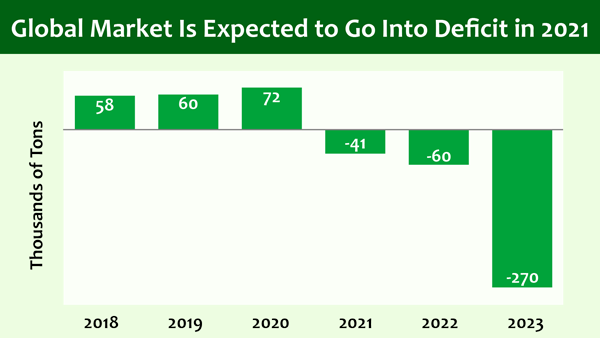

We already use more than we produce… putting us upside down in supply and demand.

We make up the difference by recycling and dipping into rainy-day reserves.

The reserves sitting in the London Metals Exchange have plunged by more than 60% since 2013.

Basically, the market is walking a tightrope…

Right now, the entire world is running on a 10-day supply, held in warehouses around the globe.

You don’t need a PhD in economics to figure out that when the supply of something we NEED for thousands of life’s necessities is shrinking…

And demand is exploding…

That prices are going to SOAR.

So it’s pretty clear why this “road to nowhere” actually makes sense: Because it’s heading straight to four million tons of this desperately-needed metal.

Outside of the violent and war-torn Congo, there is no other place on earth where it exists in such rich quantities.

And one small company is sitting on the motherlode of it all.

Enough to Last America for Years

It has exclusive mining rights to 350,000 acres packed with so much of this miracle metal that it could supply every buyer in the United States for the next three years.

It’s worth $20.2 billion at current prices. No one else can touch it. And it’s right on U.S. soil.

So there’s no worries of war, corruption, or any of the countless other roadblocks that miners run into abroad.

No threat of crushing new taxes, tariffs, or trade wars. No negotiating with foreign countries… every single ounce is pure American profit.

As a bonus, the company has found another $2.4 billion in zinc, $1.6 billion in gold, $1.2 billion in cobalt, $700 million in silver, and $400 million in lead.

Add it all up and this tiny company is sitting on a $26.5 billion treasure trove.

And the truth is… this is such a resource-rich area that there could be billions more hiding just under the permafrost.

Of course, it’s going to cost a lot to dig it all up. But even accounting for all future expenses, an independent analyst has determined the project is worth nearly $2 billion. Right now, in today’s dollars.

Meanwhile, the company has a market cap of just $270 million—a massive discount to its underlying worth. Translation: This stock should be trading for 6x as much.

So what’s going on here? Why is an asset worth $2 billion going for $270 million?

After all, this is no secret in mining circles. Geologists have known about these massive deposits since 1958.

They’ve helicoptered in and out since the 1980s, drilling boreholes and taking samples.

They’ve helicoptered in and out since the 1980s, drilling boreholes and taking samples.

The most recent appraisal shows that there is $26 billion is up for grabs, just sitting there for the taking.

We know exactly where it is and exactly how much it’s worth… there’s just one big problem…

No one can get to it… because there is no road in or out.

And I don’t care how much treasure you have sitting in the ground, it’s worthless unless you can bring it to a buyer.

And that’s why such a remarkable company has gone unnoticed for so long—and why Wall Street is ignoring its stock.

But that’s all about to change…

Coming Soon… 211 Miles of Gravel to $26 Billion

After five years of prep work, endless meetings, legal wrangling, and multiple permit applications, the wheels are finally in motion to start building a 211-mile road to unlock this trapped wealth and bring it to the outside world.

And it gives you the chance to turn $10,000 into $312,000. I’ll explain that number in a minute.

Things are moving quickly here…

The road needs the OK of the Bureau of Land Management (BLM) because 18 miles of it will run through BLM land.

And from what we hear, we are convinced that they will decide to issue the right of way.

In fact, the BLM is spearheading the entire permitting process. You don’t see that very often. They have already prepared the crucial Environmental Impact Statement (EIS). And the ultimate go/no-go vote could happen any day now.

We think it will be a go. Actually it’s pretty much inevitable, for six reasons:

- Alaska’s development authorities (AIDEA) desperately want this road for the 2,700 jobs it will create in a region with high unemployment. So they are big boosters of this road.

- AIDEA has successfully done this before, when it opened up a road to the nearby Red Dog mine. Red Dog is now the largest zinc mine in the world, producing 10% of the world’s new zinc every year.

Alaska is a pro-development state. Mining is its #1 revenue generator after oil and this project will generate $1.1 billion in tax revenues over its lifetime.

Alaska is a pro-development state. Mining is its #1 revenue generator after oil and this project will generate $1.1 billion in tax revenues over its lifetime.- Governor Mike Dunleavy is a fan of the project. He is married to a woman from a village in the area, and all three of their children have worked at the nearby Red Dog mine.

- It won’t cost taxpayers a cent. In fact, this historic project will actually generate $34 million a year in tolls for the state, all paid for by the mining companies that use the road. So there won’t be any blowback from citizens worried about footing the bill.

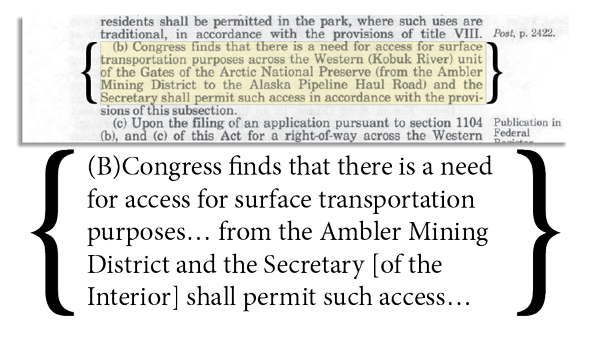

- Finally, the U.S. Congress itself has gone on record supporting a road in this area of Alaska. It’s in public law 96-487:

Once AIDEA gets all the permitting, we believe they will move fast on this project.

Again, the permitting process has been five years in the making–which as you may or may not know is lightning-quick in the mining business…

And it’s all coming to a head.

The final decision is expected by the end of April 2020.

But I wouldn’t wait that long to make your move…

Because like any project this monumental…

Word is bound to leak out. And when it does, people are going to jump all over this opportunity.

If It’s “Thumbs Up”…

Some Smart Investors Are Going to Get Rich

I mean think about it… a “yes” vote will unlock an incredible amount of wealth.

And while a “no” vote is certainly a possibility… it’s one that gets further in the rearview mirror with every passing day.

Because there are too many powerful forces pushing in the same direction on this. And too much profit sitting there for the taking.

The governor wants it. Congress is on record supporting it. The locals are desperate for the high-paying jobs. There won’t be any taxes or cost to anyone in Alaska so no one should object on those grounds.

Plus this mine is located in the U.S. so there’s no political risk.

Bottom line, this isn’t in the Congo—the road will be built.

And when it is, it will open up a massive new supply of the most important metal on earth: COPPER.

Yes, copper. The first metal man ever used.

Copper is the most important metal on earth because it’s the most useful metal on earth.

It has been making our lives better for more than 10,000 years.

There’s nothing else quite like it…

It is malleable and ductile. It conducts heat and electricity like a charm. It is indispensable in electronics, construction, and medicine.

And it’s virtually indestructible…

The copper plumbing inside the Pyramid of Cheops still works after more than 5,000 years.

Over 300 generations of humanity have used it for everything from simple tools to putting man on the moon.

It’s also the only metal the world needs more of every year.

So that’s why this new road is going up. Plain and simple.

It’s almost guaranteed to make a few smart investors rich… and I know a way you can get in on it from the comfort of your armchair with one stock.

The beauty of this situation is that you can make a lot of money before they even break ground on the road.

Because as soon as word gets out that the road is going through, Wall Street analysts are going to be tripping over themselves to green light this tiny stock.

Currently selling for around $2, it could easily double, jumping to $4 in a flash.

And if inflation ticks up, the value of the metal in the ground will skyrocket.

Every 1¢ Move in Copper Adds $78 Million

to this Treasure Trove

That’s how massive this discovery is.

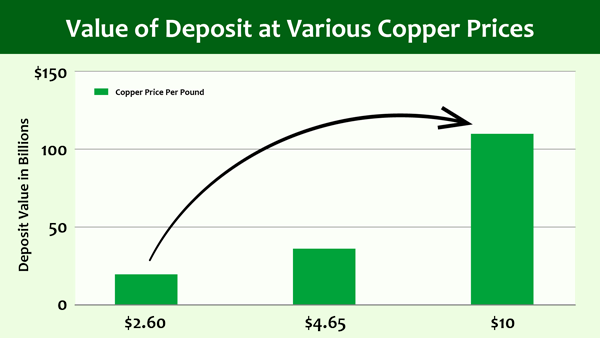

Every single penny that the price of copper moves up adds $78 million to the value of these deposits.

Let’s run a few numbers to show you what this could mean for us…

Right now, copper is trading at about $2.60 a pound. If copper inches up to $2.95 lb, where it was at just a year ago, this company will be sitting on an extra $2.7 billion in bonus wealth.

If copper revisits its most recent high of $4.65, the value of this company’s copper will hit $36 billion. That exceeds the market cap of 95% of the stocks in America.

But that could be just the beginning…

Mining stock analyst Leigh Goehring predicts that electric cars are going to need so much copper that it could hit $10 a pound.

He makes a good point.

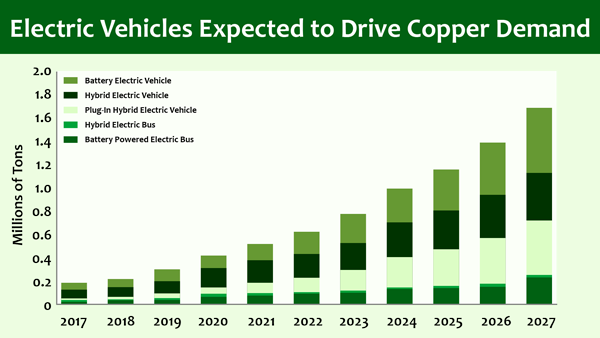

Electric vehicles are HUGE copper gobblers.

There is almost a mile of copper wiring in every electric engine. Put it on a scale and it weighs 183 lbs.

That’s almost four times more than what’s in gas-powered vehicles.

So every new electric car that rolls off the assembly line uses up a bit more of the world’s remaining copper… which adds to the pressure under prices… and to the tailwind behind any company sitting on untapped deposits.

I don’t think most people realize what a huge deal electric vehicles (EVs) are becoming.

They’re not some feel-good fad for granola-eating tree-huggers. Far from it.

Electric Cars Are Taking Over the Car Business

(and They Need a LOT of Copper)

The fact is, they’re taking over the car business…

According to Bloomberg, 54% of ALL new cars sold will be electric by 2040. That’s over half, just 20 years from now.

This is shaping up to be one of these rare industrial megashifts that build lasting fortunes for investors who see it coming.

Nissan, BMW, Ford, Chevy, Kia, Porsche, GM, Toyota, Volvo, and Volkswagen are all ramping up EV production.

But the real action is in China. The Chinese are buying more electric vehicles than the rest of the world combined.

In 2018, EV sales jumped 83% there. More than half of all electric vehicles now on the road are in China.

And that number is going even higher, because China is banning new auto factories unless they make electric cars.

In fact, China is planning to outlaw gas-powered vehicles completely.

Germany wants to follow suit in the next decade.

England, France, and India won’t be far behind either.

And eight more nations, from Sweden to Sri Lanka, plan to do the same.

Two things are crystal clear from all this: electric vehicles are going to dominate the future of the auto business… and we are going to need a heck of a lot more copper.

The key players aren’t waiting around for these rules to kick in…

The mad dash to lock up copper supplies is happening right NOW.

Car makers are already feeling the squeeze.

Tesla’s global supply manager says they’re heading toward a serious shortage in the copper they need.

At a recent shareholder meeting, Elon Musk said his company might have to start mining copper itself.

Musk isn’t kidding. Because without copper, the shift from gas-powered cars to EVs will screech to a halt. And that would be the end of Tesla.

The only remotely plausible substitute for copper is silver. But it’s more than 100x more expensive. At $18 an ounce—vs. copper at 16 cents an ounce—it’s really no substitute at all.

Look, I realize there’s no law saying the world absolutely has to use more copper every year. But unless people are willing to go without new cars, computers, and cell phones, there’s no way around it.

So barring a global economic collapse, I just don’t see demand dropping off.

And in the face of diminishing new supplies, it’s entirely realistic to see copper reaching $10 a pound. At that juncture this company’s proven reserves would shoot up to $110 billion.

That’s when we’ll see this stock blow through $10 a share.

If that sounds unrealistic, I assure you it isn’t.

Keep in mind that the mining business is extremely leveraged.

Once you cover your fixed costs, every bit of increase in the price of the metal is pure profit.

That’s why when copper moves even a little, copper stocks surge… and make huge gains for investors.

When Copper Moves a Little…

Copper Stocks Move a LOT

I’ve seen it again and again…

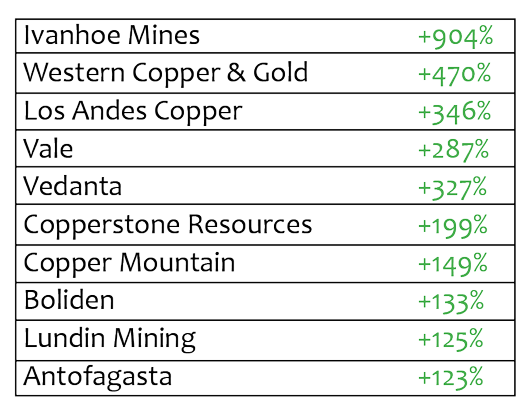

In 2016 copper was up 18%. But copper miner Ivanhoe Mines jumped 316%—17 times more than the move in the underlying commodity.

That same year Vale, another big copper miner, jumped 133%… Oroco rose 100%… and Rio Tinto rose 68%.

By the following April, copper was up 27%. Not a huge move, but copper stocks absolutely exploded—especially the small early-stage outfits like the one I’m talking about today:

These 10 copper plays shot up an average of 306%… quadrupling their shareholders’ money.

Even though copper was up just 27%!

That’s 11 times more than the move in copper itself.

Just think about it for a second…

If startup copper stocks quadrupled in a wimpy bull market like that, imagine what they’ll do when copper really moves.

If Leigh Goehring is correct, and copper hits $10 from today’s $2.60… I think you’ll see this $2 stock bounce to $10… then to $20… and quite likely keep going.

You just saw how a group of copper stocks moved up 11 times higher than copper itself…

So if copper moves from today’s price to $10 (a 284% gain) and stocks rise 11x more than that, we’re looking at a possible 3,124% gain here.

That would push this $2 stock up to $60.48… and turn $10,000 into $312,400.

Putting a few thousand bucks into this stock could buy you a dream vacation anywhere you want.

You could even take cruise to Alaska… and wave toward the mine as you sip champagne on deck.

And that’s just based on what we know is in the ground at this point.

Every time the company conducts another drilling test, they find more wealth in the ground.

It’s like they’ve stumbled upon the gift that keeps on giving.

And they’ve only prospected a tiny fraction of their acreage. Who knows how much they will discover once they survey it all?

After all, the mineral belt they control is 70 miles long.

They’ve analyzed just two sites and have already found billions in wealth in the ground.

I’m betting they will find plenty more, because in geological formations like this one, the mineral deposits tend to come in clusters.

There’s a formation just like it in Spain with 90 mines.

That’s why I think the profit projections I’m sharing with you could double or triple by the time this first mine is up and running. And the money could keep flowing for decades.

The nearby Red Dog mine has been producing since 1989 and is going to keep operating until 2031. That’s a 42-year run… during which they have already extracted $77 billion in wealth from the ground.

The new mine I’m telling you about now is projected to run for 21 years… and like any good copper mine it could spit out money for a long time…

How much could this be worth to you?

Well, Southern Copper listed on the NYSE in 1996 at $16.25 a share.

And anyone who bought 1,000 shares and held on is now sitting on $678,790. That’s a total return of 4,048%. Plus they’re getting $31,030 in dividends a year. Almost twice as much as they paid for the stock to begin with—every year!

That’s the potential this new copper play gives you.

It’s Time to Follow the Money—

Because Insiders Are Piling In

We all know that nothing in life is guaranteed… and this opportunity is no different. It’s true what they say, all investments carry risk. But the people closest to this new copper prospect believe in it so much they’re snapping up shares at a breakneck pace.

The longtime CEO, who led this company for 15 years and just retired, has picked up 2.8 million shares—worth about $5.6 million. And he bought them all on his own. They weren’t gifted to him as a stock option or bonus.

I don’t have to tell you, when the man who runs a company bets millions of his own personal money on an unfolding situation… the outcome is all but certain.

I mean think about it: he knows things that you, I, or anyone outside the tight inner circle could NEVER know…

And he’s not the only insider jumping on this…

The new CEO, who ran the largest zinc mine in the world for three years, and who has a ton of experience in Alaska, is being paid entirely in company stock. That’s a pretty good clue that he believes 100% in this project.

I wouldn’t bet against this man. The last copper company he ran was bought out for $1.8 billion.

And so on down the line…

The CFO bought $279,800 worth of shares in September, bringing her total holdings to $1.74 million. The VP just bought 6,000 more shares for his personal account. And he said he wanted to sell his house to buy more.

You can’t blame them for going all in… because the projections here are fantastic.

The project will throw off $450 million a year and pay for itself in less than three years at current metal prices.

At $3 copper, which is just a bit higher than today, the payback period drops to two years.

It’s almost unheard for a mine to pay for itself so quickly.

The key here is that it’s an open pit mine. Most copper mines are underground.

That’s a huge advantage because it’s so much cheaper to mine above ground than below it.

Looking at all these numbers, there’s no doubt that this project would have been developed years ago if there had been any way of getting to it.

Now that the road is coming into place, it’s time to make your move.

The tailwind behind copper prices only adds to the payoff you could see.

The “Big Boys” Are Bullish, Too

The big bankers on Wall Street don’t cover this stock. It’s too small. But they do follow copper, and they are extremely bullish.

Morgan Stanley says the “stars are aligned” for copper.

Citigroup and Goldman Sachs are copper bulls, too.

Goldman Sachs has gone on record saying that copper prices may be “unimaginably” high in three years.

Billionaire mining executive Robert Friedland says “You’re going to need a telescope to see copper prices in 2021.”

That’s not in 2025… or 2030, folks…

2021 is less than a year away.

Here’s one more thing that’s pretty telling…

Unlike virtually every other junior miner out there, this one has $19 million in the bank and zero debt.

So the resourceful team running the show won’t have to sell more shares to raise cash and dilute your stake.

They don’t want to give up a single share of this fantastically rich mine if they don’t have to.

I mean it’s extraordinary, because…

The Copper from this Mine Is Almost Free!

The average grade of copper ore around the world today is about 0.6%. So for every ton of rock that’s dug up, crushed, and processed, you get about 11 pounds of copper.

But this project is a different beast. Geologically-speaking, it’s a freak. The ore is so rich that it is projected to produce at about 5% copper—almost 10 times richer than average.

It’s so high-grade that total projected costs for digging up, refining, and transporting the copper are just $0.63 per pound.

That’s less than a third of the average global cost of $1.90 per pound.

Even super-efficient Codelco, the world’s biggest copper producer, has production costs of $1.42 per pound.

But the true cost of copper for this Alaskan project is actually even lower…

When you add in the byproduct revenues from gold, silver, and zinc, its net cost for the copper plummets to 15 cents a pound.

Which means they’re almost getting it for free.

Copper prices could plunge and this company would still make money.

Bottom line, there is extraordinary potential here. And all this good news about the road means it’s getting close.

It’s no doubt why a big Australian miner just poured $145 million into the company in return for a 50/50 joint venture.

That implies the outfit is worth $290 million right now, before an ounce of anything has been pulled out of the ground.

The Aussies recently bought out a similar project for $1.3 billion… giving those stockholders a 50% gain overnight.

But if all we make here is 50%, I’ll be a little upset.

Because I don’t want to see this stock snatched away from us.

Once word gets out that the road is going through, it should light a bonfire under this tiny company’s share price.

We’re looking at a situation where—because of the tremendous upward pressure on copper prices—we could make 10x our money before the company mines its first ounce.

The stock could easily soar to $10. And $20 after that.

One scenario I’m looking at has it hitting $49 and change by 2021.

We might even end up with a 40-bagger, like we saw with Southern Copper.

This gives you the rare chance to capture the kind of wealth that’ll pay for ski trips to the Swiss Alps… cruises in the Bahamas… and still leave you with enough left over to cover college for your grandkids.

Get Started Now for Next to Nothing

With the stock this low, all you need is a few hundred bucks to get started.

The amount isn’t important. What matters is that you make your move before every investor in the world starts barging in.

At around $2 a share right now, you can build a big position for next to nothing.

And you won’t have much competition from other buyers…

Because the company that controls all this mineral wealth is barely known outside of mining circles.

Because the company that controls all this mineral wealth is barely known outside of mining circles.

It trades less in five months than AT&T trades in a day.

So this is a golden opportunity to get in before the crowd rushes in behind you.

I’m telling my readers to get moving on this ASAP.

To make it easy, I’ve prepared an action plan that spells out step by step what to do.

It’s called: 211 Miles to $26 Billion: How to Turn $10,000 into $312,000 on Alaska’s Copper Road.

This report gives you everything you need to know to get started and capitalize on this situation. With your permission, I’d like to give you a copy, too.

You can download my report in a few minutes.

You can download my report in a few minutes.

But first let me introduce myself…

I’m Dr. Stephen Leeb.

If I look familiar, maybe you’ve seen me on CNN, ABC, Fox Business, or Bloomberg TV.

For the past 44 years, I’ve run a boutique money management firm in Manhattan, catering to high-net-worth individuals.

Along the way, I’ve written eight books… each one predicting a major turn in the markets.

In the late ’80s, I released Getting in on the Ground Floor, predicting the biggest bull run in stock market history…

The Dow couldn’t break 1,000 at that point… but I called for “Dow 4,000.”

All the so-called experts thought I was crazy.

But as we all know… the Dow raced up to 10,000 right before the dot-com bubble.

I was on top of that, too. In 1999, I wrote Defying the Market, calling the Tech Crash… a year before it happened.

And by 2006, I already saw the subprime mortgage crisis coming…

In my book The Coming Economic Collapse, I stated that we would see “the vicious circle to end all vicious circles…. Interest rates would likely fall to zero. Government spending would need to reach unimaginably high levels.”

All of which actually happened after the 2008 Great Financial Crisis.

But it’s in commodities and natural resources that I’ve really made my mark.

In my 2005 bestseller, The Oil Factor, I went on record predicting the price of oil would eclipse $150 a barrel.

That was considered absurd in those days. I mean, people were filling up on regular for less than $2 a gallon.

Again, the “experts” laughed me out of the room.

But when oil hit $156 a barrel, they shut up pretty fast.

Then, in my 2012 book Red Alert, I warned of a coming shortage in graphite… and in the following months, prices surged from $1,000 per flake to over $2,500 per flake.

I’m telling you all this so you understand that everything I’ve laid out here today about this situation in Alaska is coming from someone who has made his living on predictions like this for more than 40 years…

I’ve seen firsthand what happens to copper stocks in a bull market.

In Red Alert, I sounded the alarm about how the declining quality of copper ore would mean more work and higher costs for miners…

All of which would eventually show up in rising copper prices.

And again, that’s exactly what happened.

Copper went from about $1.50 to $4.50 a pound… and copper stocks blasted off.

Imperial Metals, for example, surged an astounding 1,114%.

Now… because our copper road stock is an early-stage exploration company highly leveraged to copper prices, the potential here is even greater.

It’s all laid out in 211 Miles to $26 Billion: How to Turn $10,000 into $312,000 on Alaska’s Copper Road.

This report isn’t for sale at any price.

Instead, I’d like to send it to you at no charge as an ideal introduction to my Real World Investing advisory service.

As you’ll see immediately, there’s nothing fancy about how we make money here. It’s basic Economics 101.

When people are clamoring for something and there isn’t enough to go around, you’re being handed a gift-wrapped profit opportunity.

It’s the Best Spot an Investor Can Be In

There’s no stronger position you can be in as an investor than on the selling end of a market that’s desperate for your product…

Supplying people with the critical resources they need to survive: oil, coal, zinc, silver, natural gas, and most dependably of all, copper.

As long as the world keeps growing and people keep having babies, there will always be demand for these raw materials.

It’s all about profiting from scarcity.

Once you burn a barrel of oil or a ton of coal, it’s gone forever. No one else can come along and make more.

Meanwhile, every year 140 million new people are born who need to be fed and sheltered.

All while supplies of virtually every natural resource the world needs are shrinking.

Most people have no idea how close we are to running out of many critical resources.

For example, if we keep using silver at the same rate we’re consuming it today, the world’s known supply will be gone in nine years.

Lead will be gone in eight years.

Indium, which, like copper, is crucial in electronics, will be gone in four years.

This isn’t just theoretical textbook stuff I’m talking about here.

It is making people real money… and you can see it happening right now…

If you look at the biggest movers in the stock market, you’ll see that a huge number have the scarcity angle working for them.

As I put this presentation together, 31 of the 237 metals and mining stocks in the United States have jumped more than 100% in the past 12 months.

That’s 13.1%… which is pretty remarkable considering only 3.5% of other stocks did that well.

So even if you picked mining stocks at random, you were almost 4 times more likely to double your money as other investors were.

That’s just one more reason why I’m convinced that investing in the right miners now will make you more money in the coming decade than you’ll make anywhere else.

I’m not just talking about stocks that outpace the market by a point or two. In Real World Investing, we dig deep for real life-changers. They’re out there, in droves.

Look at how these mining stocks have moved in just the past 12 months:

- Idarado Mining is up 54,900%

- Discovery Gold Corp is up 46,857%

- Atacama Resources is up 2,983%

- Azteca Gold is up 1,650%

- Amex Exploration is up 1,631%

- European Metals Corp is up 3,150%

- Nuinsco Resources is up 2,530%

- Quest Rare Minerals is up 2,267%

- Greenlite Ventures is up 3,025%

But those gains are behind us. Looking ahead, I believe the copper road stock has just as much upside as any of these.

You’ll see why in 211 Miles to $26 Billion… and I’d like to send you a FREE copy today when you take a look at my Real World Investing advisory service. Give me the word and you’ll be getting all this, starting today:

Weekly intelligence reports—I send a streamlined briefing each week recapping the latest developments, what actions to take, and how to profit from them.

Flash-Alert Emails—Anytime there’s an urgent trade you need to know about, I’ll send you a quick-action alert via email or text. My alerts are easy to follow. In a few simple sentences, you’ll have all the information you need to place your trade. You’ll get the name of the stock, the ticker symbol, exactly when to place your trade and price limits. Just hop online to your brokerage account… or phone your broker… and in minutes you’ll place your trade.

Flash-Alert Emails—Anytime there’s an urgent trade you need to know about, I’ll send you a quick-action alert via email or text. My alerts are easy to follow. In a few simple sentences, you’ll have all the information you need to place your trade. You’ll get the name of the stock, the ticker symbol, exactly when to place your trade and price limits. Just hop online to your brokerage account… or phone your broker… and in minutes you’ll place your trade.

24/7 access to my private website—You will get a password to my members-only site. It’s your one-stop hub for all my timely alerts… special market updates… and any other news or updates that could hand you even more profits…. Plus a full archive of all previously published content and advice. No matter where you are or what time it is, you will always have access to my latest move.

Unlimited access to my entire portfolio—Anytime you want to check the price of our stocks, simply log on and you’ll see prices for all our picks. Plus up-to-the-minute buy, hold, and sell advice for every position.

Access to my team (a subscriber favorite)—You’ll get personal attention from my team and me. If you ever have a question or a comment about one of our recommendations, just post it to our Stock Talk message boards, and we’ll be sure to get back to you. (Sorry, we can’t answer questions about your individual investing situation.)

Now, you may be wondering… how much does all this cost?

That’s the best part.

The regular price for Real World Investing is $2,495 a year.

Considering the copper road opportunity I’m going give you today could turn $10,000 into $312,000, that’s a drop in the bucket.

However, if you’re one of the first 500 people to get back to me today, I’ve got a better deal for you.

Instead of paying $2,495 for one year…

You can join for only $1,495.

My Next 500 Members Get $1,000 Off

That’s right… if you’re one of the first 500 people to grab this one-time offer… you’ll receive $1,000 off the regular price.

And the moment you agree to give it a try, you’ll get immediate access to the special report detailing the remarkable copper opportunity in Alaska.

You’ll also have access to every single recommendation I’ve made – and will be making – in Real World Investing… including a handful of picks that are on the verge of major breakouts.

I am so confident that you’ll make money with us that I’m guaranteeing it.

In fact, if you don’t see the opportunity to double your money over the next 12 months…

Simply give us a call and let us know. And we’ll give you an additional year of service on the house.

So go ahead and give Real World Investing a try. Just click on the button below. And – at a minimum – take a look at my research on the situation in Alaska before the week is out.

All of the information I give you – including your copy of 211 Miles to $26 Billion and all of my official “BUY” recommendations – are yours immediately.

But I Need to Hear from You Soon…

The final decision to build the road is going to come down in late January 2020.

We have that date straight from the Bureau of Land Management.

When a regulator gives you a precise date, it usually means they’re serious about making it happen.

But this $2 stock could move well before then.

In fact, the breakout could happen any day now, and when it does, this stock could go vertical…

So if you are at all interested don’t put it off. Don’t watch this stock soar without you.

The moment I hear from you, you’ll get all the details on this unique situation.

You’ll get the name of the company, its stock symbol, and detailed instructions on how to buy it for a small fraction of its real value.

And you’ll see one scenario that would take this $2 stock all the way to $60.48… possibly as soon as 2021.

That’s enough to turn 1,000 shares into $27,800… and every $10,000 you invest into a $312,000 cash windfall.

Of course, to maximize your returns, you need to get in ASAP.

So I encourage you move on this today…

All the details on this company are yours the minute you give me the word.

Don’t sit on this… get in now while the stock’s still so cheap you can pick up a thousand shares for around $2,000.

We could be in for a wild ride, but the upside here is staggering.

Click this button and get started now.

I look forward to working with you.

Thanks, and have a great day.

Stephen Leeb, PhD

Chief Investment Strategist

Real World Investing

PS I’ve just learned that Baupost, the hedge fund with the best stock picking record of the past 30 years, has quietly amassed a huge position in our copper road stock.

The fund is run by Seth Klarman, who has become a billionaire by putting his money into undervalued stocks.

Plus the three insiders closest to the action—the company's CEO, CFO, and VP—are loading up, too.

Any moment, a giant player like Vanguard or Goldman Sachs could swoop in and swallow the remaining shares. Hesitate, and you could miss out completely.

Things are developing fast here… and you need to move on this to give yourself the best shot at maximum profits.

The opportunity is right in front of you. I urge you to seize it today. Simply click the button below to get started now.

Copyright © 2020 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.