The Great

Inflation Crisis of 2022

...and what you can do about it

Why you must reposition your assets now if you’re serious about preserving and building your wealth

Fellow investor,

I’m concerned — no, make that worried — that you may be setting yourself up for huge losses in the next 24 months.

You see…

- Despite recent highs in the stock market

- Despite drops in the U.S. unemployment rate

- Despite gains in consumer confidence

Everything is not OK, my friend, and not by a long shot.

The result is about to crush the hopes and dreams of millions of unwitting Americans who fail to understand the dramatic situation that’s now unfolding.

The reasons are many, compelling, and clear:

- President Biden came into office promising economic reforms, but some of them could turn out to be catastrophic for the U.S. economy over the next 24 months.

- What’s more, stocks aren’t generating the kind of earnings growth to justify their high prices. How can they? According to the widely-followed Shiller P/E ratio, they’re already selling for 39 times earnings. That’s 131% higher than the average P/E of 16.8 recorded historically

- Worse still, the global economy isn’t strong enough to support stock prices — especially in the face of many countries still recovering from the pandemic and having trade barriers and tariffs, which will raise the prices you pay for goods.

- All of this is happening as the Fed is pumping money into the financial system like never before and our dollar is getting weaker, adding inflationary pressures that are eating away at the average American’s spending power.

- The end result will increase national debt, exacerbate the budget deficit, and raise prices for everything you buy.

- The chain reaction will not only result in high inflation and low growth, but also drive the dollar down further while boosting prices for resources, food, and energy — all as the cost of Medicare and Social Security continue to spiral out of control.

- That's when the Fed’s sins of past years of low interest rates and stimulus policies will finally come home to roost — triggering the biggest surprise of the next 24 months: The return of higher inflation that will rock Wall Street for years to come.

- Thanks to Trump’s trade war with China — which Biden is continuing — the price increases are only going to get worse. CNN recently reported that the US still has tariffs on 66% of Chinese goods, with an average rate of 19% (6X higher than before the trade war began in 2018).

And the spike in prices we see headed our way has already begun.

Over the last 12 months:

- Energy commodity costs are up a staggering 41.2%

- Food costs are up 3.4%

- Hospital services are up 2.8%

- Major appliances are up 12.3%

- Rent is up 1.9%

- And car & truck rentals are up 73.5%

Yet, none of this is being reported in the press!

How can this be? Because the government changed the way it calculates inflation in 1980.

The new way understates inflation. And it does so significantly.

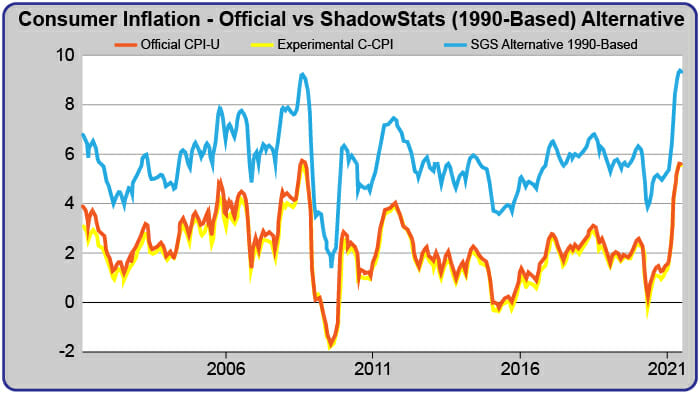

Look at this chart, maintained by ShadowStats:

The blue line shows what inflation would be under the old way of measurement. You can see with your own eyes how prices have skyrocketed since the pandemic outbreak.

Make no mistake...

Prices are only going to jump higher again in 2022 and beyond as China continues to gobble up big chunks of the world’s natural resources on the cheap using the U.S. $3 trillion they’ve accumulated in foreign reserves.

Although we cannot rule out oil declining again, we think prices could re-approach $100 by the end of 2022 or sooner. It doesn’t take a huge demand bump or supply reduction to turn the oil market around.

The result will continue to push up the prices of everything we buy — from toothpaste to tomatoes to technology... and everything in between.

I’m not the only one who says the scourge of inflation is upon us.

Investor Peter Schiff — who is well-known for publicly predicting the 2008 financial crisis — said in a recent post: “When it comes to inflation, we're just getting started.”

And it’s all thanks to the trillions of dollars in liquidity the Fed has cranked out over the past several years that the banks continue to hold onto in the form of excess reserves.

Billionaire Warren Buffett also confirmed suspicions at the annual Berkshire Hathaway shareholder meeting: ”We are seeing substantial inflation… we are raising prices. People are raising prices to us, and it's being accepted."

Tragically, most investors are totally blind to the inflation story that’s been brewing behind the scenes for 2 reasons...

- The financial media generally reports ONLY the government’s inflation numbers, which understate the impact of many living expenses that are currently rising.

- The return of inflation has become the Wall Street equivalent of “the boy who cried wolf ” for the past 30 years. Any analyst who dares to broach the subject could suffer.

But with rising prices for everyday necessities like gas, food, and appliances…

And warnings from billionaire investors like Buffett…

It seems like the writing is on the wall.

That’s the whole reason I’ve sent you this special alert.

To tell you what the government, the financial media, and the analysts aren’t telling you about the single greatest threat to your wealth now — the return of inflation — and how to protect your home, your savings, your investments, and your retirement.

Plus, to tell you about the six types of investments that are destined to soar 275%, 375%, even up to 575% over the next few years as the winds of inflation flatten the U.S. economy like a mud hut in a hurricane.

A Warning and an

Opportunity to Take Seriously

My name is Stephen Leeb, and in my 40 years of covering the financial markets, nobody’s ever accused me of being a fear monger.

But frankly, I’m worried — and you should be too.

We’re facing a new kind of inflation — one that’s never been seen before.

And it’s far more dangerous because it stands to destroy every dollar you’ve saved and invested for your retirement.

Here’s why:

Previous periods of high U.S. inflation have been driven by the combination of (1) rising wages and rising prices and (2) the failure of material supplies to rise as rapidly as the money supply.

In the past, wages forced business costs up, which forced prices up... and in a self-reinforcing loop, the prices drove wages up.

But that’s not the kind of inflation we’re facing today.

We’re facing a different kind of inflation threat that comes not only from rising commodity prices… but is being exacerbated by loose fiscal and monetary policies.

Unless you reposition your assets now, as I will show you throughout this special report, you will soon find the stock market a better place to lose a fortune than to make one.

The reason?

The billions in government stimulus spending to combat the Great Recession have only gotten the economy growing at a modest pace for Americans over the past decade...

And at the same time have handed the Chinese more than $3 trillion to build up their own nation.

As their economy has flourished, Chinese citizens have seen their quality of life rise — and with it there has been more spending by China...

All of which has driven that nation to bid up commodity prices globally as they build the cities, factories, and technology infrastructure they need to catapult their country into the 21st century.

I’ve long warned about the impact an increasingly powerful China would have on the West, such as in my 2011 book Red Alert...

And now the pandemic has seemed to only speed up the transition of power toward the Eastern part of the world.

Spending on infrastructure and the transition toward renewable energies also will likely create inflationary pressure never felt before.

Mainstream news outlet Bloomberg News has been among those touting the struggles of the commodities market...

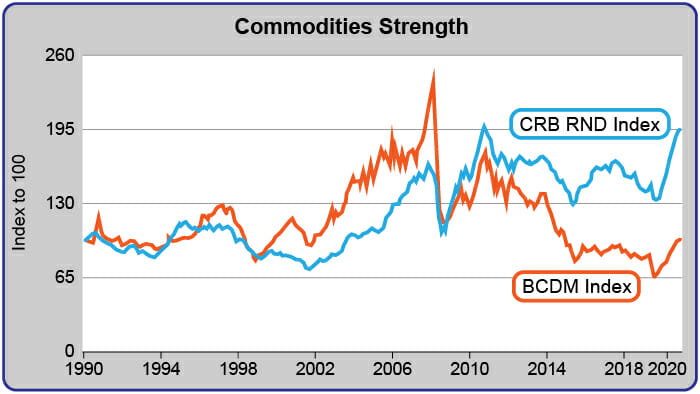

One of their headlines read: “Commodities Drop to 12-Year Low as Oil Slumps Amid Global Glut.” However, the chart below highlights why such headlines do not tell the whole story.

The Bloomberg Commodity Index shows the prices traded on commodity exchanges. On the other hand, the CRB Index of Industrial Raw Materials shows the prices paid by intermediate manufacturers who convert the commodities into consumer products or intermediate industrial products.

In other words, the CRB Index more accurately reflects the actual cost of commodities in the real economy.

As you can see, commodities are holding up much better than the commonly quoted prices would lead you to believe.

In fact, it is remarkable that commodity prices are as high as they are, even though the world experienced a period of the slowest growth since the end of World War II...

And Europe and Japan — two of the world’s largest economies — struggle to maintain even low growth rates.

The culprit is resource scarcity — it’s becoming more difficult to produce these essential materials that feed the world economy.

Imagine if there were any significant global economic growth, commodity prices would take off to the moon and inflation would return with a vengeance!

For investors, that is a very scary proposition.

This is why food and basic building materials — from wood to steel to copper — have skyrocketed as U.S. consumer spending and wages have barely risen.

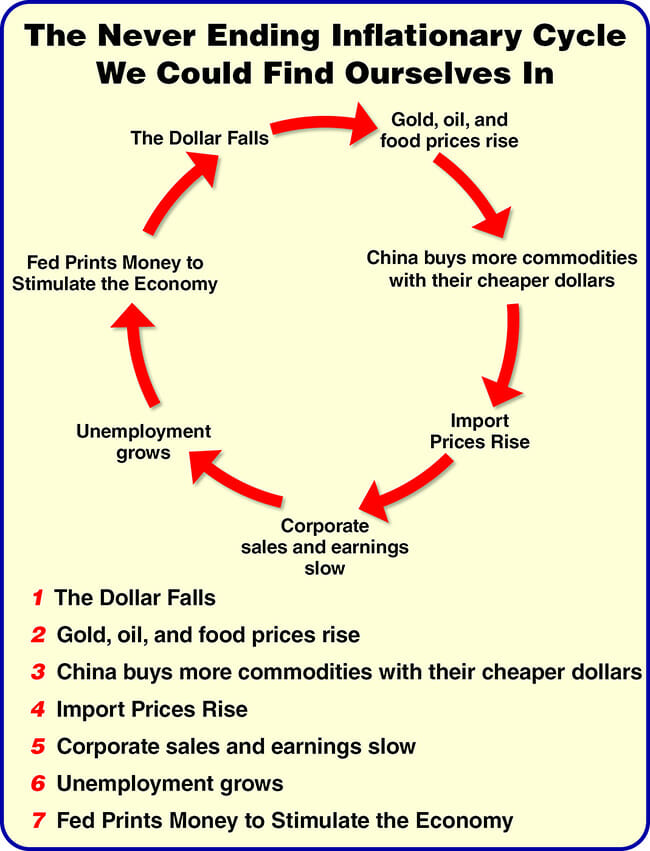

As a result, what we could face is a never-ending inflationary cycle whereby the Fed continues to maintain a very loose monetary policy, the dollar falls lower, commodities rise higher, and the Chinese buy up more commodities on the cheap as our dollar goes down.

The end result forces up everything you buy here, as wage growth cannot keep pace with inflation...

Creating an unstoppable inflationary boom cycle (for the Chinese) and bust cycle (for us) wreaking havoc on the American economy.

The situation will only get worse over the next year as inflation begins to climb and the Fed struggles to balance weak economic growth and rising price levels.

When you throw in the fact that the government has bought $2.3 trillion in treasury notes and bonds from March 2020 to July 2021 to pay for all this…

You can see why the U.S. has painted itself into a dangerous and frightening inflationary corner.

And now, there’s only one option: Keep raising interest rates just as Paul Volcker did in the 1970s.

And recently the Fed has started to do just that.

The result will soon blindside millions of unwitting investors who see the market’s rise as the sign of recovery instead of what it really is...

Another investing bubble that’s been pumped up with low interest rates.

Frankly, what we are looking at is a repeat of the housing boom/bust of 2003-2008.

But instead of all the hot money chasing real estate, it’s now chasing stocks that could reverse course when interest rates rise and this new house of cards collapses.

Only this time, the selloff will be worse...

Because the inevitable rise in interest rates will not only crush the housing market but will trigger an exodus from stocks as well.

The end result will create a dangerous and costly anomaly where the dollar falls and interest rates rise along with higher prices for everything you buy — crushing earnings and blindsiding those who are just now hopping aboard the “recovery” bandwagon...

All while delivering almost obscene profits to those who reposition their assets now with an eye toward inflation-loving companies.

Which is why I’m telling you …

Investors Who Ignore This Warning

Will Lose Their Shirts…

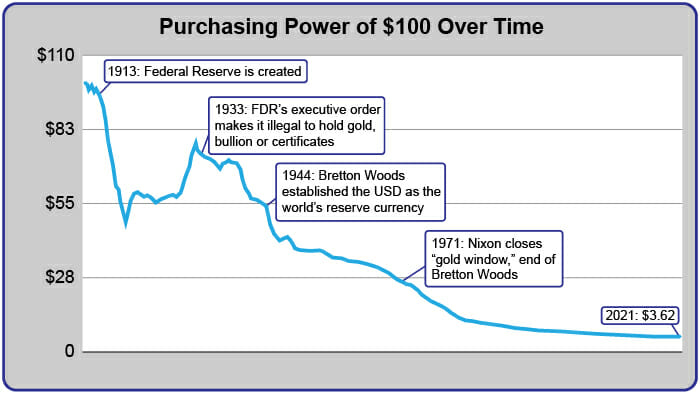

I’m not talking about just in the stock market, my friend, but your entire life… as you see your purchasing power collapse and everything you buy costs more.

Of course, nobody can tell you how far and how fast prices will rise or the exact day inflation will head up this year...

But I can tell you this:

- The 6.5% annualized inflation rate the U.S. Department of Commerce reported for the second quarter of 2021 could jump another 50% or more.

- Consumer interest rates could rise as well, devastating both the consumer lending sector and home borrowing.

- Many “safe” blue chips would also suffer devastating losses as foreign investors who see their dollar- based assets decline will exit U.S. stocks for opportunities that will rise against a falling dollar.

- Bond holders and fixed income investors may suffer the worst, as they see the spike in interest rates devastate the bond market. Investors stand to lose 30% of their wealth, just as they did in 1970. If you hold any long-term bonds, sell them!

- Many utility stocks and foreign parts-dependent U.S. manufacturers will also take a beating for the same reason, as they will not be able to raise prices to keep up with inflation.

- Many states would find themselves in serious trouble, as state borrowing would decline — and along with it, the billions of dollars in infrastructure projects that fuel jobs.

- Rents will skyrocket even higher, as foreclosures reverse their forward course and more Americans fall into the rental pool where demand is high and supply is low.

- Food, energy, and durable goods items will rise as China’s grip on commodity supplies and resources tightens.

- As the stock market falters, pensions and 401(k) plans won’t keep up with rising prices. The lack of consumer spending will continue to sabotage the recovery, sending millions of investors, savers, and retirees to the poorhouse.

- Tragically, as costs skyrocket and investment returns falter, many retirees on fixed income may have to choose between rent, medicine, and food in order to survive.

But while the looming economic situation is perilous, it’s not insurmountable.

In the midst of every economic crisis lay numerous profit opportunities — and this one is no exception.

And the profits you make can be enormous.

And This Brings Me to the

Critical Choice You Face Today

If you’ve read this far, then I know you’re taking this inflationary threat seriously.

Perhaps that’s because I have reinforced some of the things you’ve noticed in your own life — that your cost of living is shooting through the roof — and I’ve backed my forecasts with proof that things will only get worse.

While I can’t tell you the exact day it will happen, I can tell you one thing...

The result will divide America — and much of the world — by an inflationary wedge into two separate and unequal groups...

Those who profit from rising inflation and those who become the victims of it.

Which side will you end up on?

You don’t have to be a graduate of the Wharton Business School or have a Ph.D. in Psychology like I do to end up on the profitable side.

All you need to do is own the handful of stocks that are set to soar as inflation rises, interest rates soar, and commodities skyrocket...

The same stocks that we own here at The Complete Investor:

- Energy, water, and natural resources

- Gold and commodities

- Select small-cap and technology stocks

By acting now, you will be in an enviable portfolio position early — before the big spikes we’re forecasting take hold and the dollar falls even further.

Why You Would Be Wise to Overweight Your Holdings in Natural Resources Stocks NOW

As I told my readers in Defying the Market (1999), The Oil Factor: Protect Yourself and Profit from the Coming Emerging Crisis (2004), Game Over: How You Can Prosper in a Shattered Economy (2009), and again in Red Alert: How China’s Growing Prosperity Threatens Your Way of Life (2011)...

The rise of China, India, Russia, and Brazil would put enormous pressure on natural resources as those countries make the leap into the 21st century.

The end result would create a supply-demand squeeze for energy, water, and building materials on a global basis, as noted economist Dambisa Moyo confirms in his eye-opening 2012 exposé, Winner Take All: China’s Rush for Resources and What It Means to the World.

You need only look at the pace at which China consumes commodities.

With about 20 percent of the world’s population, the Middle Kingdom has accounted for between 50 percent and 100 percent of global consumption growth across most major commodities.

While the consumption trends for most commodities in the rest of the world have been slow or even negative, they have soared in China.

The reason is simple...

The country consumes 60 percent of the world’s concrete, 60 percent of its iron ore, and about 50 percent of its steel, copper, and aluminum, just to cite a few examples.

Consider these mind-boggling factoids: China recently used more cement in three years than the U.S. used in the entire 20th century and it now consumes more copper than the entire western world combined.

And the uptrend will continue...

China is considering abandoning aluminum wiring for more expensive, but more reliable, copper wire for its grid infrastructure, which now accounts for about half of the country’s copper consumption.

What’s more, China is rolling out an ambitious One-Belt, One-Road initiative (OBOR), which seeks to connect more than 60 countries (most of them developing countries) in the Asia Pacific region, the Middle East, and Europe via three main routes.

The effort will cover about two-thirds of the world's population and about one-third of its GDP.

The size of the OBOR is projected to be about 12-times that of the Marshall Plan, which rebuilt Western Europe after World War II.

This incredible undertaking will require immense amounts of infrastructure development.

The chain reaction will spike demand for industrial commodities beyond anything we’ve ever seen before.

And it’s all because many of the countries along the OBOR simply lack the necessary infrastructure for the trading boom envisioned by China.

The result will put powerful upward pressure under the stock prices of a number of commodities.

But that’s not all...

The same supply-demand squeeze can be seen headed your way in the food and water sectors as well, as China’s arable land shrinks and water resources continue to be taxed by the largest population in the world.

The recent relaxation of the one-child policy means that the current projection for 1.4 billion people is probably way too low.

And what about the global picture?

Globally, it’s estimated that up to 811 million people are already affected by food shortages... and this could get worse.

The United Nations has said the cost of food has risen at the fastest pace in over a decade And with the massive disruption caused by the pandemic….

Things are only going to get worse.

Prices that rocketed to record heights in recent years on Chinese buying could fly even higher.

That would be good news for companies that produce those commodities and investors who have placed bets on them.

Materials in tight supply or at risk of significant constraint, like copper and palladium, could be vulnerable to sharp price increases.

Their prices recently shot up 90% and 319%, respectively, in just 5 years.

Although commodities are off their peaks, due to economic malaise in Europe and a decline in oil prices, as a group they have held up quite well considering much of the world economy (the European Union and Japan) have shown little-to-no growth in recent years.

The lull in prices has reduced investment and development activities for commodity producers and many commodities are already feeling the tight supply.

It really wouldn’t take much to see commodity prices shoot up again.

Of course, driving the coming spike in commodities prices is the falling dollar that’s been pushed by a money-printing Fed.

Many investors may not know this, but because resources are priced in dollars, when the dollar goes down the price of the commodity goes up.

This is why you see oil, food, and energy prices shoot up when supplies are plentiful and demand is in check...

It’s because the falling dollar has pushed the price upward

You need only look at the kinds of profits natural resource stocks can hand you during periods of high inflation to see why this is one sector that will let you sleep safely at night.

Consider the gains in these sample commodity stocks from the depths of the Great Recession. Over the next two years they handily beat the overall market:

- Freeport McMoRan, +97%

- ConocoPhillips, +91%

- BHP Billiton, +94%

- Alcoa, +82%

However, I’m not recommending that you buy into these companies now.

These are historical examples to show you the kind of profits you can make when the great inflation surprise hits.

You’ll find a description of the newest companies I have targeted for profits here and in a special report I'd like to send you. More about that in a moment...

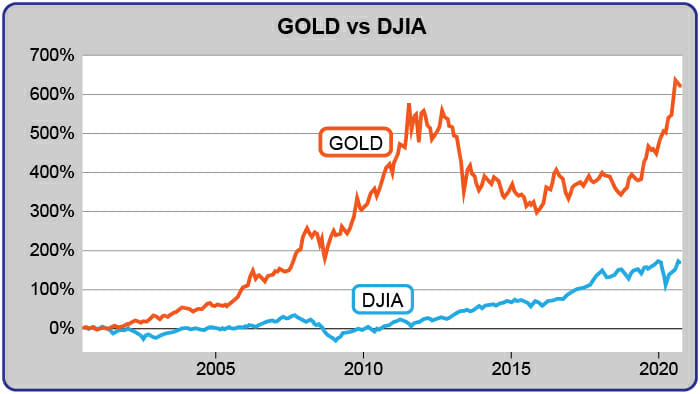

You Would Also Be Smart to Take a Strong Position in Select Gold Mining Stocks NOW

It took gold almost a decade to set a new record high in 2020. Prior to that, gold sold off from its Sept. 2011 peak for a variety of reasons...

The main trigger was the Cyprus banks selling $500 million to pay back the European Central Bank for their bailout.

That may seem like a lot but in reality it’s quite a small amount.

The strength of the U.S. dollar versus other currencies and the expectation that the U.S. Federal Reserve would begin to tighten monetary policy also fed into the decline.

But despite the Fed’s wish to “normalize” interest rates, it’s going at a very slow pace...

And the Covid-19 outbreak forced it to go back to rock-bottom interest rates.

The larger story involves the systematic, desperate attempts by the central banks of significant economic blocs such as the EU, Japan, and the U.S. to support their economies through unprecedented loose policies.

In a world where resource scarcity will be an increasing problem, gold — of which there is a finite quantity in the world — will be in high demand as the means to pay for the resources in place of fiat currencies, which central banks are creating out of thin air at whim.

Herein the Fed needs to retake Economics 101...

It’s a simple fact: ruin one thing (in this case, the dollar), and people will look for a substitute.

It’s plain as day: no matter how gold prices move temporarily, it will always be a substitute for a debased currency.

And now, thanks to a recent change to new Basel III rules, gold is now considered a Tier 1 asset. This means that gold is in the same tier as cash in terms of risk… and financial institutions can hold gold to satisfy their capital reserve requirements.

The chips are falling into place.

Eventually gold will find its way into a reserve currency basket and in the process will likely advance much higher from where it is today.

As you know, gold has been — and will always be — one of the most effective hedges against inflation.

That’s because unlike dollars, gold is a real asset with intrinsic value.

The government can’t print more gold when they need it.

The only — and I repeat ONLY — way to increase supply is to dig it out of the ground.

This is why, as the value of the dollar goes down and inflation rises, the price of gold goes up — all because the government simply cannot conjure it out of thin air.

As the dollar continues to fall and inflation rises, powerful upward pressure will build under the stock prices of select gold mining companies with huge reserves.

"What we are looking at is a repeat of the

housing bust of 2008 — only this time

the sell-off will be worse."

The reason is simple: They offer you much bigger and faster profits than actually owning gold bullion when gold prices shoot higher.

You need only compare owning junior gold mine stocks with huge reserves to owning shares of Apple before it released its first iPhone, iPad, or iMac to understand why.

You see…

Just like in Apple’s case, where profits weren’t realized until after one million or so iPhones were sold, junior gold miners don’t bank the big bucks until after the millions of ounces of gold are flowing into the market.

Which is why owning the right junior gold mine prior to production is a lot like owning Apple before its next product release — only the profits from the gold mine can be much bigger and faster.

The moment a junior miner starts to realize profits from production, it instantly adds billions to its balance sheet as its inventory now comes to market...

And the results can push the stock price up 1,000%, 2,000%, even as much as 4,000%!

Just look at the 4,000% profit investors made in 2006, when Aurelian Resources’ stock price jumped from $0.89 to almost $40 in the blink of an eye.

Then there’s ECU Silver (now Golden Minerals) whose shares skyrocketed 330% upon news of a mammoth gold discovery — even before one ounce of gold had been produced.

The bottom line here is this:

History is filled with triple-, quadruple-, and quintuple-digit profits investors have made in mining stocks.

Unfortunately, we can’t go back in time and grab those profits.

However, by adding our newest recommendations to your holdings now, you’ll be able to take advantage of this historic profit opportunity in gold BEFORE the scourge of rising prices hits home and gold prices skyrocket.

Here’s why:

This company is sitting on 39 million ounces that have yet to be mined. With a projected production cash cost of nearly $600 per ounce...

The company is potentially sitting on more than $30 billion in profits.

Surprisingly, the company is only priced around $2.2 billion for their in-ground reserves. Which is why the moment they start mining the gold, the company’s stock price could skyrocket 10-fold or more.

Best of all, this is just one of a handful of junior gold mining companies I’m recommending for windfall gains as rising inflation, the falling dollar, and skyrocketing demand continue to tighten supply and push prices up even higher.

That’s why we are so bullish on junior miners right now.

And it’s all because—as you saw previously with Aurelian Resources’ 4,000%, gains — these stocks not only jump on new discoveries but also can rise exponentially when gold prices rise because their entire reserves become more valuable.

As you’ll see in a free companion report I'd like to send you, my newest recommendations here are giving you the chance to match Aurelian Resources and ECU Silver’s historical gains.

More about that in a moment... but first let me tell you about another inflation-centric opportunity that’s headed your way.

Why Small-Cap Stocks Are Set to

Rise Steeply as Well

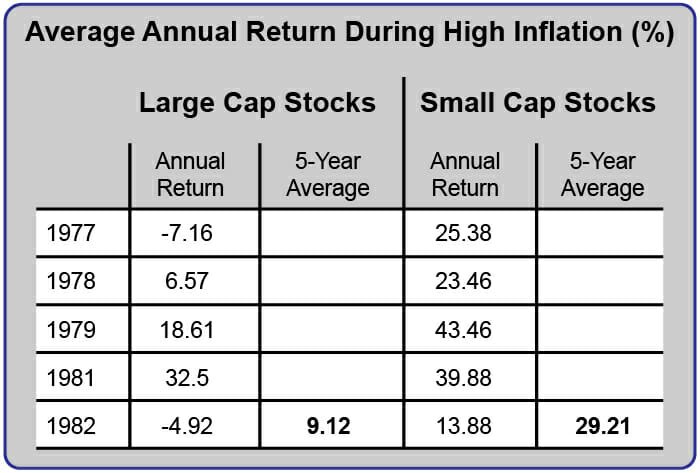

Most investors don’t know this, but in periods of rising inflation, small-cap stocks outperform all other asset classes by a country mile.

In fact, in the six inflationary periods between the summer of 1976 and the summer of 1982, small-cap stocks gained nearly 29% a year while large-cap stocks lost half their value (adjusted for inflation).

And small caps didn’t outperform just during that stretch.

Since 1926, whenever the Consumer Price Index (CPI) rose over any five-year period, small-cap stocks continued to outperform large-cap stocks.

When the CPI was rising at a 5% clip or higher, small-cap stocks rose 21.2% per year compared with just 9.4% for large-cap stocks.

And it’s all because small-cap stocks by their very nature have ONE BIG advantage built in that allows them to grow their earnings faster when prices are rising: pricing power.

Let me explain why that is so important now...

You see, unlike large-cap companies with billions of dollars in overhead, small-cap companies tend to run leaner and meaner.

As a result, they not only can cut costs quicker but can also expand their profit margins and sales faster during times of rising prices.

For these reasons, it’s much easier for a small-cap company with $100 million in sales to double or triple its profits than it is for a billion-dollar behemoth whose fastest-growing years are behind it.

What’s more, since small-cap companies tend to be more highly leveraged they can pay down their debt quicker with cheaper dollars — just like the government does.

When you add everything up — their pricing power, leverage, and speed to market advantage — it’s no wonder why small-cap stocks can earn $1, $2, $3, even up to $5 for every dollar they invest as their sales and earnings rise, growing both their balance sheet and their bottom line along the way.

Which is why small-cap stocks have continued to deliver market-beating growth (and then some) during every inflationary period we’ve seen since 1926.

This is why I’m highly recommending a handful of select small-cap stocks that will dominate their markets, grow their global market shares, generate tons of cash, and control technology in their industries.

The reasons are compelling and clear.

Over the next four to five years, as inflation rises, the battle for customers and profits will enter a new and brutally competitive phase. Those that can maintain their leadership position through market share, pricing power, and technology will strike it rich… while those that can’t find themselves out of business.

You’ll find our approach to making money in small-cap stocks can best be compared to winning a game of Monopoly.

Instead of winning by owning the most squares on the playing board, you win by owning just the companies with the greatest pricing power, the biggest cash flows, the fastest-growing market share, and the widest, best technology.

To make sure you end up on the profit side of this economic situation, I’ve just put the finishing touches on a basic inflation survival and profit guide that I’m sending my new readers.

It’s called 3 Ways to Grow Rich from the Great Inflation Surprise. And I want you to have a free copy, so that you can get the full story on our recommendations before the great inflation surprise hits.

In it, I will show you step-by-step what you must do now to protect yourself and profit from the catastrophic spike in inflation we see headed your way.

You’ll also discover my “survive and prosper” portfolio of select energy, water, metals, and small-cap stocks that are set to explode in value from the falling dollar, rising prices, and mammoth foreign demand that’s building as we speak.

My picks include:

- My favorite precious metals stock whose reserves and leverage match the same profit profile that sent Aurelian Resources’ stock skyrocketing 4,000%. As you’ll see in your free report, it sits on untapped reserves that will jump exponentially as the price of gold rockets higher.

- A junior copper miner that sits on a world-class deposit in Alaska that is projected to average 125 million pounds of copper per year. Taking byproducts (zinc, lead, gold, and silver) into account, the copper-equivalent output is expected to be 210 million pounds annually.

- An American agricultural equipment all-star which manufactures many of the innovative tools needed to feed an ever-growing population including tractors, sprayers, harvesters, planting equipment, and others. If it grows in the ground… odds are this company has something for it.

I can’t promise they will match the monster gains my Intel recommendation delivered more than 15 years ago when it went from about 50 cents to $50, (or about 10,000%)...

But I can promise you this...

Each one has the potential to deliver 30% to 50% gains, or more.

All thanks to their linchpin positions in metals, water, and infrastructure sectors that should allow them to profit richly in the face of rising prices.

Best Of All, 3 Ways to Grow Rich from the Great Inflation Surprise Won’t Cost You a Dime

In a way I felt obligated to give it to you since you’re not getting the information you need to protect yourself and profit from the government, the financial media, or the analysts.

Nor are they telling you how to grow your income in times like these where fixed income and bond investors will get crushed.

For these reasons, I’m also going to send you an additional free report that will help you keep your income growing faster than inflation, too.

It’s called 5 Inflation-Beating Income Stocks Every Investor Must Own Now.

It’s called 5 Inflation-Beating Income Stocks Every Investor Must Own Now.

If you’re retired, or will soon be, this is one report you won’t want to miss.

These 5 hand-picked stocks have generated steady and predictable cash flow for years…

In fact, one of these incredible income stocks hasn’t missed a single dividend payout in nearly 100 years!

Each pick has the potential to deliver a rich and rising income stream in the face of the skyrocketing food, water, and energy costs coming down the pike.

Together, these FREE reports offer you the smartest, safest, and most profitable ways to protect yourself over the next two to three years.

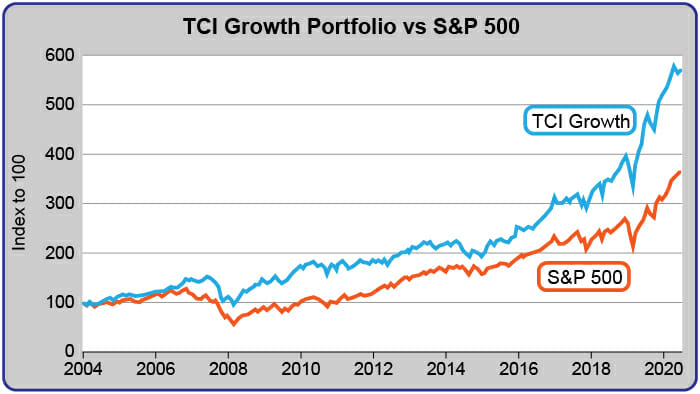

All I ask in return is that you accept a risk-free trial subscription to my monthly investment advisory, The Complete Investor, which I launched years ago to help my readers benefit from the most profitable trends while filling the three-year gap between the publishing of my books.

And that’s so important in this day and age, when economic winds can change in a moment — along with the strategies to profit.

You’ll find that my Complete Investor advisory will bring you just that — 24/7/365 through our private website, weekly updates, monthly issues, flash alerts, and online forum discussions with myself and my expert TCI analysts.

Once you read your first issue of The Complete Investor, you’ll agree there’s nothing like it available anywhere else.

That’s because it contains the same kind of precise predictions, factual research, and winning recommendations found in my eight bestselling books...

Information that has later gone on to become front-page news, including...

The bursting of the tech bubble… $1,500-an-ounce gold… $100-a-barrel oil… the growth of the solar and wind markets… the 2009 stock market rebound…

The kind of predictions and economic overviews that have not only protected my readers from the greatest financial threats of the past 40 years...

But also made them fortunes along the way.

That’s because each issue is chock-full of precise predictions for where the dollar is headed... what to expect from oil, interest rates, gold, and bonds... and how each one will affect the economy and your investments.

As you’ll see when your first issue arrives, we walk you through the latest financial events and show you step-by-step how each one will affect your savings, your investments, your retirement, and your job (as I have here in this report)...

So that you can invest ahead of the curve on a near daily basis.

Because of the pressing nature of this inflation threat, I’ve made it easy, convenient, inexpensive, and risk-free for you to test-drive The Complete Investor and receive your FREE reports.

Together, I guarantee they will give you the information, strategy, and recommendations you’ll need to protect your home, your savings, your investments, and your retirement before the winds of inflation flatten the U.S. economy.

An 70% Savings and a

100% Money Back Guarantee

When I launched The Complete Investor in 2003, I did so with the promise of a 100% risk-free guarantee for your satisfaction.

Naturally, I couldn’t make an offer like this and still be in business today if my economic forecasts were wrong and my recommendations did not make my readers any money.

On the contrary, I have one of the most accurate track records for predicting the biggest turns in the economy over the past 40 years.

Once you begin to see our complete economic analysis and investment profiles — and most important — begin profiting from our recommendations...

You’ll fully understand how my advice has helped my readers protect themselves and profit from every financial crisis over the past three decades.

Like Kevin S., Los Angeles, California who writes …

Peter R. of Maine would tell you the same thing …

That’s why I can make you this 100% risk-free offer with complete certainty that you WILL profit.

If at any time during the first 90 days, you don't feel like The Complete Investor is right for you — simply let one of our customer representatives know.

An they will promptly refund every dollar you paid.

And even beyond your first 90 days, you can invest in my recommendations with confidence and trust as well, knowing that you can still cancel at any time if you are not 100% impressed and delighted with our analysis, commentary, and recommendations and receive a complete refund for the balance of your subscription.

By joining me now, you’ll not only get my two 2021 profit forecast reports FREE but also save 70% off the regular subscription rate and pay just $39. You save $90 (reg. $129).

That 11-cents-a-day membership price includes…

- Twelve monthly issues of The Complete Investor featuring our monthly economic outlook and timely recommendations, complete with specific buy, sell, and hold recommendations.

- Two FREE Investment Forecasts: 3 Ways to Grow Rich from the Great Inflation Surprise and 5 Inflation-Beating Income Stocks Every Investor Must Own.

- FREE access to our private website with an archive of past issues and special reports including all of our model portfolios.

- FREE weekly updates sent every week to keep you on top of the markets.

- FREE FLASH alerts to help you react to breaking news that affects your investments.

- FREE educational videos that will help make you a smarter and more profitable investor.

- PLUS my 100% Money-Back Guarantee. You are protected by a prorated refund for as long as you subscribe.

When you consider that the cost of subscribing comes to just 11 cents a day, I think you’ll agree it’s an irresistibly attractive offer...

And a diamond- studded opportunity for you to learn how to protect yourself and profit from the greatest threat to your wealth I’ve ever seen.

And because we see this situation lasting for at least the next two years, we’ve made it possible for you to join us for two years for $78 — a savings of $180 off the regular rate.

In the bargain you’ll also receive all the benefits above plus two additional free reports: How to Cash In on the Natural Gas Revolution, and Why Security Stocks Will Reap Big Profits in 2022.

Since both subscription offers come complete with our money-back guarantee, why not consider the two-year trial?

While you decide if The Complete Investor is right for you, you get to lock in our best price for two years and get all four of our free reports.

I can’t think of a better, easier, less expensive or more cost-effective way for you to try The Complete Investor.

When you add everything up, how can you say no?

To begin your risk-free trial, just click the button below to get started.

Yours for investing success,

Dr. Stephen Leeb

Chief Investment Strategist

The Complete Investor

Copyright © 2021 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.