The amazing story of the "Keystone Clones"...

How Two "Stealth Pipelines" From Canada Outfoxed an American President

Canadian crude is flooding to the Gulf Coast--despite Obama's veto of the Keystone XL pipeline.

Green groups may be livid--but investors are smiling.

Five companies are poised to profit hugely from the Keystone Clones--and this play is in our own familiar backyard, not across any border.

Five companies are locked in to profit as the twisting tale of the “Keystone Clones” unfolds. More on that story in a minute.

Quick sum-up: President Obama hates Canadian oil—U.S. refiners love it.

Obama decries “heavy oil” from Alberta as “extraordinarily dirty” to extract.

Gulf Coast refiners say the oil from up north is ideal for producing gasoline and jet fuel.

For the past six years, President Obama dithered over the Keystone XL pipeline project—keeping both Canadian oil companies and his wealthy eco-donors dangling.

In the end, Obama vetoed Keystone XL. The President chose green—for his personal convictions and for big contributions from his rich pro-environment patrons.

But Wait...

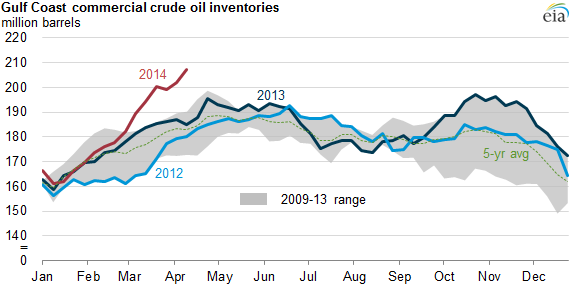

When Obama began his deliberations on Keystone XL, less than 100,000 barrels per day (bpd) of Canadian oil were reaching the Gulf Coast.

Today, nearly 400,000 bpd of crude from Canada are flowing all the way down to the Gulf Coast refineries—a 300% increase. And the amount is relentlessly growing.

How can this possibly be happening? Meet…

The Keystone Clones

While Obama played Hamlet over his Keystone XL decision, crafty Canadian oil producers planned other pipelines—to outmaneuver the veto they had a notion was in the works.

As the U.S. President delayed his decision, the Canadians got busy.

First, the Canadians quietly evaded the need for State Department approval by using an existing pipeline that already crosses the U.S.-Canadian border.

Then, they linked it to two new pipelines to carry their oil the rest of the way to the Gulf Coast.

Today, their clever “end-around” accomplishes what Keystone XL was supposed to do—move Canadian heavy crude all the way from the Alberta oil-sands to thirsty refineries on the Gulf Coast where much of it becomes cheaper gasoline for Americans.

Adding more irony to the tale, the stealth route is capable of moving roughly the same amount of oil—850,000 bpd per day—as the proposed Keystone blocked by Obama.

Furious eco-activists have denounced these pipelines as the “Keystone Clones”—but there’s little they can do to stop them…the stealthy duo are already pumping oil southward!

For Energy Investors, It's a Beautiful Thing!

Upshot: The greens may have won the Keystone XL battle for now—but they’ve lost the war to stop Canadian oil from flowing to U.S. refineries that are just beginning to soak up huge profits.

In his 2013 interview with the Houston Chronicle, Al Monaco, CEO of Canadian pipeline giant Enbridge, described the combination Canada’s vast treasure of heavy crude and Gulf Coast refining capacity as “the perfect marriage” of supply and demand.

Here’s why I believe he’s right. And why five companies are a virtual lock to profit hugely from Canadian crude flowing into the Gulf refinery region.

In brief, the heavy, hydrocarbon-bearing oil from Alberta that President Obama disparages as “dirty” happens to be an ideal fit for many Gulf Coast refiners.

Most of the Gulf Coast’s refining capacity is structured to process thick, heavy oil—despite the increased availability of light, sweet oil from U.S. shale regions like the Bakken and Eagle Ford.

A major reason for this preference for heavy oil is price. Until the recent oil-price collapse, lighter oil from unconventional wells in the States has been expensive, due to the high cost of fracking and horizontal drilling.

Many Gulf refineries made major capital investments to process heavier (and cheaper) crudes from Canada, Venezuela and Mexico. Since then, however, Latin American heavy oil production has become much less reliable.

Crude production in Mexico has fallen by almost 1 million barrels bpd since 2004. And total oil production from politically unstable Venezuela is down over 700,000 bpd.

The loss has to be made up—the Keystone XL pipeline providing additional crude from Canada was counted on to achieve just that.

What to do?

The Sweet Spot of Profits

This is where the Keystone Clones—the newly completed Flanagan South and Seaway pipelines—save the day.

The fresh infusion of 400,000 bpd—and eventually a projected 850,000 bpd—of Canadian crude surging through the Clones to the Gulf are a boon to refineries on the receiving end.

With Americans buying more gasoline in response to lower prices, and U.S. air carriers consuming more jet fuel in the face of anticipated record passenger loads—these refiners are smack in the sweet spot of profits.

The time for investors to act is now. Read on to find out how my investing advisory newsletter, The Energy Strategist, will help you jump on board.

This is an immediate buying opportunity. Most people have taken Obama’s Keystone XL veto at face value—meaning no Canadian oil for the U.S. That’s it. Game over.

As I’ve just shown you, nothing could be further from the truth.

Right under the noses of investors, a mighty tide of Canadian crude is flowing straight to the refiners who know exactly what to do with it—turn it into fuel for Americans raring to “hit the road, Jack.”

It’s the perfect setup for extreme profits—starting with these five picks:

My #1 recommendation…

…is the largest refiner in the world that doesn’t also produce crude. It’s also my overall number one Best Buy in The Energy Strategist portfolio.

This outfit is gassed up and ready to go. They boast 15 refineries with a combined global capacity of 2.9 million bpd and more than 7,400 filling stations. With Gulf Coast refineries located in McKee and Port Arthur, Texas, they are strategically situated to benefit from the flood of Canadian crude surging to the U.S. via the Keystone Clones.

This company’s stated objective is to have one of the highest cash returns to its shareholders in the industry. They back up those intentions. Operating income grew 49% last year, allowing the company to return $1.9 billion to shareholders via buybacks and dividends even before they raised their dividends by 45% early this year.

Speaking of returns, the share price has risen 173% over the past three years, more than triple the gain of the S&P 500. That’s what an indisputable “Best Buy” looks like—and why I’m advising my subscribers to buy this stock now.

That’s just the beginning, however. Here are the other superb investment opportunities I want to tell you about:

- Heavy-Oil Heavyweight. Right behind my number one pick is a company with roots going back to 1887. The nation’s third largest refiner, they own seven refineries in the Midwest and Gulf Coast with a total capacity of 1.7 bpd. They also operate 8,300 miles of pipeline, 5,400 retail locations and 2,740 convenience stores. This refiner prizes Canadian crude. The CEO recently told the Financial Post, “We’ve been running Canadian heavy for quite some time, and I’d like to run more.” The stock is up 146% over three years, and we’re looking for additional gains from this workhorse refiner that accounts for almost 10% of the total U.S. refining capacity.

- Strong Canadian Connections. This pick is one of the largest independent refiners in the U.S., producing gasoline, diesel, jet fuel, “heavy” products (asphalt, fuel oil, slurry, and roofing flux) and lubricants at its five mid-continent refineries. With a total capacity over 400,000 bpd, all of their refineries have access to pipelines pumping in Canadian crude. They control 2,900 miles of oil and gas pipelines, as well as storage and refining facilities. This very smart refiner has a track record of buying assets at bargain prices, having acquired natural gas assets when the price of gas bottomed. The share price is up 224% over 5 years—and the current dividend yield is a generous 3.5%. They’ve increased their regular dividend seven times since 2012.

- This company is after black gold—specifically heavy crude from Canada for its busy West Coast refineries. The refinery they operate in Washington State receives crude via pipelines direct from Alberta. With a capacity of 850,000 bpd, they are the fourth largest U.S. refiner by volume. Another jewel in their crown: They operate the only refinery in the North Dakota Bakken. In addition to refining, they run marine operations for oil transport, plus a network of retail outlets selling gasoline and diesel fuel under their own name, as well as other oil majors. A true gem of an investment, the stock more than quadrupled the S&P 500 return over the past three years.

- My fifth pick is not a refiner--But they own (in partnership with a Canadian company) the final 512-mile pipeline link from the mammoth Cushing, Oklahoma oil depot to Freeport, Texas on the Gulf Coast. This is the largest MLP in the U.S., offering a diversified mix of services that includes natural gas and oil pipelines, offshore production platforms, tank barges and a vast array of midstream services. A true energy “toll collector,” roughly 70% of their revenue comes from assets that generate fees whether they operate at full capacity or not. Heavily owned by insiders, the company has a long history of increasing dividends, doing so every quarter for the last 10 years. Current dividend is a solid 4.76. This is a strong “Best Buy.”

I’ll identify these 5 refining superstars in my new special report, The “Keystone Clones” Will Fill Up Your Portfolio With Profits, which is yours FREE just for taking a look at The Energy Strategist, my unique financial advisory service.

You can count on this:

As surely as night follows day, energy stocks will rebound from the 30% to 50% sell-off by panicked investors. Join us as we seize the moment and snap up bargain buys BEFORE the market comes to its senses.

Energy Is My Life—Not Just a Hobby

I’ve worked in the energy field for over 20 years. I became hooked on investing at age 15, buying stocks with my paper-route earnings.

After graduating from Texas A&M with a B.S. in chemistry and mathematics, and a master’s in chemical engineering, I went to work in the energy business immediately. I’ve been at it ever since.

For two years, I was an efficiency expert at a petrochemical complex in Houston. In Billings, Montana, I figured out a way to blend gasoline that saved the company $9 million a year. For a couple of years, I led a butanol-production team in Germany.

Along the way, I picked up five patents, one for a new way to convert ethane into ethylene, cutting production costs by $5 million per year (U.S. Patent 7,074,977).

My work has taken me all over the globe. For ConocoPhillips, I ran a research lab in Oklahoma developing gas-to-liquids technology. I was on a team in Billings, Montana, optimizing refinery profitability in part by determining which crude oils we should purchase. I headed up a team of engineers in Scotland developing oil and gas projects in the North Sea.

Later, I worked as engineering director for a Dutch environmental-technology company and provided engineering support for a facility they were building in China.

Finally, I’ve taken on a new role conducting technical due diligence on new energy projects. Based in Hawaii, I travel around the world evaluating startup energy companies for wealthy private investors and hedge funds.

After grilling management and assessing the technology on site, I make a go/no-go investment decision that can mean millions of dollars flowing into these cutting-edge outfits.

In other words, I decipher which energy companies have legitimate, game-changing technology and are worthy of investment—and which are exaggerating their capabilities to obtain funding.

So, here’s my free advice about the future of energy overall…

The World Can’t Live (or Grow) Without It

I’m sure you’re hearing a lot about the “oil glut,” the sharp drop in the price of oil and the corresponding panic to sell energy stocks. It’s been over the news.

But historically the price of oil bounces back quickly. It’s Economics 101: When the cost of any commodity drops, consumption inevitably increases and prices rise again.

Already, the cheaper cost of gasoline is impacting consumer behavior.

"U.S. Auto Sales Speed Toward 17 Million."

--Wall Street Journal, May 30, 2015

Right on cue, as last year drew to a close, auto sales revved up precisely as the price of gasoline plunged.

Halfway through 2015, the trend continues. Automotive analysts project overall 2015 vehicle sales could reach the 17-million mark—powering the industry to a level not seen since 2001.

Leading the way: SUVs and pickups including Jeep Cherokee, Chevrolet Silverado and Ford F-150.

Need I point out this is break-out-the-champagne news for refiners?

Compared with last year, gasoline consumption in the U.S. is up more than 300,000 barrels per day. (Source: Reuters.)

Americans are buying cars and filling their gas tanks. You couldn’t ask for a better example of the consumer market in action.

As for the overall energy picture, keep in mind…

At the bottom of the 2008 crash, oil cratered in the $40-per-barrel range. But remember, at that time the U.S. and world economy were in perilous free-fall, with the entire financial system seemingly on the verge of total meltdown. Energy stocks were pummeled.

Yet they bounced back 56% in less than 24 months.

This time around, the U.S. economy is in much stronger shape, and oversold energy stocks are likely to rebound very strongly and even faster. In short…

This is a Clear-Cut Buying Opportunity

Energy and growth are symbiotically linked. You can’t have economic growth without more energy—and the world (especially the developing world) wants growth, growth, growth.

A great way to begin profiting from this megatrend is with a complimentary copy of my new report, The “Keystone Clones” Will Fill Up Your Portfolio With Profits, which is yours FREE just for taking a look at The Energy Strategist, my investing advisory newsletter.

All I ask is that you give The Energy Strategist a test run. Put it to your own personal test—the tougher, the better.

With your first issue of The Energy Strategist, you’ll realize it gives you access to some of the most extraordinary investments you’ll ever come across.

How am I doing? You be the judge.

Here’s a current sampling from our portfolio. We’re up…

- 792% in pipelines

- 337% in a diversified MLP

- 163% in exploration and production

- 60% in refining

- 100% in LNG tankers

- 91% in a midstream MLP

- 72% in major oil

- 78% in midstream energy assets

Please note that these are all current portfolio positions—with plenty of room to grow. And I’m confident they will grow… because despite scary headlines and nerve-jangling market fluctuations, we are living in a transformational era for the energy industry and the entire world.

I’ll call it what it is: a bare-knuckles, trillion-dollar global brawl over energy—and I’m convinced it’s going to last for decades.

“Brawl” is no exaggeration. Consider…

--European Union countries are desperately trying to free themselves from the energy grip of Russia and its increasingly belligerent leader, Vladimir Putin. The struggle has generated the biggest East-West European crisis since the Cold War.

--Feisty Canada is risking an international incident with Russia by claiming the North Pole and the 90 billion barrels of oil and 1,670 trillion cubic feet of natural gas estimated to lie beneath it.

--China and Russia appear to be partnering up on a troubling (to the West) new energy partnership. Beijing has already agreed to buy more than $350 billion of Russian crude oil in the coming years.

--At the same time, China is throwing its weight around in the South China Sea, a region with its own energy riches. Five other nations—Vietnam, Brunei, Malaysia, Taiwan and the Philippines—also claim parts of the sea and are on the receiving end of Chinese threats to back off or else.

--Canada, as you’ve just read, is even daring to defy an American president by cleverly outflanking his veto of Keystone XL with two new pipelines flooding U.S. refineries with Alberta crude. On top of that, the Harper government is threatening to build new pipelines to the Pacific Coast to ship oil and gas to…here it comes…China.

Here's the Bottom Line

Quite simply, The Energy Strategist is the most comprehensive investing source available today… not only on America’s energy revolution, but on energy opportunities across the world.

I’m looking at every energy source out there: oil, natural gas, solar, wind, hydro, biomass, geothermal… everything.

My staff and I search for investing gold in energy exploration, recovering, refining, gathering, processing and transport, as well as one of the great opportunities primed to create new wealth: liquid natural gas (LNG) exporting.

Here’s another huge opportunity we’re covering…

Did you know solar energy is making the leap from backyards and rooftops to electrifying entire cities? It’s happening. In California, there’s a solar installation coming online that generates enough electricity for 400,000 people—that’s the size of Oakland, CA.

I’m recommending three solar stocks that are leading this shift. They are up an average of 34% since we bought them. And that’s quite likely just the start, because this trend is virtually unstoppable. You’ll find these stocks in your first issue of The Energy Strategist.

After you receive my new special report, The “Keystone Clones” Will Fill Up Your Portfolio With Profits, you’ll find a whole universe of energy opportunities in our:

- Two monthly issues. Twice a month, I’ll send you my latest energy investment research, including new recommendations, updates and analysis.

- Energy Strategist Flash Alerts. Anytime there’s breaking news on one of our positions or a new opportunity that can’t wait until the regular issue comes along, you’ll receive a Flash Alert.

When you join, you’ll also get members-only access to The Energy Strategist website, where you’ll enjoy a host of powerful tools like:

- An easy-to-navigate archive of all my research. That includes every issue, special alert and report I’ve ever written. It’s the most comprehensive coverage of America’s energy renaissance out there, and chock full of ways to profit from it.

- You’ll also get access to my Conservative, Growth and Aggressive Portfolios. Each portfolio is updated every day with a detailed status of every pick I’m recommending, so you’ll always know where you stand.

- I’ll also email you a special subscribers-only bulletin called The Energy Letter every week at no extra charge. In addition to breaking news and market commentary, I use this bulletin to update my portfolio with new buy/sell recommendations.

- First-class customer service. If you ever have a problem or a question, our friendly Customer Services staff is here to help. Send us a quick email or call us toll-free. No matter which you choose, we’ll do everything we can to make you happy.

- My zero-risk guarantee. I want you to be 100% satisfied with The Energy Strategist. That’s why I’m giving you three months to try it out and experience everything it has to offer. If you aren’t happy, let us know and we’ll quickly issue you a full refund.

One more thing: As a subscriber, you’re also invited to join our monthly online chats. You can “fire away” and ask me specific questions about anything you want.

If you can’t wait for one of these chats, just shoot me an email or post your question on our website. I’ll get back to you as soon as I can.

I should point out—a package of investor services like ours typically costs $1,000 to $3,000 a year.

By contrast, The Energy Strategist’s package of investor services (24 monthly issues delivered online, weekly website articles, immediate-action Flash Alerts via email, access to me personally every month in our online chats) costs only $697 a year, easily one of the best bargains in all of financial publishing.

With this special invitation, you can start a no-risk one-year subscription for just $497. You save $200 from the get-go—with a full, 100% money-back guarantee.

Or here’s a better idea: Try a quarterly subscription to The Energy Strategist for only $147—with a full three months to evaluate our recommendations.

Either way, you have a full 90 days to try it out risk-free. If you decide it’s not for you, just let us know and we’ll send you your money back—every penny of it. After 90 days, you can still get a refund for the unused portion of your subscription at any time you decide to cancel. (The special report is yours to keep, along with my thanks for giving The Energy Strategist a try.)

Remember, the risk of trying The Energy Strategist is… zero.

If, over the next three months, you’re not satisfied, I want you to ask for a full, 100% refund. (My new special report, The “Keystone Clones” Will Fill Up Your Portfolio With Profits, is yours to keep, along with my thanks for giving The Energy Strategist a try.)

Time is of the essence. Investors will soon wake up and realize they panicked badly and sold energy stocks low—in other words the opposite of Warren Buffett’s investing rule, “Buy when others are fearful.”

They’ll start buying energy stocks again, and our rebound bargains will melt away as these stocks rise.

But get in now and you’ll reap windfall profits by investing in these five refineries—thanks to the Keystone Clones.

You’ll find everything you need to know about this fast-breaking opportunity in The “Keystone Clones” Will Fill Up Your Portfolio With Profits. It’s yours free just for taking a no-risk look at The Energy Strategist.

I hope to hear from you today, if possible—so I can give you immediate access to this time-sensitive new report absolutely FREE.

We Want You to be 100% Satisfied With

The Energy Strategist

The Energy Strategist

Please click the button below to start your complimentary test-drive of The Energy Strategist, and you could be on your way to riding the biggest gains of your life.

Remember, if at any time during the next 90 days you’re unsatisfied with this service, just cancel it.

We’ll promptly refund every penny – you have my word.

But I’m confident that once you have a closer look at every single wealth-creating secret and stock pick The Energy Strategist has to offer... you’ll want to stick around and get all the upcoming recommendations...

All you have to do to get started today is to click the button below.

If you commit to the 90-day subscription and change your mind down the road, that’s fine, too. You can cancel at any time and receive a pro-rated refund of your subscription fee. And again, you can keep everything I would have sent up until that point.

Download your free report and start your risk-free trial today!

Sincerely,

Robert Rapier

Chief Investment Strategist

The Energy Strategist

P.S. As soon as you join The Energy Strategist, I’ll rush you The “Keystone Clones” Will Fill Up Your Portfolio With Profits. This is a remarkable and timely BUY opportunity. These five top companies are sitting in the “catbird seat,” with cheap Canadian oil barreling down from Canada (via the Keystone Clones) and restless Americans lining up at gas stations to fill up. You don’t want to miss the ride.

P.P.S. Bear in mind, this is a special pricing offer for The Energy Strategist. You will never find it for less.

And remember, your risk is zero with this offer. So you’ve got nothing to lose by giving it a shot.

You’ll have the next three months to make up your mind. In other words, you are only agreeing to try my work to see if you like it.

If you don’t, no problem. Simply call our Customer Service team and we’ll issue you a 100% refund. No “restocking fees”… no hidden charges… no strings whatsoever. The report on The “Keystone Clones” Will Fill Up Your Portfolio With Profits is yours to keep.

Make the right decision.

Activate your no-risk subscription to

The Energy Strategist today.

Activate your no-risk subscription to

The Energy Strategist today.