Long-Forgotten “America First” Initiative Breathes New Life into $2.7 Trillion Industry

Patriotic Investors Who Take THESE Critical Steps Could Soon See Windfall Returns of 3X… 4X… Even 10X Their Money…

Get the Full Story Below

Dear Investor,

He may not have realized it at the time…

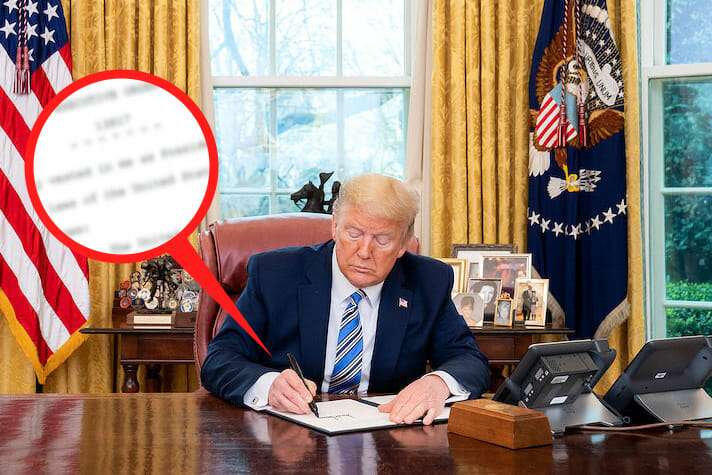

But when then-President Donald Trump put his signature on the dotted line of the short, two-page document above…

He created what just might go down in history as the most important Executive Order of the century…

One that positions America to win back its former glory as “top dog” in a $2.7 trillion per year industry we created…

Returning investment capital, intellectual property, expertise, and jobs to U.S. soil.

To boot…

Congress just committed a cool $76 billion to (re)kickstart this industry here in the U.S.

My research has pinpointed a small handful of All-American underdogs who are on the verge of becoming titans of this exploding industry…

And investors who follow the instructions I reveal in this presentation could soon see themselves sitting on more cash than they can shake a stick at.

The Disaster that Created this Golden Opportunity

As a quick refresher…

In the years leading up to 2020 — well before the term “COVID-19” became part of our daily dialogue— cryptocurrency miners had already put a “squeeze” on the semiconductor market.

Companies who could afford to were quick to fill football field-sized warehouses with high-end computers and graphics cards…

Sending prices through the roof.

Then, in early 2020… COVID-19 brought the world to a screeching halt…

Decimating the global semiconductor supply chain… link by link.

It started with shutdowns in major chip manufacturing plants around the world…

Followed by a giant uptick in sales of laptops, webcams, video game systems, and other electronics while people increasingly worked and played from home.

Big box electronics chain Best Buy saw online sales skyrocket 242% during the second quarter of 2020.

This explosion in demand for home electronics happened at the same time wireless companies were loading up on semiconductors to build and roll out their 5G networks across the globe.

The result…

Week after week, headlines like these were hitting the airwaves…

All around the globe the crisis has resulted in:

- Higher prices

- Long delivery delays

- And giant corporations losing gobs of money

As disastrous this semiconductor shortage has been…

It’s shone a light on an inconvenient fact most Americans — including our elected officials in Washington — have ignored for far too long…

One that’s a huge source of embarrassment for us all.

“America First” to the Rescue?

In case you’re not familiar with the history…

The entire semiconductor industry was born and raised right here in the U.S. of A.

- American physicist William Shockley invented the first semiconductor in 1947…

- A team of American scientists was awarded the Nobel Prize for Physics for their research on semiconductors in 1956…

- And the work done at Bell Laboratories in New Jersey allowed for the miniaturization that eventually made the semiconductor a…

Not only that… but California’s Silicon Valley is named for silicon…

The chemical element used to produce virtually every semiconductor made to date.

You don’t need me to convince you how big an impact Silicon Valley has had on technology innovation around the globe…

Or the trillions upon trillions of dollars in wealth that’s originated from that tiny “neighborhood” just south of San Francisco.

It’s telling that seven of the nine richest people in the world today are either founders or executives of Silicon Valley tech companies…

And the stock of these same companies has changed the lives of countless investors just like you…

Turning some into multi-millionaires…

And handing many more the chance to live a luxury retirement most people can only dream of.

It’s not an exaggeration to say semiconductor technology is about as All-American as baseball and apple pie.

But in the past few decades, the situation has changed in some pretty drastic ways…

And none of them in our favor.

Despite inventing the semiconductor, perfecting the art of miniaturizing it, and transforming the world with the technology…

America is no longer the world leader.

In fact, we’re not even close.

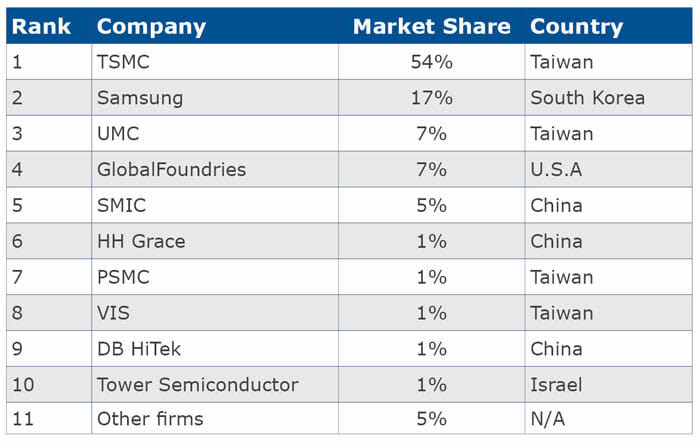

Today, Taiwan, China, and South Korea own close to 87% of the global semiconductor market share.

There’s only a single U.S. company in the top 10 list…

And in fourth place… they don’t even make the winner’s circle.

In case it’s not clear… this isn’t a niche industry.

It’s one of the biggest on the planet.

A recent study shows semiconductors contribute $2.7 trillion to the global economy… every year.

So over the past decade alone, it’s a safe bet that trillions of dollars in capital has been siphoned out of America’s heartland straight into a small handful of foreign countries.

And that says nothing of the brain power and jobs we’ve lost as a result.

So it doesn’t surprise me one bit that President Trump — during his first year in office — looked at the numbers and essentially asked…

How in the heck, are countries like South Korea, Japan, and Taiwan eating our lunch on a technology WE invented?

It also doesn’t surprise me that he immediately gave his administration marching orders to figure out why it was happening…

And, more importantly, how to fix it.

Now, I’m not saying Trump had a crystal ball in the Oval Office…

But it sure seems like he had some sort of inside edge.

Because a full two years before COVID turned the global semiconductor supply chain upside down…

President Trump signed Executive Order 13817 — a short, two-page document I believe holds the key to handing you a windfall profit.

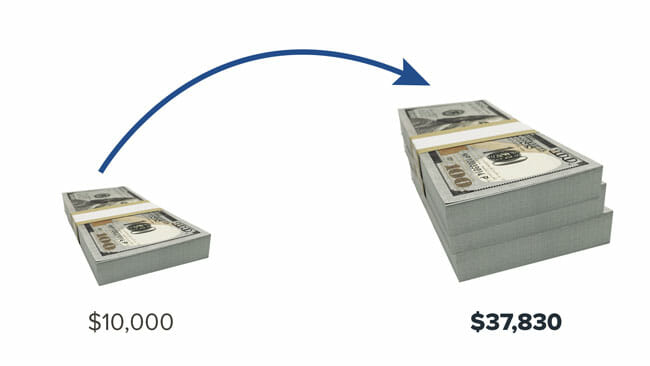

One that could potentially turn…

- Every $1,000 into $6,135…

- Every $5,000 into $30,676…

- Or every $10,000 stake into a massive $61,353 jackpot

In just a moment, I’ll give you the precise steps you can take to get started today.

But first, a brief introduction is in order…

My Name is Dr. Stephen Leeb…

And I’ve dedicated my entire 30+ year career to helping everyday investors profit in the markets…

And I’ve dedicated my entire 30+ year career to helping everyday investors profit in the markets…

Whether they’re moving up, down, or sideways.

I’m a frequent on-camera contributor to NPR, Fox News, CNN, and Bloomberg…

My work has been quoted countless times in USA TODAY, Business Week, The Wall Street Journal, and The New York Times…

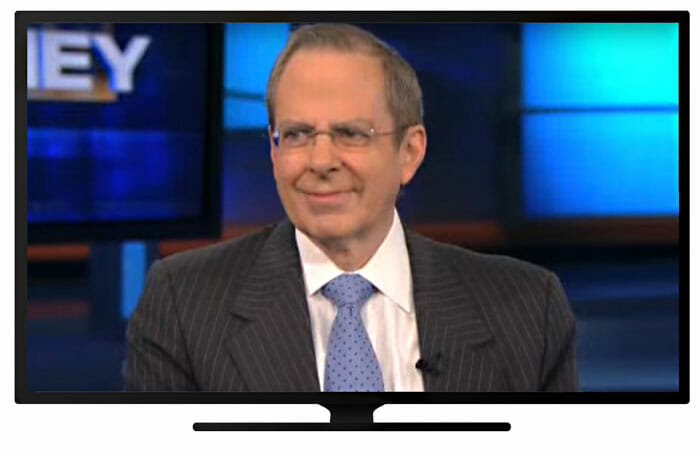

So far, I’ve written nine best-selling books… including The Oil Factor, The Coming Economic Collapse, Red Alert, and China’s Rise and the New Age of Gold…

So far, I’ve written nine best-selling books… including The Oil Factor, The Coming Economic Collapse, Red Alert, and China’s Rise and the New Age of Gold…

For over three decades, I’ve been following, researching, and predicting large-scale economic trends.

And I’ve done it with pinpoint accuracy countless times.

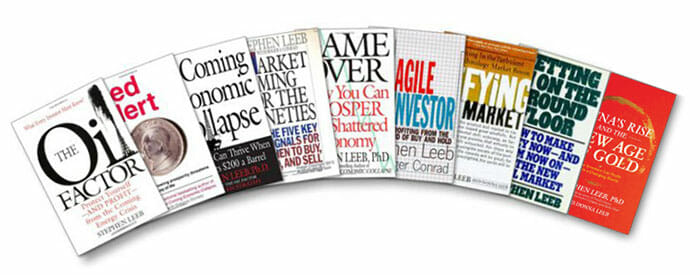

In 1999, I predicted the collapse of the Dot Com Bubble. And less than a year later, the entire NASDAQ index was down by almost 4,000 points…

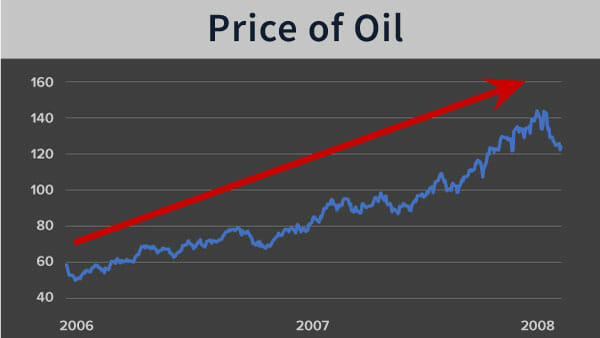

In 2004, when oil was trading close to $40, I predicted it would break $100 a barrel.

Within 3 short years… oil had blown past $100 and was headed toward an eventual high of over $144 a barrel.

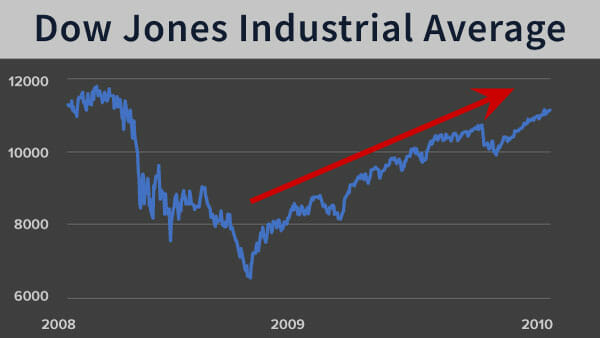

In December of 2008, I predicted the post-Mortgage Crisis stock market rebound... and within weeks, the market had begun its climb to historic new heights…

And in 2004, I predicted gold would break $1,500 an ounce… which it did just a few years later…

What Experts Are Saying About Dr. Stephen Leeb..

“Stephen Leeb is a top performing money manager”

— New York Post

“Stephen Leeb has devised a simple, yet enormously profiatble, stock-picking formula.”

— Daily News

“Leeb spins advice that can survive the siege.”

— U.S. News and World Report

“Brilliantly and superbly written. Truly impressive.”

— Gene G. Marcial Senior writer and inside Wall Street Columnist, Business Week

“I have been a beneficiary of [Stephen’s] wisdom in ways that have benefited both my mind and my pocket book.”

— Thomas Kaplan, Chairman, Tigris Financial Group

I’ve been named America’s #1 Stock “Market Timer” by Timer Digest…

And I’ve won both the Forbes and Wall Street Journal stock-picking competitions.

I don’t share any of this to brag.

I share it because I have a multi-decade track record of identifying massive market moves before they happen, and because…

Everyday investors who’ve followed my work have had opportunities to make life-changing fortunes, not just once or twice…

But dozens of times over the past few decades.

And that includes the triple-digit gains I’ve shown readers in the following industries:

- 261% on an innovative Technology company

- 949% on one of America’s top Defense contractors

- 181% from an international Entertainment conglomerate

- 114% on a leading solution provider in the Natural Resources sector

- 122% from a top gold Mining company

- 161% on a life-saving Biotechnology firm

- 247% on an Energy service provider

These trades have given some everyday investors the opportunity to rake in up to 10X their money.

Now, these gains aren’t typical and there’s no way I can guarantee you’ll see similar results.

However, I don’t believe it’s an exaggeration to say…

Returning the U.S.A. to its former glory in the semiconductor industry — and solving a paralyzing global crisis in the process — has the potential to be the biggest investment opportunity of our lifetime.

Think about it for a moment…

Virtually every man, woman, and child in the developed world interacts with dozens of electronic devices every day…

Mobile phones, tablets, laptop and desktop computers, smart speakers, household appliances, cars, buses, trains… you get the picture.

And every last one of these devices can contain dozens, hundreds — sometimes thousands — of semiconductor components.

Demand for these components isn’t slowing down…

If anything, it’s growing at an ever-increasing clip.

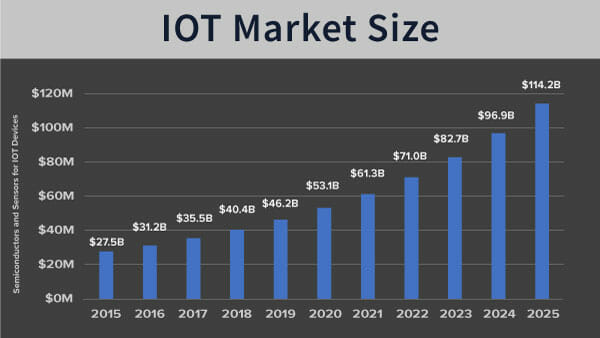

As an example, the “Internet of Things” — the name given to the growing list of Wi-Fi-connected appliances and smart devices (including products like Nest thermostats, Phillips Hue lighting, and Amazon Alexas) — is expected to grow by almost $53 billion between now and 2025.

All totaled, trillions of dollars and millions of jobs could hang in the balance…

And companies that rise to the occasion and meet this exploding demand will position themselves to take home the lion’s share of the profits.

Most importantly… the stock of these companies holds the potential to turn average investors into multi-millionaires.

Imagine if…

Tomorrow morning, while enjoying your coffee, you could pick up stock in three virtually unknown companies…

Then watch as all three surge higher and higher… well into the future.

A simple move like that could put you on the path to a retirement most people only dream of.

If taking control of your financial future this way is important to you…

You’ll want to pay very close attention to what I’m about to share…

Including why taking action today could make the difference between home run profits… or barely breaking even.

First, I want to make something crystal clear.

What I’m about to reveal is…

“Vital to the Nation's Security and Economic Prosperity”

A few days before Christmas in 2017, President Trump signed his name to the bottom of a short, two-page document with a pretty boring title…

Executive Order 13817 — A Federal Strategy To Ensure Secure and Reliable Supplies of Critical Minerals

Its micro-length and sleep-inducing name are the likely reasons most investors — including many Wall Street “pros” — completely ignored it.

And the fact they’re still “looking the other way” means that right now the door is wide open for you to use the information in this presentation to set yourself up for the profit bonanza of a lifetime.

But I don’t expect that to be the case for much longer.

You see, this Executive Order gave the heads of several government departments — including Commerce, Defense, and Energy — strict marching orders to quickly put together a list of “critical materials.”

Most importantly…

The order instructed these same agency heads to develop an iron-clad plan to ensure America has a sufficient supply of these materials well into the future.

So what exactly ended up on this list?

And what makes a material “critical” in the first place?

According to Trump’s Executive Order, a critical material is one that’s…

“… essential to the economic prosperity and national security of the United States.”

In very short order, Trump’s department heads came back with a list of 35 minerals they deemed critically important.

The list included many of the usual suspects…

Minerals like cobalt, lithium, and titanium… elements critical to the rechargeable batteries most of the world’s cars, trucks, buses, and trains will soon be running on…

Not to mention batteries in the phones, tablets, smartwatches, and laptops we rely on today.

But it also included a handful of obscure minerals most investors have never heard of.

And it’s these “mystery metals” that could be the key to returning America to “apex predator” status in the global semiconductor industry…

And flooding your investment account with more cash than you can shake a stick at.

I’ll reveal those minerals in just a moment.

Before I do that, let’s address the elephant in the room…

Will “Team Blue” Try and Dismantle this Order?

It’s not unusual for liberals and conservatives to disagree on some fundamental issues.

For example…

Within days of his inauguration in early 2021, President Biden put the wheels in motion to overturn 15 of Trump’s executive orders.

Not surprisingly, these included orders involving the Paris Climate Accords, COVID mask mandates, and the border wall with Mexico.

But when it comes to matters of “economic prosperity and national security”…

That’s one area where Republicans and Democrats are almost always firmly on the same page.

In fact, in February 2021, President Biden signed an executive order of his own, ensuring his administration finds ways to ensure America has access to the semiconductors our industries need to thrive.

He even went on record during a White House meeting with industry CEOs to discuss the semiconductor shortage, stating:

When you think about it…

This is the closest Biden has ever come — and likely will ever come — to saying the words…

“Trump was right!”

It’s also worth mentioning that Biden “put his money where his mouth is” in early August when he signed the CHIPS Act into law.

The Creating Helpful Incentives to Produce Semiconductors for America (CHIPS) Act earmarks $76 billion to help restore America’s leadership in semiconductor manufacturing.

That’s four times more money than the government spent on Operation Warp Speed to help get us out of the COVID-19 pandemic.

CHIPS passed votes in both the House and Senate with strong bipartisan support in late July 2022…

And President Biden made if official less than a week later.

Details on exactly which companies will receive a piece of the $76 billion haven’t been shared yet.

But the moment they’re available, I expect to see them plastered across the front page of every news outlet in the country within minutes.

That’s bound to put a lot of new attention on the semiconductor industry…

And on the companies I’m going to reveal right now.

All combined, the evidence I’ve just shown you is solid proof of just how important this issue is to both sides of the political aisle.

So while it’s technically possible for a Democratic President to reverse EO 13817…

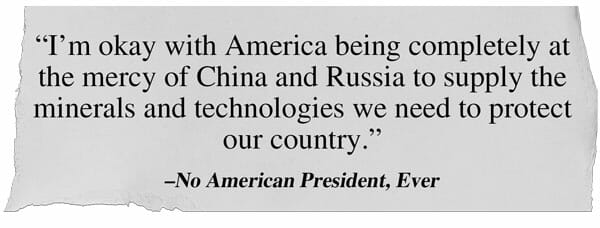

Doing so would essentially be saying…

I’m 100% confident that’s not going to happen…

Not today…

And not at any time in the foreseeable future.

That makes Executive Order 13817 as close to being etched in granite as any government document in history… red or blue.

And as far as I’m concerned, it also makes the investment opportunity you’re about to see as close to a sure thing as we’re likely to see in this lifetime.

Three “Under-the-Radar” Semiconductor Stocks that Could Unleash Massive Wealth…

The evidence is clear:

- No fewer than five government agencies are laser-focused on ensuring America has a free and clear supply of the materials critical to semiconductor production…

- The Biden Administration has agreed to inject $76 billion into the U.S. semiconductor industry… potentially within weeks…

- Korean giant Samsung is pumping $17 billion into a new fabrication plant in Texas…

- Global juggernaut Intel is investing $40 billion into construction of four state-of-the-art chip factories in Arizona and Ohio...

- Semiconductor powerhouse Micron has agreed to spend $40 billion into home-grown chip manufacturing — creating as many as 40,000 U.S. jobs in the process...

- And Texas Instruments is investing up to $30 billion to construct factories in Texas and Utah

All of this has me convinced there’s never been a better time to invest in the U.S. semiconductor industry.

The $64,000 question is…

What stocks do I buy?

Well, some so-called investment “analysts” may take the lazy route.

They type “best semiconductor companies” into Google…

Write a punchy 300-word article recommending well-known behemoths like Intel, Micron, or Texas Instruments…

Then take the afternoon off to go golfing with “the boys”…

Praying the “Google Gods” sent them a winner.

That is NOT how I operate.

Instead, I often spend dozens, if not hundreds of hours poring through dense legal documents…

Analyzing stock price charts…

And creating complex spreadsheets…

All so I can bring investors like you stock recommendations that aren’t just “good”…

But ones I’m convinced are truly best-in-class…

Stocks with the highest potential to turn a modest initial investment into a massive payday.

It’s also critically important I find these unique money-making opportunities before big banks, hedge funds, and the other “Wolves of Wall Street” catch a whiff of what’s happening.

Because when I do, it gives mainstream investors like you the freedom to buy shares at rock bottom prices, before the “smart money” dives in and drives them sky-high.

Allowing you the opportunity to sit back and wait for the rest of the world to catch on and bid the stock price up…

So you can leisurely cash out your position at a huge profit…

Needless to say, opportunities like this don’t come along every day.

So when they do…

It’s critically important you take action immediately.

Today is one of those rare days…

Because I’ve identified not one — but three — preeminent semiconductor companies…

Companies that stand so far above their industry peers that they have no real competition.

Better yet, I’m confident that less than one in a hundred investors would recognize their names…

But that could change any day.

These stocks allow you to set yourself up to profit at three different, critical stages of the semiconductor supply chain.

Starting with:

Opportunity #1: “The Prospector”

Metals can be a bit of a strange investment.

Metals can be a bit of a strange investment.

Unless they’re in the “precious” category — like silver, gold, platinum, or palladium — it becomes incredibly difficult to invest in them directly.

Take Beryllium for instance.

It’s one of the minerals on Trump’s list and it’s critical in the construction of America’s spy satellites, F-16 fighter jets, and guided missile defense systems.

Surprisingly, it looks like something you might find in a flowerbed in your backyard on a Saturday morning…

But it’s actually an incredibly rare and valuable metal.

It’s almost impossible to buy Beryllium by the ounce.

And it’s not something you’d want to have a jeweler turn into a necklace or bracelet anyway.

You might be able to buy a dump truck load of Beryllium ore…

But you’re bound to have trouble cramming that much inside the safe deposit box at your bank.

While loading up on “critical minerals” by the ton might be out of the question…

What you can do, is load up on the stock of a company that mines it.

Over the past few years, specialty miners have created tremendous profit opportunities for savvy investors.

For example…

When the growth of electric cars and trucks created a spike in demand for cobalt…

Mining powerhouse Vale generated gains that topped 871%...

When new pollution standards in Asia drove Rhodium prices to all-time highs…

Impala Platinum Holdings showed investors gains of 1,650%...

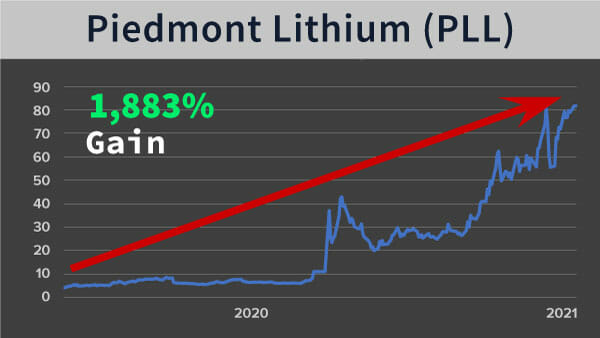

And when it became clear how crucial lithium was to the electric car industry, Piedmont Lithium rocketed 1,883% over just 12 short months…

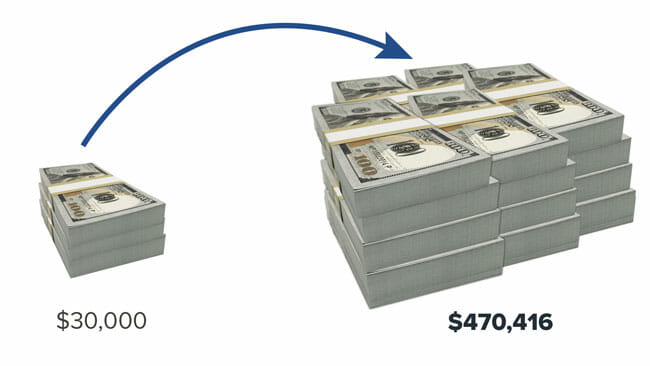

Investors who took a $10,000 stake in each of these three companies at the right time could be sitting on a whopping $470,416, today.

I can say with confidence, I believe an opportunity of this magnitude is right under our noses today.

I’ve uncovered a company that’s sitting on the biggest “rare earth metals” mine in North America.

These mission-critical metals have uses in:

- EV motors and batteries

- Night vision goggles

- LED lighting

- Mobile phones and tablets

- Medical devices

- Lasers…

- And hundreds of other leading-edge 21st century technologies.

This company isn’t a small-time player in the market.

In fact, they already supply as much as 15% of the rare earth minerals on the planet.

And with the Biden administration’s commitment to strengthening the semiconductor supply chain…

Not to mention a recent investment of $35 million from the U.S. Department of Defense…

I think it’s safe to say that the attention and investment this little company is attracting could set it up to easily top PLL’s stock gain of 1,883% in the coming months.

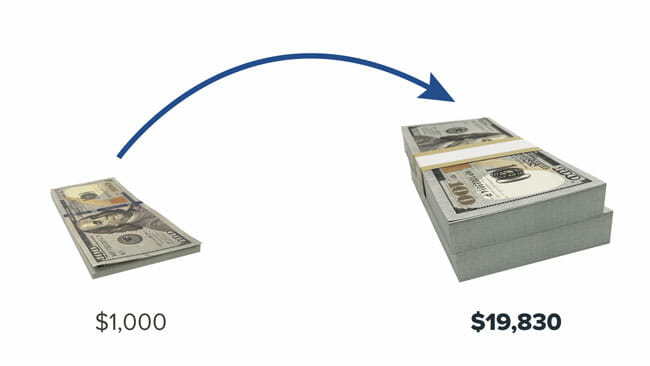

That would be enough to turn every $1,000 into as much as $19,830.

Could I be off the mark?

Of course. I’m not perfect. But, even if I’m only half right on this estimate…

We’re still talking about a potential 942% return… that’s more than 10X your money.

And while the raw materials this company mines are in high demand and have the potential to add multiple zeros to your investment account, they’re just the tip of the iceberg…

Because the next step in this three-pronged approach to semiconductor riches is…

Opportunity #2: "The Producer" (A $5 Gem)

Are you familiar with Moore’s Law?

I won’t bore you with the details but...

It’s an observation named after Intel co-founder Gordon Moore who noted in 1975 that semiconductor computing power doubles approximately every two years.

Moore’s Law held true for just over four decades, until 2016 when Intel disclosed their microchip power increases were no longer able to keep pace with their founder’s “law.”

The problem?

Heat.

You see, semiconductors have been shrinking for almost 100 years.

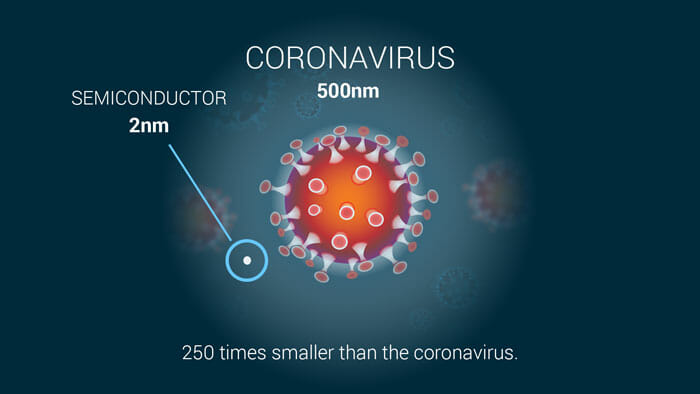

In fact, today’s smallest microchip technology comes in at 2 nanometers.

That’s about 250 times smaller than the Coronavirus.

With each iteration, engineers have packed more and more transistors into smaller and smaller areas.

And when you have more electricity flowing through a smaller physical space…

It generates more heat.

For years this hasn’t been a big issue…

Manufacturers have dealt with heat dissipation by installing increasingly larger and more efficient fans, radiators, and heatsinks inside computer chassis.

But recently, the industry reached a breaking point.

Advanced semiconductors can now be made so small, so dense, and generate so much heat that it costs more to cool them than it does to run them.

As 5G networks and billions of new “Internet of Things” (IoT) devices flood the world’s cloud computers with thousands of terabytes of data every day of the year…

Our ability to design and run efficient computer systems is more important than ever.

This is where our “producer” or semiconductor fabricator enters the picture.

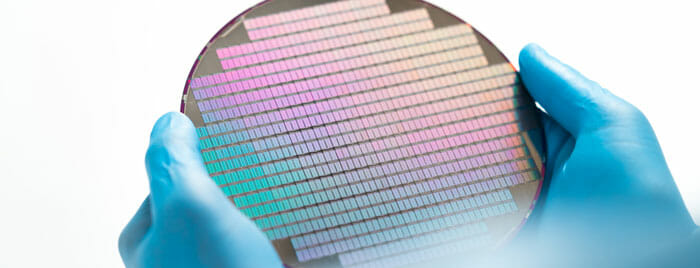

The company I’ve uncovered is one of America’s premier manufacturers of high-performance semiconductor wafers.

The company I’ve uncovered is one of America’s premier manufacturers of high-performance semiconductor wafers.

Wafers are the shiny, CD-like discs microchips are etched onto.

For over 50 years, semiconductors have been fabricated almost exclusively on silicon wafers.

Silicon is cheap and easy to mine — it’s the second most common element on the planet.

But when circuits get small and dense — as Intel discovered — silicon simply generates too much heat for its surface area to handle on its own.

Imagine a future where every feature in a modern smartphone — including video playback — is miniaturized to the point where it can be built into an eyeglass frame.

Now… imagine having to plug your “smartglasses” into a battery the size of a briefcase… just to power its cooling system.

Personally… I’d take a hard pass.

My guess? So would most consumers on the planet.

However, one of the technologies our “producer” specializes in is called gallium arsenide (GaAs).

Gallium and Arsenic are two different materials — both named on the government’s “critical minerals” list.

When combined into GaAs, these minerals form a near-perfect semiconductor wafer material.

It’s up to five times faster than silicon.

And compared to silicon, it’s insensitive to heat — which means less energy is required to power fans, heat pumps, and other cooling hardware.

I don’t think it’s a stretch to say GaAs could easily be at the epicenter of the next stage of semiconductor evolution…

Allowing virtually every electronic device we know and love to become smaller, faster, and last far longer on a single battery charge than the silicon-based devices we use today.

Meaning companies who specialize in this near-mythical semiconductor material could stuff wads of cash into the pockets of investors who make the right moves today.

What makes me so confident?

Well, ever since Intel announced “the death” of Moore’s Law in February 2016, companies who manufacture GaAs wafers and related components have been on a steady climb upward.

For example…

Qorvo Inc. — a major player in the wireless communications sector — is up over 159%...

Win Semiconductors — a specialty manufacturer of GaAs wafers — has popped 158%...

And California-based fabricator Lam Research has shown some savvy investors gains that have topped 557%...

GaAs truly is next-level tech.

And with silicon having reached is physical limits…

I fully expect companies who manufacture GaAs and GaAs-based semiconductors to continue generating outsized stock gains well into the foreseeable future.

Even better…

I’ve recently discovered a little-known fabricator who’s one of a small handful of firms in the world with the ability to produce GaAs wafers in high-volume and ship them quickly to customers around the globe.

Even better… you can pick up stock in this “off the radar” gem today for just a shade over $5 a share…

(As I write this, a modest investment of $5,000, would net you nearly 1,000 shares…)

And with silicon-only technology reaching the end of the road…

And global demand for high-speed semiconductors growing with each passing day…

I don’t think it’ll be long before we see this unsung hero generating stock gains that could easily eclipse the 557% Lam Research has shown some investors.

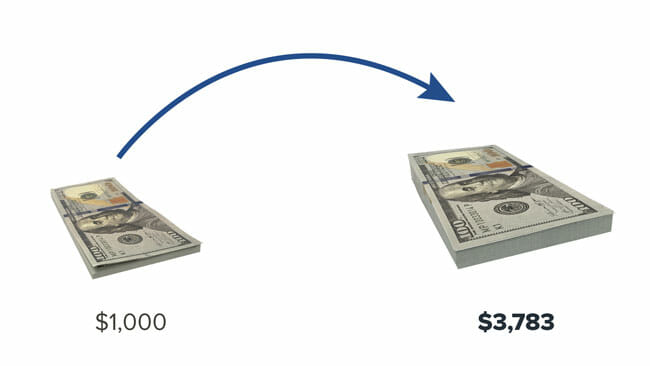

Again here, even if I slice my expectations in half…

We’d still be looking at the potential to turn every $1,000 into $3,783…

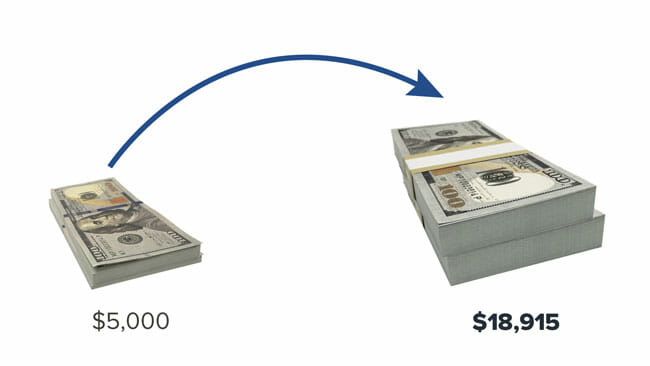

Every $5,000 into $18,915…

And every $10,000 into an impressive $37,830…

But the profits don’t stop there, because…

The third and final step in my strategy to turn Executive Order 13817, along with recently passed CHIPS Act, into cold, hard cash is…

Opportunity #3: “The Packager”

So far, I’ve shown you how to profit from raw “critical minerals” as they come out of the ground…

And again, after they’re combined to form bleeding-edge semiconductor construction materials.

Now, I’m going to pull you inside one of the virtually-invisible — but critical — final stages of the semiconductor supply chain…

Packaging.

Now, admittedly… this opportunity doesn’t directly involve “critical minerals” themselves.

But it’s an ideal complement to the first two stocks we’ve discussed.

You see, I think of semiconductor packaging as a kind of “stealth” investment…

Because most investors don’t even know it exists.

Here’s why…

When an electronics company pays a fabricator to etch its semiconductor design onto a wafer…

What they get back looks a lot like this…

Each tiny square on a wafer’s surface is a distinct miniature electronic circuit often containing thousands of individual transistors.

While they’re still on the wafer, these circuits can’t do anything useful.

They don’t become a functional microchip until they’re…

- Painstakingly cut and separated from the adjacent miniature circuits…

- Tested to make sure they working properly…

- Then placed inside a protective housing with input and output leads that can be connected to other electronic components.

The final result often resembles this…

Only after it’s “packaged” this way does the chip get soldered into the latest and greatest mobile phone, TV, or video gaming system.

Only after it’s “packaged” this way does the chip get soldered into the latest and greatest mobile phone, TV, or video gaming system.

You’re likely familiar with companies like Intel, Sony, and Toshiba.

Millions of Americans have at least one of these company’s products in their homes today.

But I’m guessing less than one in a thousand investors can name the company that “packages” their microchips.

Now, sometimes companies are unknown because they’re bad investments…

And other times, they’re amazing investments… but unknown simply because they don’t make direct-to-consumer products.

Instead, they make what’s inside consumer products.

The packaging company I’m following closely is absolutely crucial to the manufacturing of hundreds of consumer products from Intel, Toshiba, Sony, and others…

But if you pop open a Sony PlayStation chassis… you’ll never see this company’s name on any of the chips inside.

Trust me… that’s a good thing.

Especially in an industry that’s clawing its way back from a global shortage…

And receiving more financial and political support from the U.S. government than it’s seen in the past 50 years.

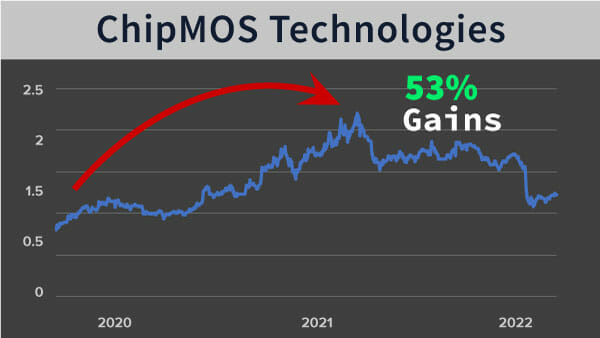

Here are just a few examples of the gains semiconductor packagers have shown investors since early 2020…

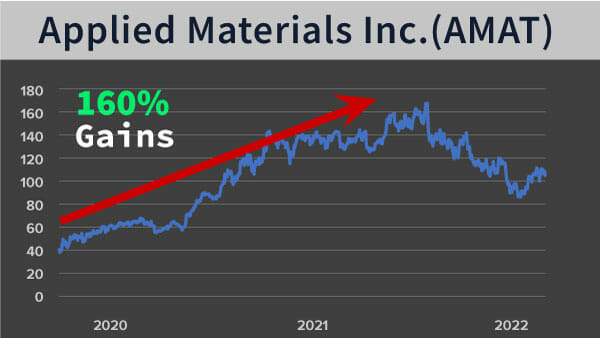

ChipMOS Technologies is up a healthy 53%...

ASE Technology has jumped almost 83%...

And Applied Materials Inc. is up over 160%...

While none of these stocks have seen straight rides to the top — most stocks never do…

Each has generated well-above-average returns during what’s bound to go down in the history books as one of the most volatile stock market periods… ever.

And despite this…

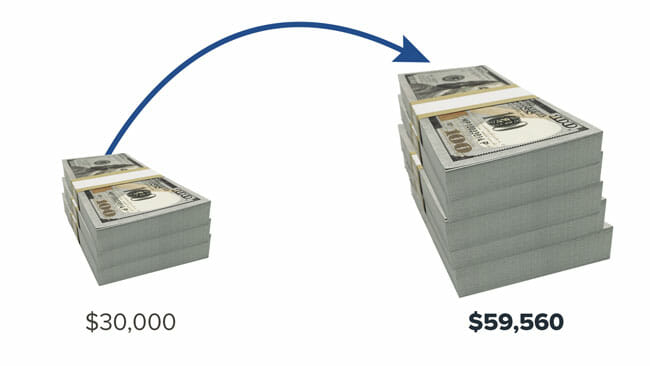

If you’d taken a $10,000 stake in each company shortly after COVID lockdowns began in early 2020, you could be sitting on as much as $59,560 today.

That would make for a satisfying payday.

But based on where I predict this niche industry is headed…

A $60,000 windfall is likely barely scratching the surface of what could be in store for you.

For starters, the semiconductor packaging market is on track to reach $41.8 billion by 2027.

So, while it might be a “stealth” market… semiconductor packaging is one of the most critical points in the supply chain.

$42 billion is a big enough pie for a top-tier company like my pick to make out like a bandit.

Of course, I don’t think they’ll swallow the entire $42 billion pie…

But even just a modest 10% slice of it could be enough to generate the stock surge I believe we’re going to see.

Second, a recent study of the global packaging industry’s biggest players found…

Just a single American firm in the top ten.

The other nine… not surprisingly… are all companies based in Asia.

Here’s why that’s important…

Recall that earlier I showed you Intel’s $40 billion investment in four new U.S. chip factories…

Texas Instruments’ $30 billion Ohio venture to build two new plants of it its own...

And Micron stepping up to invest another $40 billion.

When these plants are running at full throttle and pumping thousands of chips a day out to a market that’s rabid to buy them…

And after sinking a combined total of $110 billion into a bold “America First”-style investment…

I can’t see any rhyme or reason that Intel, Texas Instruments, or Micron would send their wafers BACK overseas for packaging and testing.

It just doesn’t make any sense to me.

Plus…

Do you think there’s a snowball’s chance in hell a single penny of our government’s $52 billion in CHIPS funding would willingly go to U.S. companies who choose foreign partners over home-grown, All-American firms offering the same services?

Once again… No way. No how.

That’s why I predict the under-the-radar packaging company I’ve recently homed in on…

Could be the undercover investment of the century.

Even without direct support from Intel, Texas Instruments, Micron, or the U.S. government…

This little-known company has already successfully built a global network of loyal customers across multiple industries including

- Automotive

- 5G

- The Internet of Things

- And even personal computers

With all these factors aligned in its favor…

I wouldn’t be surprised to see “the packager’s” stock at least double the 160% gain Applied Materials’ has generated since early 2020.

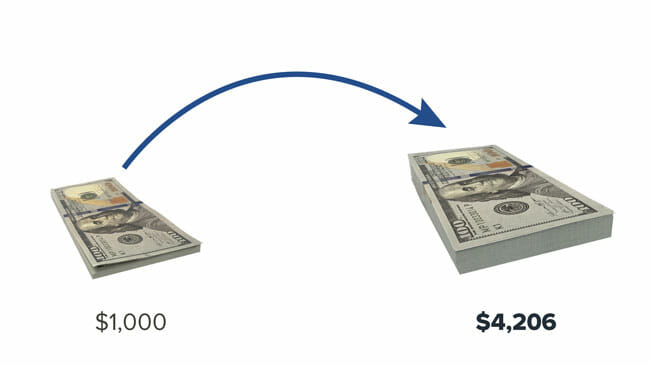

That would put us in a four-bagger territory… for a 320% gain.

Enough to turn every $1,000 into as much as $4,206.

I’ve had my eyes on this gem of a stock for a while.

And I’m confident that now is the perfect time to strike.

But keep in mind…

All investments are speculative and you should never invest more money than you’re comfortable walking away from.

These Three Industry Unknowns Could Hand You Huge Profits

The return to glory for U.S. semiconductors has been ramping up for months…

The boiling point might be just a few short weeks away.

When it happens, everyday investors positioned in the RIGHT stocks could become millionaires almost overnight.

I’d very much like for you to be one of them.

So to ensure you to have everything you need to exploit this opportunity to its fullest potential…

Without false starts, guesswork, or trial-and-error…

I’ve compiled all the details into this exclusive report…

![]() Microchip Trifecta: Three Semiconductor Stocks to Put Your Retirement on Easy Street

Microchip Trifecta: Three Semiconductor Stocks to Put Your Retirement on Easy Street

Inside you’ll discover:

- The unprecedented global events that have combined to create a “perfect storm” investment opportunity in America’s semiconductor industry.

- Three ways the U.S. government has circled the wagons to ensure American companies receive the support they need to win back their rightful place at the top of the semiconductor food chain.

- Details of the three companies I’ve shown you in this presentation and the factors that make each a best-in-breed investment opportunity.

- Plus the names and ticker symbols for each stock as well as my recommended buy prices and market timing details.

This report contains everything you need to get started…

If we were to offer it up on its own, my publisher would happily slap a $499 price tag on this exclusive report without hesitation.

After all, the details inside could hand you profits up to 100 times its sticker price in the months ahead.

And while this report isn’t available anywhere or at any price…

I’m willing to put a free copy in your hands just a few minutes from now.

So you can stake your claim in all three of these semiconductor stocks before the day is out.

A personal copy of this report can be yours today “on the house.”

All I ask in return is that you join my exclusive investment advisory service called…

Real World Investing…

Inside Real World Investing, you won’t find me taking pot shots at the same stocks every television talking head on the planet is going ga-ga over.

Why?

Because they’re almost always the first ones to tumble the moment the market sniffs any kind of uncertainty.

At Real World Investing, I uncover unique opportunities designed to thrive when the market is turbulent and uncertain…

And let’s face it… turbulence and uncertainty are almost a constant in today’s markets.

If we look at just the past 24 months, we’ve experienced …

- A global pandemic

- Two presidential impeachments

- A highly contested U.S. federal election

- Russia’s invasion of Ukraine

- Three or four cryptocurrency booms and busts

- The worst inflation America has seen since Jimmy Carter was in office

- And a rapidly-approaching midterm election that already has Washington D.C. whipped into a frenzy

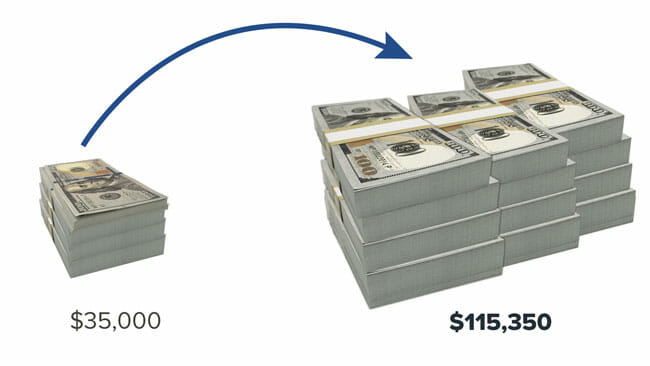

And despite the whirlwind market volatility these events have created, at Real World Investing our portfolio is still raking in gains. Some of our open trades include:

- 264% on a gold miner

- 130% on an international energy firm

- 163% on a multi-mineral mining company

- 133% on a miner with operations on five continents

- 256% on a “rare-earth” miner

- 137% on a solar panel manufacturer

- 524% on a firm specializing in rechargeable batteries

Anyone who invested $5,000 into each of these stocks when they were first recommended could be sitting on as much as $115,350 to date.

Now, I don’t want to give you the impression every stock I pick turns into a triple-digit winner. Many return less than that. And on occasion, some trades have turned against us.

But the examples I’ve shown you are a just a small sampling of the trades my readers have had the opportunity to take part in.

How do I deliver consistently profitable results?

Well, to be perfectly frank… that wasn’t always the case.

I spent the early years of my career making many of the mistakes you’d expect from a “wet behind the ears” university graduate.

But I learned quickly.

Every time the markets knocked me down, I got back up immediately…

A little wiser, and a little stronger than I was before.

And I promised myself I’d never make the same mistake twice.

Over the past 30+ years, I’ve ridden out just about every market swing you can imagine…

Up, down, and sideways.

I’ve taken the hard knocks and learned the hard lessons so YOU don’t have to.

I developed my stock picking strategies and techniques while managing multi-million-dollar client portfolios over the past three decades...

And today, through Real World Investing I’m able to offer these same battle-tested profit blueprints, along with my decades of experience and industry insights to everyday investors…

Whether they have just a few thousand to invest…

Or a few million.

But don’t just take my word on what it’s like having Real World Investing as your guide.

Here are just a few messages I’ve received from readers who’ve followed my recommendations and used my strategies…

![]()

![]()

![]()

I’ve even heard from readers who’ve let me know they’ve been following my work — and banking profits from it — for decades…

![]()

![]()

Now for the record, the results I’ve just shown you are exceptional and — as much as I’d like to — there’s no way I can guarantee your experience will be similar…

But these examples make it crystal clear what is possible when you follow my recommendations.

I’d love to feature you as my next success story…

And your path toward this financial success begins the moment you accept my offer to join Real World Investing.

When you do, you’ll get instant access to:

Market Intelligence Reports

Market Intelligence Reports

Each week, you’ll receive my hot-off-the-press briefing on any and all important market developments, what they mean for our portfolio positions, as well as any new profit opportunities I’ve uncovered. You’ll never be left wondering what to do or when to do it. I’ll be with you through every step of the journey.

Flash-Alert Emails

Flash-Alert Emails

Any time an investment opportunity requires immediate attention, I’ll send you an action alert email. These alerts are short and contain simple trade instructions to help optimize your profits. You can relay these details to your broker or use them inside your online brokerage account to place your trade within minutes of receiving my email.

24/7 access to our members-only website

24/7 access to our members-only website

Within minutes of joining Real World Investing, my team will set you up for password protected access to our private website. Inside, you’ll find my entire history of flash alerts, market updates, special reports, and portfolio positions. You can access this members-only portal from your phone, tablet, laptop, or desktop… anytime day or night… and it’s only ever a click away.

Investing Daily Insider

Investing Daily Insider

Beyond the headline financial news, there are hidden fortunes in the stories that seldom get told. Enter Investing Daily Insider, our exclusive news digest with a simple goal… to provide you with money-making insights into the week’s most pressing financial stories.

Real World Investing Premium Concierge Service

Real World Investing Premium Concierge Service

The moment you’re on the inside, you’ll have access to a special phone number where you can reach my VIP concierge team every weekday during normal business hours. The team is standing by to ensure any questions, concerns, or problems you encounter as a member are dealt with quickly and thoroughly.

As you can see, Real World Investing is the complete package.

As a member, you’ll have instant access to all the investment recommendations, research, and up-to-the-minute communication you need to build your retirement nest egg.

With everything you receive with membership, you may be wondering…

“How much does all of this cost?”

Well, I’ve got good news…

The regular rate for an entire year of access to Real World Investing is just $2,495.

And when you consider the profits from just one of the stock picks I reveal inside your copy of Microchip Trifecta: Three Semiconductor Stocks to Put Your Retirement on Easy Street holds the potential to cover your membership fee many times over…

$2,495 is incredibly fair… (at least my publisher thinks so anyway).

However, I’ve managed to do a bit of arm twisting and my he’s agreed to an unheard-of discount for traders bold enough to join me inside Real World Investing today.

I’ll reveal exactly how to lock down your discount in just a moment.

Before I do, let me show you another free gift I want to send you…

BONUS: Real World Investing Quick-Start Master Class (Value $399)

As a new member, this exclusive video series introduces you to the nuts-and-bolts of Real World Investing…

The indicators I use to predict big market moves…

As well as the three major advantages of my investing strategy that consistently generate outsized gains for members…

Allowing you to sleep like a baby every night knowing your trading profits are taking care of themselves.

We use video to deliver this introduction so you can spend less time reading…

And more time making your first money-making trade as soon as humanly possible.

I want to send you the special report and video series right away.

But I encourage you to act quickly because…

The Next 50 Members Get $1,000 Off

If you’re one of the first 50 investors to claim this offer today…

Not only will you receive the free bonuses I’ve just shown you:

- Microchip Trifecta: Three Semiconductor Stocks to Put Your Retirement on Easy Street (value: $499)

- Real World Investing Quick-Start Master Class (Value $399)

On top of these, you’ll also lock in an entire year of access to Real World Investing for only $995.

That’s a 60% discount off the regular rate…

And a cash savings of $1,500.

This isn’t the kind of offer you’ll see from us every day of the week…

In fact, I wouldn’t be surprised if remaining memberships are snapped up before the end of the day.

Especially considering that Congress just passed the CHIPS act …

Millions of investors could soon sit up and (finally) pay attention…

And potentially sending the three stocks I’ve detailed in this presentation to unprecedented heights.

If you return to this page later and discover it’s been replaced by a huge, red “Sorry… Offer Unavailable” sign, you’ll understand why.

So if the opportunity to turn a modest sum of $10,000 into as much as $61,353 is something that appeals to you…

Click the button below and lock in your membership spot right away.

Remember, this Quick-Start video series, the special report I showed you a moment ago…

And your Real World Investing membership can all be yours today for a one-time payment of…

Just $995.

And at that price, I expect all remaining discounted spots to sell out within the next few hours.

Now before we continue, I need to point out one small catch…

It’s a “catch” I use to separate serious investors — like I’m certain you are — from the tire kickers and looky-loos of the world.

Because I have a limited number of membership spots available today…

And because each has been discounted by $1,500…

I’m unable to offer refunds.

You’re either all in… or you’re out.

That may seem harsh, but Real World Investing is an advisory service for committed investors…

At the same time, it’s critically important to me that my members are protected and comfortable with their decision to join me.

That’s why when you join Real World Investing today, you’re covered by…

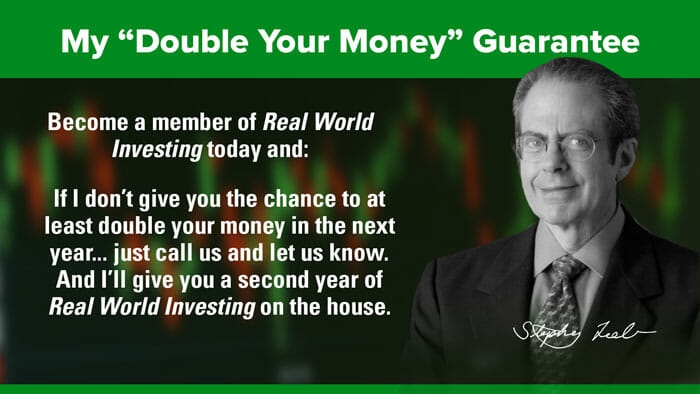

My Iron-Clad “Double Your Money” Guarantee

This guarantee does not involve a 10-page legal agreement full of fine print and conditions.

Instead, it’s one, simple sentence long…

During your membership term, if the gains from my closed trade recommendations don’t total at least 100%...

I’ll give you a second year of Real World Investing on the house.

A quick phone call to my customer support team is all it takes.

No smoke and mirrors here.

A bold promise?

Maybe.

But that’s how confident I am in my ability to deliver profits to your brokerage account.

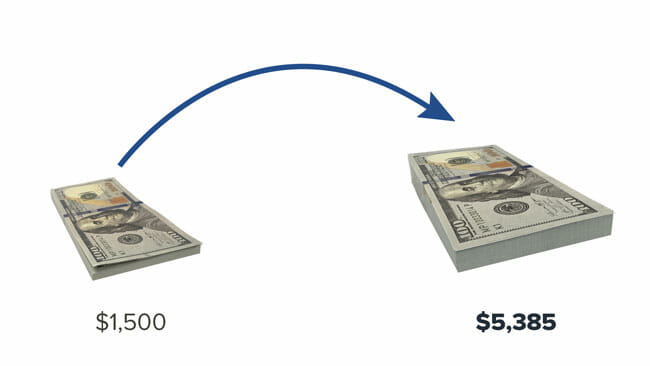

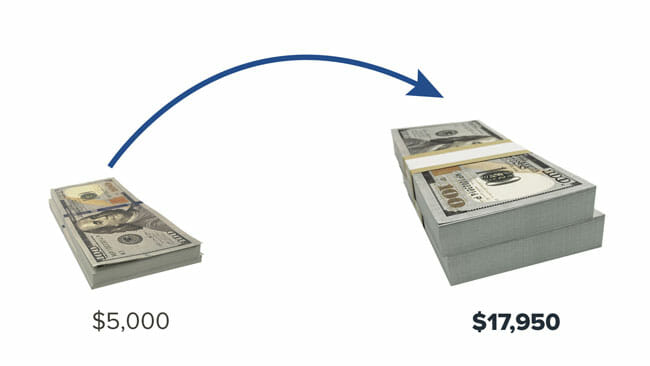

For example, a recent closed trade in Barrick Gold showed members a 259% gain.

That’s enough to turn a $1,500 stake into $5,385…

Or a $5,000 stake into $17,950…

A single trade like that would cover your membership multiple times over.

Needless to say, this rock-solid guarantee is in place to protect you…

But I’m confident you’ll be so thrilled with the gains I deliver… you won’t ever need to use it.

Here’s Everything You’ll Receive When You Join Real World Investing Today…

- Special Report: Microchip Trifecta: Three Semiconductor Stocks to Put Your Retirement on Easy Street (Value: $499)

- 12-Months Access to Real World Investing (Value: $2,495)

- Weekly Market Intelligence Reports

- Flash-Alert Emails

- Private Members-Only Website

- Investing Daily Insider

- Concierge Hotline

- Bonus: Quick-Start Master Class Video Series (Value: $399)

- Unprecedented $2,398 Discount

- My Iron-Clad “Double Your Money” Guarantee

All for a one-time payment of $3,393 $995

Plus the moment you click through to the next page, I’ll show you how to get your hands on two bonus opportunities.

Both offer potential to pack your portfolio with sky-high profits…

Bonus Pick #1

The first involves a what’s quickly becoming one of the most valuable “common” metals on the planet.

When you think of all the electric cars, trucks, busses, and trains being constructed around the globe today…

Plus the thousands of “fueling stations” being built to charge them…

Intense demand for this soon-to-be “precious” metal is driving prices into the stratosphere.

On the next page, I’ll show you all the details on this “superplay” plus…

Bonus Pick #2

Of the 35 elements on Trump’s “critical materials” list…

One of them is the only non-renewable element on planet Earth.

With the technology, medical, defense, and aerospace industries pushing demand for this unique colorless, odorless, tasteless material through the roof…

And the next closest viable source being over 43 million miles away…

Investors who make the right moves today could quickly see a flood of cash into their retirement accounts.

The details on this one are shocking… in the best way possible.

And when you click through to the next page… I’ll reveal how to get both bonus opportunities delivered to you “on a silver platter”… absolutely free.

Oh, and in case you’re wondering…

Neither of these bonus picks will be released to the general public at any price. They’re only available to new Real World Investing members who subscribe today.

One Click is All it Takes…

I appreciate you taking time out of your day to review this presentation.

Since you’ve made it this far, I can safely assume you’re a serious investor…

And every serious investor knows that real financial success doesn’t magically arrive overnight.

It can take years of dedication…

Of boldly sticking to a solid investment plan…

And trusting the expert you’ve chosen to make stock recommendations has a three-decade, proven track record of success.

That’s why many Real World Investing members have been with me for years.

Serious investors also understand that making the right investment decisions today can unlock the door for you and your spouse to enjoy the luxury retirement lifestyle of your dreams tomorrow.

Right now, you have a decision to make.

You can close this page, move on, and forget everything I’ve shown you here today.

If you do that, chances are you’ll continue down the path you’ve been on for a while...

Spending countless hours researching companies…

Or worse yet, taking the advice of some talking head on TV who gets all his investment knowledge from a teleprompter…

Buying shares in the latest hot stock…

Then nervously checking the market ticker dozens of times a day… second guessing whether or not it’s the right time to sell.

Gut-wrenching… right? Even on good days.

Let me offer you an alternative.

Imagine this…

Just a few minutes from now, you crack open your free copy of Microchip Trifecta: Three Semiconductor Stocks to Put Your Retirement on Easy Street…

Read it cover-to-cover…

You might even sleep on it.

Tomorrow, after your morning coffee, you make three trades — of any dollar value you’re comfortable with.

Then… you wait… 100% stress-free.

No need to check the ticker a dozen times a day.

No need to Google company names every few hours for breaking news.

And no need to stress over whether you should take your profits off the table or let them keep piling up…

Because you have a 30+ year veteran investment analyst at your side.

It’s Go Time

Right now, opportunity is pounding on your door…

But you have to turn the knob and open it.

The semiconductor crisis has wreaked havoc in every corner of the globe for over two years.

It’s made some products far more expensive.

It’s created months-long delivery delays for others.

Worst of all, it’s highlighted the fact that America is no longer “top dog” in the semiconductor industry.

The silver lining in this unfortunate cloud is that the U.S. is now painfully aware of our reliance on a small handful of Asian countries…

And we’re doing something — actually, a lot of things — to change the situation…

- The government is enacting laws to ensure we have access to the raw materials we need…

- Congress is earmarking billions of dollars to jumpstart America’s semiconductor industry — and this one thing could blow the lid off this opportunity within weeks…

- And U.S. giants like Intel, Texas Instruments, and Micron are doubling down on investments in onshore manufacturing.

The return of our former glory as global leader of the semiconductor industry is an event that’s unlikely to be repeated in our lifetime…

And becoming a Real World Investing member today is the most sure-fire way I know of to take full advantage of the profit bonanza that’s coming.

There’s never been a better time to stake your claim in what’s on the verge of becoming the most profitable investment opportunity of our generation.

There are less than 50 membership spots remaining and with the current discount, I don’t expect them to last much longer.

Click the button blow to lock in your membership while there’s still time.

I look forward to welcoming you as a new member very soon.

See you on the inside,

Stephen Leeb, PhD

Chief Investment Strategist

Real World Investing

Copyright © 2022 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.