In the northeast corner of the Democratic Republic of Congo lies a small village, Kalimva.

Surrounded by the Virunga Mountains, the entire area looks like the Alpine lakes of Switzerland rather than an African jungle.

And with nearby Garamba and Virunga National Parks—home to rhinos, bonobos, forest elephants, and chimpanzees—the entire area is one of the world’s few unexplored natural resource havens.

Which is why BBC foreign correspondents on the ground have reported the Congo is “potentially one of the richest countries on earth.”

They say “potentially” because these days, no outsider can come within a country mile of the village without finding themselves staring down the business end of an AK-47.

The entire area is held hostage by a militia that goes by the name Forces Democratiques de Liberation Du Rwanda, or FDLR for short.

And at any given moment, one of the neighboring insurgent groups including the Raia Mutomboki… Mai Mai Sheka… or M23—some of which have ties to Al-Qaeda—can launch a surprise attack on the FDLR.

And the entire village will descend into chaos.

Muzzle flashes burst from all directions.

RPGs crash into pickup trucks and topple the turret guns that fortify the FDLR’s defenses.

And soldiers fall to the ground as they’re pummeled by AK47s firing at 600 rounds per minute.

Over the years, 3 million people have been killed in these firefights.

They say they’re fighting to regain the land of their tribal ancestors.

But insiders know there’s a lot more to the story…

Despite their remote location, and lack of contact with the civilized world… each of these groups is intimately aware of what’s sitting below the ground…

A $24 trillion treasure chest of a rare element they call Dhababu.

Yes, that’s trillion with a “T.”

This means the FLDR controls something worth 8 times more than the entire GDP of the continent.

A financial bounty equal to the economies of the U.S. and Europe, combined.

This isn’t hyperbole.

These numbers are coming straight from the United Nations report compiled under the watchful eye of economist Achim Steiner—a German national with specialized training from Oxford and Harvard Universities.

See, thanks to its unique properties, Dhababu is a true godsend.

The American Association for the Advancement of Science believes it can “detect and kill cancer cells.”

Put simply, this could be a game-changer for the 12.7 million people who are afflicted with cancerous tumors each year.

The medical community hasn’t been this excited about a new therapy in ages.

Which is why pharmaceutical companies like AstraZeneca and CytImmune are trying to get their hands on as much of it as they can.

They’ve poured $1.3 billion into its research and development. And Phase I clinical trials show that Dhababu can kill tumors without the devastating effects of chemotherapy.

Believe it or not, this is just one of its many uses.

And the militias know it.

From medical applications to space-age technology, military weapons, energy storage, and advanced computing…

Once you see everything this miracle material can do, it’ll be easy to see why…

An everyday device infused with just 4.87 grams of Dhababu sold for $15 million.

Can you imagine anything becoming that valuable by simply adding one material to it?

It’s little wonder why people are fighting to the death to control the supply…

This discovery is going to generate more riches than anything we’ve ever seen in our lifetime.

That includes the last U.S. shale oil boom that created $3.5 trillion in new wealth…

The tech bonanza of the 2000s that transformed dorm-room geek founders and their 9-to-5 staffers into millionaires…

And the recent Bitcoin bubble that handed speculators 1,535% profits.

At this moment, the biggest investors on the planet are securing their seats to ride this fast-approaching windfall.

George Soros—the man who started the Quantum Fund and broke the Bank of England—has committed $56.6 million to its exploration.

David Einhorn of Greenlight Capital is throwing in $215 million.

John Paulson, who made a fortune betting against the subprime mortgage market in 2007, has invested $517 million.

And Ray Dalio, founder of Bridgewater Associates—one of the world’s largest hedge funds—is funneling $7.5 billion to this new discovery.

Banks… hedge funds… Fortune 500 companies… and world governments are all following suit.

They’re funneling billions of dollars into exploring this resource as we speak.

Dhababu is so valuable—and its supply is so low—prices could surge as much as 2,043% in the coming months.

That’s good news for a tiny $5 miner I’ve identified…

And you.

Because if you follow my simple instructions in just a few minutes and pick up a handful of shares today…

They could help you transform every $1,000 invested into $21,430.

A $5,000 stake could grow into $107,150.

And just $10,000 will be enough to bank $214,300.

Quite frankly, we’re witnessing an opportunity that only comes around once in a lifetime.

I know that may sound hard to believe.

I mean, how often do best case scenarios pan out as they should?

We all know it’s rarely… if ever.

But listen…

Even if this discovery only makes 1/4th of what I think it could… it’ll still be good enough to turn every $10,000 you invest into $53,575.

And even if it only does 1/20th of what I’m predicting, you’ll STILL walk away with a 102% profit!

Not bad at all. And the deck is stacked in your favor.

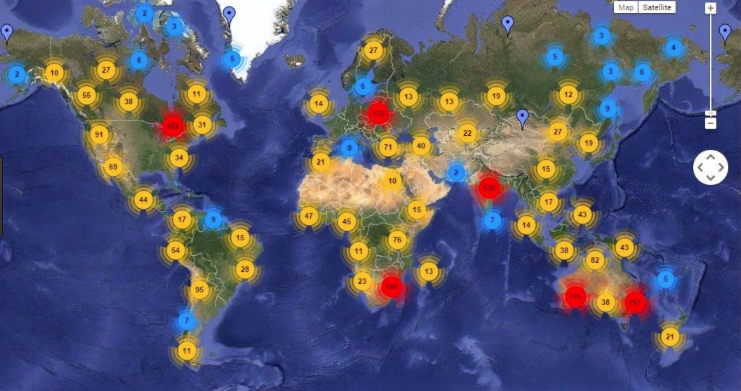

Because as the situation escalates in the village of Kalimva, other parts of the world are involved in what National Geographic’s Dr. Sylvia Earle calls an “invisible land grab.”

All around the world, governments and private companies are covertly launching mass scale expeditions in hopes of hitting the jackpot with a major Dhababu discovery.

In nearby South Africa, the government and an alliance of 24 private companies have created one of the true engineering marvels of the world…

An entire underground metropolis called Mponeng.

In the heart of the Gauteng province, Mponeng is 2.5 miles deep under the earth’s surface and stretches 11 square miles—half the size of Manhattan.

Every morning, over 4,000 workers risk their lives and slave away under treacherous conditions…

In a desperate attempt to find Dhababu.

This material is so valuable… the entire metropolis is guarded by an elite police unit called the Hawks.

Their aim is to ensure every discovery—no matter how small—stays within the country’s borders.

Because thieves have already looted $2 billion of this cherished prize. It’s pretty easy since…

A pocket full of Dhababu is worth $30,000… and a loaded briefcase would sell for north of $700,000.

The stolen Dhababu ends up going to the highest bidders in Rwanda, Tanzania, Uganda, and Kenya.

From there it is smuggled around the world to India, the Philippines, Russia, and many other places that nobody can track.

No matter where it ends up, it’s always welcomed with open arms.

For example, in Russia, they call this resource Zoloto… named after the coins that mark one of the country’s most prosperous eras—the 34-year rule of Catherine the Great..

Because as oil and gas prices tumble and its GDP tanks, Russia is looking towards this resource to usher in an economic revival.

That’s why, in addition to bolstering their supplies from the budding black market, Vladimir Putin has spent a staggering $4.9 billion scouring vast expanses of Siberia for Zoloto.

It’s been a slow process…

To obtain a quarter-size amount of Zoloto, the Russians have had to dig 30 tons of earth and rock—the equivalent of the Great Pyramid of Giza.

Can you imagine?

That’d be like digging up your entire backyard, just to find something the size of a sewing needle.

But when that “sewing needle” can pay for your mortgage, fund your retirement, AND set your kids and grandkids up for life, it makes perfect sense to make it “your job.”

And it’s been worth every penny for Russia so far.

Intelligence reports indicate they’ve hoarded 1,680 tonnes of Zoloto.

That’s enough to fill the first 3 floors of the New York’s Empire State Building.

Giving them one of the world’s largest stockpiles on the planet. One that’s worth over $69 billion.

And just south of Russia…

China has created an entire clandestine army dedicated to mining this rare element.

Twelve detachments are sent to remote—inaccessible—areas of the country.

They are under government orders to seize any land which might contain traces of this bombshell they call Jīn.

Amounts are secretive, but the intelligence community estimates China is sitting on 1,842 tonnes, which puts them ahead of their comrades in Russia.

This has touched off what I call…

The Race for Jīn.

From Congo to South Africa, Russia, China, Uzbekistan, Indonesia, Ghana, Peru, Canada, and Australia…

Governments, private companies, and even everyday folks are literally moving mountains to get their hands on this precious resource.

So it’s no surprise that the United States is not sitting around watching.

No way. Too much is on the line.

Congress has passed an aggressive regulation that allows private companies to mine public lands for FREE in these 9 states…

- Alaska

- Nevada

- Utah

- Colorado

- California

- Washington

- South Dakota

- Montana

- Idaho

The U.S. Geological Survey has determined these states are hotspots for finding Jīn.

Last year, numerous companies managed to unearth 209 tonnes from all corners of the U.S.

Given the value of the resource at hand…

Any one of these businesses could be a great investment.

However, one company is in the driver’s seat.

They’re sitting on a staggering 1,032.8 tonnes of Jīn.

That’s 4X more than the next competitor in line…

And 10X more than what was extracted from the U.S. all last year!

By the way, this isn’t a speculative number.

A team of geologists has determined that this figure is “proven and probable.”

That’s industry speak for “beyond the shadow of a doubt.”

Right now, you can pick up shares of this company for under $5.

But as the race for Jīn heats up and the cost of this irreplaceable resource skyrockets…

Share prices could soar to $15…

$25… $100… (maybe even more)

That means you’ll have the chance to capture the kind of wealth that’ll pay for ski trips to the Swiss Alps… cruises in the Bahamas… and still leave you with enough left over to cover the cost of college for your grandkids.

With share prices this low, all you need is a few hundred, or few thousand, bucks to start. The amount isn’t important.

What matters is that you get in right now before every investor in the world starts barging in.

Throughout the rest of this report, I’m going to reveal everything you need to know to capitalize on this opportunity.

But first, allow me to introduce myself.

I’m Dr. Stephen Leeb.

If my name sounds familiar, it’s likely because you saw me on CNN, ABC, Fox Business, or Bloomberg TV.

Or perhaps you’ve read one of my eight books on macroeconomics, finance, and investing.

Ever since I can remember, I’ve been fascinated by investing in “real things.”

I’m talking about commodities like oil, silver, platinum, bushels of wheat—anything that people can physically hold in their hands and use in some way.

And that’s why I got a Master’s Degree in math from the University of Pennsylvania prestigious Wharton School of Business. And a Ph.D. in psychology from the University of Illinois.

I wanted to research how people’s psyches drive prices on the world’s natural resources.

And it’s paid off. In my bestselling book, The Oil Factor, I went on record saying the price of oil would eclipse $150 a barrel.

That was absurd in those days. I mean, people were filling up on regular for less than $2 a gallon.

The so-called “experts” laughed me out of the room.

But when it hit $156/barrel in June of 2008, they all went back to their corners with their tails between their legs.

That’s far from the only time I made a bold prediction that came true.

In my book Red Alert, I warned of a coming shortage in graphite… and in the months that followed, prices surged from $1,000 per flake to over $2,500.

I also sounded an alarm about how the declining quality of copper ore would mean more work and higher costs for miners…

All of which would eventually show up in copper pricing.

And again, that’s exactly what happened.

Because in the years that followed, copper prices skyrocketed over 500%.

The ability to project how current situations will affect the future is one of the reasons large companies regularly seek my out my opinion…

Like when I was called in to help close a $2.5 billion acquisition.

I’m not telling you this to brag.

Instead, I want you to understand that what I’m about to say is coming from someone with a 35-plus-year history of making accurate predictions…

The Race for Jīn is unlike anything I’ve ever seen before.

Its rise is inevitable.

When it happens, it’ll create a massive wave of new wealth…

Shift the global balance of power…

And change our lives in ways you never thought possible.

Whether it’s called Dhababu… Zoloto… or Jīn…

What we’re dealing with is the most valuable resource known to man.

If that sounds like a bold statement… consider this…

Researchers at the Massachusetts Institute of Technology found that a thin coating of this miracle material in a lithium-ion battery—the type used in electric cars—could DOUBLE the mileage range.

Which is why it caught the attention of Tesla CEO, Elon Musk.

See, the current line of his electric cars use lithium-ion batteries and can run for 335 miles on a single charge.

Pretty impressive. Tesla’s shares have surged 975% in a few short years on that note alone.

Now think about how many MORE people will buy their cars (and how valuable the company will become) when you can drive across the entire state of Texas without stopping to “fill up.”

It’s revolutionary!

That’s why Tesla has already filed a patent which involves using Jīn to supercharge their battery’s performance. They want to roll out the technology and secure a monopoly in the event of a mass discovery.

And that’s not the only reason Elon Musk has his eyes on Jīn.

See, he has another private company valued at $12 billion—SpaceX.

By 2019, they want to launch 4,424 satellites into space that’ll provide internet for the entire world.

This will eliminate all the hassles of digging trenches, laying cable, and obtaining property rights that companies need to go through right now to bring the internet to folks…

Saving tens of billions of dollars and years of maneuvering political red tape across multiple borders.

And Jīn will be a key resource used in these satellites.

The National Oceanic and Atmospheric Administration believe that a thin film can “protect against corrosion from UV light and x-rays.”

In other words, it’s a shield against all the ravages of space which slowly eat away at these satellites and render them useless.

That’s why SpaceX is willing to go “all in” and pay as much as $400 million for a satellite.

They know that Jīn is the ultimate insurance policy for their machines.

One which will allow them to slam the door on the competition…

And pave the way for the company’s valuation to soar and hand investors a triple-digit windfall—just like when Tesla delivered 975% gains.

This would give Elon Musk two of the most valuable, coveted companies in the world.

Think about that for a second…

One miracle material is going to play a key role in two rapidly growing companies.

However, Musk is going to need to cough up a pretty penny to get what he needs.

And…

I’ve found one tiny $5 company that stands to benefit the most from this unprecedented new demand.

In fact, as supplies dwindle and the price of Jīn explodes…

I firmly believe this company’s share price could skyrocket 21 times higher.

Maybe more.

How can I be so sure?

Because it’s not just Tesla and SpaceX that are going to drive demand for Jīn through the roof.

Other companies have their eyes on this treasure as well.

I told you earlier this miracle material can kill tumors without the devastating effects of chemotherapy.

And that AstraZeneca and CytImmune have already spent $1.3 billion on Phase 1 trials…

Well, it turns out Jīn also gives hope to the 1.5 million Rheumatoid Arthritis sufferers in the U.S.

See, researchers have classified it as a DMARD. That stands for:

Disease-Modifying Anti-Rheumatic Drug

Just a trace amount of Jīn can be injected to not only reverse joint pain and swelling… but also prevent joint damage entirely.

Talk about a godsend!

The company who scoops up the lion’s share of a major Jīn discovery will hold the keys to the pharmaceutical kingdom.

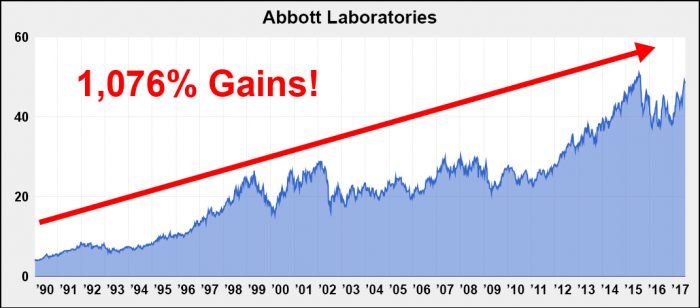

Right now, the #1 drug for rheumatoid arthritis is Humira, which also happens to be the bestselling drug in the world with $9.6 billion in sales.

And if you had invested in Abbott Laboratories, the original maker of the drug, before they developed the current miracle cure…

You would’ve pocketed 1,076% gains!

Enough to turn every $10,000 you invested into $107,600.

Now imagine how much the company that harnesses the power of Jīn will be worth.

Thanks to its proven uses against arthritis and cancer, it could easily be twice what Abbott turned out to be.

I mean, just think about the millions of people who need these treatments. That’s a massive amount of Jīn needed to fill those prescriptions!

Amazingly, this new demand drive STILL isn’t even the biggest reason why I believe prices could soar 2,043%.

Because…

According to the U.S. Geological Survey, smartphone makers need 0.034 grams of Jīn for EVERY phone they make.

Now, I’ll admit .034 grams is small potatoes.

It’s about half the size of a U.S. penny.

Not a lot…

Until you consider the billions of smartphones and computers sold worldwide each year.

The U.S. has a population of 323.1 million.

69% of those folks own smartphones.

India has a population of 1.32 billion.

22% of them own devices.

China has 1.4 billion people…

And 51% of them have their heads down sending texts and browsing the web.

And that’s before I can go through Europe, Russia, South America, and every other country in the world.

All of a sudden, those half pennies of Jīn add up to A LOT.

Here’s another way to look at it…

For Apple to meet demand for the iPhone 5s—their model from 2013…

A staggering 1.6 million tons of earth and rock had to be excavated from mines around the world. Just to get the Jīn for each of the phones they made.

Let me put that into perspective for you…

That’s not double the amount of steel used in the Empire State Building…

That’s not 5 times the amount…

It’s not even 10X…

1.6 million tons of earth and rock is equal to a staggering 28 times the amount of steel that’s in the Empire State Building.

Can you imagine piling that much dirt and rock just so we can snap photos… send text messages… and make calls from our smartphones?

It’s pretty insane when you think about it.

And this is just the beginning…

Computer makers use AT LEAST 18X more Jīn than cellphone companies do.

For EVERY single computer they churn out.

That’s at least 0.612 grams for each and every laptop and computer out there right now.

And every one that will ever be made in the future.

Now, we’re talking SERIOUS stockpiles.

So you can see why Russia is moving land equivalent to the size of the Great Pyramid of Giza to get their hands on an amount of Jīn equal to the size of a U.S. quarter.

You need a lot of dump trucks, bulldozers, and shovels working to get this precious resource!

So why is every electronics company going through these pains for Jīn?

Put simply…

You can’t find anything else like this material anywhere on the planet.

A Yale University study published in the Proceedings of the National Academy of Sciences determined Jīn is one of a dozen elements for which there is no substitute.

Meaning, we can’t swap it out for copper, or silver, or palladium, or steel.

It’s one of a kind.

Consider this smartphone on your screen:

This isn’t your out-of-the-box iPhone that goes for $500… or even $800.

Created by British luxury designer, Stuart Hughes, it’s the most expensive smartphone on the planet.

It recently sold for $15 million to a Chinese business mogul who remains unidentified.

See, this smartphone is covered in Jīn.

If you’re thinking that it looks a lot like gold, you’d be right on the mark.

That’s exactly what it is.

Jīn is the Chinese word for gold.

So why not just call it that from the beginning?

Two reasons…

First, I didn’t think you’d hear me out since most people think of gold the wrong way.

They see it as jewelry… something that can back currencies… or a “safe haven” against inflation.

Second, and more importantly, referring to Jīn simply as gold doesn’t do it justice anymore. That’d be like suggesting a Ferrari is “just another car.”

Or a Rolex is just another watch.

Jīn is literally one of the most vital resources to our economy today.

It fuels electronics, space exploration, energy storage, medicine—it touches our everyday lives in ways we don’t even think of.

And it literally MULTIPLIES the value of everything it touches.

I mean, what else can you think of that has turned a $500 phone into something worth $15 million?

Let me answer that for you… Nothing!

That’s why I’ve put together a special report that will give you the opportunity to turn $10,000 into $214,300… maybe more.

I’ll show you exactly what’s in it—and how to reserve a free copy for yourself—in just a moment…

Before I do, I think it’s critical for you to understand why Jīn plays a crucial role in EVERY phone… in EVERY computer on the planet.

Have you ever opened the hood of your car to swap out a battery and come across this?

Or have you ever reached for those unused jumper cables and found this?

Call it oxidation… corrosion… or simply rust…

It’s the result of air and moisture reacting with the metal and eating away at it.

And the same thing is happening inside your smartphone and computer as we speak.

At first glance, it doesn’t seem like this is a major problem.

After all, if you’re anything like my kids and grandkids, you get the latest gizmos every year.

But here’s the thing…

This rust building up inside these devices interrupts the electrical currents.

So if you’ve ever had to spend a Saturday afternoon at the Apple store because a phone started chugging along like a glacial tar pit all of a sudden, this could be why.

Not only does this tick off customers, but it puts Apple, Samsung, and other companies on the hook for the warranties they need to service.

And gold makes the rust problem obsolete.

See, just like this miracle metal can withstand the damaging effects of space…

It can also weather the brutal elements here on Earth.

In fact, Harvard researchers say it is “treasured for its properties as a non-reactive metal.”

In other words…

Pure gold is virtually indestructible!

This property makes it the ultimate conductor to carry the tiny currents inside the devices you and I use every day.

Which is why Apple, Samsung, Microsoft, Dell, HP, IBM, and just about every other company that makes phones or computers are rushing to scoop up as much gold as they can.

In 2016, Apple reported that they’ve managed to recover 2,204 pounds—nearly 1 metric ton—of gold from various corners of the world.

This small amount gives them an asset worth over $40 million.

And they have ambitious plans to acquire one-third of all gold on the planet.

Heck, with their $256.8 billion in cash reserves, they can certainly get a good chunk.

Samsung is even placing a bet and starting a small $20 million mining operation in the small African country of Burkina Faso.

They believe it’s an unexplored hotbed for gold that other countries and companies haven’t tapped into yet.

If this bet proves successful, Samsung would essentially get access to gold at below-market prices.

So far, things look promising…

They went from producing 23 tonnes one year to 32 tonnes the next—a 32% increase at a time when everyone else had to move heaven and earth to get even an ounce.

These are the kinds of breakthrough discoveries that companies need.

Because…

We’re running out of gold.

The world only has 200,000 tonnes left.

That’s not even enough to make a pile as high as your run-of-the-mill Manhattan skyscraper.

And so far, I’ve shown you that:

- Pharmaceutical companies want gold for promising treatments against cancer and rheumatoid arthritis.

- Elon Musk’s Tesla wants it to double the range on their electric cars, as well as for SpaceX satellites.

- Every smartphone and computer maker on the planet needs it for all the devices they’ll produce… now and in the future.

Just one of these uses could severely deplete everything we’ve got.

Which is why Goldman Sachs is reporting that there are “only 20 years of mineable reserves left.”

It’s also why…

One $5 miner I’d like to give you the name of could become one of the most valuable companies on Earth.

With their reserves 4X bigger than the next guy in line…

They could be the #1 supplier to all these companies AND other industries as well.

Like the global jewelry industry which sells $172 billion worth of rings, necklaces, earrings, and bracelets annually.

According to the prestigious consulting firm, McKinsey and Co., that number is expected to hit $290.7 billion by 2020.

Gold will play a major role in that growth.

In dentistry, 15 million Americans get crowns every year. Many of those contain gold.

And the most surprising use of gold is in buildings.

That’s right. Glass makers inject small pigments of gold into window panes to create a shiny coating.

In the summertime, it reflects heat outwards. And in the winter, it locks the heat inside the building.

Right now, all the major building markets—the United States, Europe, China, Brazil, India, and Japan—are offering incentives of up to $300 billion for green buildings.

And as developers put in their orders for glass, the manufacturers will need gold to fill them.

Again, that’s A LOT of gold that companies will need.

And the phone will be ringing off the hook for this one tiny company that I’m going to tell you about today.

Early investors who get in right now could become crazy rich as the collision of low supplies and high demand inevitably drive the price of gold into the stratosphere.

It’s Economics 101. The less there is of something… the more it’s worth.

And since this company is sitting on a massive untapped supply of gold—its $5 shares could race to $33… $81… even as high as $107 as gold prices skyrocket.

Remember, that’s just on practical uses of Jīn.

I haven’t even talked about how it can be used as a store of value during turbulent times, a hedge against inflation, or how central banks hoard it to stabilize their currencies.

This brings us to an historic situation that’s unfolding before our eyes…

Gold’s rise to $20,000 an ounce.

At first, this idea might sound crazy.

I mean, gold has never even crossed $2,000. Even during its last bull run in 2011.

However, we’re at a point where all the low-hanging fruit has been picked already.

Future discoveries will require more effort. More tech innovation. And more money.

That’s why miners need to move 20 tons of earth just to get enough gold for a wedding ring. And why entire underground metropolises need to be built.

All the big gold rushes have already happened.

You’ve probably heard about some of them.

The California Gold Rush in 1848…

The Barberton rush in South Africa that happened in 1883…

The Canadian Klondike Gold Rush…

The Fairbanks frenzy that put Alaska on the map as a major producer in the early 1900s…

And many others that have taken place in Australia, Peru, Russia, and Europe.

These were the good ol’ days when people just rolled up their pant legs, grabbed a pan, and then went wading for riches.

That’s not the case anymore. It’s a much more elaborate process.

All the new digging in remote areas… all the complex regulations… all the new investments in technology will drive up prices.

If this weren’t enough already, consider this:

China is about to propel

gold demand into the STRATOSPHERE.

You’re probably aware that President Nixon abandoned the practice of backing U.S. dollars with physical gold in 1971.

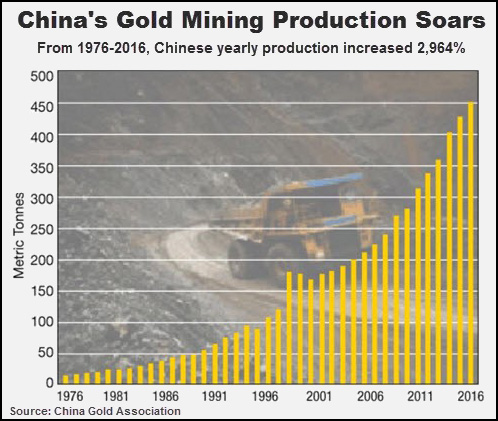

But what you may not know is that shortly after, China made a push to become the largest gold-producing country in the world.

Coincidence? Hardly.

As I mentioned before, they created an entire military unit called the Gold Armed Police.

Their mission is to locate, mine, and protect the country’s gold reserves.

They travel to far-off corners, and brave rugged terrain, snowstorms, wind, rain, sandstorms, and extreme heat in their quest.

And their efforts have paid off.

Since then, their gold production has shot up 2,964%.

This is part of China’s decades-long plan to elevate the yuan’s status in the world economy by backing it with gold.

Here’s the way the Chinese government see it…

If they have a currency backed by gold—instead of the government IOUs your dollars are backed by—businesses, central banks, and other financial institutions would see it as stable. And it will become the #1 player in the international trade arena.

Could this actually happen?

Who knows…

But the world has over a trillion yuan in circulation.

That means they’re looking to hoard A LOT of gold to back it all up.

So when you combine China’s crushing gold demand with all the other uses…

It’s easy to see why prices will inevitably reach historic highs.

And I’ve identified ONE $5 mining stock could hand you

a 2,043% windfall…

That’s good enough to turn every $1,000 you invest into $21,430!

Look, I know that may sound hard to believe.

But gold prices surging over 2,000% really isn’t crazy.

Especially when you know it happened before.

In the ‘80s gold zoomed to more than $800 an ounce.

That’s a 2,600% increase over the $30/ounce it was selling for just a decade before.

So if prices hit $20,000, it would just be history repeating itself.

That’s enough to turn every $50,000 invested into nearly $1.1 MILLION.

But what if gold doesn’t hit $20,000 an ounce… $10,000… or even $2,500?

What if prices only jump 10%?

You still stand to make a ton of money.

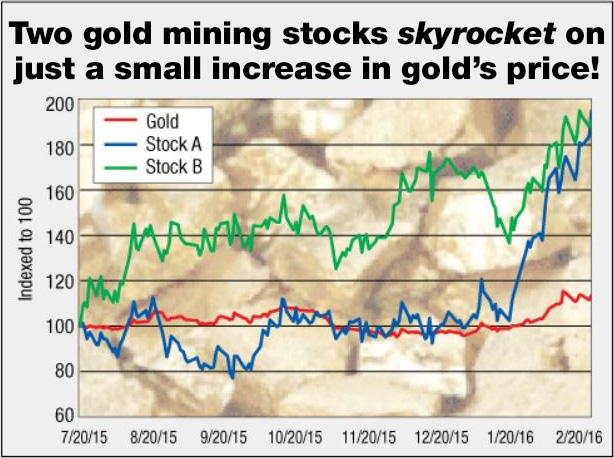

Because the prices of mining stocks are highly leveraged to the price of gold…

Which simply means even a small upward move in the price of gold can send a miner’s share prices soaring!

The chart below is a perfect example of what I’m talking about.

Not long ago, two gold mining stocks soared over 70% on just a 10% increase in gold prices…

And it was good enough to turn a $10,000 investment into $17,000 in just 7 months.

I hope it’s clear by now why I’m so excited about this situation.

With even the smallest of moves in gold prices capable of delivering you more profits in a few months than most investors see in decades…

And with a nearly unlimited amount of upside…

It’s as close as you can come to controlling your financial fate.

Again, my name is Stephen Leeb.

I’ve spent over 40 years covering the commodities markets. I rely on business acumen and hard data, as well as people’s psyches, to forecast where prices are headed.

That’s how I predicted that oil would hit over $150 a barrel when it was dirt cheap.

And how I accurately saw the shortages in graphite and copper which sent prices of both resources soaring.

I use this knowledge to not only identify profitable mining stocks…

But also the pharmaceutical companies… the tech conglomerates… and the consumer brands that rely on these discoveries.

That’s how I’ve zeroed in on gains from Sempra Energy, Franco-Nevada, Trilogy Metals, and Maanshan Iron and Steel Co.…

As well as Alexion Pharmaceuticals, Amazon, Apple… and even CVS!

Here’s just a small handful of the 19 triple-digit winners I’ve delivered to folks who follow my work:

Randgold Resources (GOLD) 105.2%

Shaw Group (SHAW) 102.7%

Apple (AAPL) 167.0%

Alexion Pharmaceuticals (ALXN) 370.0%

Biogen Idec (BIIB) 244.9%

Sabesp (SBS) 135.0%

Amazon.com (AMZN) 140.3%

Matthews Pacific Tiger (MAPTX) 159.4%

Jensen Quality Growth J (JENSX) 101.7%

Qualcomm (QCOM) 113.3%

FEI Company (FEIC) 265.3%

Sempra Energy (SRE) 110.0%

How to bank profits of $20,430 (or more) on the new “gold rush”

However, all of these could pale in comparison to the $5 company on my radar.

It’s based in Alaska—one of the largest gold-producing states in the country.

And despite the Klondike Gold Rush that started in 1897, the state still contains untapped gold reserves.

It makes sense. Just think about all the unexplored wilderness out there and the harsh weather that drives people away from exploring.

For years, it wasn’t profitable to mine for gold—even if companies were 100% sure a site had deposits.

After all, getting permits takes 3-4 years. Then you’ve got to cut roads into the wilderness, run electricity, build worker housing… and of course, start digging the mine.

All those costs add up.

But thanks to the booming demand, and the expected surge in prices, this company has committed to going “all in” on a stretch of land that the Financial Post called “the largest undeveloped precious metal project in the world.”

This project is so massive, in fact, it’s 4 times larger than competing mines in other gold-rush states and Canada.

Which is why this tiny $5 company could soon be worth $27 billion.

And believe it or not, that’s just a conservative estimate.

Here’s why…

The World Gold Council grades the quality of the yellow metal by measuring the grams per tonne.

The higher the number, the more valuable the deposit is because it’s purer.

Globally, mines have an average of 1.13 g/t.

Well, this company, with their immense stretch of land in Alaska, possess a mine that has gold graded at 2.24 g/t.

That’s double the quality of the competition!

So let’s say you’re a Fortune 500 company or a government agency in the market for gold.

Are you going to call all those other mines with inferior quality?

Or the top dog that has some of the best gold in the world?

I don’t know about you, but if it means producing superior products that can annihilate the competition…

I’d stick to the latter.

That’s why it’s critical that you get in now.

We’re in the early stages of this coming windfall. And this tiny company’s shares still trade under $5.

But not for long.

Like I said, the amount you invest doesn’t matter. Just a couple hundred, or a couple thousand bucks could be enough to create generational wealth.

My spcial report How to Make 10X Your Money When Gold Soars to $20,000 covers this historic opportunity in detail…

And I want to send it to for FREE.

This $5 stock isn’t the only way to make a fortune.

No way. From world governments hoarding gold, to Fortune 500 companies pumping in billions of dollars, and even the world’s wealthiest investors gobbling up new stakes… we have a lot of players moving money.

When you claim your FREE copy of my report—and I’ll show you how in just a moment…

You’ll discover a second mining company.

At $8 a share, they’re also a steal for investors looking to turn a small stake into a fortune.

They just produced their first gold in June of 2017.

And their mine in Canada has 246 tonnes of gold. Not a lot compared to the first opportunity I shared with you, but here’s the kicker…

At 16.1 g/t their gold is PURE.

Which is why I believe they’re a screaming buy.

Gold of this quality is hard to come by… and they can charge an arm and a leg for it.

As they ramp up their production in the coming months, they’ll be a key player in this race.

I also want to tell you about two more exciting miners.

These two companies are controlled by one of the world’s wealthiest families that you’ve probably never heard of.

Thanks to their various stakes in gold plays, they’ve amassed a $50 billion fortune.

In short, these guys don’t make many mistakes investing in the yellow metal.

So you can’t go wrong following their lead into these two off-the-radar miners.

One has property rights in major African gold hotspots. And the other has rights to deposits in Australia.

Combined, they’re expected to unleash over 15 million ounces of new gold into circulation.

Look, everyone knows junior miners are speculative. I won’t deny that.

But here’s something that folks miss with gold mining stocks…

They’re not only valuable hedges against inflation, they can also protect and grow your wealth when deflation strikes.

I’m talking about times when the economy tanks… demand for everything plummets… and businesses shut down, while the remaining few slash prices just so that people can afford to live.

Just look at Homestake Mining, which is now Newmont.

This gold miner began trading in 1879. And during the Great Depression, the worst deflationary times we’ve ever seen, Homestake’s share price went from $65 to $544.

That’s astounding.

I mean think about it, the stock market was caught in a downward death spiral and 30% of Americans were unemployed.

However, anyone who held this gold miner GREW their wealth by 737%.

That’s why billionaires like Ray Dalio, John Paulson, David Einhorn, and George Soros own stakes in gold miners.

And when I say I believe the companies I’ve identified will be the most profitable in the coming months…

I’m saying it with absolute certainty.

I’ll give you their full stories—including ticker symbols—in my report, How to Make 10X Your Money When Gold Soars to $20,000.

And I’d like to send you a 100% FREE copy today.

All you need to do is accept a 60-day trial to my premium service, Real World Investing.

Even though I’ve made my mark calling shots on oil, copper, silver, graphite, and gold…

Real World Investing covers far more than commodities, metals, and miners.

In every alert, I show you what’s going on in the world today. Then give you recommendations which allow you to safeguard your finances and, most importantly, PROSPER.

It doesn’t matter if its renewable energy, industrials, or even cybersecurity.

If I can find a way to profit from a situation—you’ll be the first to know.

For example, it’s obvious there’s tension between the United States and Russia, China, and North Korea.

It’s also no secret that defense spending tends to grow in lockstep with the war of words.

That’s why when things started heating up I had my readers establish a position in the defense contractor I believed would benefit the most.

And thanks to that advanced notice, they’re now sitting on gains of over 75%.

Better still, as national security continues to steal the headlines, I expect it to continue delivering even more profits.

I also highlighted how China’s signing of the Paris Climate Accord—in conjunction with its aggressive infrastructure growth—would potentially open the floodgates for one virtually unknown company…

And now my readers are sitting on gains of over 120% in less a year!

I did the same thing with cybersecurity.

With the reports of hackers stealing everything from identities… to money… to top-secret military intelligence…

I pointed folks one of the top cybersecurity stocks in the world.

And since then its share price continues to hit new all-time highs virtually every day.

Let’s face it. This problem isn’t going away anytime soon.

As the battle intensifies this star player’s share price will continue to pump higher and higher… delivering Real World Investing subscribers even more profits.

You, too, can cash in on these global trends—as well as this rapidly developing situation with gold. All you need to do is get in before the stories become mainstream.

And Real World Investing makes everything easy. You’ll get:

- Weekly intelligence reports—Profit opportunities like the ones I deliver wait for no one. If you’re not up to speed, you risk getting left in the dust. Which is why I send you streamlined intelligence reports every Thursday on the latest developments and how you stand to make money from them.

- Flash-alert emails— You can go about your life without worrying what’s happening in the world. Whenever there’s an earnings reports, acquisition, geopolitical event, or anything that could impact your holding, I’ll send you an email alert with step-by-step instructions on what to do next.

- 24/7 access to a private members-only website— You will get a password and login credentials to a members-only site. No matter where you are in the world, no matter what time of day it is, you will always have access to the actionable insights that can protect and grow your wealth.

And as soon as you accept this offer today, you’ll get access to the $5 gold miner that can turn every $1,000 into $21,430… the $8 company that owns some of the PUREST gold on the planet… and two tiny companies that are backed by one of the world’s wealthiest families.

You’ll also have unlimited access to the entire Real World Investing portfolio that shows you how to profit from industrials, cybersecurity, renewable energy, and much more!

Plus, you’ll get:

- Access to My Team (a subscriber favorite)—Here’s something you’ll find unique about Real World Investing: When you join, you’ll get personal attention from my team and me. If you ever have a question or a comment about one of our recommendations, just post it to our Stock Talk message boards, and we’ll be sure to answer you back.

And for the questions we can’t help you with, you’re covered by our…

- VIP concierge team—If you ever have any questions about your membership, or want to know how to make the most of it, you can call or email your concierge team and they’ll be happy to assist you.

My long-time readers have experienced the value that my insights and recommendations have delivered.

Just look at some of the letters I have piling up on my desk:

Ken K. from Eagle, Idaho wrote in to say:

“I have been following Dr. Leeb for many years and his assessments are typically right on the mark. Whether he is talking about market direction and volatility in general, or specifically what to expect regarding China or India, gold, inflation, or oil, he knows what he is talking about and you better pay attention or you will pay the price one way or another… his commentary is timely and actionable… advice you can take to the bank.”

And then there’s Kevin S. from Los Angeles who wrote:

“I have been a loyal follower of Dr. Leeb, bought all of his books, seen all of his videos, webinars, get all of his newsletters, and I am way better off for it as a retail investor. His analysis on oil, gold, commodities, China, geo-politics, the economy and stocks, are the best I have seen and read. In today’s uncertain world economy, getting plugged into Dr. Leeb’s message should be on top of everyone’s list if they want to learn how to thrive in these turbulent times.”

And these kind words came from Amelie G. of Ann Arbor, Michigan:

“The research team and the ideas put forth have been invaluable to me. As a woman who is no longer young and lost a great deal of money in the crash, finances are important. I particularly appreciate the email updates on crisis days, it helps me to steady myself and look at the big picture not just the short-term aberration due to computerized trading or some fear factor. I subscribe to two services… Thank you, Dr. Leeb!”

And I would love to have YOU as one of my next success stories!

Which is why I want to make your decision a no-brainer.

See, the regular price for Real World Investing is $2,495 a year.

Frankly, that’s a bargain.

Especially considering just one of the gold miners I’m going give you the name of today sports the potential to turn every $1,000 you invest into $21,430.

When you look at it from that perspective, it’s not hard to understand how a 1-year subscription could pay for itself many times over.

However, when you’re one of the first 500 people to respond, I’ve got a better deal for you.

Instead of paying $2,495 for one year…

You can join for only $1,495.

That’s right… if you’re one of the first 500 people to say “yes” to this one-time deal…

I’ll give you $1,000 off the regular price.

That’s a 40% savings!

Plus, it gets even better.

You’re Also Protected by

My 100% Money-Back,

Double Guarantee.

I’m so confident the profit-making research you’ll find in Real World Investing is unlike anything else out there…

I’m giving you TWO guarantees.

Let’s take a look…

Guarantee #1: If you aren’t satisfied at any time during the first 60 days, simply contact my team and they’ll refund every cent you paid. No questions asked.

Guarantee #2: If you don’t get the chance to double your money in the next year from one of the opportunities in your free copy of How to Make 10X Your Money When Gold Soars to $20,000…

Let us know.

And I’ll give you an additional year of Real World Investing on the house.

I think you’ll agree: That’s hard to beat.

And in the unlikely event you decide investment research of this caliber—and the profits that come with it—isn’t for you…

That’s perfectly fine.

Your report, How to Make 10X Your Money When Gold Soars to $20,000…

Is yours to keep.

Just as my way of saying “thanks” for giving me a shot to earn your trust.

But you must act now.

I’m limiting this deal to 500 people only. This ensures that I can keep things tight-knit and provide the best service possible.

So what are you waiting for?

The demand for gold is booming. Only those who get in now while the precious metal is still cheap will have the opportunity to capture 2,043% profits.

To ensure that you don’t miss out on this historic opportunity and the incredible deal I just laid out for you…

Simply click the button below to get started.

I look forward to working with you.

Thanks, and have a great day.

Sincerely,

Stephen Leeb, PhD

Founder and Research Chairman

Real World Investing