It’s “evaporating Americans’ savings” — ABC News

Fellow American,

My name is Robert Rapier.

Let me take you back to February 24th, 2021…

Millions of Americans are distracted, devastated, and panicking…

We’re experiencing a global pandemic that will change the world as we know it.

We’re experiencing a global pandemic that will change the world as we know it.

Meanwhile, a bill known as “H.R. 1319” is quietly introduced to the House of Representatives.

Presented as a plan to “save” the American people…

This bill could go down in the history books as one of the most regrettable and financially destructive pieces of legislation ever passed in our nation.

Signaling the very end of America as we know it…

And solidifying a new financial normal:

“LEGAL CASH CONFISCATION”

H.R. 1319 made the “confiscation” of cash from ordinary U.S. citizens completely LEGAL...

While making it easier for billionaires and hedge funds to keep raking in riches while the average American can barely afford a tank of gas…

And at the same time giving career-politicians even more power, influence, and control.

This bill continued a theme that began early in the pandemic when trillions of dollars of stimulus were doled out.

The problem is those stimulus dollars — that “free money” we all got has strings attached and the consequences are already taking their toll…

Millions of Americans have unfairly had their cash confiscated ever since.

Millions of Americans have unfairly had their cash confiscated ever since.

Like Michael Y., a 33-year-old physical therapist from McAllen, Texas who’s had over $9,000 worth of cash “confiscated” from his savings accounts and is struggling to feed his German Shepherd dogs who says, “It’s a low mood right now…”

That’s an understatement…

Tracey C., a retiree from New Canaan, Connecticut who after “confiscation” has only got $50 left in her bank account and says, “There is nothing to cut back on..."

And Kevin B. who’s had so much cash “confiscated” from his retirement accounts that he’s had to go back to work as a driver at 69 years of age.

The Wall Street Journal reports he’s “all but cut out restaurants and shopping, and is now less generous with his granddaughters…”

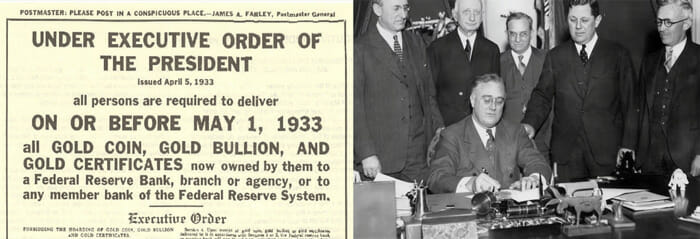

If this is sounding eerily like 1933 when Franklin D. Roosevelt ordered the confiscation of gold bullion and coins under “Executive Order 6102”...

That’s because it is!

“Confiscation” is happening in America again.

Only this time it’s your CASH at risk. ABC News says it’s...

President Biden himself admitted it’s “robbing” American families…

And although I take no pleasure in telling you this… things are about to get MUCH worse.

I believe some of our most treasured citizens are the next group to be targeted…

Retirees, the very people who helped build the country we know and love today, are the ones most at risk.

They are the ones in the firing line right now…

But truth is… NO ONE is safe. Which is probably why Warren Buffett has referred to this legal cash confiscation as “cruel”...

Forbes isn’t pulling any punches either. They don’t even call it confiscation… they consider it outright “THEFT.”

Business Insider has even gone on record about how far-reaching and devastating this confiscation has already become, saying it’s:

And it’s only going to get worse in the days ahead.

MILLIONS of Americans could soon see 10%... 25%... even as much as 34% of their nest egg confiscated. How would you fare with ONE THIRD of your savings wiped out?

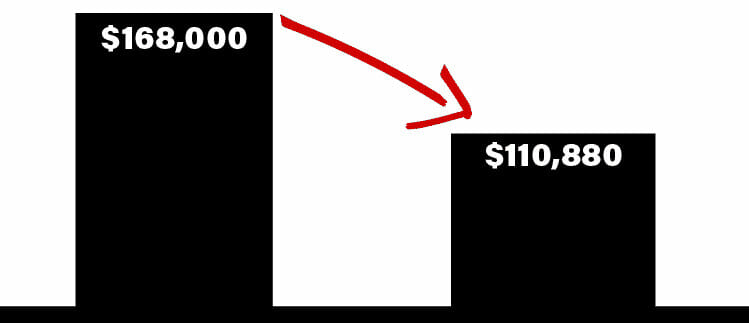

A Gut-Wrenching $57,000 Hit to the Average American…

With the average American’s retirement savings topping out at $168,000, for many that would be like taking a gut-wrenching $57,000 hit. That’s why I’m writing this letter to any retired American or American hoping to retire in the future…

You’ve worked hard for your money, and you DO NOT deserve to have it “stolen away” by a heartless cash confiscation bill.

And as it turns out, you DON’T have to sit by and watch your money evaporate.

I’ve figured out a totally legal and simple strategy that not only protects your wealth, but could keep your nest egg growing no matter what the government throws at us next…

By investing in a special asset I call “cash alternative investments” or “CAIs.”

CAIs provide a rock-solid income stream that out-earns savings accounts, bonds, and ordinary stocks alike.

In fact, the companies that make up these unique cash alternative investments are mandated by LAW to turn a profit (the Supreme Court ruled on it back in 1865).

And as I’ll show you in just a moment, they hold the real potential to actually make you MORE money than is being confiscated.

For example — my advisory service recommended a CAI operating out of Pennsylvania over 25 years ago…

Incredibly a $10,000 stake in this Cash Alternative Investment would have paid out $103,346 in income over that period…

While delivering a massive $241,954 in capital gains...

For a combined payday of $345,300 from $10,000!

Meanwhile another CAI we recommended three decades ago that boasts over 3.5 million customers would have paid out $64,988 based on the same $10,000 investment...

And delivered an extraordinary $133,612 in capital gains...

For a combined total payday of $198,600.

And, a fortune 500 CAI we recommended close to three decades ago would have paid over $33,919 in income...

While delivering a stunning $198,181 in capital gains...

For a combined payout of $232,100 from $10,000.

Now to be clear: it takes a large investment, a decent amount of shares, and the benefit of father time to reach these numbers.

But it speaks to the potential of these extraordinary cash earners.

And even better…

Whether you start out with $1,000… $2,000... or $5,000 doesn’t really matter!

You can still create a very generous income stream that grows over time.

To put it simply — with CAIs, even a $1,000 investment could turn into $50,000 given enough time and patience.

And if you’re willing to be bold and start with a larger stake, you could even grow your nest egg into a $23,400-a-year income stream fast.

As great as that sounds — and it is great! — let me be clear about something…

The market is RIPE with new-fangled tactics and strategies that promise you the world… only to rip the rug out from under you.

If you’re looking for massive gains in the next 23 hours or trying to uncover “what comes after crypto”…

This message likely isn’t for you.

Because this isn’t some new “flash in the pan” strategy that I’m still hashing out the finer details of…

In fact, my investment research firm has been publishing a predictable and effective CAI strategy for well over three decades…

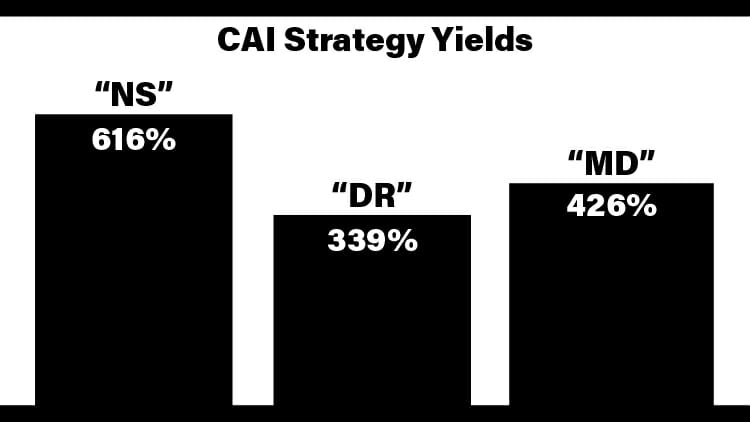

And many long-term subscribers have had the opportunity to make out like bandits because of it, seeing effective yields as high as…

- 616% on one CAI called “NS”

- 339% on another American CAI called “DR”

- And 426% on a third CAI called “MD”

Again, let me stress — this is YIELD, not capital gains. Which, if you know anything about typical “income streams” is far from the norm…. but not impossible.

The reason we’re able to turn a $10,000 investment in these CAIs into a 7X-per-year income powerhouse is because we’ve held these rare, high performers so long the dividends paid actually LAPPED their initial share price investment, several times over…

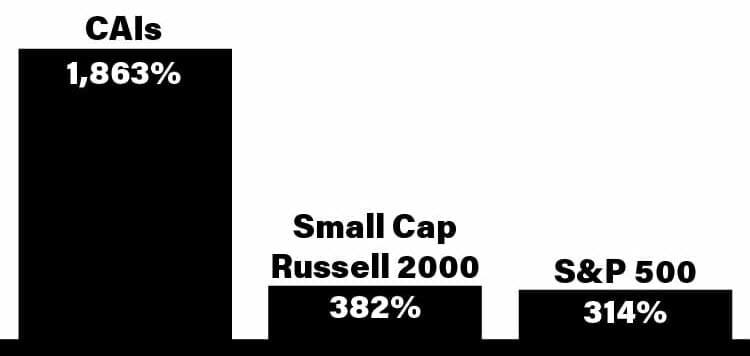

For example — since 2000 these CAIs have posted a 1,863% gain, outperforming the S&P 500 and Russell 2000 by orders of magnitude…

CAIs Crush The S&P 500 And Russell 2000…

Which is why, on average, the CAI portfolio I manage is now handing us an effective yield of 26% per year. And that’s nothing to sneeze at!

A 26% yield is the equivalent of making a $3,120 annual stream of income off every $12,000 invested.

$12,480 off every $48,000…

And $23,400 off every $90,000.

Of course, most Cash Alternative Investments won’t go down in the record books for sky-high gains in record time. But I don’t know many investments that even come close to paying out annual income like this right now…

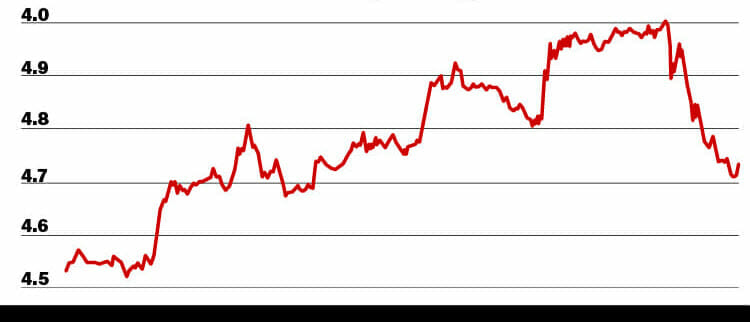

Bonds are barely paying 4%...

Bonds Don’t Come Close to CAIs When Comparing Income…

Gold — normally a safe haven asset — has taken a beating recently…

Gold Is A TERRIBLE Income Option Right Now…

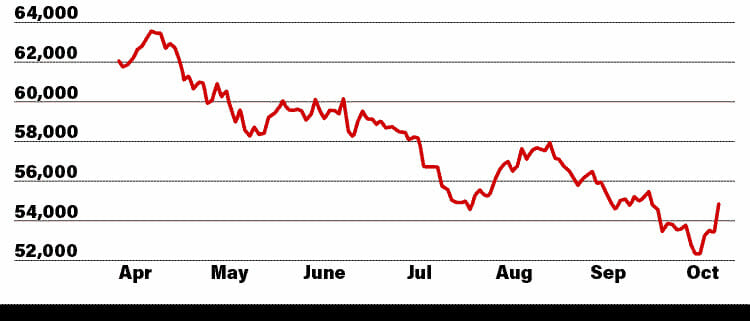

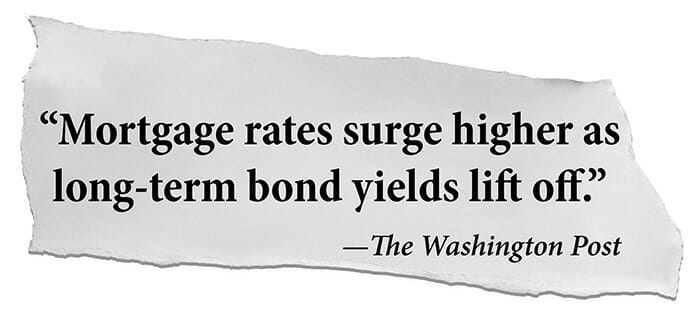

And don’t get me started on the cryptocurrency market. It’s basically imploded with the global market cap dropping from nearly $3 trillion to $700 billion in less than a year…

Crypto For Income? Think TWICE…

So, these CAIs I’m recommending are out-earning basically everything else on the market. And more importantly are an extremely safe investment. So safe that some might even call them boring.

But with an entire portfolio full of CAIs that crush the S&P 500 6 to 1…

Especially at a time when the market has more peaks and valleys than the Rocky Mountains…

I’ll take boring any day of the week!

So, if that sounds like the kind of investment strategy you can sink your teeth into, keep reading now, and prepare for a rush…

CAIs are often ignored until things start to go south, and people start to look for something a little safer than an overvalued tech stock… crypto coin… or NFT…

As cash confiscation accelerates, and people start to feel the shortfall, I wouldn’t be surprised to see them sent into a panicked buying frenzy….

Sending CAI prices rocketing to the moon…

And well positioned investors laughing all the way to the bank.

Of course, none of that matters if you don’t stake your claim NOW…

Because for investors who ignore the extraordinary opportunity CAIs represent…

Stick their head in the sand…

And simply hope their cash will still be there when they come up for air…

The future isn’t looking too bright.

But look, this isn’t my first time navigating a crisis… and it won’t be my last.

But just WHO am I… and why should you put even an ounce of trust in me?

From DIRT Poor in Oklahoma to One of America’s Top Income Experts…

My name is Robert Rapier. I grew up in one of the poorest parts of Oklahoma, where I was forced to watch my grandparents, family, and friends suffer and struggle week after week just to make ends meet.

My name is Robert Rapier. I grew up in one of the poorest parts of Oklahoma, where I was forced to watch my grandparents, family, and friends suffer and struggle week after week just to make ends meet.

I know what it’s like to do without… to be without.

It’s an absolutely helpless feeling.

Which is why as a child, I swore to myself that I would find a way to make it on my own…

It was just a few short years later, as a 15-year-old high school freshman, that I discovered my path.

In an otherwise uneventful lecture, one Algebra teacher’s simple explanation of “compounding returns” caught my attention…

It was the simple revelation that even a small investment, and small rate of return, could snowball into a seven-figure retirement account given enough time, that made me sit up and listen. That was the moment I decided investing might be my way out.

I had no idea just how right I was…

After trading my way from just a few hundred dollars as a teenager all the way to financial independence (and beyond)...

Becoming a chemical engineer and inventor holding several energy patents…

Showing tens of thousands of Americans how to achieve extraordinary wealth and develop larger-than-life income streams during their retirement years…

Appearing on 60 Minutes, The History Channel, CNBC, Business News Network, CBC, and PBS for my energy expertise...

And being published in the Wall Street Journal, Washington Post, Christian Science Monitor, The Economist, and Forbes as a Senior Editor...

I eventually picked up a reputation as a leading voice in the energy industry and one of America’s top income experts.

To be honest, I never thought I’d achieve even a fraction of what I have…

I mention some of my accomplishments now not to brag…

But rather to give a sense of who I am and so you understand I’m not just blowing smoke...

As well as to give you an insight into one of my core financial philosophies: I believe it’s possible for anyone in America to build great income streams and become financially independent.

Yes, even in uncertain times, and even if the government wants to confiscate your cash.

And that’s why I’m coming forward with this urgent message today.

I’m going to explain exactly how cash confiscation is destroying the retirement of millions of Americans…

And the exact steps you should take to protect yourself now…

While using CAIs to create an income stream that could hand you back as much as $23,400 a year.

Let’s start with just how such a law passed right under our noses in the first place…

CASH THEFT Is Now LEGAL…

I don’t need to tell you that our country is in crisis. 83% of Americans are cutting back on spending due to skyrocketing prices…

Everything from computer chips to toilet paper to potatoes is in short supply…

Mortgage rates are surging…

And rent has risen by 25% since the start of the pandemic (likely more by the time you’re reading this)...

Ruining the chances of a lot of first-time home buyers to get into the market and driving a projected 3.8 million evictions in the next few months alone.

No wonder the streets of L.A. and San Francisco look like a scene out of Mad Max…

But do you know the real origin of all this chaos?

Who’s really to blame?

If you listen to the mainstream media, or President Biden, you might conclude that “inflation” is the cause of all our problems.

After all, the President has said its his “top economic priority” right now.

Even Charlie Munger, Warren Buffet’s right-hand man and a billionaire in his own right, has come out and said it’s the:

But what is inflation really?

Is it just rising prices?

Or something that only America’s poorest or super rich should be worried about?

More importantly — where does it come from?

And how does it tie into this cash confiscation?

I believe the answers to these questions explain why many of your neighbors (or maybe even you) are living paycheck to paycheck, praying for some breathing room…

Our streets are filling with new homeless, adding to an already massive crowd…

And why a good retirement could soon be completely out of reach for millions of Americans.

It’s also why my CAI strategy is such a critically necessary tool, right now.

It all comes down to this…

The Biggest Benefactor from this “Rescue Plan”… will be the Politicians who wrote it…

Earlier, I mentioned bill H.R. 1319...

Well, this bill, which passed as Public Law 117-2 and was touted as an “American Rescue Plan”…

Was designed to “save” Americans from the financial impact of the pandemic by injecting $1.9 trillion into the economy.

While a lot of Americans received a check in the mail, which was temporarily beneficial…

What it actually did was legalize the confiscation of cash to the benefit of politicians.

Because bill H.R. 1319 made it virtually certain that the inflation our country is drowning in today would continue to hit our economy like a tidal wave.

And my research proves the politicians and power brokers who engineered this “great robbery” knew it would happen… and did it anyway.

Now look — are they literally reaching into your wallet with grubby paws and pulling out dollars?

Or stealing away funds a fraction of a penny at a time by some computer “hack” in the middle of the night?

No, of course not.

But they are doing the closest LEGAL thing they can next to that.

Gas prices. Food prices. Car prices. Everything is more expensive right now.

You have less money in your bank account…

And the dollars you do have don’t go near as far as they used to…

And it’s their fault.

Because the dollars disappearing from your wallet ARE benefiting them…

You see, to come up with the $1.9 trillion required to enact this bill, and “save” the American people, the government was forced to create new money.

And that’s because we’re flat broke.

Look at the U.S. debt clock, a running counter of money owed by the government, and you’ll see that we owe over $31 trillion and counting.

To put that in perspective, total government debt WORLDWIDE for 2022 is projected to come in at $71 trillion.

Meaning — we owe nearly HALF of all government debt in the world.

But our politicians won’t let something as small as $30 trillion in debt stop them from spending.

So, to make their “rescue” plan work, they created more money than has ever been created... printing $1 trillion in just 48 hours.

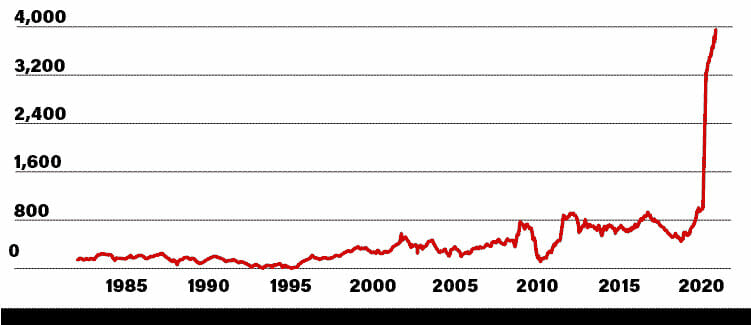

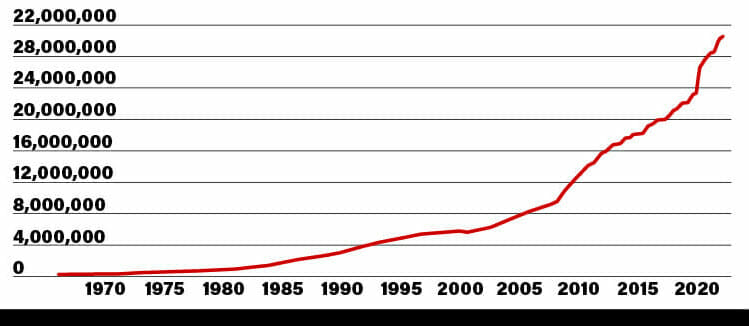

This chart shows exactly what they did and why it was so wrong…

80% of all money the U.S. government has ever created was printed in the last three years…

Now, let me ask you a few questions…

Did you vote on that?

Have your say?

And do you think most Americans understood the ramifications of PRINTING $1 TRILLION virtually overnight?

Of course not.

And the consequences are sickening.

When you print $1 TRILLION virtually overnight, you do not actually create any real monetary value…

What you actually do is CRIPPLE your own currency.

Every dollar you earn is worth less than what it was just a few days ago….

And that leads to higher prices.

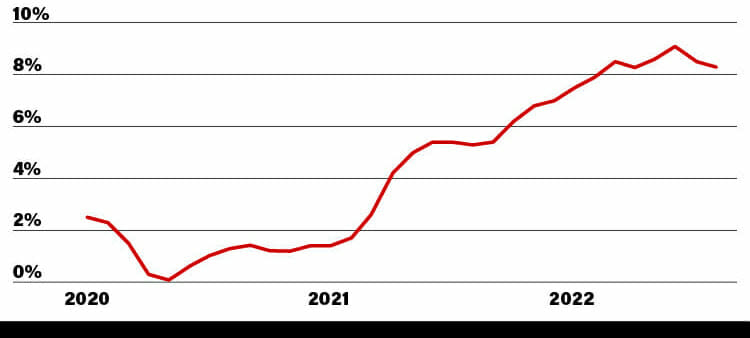

This is why we’re currently facing the highest inflation rates in over 40 years… a stunning 8.5% as I sit down to write this.

Inflation SKYROCKETED And Is Holding Steady At 40-Year Highs…

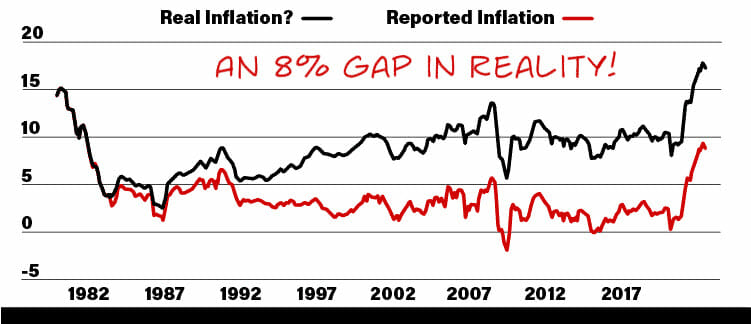

And if we counted inflation like we did in the 1980s, including housing and some more expensive items, it would actually be over 17%.

As you can see in this chart that tracks the CPI like we used to...

The Government HATES This Chart...

The REAL Rate of Inflation Could Already Be Over 17%

That’s even higher than the rates we saw back in the ‘70s which only peaked at around 14%...

But it’s not just the record-high rate of inflation that’s driving nails into the palms of everyday American citizens.

It’s the rate of MONETARY DESTRUCTION.

It’s how much cash is basically being CONFISCATED from your nest egg.

Since every dollar you’ve worked so hard to earn and save is being eroded every day, month, and year, this inflation nightmare lasts.

Of course, odds are much of this isn’t news to you… you’re already feeling the pain of this “cash erosion.”

Filling up your gas tank costs an arm and a leg…

A grocery store run is another expensive shock to the system…

And I bet the last time you saw your electricity bill you thought twice about adjusting the thermostat…

But if you’re already feeling this pinch… get ready for a suffocating SQUEEZE… because the real pain is just around the corner.

When you project this “rate of cash destruction” into the future, the devastating effects of inflation become crystal clear.

With inflation at 8.5% a year, it takes only 4 years to lose over a third of the value of your wealth.

(8.5 % x 4 = 34%)

Let me show you how…

Fast forward four years and imagine you’ve saved $100,000.

Yes, you still technically have $100,000 tucked away, but due to “cash confiscation” it’s really like it’s only worth $66,000…

Because of inflation, that $100,000 goes a fraction as far as it used to… while everything we use it for costs so much more!

It’s like an old phone that only charges to 66% no matter what you do…

It’s like an old phone that only charges to 66% no matter what you do…

Sure it boots up, and it technically works… but you're likely to find yourself halfway through the day with a dead phone in your pocket.

That’s the situation facing us today…

Every hard-earned cent you’ve struggled for is worth a fraction less because of a vote in Washington you had no say in…

Your cash has been “confiscated.”

And for wealthier Americans, who have worked hard to save the $2 million estimated to retire comfortably in America, the sheer amount of money they could lose is ridiculous…

Fast forward four years again and they could be swallowing a bitter $700,000 LOSS.

How are they supposed to make that BACK? When they’re at the end of their working career and the stock markets in the gutter…

Sure, they’ll survive. But their retirement will look NOTHING like they hoped for.

And look, this is just if inflation stays where it is now…

If it peaks back to 9.1% like it has already, or goes even higher, the rate of cash confiscation just goes up… it happens faster, hits harder, and hurts Americans more.

And some folks just can’t afford to take that kind of hit.

Like lower income earners who are among the most vulnerable.

Fast forward four years again and imagine you’re relying on a retirement nest egg of $30,000…

By then it could be like you’ve only managed to save $19,800 even though you broke your back for decades..

And if you’re living on say $1,200 of savings a month now…

You could be forced to make ends meet on the equivalent of $792. Or less than $200 a week.

In a very real sense, politically-motivated inflation or “cash confiscation” as I call it, could push millions of Americans well below the poverty line.

Now, I hope this never happens… and pray that I’m wrong, as it would be apocalyptic for America and create the kind of civil unrest you only normally see in war zones…

But even if it only gets half as bad as that… that’s still enough to crush the retirement dreams of millions.

Which is why a Cash Alternative Investment that is growing in value… that’s a company mandated by law to be profitable… and that’s paying a steady stream of income…

Is so attractive right now.

I know I wouldn’t say no to an investment that has the potential to shell out an extra $23,400 a year in passive cash…

Especially since, even if you’re relatively financially comfortable today, that story could change quickly as you find yourself having to make many unwanted changes to your lifestyle..

Instead of going out for dinner a few nights a week, you might have to settle for staying in more often… a LOT more often.

Instead of driving to see your grandkids every weekend, you might have to limit that once every few months… or maybe just major holidays.

And instead of enjoying beer and steak with your buddies every Sunday, you might have to settle for hot dogs… or skip the BBQ altogether.

These are just some of the ways high inflation could impact even a relatively comfortable or wealthy lifestyle… and that’s one of the reason’s I refer to it as cash confiscation…

It’s like your money AND lifestyle you’ve worked so hard to achieve is being stolen from you… penny by penny.

Until your financial freedom is a shadow of what it used to be.

Now, you’re probably asking yourself: If all this is true, why would any government ROB its own people?

And more importantly, how can you flip the script on these bully politicians to start creating your own Cash Alternative Income stream of as much as $23,800 a year?

Bully President Breaks U.S. Financial System…

The truth is I can’t put all the blame on Biden, as this started years ago…

As far back as 1971, under President Nixon’s administration…

Back then, unemployment was intolerably high and the country was facing a recession…

If that happened, there was a little to no chance for re-election.

Since 1900, the only president in history that had ever been re-elected during a recession was Harry Truman.

So Nixon, in a very deliberate and calculated manner, pressured Fed Chairman Arthur Burns into expanding the money supply (putting more money into circulation).

Famously telling Burns, “I don’t want to go out of town fast” (in other words, lose the election).

He even went so far to sever the tie between U.S. dollars and gold… discarding a “gold standard” that had worked to keep our currency sound since 1879…

What happened next was extremely beneficial for Nixon, but nothing less than catastrophic for America…

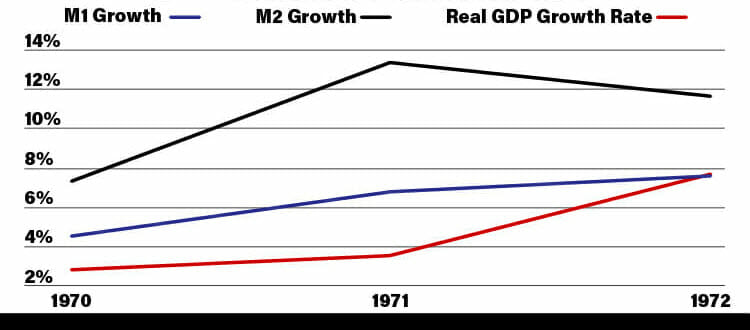

Cash Catastrophe: Our Money Supply Skyrocketed Past Real GDP

Take a look at the above chart…

You can see that M1 and M2 growth, two different measures of the country's money supply, dramatically increased from 1970 to 1972.

M1 Growth went from 4.51% to 7.56%...

While M2 surged to as high as 13.38%...

Far outpacing any real GDP growth.

Put another way… every dollar created DIDN’T create another dollar of economic growth…

Not exactly what I’d call a great use of public funds.

And this just happens to coincide with the time frame in which Nixon was running for office.

So basically, Nixon increased the money supply…

And threw away the gold standard…

While spending more and more cash on a bunch of popular social initiatives to win a landslide election.

That was in the short term…

But the long-term effects of these moves were devastating.

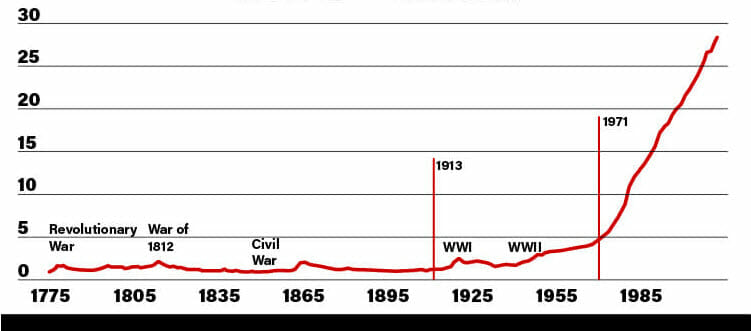

After 1971, Living in America Got a LOT More Expensive…

As you can see, from the start of the revolutionary war until after World War II, the Consumer Price Index (CPI) was relatively steady.

But after 1971, it exploded upwards.

As a reminder, the CPI tracks the affordability of living in the United States.

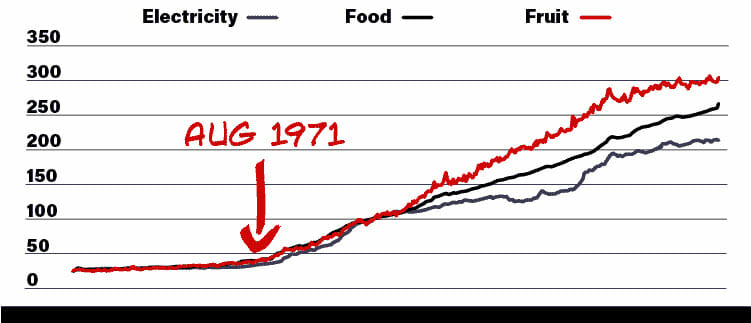

Here’s another chart that tracks electricity, food, and fruit from the St Louis Fed...

Electricity, Food, and Fruit Prices Soar Putting the Pinch on American Families…

As you can see, the price of all three consumer categories EXPLODE upwards after 1971.

Coincidence?

Could be… but it’s more likely that a departure from real, gold-backed money and the beginning of money printing on an unprecedented scale had something to do with it.

Here's my take — Nixon basically destroyed the economy and confiscated the savings of American citizens to meet his own political ends.

From 1970 to December 1979, the Dow Jones opened and closed at 839 points.

That is to say — aside from short-term market volatility — there was virtually ZERO stock market growth for close to 10 years.

Meanwhile, unemployment hit 5.9%...

Inflation swelled to 14% the following year (1980)...

Everyday staples prices, including beef, skyrocketed causing housewives to take to the streets in protest…

And worst of all the U.S. dollar went on to lose over 34% of its value in the decades ahead.

Let me be clear — none of what I’m saying is close to a conspiracy theory.

There are audio recordings of Nixon’s conversations with Arthur Burns in the National Archives — he wasn’t coy about it.

And whether the “Nixon Shock” — as it’s been termed — was ultimately positive or negative for the country is still hotly debated today by top economists.

But what is positively clear is that Nixon was re-elected.

And ever since 1971, U.S. politicians have been following a suspiciously similar Nixon-esque playbook.

Go back to 2008 and George Bush had his $152 billion Economic Stimulus Act and $700 billion Asset Relief Program…

Barack Obama had his $832 billion “American Recovery and Reinvestment Act in 2009”...

And in 2020, Donald Trump had his $2.2 trillion “CARES Act” — the Coronavirus Aid, Relief, and Economic Security Act.

Now we have the $737 billion “Inflation Reduction Act.”

As you might be able to guess, the so-called purpose of this Act is to reduce inflation.

But to me it looks more like politicians are just borrowing the same tired tricks from Nixon’s cash confiscation playbook.

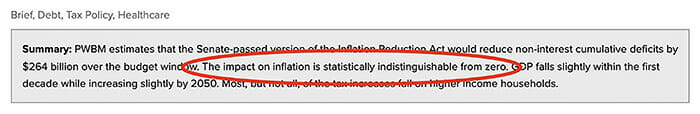

Analysis by the Wharton School of Business, one of the country’s most preeminent business institutions, reveals the Inflation Reduction Act will have a 0.1% effect on inflation within the next decade.

In their words “the impact on inflation is statistically indistinguishable from zero.”

The Inflation Reduction Act Won’t Do DIDDLY SQUAT…

Even worse, the act could potentially cause “some upward pressure on prices in 2023 and 2024.”

Which means this smokescreen of an Act could actually ACCELERATE inflation.

And the truth is the majority of the funding for the bill will be spent on energy and climate change.

What the Wall Street Journal has called:

Meaning this Act is predominantly a “Spend on Energy and Climate Act”…

One that won't reduce inflation at all...

And one that Biden is, in part, using to appeal to his progressive political supporters.

But Consider This Strange Fact Many Americans Failed to Notice…

The original bill President Biden wanted to pass wasn’t $737 billion.

It was $7 TRILLION.

Just imagine the chaos that would have been unleashed if a bill that LARGE was passed in 2020…

What gas prices… housing prices… and millions of retirement plans would look like after $7 TRILLION is forcibly injected into the economy.

The conversation we’re having right now would be a lot more panicked and dire.

But here’s the thing…

Don’t think they won’t try to pass some suffocatingly expensive bill again!

They’ve been confiscating cash to serve their own political plans for FIVE decades…

Our national debt has been growing for FIVE decades!

America’s $31 Trillion Debt Burden is an Unstoppable Pain Train…

They’ve sat and watched the pain it’s inflicted on Americans, through rising prices, housing crises, and a quality of life that is rapidly going BACKWARDS…

And they’ve simply printed more money.

Why would they stop now?

But while you never had the opportunity to cast your vote… to have a say… and potentially take action to stop your cash being confiscated…

I’m giving you the choice most Americans never had.

A chance to choose financial abundance and freedom through CAIs.

A genuine, safe investment that can, over the years, lead to annual yields of 26% over time.

And as much as $23,400 a year in extra income.

In fact, due to some market conditions I’ll explain in detail in a minute, CAIs are even more attractive right now…

That’s why I’ve put everything you need to know about CAIs into a brand-new report called…

The CAI Solution: An Income Antidote to American Cash Confiscation

Inside you’ll discover my three very best Cash Alternative Investment recommendations now.

Companies that are currently paying inflation-beating yields of 8.6%... 7.9%... and 9.8%…

That, over time, have the potential to compound into annual yields of as high as 26%...

Or an income stream as hefty as $23,400…

And that are mandated by law to be profitable!

Making them one of the safest investments available and a true alternative to cash.

Let me explain how that works…

Protected By LAW: CAIs Payout For LIFE…

There are very few things in life that are truly guaranteed.

But CAIs are one of them.

And that’s because they are so essential to the American way of life that the government mandated they make a profit well over a hundred years ago.

Think of the things you simply cannot live without, and it’s likely a CAI delivers it to you…

Water? Check.

Gas? Check.

Electricity? Check.

People usually call these kind of stocks utilities… and they have a reputation for being “boring.”

The kind of investment widows and conservative, turtleneck-wearing folk flock to.

But if you saw the inside of my portfolio, you’d realize that couldn’t be further from the truth.

Utilities (A.K.A CAIs) are – without a doubt – some of the most lucrative and life-changing investments you could ever make.

For example: the top 5 investments in my portfolio are currently showing gains of…

- 3,906%...

- 1,900%...

- 2,179%...

- 1,175%...

- And 2,477%.

My Top 5 “Boring” Investments Boast an Average Return of 2,327%

Which is the kind of extraordinary average gain that could turn a $7,500 nest egg into a $174,525 cash cow!

While still paying out generous dividends!

To be clear, these are not overnight gains…

If you’re looking for swing-for-the-fences trades with a ton of moving parts… you won’t find it here.

Some of these “set and forget” CAIs have been held for years… decades even.

But even so, these are STILL some of the most reliable investments you could ever make.

And right now, we’re facing some unique market conditions making CAIs even more attractive…

What I’m talking about is CAPITAL GAINS.

Like my 5 top investments above…

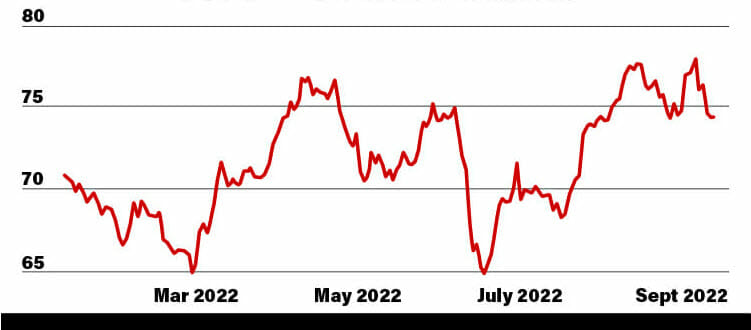

Right now utility stocks are experiencing an extraordinary boom.

If you look at utility ETFs, you’ll see some impressive gains, especially considering we’re in a bear market…

The Utilities Select Sector SPDR Fund is up 5% this year…

Utilities ETFs DEFY The Bear Market… Posting Positive Gains…

And the Vanguard Utilities Index Fund is up 4.39%.

But that’s nothing compared to the performance of some individual utility stocks…

For example…

One of our Minnesota-based holdings with 3.7 million customers in their back pocket is up 16% since June…

Another Charlotte, North Carolina-based utility that specializes in natural gas and boasts 7.2 million customers has beat the market 3 times over with a 16.26% gain…

And then there’s a unique water company based out of the “Garden State” and servicing over 14 million residents — established over 136 years ago, this “ancient” CAI is also up 14% since June...

These utility stocks — or CAIs — represent a unique and rare opportunity in our current market… one which allows you to:

- Collect a high (and rising) income stream that will compound for years, if not decades, and could even cover your retirement.

- Lock in positive gains with the potential to far outperform the S&P 500, so you can continue to grow your wealth through this bear market… and the next.

- Potentially pocket MORE money from the markets than is being confiscated by inflation each year.

And look, let me be clear…

If you think the old ways of investing in “balanced” indexes, or flashy tech stocks, or crypto is going to cut it in these market conditions — think again…

As of writing this, the S&P 500 is down nearly 20% for the year.

The FAANG stocks that have led the Tech Charge for decades have had their teeth ripped out over the last six months, cratering by as much as 40%…

And don’t get me started on crypto – Bitcoin has fallen over 70% recently and I wouldn’t be surprised to see it drop further…

But with a CAI like Duke Energy, you could have MADE a 16% gain this year and collected a dividend payment from them THREE times.

Duke paid their investors a generous dividend on:

- 2/17/2022

- 5/12/2022

- 8/11/2022

Even better, the dividend-paying CAIs I’m recommending today are even more generous than Duke…

I wouldn’t be surprised to see investors rushing into these businesses as millions of Americans begin to feel the harsh effects of enduring inflation.

And why wouldn’t they? They could wait around for the government to screw things up even more…

Or they could take their financial future into their own hands, with a bona-fide income expert at their side…

That’s why I’m making my brand-new report The CAI Solution: An Income Antidote to American Cash Confiscation (valued at $199) available to you for no cost today.

All I ask in return is you…

Take Me Up On a 100% Risk-Free, 90-Day Test-Drive of My CAI Focused Newsletter: Utility Forecaster…

Utility Forecaster is one of the longest-running and most successful newsletters in America today.

Since 1989, we’ve helped everyday Americans create life-changing income streams, and find wealth-building stocks that simply work.

I bet in the last few years you’ve seen fads and the analysts that cover them come and go…

But we’ve been using the same strategy for over 30 years, putting up numbers most publications can’t hold a candle to.

We have three key portfolios…

The first is Growth...

Inside our Growth Portfolio, we currently have 24 open positions with an average return of 612%.

The highest of which is sitting at 3,453%...

Out of those 24 positions, 21 are profitable.

Then there’s our second component: Income.

Our Income Portfolio currently holds 24 open positions with an average return of 526%.

And includes dividend yields as high as 8.1%

Finally, there’s our unique “How They Rate” spotlight…

Where I track more than 215 Cash Alternative Investments complete with buy and hold ratings, showing yields as high as 10.5%...

With the potential for BIG capital gains growth as more investors pile into CAIs as an alternative to sitting in cash or risking stock market volatility.

Plus, every single month I add a “best buy” spotlight… a growth or income focused CAI that aims to boost your wealth or start paying you income immediately.

Again, let me stress one thing: we’re not chasing the next new thing or shiny object in Utility Forecaster.

Nor are we looking for an investment to skyrocket “overnight”…

We’re making the kind of recommendations that have generated steady and rising returns and incredible income for over 30 years…

That have the backbone to outlast inflation… and anything else the market throws at us.

And even though there might seem like there’s a lot going on inside Utility Forecaster — after all, we highlight literally hundreds of income-paying opportunities…

Benefiting from our service couldn’t be easier.

But don’t just take my word for it. Here’s what some of our readers have to say about our simple approach and 33 year track-record of success…

Again, let me level with you… these kinds of results aren’t typical of all our readers…

And there are absolutely no guarantees in investing.

I can give you my best recommendations backed up by hours of research and decades of experience… but it’s up to YOU what you do with them…

On the other hand, as far as I know none of these valued readers were born with a silver spoon in their mouth…

They are simply ordinary, hard-working Americans who made a smart choice.

The same choice you have in front of you, right now.

Here’s everything on the table today...

- Monthly issues of Utility Forecaster: Inside I’ll share the most promising and profitable CAI opportunities I discover, including a monthly “best buy” recommendation and other opportunities to collect income yields that could compound into as much as $23,400 a year. As this “cash confiscation” accelerates, I believe these insights, updates, and recommendations will be amongst the most important and valuable you’ll read this year. (Value: $149/year)

- Weekly Updates: Every Friday, you’ll receive an update in your inbox keeping you on top of our portfolio positions and the market, as well as the latest income opportunities and pitfalls breaking across the nation…

- Members-Only Income Alerts: I can’t remember a time when the markets have been more volatile… or ripe with opportunity. So, when I spot a growth, income, or Cash Alternative Investment you NEED to know about, you’ll get a special “income alert” with the exact steps you need to take to lock in this opportunity, ASAP…

- 24/7 Access to Our Members-Only Website: This is where you’ll find an archive of our past issues, a full library of additional income and wealth-building opportunities, weekly updates, and most importantly: my model portfolio featuring dozens of CAIs ready for you to take advantage of today.

- Your Very Own VIP Concierge Service: Have any questions or concerns? Your VIP concierge team has you covered. They are on standby for you to reach by phone or email between 9 a.m. and 6 p.m. EST, Monday through Friday. They’ll make sure any issue or worry you have is taken care of quickly and thoroughly.

- Investing Daily Insider: Beyond the headline financial news, there are hidden fortunes in the stories that seldom get told. Enter Investing Daily Insider, our exclusive paid-subscriber-only news digest with a simple goal — provide you with money-making insights into the week’s most pressing financial stories Monday through Friday.

Add that all up, and you’re looking at a total of $348 in value!

But I want to get this urgent report into the hands of as many investors as possible…

And with inflation chipping away at your savings like a rusty knife, it wouldn’t be fair to do anything but offer a generous discount today…

So when you join me inside Utility Forecaster today… I’m not asking you to part with anything close to $348.

I’m not even asking for you to invest the $149 some investors have paid simply to access the service.

No, instead I’m doing something pretty radical and giving you the chance to…

Unlock A Radical 74% Discount On Utility Forecaster Today…

Everything we’ve just gone over can be yours for just $39.

All you have to do to claim is click or tap the “Yes! I Want In.” button below…

And as soon as you do, a new world of simple and highly effective income strategies, opportunities, and analysis will be at your fingertips.

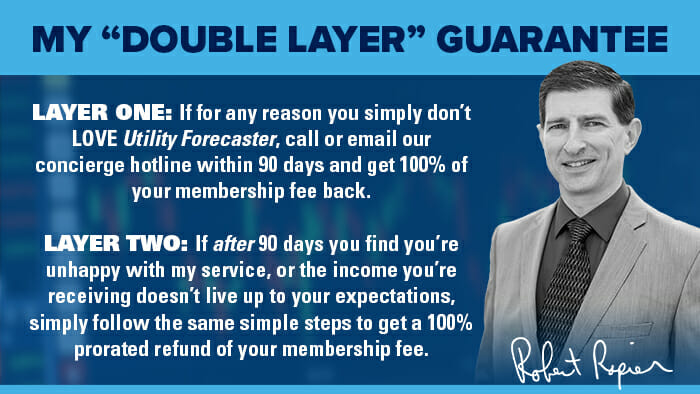

Plus, you’ll also be automatically covered by my double-layer 90-day guarantee…

Your ”Double Layer” 90-Day 100% Money Back Guarantee…

Here’s how it works…

Start your day 90-day test drive today…

Download the CAI Solution immediately, and see how the Cash Alternative Investments inside could start paying you some of the highest and most reliable dividends available in the world…

Then take your pick from our model portfolios, averaging 512% and 626% respectively, to find your next great income play…

Browse, enjoy, and use our service as you see fit for a full 90 days…

And if at ANY POINT, you decide you’re not completely satisfied for any reason at all…

Even if you just change your mind…

Simply contact our VIP concierge representative via phone or email within 90 days and get 100% of your subscription cost back — no questions asked, and no hoops to jump through.

PLUS enjoy a second layer of protection by having the option to cancel at any time after 90 days and any unused portion of your membership will be 100% refunded.

I’ll even let you keep the CAI Solution along with any other bonus reports that tickle your fancy…

Consider it my gift to you for giving Utility Forecaster a fair try.

Still on the fence?

Ok, twist my arm…

To make this even more of a no-brainer opportunity — when you click the button above I’ll show you how to get your hands on 5 more in-depth income reports that could keep your account (and your pockets) flush with cash… no matter what goes on in the markets next.

Cash confiscation is eating through every dollar you’ve ever earned by the day… and every moment wasted is more money gone for good.

Here’s exactly what you can get as soon as you click or tap the “Yes! I want in!” button…

BONUS REPORT #1:

Old School Stars: 4 Unstoppable Back-To-Basics Utility Stocks

(Valued at $199, Yours FREE!)

Out of the 200+ income stocks we’ve analyzed down to the tiniest detail inside Utility Forecaster, THESE are 4 shining stars that have held up for decades through even the harshest market conditions…

While paying out handsome income and delivering our readers steady, long-term gains!

For example: one of the companies highlighted in this report has increased its dividend 36 YEARS straight...

Making it a rare jewel in a time when reliable income is so hard to come by…

Another is one of the top dividend growers in its industry — posting annual dividend growth of 12.7% for the last 5 years running.

While a third has posted an average annual return of 119% for 29 years running!

Can you imagine DOUBLING your investment, for close to 30 years in a row?

But why stop at doubling… when your next bonus report reveals how you could...

BONUS REPORT #2:

Quadruple Your Income Overnight

(Valued at $199, Yours FREE!)

In this quick read, I reveal the 8 simple secrets behind my proprietary “Safety Rating System”…

The exact system I use to find the most reliable and lucrative income stocks in the nation.

Delve into these secrets… make them your OWN... and I doubt you’ll ever find yourself short on income-producing opportunities to grow your wealth.

Speaking of which, you’ll find TWO more profit-gushing opportunities in the third bonus report up for grabs today…

BONUS REPORT #3:

Liquid Gold Rush: How to Profit From The “Safest Stocks In The World”

(Valued at $199, Yours FREE!)

$1 TRILLION over the next 25 years.

That’s how much money could soon GUSH into this super sector...

Which is one of the safest, most reliable, and lucrative in the world.

I want you to be first in line, bucket in hand, scooping up income and massive capital gains as a select few companies’ valuations skyrocket off the back of this monumental cash injection.

But the only way I can ensure that is possible is if you download this report TODAY and get positioned immediately.

Which is why I’m cancelling out the $199 charge for this report and giving you the option to add it to your order today for FREE.

PLUS throwing in another explosive research report…

BONUS REPORT #4:

Bounceback Dream List: Earn 10-to-1 Profits in 10 Years

(Valued at $199, Yours FREE!)

Everyone loves a comeback story… especially when it pays out $10 for every $1 invested….

But this unlikely “from the ashes” story is even sweeter…

Get in this trade now, and you’ll not only see a potential 10-to-1 payday from a cash-flow-heavy American company returning to greatness…

And if everything above wasn’t enough to blow your socks off, here’s one more exciting opportunity you can sink your teeth into today…

BONUS REPORT #5:

The Incredible Dividend Map: 27 Cities Where Stocks Are Paying Us 26%

(Valued at $199, Yours FREE!)

Inside Utility Forecaster, we cover some 200 essential service companies in the U.S. and around the world.

But 40 of them — spread across 27 cities — have been such superb performers that they are now averaging a 26% yield for us...

And as I write this... every single one of them is STILL a screaming BUY.

You get them all in your copy of The Incredible Dividend Map.

On top of that, I drill down deep on five in particular that are perfect for starting your own high-yield portfolio...

- The Minneapolis cash machine (now yielding us 65%) — The perfect "boring is beautiful" stock, there's nothing fancy here. It just functions smoothly year after year. It's also hiked dividends 28 years in a row and offers one of the surest payouts we've ever seen. Buy this one and lock it away for the long haul.

- The Philadelphia water play that's yielding us 74% — You don't find a surer slam dunk income play than this. It has already rung up a 3,515% profit for us, and it's still a strong buy. As a bonus, it will reinvest your dividends for you into more shares at a 5% discount.

- A New Orleans powerhouse currently shelling out 77% — This dynamo hasn't missed a payout in decades... and has hiked that dividend for 47 years in a row. It offers a remarkable combination of value, yield, and dividend growth.

- The 10-bagger from New York City (yielding us 47%) — Leading the 5G charge, this telecom pioneer wants to replace the hassle of tapping out text messages with video messaging. It micro-targets 117 million customers with ads that follow them from their TV to their laptops to their smartphones. It's up 888% since we bought in, and we're still buyers.

- Our North Dakota juggernaut yielding 71% — We've held it for 32 years and it hasn't disappointed us yet. The real story here is its ability to grow in all markets... and the stunning 2,340% gain it has made us. This overlooked dynamo has raised its payout every year and in every economic climate, shedding bear markets like water off a duck.

That’s a total value of $1,343 value on the table today waiting for you to scoop up …

And look — if forking out $1,343 helped you avoid even a fraction of the devastating effects of cash confiscation, it would be worth every penny.

But today, I’m not asking anywhere near the full value.

Today you can get started with a no-risk, 90-day trial to Utility Forecaster for as little as $39.

The opportunity to create life-changing income that shields you from “cash confiscation” for less than the cost of a stick of gum per day… starts by clicking the big “I want in” button below:

So, with all that being said — what’s it going to be?

Inflation is here. Now. High and rising.

For many of us, the increasing costs and shrinking savings is a part of our daily life…

A coffee price hike here…

A mortgage rate increase there…

Another bill that must be paid…

It all adds up.

Which means you now have to make an important — dare I say — life-altering decision…

Are you simply going to wait around and hope for things to get better?

And if so, how long are you willing to wait?

1 year…

5 years…

10?

(And that’s if it does get better.)

Or are you ready to do something about it?

Our politicians have been following the same playbook for the last 50 years…

I don’t see them stopping now.

Why would they when they can just print more money, serve their term, and retire with a cushy pension and book deal?

Which means it’s on you to take your financial future in your own hands and STOP them from confiscating your cash!

I’m here and ready to help you.

With a basket of CAIs proven to pay steady, reliable income…

And deliver market-beating gains for over three decades now…

That could eventually pay you as much as $23,400 in income, every year.

All you have to do is say “Yes! I want in.” by clicking the button below and we’ll get your risk-free, 90-day trial started now.

Plus I’ll rush your free report The CAI Solution: An Antidote to American Cash Confiscation to you immediately.

Remember, every moment wasted is another dollar gone for good.

I look forward to seeing you on the inside.

Sincerely,

Robert Rapier

Chief Investment Strategist

Utility Forecaster

Copyright © 2022 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.