Legendary Wharton economist — who correctly predicted

$100-a-barrel oil — reveals shocking details of how this…

Strange Black Rectangle In The Desert Foretells

The End Of The Oil Age

Be among the first to discover:

- The radical and unexpected way one country is preparing for the imminent, violent death of its 80-year reign of excess, greed, and corruption…

- Why a billionaire Japanese tech visionary has become a backdoor partner on “the rectangle” scheme…

- The birthplace of a revolution that will change the way we generate, store, and consume energy on this planet… forever.

PLUS… How you can exploit this information to

triple your money…

before the end of the year.

Dear Reader,

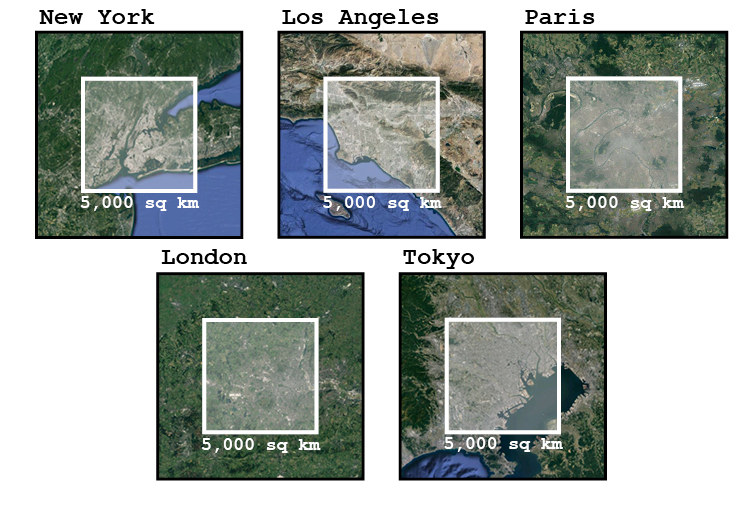

Take a close look at the image above.

What you see is a strange-looking black rectangle hovering just above a section of the Rub’ Al Khali desert.

It may look small in comparison to the surrounding ocean, mountains, and desert but…

The black rectangle is 5,000 square kilometers in size.

That’s equal to 112,050 football fields.

The rectangle isn’t an oil field.

And it’s not visible from space… yet.

But this strange, black rectangle is at the center of a $200 billion “arrangement” involving an imminent global crisis, a desperate royal family, and a Japanese billionaire with a “midas touch”…

And it’s all unfolding in one of the least likely places on earth.

If you’re shocked by any this, I don’t blame you.

It’s the kind of international intrigue you’d expect to find in a Dan Brown novel or a James Bond thriller…

Not playing out in real time in the boardrooms, palaces, and oil refineries of a sand-covered Middle Eastern kingdom.

But it’s all right there… as plain as day… for everyone to see in the pages of the Wall Street Journal and The New York Times.

If… you know what to look for.

Amazingly, very few people have put all the pieces together yet.

But I have.

And over the next few pages, I’ll reveal all the details.

But before we go any further, I want to make one thing perfectly clear…

This Opportunity DOES NOT Involve Oil

While the country where this crisis is brewing is one of the world’s top oil-producers…

The opportunity I’m going to share with you doesn’t involve crude oil, oil companies, petrochemicals, or oil-related products of any kind.

In fact, this unfolding drama will ultimately result in oil becoming much, much cheaper.

And you do not want any material portion of your wealth invested in an asset whose value is going to drop rapidly.

To better understand why this is happening, let me tell you about…

A Wealthy Country With A Big Problem

Eighty years ago, the Kingdom of Saudi Arabia was one of the poorest countries in the world. They had no electricity, no schools, no hospitals, and no roads.

Their only source of revenue was from annual religious tourism.

But when oil was discovered by a team of Americans in 1938, the country’s financial situation improved quickly and dramatically…

By 2017, Saudi Arabia ranked #13 in the world in per capita wealth — right behind the U.S.A. at #12.

But unlike the U.S.A, Saudi Arabia’s wealth is almost completely oil-based…

In 2017, the petroleum industry accounted for 87% of Saudi government revenues and 90% of the country’s export earnings.

It’s safe to say, if Saudi oil dried up tomorrow, the country’s fortunes would change almost overnight… and not for the better.

And no one’s more fearful of this reality than the Saudi royal family.

“Royal Welfare Program” Makes

Vladimir Putin Look Like A Choir Boy

Saudi Arabia is a “kingdom” in every sense of the word.

The King is the sole head of government, makes laws by “royal decree”, and has final say in all decisions involving the country, its military, its finances, and its citizens.

The balance of the political system — including most high-ranking government roles — is dominated by the King’s “royal family.”

But even family members who aren’t awarded senior political positions are “on the take.” Here are just a few examples:

- The King supports literally thousands of royal family members through monthly stipends ranging from $800 a month (for a lowly, remote relative) to as much as $270,000 a month for a prince closer to the King’s direct bloodline.

- Bonus payments are available for “marriage and palace building.” Together, these payments cost the King — and therefore the entire country — close to $2 billion a year.

- For decades, it’s been common for members of the royal family to borrow large sums of money from banks and never repay them.

- Greedy princes have also been known to expropriate land from commoners and immediately sell it to the government at a huge markup for an upcoming project.

- A small cabal of not-so-noble princes skim close to $10 billion a year from the government in what’s known as “off-budget” spending.

Needless to say, this situation isn’t great.

If you’re wondering how the King can afford to support these royal hangers-on to the tune of tens of billions a year…

Well, Saudi Arabia has a single, state-owned oil company known as Saudi Aramco that some call “the most profitable company on earth.”

Aramco’s Net income for 2017 was estimated at $67 billion — dwarfing American giants like Apple, JP Morgan Chase, and Exxon Mobil.

And as sole shareholder, the King alone has full control over Aramco’s profits — to spend as he sees fit.

At this point, you may be wondering how blatant greed, corruption, and nepotism taking place atop a sand dune half a world away has anything to do with adding zeros to your investment account…

After all, it’s highly unlikely you’re going to start receiving monthly stipend checks from the Saudi King.

Well, this is where things get interesting.

Because…

Corruption Isn’t

Saudi Arabia’s Main Problem

Look, the Saudi’s know they have a huge problem.

But shockingly, it’s not corruption.

Corruption has been an integral part of Saudi Arabian culture for almost a century. And it’s not likely to disappear any time soon.

Why?

Well, since the beginning of its reign, the royal family’s political stability has depended on an unwritten policy known as the “ruling bargain.”

Under “the bargain”, the royal family provides Saudi citizens with social services including free healthcare and education, heavily-subsidized gasoline and electricity, monthly stipends, bonuses, and zero income or sales tax.

And all of these services and programs are 100% funded by…

You guessed it…

Oil revenues.

So in exchange for these “generous gifts”, Saudi citizens generally turn a blind eye to the royal family’s extravagance and corruption.

And that generally keeps everybody happy.

So what’s the problem?

Well, the problem is the source of the royal family’s wealth — the oil beneath their feet — is literally drying up.

And the royal family knows if they don’t find another revenue source quickly, they risk seeing their personal wealth, the wealth of their nation, and the loyalty (and patience) of their citizens circle the bowl… never to return again.

Think about that…

There are literally thousands of Saudi royals who’ve done nothing their entire lives except wait for monthly stipend checks to arrive and then… spend them.

Saudi commoners have tolerated that behavior for 80 years because they’ve been “paid off” with generous social programs.

But the moment oil revenues drop, who do you think is going to suffer first and most?

If I were a betting man, I’d say, “Not the royals.”

And how will a wealthy, royal minority fair when thirty million impoverished Saudi citizens rise up singing “One Day More” and demand payback for generations of economic oppression?

There’s no way that scenario ends well for the royals.

And for the royal family, it’s much more than just their material wealth that’s at stake.

They also face a very real risk of being overturned, imprisoned, or worse by the Saudi rank-and-file. And understandably, they’re scared out of their wits about it.

Without oil, I’m afraid to say… Saudi royal family’s fate is sealed.

Now… to the credit of the royals, they have one final “Hail Mary” pass up their sleeves.

And it’s so big, it marks a global shift in how we as a species will generate and distribute mass energy into the next century and beyond.

Over the next few pages, I’m going to reveal details of the energy “backstop” Saudi Arabia is planning, plus…

How you can make a killing from this information with a single, 30-second call to your broker.

But first, let me introduce myself.

My name is Stephen Leeb…

You may know me from my appearances on NPR, Fox News, CNN, and Bloomberg…

Mentions of my work in USA TODAY, Business Week, The Wall Street Journal, and The New York Times…

Or from one of my eight books… including The Oil Factor, The Coming Economic Collapse, and Red Alert.

For over three decades, I’ve been following, researching, interpreting, and predicting large-scale economic trends.

And I’m not exaggerating at all when I say Saudi Arabia is the proverbial “canary in the coal mine” for what’s about to happen to oil as a source of power and wealth… not only in the Middle East but across the entire planet.

As dramatic as it might sound, every investor needs to pay very close attention to what I’m about to reveal because…

Your financial future hangs in the balance.

The information I’m going to share could help you make returns in excess of 200% in the next six to nine months from three U.S. stocks poised to skyrocket from a behemoth $200 billion deal Saudi Arabia has recently signed.

Listen, this game isn’t new to me…

I’ve Been Helping Investors

Build Wealth For Three Decades

You see, in addition to following and writing about economic trends and cycles, by far the most important part of my job is finding opportunities for investors to make life-changing gains from my research.

I’ve done it successfully countless times in the past.

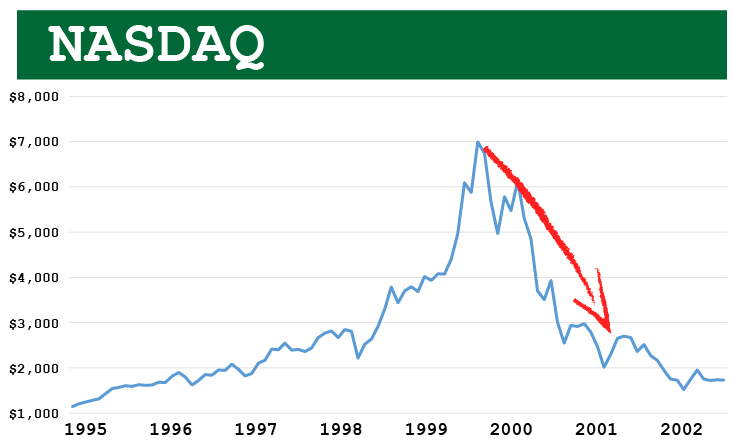

I predicted the Dot Com Bubble of 2000…

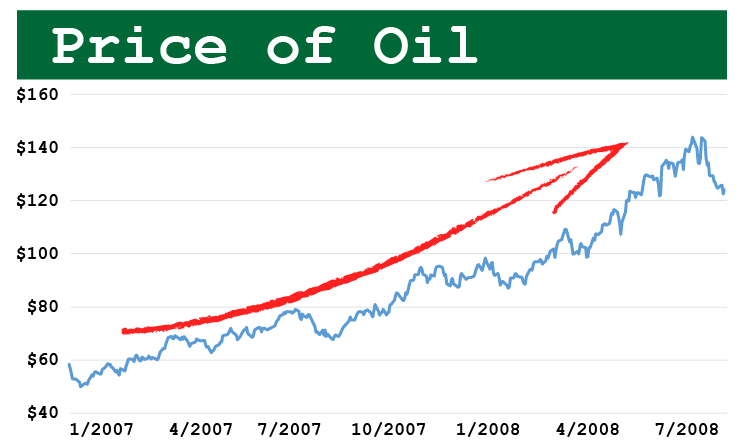

Oil breaking $100 a barrel in 2007…

The 2009 stock market rebound…

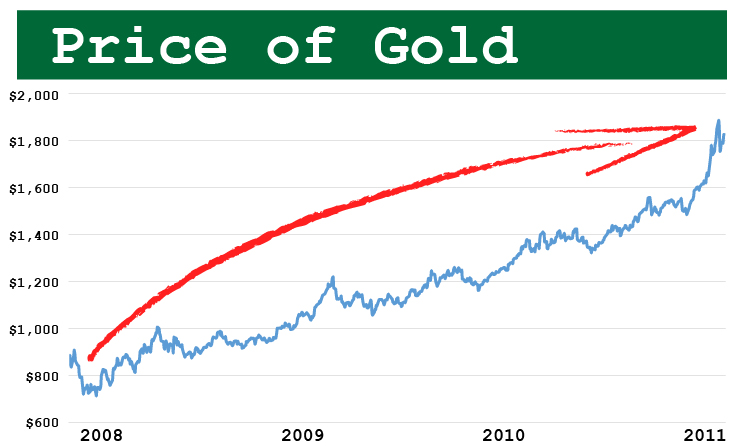

And gold breaking $1,500 an ounce in 2011…

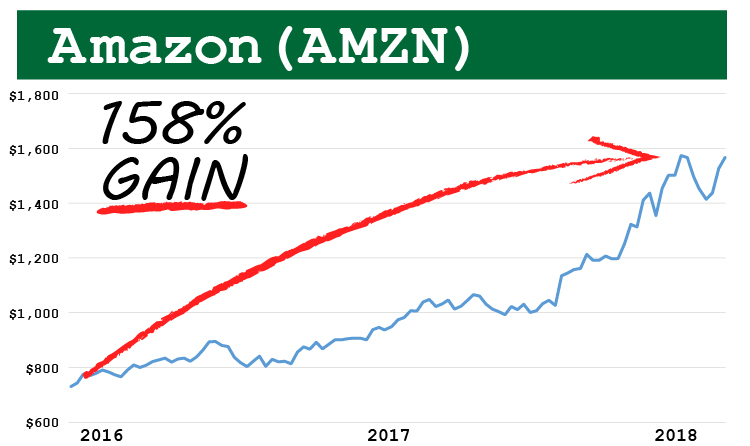

In each of these cases, investors who took my advice had a chance to make small fortunes well in advance of everyone else in the market… including many Wall Street “insiders.”

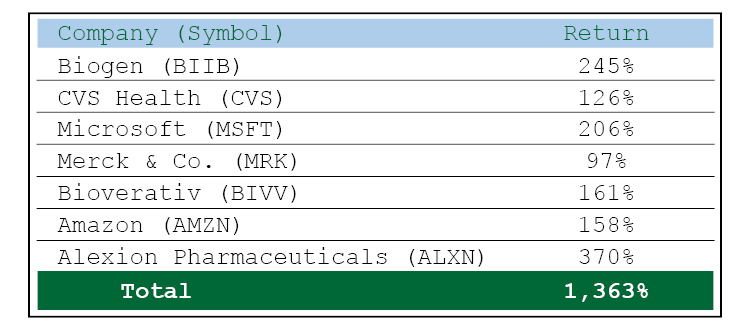

Some recent wins my readers have participated in include:

158% on Amazon (AMZN)…

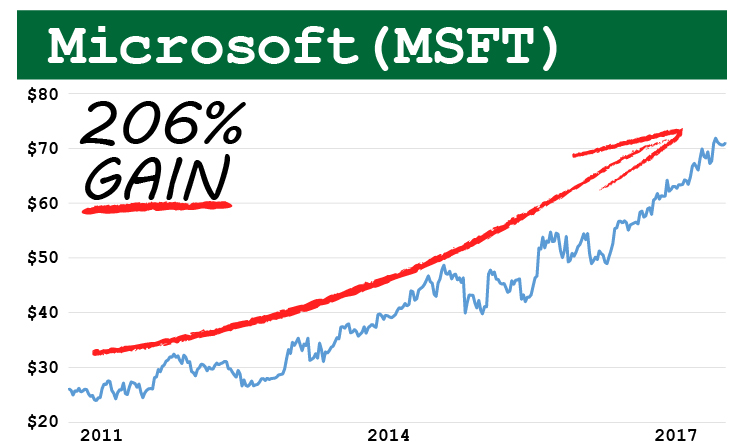

206% on Microsoft (MSFT)…

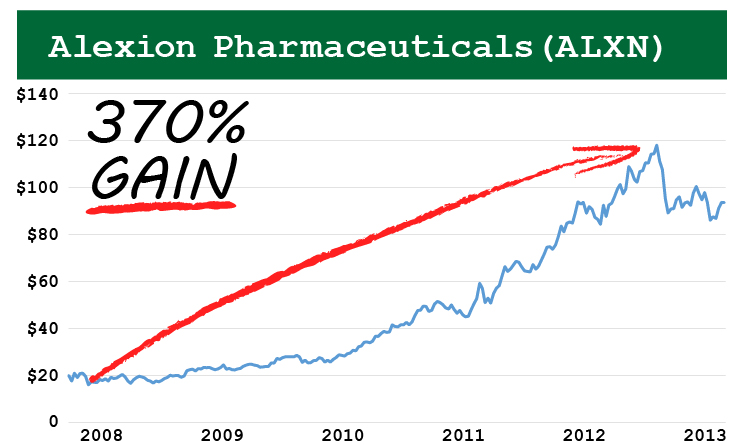

370% on Alexion Pharmaceuticals (ALXN)…

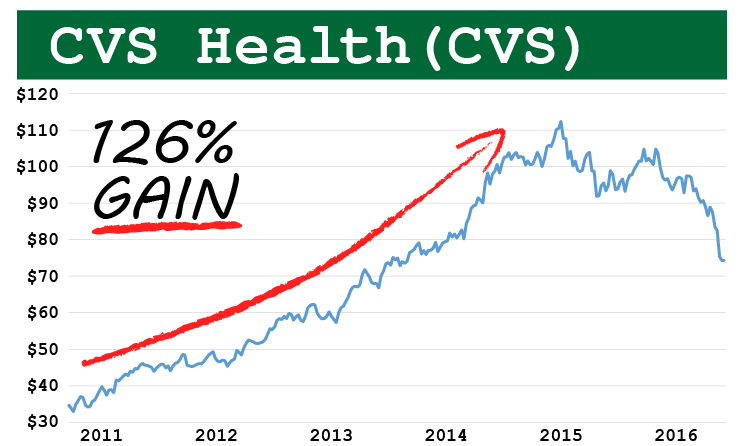

126% on CVS Health (CVS)…

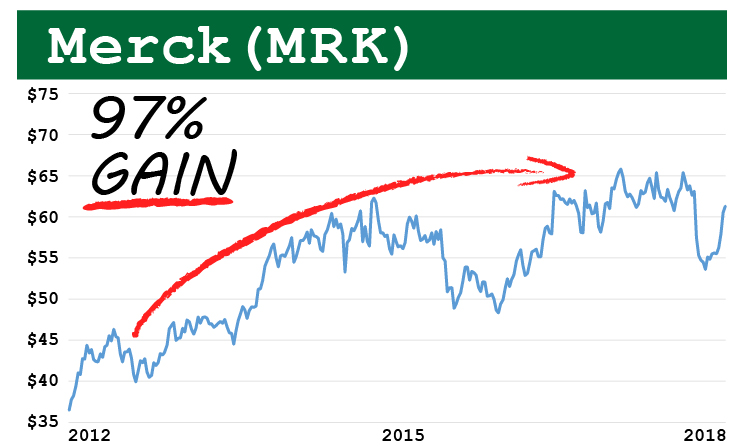

97% on Merck & Co. (MRK)…

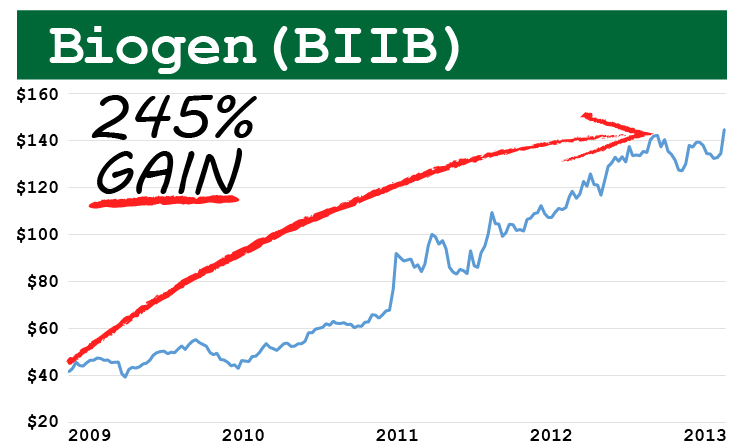

245% on Biogen (BIIB)…

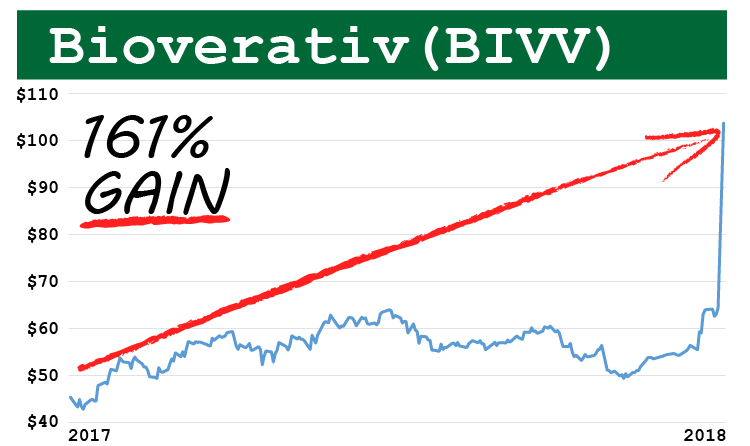

161% on Bioverativ (BIVV)…

In each of these cases, my analyst team and I pored through mountains of financial data to find and recommend companies with the absolute best prospects for future growth.

It’s an important and challenging job and I take it very seriously.

The Biggest Opportunity Of Our Lifetime

Let me be clear…

What’s happening right now in Saudi Arabia isn’t an insignificant blip we’ll all forget about a year from now.

Rather…

It’s a seismic shift that will produce permanent change in the way we generate, store, and consume energy well into the next century and beyond.

I’ve made it my life’s work to predict the timing of large-scale macroeconomic inflection points…

Understand the events responsible for creating them…

And then select and recommend specific assets that allow my readers to reap huge rewards with the lowest possible risk.

So believe me when I say, in the 37 years I’ve been doing this, what’s happening right now in Saudi Arabia is by far the most important investment opportunity most of us will see in our lifetimes.

It’s a change that will not only be beneficial for the environment and for our long-term health as a species but…

It Will Transform Thousands Of

Average Investors Into

Retirement Millionaires

Now, I realize that may sound dramatic.

But I’m about to reveal the remarkable chain of events that led to the “Black Rectangle.”

More importantly… I’ll reveal three leading-edge American companies whose stocks are ready to explode as a result of what’s happening right now in Saudi Arabia.

Weapons Of Economic Destruction

For over 50 years, major oil producing nations have had a powerful but rarely-discussed weapon they’ve used against the rest of the world whenever they’ve seen fit.

And that weapon is… oil.

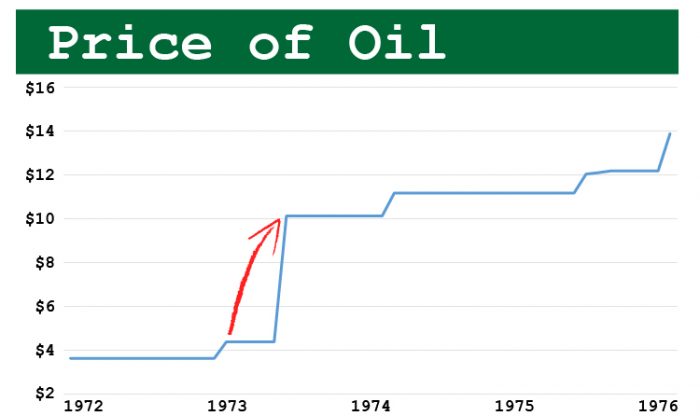

The first well-publicized use of oil as a weapon was in 1973.

When a collection of Arab countries declared an embargo in October 1973, the price of oil shot from just above $3 a barrel to more than $10 a barrel almost overnight.

The embargo resulted in inflated gas prices, horrendous lineups at service stations, and put an incredible strain on the U.S. economy.

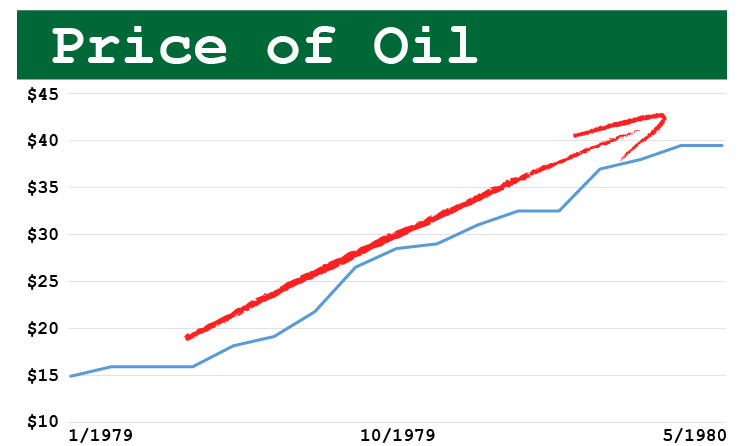

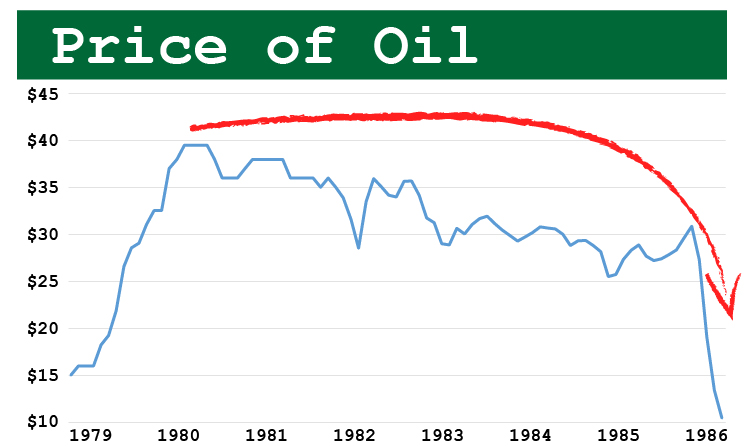

A similar price jump happened in 1979…

Production fell during the Iranian Revolution and oil prices jumped from just under $15 a barrel to almost $40 a barrel in a matter of months.

This time, while oil production dropped only 4%, memories of the 1973 crisis created widespread panic which drove oil prices higher.

Both of these situations were man-made…

The same amount of oil was sitting beneath the earth’s surface. It just wasn’t being pumped out.

Because there was no “real” shortage of oil, it was easy for prices to free-fall back down to $10 a barrel when economic activity slowed in the early 1980s.

The point here is very simple…

For close to a century, countries with oil have been able to cause financial harm to those without oil.

They’ve done this by decreasing supply — generating shortages, price spikes, and general short-term mayhem throughout the developed world.

And at times, they’ve done it by increasing supply — making it too expensive for less-efficient and less-advanced oil producers to develop new oil discoveries.

Look, you’ve likely heard this expression used before but…

This Time Is Different

While many people try to ignore it or argue with its timing…

The world is running out of oil.

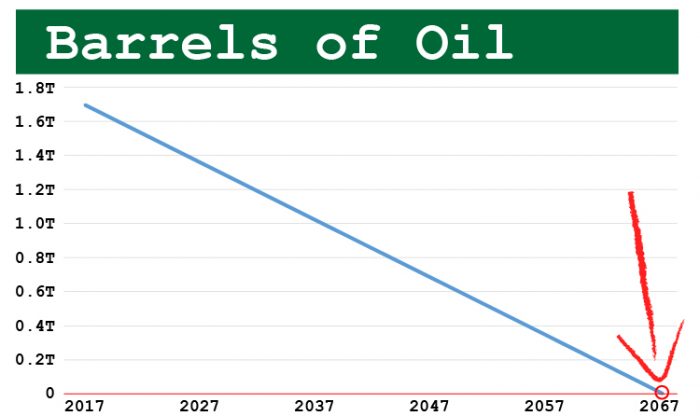

In 2017, there was a total of 1.7 trillion barrels of oil in what are called “proven reserves” — estimates of the amount of recoverable oil lying below the earth based on detailed geological and engineering studies.

1.7 trillion barrels is enough oil to fill 109,808,413 Olympic swimming pools.

Is that a lot of oil?

If you’re an Olympic oil swimmer, the answer is ‘yes.’

But the world currently consumes 35 billion barrels of oil a year.

So if proven reserves and global consumption both remain constant, the world’s entire remaining oil supply will be exhausted by the year 2067… just under 49 years from now.

It goes without saying, if either proven reserve estimates or the rate of consumption change in any material way, we may have more or less time left before we run out of oil.

But the point is this…

The amount of oil remaining on our planet is finite.

And when we finally pump the very last barrel out of the ground, that will be the end. There won’t be any oil available for several million years.

In Saudi Arabia,

Things Are Already Starting To Crumble

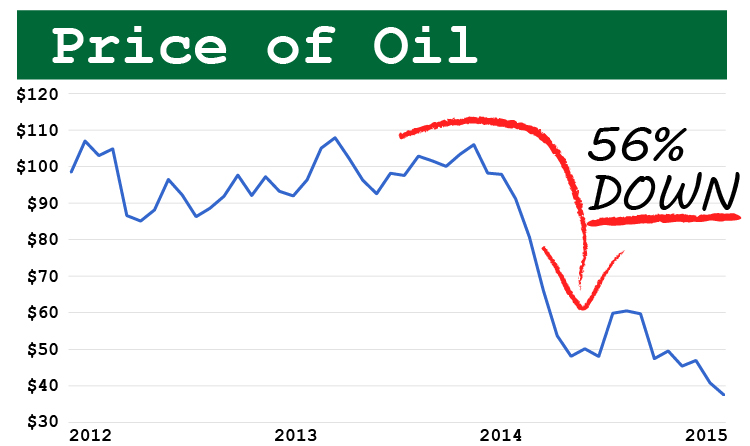

Declining global oil demand in the second half of 2014 caused oil to drop from $106 down to $47 a barrel — a 56% decline over the course of six short months.

This drop resulted in Saudi Arabia posting a whopping 14.8% budget deficit for 2015 — something they’ve been trying to climb out of for the past three years.

And while they’ve been making progress each year, this whole situation shows just how sensitive the country’s financial situation is to the price of oil.

Over that same period, the world has also had an opportunity to see how resistant Saudi citizens are to negative changes in the “ruling bargain.”

Let me explain.

In late 2016 and again in early 2018, the Saudi government initiated “austerity measures” to reduce spending and close the budget gap.

The measures included canceling bonuses, allowances, and financial incentives to public employees (who make up 70% of the Saudi workforce), introducing a 5% sales tax, and more than doubling gas prices.

On both occasions — one within a week of announcing it — the Saudi King scrambled to reverse the measures by royal decree so he could “ease burdens on citizens.”

To make matters worse, in 2018 the Kingdom announced a new stimulus program providing “an annual bonus for all state employees, a monthly allowance for government employees for a year, a 10% stipend increase for students, a bonus for soldiers, and a tax break for first-time home buyers.”

The cost of this program… $13 billion.

These aren’t the actions of a nation whose priority is balancing a budget.

They’re the actions of a royal family afraid of being forcefully separated from their hundred-million-dollar palaces, private islands, Ferrari collections, and pet tigers.

Saudi Arabia Needs A Solution… Fast!

The Saudi royal family needs to accomplish three very important goals before the oil clock runs down and there’s blood in the streets… and palaces.

1. Diversify Their Economy

As long as Saudi Arabia depends on oil for 87% of government revenues, the nation will continue to be at the mercy of oil price fluctuations.

For every dollar the price of oil declines, Saudi Arabia stands to lose as much as $3.8 billion dollars a year.

If oil were to drop to $30 a barrel — as it did in early 2016 — and stay there for an extended period, the country would lose $148 billion a year in oil revenues. That’s over half the country’s total budgeted revenue for 2018.

Unless Saudi Arabia takes immediate steps to diversify its economy, the nation faces a distinct possibility of going bankrupt within the next decade.

Think that’s an exaggeration?

In early 2018, the Saudi government passed its first-ever bankruptcy law. The timing on this strongly suggests they see trouble on the horizon.

2. Delay The Inevitable End Of Their Oil Supply

Experts will argue for years about exactly “when” it’s going to happen but they all agree on the outcome… oil will eventually dry up.

Pumps scattered throughout the Saudi desert will at some pointa sol in the not-too-distant future all make gurgling sounds… and that will be the end.

And because diversifying an economy in a country that’s known nothing but oil since its inception is a difficult job, Saudi Arabia needs to buy itself some time.

Unless they’re lucky enough to discover more oil (and relying on luck isn’t exactly the hallmark of a competent government), the only way Saudi Arabia can delay the gurgling of the pumps is to…

Use less oil domestically.

With a population of only 33 million people — about one-tenth of the U.S.A. — Saudi Arabia is the world’s fifth-largest oil consumer.

The nation consumes 25% of the oil it produces. That amounts to 950 million barrels a year.

Shockingly, the kingdom’s consumption has been growing by 7% a year — almost three times the rate of population growth.

A 2001 study by a British think tank indicated if that trend continues, Saudi Arabia would become a net oil importer by 2038!

Think about that… OPEC’s largest oil producer… importing oil.

It boggles the mind.

A big part of the problem is that up until 2016, the Saudi government sold gasoline to residents for close to 50 cents a gallon and electricity (almost all of which is generated by gas) for about 1 cent per kilowatt-hour.

And because energy was so cheap, Saudi citizens got in the habit of wasting it in deplorable ways…

They drive big, gas-guzzling cars and leave their home air conditioning at “icebox” temperatures even while they are away on vacation.

In fact, more than 70% of the electricity generated in Saudi Arabia is used for air conditioning.

By consuming so much oil domestically, at current prices, Saudi Arabia is forfeiting as much as $80 billion a year in revenue.

That’s more than a third of the kingdom’s annual budget.

And while money is an important concern, the bigger issue for Saudi Arabia is this…

The more oil they consume at home, the less time they have before their remaining supply runs out.

If they can reduce domestic consumption, Saudi Arabia can buy themselves some much-needed time to find solutions to their problems.

One of which is…

3. Continue Supporting The “Ruling Bargain”

On the back of subsidized energy, free education and health care, and low to no taxes, Saudi citizens have tolerated the excesses of their government’s “royal welfare program” for 80 years.

But as you’ve seen moments ago, the Saudi rank-and-file doesn’t take well to any form of austerity. And they’re not shy about letting the government know how they feel.

As soon as Saudi’s “loyal subjects” feel a genuine economic pinch, the royal family runs a very real risk of a violent uprising.

And that’s not a chance they’re willing to take.

With such dire needs and ever-increasing pressure to act quickly, what options do the Saudi Royals have?

This is where the strange “black rectangle” enters the picture…

A Solution From The Heavens

And no… this doesn’t involve religion.

But it does involve science.

You see, in one hour, enough sun reaches the earth to meet the world’s energy demands for an entire year.

Think about that for a moment. Each hour of the day… an entire year’s worth of energy.

Now, we don’t yet have the technology to capture, convert, and store that much energy in an hour. But as technology advances, the long-term implications are astounding.

While you let that sink in, consider also that Saudi Arabia lies smack dab in the middle of a region often referred to as “the global sun belt.”

The sunbelt is characterized by clear skies, brilliant sunlight, and very little precipitation — pretty much year round.

Combine Saudi Arabia’s abundance of sunlight, vast open deserts, and thousands of well-trained, highly-skilled engineers and you have a situation that’s perfectly-suited to undertaking…

The Most Ambitious Solar Energy Project

The World Has Ever Seen

Yes…

You read that correctly.

Without exaggeration or irony of any kind…

The world’s top OPEC oil producer is about to become the world’s top generator of solar energy…

I’m hoping you now see why I’m not exaggerating when I say this is the most dramatic and important energy upheaval in our lifetime.

But how did we get here?

I mean, solar energy has been around for decades…

If there’s any way it could compete with oil it would be winning the race by now, right?

Well, if you’d asked that question even five years ago, I would have had to say, “you’re right.”

But today…

Solar Energy Is About To Become Undisputed Heavyweight Energy Champion Of The World

When the world’s first “solar cell” — often known as photovoltaic or “PV” cell — was invented in 1941, it was too inefficient to do anything useful. It needed a lot of sunlight to produce even the tiniest electrical output.

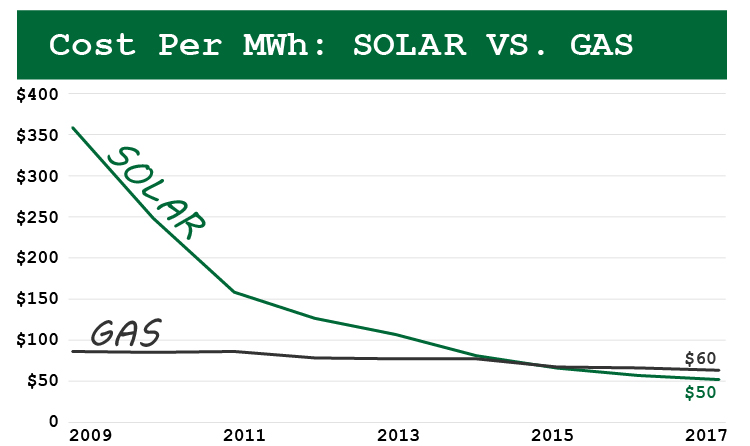

Jump ahead 68 years to 2009 and it was possible to generate one megawatt-hour (MWh) of solar energy for only $359.

The problem was, in the same year, you could generate the same amount of electricity using gas for only $83.

The price difference of $267 per MWh effectively made solar energy a fringe player suitable only for subsidized, eco-friendly homeowners… but out of the running for most large-scale utility applications.

Six short years later in 2015, the price per MWh for solar had dropped 82% to $64 — making it cheaper than gas (at $65) for the first time in history.

By 2017, solar energy had become $10 cheaper than gas per MWh… making it a mainstream contender for industrial-scale power generation.

And given solar is still a relatively new technology, I expect to see huge increases in efficiency and massive decreases in cost per MWh well into the foreseeable future. Plus…

The switchover from oil to solar will create thousands of new jobs every year right here in America. Plus…

Solar energy generates almost zero air, water, or noise pollution.

Combine these facts and there are no conclusions I can reach other than these:

- Solar is poised to deliver a speedy — but certainly not painless — deathblow to the entire oil and gas industry; and…

- Solar technologies will offer early investors like you opportunities to generate Rockefeller-style, generational wealth…

IF… you pick the right companies!

And picking the right companies is the whole reason I’m sharing this information with you today.

Specifically, the question I’m here to answer is this…

How Can A Black Rectangle In The Desert

Lead To 200% Gains Or More This Year?

Earlier in 2018, Saudi Arabia signed a memorandum of understanding to build 200GW of solar capacity by 2030.

Two hundred Gigawatts is enough electricity to power 32.8 million American homes.

And more than enough energy to power every household in Saudi Arabia.

It’s also worth noting that at the end of 2017, the entire world had only 305GW of total solar capacity.

So Saudi’s planned project represents 65% of the current global capacity.

With the latest, leading-edge solar technology, 200GW of capacity requires close to 5,000 square kilometers of solar panels.

To give you an idea how that looks from space, here’s a 5,000 sq km rectangle hovering over several major world cities.

For the record, Saudi Arabia’s not likely to construct all 5,000 square kilometers of solar panels at the same time or in the same location.

Instead, it makes more sense to spread them throughout the country both to reduce risk and to ensure each “solar farm” is close to where electricity is most needed.

The first phase of the project consists of two solar farms generating a total of 7.2GW. Both plan to be online by mid-2019.

The two farms are expected to cost a total of $5 billion, with close to $4 billion coming from loans and the initial $1 billion investment coming from a somewhat unusual source…

Saudi Arabia’s Partnership

And The Man With The “Midas Touch”

In early 2018, Saudi Crown Prince Mohammad bin Salman “quietly” traveled to New York City to sign a $200 billion partnership deal with a Japanese billionaire.

It wasn’t a secret deal. The press was invited. Photographs were taken. And several short news articles were written about the meeting.

But this $200 billion event fell off the mainstream media’s radar within days.

And as strange as that might be, it’s very good news for you.

Let me explain…

First of all, Saudi Arabia’s mysterious Japanese partner is one of the most savvy and successful investors in history — right up there with the likes of George Soros and Warren Buffett.

Virtually all of his wealth came from making insightful, strategic, and well-timed investments in other people’s companies.

As the country’s richest man, he’s sometimes called the “Bill Gates of Japan.”

But his close business associates refer to him by his nickname, “Masa.”

But how good is Masa, really?

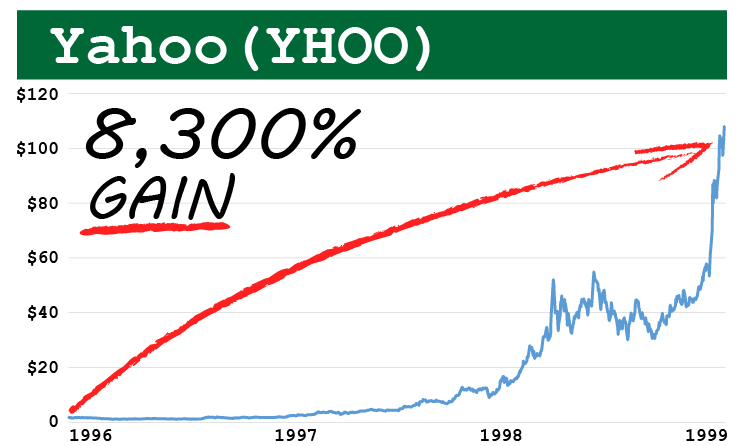

Well, in 1996, he invested $100 million in a little startup called Yahoo. By August of 1999, his 28% stake was worth $8.4 billion.

Investors who joined him for that ride could have turned $10,000 into a retirement-changing fortune of $840,000 in a little under 40 months.

In the summer of 1998, when fledgling E*TRADE Financial was looking to raise money, Masa fearlessly invested $400 million after a single phone call with the CEO.

A little more than 12 months later, his investment was worth $2.4 billion — a 500% return.

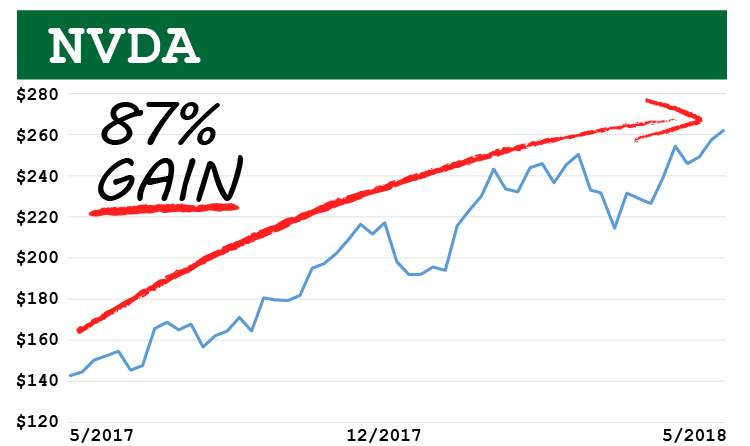

And more recently, in May 2017, Masa took a $4 billion stake in video chip manufacturer NVIDIA. By mid-June 2018, his investment was up 87%.

Another example of Masa’s “crystal ball”-like abilities is a $20 million investment he made in Alibaba back in 2000.

By the time the company went public in 2014, Masa’s stake was worth $58 billion — 2,900 times his initial investment.

Masa’s investment strategy is described accurately in this quote…

The bottom line is this…

When it comes to investing in technology ventures with global impact, Masa has the “Midas Touch.”

He’s smart. He bets early. He bets big. And he’s right a lot more often than he’s wrong.

So, if Masa is confident enough to invest $1 billion in the Saudi “black rectangle”…

There’s a very good chance it will be a huge winner.

Your Investment Dollars

Stay In America

Let’s face it…

Investing in a Middle Eastern country like Saudi Arabia isn’t the easiest pill to swallow for most of us.

- Saudi Arabia’s government is infamous for its nepotism and corruption.

- The entire Middle East region is a political powder keg — Saudi troops have been actively engaged in a civil war intervention in neighboring Yemen since 2015.

- Any material changes to the “ruling bargain” could result in a bloody uprising within the country.

- And most painfully for many of us, most of the 9/11 attackers were Saudi citizens.

All of this can make investing in Saudi Arabia both risky and morally distasteful.

But there’s good news… and I predict it will come from two different and very positive sources:

1. Deals Saudi Arabia Makes With U.S. Companies

Right now the Saudi’s don’t have the raw materials, the expertise, or the facilities required to manufacture anywhere close to the 5,000 square kilometers of solar paneling they need.

Same goes for battery storage, electronics, or any other major component of a utility-scale solar energy installation.

Now, it’s safe to assume they will build their own supply chains and expertise over time.

But at the moment, they have to move quickly to meet their Phase 1 commitments to Masa and to begin reducing the amount of oil they waste domestically.

So in the short term, they have to purchase the components they need from companies who have them available for sale.

Thankfully, the U.S. has several global leaders in solar panels, battery technology, and power distribution systems.

And since Saudi Arabia has an amicable relationship with the Trump administration, there’s a very strong chance America will benefit greatly from Saudi’s short and longer term solar needs.

This means…

You can take full advantage of Saudi Arabia’s $200 billion “black rectangle” without investing a single, solitary dollar in Saudi Arabia.

2. Increased Solar Investment Within the U.S.

The facts on solar energy are clear…

Solar is cheaper than oil.

It now costs less to generate a megawatt-hour of electricity using solar technology than it does using any fossil fuel. And the cost of solar is dropping every year.

It will soon be impossible for anyone — including oil industry lobbyists — to deny that solar makes better sense economically.

This is bound to create additional demand for solar farms here in the U.S.

Solar is better for the environment.

Whether you believe global warming is a legitimate problem or not, there’s no denying fossil fuels are responsible for air pollution, water pollution, noise pollution, destruction of wildlife habitat, and degradation of land.

And while solar panels do consume land, they can be situated in areas like deserts where impact to humans, wildlife, and countryside is minimal.

No matter how you slice it, when compared to fossil fuels, solar energy has a net positive impact on the environment in both the short and longer terms.

Oil is falling out of favor with investors.

Across the globe, large investors are pulling money out of the oil and gas sectors.

In late 2017, Norway’s $1 trillion national pension fund announced it was pulling $37 billion out of oil and gas investments.

Big pension funds in England and the U.S. have made similar announcements.

In fact, at the end of 2017, 688 institutions and close to 60,000 individuals across 76 countries had committed to selling their investments in oil, gas, and coal companies.

In total, these investors control $5 trillion dollars in assets.

Some investors are pulling support for environmental reasons.

Others simply want to avoid losing money to a market sector that’s heading toward extinction.

Either way, as this trend continues, we’re bound to see oil and the companies who produce it continue to lose value.

The money these investors are pulling out of oil needs to be reinvested elsewhere.

It only makes sense some material portion of those billions of dollars will find their way into companies pushing the Solar Age forward.

Americans are proud.

At the end of 2017, the United States ranked number three in the world for installed PV solar capacity.

This success and profile is largely a result of America’s innovation and leadership in photovoltaic and battery technologies.

America’s focus on research and development has driven costs down and made it more feasible for utility companies and individual homeowners to “dip their toes” in the solar energy pool.

But if there’s one thing Americans can’t stand, it’s being outshone on the world stage.

As soon as an oil super-power like Saudi Arabia starts to gain recognition as a world leader in solar energy…

I predict American pride will kick into high gear and we’ll see our solar capacity pick up momentum quickly.

This will create greater demand for American solar technologies here at home, increased profits for manufacturers, and higher returns for investors.

Your Solar Age Opportunity

Begins Now…

With all of this as a backdrop, I’ve carefully selected three U.S. companies — each one a leader its field — who are perfectly positioned to piggyback on the solar revolution about to kick off in Saudi Arabia.

And here they are…

A Global Leader In Photovoltaic Technology

My first pick is one of America’s largest dedicated solar energy companies — one that’s at the forefront of all PV manufacturers in research and development spending.

The company’s main product uses a proprietary technology that currently holds two world records for solar efficiency.

Their technology also has a track record for producing efficiency gains over time at a rate three times faster than competing technologies.

The company is also highly conscious of environmental impacts and manufactures their products to be 90% recyclable and reusable.

If this company were to capture only 10% of Saudi Arabia’s “black rectangle” project, it could generate as much as $20 billion in new revenues.

As a global leader in solar efficiency, I expect this company to benefit not only from Saudi Arabia’s needs but also from rising demand for its products both at home in America as well as internationally.

A Giant In Power Distribution

Pick number two is an American industrial icon.

The company had financial difficulties in the aftermath of the 2008 market meltdown but has restructured with a new and revitalized focus on its core energy division.

Within this division, it produces cabling, meters, circuit breakers, and software interfaces — all of which are critical components for integrating solar technologies into existing electrical grids around the globe.

I expect growth within this division to be close to 20% a year for the next three to five years.

With a dividend yield over 3%, this stock makes an excellent investment from both a growth and an income perspective.

A Mighty Defender

I wish the world didn’t make this next pick necessary but…

Even a billion dollar investment portfolio is of no value whatsoever if you, your family, and America’s infrastructure don’t remain safe from our enemies.

So, my third pick is a defense contractor.

My favorite company in this space is an American-based global leader in missile defense systems, electronic warfare, special purpose aircraft, aerospace systems, and cybersecurity.

The firm is geographically diverse with almost a third of its revenues originating from outside the U.S.

And most interestingly, in mid-2018, the company signed an agreement with Saudi Arabia to help build out its local defense capabilities.

The fact that Saudi Arabia will rely on this firm to protect the “black triangle” bolsters my confidence in this recommendation.

I expect this company to be among the fastest-growing major defense companies in America over the next five years.

These Three Solar Age Stocks Are

Positioned To Move Quickly…

You Must Take Action Before

September 1st

Saudi Arabia signed a $200 billion solar deal with Masa in April.

They’ve committed to start construction this year and to have their phase one solar farms up and running by mid-2019.

Since we’re already more than halfway through 2018…

Saudi Arabia will have to move quickly to stay on track.

Look, the mainstream media isn’t perfect… but they are smart.

Some journalist will eventually piece together the information I’ve shared with you in this letter.

And when that happens, the story will be blasted far and wide across every major media channel in America.

If you wait until you see it on the cover of The New York Times, there’s a good chance the investment opportunity will have already evaporated.

By then, millions of Main Street investors will have called their brokers, bought the same stocks I’m recommending, and juiced the market for a lot of the gains I’m expecting.

Don’t let that happen to you.

I predict sometime in early September (if not before!), Saudi Arabia will announce they’re beginning construction of the initial 7.2GW solar farms.

If you get in before then, you’ll be well-positioned to maximize your returns on my three favorite Solar Age stock picks.

That’s why I want you to have instant access to my brand new report titled:

The End Of The Oil Age: Your Three-Pillar Path To A Luxury Retirement

In this report, I detail the three U.S. stocks I expect to see skyrocket over the next six to twelve months as Saudi Arabia kicks off construction of its “black rectangle” — the most ambitious solar energy project ever imagined.

In this report, I detail the three U.S. stocks I expect to see skyrocket over the next six to twelve months as Saudi Arabia kicks off construction of its “black rectangle” — the most ambitious solar energy project ever imagined.

As leaders in their respective industries, I fully expect to see the profits and stock prices of these three companies continue to grow well into the next decade and beyond.

These “three pillars”, could easily become the cornerstones of your retirement portfolio.

In the report, I’ll reveal the exact ticker symbols for each company as well as detailed share price instructions to ensure you don’t overpay for them.

You can have this report on your screen in the next ten minutes.

If you’re a fast reader, you can consume it completely and be on the phone to your broker within the hour.

And I want you to have this report 100% free as my gift to you.

All I ask is that you accept a risk-free trial of my investment advisory service The Complete Investor today.

The moment you accept, I’ll give you instant access to…

The End Of The Oil Age: Your Three-Pillar Path To A Luxury Retirement

But…

That’s just the beginning of what you’re going to receive.

Your membership in The Complete Investor includes:

Membership Benefit #1: 12 Monthly Editions Of The Complete Investor In each monthly issue, I provide a detailed economic outlook, model portfolio summaries, investment recommendations, and specific buy, sell, and hold indicators for each model portfolio position. Any time an investment opportunity reaches its peak, I’ll send you an instant email alert with instructions on how and when to close out your position, maximize your profits, and be ready to invest in the next breakout opportunity. When something important happens, I don’t want you waiting for several weeks to hear about it. So each week, I send an email update to ensure you’re on top of any and all late-breaking market and company-specific news and developments. Membership Benefit #4: 24/7 Access To The Complete Investor Confidential Members-Only Website Here, you’ll find a searchable archive of past newsletter issues, special market reports, FLASH Alert histories, model portfolio details, plus… an opportunity to interact directly with me and my analyst team in our private discussion forum. I periodically add to a growing collection of informational videos designed to make you a better-informed and more profitable investor. Membership Benefit #6: The Complete Investor Premium Concierge Service As soon as you’re on the inside, you’ll have access to a special phone number where you can reach my VIP concierge team every weekday during normal business hours. The team is standing by to ensure any questions, concerns, or problems you have as a member are dealt with quickly and thoroughly.

Membership Benefit #2: Intra-Day FLASH Alerts

Membership Benefit #2: Intra-Day FLASH Alerts  Membership Benefit #3: Weekly Email Updates

Membership Benefit #3: Weekly Email Updates  As a member, you have exclusive, unlimited, around-the-clock access to my private website.

As a member, you have exclusive, unlimited, around-the-clock access to my private website. Membership Benefit #5: Educational Videos

Membership Benefit #5: Educational Videos

As you can see, The Complete Investor offers an amazingly comprehensive combination of research, communication, and exclusive member perks.

But you may be wondering, “How much does an advisory service like this cost?”

After all, newsletters, emails, alerts, videos, concierge treatment, and the opportunity to retire wealthy…

All this must be expensive, right?

Well… I’m almost certain you’ll be surprised.

But before we go any further, let me show you what else I’m going to send you today purely as a thank-you.

FREE GIFT #1: How To Cash In on the Natural Gas Revolution ($29 value)

FREE GIFT #1: How To Cash In on the Natural Gas Revolution ($29 value)

While The Oil Age is undoubtedly coming to an end — and faster than most people expect — natural gas still has some kick left it in… especially here in America.

Natural gas is a much cheaper, cleaner, and more efficient alternative to crude oil. And in this report, I reveal four not-so-obvious natural gas companies poised to explode over the next 24 months.

With just one or two of these picks in your portfolio, you could see gains in the order of 35% to 73%… or higher.

FREE GIFT #2: Why Security Stocks Will Reap Big Profits In 2018 ($29 value)

We’ve talked about the importance of security a little earlier. And regrettably, the situation is getting worse instead of better.

In this report, I reveal:

- The single-biggest, and growing, security threat facing the world today.

- The challenges America faces attracting top talent into the security field.

- One leading-edge firm whose revenue has been growing by over 25% a year and whose future prospects look tremendous.

- A second company operating in a potential market of $200 billion whom I expect to see grow as much as 15% per year for the next three to five years.

The Complete Investor Could Put

Your Retirement Investing On Autopilot

Believe me when I say, the information in these reports and bonuses can dramatically change the course of your retirement.

Instead of “having to” downsize your home, balance a monthly budget, and eat out only on special occasions…

Wouldn’t you prefer to live exactly how you want, where you want, with no restrictions on how much you spend each month or how frequently you dine in fine restaurants?

Well… these reports can have that kind of impact on your life.

And they’re yours absolutely FREE.

For the past 15 years, The Complete Investor has brought people like you the most comprehensive, prescient, and insightful investment advice available anywhere on the planet.

And if you join me today, this will be just the beginning.

So, how much does this cost?

I’ve shown you already how my recommendations have generated returns of:

Just two or three of these picks could have lifted your investment portfolio from “ho-hum” to “Oh, yeah!” in a matter of months — ensuring you and your spouse the retirement you’ve been dreaming of for decades.

In fact, many of my readers rely on my analysis and recommendations to take them into retirement very comfortably.

They include people like Ken K. from Eagle Idaho, who writes:

And Glenn C. from Harrisburg, Pennsylvania who shares:

And Glenn C. from Harrisburg, Pennsylvania who shares:

Then there’s Amelie G. of Ann Arbor, Michigan who had this to say:

There’s Sal G from New York, New York who wrote:

There’s Sal G from New York, New York who wrote:

And Kevin S. from Los Angeles, California who shared:

Every month, in The Complete Investor, my team and I share investment opportunities that could dramatically change your financial future.

This advisory service has a list price of $199 a year.

And I think you’ll agree, that’s very reasonable for everything you receive.

After all, your profits from a single stock pick could cover your membership fee 100 times over.

But…

I’ve spoken with my publisher, Brenton Flynn, and gotten his permission to offer you a huge discount if you’re one of the first 100 people to respond.

Why?

Look… you, me, and almost everyone we know have been at the mercy of oil-rich nations for the better part of 50 years…

The 1973 Oil Embargo. The 1979 Iranian Revolution. The 1990 Gulf War. The 2000’s Energy Crisis.

Oil has not only made these countries unimaginably wealthy… it’s also given them a weapon they’ve used to financially punish the rest of the world whenever they saw fit.

Now I admit… there’s no way I can reimburse you for 50 years of financial torture by OPEC nations.

But what I can do is offer you a way to profit from the end of their “reign of terror.”

So, I want to make it as easy and affordable as possible for you to become a member of The Complete Investor — without blowing your budget or sacrificing your lifestyle in any major way.

So I’ve arranged to temporarily lower the one-year membership fee to just $39.95.

That’s 80% off the regular price when you join today.

That’s a savings of $159.

As soon as you accept your trial membership, you’ll receive immediate access to “The End Of The Oil Age: Your Three-Pillar Path To A Luxury Retirement” — my special report revealing all the details of the opportunity I’ve described to you today.

You’ll also get instant access to my exclusive members-only website where you can review my past and current trade recommendations — including a handful that are ripe to skyrocket over the next few months.

I’m also including two free gifts worth $58 when you join today:

Gift #1: How To Cash In on the Natural Gas Revolution

Gift #2: Why Security Stocks Will Reap Big Profits In 2018

And you’ll get instant access to all of these as soon as you accept your risk-free trial membership for just $39.95.

That’s 77 cents a week… about what it costs to buy a pack of gum at your local convenience store.

And probably less than the amount of change you dump onto your dresser at the end of each day.

Try The Complete Investor

Without Risk Or Obligation

As I’ve done for the past 15 years, I will continue to ensure The Complete Investor brings you the absolute best investment advice available in the industry each and every month.

However, I can’t guarantee every investment recommendation I make will be a winner. To be honest, no one can. And you should be very skeptical of anyone who claims they’re never wrong.

What I can guarantee is you’ll be absolutely thrilled with the research and advice you receive from me and my team here at The Complete Investor or you’ll get your money back.

That’s right…

In the rare event you decide The Complete Investor isn’t right for you, you’re free to cancel your membership any time within the next 90 days and it won’t cost you a single, red penny.

100% of your membership fee will be returned to you immediately!

After 90 days, you’ll still be able to change your mind… but we’ll prorate your fee and refund you for any unused months remaining on your membership term.

And even if you decide to leave one month, six months, or eleven months from now… you get to keep — and continue to profit from — the free report and bonuses you’ll receive today when you accept a trial membership of The Complete Investor.

I think you’ll agree, that’s a very fair offer.

Once again… when you accept your trial membership today, you’ll receive:

- Free Report: The End Of The Oil Age: Your Three-Pillar Path To A Luxury Retirement

- Bonus Report #1: How To Cash In on the Natural Gas Revolution

- Bonus Report #2: Why Security Stocks Will Reap Big Profits In 2018

- 12 Monthly Editions of The Complete Investor

- Intra-Day FLASH Alerts

- Weekly Email Updates

- Access to My Exclusive Members-Only Website

- Educational Videos

- Premium Concierge Service

- PLUS… My 100% Satisfaction Guarantee

And all of this is yours today for only $39.95.

Saudi Arabia plans to start construction on the first phase of its $200 billion solar project this year and to have it online and generating electricity by mid-2019.

The sooner you jump on the opportunities I detail in my free report, The End Of The Oil Age: Your Three-Pillar Path To A Luxury Retirement, the better your chances of beating Wall Street to the punch and maximizing your profits.

If you hesitate to seize this opportunity today, it might get away from you. And I don’t want to see that happen.

Accept your risk-free trial of The Complete Investor by clicking the button below.

You’ll have plenty of time to review everything before you complete your order.

Within five minutes of joining, you’ll receive an email confirming your purchase, welcoming you to The Complete Investor family, and providing access details for my members-only website.

You’re only minutes away from being on the inside.

But I encourage you to act quickly…

I can only offer this 80% discount to the first 100 new members.

After that, my publisher will make me charge full price again.

Right now, you have a decision to make…

You can continue along your current investment path — scouring the Internet for free information, accepting dubious stock “tips” from friends and neighbors, and being frustrated by conflicting and confusing investment advice spouted by mainstream media talking heads.

If you stay on this path, you can expect your situation to remain pretty much the same:

- You’ll continue to see lackluster returns.

- You’ll continue to stress about whether you can maintain your current lifestyle into retirement.

- And you’ll continue to wonder how much money you’re leaving on the table by not accepting help from investment experts.

But I suspect that’s not what you want.

On the other hand, if you accept a risk-free trial of The Complete Investor today, you can expect:

- Top-notch investment research conducted by skilled analysts.

- Access to model portfolios designed to meet your growth and income needs.

- Up-to-the-minute trade alerts whenever we make changes to our portfolio holdings.

- The ability to interact directly with me and my analysts in our online forums.

- Accurate ongoing performance tracking of our stock picks.

- And confidence your portfolio will support the retirement lifestyle you’ve dreamed of.

Plus… all of my team’s research and recommendations will be delivered to your email inbox like clockwork. You’ll never have to hunt for advice when you need it.

And all you have to do is accept a trial membership to The Complete Investor today.

Remember, there’s absolutely no risk for you — you’re completely blown away by the value I provide… or your membership fee is returned without a hassle.

Click the button below to start your risk-free trial today.

Or if you’d prefer, you can call my Priority Support Team toll-free at 800-543-2049.

Just tell them you’d like to join The Complete Investor and they’ll get you set up right away.

Thank you for reading and I look forward to seeing you inside The Complete Investor.

Sincerely,

Stephen Leeb

Chief Investment Strategist

The Complete Investor

P.S. I just got off the phone with my publisher, Brenton Flynn.

It took some arm twisting, but I convinced him to agree to an extra-special discount for the first 100 new members who join The Complete Investor.

The regular membership fee is $199 per year. But if you join today, you can have two years for just $78.

That’s a savings of $320 off the regular two-year membership.

Plus… I’ll include two additional special bonus reports…

Bonus #3: 3 Ways To Grow Rich From The Great Inflation Surprise ($29 value)

Over the next five years, I predict the markets will take a massive toll on any company unable to outgrow inflation.

Unless your investment portfolio contains at least a few companies who can raise prices to keep pace, you may come out on the losing end of the inflation game.

In this report, I reveal my top three “inflation-busting” stock picks. I expect all three to outperform the market as prices skyrocket due to rising inflation.

Bonus #4: Blue Chip Blacklist For 2018 ($29 value)

This report covers 10 Wall Street “darlings” I believe are overvalued and in grave danger of being toppled by the growing risks of inflation and apotential trade war. If you have any of these stocks in your portfolio today, you’ll want to take profits immediately!

You’ll still have 90 days to try out the service and decide if it’s right for you.

You’ll still have 90 days to try out the service and decide if it’s right for you.

And even if it’s not, you can keep my free report, The End Of The Oil Age: Your Three-Pillar Path To A Luxury Retirement, all four bonus reports, and any monthly newsletters I publish during that period as my way of saying thank you.

Again, this two-year offer is only available to the first 100 new members. (And only if Brenton doesn’t change his mind before then).

Click the button below right now to lock-in your two-year membership to The Complete Investor for only $78.