Why Dr. Stephen Leeb—New York Times best-selling writer and author of the award-winning book, Red Alert: How China’s Growing Prosperity Threatens the American Way of Life—now predicts…

“Gold at $20,000!”

Here’s how to easily multiply $500 into over $5,000

as China’s secret gold strategy rockets prices all the way to

$10,000… $15,000… $20,000 an ounce.

You must act now to lock in maximum profit potential.

Dear Investor,

Every day deep in the hills of the Qinghai province, an elite unit of soldiers carries out China’s plan for world domination.

In all, the 12 detachments (thousands of men strong) travel throughout the country… scouring the most remote and inhospitable corners of this vast nation.

All in search of gold.

This clandestine military unit is the only one of its kind in the world.

Gold Armed Police sing songs on their way to explore for gold.

They’re dedicated to locating, mining, and protecting China’s natural gold reserves.

They travel in convoys of armored vehicles across rugged terrain. They labor through snowstorms in the Qilian Mountains…

And they battle heat and blinding sandstorms as they detonate explosives in the deserts of Lop Nur…

All in their single-minded quest for gold.

If I could use only one word to describe the mindset of The Gold Armed Police—and the powerful Communist regime that supports them—it would have to be…

Relentless.

But perhaps more importantly for you as an investor, China’s gold grab means something far more crucial…

Tremendous Opportunity.

Hello, my name is Dr. Stephen Leeb

Hello, my name is Dr. Stephen Leeb

In my over 30 years of reporting on investments, I have never seen a better opportunity to multiply your money and grow astronomically wealthy than the one unfolding in the gold markets today.

And over the next few minutes, I’ll reveal the 3 critical things you need to know to bank HUGE profits from this once-in-a-lifetime situation.

First, I’ll reveal how China’s “great wall of deception” will give rise to the next massive bull market in gold…

Second, I’ll prove how China’s insatiable appetite for scarce resources will drive the price of gold through the roof…

And last—but certainly not least—I’ll show you how you could grow rich by grabbing massive profits thanks to this historic situation.

And by rich, I mean opportunity after opportunity for triple-digit gains…

With a few quadruple-digit winners thrown in for good measure.

Think that’s impossible? Well, history tells us it’s not only possible… but quite probable.

You see, when just the right circumstances align—which is happening right now—gold catapults faster than any other investment on the planet.

For example, toward the end of the 1970 to 1980 gold bull market, a collection of selected junior miners climbed more than 23-fold in less than two years.

And what was the event that caused this enormous increase? Scarcity. Pure and simple.

Commodity Shortages Have Minted More Millionaires Than Apple, Microsoft, and Google… Combined!

By commodity scarcities, I mean an extreme shortage of things like corn… wheat… sugar… soybeans… beef… crude oil… natural gas… precious metals… and industrial metals used in manufacturing.

These shortages become so great that supplies don’t meet the demands of the population.

And as a result—prices explode higher.

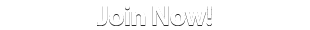

There have been two HUGE gold bull markets in the past 45 years.

Both of which happened during sustained periods of commodity shortages.

I already mentioned the first one, which began in 1971.

Now if you’re like me and lived through the 70s, you probably have some painful memories of the fuel shortages… price hikes… gasoline rationing… and long lines at the pump.

They were everywhere. From California to Pennsylvania. And from Iowa to Illinois.

NO ONE in our country escaped the fallout of gas prices quadrupling when OPEC reduced petroleum production and slashed shipments to the United States.

And no one avoided paying princely sums for staples like cereal and bread when shortages of wheat… corn… and soybeans drove prices through the roof either.

It was a crisis like we’ve never seen before.

Soaring prices drove companies out of business…people out of jobs…and ground our economy to a screeching halt.

But it also created an incredible opportunity.

Because as miserable and scary as it was, the simple truth is…

Crisis situations ALWAYS create pockets of immense profits.

And for forward-looking investors who were bold enough to take advantage of it—this situation was no different.

Here’s proof…

At the start of the decade, the price of gold was below $40 an ounce.

By early 1980 it hit $800 an ounce…

A spectacular twentyfold gain.

While the rest of the nation… and the world for that matter… suffered through ten years of economic disaster, inflation, and unemployment…

Gold investors were making money hand over fist.

And this was far from a one-time event.

Gold is consistently a safe haven and source of extreme profitability during times of crisis.

Let’s look at an example from another decade I’m sure you remember…

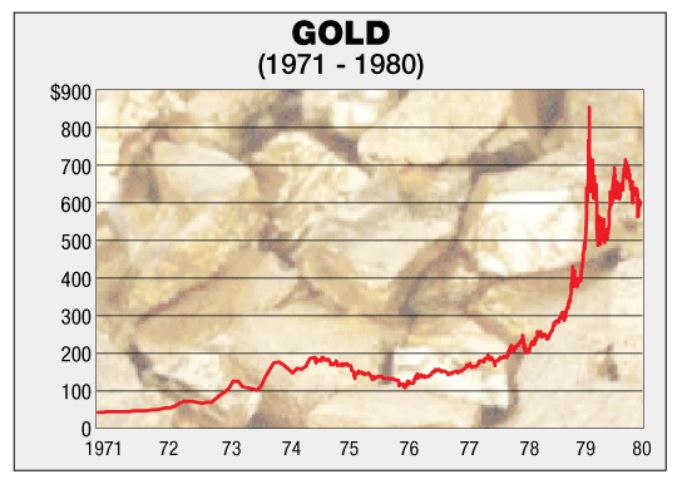

This raging gold bull market launched in late 1999 with gold trading at about $250 an ounce.

And it peaked in 2011 with gold at roughly $1,900 an ounce.

That’s an increase of over 650%.

Which was good enough to turn $1,000 into $7,500… $5,000 into $37,500… and $7,500 into a whopping $56,250.

What was happening in the world during this time that could have affected the price of gold so drastically?

A perfect storm of negative events.

Wall Street finally figured out all the tech whiz kids’ websites were full of promise…

But not profits.

And the minute that happened investors fled tech stocks in droves crashing the market.

During the same time, our country suffered through the terrorist attacks of 9-11…

Wars in Iraq and Afghanistan…

A housing market boom and bust…

The Great Recession…

Investment banks going belly up…

And a doubling of the unemployment rate…

All these events certainly helped push the price of the yellow metal upwards.

But there was something else going on behind the scenes.

You see, while the rest of the world sputtered and struggled…

A new, hungry economic superpower barreled onto the stage the likes of which we’ve never seen before…

Because one country was out-producing… out manufacturing… outbuilding… outperforming… and outmaneuvering… every other nation on the planet.

Including the United States.

I’m talking about China of course.

This once-sleeping giant, which is home to over 1.3 billion people, literally went from being an afterthought…

To an economic superpower.

All in the span of 10 years.

And it still is today.

If you think I’m exaggerating, consider this:

China has the largest manufacturing economy in the world…

Valued at $3 trillion per year, compared to $2.2 trillion for the United States.

It has 102 cities with over 1 million people — a number that is expected to double in the next decade…

And it’s plowing through critical resources—like aluminum, iron ore, and copper—at a breakneck pace just to keep its manufacturing engines humming. And its cities growing.

More critically, there’s absolutely no end in sight to the Middle Kingdom’s ambitions.

Which is why I predict we are at the precipice of a new era of scarce commodities.

One that could propel gold past $5,000… past $10,000… past $15,000… all the way to $20,000 an ounce.

The kinds of gains I envision for gold’s next bull run could turn those 23-fold gains I mentioned earlier into more than 70-fold gains.

Plus, my research shows that 100-fold gains are quite possible for some of the companies I’ve been tracking.

Meaning a $15,000 investment made today in the right company could turn into more than $1 million.

I know that’s a bold statement.

But if you give me a few more minutes of your time, I’ll not only prove beyond a shadow of a doubt why it’s possible…

I’ll show you how to get a free copy of the special briefing I’ve prepared which contains critical details on the ONE company that stands to benefit the most when gold prices skyrocket.

So, let’s get started by backing up a bit and talking some more about China’s Gold Armed Police.

If you’ve never heard of them, you’re not alone.

Most people in the Western world haven’t.

Started in 1979 under the guidance of then-leader Deng Xiaoping, The Gold Armed Police came into existence eight years after the U.S. abandoned the gold standard.

Believe me, the timing was NOT a coincidence.

Deng Xiaoping knew that once the U.S. stopped backing the dollar with gold there would be no turning back the eventual erosion of the dollar’s power on world markets.

He also knew to achieve his ultimate goal of becoming the world’s most dominant economic superpower…

The first step was to become the leading player in the global gold market.

And that’s exactly what happened thanks to The Gold Armed Police.

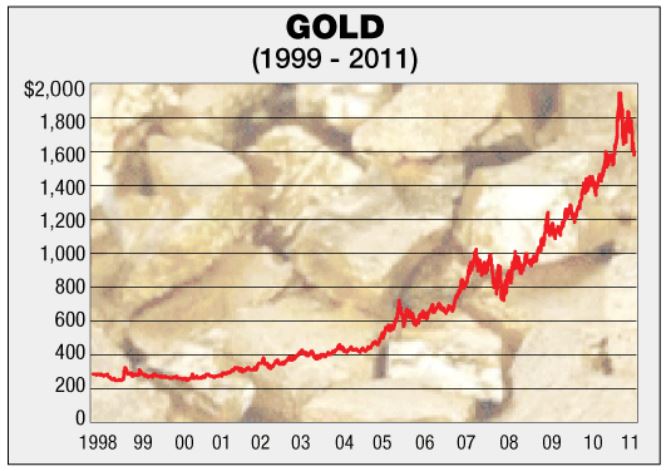

Because since this special unit was formed—it has found more than 1,800 metric tonnes of the precious metal…

Helped China’s domestic mining output soar an astounding 2,970%…

And cemented its homeland as the world’s largest gold-producing country.

In fact, the amount they’ve mined in just the last year alone is enough to completely blanket all of New York City’s famed Central Park in a thin sheet of gold almost 44 times over!

But it’s not just gold mining that’s occupied the Chinese. They’ve been on an enormous gold shopping spree as well.

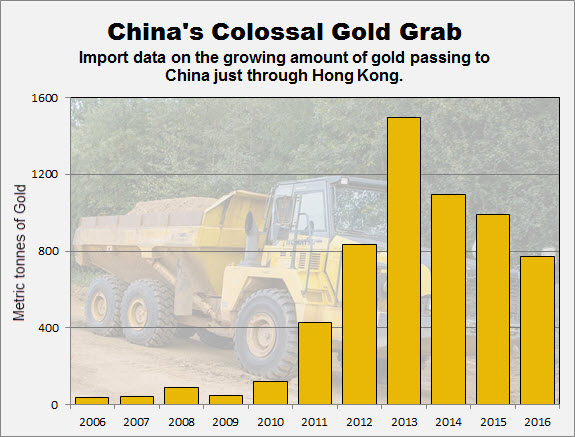

The government is secretive about the total amount it imports into the country.

However, Hong Kong does share the figures of gold imports that pass through its region headed for the mainland.

And the numbers are impressive.

According to the latest data from Hong Kong, gold imports into China have increased over 540% since 2010.

The data shows China went from importing just 37 metric tonnes of gold through Hong Kong in 2006 to importing almost 771 in 2016.

But that’s not the whole story.

For the first time in six years, officials have reluctantly revealed how much gold they claim to have in reserve.

According to the People’s Bank of China, the country boosted its gold reserves by 75% since 2009, stating that it now holds about 1,843 metric tonnes.

However, I suspect the government is severely underreporting the amount of gold they hold in reserve.

Bloomberg Intelligence estimates a more likely figure is TRIPLE what the Chinese report…

Or 3,500 metric tonnes.

Impressive to be sure.

But how will controlling massive amounts of gold lead to their global dominance?

And allow YOU to multiply your wealth 10x or more in process…

To answer this, we first need to understand:

China’s Great Wall of Deception

Part of the government’s strategy—in which it has recently found enormous success—was to have the International Monetary Fund establish the yuan as a reserve currency…

Joining the dollar, the euro, the British pound, and the Japanese yen.

By designating it an SDR (or special drawing rights currency), China is paving the way for the day when the yuan can be used to settle international trade debts.

While it won’t happen overnight, I predict countries will eventually be able to pay for consumer goods… oil… agricultural products… raw materials… just about anything you can imagine using the yuan.

Overthrowing the U.S. dollar as the world’s favored currency.

The Chinese government certainly made no secret that it wants the yuan to achieve this elevated status.

It did keep secret, however, that ultimately China wants to back the yuan with gold.

With this in mind, its decades-long quest to become the world’s largest miner of gold… spurred by its army of energetic Gold Armed Police… begins to make sense.

You see, once backed by gold, the yuan would become not just another reserve currency, but the most important of the reserve currencies.

It would become much more desired than the dollar.

Which I mentioned earlier hasn’t been backed by gold since 1971 when President Nixon killed the link between the dollar and gold.

The yuan would play a critical role in international trade.

Trading partners would see the yuan as a stable currency, one backed by an asset of tangible value.

And believe me, since the financial crash of 2008 exposed all the risks of a U.S.-dollar-based world, doing business in a stable currency is on the minds of world leaders and global corporations alike.

Let’s put it this way: Given the choice of conducting trade in a currency that can be created out of thin air and has no tangible value (such as the U.S. dollar)…

Or a currency that is backed by a commodity of value (such as the yuan when the Chinese back it with gold)…

Which would you choose?

For most countries, the obvious and best choice is a no-brainer… it will be the gold-backed yuan.

All of which leads me to say without a doubt we’ll soon see…

The Death of the Dollar and the Birth of the

Next Massive Bull Market in Gold…

Believe me when I say I get no pleasure in sounding the death knell for the dollar.

While this will be the ideal scenario for the Chinese, it will be devastating for America.

The decline of the dollar will give China’s economy a HUGE edge by making other countries seek to hold the yuan as foreign reserves they can use in international trade…

Just as they were once eager to hold dollars.

And what if I’m wrong?

What if the rise of the yuan doesn’t kill the dollar…

And it settles into just another currency on the world stage that never gets backed by gold?

That’s a fair question.

And it’s a smart question.

The good news is… gold is STILL poised for an astronomical run-up.

One that could allow you to turn every $10,000 invested into $30,200.

And possibly quite a bit more.

Because as we’ve seen, a shortage of commodities is a HUGE factor in creating gold bull markets…

And right now we are entering an age of scarcity unlike anything we’ve ever experienced before.

A few years ago, while doing research for my book, Red Alert: How China’s Growing Prosperity Threatens the American Way of Life…

I was curious to find out what other commodities and resources in addition to gold the Chinese might be stockpiling.

What I discovered was shocking.

Gold isn’t the only resource China has been quietly hoarding for decades.

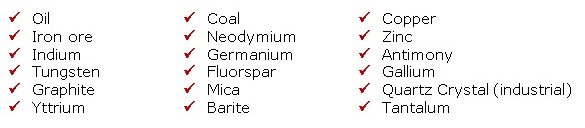

Here’s a partial list of some of the commodities, materials, and rare earth elements the Chinese government has been covertly stashing away (and in many cases, cornering the market on):

Why have they been mining the heck out of their countryside (and many other countries to boot) in search of these rare earths and materials?

Why have they consistently been reducing the amounts they sell and export to other countries—the U.S. in particular?

And why has the government been keeping their stockpiles of these resources in secret locations guarded by their military?

For two simple reasons.

First, because the Chinese know these commodities, materials, and rare earths are scarce.

Like gold, there is a finite amount left to be mined on the planet. For some of these elements, we are less than a decade away from reaching depletion.

And second, the Chinese also know these materials are critical for the survival of a variety of industries and for the survival of entire nations.

For example, let’s take a metal we’re all familiar with—copper.

Copper is needed to build homes, windmills, high-voltage cables, and hybrid cars.

So China clearly recognizes the strategic value of having a ready supply of this metal.

So much so, they paid $3.4 billion for the rights to a deposit located in a former al-Qaeda stronghold south of Kabul, Afghanistan.

For the Chinese, the risk of operating in such a dangerous region is far outweighed by the potential of controlling an enormous source of copper.

Let’s look at some lesser known elements for which China’s monopoly verges on a worldwide stranglehold…

- Neodymium is an ingredient needed by the U.S. military for high-intensity permanent magnets, laser technology and night vision goggles…

- Zinc and indium are critical for U.S. solar energy manufacturers…

- Antimony and gallium are needed for semiconductor manufacturing and the production of small arms and sophisticated military weapons…

- Germanium is vital for the U.S. fiber optics industry, while fluorspar and graphite are needed for energy storage.

I understand when you look at all the maneuvers China is making to dethrone the United States—and consider the fallout—it certainly sounds bad for the U.S. economy.

And the average American.

I’m not going to lie. It could be.

But I’m not here as a forecaster of doom.

Far from it. As I’ve proven to you in the past few minutes…

While scarcity situations certainly have a downside…

For bold, in-the-know investors they also present a massive profit opportunity.

One that could easily make you a millionaire many times over.

Because if gold really does hit $20,000…

I have a briefing I’d like you to have which gives you the details on a company that could help you make over $100,000 on every $10,000 invested.

Having trouble believing gold could soar to $20,000? Well then, let’s do the math…

First, let’s start with the scenario that China is successful in getting the yuan backed by gold.

For the reasons I’ve already outlined, the yuan will then dethrone the dollar and become the favored currency worldwide in conducting trade.

International trade will be backed up by gold held in reserves by central banks around the world.

Just how much international trade are we talking about?

According to the most recent numbers from the World Trade Organization (WTO), international trade is valued at about $39.5 trillion.

So, in the ideal world, that means the central banks would have $39.5 trillion in gold reserves to back up international trade.

However, as you know, we don’t live in the ideal world.

The central banks don’t have anywhere near $39.5 trillion in gold reserves!

In fact, the latest figures indicate they have 29,500 tonnes of gold, which is equivalent to about $1.3 trillion if gold is valued at $1,250 an ounce (the approximate value of gold as I write this).

Now you might assume the central banks better hustle and start acquiring a whole lot more gold to get their reserves up.

After all, in the gold-hungry world dominated by the Chinese, trade needs to be backed by something of value (gold) and not by worthless paper.

But here’s the dilemma: The amount of gold in the world is finite. Most of it has already been mined.

If the central banks could somehow get a hold of every single ounce of gold ever mined…

Including the gold ring off your finger and the gold fillings from your teeth…

It would still not be enough to back one year’s worth of international trade!

All the gold already mined (about 171,000 metric tonnes) is worth approximately $9 trillion if gold’s valued at $1,500 an ounce.

Again, not anywhere near enough to back our $39.5 trillion in international trade.

So, what happens to the price of something when it’s scarce and in high demand?

Naturally it goes up. Fast.

And that’s exactly what could happen to the price of gold in our scenario…

For the central banks to turn their current $1.3 trillion in gold reserves into $39.5 trillion, the price of gold would need to go up over 30-fold.

Which means gold would need to go from its current price of $1,250 an ounce to approximately $38,000 an ounce!

As much as I believe the price of gold will skyrocket in the coming years, this number seems jaw dropping even to me.

A more likely scenario is that central banks will try to beef up their supply of gold through additional purchases.

Realizing they will never be able to back up 100% of international trade with gold because there simply isn’t enough gold in the world to do so…

They might decide to only back up one half of the trade equation—either import or export trade.

So, instead of $39.5 trillion in international trade, the central banks would back up half of that ($19.75 trillion) with their available gold reserves.

The price of gold would still need to go up over 15-fold to approximately $19,000 an ounce!

But that target will likely prove just the start if, as we discussed earlier, accelerating commodity scarcities start pushing commodity prices higher.

These higher commodity prices will automatically boost the value of international transactions, meaning gold prices will have to rise even higher in order to cover that elevated value.

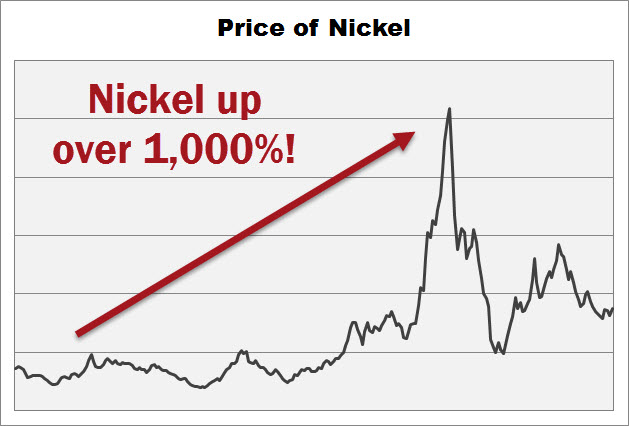

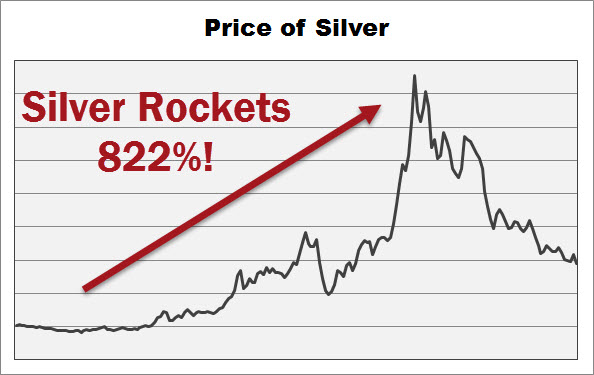

If my projections for gold seem improbably high, the world of precious and base metals has certainly seen their like before.

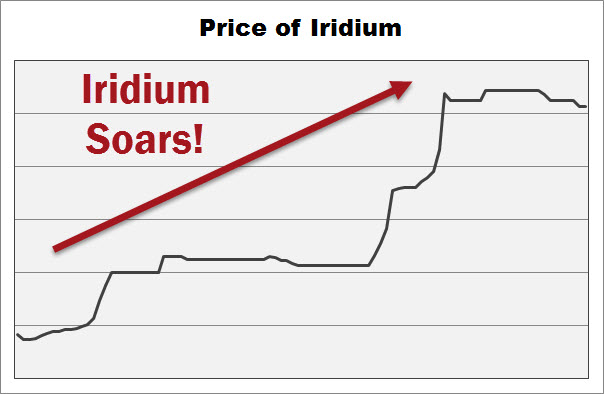

Here we see nickel jumped over 1,000%…

Silver spiked 822%…

Iridium exploded by 625%….

And gold itself rose from around $30 in the early 1970s to $800 in the late 1980s (while some junior gold miners gained a hundred-fold and more) …

So, as you can see, a fifteen- to twenty-fold rise in gold from current levels is far from a fantasy.

But what happens if gold doesn’t go to $20,000?

Can you still make a boatload of money?

The answer is a resounding… YES!

And that’s because of the power of leverage.

You see, if you know how to pick the right stocks with the right timing (which in just a few minutes I’ll prove to you that I know how to do) …

You can make a ton of money from even small moves in the underlying price of gold.

I’ve recommended many of these stocks to my readers that have each skyrocketed when gold went up less than 10%.

Look at these winners I’ve racked up recently…

- One hot gold miner shot up 63.1%...

- A gold-royalty stock soared by 53.8%...

- A miner ETF booked a 62.6% gain...

- While one miner catapulted 149.3%...

The gain from that last trade alone is enough to turn $1,000 into $2,493.

A $5,000 stake would have you sitting on $12,465.

And a $10,000 investment would have multiplied into an impressive $24,930.

All in about 6 months.

I’m eager to share with you exactly how you can start enjoying these same types of gains.

Which is why I’ve put together my top 3 wealth-building tips that will help you profit from the biggest gold bonanza of your lifetime…

Wealth Building Tip #1: Invest in this top-rated company destined to skyrocket along with gold.

What would you do with an extra $6,800?

Well, you might have found out recently if you’d invested in these precious metals company I recommended to my readers.

It’s gone up about 68% in the two years since I recommended it.

That’s enough to turn a $10,000 grubstake into a tidy $16,800.

Please don’t get me wrong by what I’m about to say next…

Because that’s certainly an excellent gain by anyone’s standards.

But the truth is it’s chicken feed compared to the gains I predict we’ll be seeing from this miner in the coming months.

You see, the company owns a 50% stake in one of the largest known undeveloped pure gold deposits in the world.

And when I say this thing is massive, I’m not kidding.

We’re talking an estimated total of 39 million ounces of gold.

To put that in perspective, at today’s current price of about $1,250 an ounce, that’s $48.7 billion worth of gold.

And I’ve made it perfectly clear I don’t think the price of gold is going to stay at a low $1,250 an ounce for long.

Not with China pushing for a gold-backed currency… and the U.S. dollar on the verge of extinction.

So $5,000 an ounce is certainly within the realm of reason… which would bring the value of this miner’s deposits to a jaw dropping $195 billion.

And if you really want to have fun with numbers, try the math if gold hits $20,000 an ounce…

Which I’ve already proven to you really could happen.

Because then you’ll end up with a mind boggling $780 billion worth of gold.

The good news for this mining company doesn’t stop here.

The gold in their mine is some of the highest quality any miner ever discovered.

Its grade of 2.2 grams per metric tonne is more than double the industry average.

Once up and running, the mine is expected to produce about 1.3 million ounces per year… for more than 27 years!

And after years of working with government agencies and plodding through paperwork, this company is in the final stages of the permitting process…

Which means they’re one step closer to constructing their mine and entering production.

Once that happens, you better believe this company—which is currently under the radar of most investors—will see a significant jump in share price.

And an even BIGGER JUMP when the price of gold begins to skyrocket.

In fact, I fully expect share prices of this company to jump TEN-FOLD… if not more.

That’s why I recommend you start loading up on shares while they’re a bargain.

And when I say bargain, I’m talking under $5 a share!

Which means you can easily afford to load up on enough shares to see significant profits when it takes off.

Which means you can easily afford to load up on enough shares to see significant profits when it takes off.

Eager to learn more about this gem of a company?

Then I urge you to immediately download and read my FREE profit briefing.

Inside I’ll reveal the company name, ticker symbol and all the details you need to get in on this trade.

I’ll show you how to reserve a copy for yourself in just a moment.

But first, I want to tell you about my…

Wealth Building Tip #2: Buy gold the right way

and hold on for the ride of a lifetime!

Imagine investing $50,000 and walking away a millionaire.

Well, that’s exactly what you could have done during the gold bull market that began in 1971 and ended in 1980.

Gold went from below $40 an ounce to $800 an ounce…

An increase of over 2,000%.

That’s enough to turn every $50,000 invested into nearly $1.1 MILLION.

But the truth is you don’t need huge moves in the price of gold to make mountains of money.

Nor do you need to invest huge sums to make substantial profits.

As an investor in gold stocks, you can achieve amazing profits from even a small move in the price of gold.

And that’s why I say buying select gold stocks can be the right way to invest in gold for maximum profit.

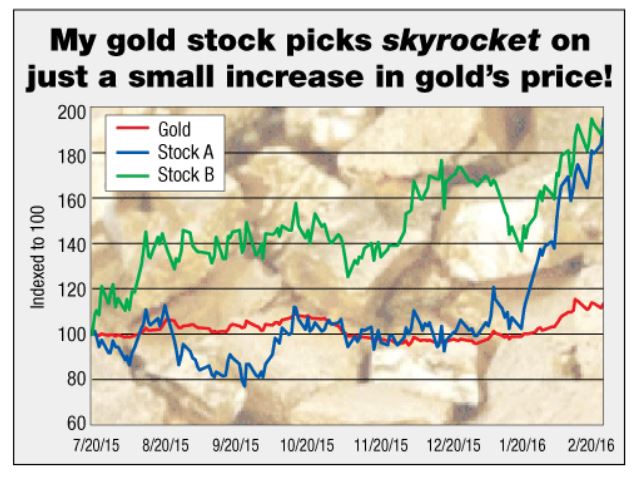

Let me show you how a 10% move in gold can lead you to over 70% in profit… in just 7 months.

Take a look at this chart…

Here you see the price of gold moved up about 10%.

Take a close look at what happened to the price of my gold stock picks “A” and “B” during that same period.

Yep, that’s right—both my picks zoomed up over 70%.

That’s enough to turn a $10,000 investment into $17,000 in just 7 months.

And remember, the next gold bull market is just about to get started.

I predict in the months to come you’re going to be reading story after story of folks who are reaping huge profits as small moves in the price of gold result in astronomical moves in related stocks.

Because good gold stocks are highly leveraged to the price of gold.

Getting in early on these opportunities before the bull market really heats up is the key to making a lot of money.

Of course, the question probably on your mind is how do you go about buying these stellar stocks?

Well, as you can see from the above chart, I know how to pick good gold stocks.

So you could simply follow my recommendations in my exclusive gold portfolio (which I’ll tell you how to access in just a minute) …

And sit back and watch the money roll in as gold roars into the bull market of a lifetime.

I know that may sound too good to be true—even though the evidence is pretty clear I know what I’m talking about.

So here’s some more proof…

Not long ago I participated in MoneyShow’s annual stock picking contest.

That’s where they survey the nation’s leading financial newsletter editors, asking them for their favorite conservative and speculative picks for the coming year.

I went out on a limb and announced a gold investment as one of my picks. I say “out on a limb” because lots of so-called experts were bashing gold at the time.

People thought I was nuts to stake my reputation on gold at a time when the metal was trending down.

Still, I stuck to my guns. My indicators and research showed my gold play was on the verge of breaking out.

Plus, I’d been following China’s increasing activity in the gold market. I knew this stock would be the perfect setup play once the bull market really started to heat up.

So what happened? My gold pick zoomed up almost 45% despite a down year in gold.

Yes, gold was down 10% that year, but I still figured out how to make a tidy profit for my readers.

And, as icing on the cake, MoneyShow named my pick a top performer of the year.

With results like these you may be wondering how you could access my private portfolio of stock picks and investment strategies…

And join my thousands of subscribers who are already enjoying double and triple-digit gains.

Well then, all you’ll need to do is follow my…

Wealth Building Tip #3: Have a proven expert on your side guiding you every step of the way.

As editor of Real World Investing, it’s my job to guide you to the right investments at the right time.

My sole focus is to study the major global trends that few pay attention to…

Such as the connection between China’s policies and the upcoming bonanza in gold… and alert you well before the news hits the mainstream press.

In fact, I’ve been accurately predicting the markets for over 30 years.

I’m a New York Times best-selling author and have written investment books which correctly forecasted a wide variety of pivotal economic events BEFORE they happened, such as…

- Defying the Market where I not only predicted the collapse of the dot-com market but also the beginning of the bull market in gold

- The Oil Factor: Protect Yourself and Profit From the Coming Energy Crisis where I called oil rising to $100 a barrel and gold surpassing $1,000 an ounce before the end of the decade

- The Coming Economic Collapse where, well before the Great Recession, I told readers what would happen if home prices started to fall

- Game Over: How You Can Prosper in a Shattered Economy where I forecast both the stock market's rise past 14,000 and the commodities boom that pushed gold prices past $1,700 an ounce

- Red Alert: How China's Growing Prosperity Threatens the American Way of Life where I forecast a new world of severe shortages in commodities and rare earth elements, all under the control of the Chinese government

I’m not telling you about all my accurate predictions to brag. That’s not my point.

My point is to prove to you that I live, breathe, and eat the financial markets.

And that my conclusions about China and gold are not just some passing fancy…

But the culmination of years of intense research and study.

The same research that proves the coming bull market in gold could be your best opportunity to not just get way ahead of the curve…

But to become extremely wealthy.

Imagine what gains like this could mean to your retirement nest egg… to your family’s financial future…

I’m proud to say I’ve helped many of my readers achieve just this kind of wealth and security over the years with my recommendations and guidance.

Here’s what a few of them should say about their experience with me:

Ken K. from Eagle, Idaho wrote in to say:

“I have been following Dr. Leeb for many years and his assessments are typically right on the mark. Whether he is talking about market direction and volatility in general, or specifically what to expect regarding China or India, gold, inflation, or oil, he knows what he is talking about and you better pay attention or you will pay the price one way or another… his commentary is timely and actionable … advice you can take to the bank.”

And then there’s Kevin S. from Los Angeles who wrote:

“I have been a loyal follower of Dr. Leeb, bought all of his books, seen all of his videos, webinars, get all of his newsletters, and I am way better off for it as a retail investor. His analysis on oil, gold, commodities, China, geo-politics, the economy and stocks, are the best I have seen and read. In today’s uncertain world economy, getting plugged into Dr. Leeb’s message should be on top of everyone’s list if they want to learn how to thrive in these turbulent times.”

And these kind words came from Amelie G. of Ann Arbor, Michigan:

“The research team and the ideas put forth have been invaluable to me. As a woman who is no longer young and lost a great deal of money in the crash, finances are important. I particularly appreciate the email updates on crisis days, it helps me to steady myself and look at the big picture not just the short-term aberration due to computerized trading or some fear factor. I subscribe to two services… Thank you, Dr. Leeb!”

It’s readers’ comments like these that inspire me to keep doing what I do best… helping people successfully invest regardless if the markets are going up, down or sideways.

Here’s everything you’ll receive with your one-year membership to Real World Investing:

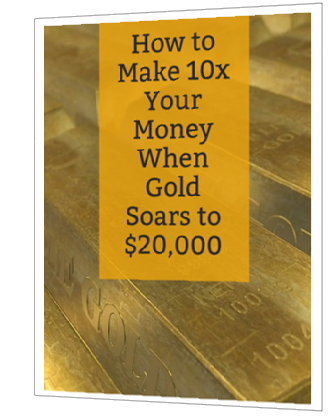

Your FREE Profit Guide, How To Make 10x Your Money When Gold Soars To $20,000

Your FREE Profit Guide, How To Make 10x Your Money When Gold Soars To $20,000

In this detailed briefing, you’ll discover all the details of my favorite gold play and what you need to do to get in on the action. This gold miner has already scored my readers gains of 65% and it’s just getting started.

I expect this golden gem to shoot up 10-fold once mining begins on its 39 million ounces of gold. And when the price of gold starts to really climb… well, the sky’s the limit for this stock. You’ll want to load up on these bargain-priced shares while you can.

Rigorous Investment Analysis

Each week you’ll receive an email alert identifying and analyzing the hottest investment opportunities and trends in the stock market.With graphs and charts and targeted analysis, this concise, timely investment advice is for investors who expect and demand consistent profits.

Flash-Alert Emails

I constantly monitor the news and its impact on the markets. Whenever there’s a major event (earnings, merger and acquisition activity, politics, etc.) that could affect a holding, I’ll send you a quick email detailing what’s going on with step-by-step instructions on how to profit. I want to ensure you never miss a big investment opportunity.

Unlimited 24/7 Website Access to my complete wealth-building portfolio

Your members-only site is your one-stop place to access every wealth-building recommendation, issue, and special briefing we’ve ever published.

Here you’ll find our complete portfolio with details on each recommendation, including buy, sell, and hold advice. You’ll always have access to the exact investments you need to make to build wealth and protect yourself.

Plus, with our Stock Talk Forum, you’ll be able to post your questions or comments on any trade or alert I issue.

First-class customer service.

If you ever have a problem or a question, our friendly Customer Service staff is here to help. Send us a quick email or call us toll-free. No matter which you choose we’ll do everything we can to make you happy.

Get 12 Months of Real World Investing

at a Fraction of Its Real Value

I’ve made people absolute fortunes over the years.

And because of that, I could easily charge $2,500 for the caliber of research I want to give you access to today.

And I typically do.

But if you become a member today, you can grab a year’s worth of my research for 60% off the list price.

Which means you’ll only pay $999.

But the good news doesn’t end there.

Because from the second you join, you’re also covered by my powerful…

No Hassles, No Questions Asked, Money-Back Guarantee

I want you to have complete peace of mind when you try my service. That’s why I want you to check out Real World Investing absolutely risk-free for the next 60 days.

If at any time during the first two months of your subscription you are not completely thrilled, just let me know and you will get back every penny. No hassles. No questions asked.

That’s right, you get every single one of my trade recommendations for the next 60 days.

That’s plenty of time to check everything out and even see some gains from opportunities like the one you’ll find in How To Make 10x Your Money When Gold Soars To $20,000.

It doesn’t matter whether you make $1,000… $10,000… or $100,000 during this time—if you’re not 100% convinced Real World Investing is right for you… you can still ask for a FULL refund—and I will send it to you pronto.

No matter what you decide, you get to keep everything I send you during these first 60 days.

Consider it a gift from me just for giving the service a try.

Why am I doing this?

Because I’m convinced there’s a once-in-a-lifetime opportunity for enormous wealth on the horizon that you deserve to profit from.

As I’ve shown you, China loves gold… is hoarding vast amounts of it… and is proceeding with long-term initiatives, including a new monetary system…

One which will propel the price of gold to the stratosphere.

You won’t get this story from the mainstream media.

But you will get it from me.

And I’m telling you if I’m right and gold zooms past $5,000… $10,000… $15,000… skyrocketing all the way to $20,000 an ounce…

And you take my easy-to-follow advice now and get in on the action…

You just might end up making more money than you know how to spend.

You have zero risk here and 100% upside potential. That’s an incredible offer.

Click on the button below and activate your no-risk membership in Real World Investing.

Let’s get started today to create the wealth of your dreams.

Yours for windfall profits,

![]()

Stephen Leeb, PhD

Founder and Research Chairman

Real World Investing