Tired of Piddly Payouts?

Tap into These Dividend Dominators For an ‘Automatic’ Double-Digit Pay Raise Every Year...

Full details below.

Fellow Income Fan,

If you’re like most people I talk to, you’ve likely never received anywhere close to a double-digit pay raise.

Not from your job... not from Social Security… and most certainly not from your investments.

But what if you could change that? And get that type of raise in your portfolio not just once... but each and every year!

I’m about to show you a rare type of investment that has raised its payouts by double-digits every year for the past 16 years.

But I’m not just going to SHOW you this company…

Stick with me a few more minutes and you’ll see how to get your hands on everything you need to get in on the action today.

Hi, my name is Robert Rapier.

And for 30 years I’ve been on the hunt for the fastest-growing and most reliable income around... sharing the results with my close-knit group of investors along the way.

But who I am, and what I do, isn’t important right now.

What IS important is that you stop what you’re doing and give me the next few minutes of your undivided attention.

Because I want to show you a little-known group of stocks that have been raising their dividends higher and faster than any blue chip ever could.

Of course, these double-digit increases are just an average.

Some of our dividends haven’t grown quite that high...

And others have soared 39%... 42%... even an incredible 80% in a single year!

Some payouts have grown so much they now hand back more in dividends each year than what shares were originally recommended at.

Case in point… one Houston firm that’s paying $1,595 in dividends for every $1,000 put into it...

A Richmond, Virginia firm that’s handing out $947 for every $1,000 put in...

And one in Atlanta that’s doling out $911 for the same size stake.

These fast-growing dividends are even more striking when you compare them to the piddly payouts of popular blue chips like Walmart, Coca-Cola, and Johnson & Johnson, whose payouts only grow 3% to 6% a year.

These fast-growing dividends are even more striking when you compare them to the piddly payouts of popular blue chips like Walmart, Coca-Cola, and Johnson & Johnson, whose payouts only grow 3% to 6% a year.

Maybe that’s enough for some people.

But those payouts don’t compare to dividend payers like this Boston firm that’s raised its dividends by a whopping 20% a year!

I call these stocks "Dividend Dominators" because they utterly dominate the puny payouts you’ll get from regular dividend stocks.

Just imagine what your life could be like if your income grew that fast...

You likely wouldn’t have to worry about the spiraling cost of living...

And you could FINALLY take that extravagant vacation you’ve put off and believed would never be more than a pipe dream...

Perhaps a 130-day around the world cruise... a stay at a Medieval French castle... or a safari tour on the African Serengeti…

Depending on your investments in these Dividend Dominators, you could even have enough left over to pay off your mortgage... your kid’s student loans... visit your grandkids more often... put them through college... buy yourself a new car... or even renovate your home...

The possibilities are endless.

Most importantly, you could have the peace of mind knowing that money is one thing you will likely not have to worry about.

Let me assure you, collecting these fast-growing payouts is not difficult.

It doesn’t involve any risky tactics. You won’t have to touch options... do any short selling... market timing... or use any other complicated strategies.

As you’ll see, it’s really as easy as buying a few shares and watching your dividends grow sky high.

So how do these companies do it?

How do these Dividend Dominators succeed so beautifully where most other companies fail?

It all boils down to four key traits they all have in common.

Whenever I see these four income keys, I know I’m looking at a company with the potential to pay out fast-growing dividends for years to come.

Leave out just one of these keys, and the dividends will falter.

That’s how vital they are to being a Dividend Dominator.

Here, let me show you what I mean.

And after, I’ll also reveal how you can get the names of the best Dominators to put your money into right now...

The 1st Key to Fast-Growing Dividends:

Products and services that sell themselves

The first thing you should know about Dividend Dominators is that securing long-term income is their TOP priority.

I know it sounds like every company would obviously do this.

But consider how many actually do the exact opposite by selling products with no future…

Useless things that nobody really needs... like electric wine openers, robot vacuum cleaners, or banana slicers.

The companies that produce such things could never pay a fat, juicy dividend because their income is based on fads and customer whims... making their stock bounce around like a ping-pong ball.

Even companies that sell popular and desirable products can’t guarantee their future sales long-term, not to mention their dividends.

Beer makers Anheuser-Busch and Molson and entertainment giant Disney are all the proof you need.

In spite of their popular products, they are among the hundreds of companies that cut their dividend payouts over the past few years because of lagging sales.

This is why my Dividend Dominators focus only on vital services that people actually need... like electricity for instance...

It isn’t just a luxury, or something you can cut back on... but something most of us can’t live without.

We couldn’t cook food, or heat or cool our homes. Hospitals couldn’t provide critical services and doctors couldn’t save lives. Stores, offices, restaurants, and even government buildings would all close.

It’s a product that sells itself. And any company providing it can easily secure a dependable long-term income.

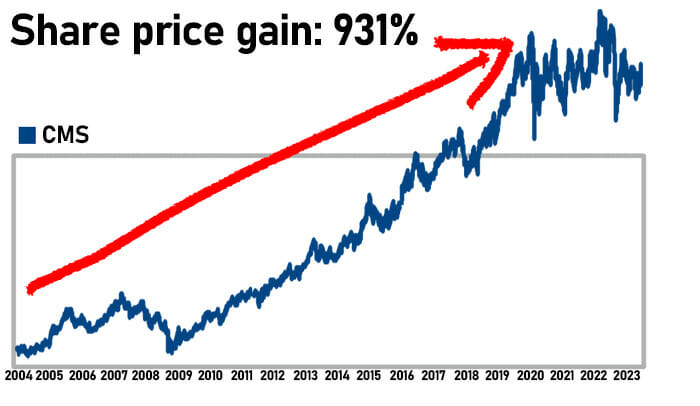

Our Michigan Dividend Dominator is a perfect example...

It provides electricity and natural gas to 6 million of the state’s residents.

Last year it collected $8.6 billion from its customers... a 17% year-over-year increase.

And it’s been passing this growing stream of cash on to shareholders regardless of what went on in the stock market or economy.

For instance, subscribers were first made aware of this opportunity in 2007.

The following year, all hell broke loose with the financial crisis of 2008...

Unemployment doubled nearly overnight... 8 million Americans lost their jobs... stocks plummeted and the top blue chips slashed their dividends by an average 23%...

It was a terrible time for income investors.

Fortunately for us, none of that mattered to this Dividend Dominator.

Because amid all this chaos, it raised our payouts by an enormous 80% in 2008!

Then in 2009, when even more companies cut dividends...

Then in 2009, when even more companies cut dividends...

Our Dividend Dominator raised its dividends again... giving us an incredible 39% pay raise.

In 2010, as other companies started paying dividends again, ours grew even more...

And then more again.

All told, while most income investors struggled through some of the toughest years of the stock market, the income from this Dividend Dominator quadrupled.

And it’s been like that in every market downturn... the Covid crash was no exception.

Even the pandemic couldn’t put a damper on our dividends

I’m sure you recall how devastating 2020 was for most people.

9 million lost their jobs while 773 companies downsized and slashed their dividends.

Countless retirees were suddenly stranded without the dividend income they’d come to depend on... leaving many barely able to make ends meet.

But this disaster didn’t affect my Dividend Dominators one bit.

Because in spite of the chaos, they were able to keep growing their revenue... and pass it onto shareholders as fast-growing dividends.

Our Massachusetts Dividend Dominator is a great example...

It provides antenna towers for phone companies like AT&T, Verizon, and T-Mobile.

Telephone service is another essential service most people can’t do without.

Without it, lives grind to a halt...

Businesses close...

Government and emergency response agencies are hamstrung...

So it’s no surprise that our Dividend Dominator’s business didn’t suffer at all during the Covid crisis.

By the time the pandemic hit our shores some folks had already enjoyed four years of spectacular dividend increases.

By the time the pandemic hit our shores some folks had already enjoyed four years of spectacular dividend increases.

Then, as the market crashed in 2020 and all hell broke loose... the dividends just kept growing...

Like clockwork.

Simply because the company provides an essential service that people refuse to go without.

I’ll give you the name and ticker symbol of this and six other Dividend Dominators I’m looking at right now.

But first, let me show you the second income key they all have in common... and which enables them to grow their dividends by double-digits, year after year.

The 2nd Key to Fast-Growing Dividends:

Low annual overhead

The second key is that it’s easier to make a lot of money if you don’t have to spend a lot to make it.

It’s something all Dividend Dominators have in common... and why even the top blue chips can’t match these fast-growing payouts.

Take Apple for instance...

It’s the largest — and one of the most successful — tech companies in the world.

It has a cult-like following of customers who insist on buying its latest product as soon as it hits the shelves—whether it’s an iPhone, iPad or one of its countless other ‘must have’ products.

There’s even talk of it developing its own electric car to compete with Tesla.

Yet, in spite of all its success, the company only pays a tiny 0.6% dividend that grows your money slower than molasses in January.

One of the reasons it can’t grow its dividends at a break-neck pace is because it’s funneling a majority of its income into developing new technologies to put into its next popular product.

Simply put, despite all its success, Apple’s stingy dividend payments come as a result of its enormous expenses.

And if that wasn’t enough, the cost of raw materials to produce all these products is simply astronomical.

It takes 70 different precious metals and rare earth elements to make each and every iPhone including lithium... gallium... silver... and gold.

The price of these materials prices have all shot up over the past few years, with lithium — the metal that phone batteries are made of — having quadrupled since the pandemic.

Together these growing expenses are leaving a smaller piece of the pie for shareholders.

The Dividend Dominators on the other hand are completely different.

Unlike most blue chips, they don’t have large, ongoing expenses.

Instead of selling products that have to be manufactured each year, the Dominators provide services with relatively small overhead.

This gives them an enormous cash flow they can then pass on as dividends to their shareholders.

Take our Florida based Dividend Dominator for instance.

It’s a wireless provider with a vast network of cellphone transmission towers in the U.S., Canada, and Central and South America.

Like many service providers, its operating costs are rarely more than ongoing maintenance, which is a tiny fraction of what blue chips spend to expand their product lines every year.

As a result, the company has plenty of cash to spend on growing its business...

And grew the number of transmission towers it operates from 30,000 to 39,000 in just two short years!

That’s a huge 30% increase in its infrastructure. Enabling it to take on more customers... grow its income... and pay out even larger dividends!

All told, it was able to grow its payouts by enormous amounts... nearly tripling in just five years.

All told, it was able to grow its payouts by enormous amounts... nearly tripling in just five years.

By comparison, it takes 30 years for most blue chips to grow their dividends this high… if they ever do.

With such incredible dividend raises, why would you invest in anything else?

In a minute I’ll tell you how to get into this Dividend Dominator and six others so you can begin to enjoy these fast-growing dividends too.

But before I do that, let me also show you the third key that makes them better than any blue-chip dividend payer...

The 3rd Key to Fast-Growing Dividends:

Government-sanctioned monopolies?

You see, what I like most about the Dividend Dominators is that they are natural monopolies with little to no competition to cut in on their business.

This is important when you’re looking for reliable, long-term income.

To see what I mean, consider how Netflix was once the undisputed king of online movie service.

It single-handedly put the whole video rental industry, including Blockbuster, out of business.

When it started, it had no competition, but it didn’t have an iron-clad monopoly either.

There was no way to keep competitors from cutting in.

Disney, Amazon, Apple, HBO, and others soon moved in and ripped away two thirds of Netflix’s market.

Netflix had no monopoly for online movies... and no way to protect its “territory” from competitors.

As a result, Netflix’s monopoly was short lived. And its years of fast growth are now far behind.

But this isn’t the case with my Dividend Dominators...

That’s because they’re all natural monopolies thanks to their vast infrastructures that prevent competitors from ever cutting in.

For instance, with Dividend Dominators that provide electricity, it would be virtually impossible for a competitor to come along and set up its own power lines next to theirs.

Other Dividend Dominators supply cell phone coverage with thousands of cell towers spread across their territories.

There’s no competitor that’s going to come along and build its own towers to steal these customers.

The sheer cost of doing it bars competitors from cutting into the Dominators’ territories.

This gives them a layer of protection few other businesses enjoy...

A natural monopoly.

And what I like even more about these companies is that in some cases, their monopolies are even protected by Federal law.

You see, many years ago, the government realized how vital some of these services are to people (and how devastating any interruption would be to the economy and the country as a whole).

So in a series of court rulings, it granted these companies the right to operate as monopolies... without fear of being broken up.

And if that wasn’t enough, most Dividend Dominators also receive billions in Federal and state funding every year that helps continue growing their businesses.

With such a strong wind at their back, it’s no wonder these companies are securing such a great income for their shareholders.

Just look at our Dividend Dominator on the Atlantic Seaboard which provides high-speed internet from Florida to Maine.

Being a natural monopoly enabled the company to build up its network... acquire more and more customers... and grow its income year after year.

Dividend Dominator grows by leaps and bounds

This allowed the company to grow its dividends by double digits.

In fact, if you had gotten in when it first started paying dividends in 2005, today your payouts would have grown a staggering 2,528%.

In fact, if you had gotten in when it first started paying dividends in 2005, today your payouts would have grown a staggering 2,528%.

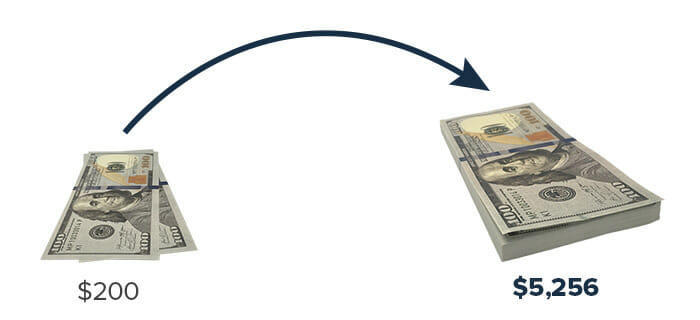

Simply put, that’s enough to turn a $200 annual dividend into $5,256 today...

With next year’s payouts being potentially even larger... the year after that larger again... and so on...

Growing an average 22% a year!

Now you can see how being a natural monopoly helps my Dividend Dominators grow their income... and your dividends over the long term.

And I’ll show you which Dividend Dominator this is in a minute, right after you see the fourth and final income key that makes these fast-growing payouts possible...

The 4th Key to Fast-Growing Dividends:

They go hand-in-hand with tenacious company growth

Up to now, I’ve focused on each Dominator’s dividend growth.

But there’s another aspect to these stocks too…

One that makes them such a great investment.

You see, it’s impossible for them to grow their income unless they also grow their operations.

Now, I know this sounds obvious, but the truth is that not all companies do this... even if they are natural monopolies that provide essential services.

Take the Dayton & Michigan Railroad for instance.

It’s a railway that operates out of Ohio transporting livestock and commodities like corn, wheat, and coal.

As a railway, it provides an essential service. And is also a natural monopoly that does business without any fear of competitors cutting in.

It also pays a very reliable dividend each year.

In fact, the company has paid steadily for the past 28 years.

It has never lowered or cut its dividends since it started paying them.

But the company hasn’t raised them in those 28 years either.

It’s paid out the same $1.75 per share each and every year.

At the same time though…

It wasn’t laying new railway tracks... not expanding its services... not attracting new customers...

Simply put, it wasn’t growing its business.

It would be impossible for this company to hand out fast-growing dividends for any length of time.

That’s why all of the Dividend Dominators are constantly growing, expanding, and upgrading their operations.

Just look at my Michigan Dividend Dominator...

It’s an energy company that provides electricity and natural gas to more than 6 million homes and businesses...

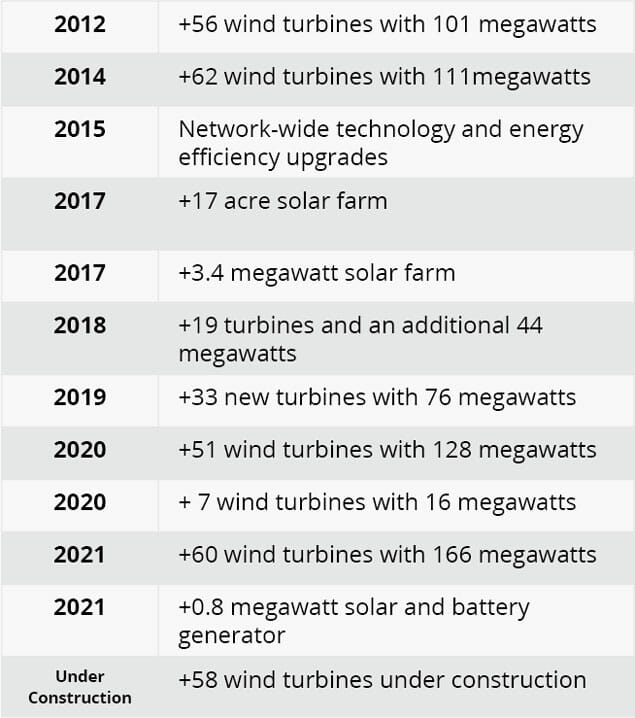

Over the past decade the company has been on a mission to upgrade its infrastructure with new high-tech wind turbines...

It’s replacing old, outdated coal plants with new state-of-the-art technology that creates electricity at a fraction of the cost, without causing any pollution.

Dividend Dominator grows its infrastructure

As a result of all this growth, the company was able to grow its income and its dividend payouts.

In fact, its dividends have grown by double digits for the past 16 years...

In fact, its dividends have grown by double digits for the past 16 years...

The company hasn’t had a problem doing it because it’s also growing its business.

When it comes to the Dominators, long-term income growth and business growth always go hand-in-hand.

And this is where the fourth income key gives us another enormous benefit...

Dividend Dominators' hidden benefit:

They hand out huge capital gains

That’s because all that business and dividend growth translates into huge capital gains...

You see, as our Michigan Dominator grew its infrastructure, its share price also shot up tenfold.

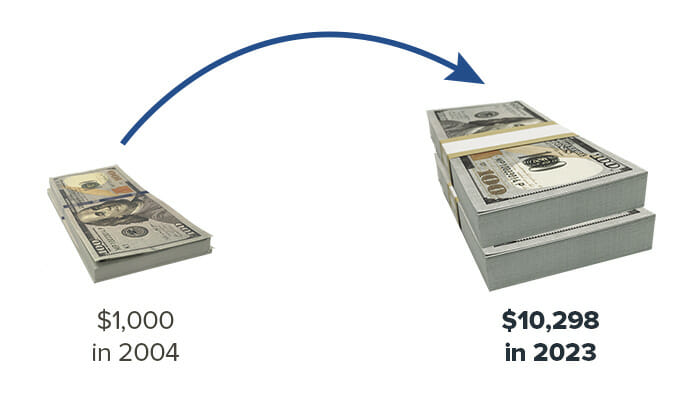

Enough to turn $1,000 worth of shares into $10,300.

But you could have always invested more than $1,000.

If you had bought $20,000 worth of shares, they would be worth $206,260 today...

With $50,000 you’d have well over half a million.

And don’t forget: you’d also have already received $163,000 in dividends...

Imagine your brokerage account growing tenfold while you collect gobs of worry-free income, year after year...

All of it without the uncertainty that comes with trading in and out of stocks...

And without ever losing sleep over the economy… the unpredictable stock market… or rising cost of living.

The point is, with Dividend Dominators, you get the best of both worlds...

Fast-growing income AND incredible capital gains!

So by now you may be wondering...

If these stocks are so great, why haven’t I already heard of them?

The answer is simple… the four income keys are my proprietary evaluation system…

They are the only way I know of to identify these Dividend Dominators.

And out of the 17,500 companies listed on the American stock market at this time…

Less than 20 currently meet my 4 criteria …

This tiny group of stocks makes up less than one-tenth of one percent of the market.

So the only people that know about them are myself — and my readers.

They are, in my opinion, the best of the best dividend stocks around.

I only came across them after years of dogged research into the four income keys they all have in common...

Poor Oklahoma boy discovers income secret

As I mentioned earlier, I’m Robert Rapier.

As I mentioned earlier, I’m Robert Rapier.

If my name sounds familiar, it could be because you’ve seen me on 60 Minutes, CNBC, or the MoneyShow.

Or you may have read my work in Forbes, The Wall Street Journal, or The Washington Post.

Today, investors from all walks of life follow my financial research... from hardworking folks with modest portfolios... to billionaires rich enough to own their own baseball teams.

And though I enjoy all this notoriety today... my roots are much more humble.

I grew up on a small Oklahoma farm where we always managed to have food on the table... but little left for anything else.

I knew what it was like to grow up with one pair of shoes.

And while my childhood is filled with fond memories...

The never-ending struggle to make ends meet made me want to learn about money so I could not only provide a better life for my own family... but be able to give back to my parents as well.

It put me on a 40-year-long quest for the secret to making money.

I knew it wasn’t what Wall Street was telling everyone to do.

If it had been, I reasoned, most investors would be rich by now.

And so my search led me in a different direction... to a small group of stocks that — to all outward appearances — ran unremarkable businesses.

But which had four key characteristics — the very same ones I showed you here — that can grow your income by double digits year after year.

With their help, I’ve been able to look after my loved ones, and cross many things off my bucket list...

I’ve seen the world from the top of the Eiffel Tower... I’ve raced snowmobiles in the Arctic Circle... ridden a bull in a rodeo... sped past a Ferrari on the Autobahn... and I’ve even written a couple of books in my spare time...

And perhaps most importantly for you, I realized that if these stocks could help me, they could certainly help others too.

So I joined up with the fiercely independent financial publisher, Investing Daily...

And started sharing my discovery with regular people from all walks of life....

Like New Jersey retiree, Ronald Z., who now collects more than $6,200 a month, thanks to my research... and told me it’s helped him become completely debt free...

Georgia native, Keith J., who told me he’s now making over $7,100 each month, thanks to his dividend checks and finally able to put his 4 kids through college...

And Pennsylvania resident, Edward C., who now collects over $4,850 a month... giving him more than enough to live comfortably while saving the rest for retirement...

These results are exceptional, and yours may be different.

All of which brings me to why I made this presentation in the first place...

You see, I want to give you a chance to join these folks too...

I’m the Chief Investment Strategist at Utility Forecaster

I share my financial research in a monthly service called Utility Forecaster.

In it, I focus exclusively on the best essential service stocks that can grow your income year after year...

No matter what else is happening in the world.

For instance, right now the average yield on cost in our portfolio is 26%.

That’s 16 times higher than what the top blue chips initial yields are today.

Simply put, it would take a blue-chip portfolio that’s 16 times larger than ours, to give you the same income.

And I should point out that 26% is just an average.

We have one Dividend Dominator that’s now paying us a hefty 32% yield on cost... another stock is paying 48%...

And we even have two dishing out an incredible 81%+.

This is phenomenal income.

And you could potentially grow yours like this too…

Maybe even more.

You see, I’ve prepared a report about the best Dividend Dominators to get into right now…

The Dividend Dominators: How to Get a Double-Digit Dividend Raise Every Year!

($199 value, YOURS FREE TODAY)

In my 30 plus-years researching and analyzing the markets, I’ve come across countless websites, books, and reports dedicated to dividend stocks of every stripe…

But not a single one covering companies with the four traits I showed you… the four vital income keys needed to deliver these fast-growing dividends.

Companies…

- Providing essential services that sell themselves…

- That have established infrastructures that provide a steady income and keep the companies’ operating costs down…

- Are legal monopolies backed by the U.S. government…

- And grow their businesses each year, providing fast-growing dividends and exceptional capital gains.

In this report, I feature the top 7 of these companies that are raising their dividends by double digits...

- One is a renewable energy company that’s been raising its payouts by an incredible 44% a year. Can you imagine your income growing that fast!? You’ll want to get in on this one fast, before its next dividend payout!

- The second is a Dividend Dominator that’s raised its dividends a whopping 2,528% since 2005... and is still going strong! That’s enough to grow initial $100 dividend payouts into $2,628 today. You’ll be hard pressed to find a stock matching this one’s long-term growth!

- Then my third pick is a young Dominator that’s nearly tripled its payouts in the first 5 years... with money like that rolling in, you won’t have to worry about the rising cost of living ever again.

- And I have four others I’ll share with you in my brand-new report called The Dividend Dominators: How to Get a Double-Digit Dividend Raise Every Year!

This report is valued at $199 and is only available to my Utility Forecaster members.

This report is valued at $199 and is only available to my Utility Forecaster members.

You won’t find it anywhere else on the internet… not in any bookstore, library, or at any other research firm.

Having said that, I’ll send you a FREE copy today, when you agree to take a 100% risk-free, 90-day test-drive of my Utility Forecaster service.

By taking advantage of this offer, you’ll be able to set yourself up with the finest income investments I’ve ever found... and stay updated on even more income opportunities over the next year.

So how much does it cost to try my service?

I know I could charge a lot of money for a year’s worth of income research, considering the amount of money on the table in these investments.

With these Dividend Dominators, you could pay off your debts... put your kids and grandkids through college... and save for your retirement... as so many of my subscribers are already doing.

Lee W. will back me up on that, because he said it helped him pay off a $30,000 plumbing bill, and take a nice, relaxing vacation.

Another subscriber in California, Raymond C. told me the income has enabled him to enjoy a worry-free retirement.

And another in Massachusetts said he made over $73,000 from just one of the Dominators I showed you today.

You could join these subscribers by giving my Utility Forecaster service a 100% risk-free, 90-day tryout today.

To get started, simply claim your Dividend Dominator report valued at $199 by clicking on the “Get Started Now” button below...

As soon as you do, I’ll also send you a second report valued at $199 that shows how to take your Dividend Dominator income... and boost it for EVEN LARGER payouts...

Boost Your Income an Extra 50% Higher

You see, everything I showed you up to now consists of a simple strategy where you buy the right stock then hold on as your income grows up to double digits every year.

It’s about as simple as you can get when it comes to collecting great passive income.

But what I haven’t shown you is how to make this income even better... and safely boost it to an even higher level.

To see what I mean, let me show you how this technique boosted the income of one particular Dividend Dominator.

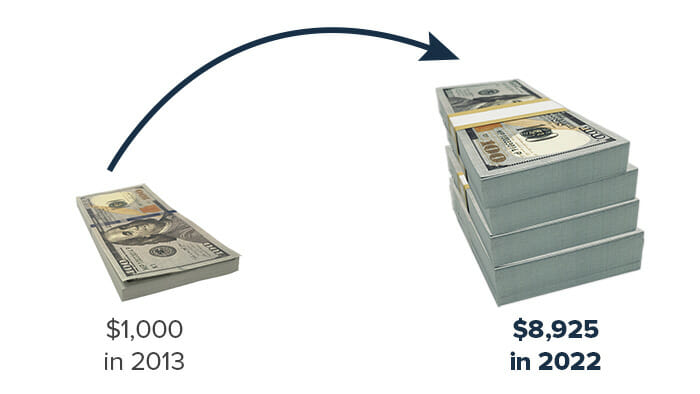

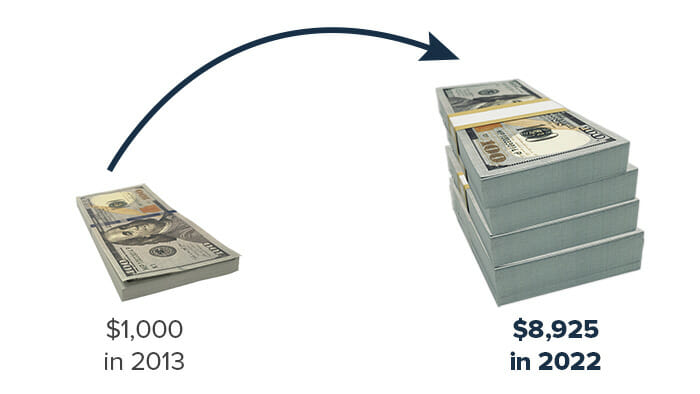

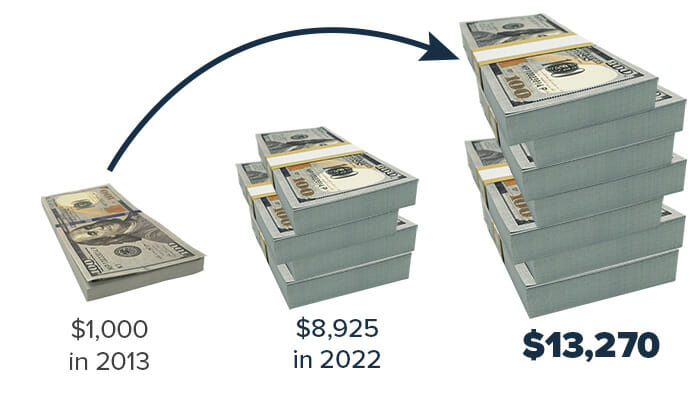

To start with, this company’s payouts have grown an incredible 792% over the past decade.

That’s how much your dividends would have grown if you simply bought the stock and collected your dividends as they came in.

So if you received $1,000 in dividends the first year, over the following decade your payouts would have grown to $8,925 per year.

Now, that in itself is an incredible dividend growth. Better than any blue chip I’m aware of.

But with the secret I’m about to show you... you could have grown these payouts even higher!

All it took was making a simple change in your brokerage account... and your payouts would have shot up 50% higher!

So instead of $1,000 in dividends growing to $8,925...

You could have watched them grow to $13,270 instead.

I share the secret of how this works with all of my Utility Forecaster members. And recommend they take advantage of it whenever possible.

One person I showed this strategy to, Bert M. in Oklahoma, was able to make an incredible $300,000 this way... and told me it’s helped him pay for his grandkids education and save for retirement as well.

And another subscriber in New Mexico, said it boosted his income to $75,000, allowing him to spend more time travelling with his wife.

I put all the details about this incredible income multiplier into a report I call Boost Your Income an Extra 50% Higher. It’s valued at $199, but I want you to have it now FREE of charge, along with the first report I mentioned...

So you’ll get...

- My 1st Research Report: The Dividend Dominators: How to Get a Double-Digit Dividend Raise Every Year! About my unique — yet simple — way to put a tiny amount of cash into a stock and receive large, fast-growing dividend raises. Valued $199, yours FREE today.

- My 2nd Research Report: Boost Your Income an Extra 50% Higher where I show you how to apply a small twist to the way you hold these Dominators to boost your income to an even higher level. Valued $199, yours FREE today.

That’s $398 worth of income investment reports.

- Plus, I’ll send you a year’s worth of financial research in my monthly Utility Forecaster You’ll get the best ways to collect large dividends, with new opportunities to grow your income. Yours with a 100% risk-free, 90-day test drive.

Armed with this valuable information, you could change the way you think about money once and for all…

It could turn the uncertainty about how you’ll make ends meet into a distant memory... and grow your income faster than today’s skyrocketing cost of living.

Plus, when you agree to give my service a 100% risk-free, 90-day try today, I’m going to give you access to another income secret that ensures you not only have access to… but a complete understanding of EVERY possible way we’re going to be looking to rake in income… regardless of how the market is performing as a whole.

Which is why you’ll also get a personal copy of my...

Income Blueprint

I’ve never shared this with anyone outside my Utility Forecaster subscribers.

In this report I’ll take you under the hood of my proprietary system for finding the very best utility stocks on the market.

It’s called my Safety Rating System, and it works like an instant “credit check”…

Which evaluates every stock I buy against eight important financial criteria that determine the safety and sustainability of its payouts.

The details inside this exclusive report reveal the true secret to my success…

And when you get your hands on your personal copy, it could become the secret OUR success.

This report is also valued at $199.

But with today’s offer, it’s yours FREE, just like the first two reports I showed you.

To recap, try my service and I’ll send you...

- My main research report: The Dividend Dominators: How to Get a Double-Digit Dividend Raise Every Year ($199 value, yours FREE)

- My Boost Your Income an Extra 50% Higher report to maximize your Dividend Dominator income ($199 value, yours FREE)

- My Personal Income Blueprint to get the most out of your entire income portfolio ($199 value, yours FREE)

That’s $597 worth of proprietary investment reports, plus...

- A year’s worth of Utility Forecaster, with new opportunities to grow your income every month.

And of course you’re fully covered by my ironclad “double barreled” guarantee:

Guarantee #1:

Guarantee #1:

Try Utility Forecaster Risk-Free for 90 Days

You see, by subscribing now, you’re only agreeing to try my research to see if you like it.

You can download your three members-only reports and take the next 90 days to delve into their incredible income opportunities.

Then take advantage of all the buy recommendations in our current Income and Growth Portfolios...

Check out the special situations I’ve detailed in my other members-only research reports...

And follow my ongoing research into new investment situations as soon as I publish them.

In short, enjoy the full treasure trove of opportunities you’ll have access to as a new Utility Forecaster member... and see how well they perform over the next 90 days.

If you’re not fully convinced they live up to everything I’ve just showed you...

If you’re not absolutely delighted with the direction your finances are taking in the next 90 days...

Simply call our Concierge Hotline and I’ll promptly return 100% of your membership fee. No questions asked.

And here’s my second guarantee…

Guarantee #2:

Your Satisfaction is Guaranteed Forever

Even after three months, if my research, recommendations, or returns don’t exceed your expectations, let me know…

Once again, a phone call is all it takes.

We’ll give you a full refund on the remaining months of your membership.

Of course, you’ll get to keep the three reports I showed you here, valued at $597…

As well all the valuable research you’ve received or downloaded over that time.

Consider it my way of saying thank you for giving Utility Forecaster a fair try.

So, how much am I asking for all my research?

I know I could charge a great deal for this valuable information.

Especially when you consider that Wall Street firms demand thousands of dollars for this caliber of work.

Though I’m sure they won’t tell you about these Dividend Dominators.

In contrast, my three income reports are a steal at their combined $597 value.

But I won’t ask you anything near that price.

Instead, you can have everything I showed you today, for just $39.

That works out to less than 11¢ a day... more than a 73% discount off the standard rate of $149.

Simply put, for just pennies a day you’ll have access to top-notch financial research that could set you up with the fastest-growing income for life.

So why am I giving away my service for so little?

Because I'm here to help people.

And I realize that in spite of everything I’ve said today, there are many who need an extra “nudge” to try something new.

And you have to try my service to see how well it works.

That's why I’m offering it at such a low price — to make it easy and affordable for you to dip your toe in the water, with no-risk.

So take the next step.

Right now, you stand at a momentous cross-roads...

You can either go back to what you’ve been doing up till now... and (hopefully) continue to make the same income you’ve always made...

Or you can try out my Dividend Dominators and potentially obliterate your financial worries for good.

So what are you waiting for?

Click on the link below.

You'll be taken to a secure page where you can review your order before you make your final decision.

Sincerely,

Robert Rapier

Chief Investment Strategist

Utility Forecaster

Copyright © 2023 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.