***INVESTING DAILY OPPORTUNITY ALERT (TIME-SENSITIVE)***

The $1.78 Trillion Secret of

Bongo 76-43

A drilling station at a remote spot in the Texas desert is using a radically advanced compound known as “Augmented SiO2” to unlock the second largest oil field on the planet.

The last time there was a breakthrough of this magnitude in the energy industry early investors raked in 469%… 737%… 863%… even up to 3,790% profits. Starting today, you can too… here’s how:

Each morning while middle school students in the small, quiet town of Kermit, TX wait outside for their school bus to arrive, an 18-wheeler carrying the specialized compound you’re looking at now travels down a dusty road…

This material, which few people understand, is mined over 1,300 miles away in rural areas of western Wisconsin and southeastern Minnesota.

After that, it is processed and exported to select sites throughout the US including: North Dakota, Pennsylvania, Louisiana, and Texas.

Companies using this mysterious substance are set to generate hundreds of billions of dollars in revenue over the next 2-3 years, along with providing triple-digit gains for investors…

…Just as they did a few years ago.

This material is so crucial to unlocking these riches a handful of oil producers are paying up to 5x its normal price to lock up supplies…

And some, like Pioneer Natural Resources (PXD), have even purchased their own mines to ensure they never run out.

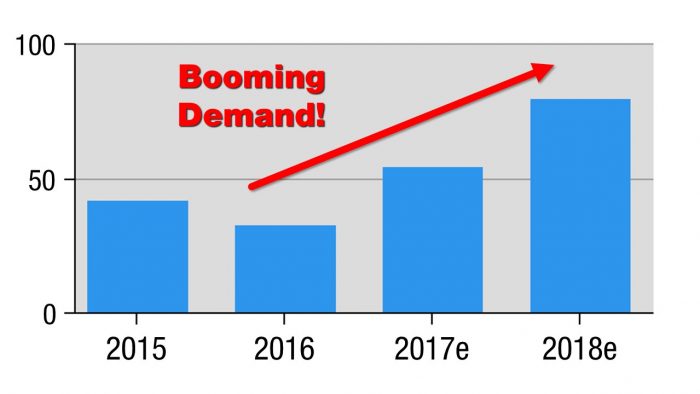

That’s not hard to understand when you see how demand is exploding.

What makes this material so special?

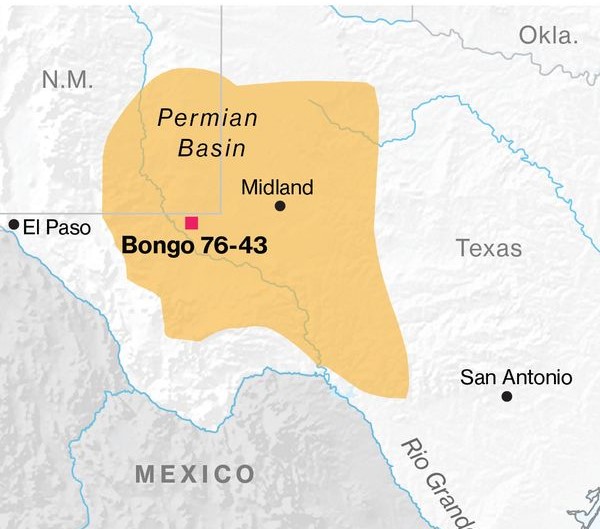

You don’t need to look any further than a little-known patch of land in the Permian Basin called Bongo 76-43 for the answer.

Because there you’ll find conclusive proof Augmented SiO2 is the key to revolutionizing the oil and natural gas industries, increasing American oil production, and stealing influence from big producers like Saudi Arabia and other OPEC (Organization of the Petroleum Exporting Countries) members.

This compound, along with the drilling breakthrough that’s driving its exploding demand, is creating the next wave of energy millionaires.

In fact, in just a few minutes I’ll show you how to get your hands on a special report that contains the names of three companies perfectly positioned to surge once the story of SiO2 becomes public knowledge later this summer.

Before I do, let me introduce myself.

My name is Robert Rapier.

I’m the Chief Investment Analyst for a research advisory named The Energy Strategist.

In the past 25 years, I’ve traveled to all 50 states and to 38 countries to advise companies on energy-related matters…

And I can tell you without reservation, what’s happening at Bongo 76-43 is an extremely rare situation.

One that could hand you gains of 469%… 737%… 863%… even up to 3,790%.

How can I be so sure returns of that size are possible?

Because it has already happened before when similar transport trucks delivered this specialized material to select drilling sites in North Dakota, Pennsylvania, and Louisiana…

History Is About to Repeat Itself

(And It Could Make You Very Wealthy)

I can’t tell you how many times I’ve heard people say, “If only I recognized and invested in the (fill-in-the-blank) opportunity before it became mainstream – I’d be wealthy, retired, and sipping frozen drinks on a beach somewhere…”

Well, what I’m about to show you is your chance to do exactly that. Because this newly developing opportunity in the Oil and Natural Gas industries is almost identical to one that made people rich just a few short years ago.

Take what happened in North Dakota for example.

Around 2006, people started to notice countless trucks like the one I mentioned earlier driving to and from the Bakken oil fields in North Dakota. They were all transporting tons upon tons of Augmented SiO2 to various sites.

And shortly after the trucks showed up, shares of Abraxas Petroleum (AXAS) spiked up 894%… Rosetta Resources (ROSE) jumped 514%… Whiting Petroleum (WLL) shares rose 688%… Continental Resources (CLR) went up 717%… and Brigham Exploration (BEXP) gave investors a massive 1,040% gain.

Had you invested just $1,000 into each of those five plays – you could have turned your investment into $43,500.

And that’s far from the only time this phenomenon took place!

When those same trucks transporting Augmented SiO2 started showing up in the mountains of Pennsylvania and the remote bayous of Louisiana…

It wasn’t long before Devon Energy (DVN) shares rose 109%… Chesapeake Energy (CHK) jumped up 127%… Encana (ECA) went up 119%… and Southwestern Energy (SWN) handed investors 192% gains.

The fact of the matter is this: Every single time these trucks transport massive amounts of Augmented SiO2 somewhere, forward-looking investors get rich.

And right now, they’re showing up in ever-growing numbers in Texas.

Get In On The “Black Gold” Rush

Happening In Western Texas

Just a few months ago, Exxon Mobil (XOM), the world’s largest publicly-traded oil company snapped up approximately 275,000 acres of west Texas property for an astounding $6.6 billion.

That same week, Noble Energy Inc. (NBL) said it would pay $2.7 billion to buy west Texas producer Clayton Williams Energy Inc. (CWEI) to access 120,000 acres of oil-rich land.

Prices for drilling rights in the area have averaged between $20,000 and $60,000 – per acre.

And according to financial firm Morgan Stanley (MS), companies have invested close to $30 billion into 1.2 million net acres in west Texas since the middle of 2016.

This “Black Gold” rush is just a part of the massive land grab that’s been going on in west Texas in an area known as the Permian Basin where the radically-advanced drilling site Bongo 76-43 is located.

CNN reports that, “Land prices in the Permian have skyrocketed, drilling activity has tripled since last year and production there is poised to soar despite cheap oil prices.”

Scott Sheffield, executive chairman of Pioneer Natural Resources says, “The Permian Basin has now become the crown jewel of the world’s oil and gas industry.”

Some are even predicting this hotbed of shale drilling activity could eventually surpass the colossal Ghawar field in Saudi Arabia and become the world’s biggest oilfield.

Incredibly, all this is happening, even though oil prices are below $55 a barrel.

And absolutely NONE of it would be possible without the unique crystalline compound referred to as “Augmented SiO2.”

In fact, it is about to unlock up to $1.87 trillion worth of oil and natural gas reserves in the US alone. And it could make investors who ride this new energy wave very wealthy.

Let’s take a look at SiO2 again so I can show you what makes it so unique. And essential.

On the left, are typical grains of sand. It’s the kind of sand that you might find on a sunny beach. In a child’s backyard sandbox. Or the kind that you might combine with a bag of concrete to patch up cracks in your sidewalk.

And on the right is Augmented SiO2…. you can immediately spot the physical differences between the two.

For instance, Augmented SiO2 is rounder. It has more uniform sized grains. And there’s a more uniform composition than the ordinary sand on the left – because it is almost 100% pure quartz.

All those things are pretty obvious.

However, as someone with a Master of Science degree in Chemical Engineering – I want to share something with you most people don’t know about this “sand.” And it could make you a lot of money…

The Immense Profit Potential Of

Augmented SiO2 Over The Coming Years

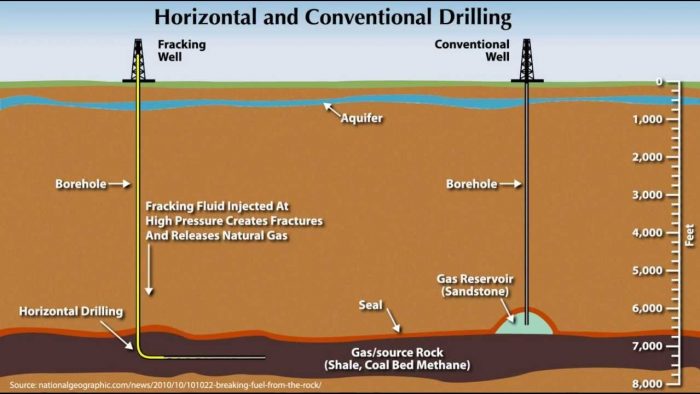

Over the past several years, you’ve likely heard of hydraulic fracturing. Most people simply call it fracking.

However, unless you work in the Oil and Natural Gas industries or you regularly invest in companies in those industries, you probably don’t know exactly what that means.

Without getting into too much detail – here’s how it works.

On the right is a conventional well that has a borehole which goes straight down. To the left is a fracking well with a borehole that goes down, and then becomes horizontal – drilling through shale.

The fracking process involves the high-pressure injection of “fracking fluid” and Augmented SiO2 to crack open the deep-rock formations (usually several thousand feet underground)

When the hydraulic pressure is removed from the well, the small grains of Augmented SiO2 “prop” the fractures open – allowing much more oil and natural gas to flow out of the shale. And finally reach the surface.

This diagram gives you a better picture of what’s happening…

Because Augmented SiO2 looks similar to sand, and is used for fracking – it’s often just called “frac sand.”

However, there’s an unseen molecular component of Augmented SiO2 that sets it miles apart from ordinary sand. And it’s something that makes it incredibly valuable to oil and gas companies and various billionaire investors.

Its TOUGHNESS.

In other words, its crystalline structure is so crush-resistant that it can resist compressive forces up to several tons per square inch. And that’s crucial for how it is used at oil and natural gas exploration sites throughout the world.

Here’s the bottom line: Without this compound, the trillion-dollar energy revolution happening in the United States right now would come to a screeching halt.

Because every single company that uses fracking technology NEEDS it for their daily operations.

Analysts at Raymond James, a US based financial services company, expect to see Augmented SiO2 demand set all-time highs in 2017. And demand for 2018 is projected to be at least 150% higher than it was in 2016.

That’s not a typo.

Demand for this material is set to more than double in the next 18 months.

The last time Augmented SiO2 surged like this, early investors had the opportunity to pocket massive profits in a short period of time.

For instance…

- Hi-Crush Partners (HCLP) share prices increased 469% in less than two years.

- S. Silica Holdings (SLCA) delivered investors 737% gains in two years.

Had you invested just $1,000 in each of those two plays, you could have turned your initial investment into $14,060.

A $5,000 investment would have ballooned into $75,300.

And a $10,000 stake would have let you walk away with a whopping $150,600.

Quite frankly, if you were to buy Hi-Crush Partners (HCLP) at a share price of $20 or less and U.S. Silica Holdings (SLCA) at a share price of $45 or less today – you could conservatively bank up to 150% profits between those two companies over the next 2-3 years.

But there are several other plays I want to show you right now that could be far more profitable.

And their success has everything to do with what’s going on right now at the Bongo 76-43 drilling site in the Permian Basin of west Texas…

Bongo 76-43 Is the Start of

The NEXT Energy Revolution

Because recently the owner of this site, Royal Dutch Shell, has come around to using the same process at Bongo 76-43 that’s minted millionaires in the foothills of Pennsylvania. The plains of North Dakota. And the bayous of Louisiana.

And as a result…

This billion-dollar energy company is using three times more Augmented SiO2 than ever before.

From just one drilling site.

That’s where things start to get interesting. And profitable.

Because Shell is far from the only major energy company that’s latched on to using fracking technology and Augmented SiO2.

Remember, Exxon plunked down over $6 billion for a plot of Permian land that requires the use of fracking to release its bounty.

And now Chevron is getting in on the action too.

Because it recently announced plans to spend around $2.5 billion on shale and tight investments (a 67% increase), the majority of which is slated for the Permian Basin.

A recent Chevron memo says its shale output will increase as much as 30 percent per year for the next decade, with production expanding to 500,000 barrels a day by 2020, from about 100,000 now.

That means in the next four years, another one of the biggest energy companies in the world expects to use 5x more SiO2 than its using today.

Talk about an explosion in demand!

More importantly, Shell, Exxon, and Chevron are just a few of the companies racing to unlock the 234 billion barrels of oil and 2,474 trillion cubic feet of natural gas resources in the United States.

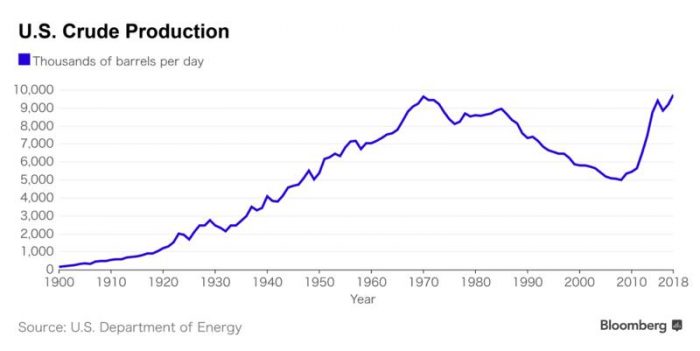

When the U.S. Energy Information Agency looked at the potential output of all the energy companies operating in the United States, it concluded domestic production is likely to top 10 million barrels a day by December 2018.

We haven’t produced that much oil since 1970.

And it’s all thanks to fracking—a process that completely relies on Augmented SiO2.

The why I believe now is the perfect time to pick up shares of the three companies in my executive research report called: The Permian Push – Three Ways to Massively Profit from the Next Energy Wave.

I’ll tell you how to get a copy in moment. But before I do, let me give you a brief preview of the profit opportunities you’ll find in it…

Get In On These Three Plays

As Fast As You Can

As you can see, what’s happening in the Permian Basin will lead to many profitable investing plays. And it will create countless new millionaires.

And I’ve uncovered three opportunities I believe will help you become one of them.

Permian Push Opportunity #1

The first company is a pure-play low-cost producer of high-quality Augmented SiO2.

This Texas-based company has over 240 million tons of proven recoverable reserves of this material along with over 90 million tons of probable reserves.

In other words, with the incredible demand for Augmented SiO2 for fracking operations in the Permian Basin and throughout North America, this company’s reserves will be able to supply oil and gas exploration companies well past 2035.

With its location on a Class 1 rail, it can provide a continuous supply of Augmented SiO2 by train to anywhere in North America.

And more critically, to the red-hot Permian Basin.

Unlike its competitors who are loaded with debt, this company has exceptionally low debt load which means there’s no danger of it going out of business and taking your hard-earned money with it.

Finally, it is currently trading for less than $14 per share – making it a flat-out bargain.

Because of its current financial status, combined with increased demand for Augmented SiO2 – you could see its share price spike up 400% to 700% (or more) over the next 2-3 years – just like its competitors Hi-Crush Partners (HCLP) and U.S. Silica Holdings (SLCA) did during the first fracking boom almost 10 years ago.

Permian Push Opportunity #2

This oil and natural gas company is directly benefitting from this new Augmented SiO2 boom. And I’m not talking about the “big boys” like Exxon (XOM) or Chevron (CVX).

Those two companies are huge. And while they will make a lot of money for the Augmented SiO2 company that I call Permian Push Opportunity #1 – you won’t get rich investing in those two oil giants.

However, this smart driller is set to grow… and Grow… and GROW.

In fact, it is my top Permian play for 2017. Here’s why…

Since its IPO in 2012, it has delivered its investors over 500% gains. And it has never had a down year.

More importantly, because it operates exclusively in the Permian Basin – it is positioned for a continued surge of growth over the coming years.

In fact, it has recently purchased over 112,000 acres in the Permian Basin, up from 78,000 acres just two years ago in March 2015.

Plus, while most oil and natural gas drilling and exploration companies in the Permian Basin are forecasting 15% to 20% growth for this year – this company currently has eight rigs running and is targeting over 65% annual production, which is up from 30% annual production in 2016.

Because of its solid financials, strong management team, and land acquisitions – not to mention its use of Augmented SiO2 in its drilling operations – this could be a stock that you hold onto for the next decade and watch it rack up an average of 40% to 60% gains year after year.

That simply means if it continues its current trajectory, investing in this company today could allow you to turn every $10,000 into $400,000… $500,000… even up to $600,000 over the next 10 years.

This play alone could significantly boost your retirement fund… or even provide enough money to completely pay your children’s (or grandchildren’s) way through college.

But only if you take action and get my research report that has its name today.

I’ll show you in just a moment. Before I do, let me show you…

Permian Push Opportunity #3

The third company I’ve been investigating is a major Augmented SiO2 producer and transporter that has operations in British Columbia, Alberta, Saskatchewan, and Wisconsin.

This opportunity has two key points of interest.

First, it is the first company of its kind that has train terminals which can accommodate up to 100 train cars – allowing them to offer a high volume of Augmented SiO2 to their customers, and do so very efficiently.

Second, they’ve solved a recurring problem that plagues many Augmented SiO2 producers – which is a dependency on the trucking supply chain (like the ones I mentioned at the beginning of this presentation) and lack of immediate access to it at the oil and natural gas drilling sites.

They do this by offering a well site solution with a proprietary mobile storage and handling system – which holds 1800 Metric Tons (almost 4 million pounds) of Augmented SiO2.

This company just had its IPO earlier this year this year. And when Wall Street gets wind of its potential, I fully suspect share prices will double or triple in the coming months.

I’ll give you all its details along with the other two Permian Push opportunities when you agree to try out…

The Energy Strategist

As I mentioned earlier – my name is Robert Rapier.

If my name sounds familiar, it may be because you’ve seen it on The Wall Street Journal‘s “ask the experts” panel.

Or perhaps you’ve read my columns in Forbes or the Washington Post or seen me on television on 60 Minutes.

After a 25-year career in energy that has taken me all over the world, a lot of people have become interested in my opinion on energy matters.

Perhaps it’s because I hold five energy patents… or the fact that I saved ConocoPhillips millions of dollars by changing the way they blended gasoline.

Maybe it’s because of the high-profile oil and gas projects I worked on in the North Sea

Whatever the reason, the fact is that serious energy investors seek out my opinion and my in-depth investigative reports. Wealthy investors and hedge funds hire me to evaluate start-up energy companies for them.

A thumbs-up from me can mean millions of dollars in funding.

A thumbs-down usually means bad things for the company. For example, I wrote a review on a renewable energy company called KiOR and it fell by 90% in the following two years.

I gave negative forecasts for ethanol producers Range Fuels and Xethanol, Inc. – and they are now out of business.

Look, I don’t tell you this to brag. I just want you understand that when I talk about energy, I’m bringing you a perspective that certain people pay good money to get.

It’s a perspective you can get access to for a fraction of what those guys pay me.

And if you’re wondering why I’d do that, the answer is simple: reaching a wider audience.

I love the work I do and I take it seriously. But the kinds of investors who can pay me to fly all over the world are a very small club. And average investors could never get access to the companies I vet for the wealthy investors and hedge funds anyway.

So when Investing Daily asked me to write for them, I jumped at the chance.

Over 175,000 investors from 32 countries rely on Investing Daily for its unique brand of financial advice.

I now work alongside some of the sharpest minds in this business – a small army of researchers who spend day after day reading annual reports… calling CEOs… scouring trade publications… flying to conferences… and digging up SEC filings.

Joining the Investing Daily team was the best way I could think of to share my knowledge and help a much larger audience profit from what’s going on in the energy sector.

After all, who doesn’t want a bigger media outlet when you’re in the business of presenting your research to the world?

Plus, some of the most lucrative research I’ve ever released has appeared in the pages of The Energy Strategist. In fact, our readers are currently enjoying cumulative gains of:

- 55% in LNG shipping

- 155% on utilities and midstream companies

- 137% on exploration and production

- 820% on pipelines

- 205% on other select energy plays

And that’s made readers very happy.

So much so that they’ve taken time out of their busy lives so send me notes like this one from Bill C. who says…

“Robert Rapier is top of the class. He knows the energy business and his picks are well thought out and tend to be profitable.”

And Rodney R. recently wrote in to update me on my recommendation that he says is…

“…now $11k above water.”

I do want to be clear about one thing, though. Not every pick I make is a winner. That’s impossible. But I can guarantee you this: When I make a stock pick that moves downward without prospects of it re-surging in the very near future – I get rid of it fast.

The last thing anyone who has their money tied up in our recommendations wants is to watch it go down.

I wouldn’t do that with my money and I most certainly won’t do it with yours.

I don’t have an emotional connection to the stocks I recommend. It’s all about performance for me. If the company doesn’t meet my performance expectations based on my research, I cut it fast.

The good news is, of the 24 picks made in the course of 2016, 23 were profitable for us at year end. Three of our recommendations returned more than 50% and five others delivered at least 24%.

Also, the 24 selections we made in 2016 averaged a gain of 17.2% despite an average holding period of just four and a half months.

And here’s another thing I think you’ll like, especially if you’re looking for solid income plays: Many of the companies I focus on are flush with cash. So much so, that some of my picks are giving my current readers dividend yields of 6.87%… 7.74%… 8.02%… and even up to 10.82%.

Even after everything I just showed you, I know that spending your hard-earned money on investment research and advice isn’t exactly at the top of your to-do list.

So allow me to…

Remove ALL Doubt From Your Mind

There are two things I believe we can all agree on…

First, Augmented SiO2 is the key to unlocking billions of barrels of oil and trillions of cubic feet of natural gas resources.

And second, the use of fracking by billion-dollar energy giants like Exxon, Shell, and Chevron will drive the demand for SiO2 through the roof.

My prediction is that the next wave of energy millionaires will come from forward-looking investors who understand the immense opportunity I just laid out for you…

And immediately take action.

To make sure you don’t miss out, I’m going to give you a gentle nudge in the right direction by  making you this special offer.

making you this special offer.

I want you test-drive my investment research advisory service, The Energy Strategist.

Take a full 60 days to try out everything it has to offer… risk-free.

As a thank-you for taking this test drive, I’ll send you my executive research report, The Permian Push – Three Ways to Massively Profit from the Next Energy Wave.

…completely free of charge.

Plus, there are several other benefits I believe would be of value to you…

Here’s Everything You’ll Get When You

Try Out The Energy Strategist 100% Risk-Free

I’ll be honest. When we talked about putting this presentation together for you, we discussed giving you a bonus report, too.

But then we decided against it. And here’s why…

Quite simply, The Energy Strategist itself IS the most comprehensive bonus report we could ever assemble… not only on America’s energy revolution, but on energy opportunities across the world.

After you get through my Permian Push report, you’ll find a whole universe of energy opportunities in our:

Weekly Investment Alerts. Most investment research services publish their findings once a month… or sometimes, even bi-weekly.

However, I feel that is a disservice to investors. One of the weaknesses of a rigid monthly or bi-weekly publishing schedule is that some developments in the energy markets warrant immediate coverage. And some stock picks warrant timelier updates.

This means I’ll send you my latest energy investment research, including new recommendations, updates, and analysis as they come across my desk – providing you with the opportunity for even greater profits.

When you join, you’ll also get members-only access to the Energy Strategist website. There you’ll enjoy a host of powerful tools like:

An easy-to-navigate archive of all my research. That includes every special alert, and report I’ve ever written. It’s the most comprehensive coverage of America’s energy boom out there, and filled with ways to profit from it.

You’ll also get access to my Model Investment Portfolio. This portfolio is updated every day with a detailed status of every pick I’m recommending so you’ll always know where you stand.

I’ll also email you a special subscribers-only bulletin called The Energy Letter every week at no extra charge, providing you with my views on the domestic and global energy markets.

First-class customer service. If you ever have a problem or a question, our Subscriber Services staff is here to help. Simply send us a quick email or call us toll-free. No matter which you choose, we’ll do everything we can to make you happy.

My zero-risk guarantee. I want you to be 100% satisfied with The Energy Strategist. That’s why I’m giving you a full 60 days to try it out and see everything it has to offer. If you aren’t happy, simply let us know and we’ll quickly issue you a full refund.

One more thing: As a subscriber, you also get to join our monthly online chats. You can “fire away” and ask specific questions about anything you want.

If you can’t wait for one of these chats, just post your question the members-only Forum on our website. A member of our team will get back to you with a response as soon as possible.

Typically the next business day at the very latest.

Take Me Up On My Simple Offer

I’d like to send you The Energy Strategist on an “approval” basis. In other words, you only pay if you like it.

I think 60 days is a fair trial period for you to make up your mind.

So here’s what I propose…

I’ll start you off with a free copy of The Permian Push – Three Ways to Massively Profit from the Next Energy Wave.

Then I’ll ask you to give The Energy Strategist a try over the next 60 days. During that time, if you’re not satisfied with my work, I want you to ask for a 100% refund.

However, I’m confident that – like countless others who value my investment research and recommendations – you will value it not only today, but for years to come.

The Energy Strategist is the most comprehensive guide to America’s energy explosion that I know of, and I take great pride in putting my name on it.

As you can tell by the nature and content of this presentation – The Energy Strategist is designed for serious investors only. Investors ready to react as quickly to today’s rapidly shifting energy markets and the incredible profit opportunities they present.

Investment guidance from an experienced financial and energy professional like me is worth at least $10,000 to $20,000 a year to hedge funds and other high net worth investors.

And while I can’t share the specific fees I’ve been paid to consult on private energy projects across the world, it’s often much higher than that… for only a small amount of my time.

That’s why the $3,000 retail price is such a bargain.

Especially considering the massive profits you’ll likely generate thanks to my intensive research.

But today, I’d like to make you a special limited-time offer…

One that only 100 people can be part of.

If you pull the trigger and sign up for a year’s worth of The Energy Strategist right now, you can do it for only $995.

That’s over $2,000 off the normal one-year price.

Plus, you can lock-in that discounted rate for as long as you’re a subscriber. No matter how much we raise our prices in the future.

Why would I offer such a significant discount?

There are two reasons.

First, like I mentioned earlier, I want my research – which I take great pride in – to reach a wider audience.

Second, and more importantly, I believe in taking the long view. Which simply means if you get my research at a lower price and you like it (and profit from it), then you’re likely to remain a subscriber for many years to come.

That makes it a WIN-WIN-WIN situation.

It’s a WIN for my publisher with long-term revenue from more subscribers that can afford the discounted price…

A WIN for me by expanding my reach to a wider audience…

And most importantly – it’s a WIN for you because not only do you get my research at a discounted price today, you can lock in that rate forever.

But again, my publisher only agreed to let 100 people join The Energy Strategist under this unique offer.

And because of that, I can’t say how long it’ll take those slots to fill up. Especially when you consider that our email list has over 175,000 people on it. But I’d bet that it won’t be more than a few hours.

Remember, when you join, you’ll immediately receive my new special report along with instructions on how to log into the website.

That way you can start taking advantage of all the profitable opportunities I’ll show you – right away.

And you can relax knowing that if you’re not happy for any reason within the first 60 days, you can get a full refund.

Best of all, the special report, The Permian Push – Three Ways to Massively Profit from the Next Energy Wave, is yours to keep no matter what you decide.

To get started, simply click on the link below. It will take you to a secure order form which only takes a minute to complete. From there your order will be processed immediately.

And you’ll have access to all my work in a matter of minutes.

For instant access, click here now.

To your wealth,

Robert Rapier

Chief Investment Analyst

The Energy Strategist

P.S. – Keep in mind that this is a limited-time special pricing offer for The Energy Strategist. Be among the first 100 people today to take advantage of our discounted annual rate of just $995.

And remember, your risk is zero with this offer. So you’ve got nothing to lose by giving it a shot.

You’ll have the next 60 days to make up your mind. In other words, you are only agreeing to try my work to see if you like it.

If you don’t, no problem. Simply call our customer service team and we’ll issue you a 100% refund. No “cancellation fee”… no hidden charges… no strings whatsoever.

I look forward to welcoming you on board…