85% Accurate Trader Declares…

“Give Me 9 Minutes a Week and I’ll Show You How to Make As Much As $67,548 a Year”

Dear Income Seeker,

My name is Jim Fink. I’m a lawyer by training, but for the past 25 years, I’ve been trading the market for extra cash.

I’ve averaged about $185 per day – $185.06, to be exact. Some days are better than others of course, but over time it’s been a consistent $185 per day.

It all adds up to $67,548 per year… and if I tell you exactly what I’m buying and selling, you can copy me and potentially make the exact same profits I do.

Why not? All it takes is nine minutes a week. And you don’t have to invest a dime up front.

Thousands of men and women who had never traded this way in their lives are doing it. Some say they are already making well over $100,000 a year.

$185 Per Day, Every Day… Forever

The $67,548 I’m talking about isn’t a hypothetical number.

It’s what you could have actually made each year – for four years running – if you’d followed the recommendations released to a small group of investors beginning in 2011.

That’s when I started my first options trading advisory service for Investing Daily… and I’ve been running it ever since.

Now, before you run away screaming because I uttered the dreaded “O” word, please hold on a second.

The way I trade options is NOTHING like the roll-the-dice gambling you’re probably imagining.

In fact, it’s the exact opposite.

The way I trade options is so boring that some of my readers buy penny stocks on the side for a little excitement – just to keep their pulse above 60.

But you know what? That’s just how I like it. Boring. Predictable. No surprises.

After 1,520 days, watching the steady drip… drip… drip of $185 each day, and at one point going almost an entire year without a loss, I’m starting to think boring is beautiful.

Let’s Take a Look at the Numbers…

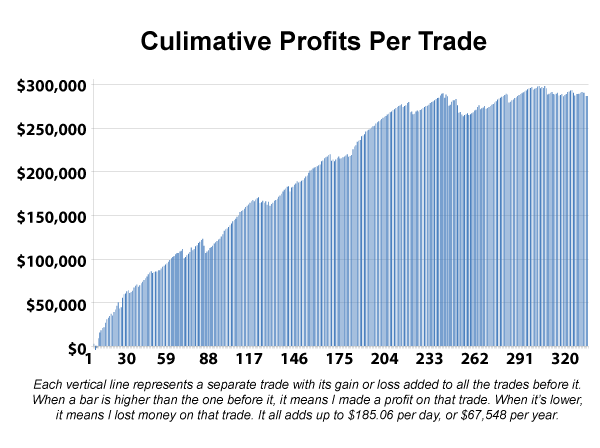

This chart outlines 346 trades I recommended during that time… 293 of which were profitable.

Anyone who followed each one to the letter had the opportunity to receive $303,100 in upfront payments. And they would have paid just $16,020 to cover losing trades, so the net profit was $287,080 (excluding commissions).

As you can see, this chart shows how each trade worked over time, wins and losses included:

Now these numbers are based on 10 options contracts per trade. If you have a bigger bankroll, you could have traded two or three times as many contracts and made two or three times as much money. Or you could have started out slowly and traded just one contract and made one-tenth the money. It’s all up to you.

To be clear, these trades don’t happen every day, so you don’t actually get paid daily. Our profits can be “lumpy,” and they don’t always arrive in a smooth, straight line.

Instead, I achieved these results by trading about once a week, making gains like $1,300… $2,550… and $1,570. But when you do the math, it comes out to over $185 per day.

End to end, the average trade lasts around 138 days, less than half a year. That way you can make profits fairly fast and recycle your cash gains into new trades.

Even with my most conservative trades, this led to a 130.95% total return, nearly doubling the market over the same time period.

We Make Money on 85% of Our Trades

Talk to my followers and they’ll tell you that just as important as the profits they’re making is how consistently they make them.

When we do have a loser, it’s usually a defensive “hedge” trade that you don’t even have to implement if you don’t want to (more on that in a minute).

But as I said, out of the 346 total trade recommendations made over 50 months, 293 were profitable – that’s a “win rate” of 84.68%.

A follower of mine named Fred shot me a note to say how thrilled he is with his results:

“I consistently make $8,000 per week and my life is varied in things I do with the money. Those include enjoying life, philanthropic pursuits, helping family and friends, and spending much quality time with my wife.”

My email inbox is flooded with thanks from people like Fred – investors who decided to try something different to start generating extra cash month after month.

Like Steven who “had numerous gains in the 50-60% range.” And Robert, who says my method is “great for reliable 20% annual gains.” 20% may not sound that impressive if you’re a “big gain hunter,” but the reality is it’s much more than most investors make in a year, if they’re lucky.

Better yet, collecting these profits only takes about 9 minutes a week.

Now before I go any further, I need to point out the obvious…

Not everyone does this well following my lead.

But it does show you what’s possible.

I’m about to show you how you can do it, too – and how you can use my method to get started today. But first, let me tell you how I got hooked on options in the first place…

How I Turned $50,000 Into $5.3 Million

You see, I wasn’t always into options.

Back in the ‘80s, I was slaving away for 70 hours a week in Chicago, for a law firm that Forbes called “the most powerful firm on Wall Street.”

I was burning the midnight oil for clients like Goldman Sachs and Citigroup.

And I was miserable.

Fortunately for me, the Chicago options exchange was right down the street. I started spending my lunch hour watching the options traders on the floor.

They were making a lot more money than me, working far fewer hours, and having a whole lot more fun!

So I got friendly with some of the traders at the exchange – and started learning the ropes.

After a crash course in options trading… reading dozens of books… and pestering the seasoned market makers with countless questions… I began trading options myself.

I started out with $50,000 (much more than I needed, actually), and over the next 10 years continued to perfect this strategy.

By 2001, my $50,000 had grown into $5.3 million.

That’s a return of 10,600%.

As you can guess, I never would’ve made that much money that fast by slaving away as a lawyer.

That’s when I decided to quit my job and trade options full-time. And I’ve been trading ever since.

Now, I’m not promising you’ll turn $50,000 into $5.3 million just like me.

I was young and single and I “bet the farm” on risky trades that I don’t do anymore. Now that I’m supporting a family, I stick to safer trades that funnel steady sums into my bank account every month, with little chance of ever turning against me.

But please don’t get the idea that we’ll never lose either.

No system is perfect, and we could go through a losing period at some point.

But the way these trades work, even our losers tend to be much safer than the losses you’d see in normal stocks in a volatile market.

And Believe It or Not,

I Could Win Even More Than 85%

of the Time If I Wanted…

You’re probably thinking, “What?! Why wouldn’t you win more often if you could?”

Let me explain…

As I said, out of the 346 total trade recommendations, 293 made money – an 84.7% success rate.

That’s unheard of for most investors – in stocks, options, or anything else.

In fact, Marketocracy, a company that audits the performance of top investors, says that “a winning percentage of 66% would be excellent and would rank among our best investors.”

Our win rate is well above that figure of excellence.

But as you’re about to learn, it actually understates how often we’ve been right.

Because that percentage was dragged down by 15 losing “hedge” trades I made to protect our gains from a bear market.

Losing on hedges is okay. They only pay if the market turns against us, so I’m always glad when they don’t work out.

Think of them like homeowners insurance – something you pay for but hope you’ll never need to cash in.

Of course, those hedge trades hurt my win rate, but it’s for a good cause.

It’s like when a quarterback throws the ball away to avoid a sack. His quarterback rating drops, but it’s for the good of the team.

Here’s the thing: If you don’t want to use these insurance trades, you don’t have to. And you’ll probably have an even higher win rate.

In fact, the crux of my strategy, what I call “conservative income” trades, have seen win rates over 91%.

These safe plays aren’t going to shoot to the moon, but they churn out cash for us like a Swiss clock.

In fact, during one of our most profitable months using trades like this, 12 of our trades ended and all of them totaled a profit of $12,910:

And remember, success like this isn’t out of the ordinary.

Many people say they are collecting payments of $1,500, $2,000, and even $4,000 several times each month.

In fact, so many of my followers have collected over $100,000 that I’ve started a “$100,000 Club.”

Let me be clear, these people are not investment geniuses.

They’re regular Joes who were willing to take a chance and try a new way of building wealth.

An approach that Forbes says is “like finding money in the street.”

And that Barron’s thinks is “too often ignored by investors.”

In fact, so many retirees are now trading options that Reuters calls it the “new Baby Boomer hobby.”

I hear all the time from subscribers who are ecstatic they decided to give options trading a try.

After all, who wouldn’t be glad when you’re consistently collecting anywhere from $1,000 to $2,000 on every trade you make?

Before we go any further, I want to make sure I clarify something about these trades.

This is important, so pay attention.

It sounds strange, but with many of my trade recommendations, you actually collect your money up front without actually investing a dime.

Then you lock in your profits when you close out your trades just a few months later. (As I said, our trades typically last around 138 days.)

I’ll show you exactly how it works in a minute – and how you can make your first trade in just a few minutes later today.

Not to mention many more after that.

But first, I’d like to tell you a story about a man using this same type of strategy.

His name is Warren Buffett.

After All, This Strategy Is So Dependable…

Warren Buffett Uses It

Yes… the man who’s so conservative with his cash that he lives in the same Omaha home he bought back in 1958…

…the man who avoids taking risks like some people avoid going to the dentist…

…the man who made super-safe “value investing” a household name… trades options.

Buffett realizes something most investors don’t: Trading options does NOT have to be risky – if you stick to a few conservative strategies when using them.

These strategies could let you collect thousands of dollars in extra cash several times a month… and when used correctly they tend to end up being much SAFER than investing in stocks.

Buffett made $4.9 billion trading options in a single decade.

And he did it the same way I like to: by creating a steady stream of income with modest but high-probability winners.

In case you haven’t noticed, funneling an unshakably steady stream of income into your account is the essence of this approach.

It’s right in the name of my main strategy: “options for income.” There’s a reason I don’t call it “options jackpot.”

That’s because I stress safe and steady income above all else.

Here’s My #1 Rule: Don’t Buy Options… SELL Them!

Now you may have heard that trading options is risky.

And that’s true… especially if you’re an options buyer.

But that’s not the way I usually trade options. Warren Buffett doesn’t buy options, either.

Instead, we both like to sell them.

Why? Because it’s been proven that options buyers lose money on 7 of every 10 trades they make.

Most option buyers are speculators. They place high-risk trades, hoping for a big payout. And that’s why they strike out 70% of the time.

But when you sell options, the odds of winning tilt in your favor. Because every time the buyers strike out, you’re the one keeping their money.

And that’s why selling options is about the closest you can get to never losing money investing.

It helped the legendary “Oracle of Omaha” collect $4.9 billion in cash, and I want you to start using it too.

Just Look How You Could Collect Thousands of Dollars Every Month

Most of the options I sell are called puts. It’s simple and, if you follow a few rules, very safe.

All you need is a small amount of trading funds, and you can collect hundreds in extra cash several times each month.

Here’s how it works…

When you sell a put option, you’re giving someone else the right to sell a stock to you at a particular “strike” price.

So say you’re selling a put option on Pfizer.

And let’s say Pfizer’s stock is sitting at around $35.

An options buyer might pay you $1 per share, or $100 per options contract, for the right to sell, or “put,” their Pfizer stock back to you at $30 a share anytime in the next couple of months.

So you sell 10 contracts, and the buyer immediately deposits $1,000 in your account.

That’s usually the end of the story. Chances are the put option you sold them is going to expire worthless because Pfizer won’t hit $30.

That’s good for you as the options seller, and bad for the buyer.

You’ll be $1,000 richer without investing a dime.

In the past, I’ve recommended selling puts on stocks like Amgen, McDonald’s, Cisco, SolarWinds, and Molson Coors Brewing, just to name a few.

And if you’d followed those five recommendations, you would have pulled in a total profit of $29,320. Just by selling 10 contracts on those five stocks.

Because the stocks never dropped below the strike price, we kept the entire upfront payment and didn’t pay anyone anything.

Now, I have to tell you something here: Even though collecting income this way is generally very safe, it still makes some people a little nervous.

Because if the stock price does happen to fall below your option “strike” price – $30 in this Pfizer example – you might have to buy the stock at that price.

But if that happens, it’s no big deal.

You can just sell it a moment later. So it’s nothing more than a minor inconvenience.

And to me it’s not even that.

That’s because I only sell puts on stocks I’d be happy to own anyway… and at a price I’d like to own them at.

So in our example if I have to buy Pfizer at $30 – it’s a nice 14% markdown on the original price – so I’m fine with that.

There’s no better way to pick up good stocks at a discount than following this strategy.

Here’s How to Make Your Trades

Even Safer

Even though I rarely have to buy a stock when I sell puts, I invest as if I might.

If that spooks you, don’t worry: There’s also a simple way make sure you almost NEVER end up having to buy a stock in one of these trades.

It’s a way to make options trading even safer than how Warren Buffett does it.

Instead of only selling a put contract, you trade what’s called a credit spread instead. With a credit spread, you sell one put contract… and you buy another one at a lower price.

You simply pocket the difference between the two. And remember, that money is deposited into your account immediately.

The beauty of a credit spread is that it forms a “safety net” that limits any loss.

The trade-off is that your gains are a little lower than if you only sold the puts. But there’s a much tinier chance of anything going wrong.

And you can still easily make returns like 36%, 48%, and even 71% in just a few months.

I know, because I have… many times.

In fact, those are the real-life gains we made on put credit spread trades on Procter & Gamble, Praxair, and Dick’s Sporting Goods.

And those aren’t the only credit-spread profits we made.

We made $2,400 on Lab Corp and $2,010 on GNC Holdings. And we did it in less than four months.

We also made $1,200 on Intuit, $1,400 on Union Pacific, and $2,800 on Priceline.com… all in less than five months.

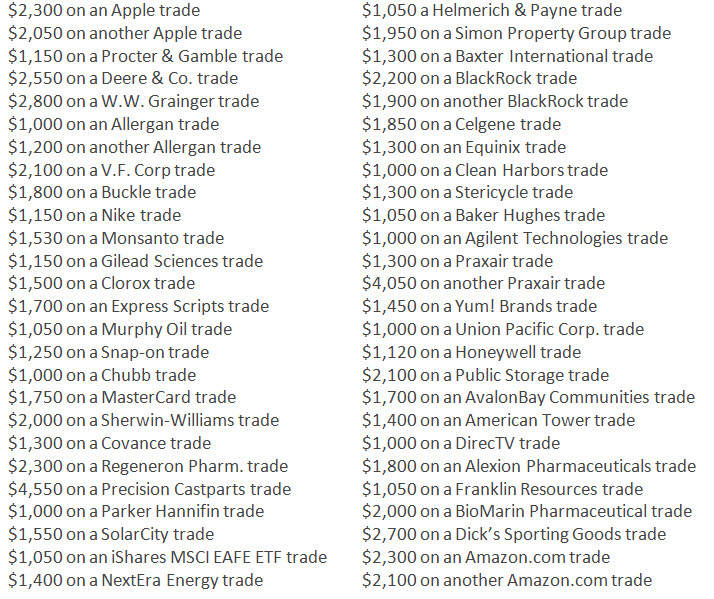

I love these trades because they almost never go against us. Just take a look at a bigger list of some of our winners…

These are actual trades I’ve recommended.

And by trading just 10 options contracts on each of the companies above, you would have collected $87,150.

And with my 85% success rate, the best part is that we’re making this money consistently.

My “Secret Sauce”

Look, I was no overnight success.

Before I stumbled across the magic of selling options, I spent more than a decade trading stocks.

I went through Yale partly on my profits… and kept on trading to help finance my master’s from Harvard, my MBA from the University of Virginia, and my law degree from Columbia.

But I’m proof that even a math whiz with a wall full of degrees can make boneheaded mistakes.

Because I made plenty of them. Especially early on.

The upside is that I learned something crucial from my stumbles. I now realize that the biggest challenge in options trading isn’t figuring out what trade to make. It’s figuring out when to make it.

Entering a trade at the wrong time can mean the difference between a home run and a strikeout.

Thankfully, I use a special tool that gives me a powerful edge and improves my odds of banking a winner.

It’s called seasonality.

Seasonality is simply the tendency of stocks to move in a given direction during a particular time of the year.

If you’ve heard the adage “sell in May and go away,” then you’re familiar with the concept.

It’s amazing how well this simple rule works.

Starting in 1950, if you’d put $10,000 in the Dow, between November and April, your $10,000 would’ve grown to $1,008,721 by 2017.

But if you’d done the opposite and only invested from May to October, your $10,000 would’ve only grown by $1,031!

That’s how powerful seasonality is. And that’s why I incorporate it into my recommendations.

It’s my “secret sauce” that no other options adviser I know of is using.

But “sell in May and go away” isn’t the only way you can use the calendar to make money.

You can also take advantage of the fact that the market tends to rise at the end of every month.

The reason is pretty simple – a lot of money flows into the market from monthly salary payments.

The market also does better just before market holidays and weekends. People are in a good mood, and short sellers buy back their positions, so they aren’t exposed over the holiday. This puts upward pressure on stock prices.

Other seasonal tendencies are based on the weather (temperature and precipitation)… spending surges (holiday shopping and tax refunds)… and financial events (earnings reports and dividend hikes).

It seems odd that seasonal patterns exist in the market, but they do.

For example, consumer stocks in industries like food, pharmaceuticals, utilities, and retail tend to outperform the overall market between May and October.

Manufacturing-oriented stocks like chemicals, construction, mining, and steel companies outperform between November and April.

What most investors don’t realize is that individual stocks move up and down according to the calendar too – not just broad sectors.

So I’ve developed a proprietary software tool covering thousands of stocks that shows exactly how they move over various time periods.

It analyzes a stock’s 10-year price history between any date I choose and the six nearest option expiration dates.

I’m hooked on it, and I use it whenever I make a trade…

Because it lets me make sure the stock has moved in the direction I want it to at least 80% of the time before I make a trade.

If it hasn’t, I won’t make the trade.

Of course, you won’t need to use any software.

When you get a trade update from me, all that work is already done.

When I first started trading, seasonality data like this was available only to professional traders who paid thousands a year to access private terminals.

But as I’ll share very soon, you can get access to its profitable insights free of charge today.

How You Can Profit at Least

8 Out of 10 Times

I think by now it’s clear that I’ve hit upon a pretty reliable trading methodology.

It’s not perfect… but I’ve shown you the numbers, and now it’s up to you to draw your own conclusions.

MY conclusion is that any activity that’s made money nearly 85% of the time is at least worth giving a try.

Especially when it only takes about nine minutes a week

But talk is cheap. My publisher wants as many people as possible to try out this technique…

So he’s going out on a limb and guaranteeing you’ll have the opportunity to make money on 85% of your trades using my approach.

Since I’ve consistently come out ahead on 85% of my trades (actually 91%, if you don’t count the “insurance” trades, which are designed to lose), that’s a pretty easy guarantee for him to make.

The investors who already follow me at my premium trading service are racking up steady streams of income trading this way… month after month after month.

Like Marilyn, who reports she “earned over $1,000 in a month“…

Or Donald, who made $13,683.71 on just one trade…

Or Joseph, who pocketed $120,000 in one year…

Again, these are exceptional results to be sure.

But at the same time…

Marilyn, Donald, and Joseph are members of a group hundreds of investors strong — who have decided to try something new… and have never looked back.

More importantly, before they started trading with me, many of these investors had never traded options in their life.

If You Have Just 9 Minutes of Extra Time This Week, You Can Join Them

That’s all it takes to implement my strategy. And to prove it to you, I’d like to send you a trade today.

When you get the email, I’ll walk you through the process step-by-step.

First, I tell you exactly why my fundamental, technical, and “secret sauce” seasonal analysis tells me to enter that trade.

Then I give you specific trading instructions that you can read word for word to your broker.

It will honestly take you just 9 minutes – often times even less.

And as you get more experienced and are willing to put aside more capital to invest, the sky is the limit regarding how big your profits can be.

For example, you could have easily made $2,700 on a Dick’s Sporting Goods trade.

Or $6,800 on my Berkshire Hathaway trade.

Or a cool $10,600 on a Molson Coors trade.

So there’s really no limit to the amount of money you can make.

Of course, I can tell you about all the money we’re making until I’m blue in the face, but you’ll never know if this system is for you unless you actually try it for yourself.

So let me ask you a question…

Are You Ready to Start Making an

Extra $185 Per Day?

I hope so… because you’ll be taking the first step towards money like that on when you say “yes” and join me today inside Investing Daily’s flagship investment advisory service Personal Finance.

Personal Finance is unlike any investing service you’ve ever seen.

Unlike so many financial websites and TV shows, we’re not about what everyone else is already doing with their money.

By the time anything hits the news, it’s too late – stay away.

Instead, we’re about doing what virtually no one else is doing with their money.

But most important of all, we’ve increased subscribers’ wealth even in horrible investment years.

And that’s exactly why I want to equip as many investors as I can with the safe, reliable options strategy you can use right now.

As you know, today’s market is choppy, volatile, and going nowhere fast.

We’ve seen it happen before too.

For example, from 2000-2010, the S&P 500 went backwards. Most Wall Street “experts” and fund managers did very poorly.

But during those same 10 years, which included the worst market crash since 1929, Personal Finance subscribers had the opportunity to gain almost 70%. And they did so while incurring 17% less risk, or volatility, than the market.

When you join Personal Finance today, you’ll get every special alert our team issues, weekly market updates, and full 24/7 access to our subscribers-only website.

Plus, I’ll make sure you’re equipped with everything you need to start trading options profitably using the strategies I’ve shared today.

That includes immediate access to these special bonuses when you join us today:

- My Options Strategy Manual: I’ve charged nearly $2,000 for access to this information in the past. But when you sign up for Personal Finance right now, it’s yours entirely free of charge. Inside you’ll discover the key to finding consistently profitable options trades… as well as a full explanation on the strategies I’ve been perfecting for years now. And with just a little bit of practice, you can use them yourself to earn extra income each and every month.

Plus, you’ll also receive:

- Your First “Easy-Start” Options Trade: The moment you subscribe, you’ll get immediate access to one of my favorite options trade recommendations you can use right now. I’ll walk you through it step-by-step and give you explicit instructions that you can execute for yourself. From beginning to end, it should take 9 minutes or less. It should also help you pay for your subscription, with plenty left over.

Look, I’m not going to insult your intelligence by saying everything we touch will turn to gold. No system is perfect after all.

But considering I’ve been doing this for years now with 85% success…

All I can really do is remind you of the facts: Investors who followed all 346 trade recommendations I made over one 1,520-day window — had the opportunity to grow their portfolios by as much as $287,080.

Is it possible that those years were a fluke? I suppose so. But I doubt it.

Why throw away a chance to discover how to make as much as $67,548 a year when the odds are so clearly in your favor?

All you need is a few hundred dollars in your account to get started.

Now before we continue, I want to be clear about something…

You’re not going to get rich starting with a stake that small.

At least not as first.

And that’s ok.

It’s not a race.

In fact, I tell all options newcomers to start small and be patient.

The point is, just do what you can afford. Pace yourself. And do what’s comfortable.

Having said that, if you really want to accelerate your potential, sign up for two years today and you’ll get these extra bonuses absolutely free:

- My Quick-Start Online Video Program – This comprehensive online video program teaches you the powerful secrets I’ve learned in my 20-plus years of trading – the strategies that have made me millions trading options for consistent income. No prior options knowledge is needed! All you have to do is follow the specifics in these videos… and based on what I’ve seen personally over the past few years, the odds are good that you will be ahead by $67,548 or more a year from now.

- “How to Buy Stocks at a Discount” – This companion report to my video training series explains an easy way to buy shares of stock at a meaningful discount to their current prices. You’ll never pay normal prices for stocks again after seeing this.

Get Started Now

The regular one-year rate for access to my most elite options trading service is $1,950. And even then, customers can make that amount back on their very first trade.

But when you join me inside Personal Finance today for one year, you won’t pay even half of that.

In fact, you won’t even pay one-quarter or one-tenth.

Because for the first 100 people to respond to this offer today, my publisher is letting new Personal Finance subscribers join for only $39.

Or you can extend your savings even more by accepting the extra bonuses that come with a deeply discounted two-year subscription.

These prices are the lowest we’ve ever offered for access to my options trading guidance.

And given my track record of earning $185 per day in extra income, you’ll be ahead of the game immediately after joining.

When you get your hands on your first trade, contact your broker and make sure your account is set up to trade options (you might have to fill out a simple authorization form first).

Then, to make your trade, just read your broker the step-by-step instructions I send you. Or you can just make the trade yourself online.

I expect that your first trade will pay for your entire subscription fee, with enough left over for a nice dinner out.

And remember – it’s just the first of a long string of cash payouts you’ll be getting soon.

Plus…

If You’re Not Completely Happy…

I’ll Pay You Back

Yes, I’m serious about that.

If you’re not thrilled with the profits you’re seeing in your first 90 days, simply give us a call and we’ll refund every penny.

And to thank you for giving Personal Finance a try, you can keep every bonus report we send you with my compliments.

Even if you win on 75%, 80%, or even 83% of your trades over the next 12 months, you can call anytime and get the remaining balance of your subscription back.

We don’t get many refund requests. After all, think of how quickly the profits add up using a technique like mine… and what you could do with the extra cash in your pocket.

One of my first followers, Glenn D., used his gains from just two months of trades to pay for a trip to South America.

Glenn is one of my first “$100,000 Club” members. But I want even more subscribers to rake in six figures in extra income.

I want more names in the “$100,000 Club.”

You could be the next member. It’s as easy as joining Personal Finance at this extremely low price.

Join right now and you’ll be able to get started right away.

If you have a question or prefer to join over the phone, call us toll-free at 800-543-2049.

When you call, tell us that you want to try Personal Finance for 90 days, and we’ll set you up to start collecting your cash right away.

Jim Fink

P.S. Not only can you collect constant income with these simple options strategies, but you can also collect this income TAX-FREE.

That’s right. Thanks to a loophole in the Taxpayer Relief Act of 1997, you can grow your account up to a million dollars – and not pay a dime to Uncle Sam.

I tell you all about it in my special report, “The Biggest Legal Loophole in the IRS Tax Code!” It’s yours FREE when you agree to try Personal Finance in the next 24 hours.

Try it now while there’s still spaces available – click here!

Copyright © 2022 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ disclosures, terms, and conditions and privacy policy pages.