Veteran Trader Who Turned $50,000 Into $5.3 Million Reveals…

The #1 Retirement Trade in 2025

Forget A.I. — Forget Oil — Forget Gold

This brain-dead simple “trading trick” unlocks gains of 116%… 137%… and even 227%… in weeks… not years.

Get the full story below…

Fellow Investor,

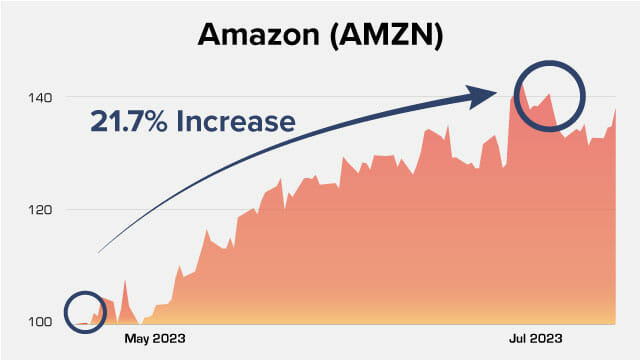

If you knew — with 90% certainty — Amazon was about to tack on 22.5% to its share price…

AND you also knew exactly when that climb would start and end…

How much money do you think you’d be able to rake in?

$1,000…

$5,000…

$25,000…

Maybe even more?

Hi, my name is Phil Ash…

I’m the President here at Investing Daily…

And if you’ll give me the next 5 minutes… I’d like to help you answer that question.

You won’t hear what I’m about to share with you on Mad Money, Squawk Box, or Money Matters…

From your broker down the street…

Or your market-obsessed golf buddies…

And that’s a shame.

Because while most folks are struggling to turn any kind of profit in the market right now…

A small group of in-the-know investors are using this advanced knowledge to rake in incredible gains.

And if you were one of them…

You would have known — down to the day — when Amazon’s 83-day profit window was going to open.

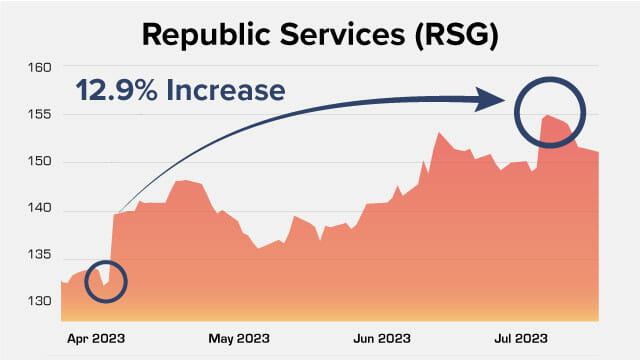

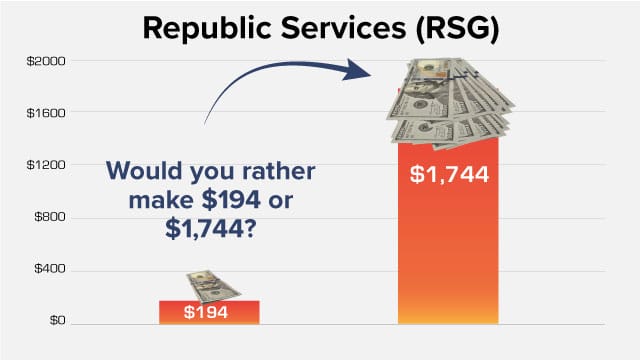

You would have known the exact date the waste management company, Republic Services, would start an 86-day climb that tacked on 12.9%.

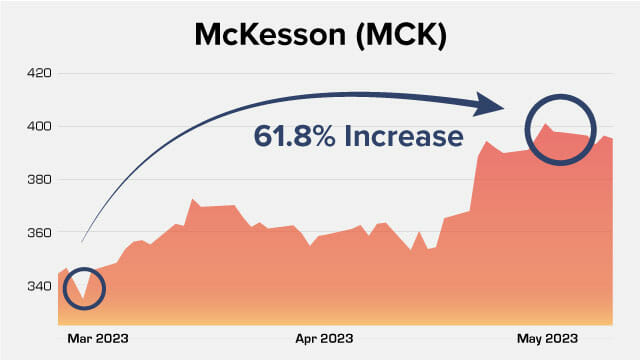

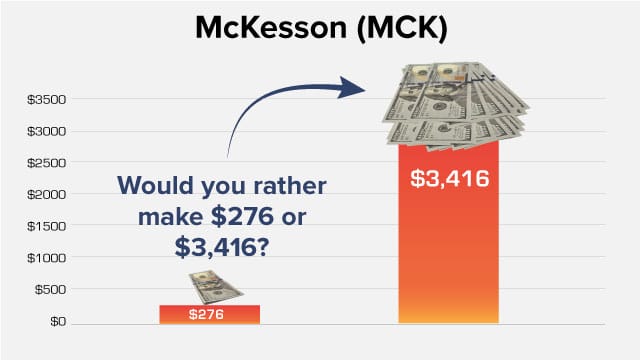

And you could’ve circled the date on your calendar when healthcare provider McKesson’s share price was about to shoot up as much as $61.84…

All in less than two months.

Now consider what it would mean if you knew these moves were about to happen…

Not just this year…

But every year…

Just like a change of seasons.

And imagine if you knew all of this before 99.99% of regular investors…

Before The Wall Street Journal or Fortune stumbled upon it…

And amazingly, even before Wall Street’s sharks caught on to what was happening and sank their teeth in.

Would you share what you know with others…

Or keep it to yourself?

No matter which route you’d choose…

I think it’s obvious…

Access to insight this powerful puts you in the “catbird’s seat.”

Because knowing when these seasonal profit windows are about to open…

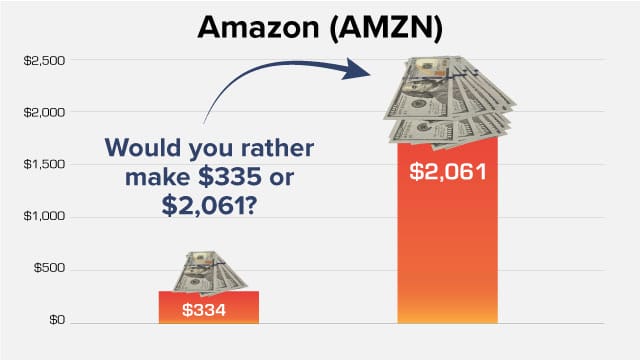

Gives you the opportunity to make a simple trade that multiplies Amazon’s respectable 22.25% gain…

Into a 137.39% winner!

One that turns Republic Services 12.9% gain…

Into a 116.24% profit…

And one that juices McKesson’s 18.4% jump…

Into a mammoth 227.71% windfall.

Over time…

Using this unique market move — coupled with the advanced insight that comes from knowing when these seasonal profit windows are about to open…

Puts you in line to make a stone-cold fortune…

Over and over again!

That’s not wishful thinking… it’s personal experience.

I believe in the accuracy of these seasonal profit windows — and the man who introduced me to them — so much…

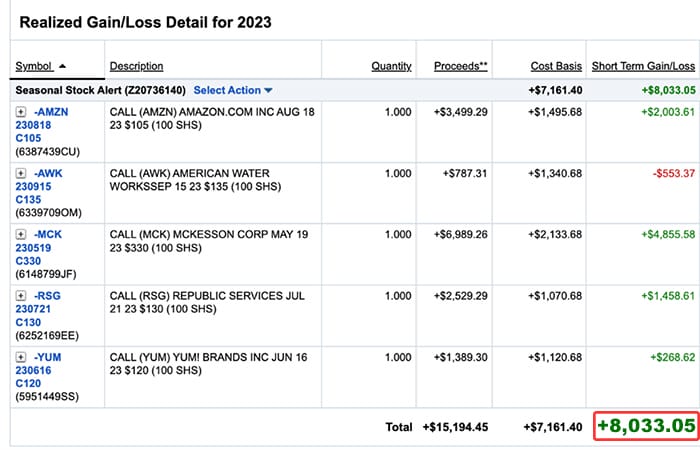

I put my own money on the line and invested in each of the three opportunities we just covered…

And walked away with $8,317 in pure profit.

Now to be clear…

While these seasonal profit windows have proven to be highly accurate…

They’re not perfect.

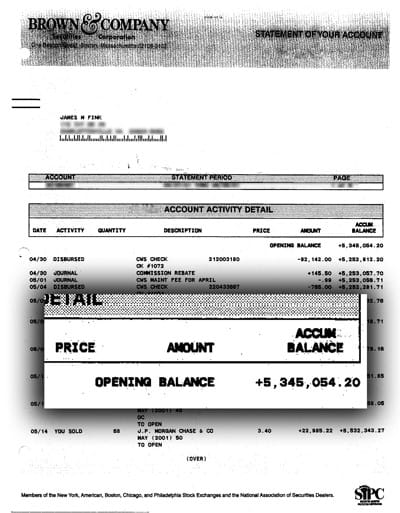

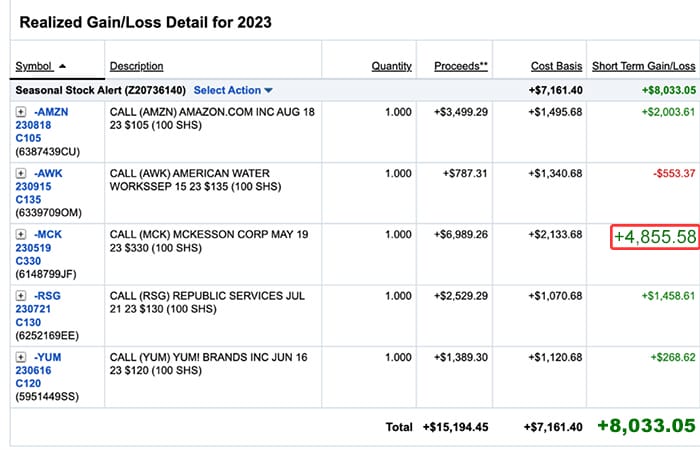

In fact, as you can see from this snapshot of my portfolio…

I had a losing trade here and there.

But the net result?

I made $8,033 in pure profit.

And that brings me to why I’m here with you today…

Because the simple fact is — not enough people know about these seasonal profit windows.

And when I say not enough… I mean it.

Only around 130 people in the entire world currently have access to these insights.

At first, that was intentional…

Because while I have the utmost confidence in the man I’m going to introduce you to in the next few minutes…

The fact of the matter is…

When he showed me how accurate these windows are at predicting when a stock will start to move…

Including which direction…

And how he uses that advanced knowledge as the foundation for what he calls “the most brain-dead simple way to make money on earth”…

One that even folks that are new to investing can understand…

And more importantly — profit from…

It all seemed too, well… easy.

I mean, I’ve been in the financial publishing business since I was a kid (my dad founded Investing Daily way back in 1974)…

So I’ve seen our competitors trot out more than their fair share of “can’t miss” ways to invest…

And some of them are in a word… Awful.

Or in a few more words… Pitiful. Dumb. And just plain dangerous.

So when I sat down with my analyst to get the inside scoop on exactly how these seasonal windows work…

And the unique spin he wanted to put on them to juice the profits…

My first instinct was to say “no.”

But the more I dug into what he actually wanted to do…

And the more we talked about it…

The more sense it made.

At the same time…

My first obligation is to our readers.

So rather than open the floodgates and give thousands of people access to this opportunity…

Hoping we got it right…

And that it worked out exactly the way we drew it up…

I decided…

- I would strictly limit the number of people who could sign up

- I would be subscriber #1

- I would put my own money at risk to prove it worked

Why go to such lengths?

Because there’s simply no better way to ensure my team is running a world-class investing service…

One that you don’t need a PhD to understand…

And one I believe could help you make a lot of money (and have a little fun at the same time)…

Than by putting real skin in the game and sharing the experience — both highs and occasional lows — right alongside our readers.

Some of whom have let us know in the short time since we started sharing how to make money from these seasonal profit windows…

That they’ve already brought home good money.

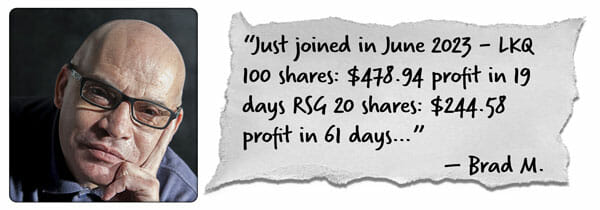

Like Brad M. who says he banked more than $723 on two quick trades…

Tom says he banked an 82.4% profit in one day…

Ken told me he doubled his money in a month…

David B. shared that he brought home over $3,200…

And Jim M. told us he’s up $4,000…

In just a minute you’ll hear more about how the seasonal profit windows these folks used… led to these massive, quick gains…

And more importantly, you’ll discover how you can use them for yourself.

But first, I’d like to introduce you to the man behind this unique moneymaking strategy…

But first, I’d like to introduce you to the man behind this unique moneymaking strategy…

An attorney who — at the tender age of 37 — “retired” from a high-profile Chicago law firm to become a full-time trader…

And quickly multiplied his life savings of $50,000 into a future-changing $5.3 million.

His name is Jim Fink and today he’s regarded as one of the nation’s top traders…

Not just because he made a personal fortune navigating the waters of every bull and bear market on record over the last four decades…

But because he’s shown thousands of regular investors, myself included, how to do the same thing.

Jim, I’m thrilled that you could carve out some time to be here…

And I’m sure by the time we wrap things up…

Everyone watching today will be as well.

Jim: Thanks for having me Phil. It’s great to be here.

Before we dive in… let me start things off by saying what I’m about to reveal is the very foundation that I’ve built my trading career on.

It is quite literally the greatest, most profitable discovery I’ve ever made.

And I’m thrilled to share it with everyone here today.

Phil: I’m excited too. Because I think — no, I KNOW — what you’re sharing today can help a lot of people…

And it couldn’t have come at a better time.

Because it’s getting harder and harder for regular folks to get by.

That’s not just my opinion either...

In a recent Bankrate survey…

75% of Americans say they aren’t financially secure right now.

Jim: That’s 7 out of 10 people.

Phil: Right! And if that isn’t shocking enough…

Did you know that 30% of Americans today don’t believe they’ll ever be financially secure?

Jim: Well hopefully what I share today will reach those people…

And at the very least, give them a sense of hope.

Because to be blunt…

It’s a crying shame that anyone in our country — as abundant as it is — should live without the feeling that a brighter future is within reach.

Phil: It’s sad for sure.

It’s also unusual that the path your strategy puts people on to achieve a better future is so much different than what most financial experts recommend.

I mean, conventional wisdom says you should scrimp and save…

Putting every dollar you can into index funds…

And over the course of a few decades — the power of compounding will leave you with a sizeable nest egg.

Jim: Well, that’s certainly one way to do it. And I think for some folks that’s probably the right course.

But what if retirement isn’t just some abstract concept that’s decades away?

What if — in the struggle of living paycheck to paycheck — many of your prime wealth-building years have slipped into the rearview mirror…

And now you find yourself needing a way to safely pad your nest egg in months instead of years?

Phil: So in other words, you’re saying you can make money fast…

Jim: I am. But I want to be clear…

While you won’t have your money tied up for years…

This strategy also has nothing to do with risky day trading.

Most of the seasonal profit windows that open only stay that way for two or three months…

Which as far as I’m concerned is the sweet spot between being chained to your computer because you’re afraid you’ll miss something…

And losing precious days… weeks… or even longer trying to squeeze an extra one or two percent gain out of a slow-moving stock.

Phil: Ok, I have to ask — what’s your secret? Because while it’s easy enough to understand how knowing a stock is going to move before it happens could open the door to making money…

Most investing systems I’ve seen that are built to do this exact thing are hopelessly complicated…

And typically geared towards only the most experienced investors.

Jim: Right. But that’s not the case with the strategy I’m sharing today.

Because this beginner-friendly system is built on two things…

Simplicity. And common sense.

I mean think about it…

If it rained on your wife’s birthday cookout every July 7th for the past 10 years running…

Aren’t you going to consider moving it indoors this year? Or at the very least have your house cleaned and ready to go in case it does?

Phil: Of course! It would be crazy not to. Because chances are — it’s going to happen again.

You don’t need a meteorologist to tell you that. The pattern is as clear as day.

So it only makes sense to be prepared.

Jim: Well, it’s the same story with the stock market.

Most folks don’t know it, but certain stocks move in the same direction at the same time…

Year after year.

Sometimes the movement is due to the weather, which can affect crops...

Or how much fuel we use to heat and cool our homes.

Sometimes it’s because of repetitive spending surges like holidays and back-to-school shopping.

And other times it’s based on when a company releases earnings reports to Wall Street…

Or announces dividend increases.

No matter what the reason…

The simple truth is some stocks have very statistically predictable movements based on what time of year it is.

And I have a program that singles out this pattern with laser precision.

Phil: But isn’t that a lot of data, Jim? I mean how many years do you go back…

Three… Five… or even more?

Jim: I go back at least 10 years when possible.

Phil: Whoa. There are more than four thousand companies listed on U.S. exchanges, right?

Jim: Somewhere around there.

Phil: So we’re talking about billions and billions of data points then.

Jim: Yep. Just because it’s a simple idea doesn’t mean it isn’t a lot of work.

It takes brute force computing power to chew through it all.

But it’s totally worth it after you see the profit opportunities it turns up.

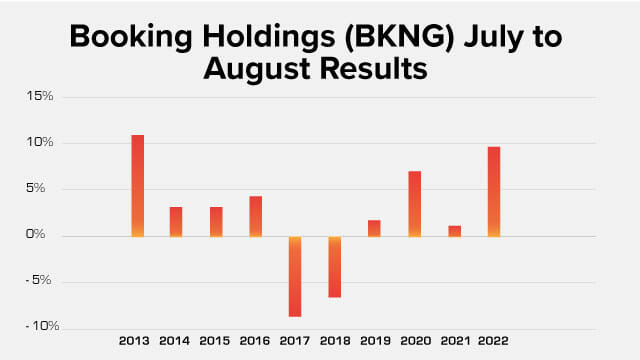

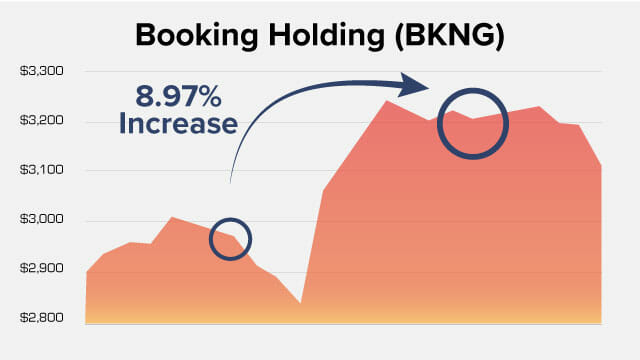

Take Booking Holdings for example.

The share price of the world’s leading provider of online travel services went up an average of 2.6% starting the last day of July…

Over one 10-year time frame.

Not exactly something that would get your blood pumping if you’re planning to buy shares.

But I found a trade that would capitalize on a move as small as 1%.

And when Booking’s share price inevitably popped 8.97% over the weeks that followed...

The special type of trade I make would have delivered a 123.8% gain.

Phil: That’s 13x better than buying shares.

Jim: It is.

And I’ve found dozens of examples which prove beyond a shadow of a doubt…

That knowing when a stock is about to jump…

And then making one simple market move…

Could help you to multiply even the smallest gains into oversized winners.

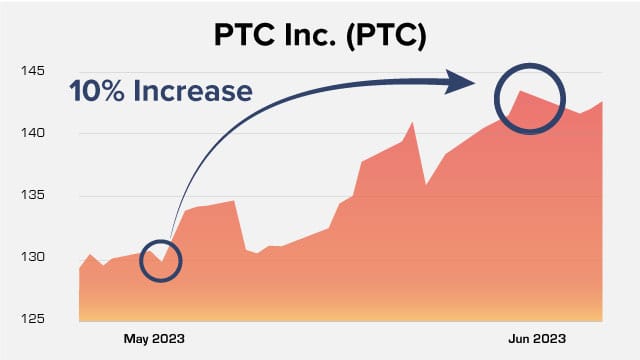

Take the global software company, PTC Inc., for example…

Over the past decade, its share price went up an average of 6% starting on May 16th.

And in the case of this trade example, it wasn’t any different because PTC’s share price shot up 10% over the next 31 days…

That’s not bad… any gain is a good gain after all.

But you would have sold yourself short if you knew this jump was coming…

And all you did to take advantage of it was pick up some shares.

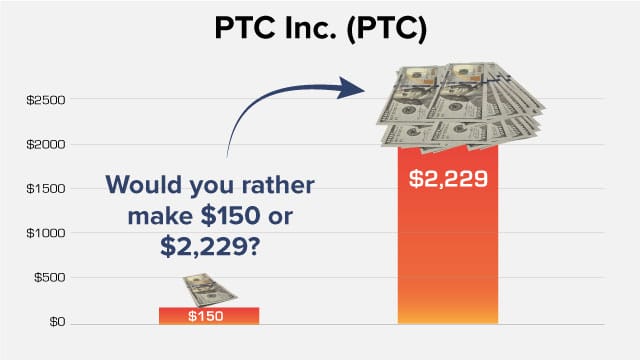

Because the advanced knowledge my system provides would have allowed you to enter a trade that turned that 10% move into a 148.62% winner.

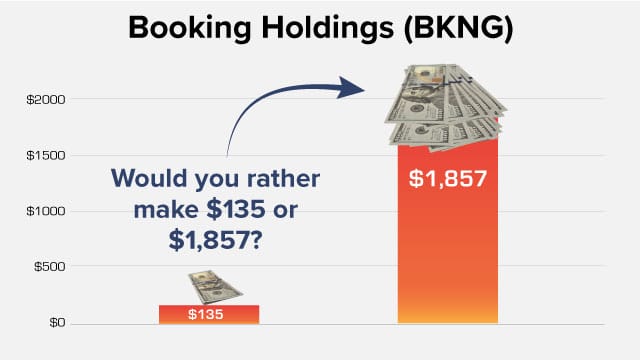

That’s the difference between walking away with a meager $150 profit…

Or a wallet-busting $2,200 windfall.

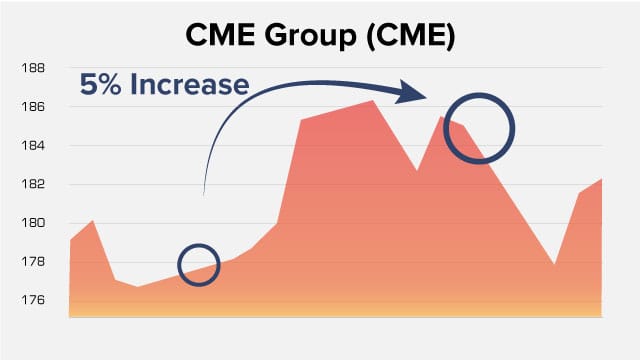

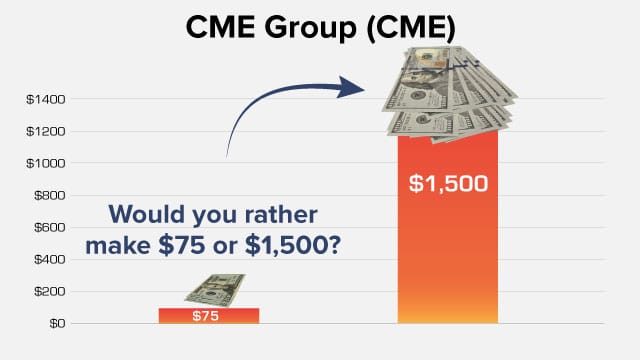

My system also pinpointed a window at the end of each May, where CME Group rose like clockwork over the past 10 years…

And if you entered the trade I found before the profit window opened again that year, you would have had the chance to turn this small 5% movement…

Into a 100% gain.

That’s 20 times better than buying shares.

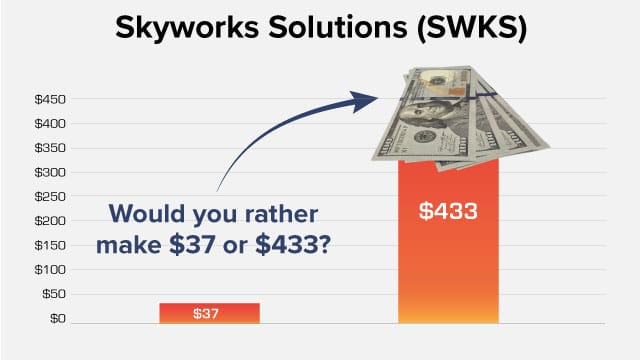

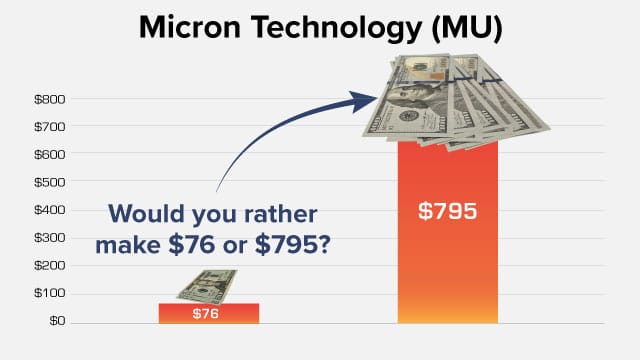

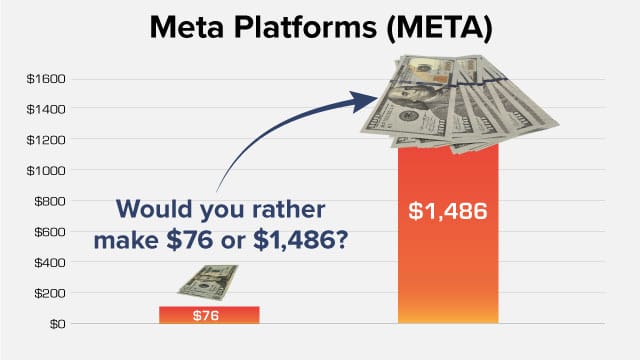

I also pinpointed trades on Dick’s Sporting Goods, Skyworks Solutions, Micron Technology, and Meta Platforms…

Each of these trades sported the potential to hand you a massive winner when their seasonal profit windows opened.

Phil: Can I jump in here real for a second, Jim?

Jim: Sure thing.

Phil: Great, thanks…

I just want to put a point on this performance gap.

If you bought $1,500 worth of regular shares for each of the seven trade examples Jim just covered… and you did it right before their seasonal profit windows opened…

You would have made $783. Total.

But if you put the same amount of money into the unique type of trades Jim uses…

You would have had the opportunity to walk away with $10,266.

That’s an incredible difference Jim!

Unlocking gains of this size can make the difference between a retirement filled with first-class travel accommodations…

And waiting for your Social Security check to show up so you have enough to fund a quick day trip to the state park in the next town over.

Jim: Thanks, Phil. But I do want to point out that not every trade turns a profit…

It’s true what they say, nothing in life is guaranteed… especially when it comes to the stock market.

Which is why you should never put more money into an opportunity than you can afford to walk away from.

Phil: Of course. It doesn’t take a rocket scientist to understand that.

But at the same time…

I’d be doing everyone a great disservice by not sharing what’s possible…

Especially when it’s so clear which path is better.

Jim: Well, the way I trade these seasonal profit windows isn’t for everyone…

Phil: You mean because you use options?

Jim: Well, when I find a profit window that’s about to open…

I actually recommend three different ways to profit.

The first is to simply buy the stock…

Which as you’ve seen…

Produces lower profits.

But to directly answer your question…

Yes, the other two ways moves I make involve options.

Phil: If buying stock produces lower returns Jim, why do you recommend buying them?

Jim: Well, for one thing any profit is a good profit. And I believe it’s my responsibility to leave no stone unturned when it comes to finding ways to make money.

Plus, I’m well aware that the moment some folks hear the word "options" they just shut down…

So rather than having them completely miss out on making money from these seasonal profit windows, I include instructions on how to buy the stock too.

That way people can pick the path they’re most comfortable with.

Phil: Makes sense. But it leads to another question…

In your experience, why do people shut down when they hear you’re using options?

Especially since as we’ve seen, the profits they deliver can be so much better than buying shares.

Jim: Oh man, talk about a loaded question!

I’ve been trading options for over 30 years…

And while I’ve heard every reason under the sun…

It typically boils down to folks thinking they’re complicated...

A fast way to lose money...

And that the odds are against you.

But none of this is true!

At least not the way I trade options.

I designed my system to make options trades more affordable, more predictable, and best of all, more profitable.

You know what…

It’s one thing for me to say that…

But I’m a "seeing is believing" type of guy…

And I’m sure some of the folks watching are too…

So would it be ok for me to take a minute to show everyone how easy it is to make the trades I recommend?

Because I think it will go a long way to dispelling the myth about options orders being complicated to execute.

Phil: Of course, this is good stuff, Jim!

Jim: Thanks. So now I’m going to pull up a recording of a trade I did in my online account.

I had everything filled out already to save a little time.

But here you can see I put in the strategy we used…

Which is a simple buy order.

I filled out the company we want to make this move on…

The line of detail for the trade…

And the total amount I was willing to invest…

From there I just clicked “Review Order”…

Made sure everything matched up with my instructions…

And clicked "Submit."

Phil: You ran through that pretty quickly. Was I seeing things, or did it really only cost $127 to open that trade?

Jim: Yep. It would have cost $127… before commissions of course.

Phil: And that allows you to control 100 shares of stock?

Jim: It gives you the right — but not the obligation — to buy those shares at the agreed upon price…

Which in this case was $57 a share.

Phil: And how many shares would you have been able to buy with that $127.

Jim: Two.

Phil: And if you wanted to buy 100 shares?

Jim: $5,679.

That’s why I love options. Your risk is far lower… and it’s capped.

Phil: So the most you would be out if your options trade didn’t work is the $127?

Jim: Yessir!

Phil: That’s a massive difference from $5,600. And, having done a few of these trades myself, I have to say…

Getting into them doesn’t really take any more work than buying shares outright…

Jim: It’s really not.

Phil: So how long would you say it takes for someone who’s never placed an options trade to do what you just did?

Jim: Well, it’s interesting you asked. I let my son try to enter a similar order last night just to see if he could do it…

And he came through with flying colors… in only 2 minutes.

I think that’s about right based on what I’ve heard from folks who’ve followed my instructions before.

Having said that, even if it takes a little longer…

Does it really matter when the end result is profits of 116%... 137%... or even 227%?

Phil: It shouldn’t. And you’re going to send out the full details on your newest trades pretty soon, right?

Jim: Yep, that’s right. I release two new trades to a small group of people who make up my VIP advisory called Seasonal Stock Alert on the fourth Wednesday of every month.

Phil: We’re going to cover exactly what Seasonal Stock Alert is all about in just a bit.

But first things first.

I want to circle back to something you said a minute ago…

When you were talking about options being less risky than buying shares of stock…

Because that’s not what the mainstream financial press says when they talk about trading the way you do…

And it’s not what Wall Street says either.

Jim: Well, as far as I’m concerned the mainstream financial press is just a paid mouthpiece for Wall Street…

So I’m not surprised they’re both singing the same song.

But the fact of the matter is… they’re both wrong.

Phil: Why would they do that?

Jim: Money. Pure and simple.

I mean think about it… Wall Street bandits like hedge funds and investment houses would much rather pressure you to the point where you give up trying a strategy like mine…

And pour a massive amount of money into some “can’t miss” small cap stock or index fund…

Because it not only sets the stage for them charging you a king’s ransom in fees and commissions…

Quarter after quarter…

It also tees you up for massive losses when they decide to pull the rug out from under you.

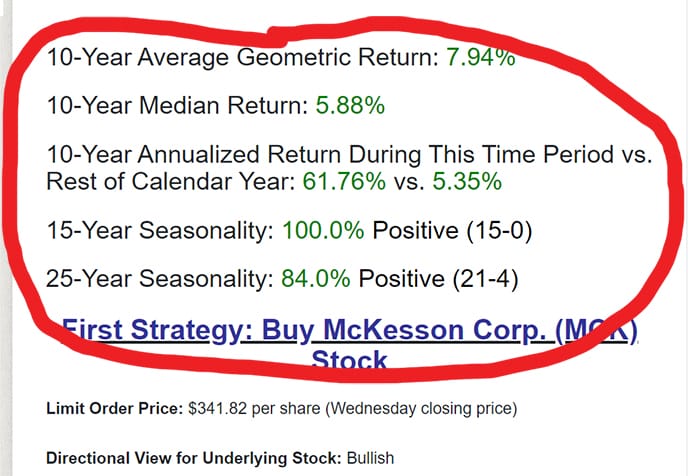

Take the $4,855 profit my McKesson trade generated for you in 57 days for example…

To make the same amount of money from buying shares you would have had to risk $18,000…

Phil: Well, it’s actually $18,565.

Jim: Right. And the problem with that — other than most folks don’t have that kind of money to sink into one trade…

Is it dramatically magnifies how much you could lose to a downside move.

I mean, what if McKesson plunged 50%? It’s happened before.

Phil: I would have lost over $9,000.

Jim: Exactly. Now you tell me…

Which trade is riskier?

The one that lets you triple your money in less than 2 months…

Or the one where you’d have to pony up $18,000 for a shot at making less than 20%?

Phil: Well, when you look at it like that, it’s obvious buying regular shares would put far more of my money at risk.

Jim: Right. Investing is all about risk and reward.

And my turnkey profit window system gives you the opportunity to make far more money… by risking far less.

On the exact same share price move.

In the exact same amount of time.

Phil: That’s incredible. It’s also one of big reasons I gave you the greenlight for this project… and even invested my own money in some of your trades…

Because with all the unpredictability in the stock market… the economy… and life in general…

What most Americans need more than anything right now is the simplicity and certainty that only comes with financial peace of mind.

Jim: Agreed. And that brings up another point I’d like to make, Phil…

I don’t want folks to think that the only thing I use to evaluate these opportunities is whether the stock went up between two dates on the calendar at least 8 out of the 10 past years…

Because while that’s definitely where the process starts…

It certainly doesn’t end there.

Every potential seasonal profit opportunity I consider runs through a rigorous financial boot camp designed to maximize your odds of walking away with a profit.

The first step of which is a 11-point valuation model.

That’s where I look at specific, critical metrics in the stock’s financial statements to make sure it’s a stable company.

And while this step alone exposes the ugly underbelly of virtually every “pretender” that could lead to a failed trade…

I don’t stop there.

Because for each stock that clears the fundamental analysis hurdles I put in front of it…

The very next thing I do is a technical analysis deep dive into its charts…

Looking for positive trends in price momentum and volume of shares being traded.

That means, even if a stock has an overwhelmingly positive seasonal profit window history…

I still triple check everything to make sure it’s capable of delivering an “encore performance.”

Finally, I look at bigger picture influences like the economy.

Again, I want to be sure all the right conditions are in place… that the stock is ready to go… and that the path is all clear.

This all might seem like overkill now… but it’s a safety valve that you’ll come to appreciate when you have money in the game.

Phil: The thing I really like about what you do Jim… and the thing that sets you apart from virtually every other analyst I’ve met…

Is your uncanny ability to distill all this complicated analysis down to something even a beginner can understand…

And more importantly, profit from.

Jim: Thanks, Phil, I appreciate that. But as far as I’m concerned, making things simple to grasp isn’t just something that’s “nice to have”…

It’s my duty to the people who follow my work…

And I take that responsibility very seriously.

Phil: Of course! As Investing Daily’s President, I appreciate your thoroughness…

And as someone who put money into your trade recommendations…

I appreciate how turnkey everything is even more!

Speaking of which…

Do you mind if I pull up one of your alerts so folks can see how easy they are to understand… because to use your own words… seeing is believing.

Jim: Sure thing.

Phil: Great. The first thing I want to make clear to the folks who tuned in today is that this alert is no longer active… so please don’t try to enter the trades.

Ok…

Let me scroll through the beginning here…

As we mentioned earlier… the alerts Jim puts out each month always has trades on two stocks…

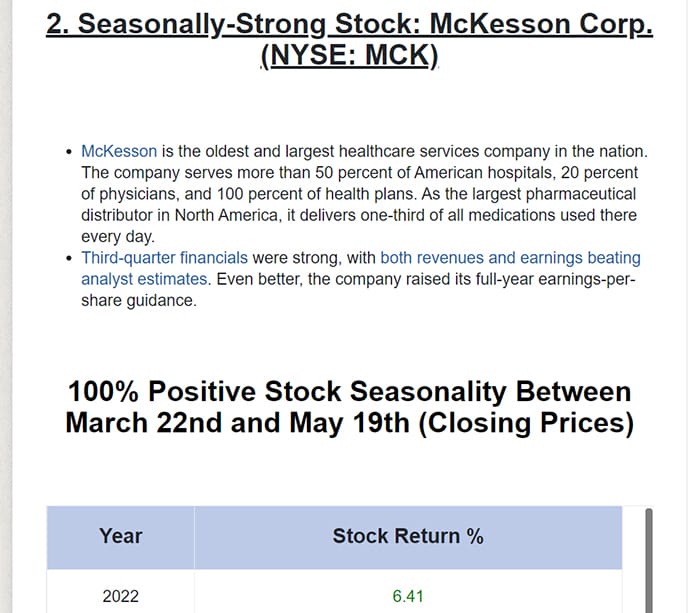

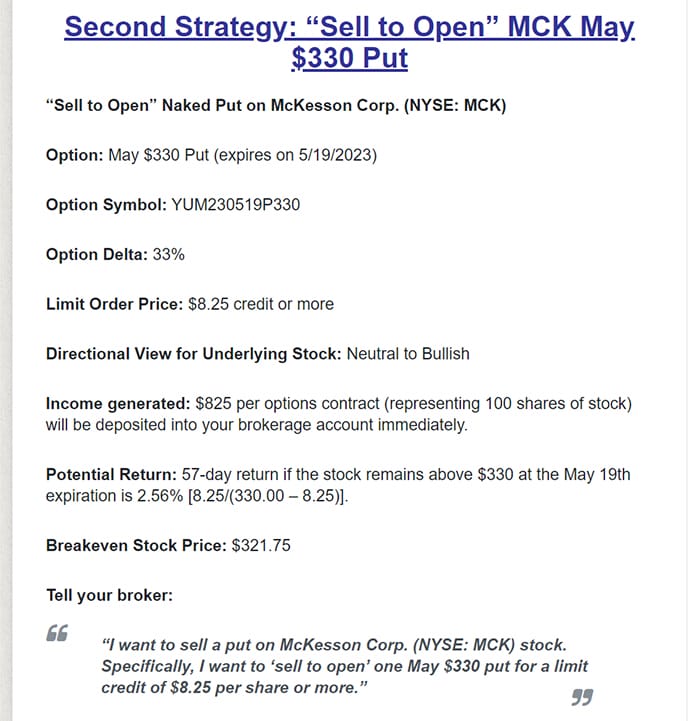

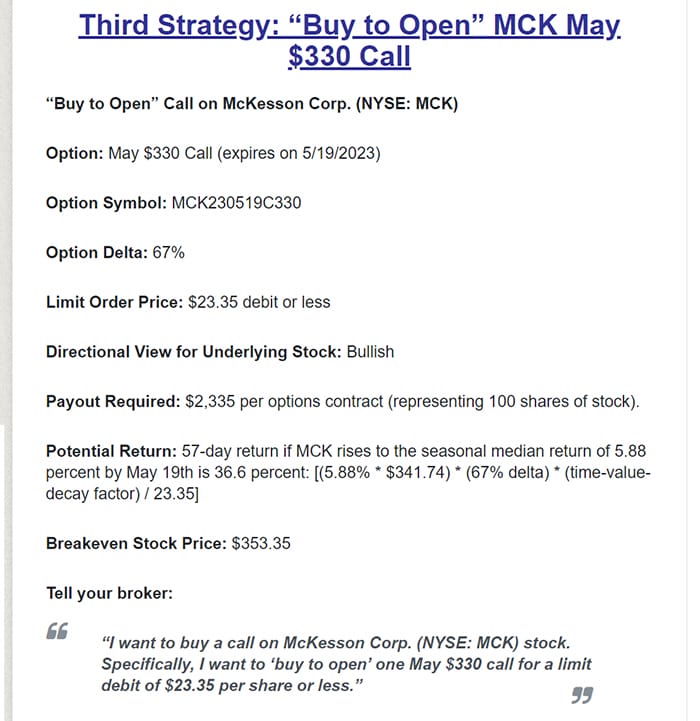

And in the interest of time, I’ll going to skip over the first one and go to the trade on McKesson…

Which is the one I racked up a $4,855 windfall on…

So, of course, it’s one of my favorites.

Here we go…

As you can see… the first thing Jim covers is a quick recap on the company, what it does, and some top-level financial notes.

Then he jumps right into the good part…

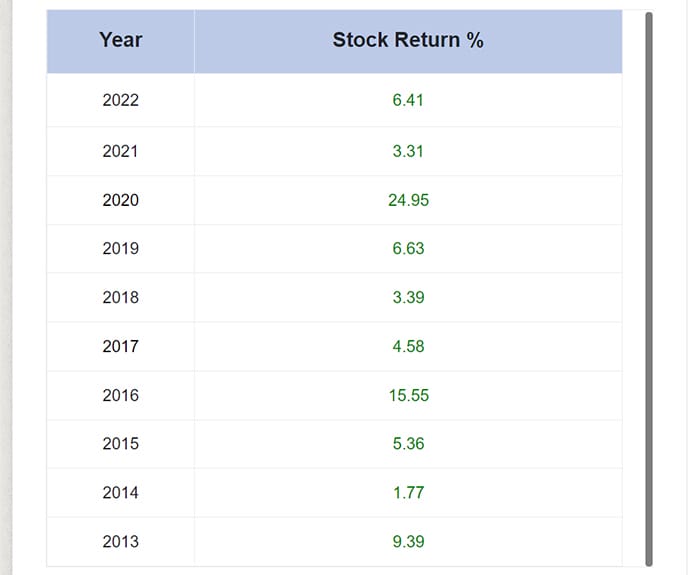

Which is the seasonal profit window.

In this case Jim, you found a two-month period of time — March through May — where over the last decade McKesson’s stock went up 10 out of 10 times…

How common is that?

Jim: Well, it certainly doesn’t happen every time. But it IS the holy grail — and it pops up more than folks think.

And if nothing else… it’s certainly a big, fat green light to dig deeper into the stock.

Phil: And how many years does a profit window have to open to merit your consideration as a trade.

Jim: 8 out of 10. If it’s any less, there would have to be some other type of overwhelmingly compelling data showing up for me to consider it.

Phil: Great. Let’s keep going then… what are the figures I just circled here…

Jim: They’re stock return data points that serve as my final “go, no-go” hurdles.

Phil: Sorry to interrupt, but is it safe to assume the stronger these numbers are the better?

Jim: Yes. It some cases they serve as the tipping point… and other times they just confirm the trade is a slam dunk.

Phil: Great. Makes sense. So what’s next?

Jim: From here it’s all about ways to put yourself in a position to profit.

The first is simply buying the stock.

The second is an options trade geared towards generating instant income.

And the last type of trade is a way to multiply small stock movements into massive winners.

Phil: You’re talking about buying call options, right?

Jim: Yessir.

Phil: Folks, these call option trades are the ones we track in the Seasonal Stock Alert model portfolio…

They’re the ones I put my own money in…

And they’re the ones that boosted my trading account by $8,033.

They’re also so simple to understand and execute — even for beginning investors — that around the office we call them “options training wheels.”

But as we’ve shown you over and over…

The profits they can deliver — are far superior to what most beginning investors ever see.

And Jim, this is all possible thanks to knowing when a company’s profit windows have opened and closed over the years correct?

Jim: That’s right. All options trades have specific end dates. So without knowing when the window is set to open…

And close…

It would be impossible to know which options trade to get into.

Phil: That’s a big deal right?

Jim: For sure. There are thousands of combinations of strike prices and end dates to pick from.

Phil: And you provide all that in your trade instructions right?

Jim: Absolutely. Can you pull the alert back up?

As you can see…

I literally provide directions you can read word for word to your broker – or enter yourself in your trading account.

Phil: It can’t get any easier!

And I see you do it for all three types of trades…

Including buying shares.

Jim: Right. I’m a firm believer in the idea that no matter what trade someone makes, it’s the most important one to them… and because of that, each set of trade instructions deserves equal effort from me.

Phil: I agree 100%. Speaking of which…

You’re about to release a new set of trades in a few days right?

Jim: Yep. The 4th Wednesday of this month…

And every month that follows as well.

Phil: Ok, great. Before we show folks how to put their name on the email list that these trades get sent to…

There’s one more thing I’d like cover…

And that’s the trade that generates instant income.

Because while buying shares…

Or a call option…

Are both simple enough to understand from the respect that you are buying into a trade and waiting for the price to go up…

The third way to take advantage of these profit windows is by making a trade that pays you at the beginning?

I’m sure I’m not the only person wondering how this works.

Because in the first two types of trades you covered…

You were making an upfront investment.

But in this one, it’s the exact opposite.

Jim: You’re precisely right. It is the EXACT opposite.

Because we’re taking the other side of the trade.

Let me explain.

Every options trade has two sides…

On one side there’s someone who believes a stock is going to drop and is willing to buy into a trade where they can make money if it does.

But on the other side there needs to be someone who believes the exact opposite will happen…

And is willing to accept that bet.

Phil: So we’re the ones that are taking the bet… I mean, what you’re saying is this trade involves selling options?

Jim: Yep. Why wouldn’t you when you know a profit window is about to open and share prices have a high probability of going up?

For instance, let’s say I’ve found a profit window that’s about to open on shares of JP Morgan (JPM) which are trading for $149.

With that insight, I could put a trade together that would allow you to instantly collect at least $570 from investors who believed the financial giant’s share price was going to drop below $145.

Phil: Ok, I have to ask then… what’s the downside?

You collect the money upfront every single time you make the trade…

But what if the stock falls? That’s when you lose, right?

Jim: Yes and no.

If the price of JPM falls to say $147, it didn’t fall low enough to hit the $145 price you and the options buyer agreed to when you sold him the put.

So you STILL win.

Phil: And if it falls far enough that it hits the price you agreed to?

Jim: Well, that’s when you lose the bet.

Because the stock gets “put” to you. Which simply means you have to buy the number of shares you agreed to when you sold the options contract.

Even then, it’s not really a bad thing.

And here’s why…

First, you still get to keep the money you collected when you sold the put.

And if you haven’t used it for something else, you can use it towards the cost of buying the stock.

But more importantly, since I only make this move on companies that pass my rigorous, proprietary, seasonal stock selection system…

All you’ve really done is bought shares of a great company, which in this case is one that pays out a generous $5.00 annual dividend.

And best of all… you picked it up at a solid discount.

Phil: So it’s like getting paid to buy a great stock!

Jim: You could look at it that way. Which is why the profit window analysis I do before putting out a recommendation is so critical.

Phil: But what if the price never drops, and you never buy the shares?

Jim: That’s exactly what you want…

Because it means you get to walk away with the money you collected at the beginning of the trade.

And you can do it all over again on the next trade I release and collect even more cash.

It’s literally one of the biggest win-wins I’ve ever seen in investing.

One that 99% of investors never try just because they get scared off when they hear it involves options.

Phil: It sounds like you’ve found every possible way to squeeze money out of the market!

And you’ve done it in a way that even new investors can understand…

Yet is powerful enough to get seasoned traders excited too.

Jim: Thanks.

And while that was certainly my goal…

I do want to point out one more time, there are instances where you can lose money using my profit window strategies.

Nothing is perfect after all.

Phil: Of course. But it’s hard to argue just how drastically the odds of winning are stacked in the favor on Seasonal StockAlert members who follow your lead.

I mean in the last half hour you’ve shown us a handful of opportunities that would have turned $1,500 into a profit of $795… $1,486… $1,500… $1,857… and even $2,229…

And considering it’s such a low risk, high reward trading approach…

One that doesn’t take a PhD to understand…

I don’t see any reason to not give it a try.

Especially with the deal I’ve put together for folks who took the time to tune in today.

Before I cover that though, Jim, unless you have anything else to add, I want to thank you for showing us how easy it is to trade these profit windows.

I know it’s taken you an extraordinary amount of time — and hard work — to research and refine this trading strategy.

Jim: My pleasure Phil. Thanks for having me.

I’m looking forward to seeing each of you inside the Seasonal Stock Alert…

And remember, I’ve got two trades teed up and ready to send to you in just a few days.

Phil: Great.

We’ve mentioned Seasonal Stock Alert a number of times today.

So let me show you why it’s so special…

And cover the details on everything you get when you become a member.

As Jim just mentioned, in the next few days, he’ll send you instructions for both trades he’s pinpointed.

They’re the perfect way to kickstart your journey to raking in massive gains in the coming weeks.

Remember, for every profit window opportunity Jim recommends…

He includes detailed instructions on three different ways to play the opportunity…

So once a month — every month — for the next year…

You’ll get half-a-dozen ways to make money.

And whether you open the trade alert and skip right to the simple instructions which you can carry out in just a few minutes…

Or grab a cup of coffee and read the entire writeup…

The end result is the same.

Because you’ll have the opportunity to turn small stock movements of as little as one or two percent…

Into quick winners that could flood your trading account with cash over the coming year.

You’ll also get the password that unlocks the private Seasonal Stock Alert website.

You’ll also get the password that unlocks the private Seasonal Stock Alert website.

Inside you’ll find a FREE library of invaluable tools like the Cliff Notes inspired digest, How Seasonal Stock Alert Works.

This quick 5-minute read lays out in plain English everything you need to know about the three strategies Jim uses to make money when he finds a profit window is about to open…

That way when your alert shows up just days from now, you’ll be up to speed and primed to take immediate action.

You’ll also receive a copy of Programmed to Pop: The Simple Secret to Finding Recurring Seasonality-Based Trade Ideas.

Perfect for the kind of person who likes to understand exactly how something works...

Perfect for the kind of person who likes to understand exactly how something works...

This e-book does a deep dive into seasonality investing and why Jim uses it, including…

- Five popular investing strategies that Seasonality beats

- Seasonality speed bumps & how Jim overcomes them

- Four Seasonality Secrets to supercharge your portfolio and…

- 12 picks with Strong Seasonality

That’s not all you’ll find on the website though.

You’ll get Jim’s 3-part video Boot Camp...

Which is an “over the shoulder” look at everything from how to find your own seasonal profit opportunities…

Which is an “over the shoulder” look at everything from how to find your own seasonal profit opportunities…

All the way to how to place the three types of trades we’ve covered today.

You’ll also find the full model portfolio, which is a scorecard that tracks every call option recommendation Jim has ever put out.

Perhaps the most popular thing you’ll get on the website though — is direct access to the entire Seasonal Stock Alert community…

Because it’s the number one place to go if you ever have a question.

Look, I don’t care if you’re a complete novice when it comes to options… or if you’ve been trading them for a while…

Everyone needs help on occasion.

And you’ll always get it on the Stock Talk forum.

I know Jim loves the saying that it takes a village to raise a child…

And he believes creating successful traders is no different.

When you join Seasonal Stock Alert you’re officially part of Jim’s tribe.

Failure is not an option as far as he’s concerned.

So much so that if you ever post a question to the forum, you might hear from Jim himself.

Because he’s very hands on and jumps in to answer questions quite a bit.

Look, I’ve been in the publishing business for a long time now.

And I can tell you without hesitation getting support like this — especially from an analyst as accomplished as Jim — is completely unheard of.

I’m sure by now you’re wondering how much it costs to be a part of this unique moneymaking advisory…

And the short answer is…

It’s not cheap.

Only a handful of analysts know how to use options to amplify the gains profit windows deliver when they open.

And there’s even less who know how to use them safely.

That makes Jim’s extensive success as an options trader very rare…

And very valuable.

So I can’t just give his advice away!

Which is why the regular price for a one-year membership in Seasonal Stock Alert is $2,000.

But here’s the thing, I’m not asking anyone to pay anywhere near that much today…

I’m well aware times are tough…

And most folks are hesitant to spend that kind of money right now.

Which is why I’m slashing the price by 98%

That means — in the end — you’re getting a Seasonal Stock Alert membership for only $39.

Which saves you $1,961.

Consider the massive discount my gentle way of giving you a nudge in the right direction!

And to give you some additional peace of mind…

You’re covered by my 90-day — 100% guarantee.

I want you to be 100% sure Seasonal Stock Alert is right for you.

So I’m giving you three full months to try it out at my expense.

That’s plenty of time to check out everything on the Seasonal Stock Alert website…

Read a few issues…

And potentially cash out with a few winners too!

If at any time during those first three months you’re not happy with what you’re getting from Jim — or the profits you’re seeing — simply let our Customer Service team know...

And we’ll issue you a prompt, no-questions-asked refund for every penny of your membership.

I have no interest in keeping your money unless you’re 100% satisfied.

And even if it’s past the 90-day mark and you find yourself unhappy for any reason, we still have your back.

Simply let us know and we’ll give you a refund for the unused portion of your subscription.

On the off chance you do decide Seasonal Stock Alert isn’t all I promised it would be…

I insist you keep everything you received from me as my way of saying thank you for giving it a try.

I’ll be honest — I’m not too worried about that happening.

I’d never make such an outrageous offer if I wasn’t absolutely sure Jim could back it up.

I couldn’t afford to!

You need to make your move now

But here’s the thing.

If you want to lock in the massive savings I’m offering you today…

Along with the double-barreled satisfaction guarantee…

And access to at least 72 profit opportunities that could help you make $1,744… $2,061… $3,416…

Over and over again…

You’ve got to make your move now.

To make sure everyone gets the attention they deserve…

I’m only opening the doors to Seasonal Stock Alert for a brief window…

And based on response — I’ll decide whether to keep them open — or close them for good.

Please be aware, there’ll be no warning when this is about to happen.

This page will simply disappear. And you’ll be locked out.

No exceptions.

I know that may not be a popular decision.

But the truth is, if you haven’t reached for your wallet yet, Jim’s program probably isn’t right for you anyway.

Considering we’ve invited well over 40,000 people to watch this webinar…

Today is probably going to be your one — and only — chance to join.

To see the full details on this limited-time opportunity, simply click the big blue button at the bottom of your screen now.

Remember, Seasonal Stock Alert is a VIP trading service run by Jim Fink, one of the world’s foremost options experts.

And he regularly uses his profit window method to pinpoint stocks that are about to move…

And then puts together trades that deliver gains of 116.24%... 137.39%... and even 227.71% to a small group of regular investors…

Some of whom never traded options before meeting him.

Now it’s your turn.

Click the blue button below to review all the details on how you can set yourself up to reap massive windfalls month in and month out with Seasonal Stock Alert.

Thanks for taking part in this special webinar.

This is Phil Ash signing off.

To massive seasonal stock profits,

Phil Ash

President

Investing Daily

Copyright © 2025 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.